The White House has mandated federal agencies to conduct risk assessments on AI tools and appoint officers, including Chief Artificial Intelligence Officers (CAIOs), for oversight. This directive, led by the Office of Management and Budget (OMB), aims to modernise government AI adoption and promote responsible use. Agencies must integrate AI oversight into their core functions, ensuring safety, security, and ethical use. CAIOs will be tasked with assessing AI’s impact on civil rights and market competition. Agencies have until December 1, 2024, to address non-compliant AI uses, emphasising swift implementation.

How will this impact global AI adoption? Ecosystm analysts share their views.

Click here to download ‘Ensuring Ethical AI: US Federal Agencies’ New Mandate’ as a PDF.

The Larger Impact: Setting a Global Benchmark

This sets a potential global benchmark for AI governance, with the U.S. leading the way in responsible AI use, inspiring other nations to follow suit. The emphasis on transparency and accountability could boost public trust in AI applications worldwide.

The appointment of CAIOs across U.S. federal agencies marks a significant shift towards ethical AI development and application. Through mandated risk management practices, such as independent evaluations and real-world testing, the government recognises AI’s profound impact on rights, safety, and societal norms.

This isn’t merely a regulatory action; it’s a foundational shift towards embedding ethical and responsible AI at the heart of government operations. The balance struck between fostering innovation and ensuring public safety and rights protection is particularly noteworthy.

This initiative reflects a deep understanding of AI’s dual-edged nature – the potential to significantly benefit society, countered by its risks.

The Larger Impact: Blueprint for Risk Management

In what is likely a world first, AI brings together technology, legal, and policy leaders in a concerted effort to put guardrails around a new technology before a major disaster materialises. These efforts span from technology firms providing a form of legal assurance for use of their products (for example Microsoft’s Customer Copyright Commitment) to parliaments ratifying AI regulatory laws (such as the EU AI Act) to the current directive of installing AI accountability in US federal agencies just in the past few months.

It is universally accepted that AI needs risk management to be responsible and acceptable – installing an accountable C-suite role is another major step of AI risk mitigation.

This is an interesting move for three reasons:

- The balance of innovation versus governance and risk management.

- Accountability mandates for each agency’s use of AI in a public and transparent manner.

- Transparency mandates regarding AI use cases and technologies, including those that may impact safety or rights.

Impact on the Private Sector: Greater Accountability

AI Governance is one of the rare occasions where government action moves faster than private sector. While the immediate pressure is now on US federal agencies (and there are 438 of them) to identify and appoint CAIOs, the announcement sends a clear signal to the private sector.

Following hot on the heels of recent AI legislation steps, it puts AI governance straight into the Boardroom. The air is getting very thin for enterprises still in denial that AI governance has advanced to strategic importance. And unlike the CFC ban in the Eighties (the Montreal protocol likely set the record for concerted global action) this time the technology providers are fully onboard.

There’s no excuse for delaying the acceleration of AI governance and establishing accountability for AI within organisations.

Impact on Tech Providers: More Engagement Opportunities

Technology vendors are poised to benefit from the medium to long-term acceleration of AI investment, especially those based in the U.S., given government agencies’ preferences for local sourcing.

In the short term, our advice to technology vendors and service partners is to actively engage with CAIOs in client agencies to identify existing AI usage in their tools and platforms, as well as algorithms implemented by consultants and service partners.

Once AI guardrails are established within agencies, tech providers and service partners can expedite investments by determining which of their platforms, tools, or capabilities comply with specific guardrails and which do not.

Impact on SE Asia: Promoting a Digital Innovation Hub

By 2030, Southeast Asia is poised to emerge as the world’s fourth-largest economy – much of that growth will be propelled by the adoption of AI and other emerging technologies.

The projected economic growth presents both challenges and opportunities, emphasizing the urgency for regional nations to enhance their AI governance frameworks and stay competitive with international standards. This initiative highlights the critical role of AI integration for private sector businesses in Southeast Asia, urging organizations to proactively address AI’s regulatory and ethical complexities. Furthermore, it has the potential to stimulate cross-border collaborations in AI governance and innovation, bridging the U.S., Southeast Asian nations, and the private sector.

It underscores the global interconnectedness of AI policy and its impact on regional economies and business practices.

By leading with a strategic approach to AI, the U.S. sets an example for Southeast Asia and the global business community to reevaluate their AI strategies, fostering a more unified and responsible global AI ecosystem.

