The Retail industry has had to do a sharp re-think of its digital roadmap and transformation journey – Ecosystm research shows that about 75% of retail organisations had to start, accelerate, or re-focus their digital transformation initiatives. However, that will not be enough as organisations move beyond survival to recovery – and future successes. While retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough in 2021. Ecosystm Principal Advisors, Alan Hesketh and Alea Fairchild present the top 5 Ecosystm predictions for Retail & eCommerce in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Retail & eCommerce Trends for 2021

- There Will Only be Omnichannel Retailers

The value of an omnichannel offer in Retail has become much clearer during the COVID-19 pandemic. Retailers that do not have the ability to deliver using the channel customers prefer will find it hard to compete. As the physical channel becomes less important new revenue opportunities will open up for businesses operating in adjacent market sectors – companies such as food and grocery wholesalers will increasingly sell direct to consumers, leveraging their existing online and distribution capabilities.

Most customers transact on mobile device – either a mobile phone or tablet. New capabilities will remove some of the barriers to using these mobile devices. For one, technologies such as Progressive Web Apps (PWA) and Accelerated Mobile Pages (AMP) will provide a better customer experience on mobile platforms than existing websites, while delivering a user experience at par or better than mobile apps. Also, as retailers become AI-enabled, machine learning engines will provide purchase recommendations through smartwatches or in-home, voice-enabled, smart devices.

- COVID-19 Will Continue to be an Influence Forcing Radical Shifts

In driving the economic recovery in 2021, we will see ‘glocal’ consumption – emphasis on local retailers and global players taking local actions to win the hearts and minds of local consumers. There will be significant actions within local communities to drive consumers to support local retailers. Location-based services (LBS) will be used extensively as consumers on the high street carry more LBS-enabled devices than ever before. Bluetooth beacon technology and proximity marketing will drive these efforts. Consumers will have to opt-in for this to work, so privacy and relationship management are also important to consider.

But people still want to “physically” browse, and design aesthetics of a store are still part of the attraction. In the next 18 months, the concept of virtual stores that are digital twins will take off, particularly in the holiday and Spring clearance sales. Innovators like Matterport can help local retailers gain a more global audience with a digital twin with a limited technological investment. At a minimum, Shopify or other intermediaries will be necessary for a digital shop window.

- The Industry will See Artificial Intelligence in Everything

AI will increase its impact on Retail with an uptake in two key areas.

- Customer interactions. Retail AI will use customer data to deliver much richer and targeted experiences. This may include the ability to get to a ‘segment of one’. Tools will include chatbots that are more functional and support for voice-based commerce using mobile and in-home edge devices. Also, in-store recognition of customers will become easier through enhanced device or facial recognition. Markets where privacy is less respected will lead in this area – other markets will also innovate to achieve the same outcomes without compromising privacy but will lag in their delivery. This mismatch of capability may allow early adopters to enter other geographic markets with competitive offers while meeting the privacy requirements of these markets.

- Supply chain and pricing capabilities. AI-based machine learning engines using both internal and increased sources of external data will replace traditional math-based forecasting and replenishment models. These engines will enable the identification of unexpected and unusual demand influencing factors, particularly from new sources of external data. Modelling of price elasticity using machine learning will be able to handle more complex models. Retailers using this capability will be in a better position to optimise their customer offers based on their pricing strategies. Supply chains will be re-engineered so products with high demand volatility are manufactured close to markets, and the procurement of products with stable demands will be cost-based.

- Distribution Woes Will Continue

Third party delivery platforms such as Wish and RoseGal are recruiting additional international non-Asian suppliers to expand their portfolios. Amazon and AliExpress are leaders here, but there are many niche eCommerce platforms taking up the slack due to the uneven distribution patterns from the ongoing economic situation. Expect to see a number of new entrants taking up niche spaces in the second half of 2021, sponsored by major retail product brands, to give Amazon a run for their money on a more local basis.

As the USPS continues to be under strain, delivery companies like FedEx in the US who partner with the USPS are already suffering from the USPS’s operational slowdown, in both their customer reputation and delivery speed. In 2021, COVID-19 – and workers’ unions – will continue to impact distribution activities. Increased spending in warehouse automation and new retail footprints such as dark stores will be seen to make up for worker shortfalls.

- China’s Retail Models Will Expand into Other Markets

China’s online businesses operate in a large domestic market that is comparatively free of international competitors. Given the scale of the domestic market, these online companies have been able to grow to become substantial businesses using advanced technologies. All the Chinese tech giants – among them Alibaba, ByteDance, DiDi Chuxing, and Tencent – are expanding internationally.

