The process of developing advertising campaigns is evolving with the increasing use of artificial intelligence (AI). Advertisers want to optimise the amount of data at their disposal to craft better campaigns and drive more impact. Since early 2020, there has been a real push to integrate AI to help measure the effectiveness of campaigns and where to allocate ad spend. This now goes beyond media targeting and includes planning, analytics and creative. AI can assist in pattern matching, tailoring messages through AI-enabled hyper-personalisation, and analysing traffic to communicate through pattern identification of best times and means of communication. AI is being used to create ad copy; and social media and online advertising platforms are starting to roll out tools that help advertisers create better ads.

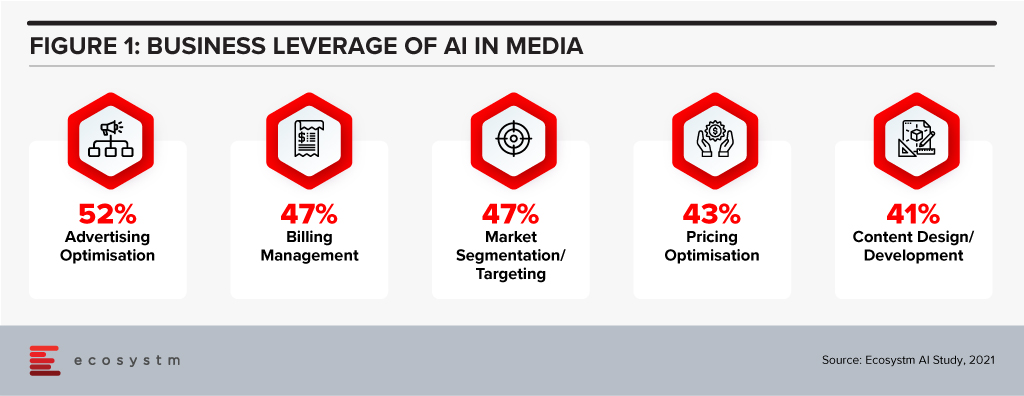

Ecosystm research shows that Media companies report optimisation, targeting and administrative functions such as billing are aided by AI use (Figure 1). However, the trend of Media companies leveraging AI for content design and media analysis is growing.

WPP Strengthening Tech Capabilities

This week, WPP announced the acquisition of Satalia, a UK-based company, who will consult with all WPP agencies globally to promote AI capabilities across the company and help shape the company’s AI strategy, including research and development, AI ethics, partnerships, talent and products.

It was announced that Satalia, whose clients include BT, DFS, DS Smith, PwC, Gigaclear, Tesco and Unilever, will join Wunderman Thompson Commerce to work on the technology division of their global eCommerce consultancy. Prior to the acquisition, Satalia had launched tools such as Satalia Workforce to automate work assignments; and Satalia Delivery, for automated delivery routes and schedules. The tools have been adopted by companies including PwC, DFS, Selecta and Australian supermarket chain Woolworths.

Like other global advertising organisations, WPP has been focused on expanding the experience, commerce and technology parts of the business, most recently acquiring Brazilian software engineering company DTI Digital in February. WPP also launched their own global data consultancy, Choreograph, in April. Choreograph is WPP’s newly formed global data products and technology company focused on helping brands activate new customer experiences by turning data into intelligence. This article from last year from the WPP CTO is an interesting read on their technology strategy, especially their move to cloud to enable their strategy.

Ethics & AI – The Right Focus

The acquisition of Satalia will give WPP and opportunity to evaluate important areas such as AI ethics, partnerships and talent which will be significantly important in the medium term. AI ethics in advertising is also a longer-term discussion. With AI and machine learning, the system learns patterns that help steer targeting towards audiences that are more likely to convert and identify the best places to get your message in front of these buyers. If done responsibly it should provide consumers with the ability to learn about and purchase relevant products and services. However, as we have recently discussed, AI has two main forms of bias – underrepresented data and developer bias – that also needs to be looked into.