The Risks

U.S. government agencies face the challenge of sourcing experts in technology, legal frameworks, risk management, privacy regulations, civil rights, and security, while also identifying ongoing AI initiatives. Establishing a unified definition of AI and cataloguing processes involving ML, algorithms, or GenAI is essential, given AI’s integral role in organisational processes over the past two decades.

However, there’s a risk that focusing on AI governance may hinder adoption.

The role should prioritise establishing AI guardrails to expedite compliant initiatives while flagging those needing oversight. While these guardrails will facilitate “safe AI” investments, the documentation process could potentially delay progress.

The initiative also echoes a 20th-century mindset for a 21st-century dilemma. Hiring leaders and forming teams feel like a traditional approach. Today, organisations can increase productivity by considering AI and automation as initial solutions. Investing more time upfront to discover initiatives, set guardrails, and implement AI decision-making processes could significantly improve CAIO effectiveness from the outset.

Microsoft’s intention to invest a further USD 10B in OpenAI – the owner of ChatGPT and Dall-E2 confirms what we said in the Ecosystm Predicts – Cloud will be replaced by AI as the right transformation goal. Microsoft has already invested an estimated USD 3B in the company since 2019. Let’s take a look at what this means to the tech industry.

Implications for OpenAI & Microsoft

OpenAI’s tools – such as ChatGPT and the image engine Dell-E2 – require significant processing power to operate, particularly as they move beyond beta programs and offer services at scale. In a single week in December, the company moved past 1 million users for ChatGPT alone. The company must be burning through cash at a significant rate. This means they need significant funding to keep the lights on, particularly as the capability of the product continues to improve and the amount of data, images and content it trawls continues to expand. ChatGPT is being talked about as one of the most revolutionary tech capabilities of the decade – but it will be all for nothing if the company doesn’t have the resources to continue to operate!

This is huge for Microsoft! Much has already been discussed about the opportunity for Microsoft to compete with Google more effectively for search-related advertising dollars. But every product and service that Microsoft develops can be enriched and improved by ChatGPT:

- A spreadsheet tool that automatically categorises data and extract insight

- A word processing tool that creates content automatically

- A CRM that creates custom offers for every individual customer based on their current circumstances

- A collaboration tool that gets answers to questions before they are even asked and acts on the insights and analytics that it needs to drive the right customer and business outcomes

- A presentation tool that creates slides with compelling storylines based on the needs of specific audiences

- LinkedIn providing the insights users need to achieve their outcomes

- A cloud-based AI engine that can be embedded into any process or application through a simple API call (this already exists!)

How Microsoft chooses to monetise these opportunities is up to the company – but the investment certainly puts Microsoft in the box seat to monetise the AI services through their own products while also taking a cut from other ways that OpenAI monetises their services.

Impact on Microsoft’s competitors

Microsoft’s investment in OpenAI will accelerate the rate of AI development and adoption. As we move into the AI era, everything will change. New business opportunities will emerge, and traditional ones will disappear. Markets will be created and destroyed. Microsoft’s investment is an attempt for the company to end up on the right side of this equation. But the other existing (and yet to be created) AI businesses won’t just give up. The Microsoft investment will create a greater urgency for Google, Apple, and others to accelerate their AI capabilities and investments. And we will see investments in OpenAI’s competitors, such as Stability AI (which raised USD 101M in October 2022).

What will change for enterprises?

Too many businesses have put “the cloud” at the centre of their transformation strategies – as if being in the cloud is an achievement in itself. While cloud made applications and processes are easier to transform (and sometimes cheaper to deploy and run), for many businesses, they have just modernised their legacy end-to-end business processes on a better platform. True transformation happens when businesses realise that their processes only existed because they of lack of human or technology capacity to treat every customer and employee as an individual, to determine their specific needs and to deliver a custom solution for them. Not to mention the huge cost of creating unique processes for every customer! But AI does this.

AI engines have the ability to make businesses completely rethink their entire application stack. They have the ability to deliver unique outcomes for every customer. Businesses need to have AI as their transformation goal – where they put intelligence at the centre of every transformation, they will make different decisions and drive better customer and business outcomes. But once again, delivering this will take significant processing power and access to huge amounts of content and data.

The Burning Question: Who owns the outcome of AI?

In the end, ChatGPT only knows what it knows – and the content that it learns from is likely to have been created by someone (ideally – as we don’t want AI to learn from bad AI!). What we don’t really understand is the unintended consequences of commercialising AI. Will content creators be less willing to share their content? Will we see the emergence of many more walled content gardens? Will blockchain and even NFTs emerge as a way of protecting and proving origin? Will legislation protect content creators or AI engines? If everyone is using AI to create content, will all content start to look more similar (as this will be the stage that the AI is learning from content created by AI)? And perhaps the biggest question of all – where does the human stop and the machine start?