China’s rapidly recovering economy puts those businesses in a strong position to fund a competitive expansion into international markets using their domestic base, particularly with their Government’s promotion of the country’s tech sector. It is harder to impose restrictions on software-based businesses, unlike the approach that we have witnessed the US Government take for hardware companies such as Huawei – placing constraints on mobile phone components and operating systems.

These tech giants also have significant experience in a Big Data environment that provides little privacy protection, as well as leading-edge AI capabilities. While they will not be able to operate with the same freedom in global markets, and there will be other large challenges in translating Chinese experience to other markets – these tech players will be able to compete very effectively with incumbent global companies. Chinese companies also continue to raise capital from US stock exchanges with The Economist reporting Chinese listings have raised close to USD 17 billion since January 2020.

Organisations across the world are experimenting with what work model would work best for them in 2021. The last week saw several announcements that make it clear that irrespective of the model that becomes prevalent, remote working and the hybrid/blended work model are here to stay.

Remote Working Remains a Reality in 2021

The reduced demand for office space has led companies to re-think their lease renewals and physical space requirements. Deloitte has announced that it will close 4 of its 50 offices in the UK. The four offices in Gatwick, Liverpool, Nottingham and Southampton employ around 500 people who would be allowed to move to other locations or offered permanent remote working options. Ecosystm research finds that about a quarter of global organisations expect to reduce commercial office space in 2021.

Most organisations have introduced remote working options till the end of 2020 and beyond; while some others have made working from home a permanent option. Organisations will have to re-evaluate when employees can be realistically expected to come back into the office, and many will extend their work from home policy. Amazon recently announced the extension of its work from home policy till June 2021, from January 2021. Other organisations are expected to follow suit as the virus continues to be active in many countries.

The Experimentation will Continue

Companies will continue to enable seamless collaboration that spans across virtual and physical realms. But what will be important is to see how organisations can successfully incorporate a remote working culture across its different locations. Dropbox has announced a new ‘Virtual First’ remote working policy which includes features such as the ability for employees to decline unnecessary meetings, and a way to open source their learnings with the wider business community. Dropbox will still retain some physical spaces called Dropbox Studios, that will either be repurposed office space or entirely new spaces designed for meetings, group events and special offsites. The core collaboration hours will typically be between 9am-1pm, as employees are no longer expected to be in the same locations or time zones.

Ecosystm Principal Advisor Ravi Bhogaraju says, “Flexibility (Work from home or Office Anywhere) is a company strategy and not a tactic. It needs to be evaluated within the context of the overall strategy of the company, how it creates value and how technology and talent can help provide better customer experience.”

Another experiment that was announced last week was Dubai’s efforts to revive its tourism industry. Remote working has been associated with stress and organisations are increasingly having to monitor employee emotional well-being. To overcome this, Dubai is inviting overseas remote workers to expand their workplace and remote working environment. Dubai’s new remote working program is welcoming remote workers with a valid passport, health insurance, proof of employment and a minimum monthly salary of USD 5,000 to visit and work from Dubai. Programs such as these highlights the potential change in the work environment that we might witness.

Talking about the implications of such moves on organisations, Bhogaraju says, “having everybody as free agents within the network working from anywhere – without fully enabling the process and workflows across teams and the entire organisation – will require a lot more patching or coordination. It can impact the customer experience, and also opens up the firms to compliance, tax and regulatory risks if not carefully managed – especially when cross-border work is involved.”

With experiments such as these, it will become even more important for organisations to ensure that they have the right technology in place that can not only ensure seamless access to company resources irrespective of the location of the employees but also that IT and cybersecurity teams are not overburdened by the need to secure the endpoints and network.

Other Factors to Consider

While organisations must keep working on understanding the right model that will work for them, there are some other factors that they should consider.

Ecosystm Principal Advisor, Mike Zamora says, “what employees are learning is that their home expenses are increasing – E.g. electricity, connectivity costs, and even food where employers have previously provided snacks, beverages and lunches. Increasingly this needs to be addressed by Businesses in order to maintain a strong connection with employees. If not, when the economy recovers, companies might find their talent moving to other companies.”

“As some companies have limited return to the office, the Business and Employees have learned what is essential to be completed at the office. This is usually collaborative tasks which cannot effectively be done through remote collaboration. In addition, there are some specialised assets (special work rooms for some industries) which cannot cheaply or effectively be recreated in the home environment.”

Bhogaraju also cautions, “an advantage of working from anywhere is that it opens up talent pools that were not available or accessible to employers before. However, without knowing what kind of employees would be needed to sustain the strategy on a mid to long-term basis the hiring would probably result in poor fit to the working environment – and lead to a spike in attrition as the employees would not be able to cope with the working arrangement.”

Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021

The full findings and implications of The top 5 Future of Work Trends For 2021 are available for download from the Ecosystm platform. Signup for Free to download the report .

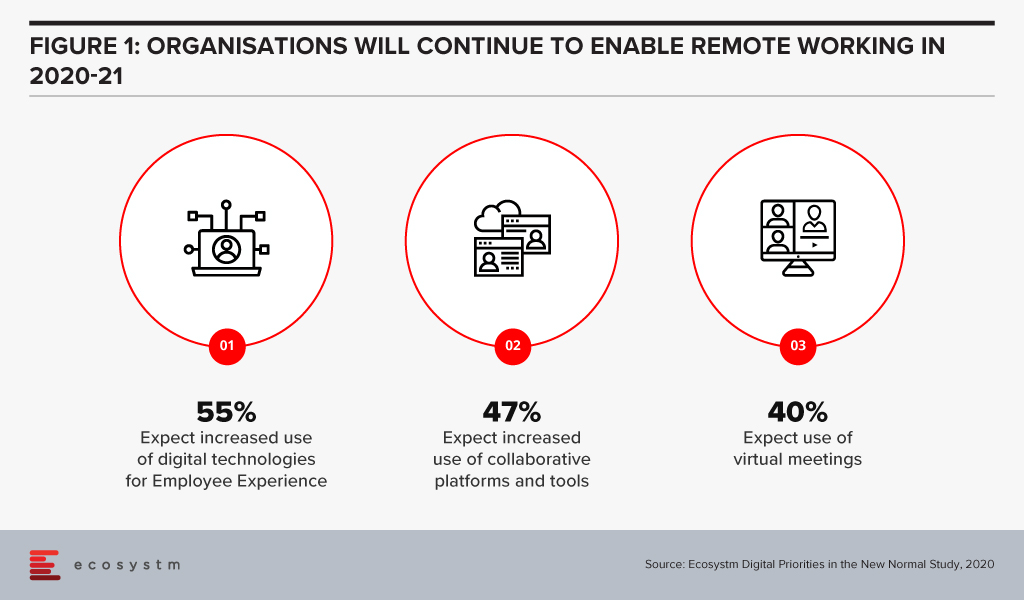

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.

India has clearly been a target market for Facebook due to the size of the country’s untapped market and the proportion of its younger population. It is estimated that nearly 45% of the population is below 25 years – a prime target for social media and eCommerce platforms. Facebook’s Free Basic program, launched in 2016 to introduce the potential of the Internet to the underprivileged and digitally unskilled, failed primarily because it did not have knowledge of the telecommunications market in India. Facebook returned to the India market the following year, this time in collaboration with Airtel, to launch Express WiFi, aimed at setting up WiFi hotspots to provide internet in public places – again aimed at India’s connectivity issues.

Making its largest foray into the Indian market yet, last week Facebook announced that it is investing US$5.7 billion in Jio Platforms – India’s largest telecom operator – for a 9.9% minority stake. Facebook makes its intentions very clear and is targeting the 60 million small and medium enterprises (SMEs) who can be the backbone of India’s growing digital economy. This includes a rather unorganised retail sector, which has had to adopt digital at breakneck speed following the Government’s earlier financial reforms, which impacted the smaller retailers, dependent primarily on cash transactions. Facebook is by no means the only global giant with an interest in India’s retail business – with Amazon and Walmart leading the way.

The JioMart and WhatsApp Pilot

Just days after the announcement, JioMart – an eCommerce venture also a wholly-owned subsidiary of Reliance Industries, like Jio Platforms – has launched a pilot in Mumbai which allows users to order groceries through WhatsApp. Customers can now place grocery orders through WhatsApp Business with JioMart reaching out to small-scale retailers and brick and mortar stores – or “Kirana stores” as they are referred to in India – to fulfil the order. More than 1,200 local stores have been engaged for this pilot. It currently does not include a digital payment option and invoices and alerts are sent through WhatsApp. Mukesh Ambani, Chairman and MD of Reliance Industries, says that the JioMart and WhatsApp collaboration has the potential to make it possible for around 30 million neighbourhood stores to transact digitally.

India Emerging as the New Battlefield

India is an important eCommerce market for global giants such as Facebook and Amazon, who have struggled with establishing a presence in China. Walmart has also set it its sights on India, with its recent acquisition of Flipkart. Ecosystm Principal Advisor, Kaushik Ghatak says. “India represents the final frontier, where the battle lines are being drawn, and the three are heading towards a collision path. Facebook’s recent move has just upped the game for Amazon and Walmart, as well as for the eCommerce and Fintech start-ups who have been eyeing this market.”