Summary

The role of AI in the orchestration of the advertising process is developing rapidly. Media firms are adopting cloud platforms, making IP investments, and developing partnerships to build the support they can offer with their advertising services. The use of AI in advertising will help mature and season the process to be even more tailored to customer preferences.

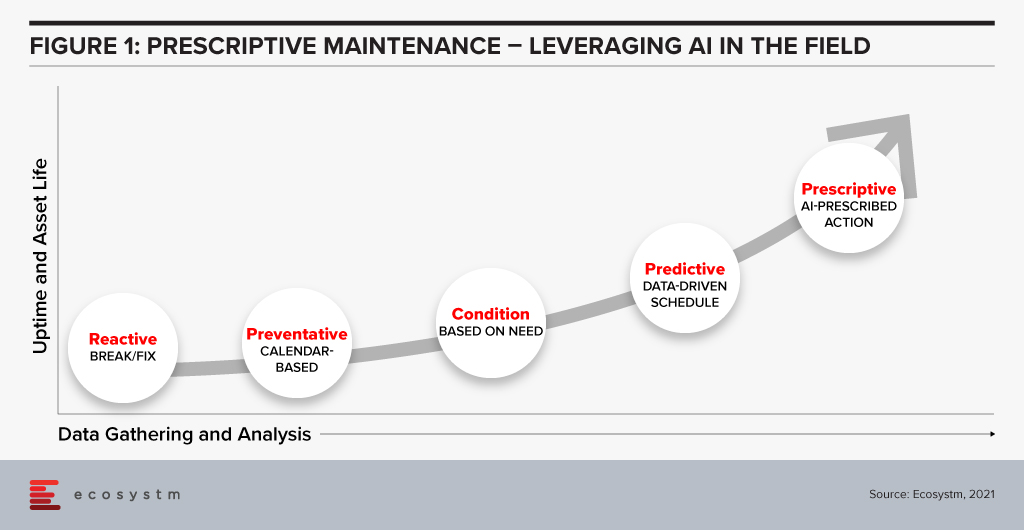

The rollout of 5G combined with edge computing in remote locations will change the way maintenance is carried out in the field. Historically, service teams performed maintenance either in a reactive fashion – fixing equipment when it broke – or using a preventative calendar-based approach. Neither of these methods is satisfactory, with the former being too late and resulting in failure while the latter is necessarily too early, resulting in excessive expenditure and downtime. The availability of connected sensors has allowed service teams to shift to condition monitoring without the need for taking equipment offline for inspections. The advent of analytics takes this approach further and has given us optimised scheduling in the form of predictive maintenance.

The next step is prescriptive maintenance in which AI can recommend action based on current and predicted condition according to expected usage or environmental circumstances. This could be as simple as alerting an operator to automatically ordering parts and scheduling multiple servicing tasks depending on forecasted production needs in the short term.

Prescriptive maintenance has only become possible with the advancement of AI and digital twin technology, but imminent improvements in connectivity and computing will take servicing to a new level. The rollout of 5G will give a boost to bandwidth, reduce latency, and increase the number of connections possible. Equipment in remote locations – such as transmission lines or machinery in resource industries – will benefit from the higher throughput of 5G connectivity, either as part of an operator’s network rollout or a private on-site deployment. Mobile machinery, particularly vehicles, which can include hundreds of sensors will no longer be required to wait until arrival before the condition can be assessed. Furthermore, vehicles equipped with external sensors can inspect stationary infrastructure as it passes by.

Edge computing – either carried out by miniature onboard devices or at smaller scale data centres embedded in 5G networks – ensure that intensive processing can be carried out closer to equipment than with a typical cloud environment. Bandwidth hungry applications, such as video and time series analysis, can be conducted with only meta data transmitted immediately and full archives uploaded with less urgency.

Prescriptive Maintenance with 5G and the Edge – Use Cases

- Transportation. Bridges built over railway lines equipped with high-speed cameras can monitor passing trains to inspect for damage. Data-intensive video analysis can be conducted on local devices for a rapid response while selected raw data can be uploaded to the cloud over 5G to improve inference models.

- Mining. Private 5G networks built-in remote sites can provide connectivity between fixed equipment, vehicles, drones, robotic dogs, workers, and remote operations centres. Autonomous haulage trucks can be monitored remotely and in the event of a breakdown, other vehicles can be automatically redirected to prevent dumping queues.

- Utilities. Emergency maintenance needs can be prioritised before extreme weather events based on meteorological forecasts and their impact on ageing parts. Machine learning can be used to understand location-specific effects of, for example, salt content in off-shore wind turbine cables. Early detection of turbine rotor cracks can recommend shutdown during high-load periods.

Data as an Asset

Effective prescriptive maintenance only becomes possible after the accumulation and integration of multiple data sources over an extended period. Inference models should understand both normal and abnormal equipment performance in various conditions, such as extreme weather, during incorrect operation, or when adjacent parts are degraded. For many smaller organisations or those deploying new equipment, the necessary volume of data will not be available without the assistance of equipment manufacturers. Moreover, even manufacturers will not have sufficient data on interaction with complementary equipment. This provides an opportunity for large operators to sell their own inference models as a new revenue stream. For example, an electrical grid operator in North America can partner with a similar, but smaller organisation in Europe to provide operational data and maintenance recommendations. Similarly, telecom providers, regional transportation providers, logistics companies, and smart cities will find industry players in other geographies that they do not naturally compete with.

Recommendations

- Employing multiple sensors. Baseline conditions and failure signatures are improved using machine learning based on feeds from multiple sensors, such as those that monitor vibration, sound, temperature, pressure, and humidity. The use of multiple sensors makes it possible to not only identify potential failure but also the reason for it and can therefore more accurately prescribe a solution to prevent an outage.

- Data assessment and integration. Prescriptive maintenance is most effective when multiple data sources are unified as inputs. Identify the location of these sources, such as ERP systems, time series on site, environmental data provided externally, or even in emails or on paper. A data fabric should be considered to ensure insights can be extracted from data no matter the environment it resides in.

- Automated action. Reduce the potential for human error or delay by automatically generating alerts and work orders for resource managers and service staff in the event of anomaly detection. Criticality measures should be adopted to help prioritise maintenance tasks and reduce alert noise.

An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.

Many years ago – back in 2003 – I spent some quality time with BMC at their global analyst event in Phoenix, Arizona and they introduced the concept of “Business Service Management” (BSM). I was immediately a convert – that businesses can focus their IT Service Management initiatives on the business and customer services that the technology supports. Businesses that use BSM can have an understanding of the impact and importance of technology systems and assets because there is a direct link between these assets and the systems they support. A router that supports a customer payment platform suddenly becomes a much higher priority than one that supports an employee expense platform.

But for most businesses, this promise was never delivered. Creating a BSM solution became a highly manual process – mapping processes, assets, and applications. Many businesses that undertook this challenge reported that by the time they had mapped their processes, the map was out of date – as processes had changed; assets had been retired, replaced, or upgraded; software had been moved to the cloud or new modules had been implemented; and architectures had changed. Effectively their BSM mapping was often a pointless task – sometimes only delivering value in the slow to change systems – back-end applications and infrastructure that delivers limited value and has a defined retirement date.