Amazon has been the early mover, establishing its eCommerce presence in India way back in 2013. Ghatak says, “From its initial marketplace approach of curating suppliers to start selling on its platform, Amazon graduated to offering its own delivery and fulfilment services, by establishing dozens of warehouses across India. This was to ensure the quality and timeliness of deliveries, upholding its ‘Fulfilment by Amazon’ (FBA) brand promise. There was a considerable cost though, in terms of time to ramp up and investments – with the associated asset risks. Also, reaching out to the diffused retail sector, with their non-existent or very low level of digitalisation, has been difficult for all the major eCommerce players such as Amazon and Flipkart. Jeff Bezos’ announcement of an additional investment of $ 1 billion, earlier this year, to digitise SMEs, allowing them to sell and operate online, is a step to extend its reach into this diffused retail market.”

JioMart’s model, according to Ghatak is in stark contrast to Amazon’s. “JioMart’s currently ongoing pilot in Mumbai is a classic B2C marketplace model, with little or no asset risk. The orders placed by the customers are routed to the nearest Kirana store based on stock availability, with the customers going to pick up the ordered items themselves at times.”

Ecosystm Principal Advisor, Niloy Mukherjee says, “Jio has unparalleled market access in India with reports showing north of 370 million subscribers. Even at a $1.7 per month revenue from such a huge number, one can get to a $7.5 billion-dollar annual business. But even this is dwarfed by what that subscriber base itself is worth – through the data it provides, the products that can be sold and so on. Similarly, WhatsApp will prove to be more important than Facebook in India, with more than 400 million users. Using WhatsApp to get Kirana stores to do delivery can be a true game-changer.”

Talking about how this competes with Amazon, Mukherjee says, “This can eat into the business of an Amazon and my guess is, it will be far more efficient. The proximity to the customer will allow multiple deliveries per day at short notice, and fresh produce guarantees – maybe even door returns if not satisfied – that would be hard to match. Given the traffic situation in large Indian cities, delivery logistics from a more distant source will always struggle to compete. This is one tip of a multi-pronged spear – there are obviously other products that can be contemplated, leading to additional revenues.”

The Possibilities Ahead

Mukherjee explains why he thinks Facebook invested in Jio Platforms, rather than just forging a collaboration model. “Clearly both parties want to tie the other down and make sure that this alliance is long term. And this possibly means revenue will be shared instead of the usual commission model. Also, the go-to-market implications can run to more than just the Indian market. WeChat Pay is huge in China but not really elsewhere. If this works, there could be a potential “WhatsApp Pay” in the rest of the world. For Jio who already dominates the telecom landscape in India, this deal is a step towards taking their earnings to a new level, above the top end of the telecom category – they can access profit pools available to hardly any telecom provider worldwide.”

At a time when a market entry for foreign players in India is getting tougher with increasing regulatory pressures, a tie-up with the biggest player in India is indeed a very promising step – for both Facebook and Reliance. “For Facebook, this is a great opportunity to take its dependence away from a primarily ad-driven revenue model. The digitalisation of the diffused retail sector in India will open up new revenue opportunities from its WhatsApp Business App, WhatsApp Business API, and WhatsApp Pay-UPI gateway (pending regulatory approval). There is a potential of revenues from a variety of marketing services, membership fees, customer management services, product sales, commissions on transactions, and software service fees,” says Ghatak.

Talking about the potential for Reliance Industries, Ghatak says, “The technology horsepower of Facebook will help propel them ahead of Fintech and eCommerce companies in India – challenging already established players such as Amazon and Flipkart, and the newbie start-ups. Ability to drive transactions and digital payments in the diffused retail sector will open up huge revenue opportunities that were largely untapped until now, with low asset risks. Also, this sector has traditionally operated on a cash-based model and the recent COVID-19 crisis has exposed how vulnerable the sector is with a limited view of the supply chain, and limited funding for working capital. Developing relationships with the millions of Kirana stores spread across India also gives the opportunity of revenue generation through supply chain financing – a largely ignored sub-sector until now.”

Mukherjee thinks that this alliance will challenge players such as Amazon and Amazon Pay, Google Pay and PayTM. Ghatak also thinks that eventually, Jio Platform will have to either choose between or integrate the best features of WhatsApp Pay and the Jio Money Merchant payment gateways.

However, Ghatak offers a word of caution on the downside risks as well. “Partnering with Facebook is a hugely ambitious game plan for Reliance Industries. The success of its plans will also depend on how well it is able to curate the suppliers who are responsible for the actual delivery. In a consumer-driven business model, trust and customer experience cannot be compromised. The low asset, high leverage and high reach model can unravel itself if the customer gets the short end of the stick, in this rush for eCommerce domination.”