The Growth of Digital Business Strategies

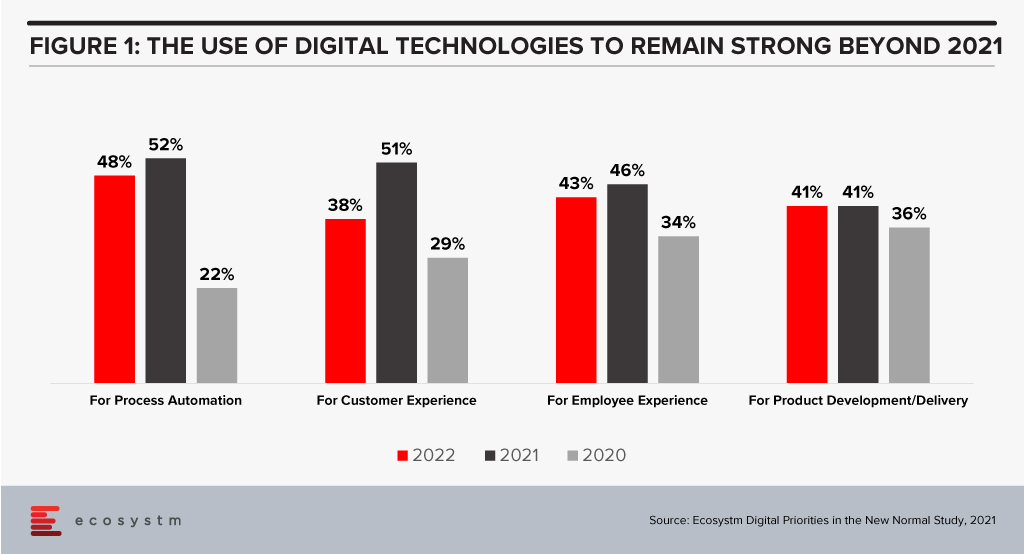

Our technology systems are becoming more important than ever as digital business strategies are realised and digital interactions with customers, employees, and partners significantly increase. Many businesses expect their digital investments to remain strong well into 2022 (Figure 1). More than ever, we need to understand the link between our tech systems and the business and customer services they support.

I recently had the opportunity to attend a briefing by ServiceNow regarding their new “AI-Powered Service Operations” that highlighted their service-aware CMDB – adding machine learning to their service mapping capabilities. The upgraded offering has the ability to map entire environments in hours or minutes – not months or weeks. And as a machine learning capability, it is only likely to get smarter – to learn from their customers’ use of the service and begin to recognise what applications, systems, and infrastructure are likely to be supporting each business service.

This heralds a new era in service management – one where the actual business and customer impact of outages is known immediately; where the decision to delay an upgrade or fix to a known problem can be made with a full understanding of the impacts. At one of my previous employers, email went down for about a week. It was finally attributed to an upgrade to network equipment that sat between the email system and the corporate network and the internet. The tech teams were scratching their heads for days as there was no documented link between this piece of hardware and the email system. The impact of the outage was certainly felt by the business – but had it happened at the end of the financial year, it could have impacted perhaps 10-20% of the business bookings as many deals came in at that time.

Being able to understand the link between infrastructure, cloud services, applications, databases, middleware and business processes and services is of huge value to every business – particularly as the percentage of business through digital channels and touchpoints continues to accelerate.

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

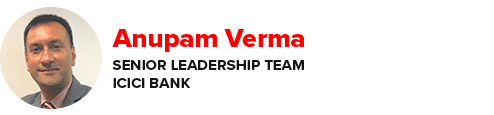

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Ecosystm RNx is an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform. In this edition, we rank the Top 10 Global AI & Automation Vendors.

If you are an End-User, you are realising that the right investments in Data & AI now will be the key to your future success. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are an AI & Automation Vendor, it’s an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Since the start of this millennium, no region has transformed as much as Asia. There has been significant paradigm shifts in the region and the perception that innovation starts in the US or in Europe and percolates through to Asia after a time lag, has been shattered. Asia is constantly demonstrating how dynamic, and technology-focused it is. This is getting fueled by the impact of the growing middle class on consumerism and the spirit of innovation across the region. The region has also seen a surge in new and upcoming business leaders who are embracing change and looking beyond success to creating impact.

What is Driving Innovation in Asia?

The “If you ain’t got it, build it” attitude. One of the key drivers of this shift is the age of the average population in Asia. According to the UN the Asia Pacific region has nearly 60% of the world’s youth population (between the age of 17-24). With youth comes dynamism, a desire to change the world, and innovation. As this age group enters the workforce, they will transform their lives and the companies they work in. They are already showing a spirit of agility when it comes to solving challenges – they will build what they do not have.

The Need to enable Foundational Shifts. The younger generation is more aware of environmental, social and governance issues that the world continues to face. Many of the countries in the region are emerging economies, where these issues become more apparent. COVID-19 has also inculcated an empathy in people and they are thinking of future success in terms of impact. The desire to enable foundational shifts is giving direction to the transformation journey in the region. The wonderful new paradigm that is the Digital Economy allows us to cut across all segments; and technology and its advancements has immense potential to create a more sustainable and inclusive future for the world.

Realising the Power of Momentum. The pandemic has caused major disruptions in the region. But every crisis also presents an opportunity to perhaps re-imagine a brighter world through a digital lens. The other thing that the pandemic has done is made people and organisations realise that to succeed they need to be open to change – and that momentum is important. As organisations had to pivot fast, they realised what I have been saying for years – we shouldn’t “let perfect get in the way of better”. This adaptability and the readiness to fail fast and learn from the mistakes early for eventual success, is leading to faster and more agile transformation journeys.

Where are we seeing the most impact?

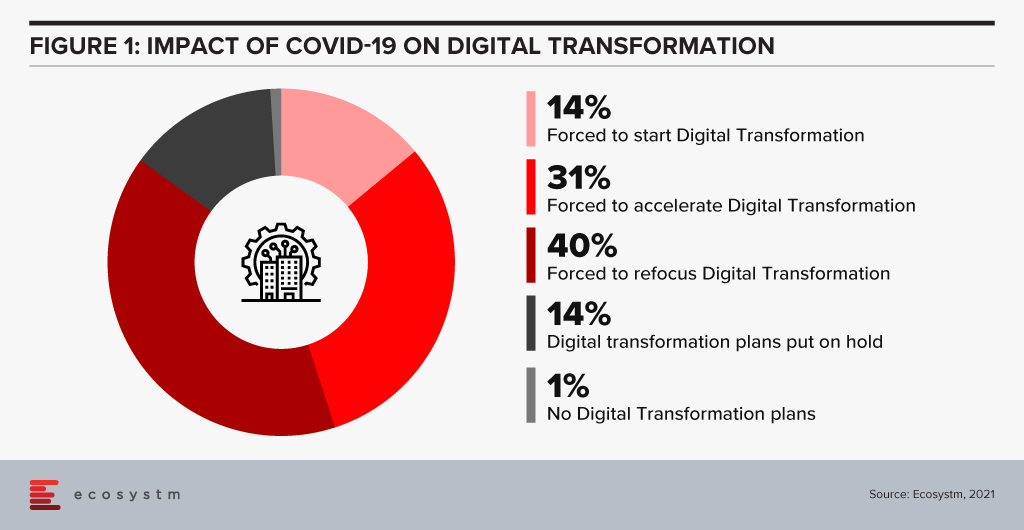

Industries are Transforming. There are industries such as Healthcare and Education that had to transform out of a necessity and urgency brought about by the COVID-19 pandemic. This has led to a greater impetus for change and optimism in these industries. These industries will continue to transform as governments focus significantly on creating “Social Safety Nets” and technology plays a key role in enabling critical services across Health, Education and Food Security. Then there are industries, such as the Financial Services and Retail, that had a strong customer focus and were well on their digital journeys before the pandemic. The pandemic boosted these efforts.

But these are not the only industries that are transforming. There are industries that have been impacted more than others. There are several instances of how organisations in these industries are demonstrating not only resilience but innovation. The Travel & Hospitality industry has had several such instances. As business models evolve the industry will see significant changes in digital channels to market, booking engines, corporate service offerings and others, as the overall Digital Strategy is overhauled.

Technologies are Evolving. Organisations depended on their tech partners to help them make the fast pivot required to survive and succeed in the last year – and tech companies have not disappointed. They have evolved their capabilities and continue to offer innovative solutions that can solve many of the ongoing business challenges that organisations face in their innovation journey. More and more technologies such as AI, machine learning, robotics, and digital twins are getting enmeshed together to offer better options for business growth, process efficiency and customer engagement. And the 5G rollouts will only accelerate that. The initial benefits being realized from early adoption of 5G has been for consumers. But there is a much bigger impact that is waiting to be realised as 5G empowers governments and businesses to make critical decisions at the edge.

Tech Start-ups are Flourishing. There are immense opportunities for technology start-ups to grow their market presence through innovative products and services. To succeed these companies need to have a strong investment roadmap; maintain a strong focus on customer engagement; and offer technology solutions that can fulfil the global needs of their customers. Technologies that promote efficiency and eliminate mundane tasks for humans are the need of the hour. However, as the reliance on technology-led transformation increases, tech vendors are becoming acutely aware that they cannot be best-in-class across the different technologies that an organisation will require to transform. Here is where having a robust partner ecosystem helps. Partnerships are bringing innovation to scale in Asia.

We can expect Asia to emerge as a powerhouse as businesses continue to innovate, embed technology in their product and service offerings – and as tech start-ups continue to support their innovation journeys.

Ecosystm CEO Amit Gupta gets face to face with Garrett Ilg, President Asia Pacific & Japan, Oracle to discuss the rise of the Asia Digital economies, the impact of the growing middle class on consumerism and the spirit of innovation across the region.

2020 was a strange year for retail. Businesses witnessed significant disruption to supply chains, significant swings in demand for products (toilet paper, puzzles, bikes etc!) and then sometimes incredible growth – as disposable income increased as many consumers are no longer taking expensive holidays. Overall, it was a mixed year, with many retailers closing down and others reporting record sales. The grocery sector boomed – with many restaurants and fast-food providers closed, sometimes the supermarkets were some of the few remaining open retailers.

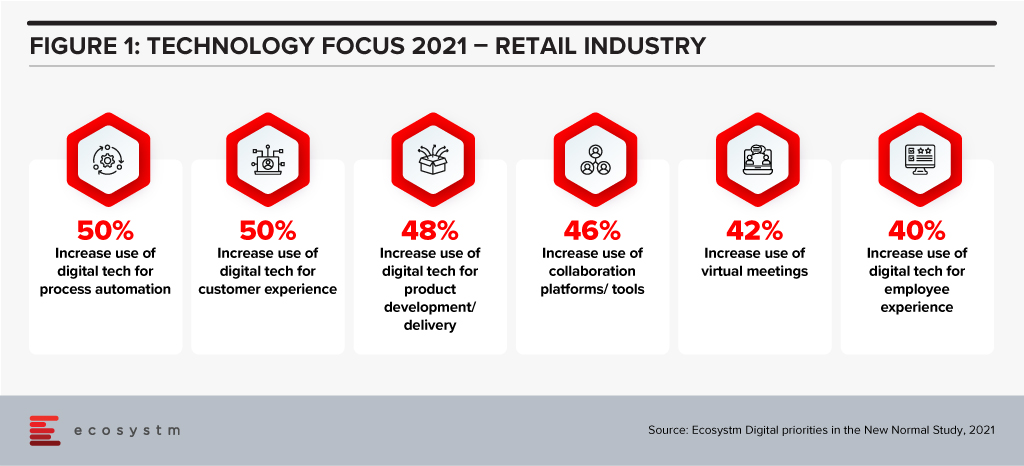

For many retailers, technology has become a key enabler to their transformation, survival and success (Figure 1).

Woolworths, Australia’s largest retailer, operates across the grocery, department store, drinks, and hospitality sectors. They hold a significant market share in most markets that they operate in. The company had a strong 2019/20 (financial year runs from July 2019 to June 2020) with sales up 8% – and in the first half of the 2020/21 financial year, sales were up nearly 11%. But the company is not resting on its laurels – one of its 6 key priorities is to “Accelerate Digital, eCom and convenience for our increasingly connected customers”. This requires more than just a deep technology investment, but a new culture, new skills, and new ways of working.

Woolworths’ Employee Focus

Woolworths has committed to invest AUD 50 million in upskilling and reskilling their employees in areas such as digital, data analytics, machine learning and robotics over the next three years. The move comes as a response to the way the Retail industry has been disrupted and the need to futureproof to stay relevant and successful. The training will be provided through online platforms and through collaborations with key learning institutions.

The supermarket giant is one of Australia’s largest private employers with more than 200,000 employees. Under Woolworths’ ‘Future of Work Fund’ their staff will be trained across supply chain, store operations, and support functions to enhance delivery and decision-making processes. The retailer will also create an online learning platform that will be accessible by Woolworths employees as well as by other retail and service companies to support the ecosystem. Woolworths has plans to upskill their staff in customer service abilities, leadership skills and agile ways of working.

Woolworths’ upskilling program will also support employees who were impacted by Woolworths planned closures of Minchinbury, Yennora, and Mulgrave distribution centres due in 2025.

Woolworths’ Tech Focus

Woolworths has been ramping up their technology investments and having tech-savvy employees will be key to their future success. In October 2020, Woolworths deployed micro automation technology to revamp their eCommerce facility in Melbourne to speed up the fulfilment of online grocery orders, and front and back-end operations. Woolworths also partnered with Dell Technologies in November 2020 to bring together their private and public cloud onto a single platform to improve mission-critical processes, applications and support inventory management operations across its retail stores.

Future of Work

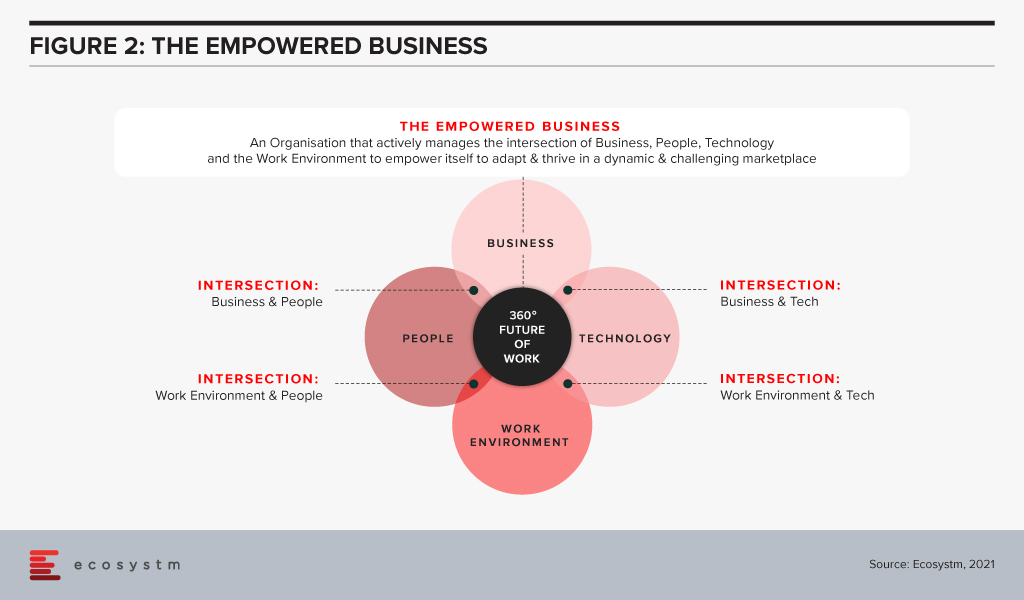

For many years, Ecosystm has been advising our clients to invest more in the skills of the business. Every business will be using more cloud next year than they are this year; they will suffer more cybersecurity incidents; they will use more AI and machine learning; they will automate more processes than are automated today. More of their customer engagements will be digital, and more insight will be required to drive better outcomes for customers and employees. This all needs new skills – or more people trained on skills that some in the business already understand. But too many businesses don’t train in advance – instead waiting for the need and paying external consultants or expensive new hires for their skills. Empowered businesses – ones that are creating a future-ready, agile business – invest in their people, work environment, business processes and technology to create an environment where innovation, transformation and business change are accepted and encouraged (Figure 2).

Empowered businesses can adapt to new challenges, new market conditions and respond to new competitive threats. By taking these steps to upskill and empower their employees, Woolworths is building towards empowering their own business for long term success.

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

BetterUp, a mobile-based professional learning and wellness platform that connects employees with career experts recently raised USD 125 million Series D funding backed by Salesforce Ventures, in partnership with ICONIQ Capital, Lightspeed Venture Partners, Threshold Ventures, and Sapphire Ventures among others, bringing the company’s valuation to USD 1.73 billion. Previously in 2012, the company had raised USD 43 million in venture capital funding with an additional Series B funding of USD 30 million in March 2018. The BetterUp platform combines behavioural science, AI, and human interaction to enhance employees’ personal and professional well-being. Recently, the company also revealed two new products – Identify AI, to help organisations determine the right people to invest in and the appropriate coaching needed through the use of AI; and Coaching Cloud for customised training for frontline, professional, and executive employees.

This announcement comes on the back of several wins for BetterUp. To boost employee performance and organisational growth NASA and the Federal Aviation Administration (FAA) partnered with BetterUp to support new ways of coaching and preparing a workforce for change. The world’s largest brewer, AB InBev has partnered with BetterUp to strengthen diversity and inclusion through BetterUp’s coaching platform.

The Need to Improve Employee Experience

The pandemic changed the working arrangement of millions of employees and industries across the globe who are now working remotely or in a hybrid environment.

Ecosystm Principal Advisor, Audrey William says, “Driving better employee experience (EX) should take centre stage this year with enterprises putting employees at the centre of all initiatives. We will see EX platforms get integrated further and deeper into workplace collaboration and HR applications. In the last 12 months, we have seen apps monitoring wellness and sleep, training and coaching, meditation, employee motivation, and so on sit within larger collaboration platforms such as Slack, Zoom, Microsoft, Cisco and others.”

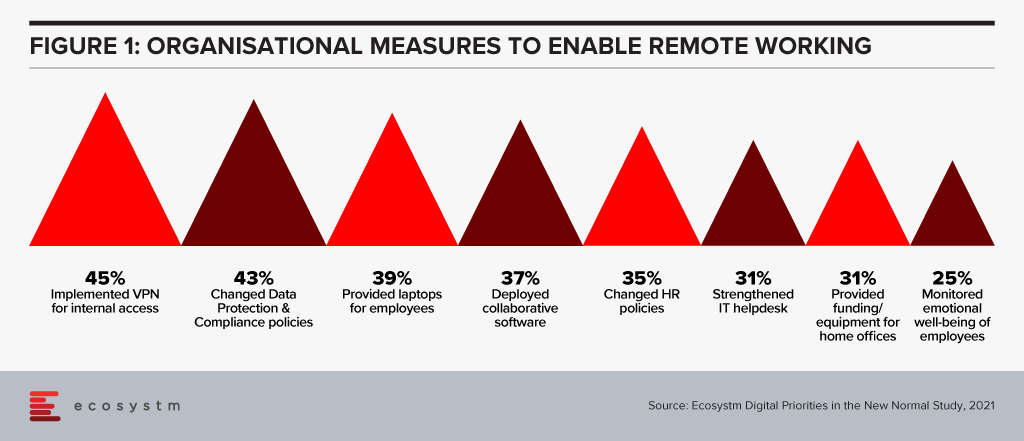

While the primary focus has been on optimising the work environment, it is time for organisations to start focusing on employee well-being. Ecosystm research shows that organisations implemented several measures to empower a remote workforce last year when the pandemic hit. But there was not enough focus on employee well-being (Figure 1).

William says, “A hybrid work environment may have negative impact on your employees. You may face issues such as longer working hours, employee burnout, lesser social engagements and connection, loneliness – and mental and emotional issues and depression”.

“Organisations that place an emphasis on the employees will see their revenues grow and also see less attrition. The more you invest in your people, the more you will get back in return. It is as simple as that! You can see that now in some organisations where employees are being given more flexibility, employers are not dictating how they should work, diversity and inclusion efforts have become mainstream, and efforts are being made to make employees feel like they belong.”

William adds, “However, Ecosystm research finds that organisations have gone back to putting customers and business growth first – losing focus on their employees. Only 27% of organisations globally say that they have improving employee experience as a key business priority in 2021. It is time for this culture and mindset to change. And solutions such as BetterUp can make a difference.”

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.