These questions will need answers and they are not going to be answered in advance. Whatever the answers might be, we are definitely at the beginning of the next big shift in human-technology relations. Microsoft wants to accelerate this shift. As a technology analyst, 2023 just got a lot more interesting!

Customer experience (CX) is an integral part of a brand today – and excellence in CX is a moving target (think how tools such as ChatGPT can revolutionise communications and CX). Organisations will find themselves aiming for personalised CX across channels of preference, with convenience, empathy, and speed at the core.

Here are the top 5 trends for the Experience Economy for 2023 according to Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy.

- Organisations Will Focus on Building a “One CX Workforce”

- AI Will Lead Voice of Customer Programs

- Metadata Will Become Important

- The Conversational AI Market Will Mature

- Organisations Will Go Back to Focusing on Web Experience

Read on for more details.

Download Ecosystm Predicts: The Top 5 Trends for the Experience Economy in 2023 as a PDF

In the rush towards digital transformation, individual lines of business in organisations, have built up collections of unconnected systems, each generating a diversity of data. While these systems are suitable for rapidly launching services and are aimed at solving individual challenges, digital enterprises will need to take a platform approach to unlock the full value of the data they generate.

Data-driven enterprises can increase revenue and shift to higher margin offerings through personalisation tools, such as recommendation engines and dynamic pricing. Cost cutting can be achieved with predictive maintenance that relies on streaming sensor data integrated with external data sources. Increasingly, advanced organisations will monetise their integrated data by providing insights as a service.

Digital enterprises face new challenges – growing complexity, data explosion, and skills gap.

Here are 5 ways in which IT teams can mitigate these challenges.

- Data & AI projects must focus on data access. When the organisation can unify data and transmit it securely wherever it needs to, it will be ready to begin developing applications that utilise machine learning, deep learning, and AI.

- Transformation requires a hybrid cloud platform. Hybrid cloud provides the ability to place each workload in an environment that makes the most sense for the business, while still reaping the benefits of a unified platform.

- Application modernisation unlocks future value. The importance of delivering better experiences to internal and external stakeholders has not gone down; new experiences need modern applications.

- Data management needs to be unified and automated. Digital transformation initiatives result in ever-expanding technology estates and growing volumes of data that cannot be managed with manual processes.

- Cyber strategy should be Zero Trust – backed by the right technologies. Organisations have to build Digital Trust with privacy, protection, and compliance at the core. The Zero Trust strategy should be backed by automated identity governance, robust access and management policies, and least privilege.

Read below to find out more.

Download The Future of Business: 5 Ways IT Teams Can Help Unlock the Value of Data as a PDF

In recent years, businesses have faced significant disruptions. Organisations are challenged on multiple fronts – such as the continuing supply chain disruptions; an ongoing energy crisis that has led to a strong focus on sustainability; economic uncertainty; skills shortage; and increased competition from digitally native businesses. The challenge today is to build intelligent, data-driven, and agile businesses that can respond to the many changes that lie ahead.

Leading organisations are evaluating ways to empower the entire business with data, machine learning, automation, and AI to build agile, innovative, and customer-focused businesses.

Here are 7 steps that will help you deliver business value with data and AI:

- Understand the problems that need solutions. Before an organisation sets out on its data, automation, and AI journey, it is important to evaluate what it wants to achieve. This requires an engagement with the Tech/Data Teams to discuss the challenges it is trying to resolve.

- Map out a data strategy framework. Perhaps the most important part of this strategy are the data governance principles – or a new automated governance to enforce policies and rules automatically and consistently across data on any cloud.

- Industrialise data management & AI technologies. The cumulation of many smart, data-driven initiatives will ultimately see the need for a unified enterprise approach to data management, AI, and automation.

- Recognise the skills gap – and start closing it today. There is a real skills gap when it comes to the ability to identify and solve data-centric issues. Many businesses today turn to technology and business consultants and system integrators to help them solve the skills challenge.

- Re-start the data journey with a pilot. Real-world pilots help generate data and insights to build a business case to scale capabilities.

- Automate the outcomes. Modern applications have made it easier to automate actions based on insights. APIs let systems integrate with each other, share data, and trigger processes; and RPA helps businesses automate across applications and platforms.

- Learn and improve. Intelligent automation tools and adaptive AI/machine learning solutions exist today. What organisations need to do is to apply the learnings for continuous improvements.

Find more insights below.

Download The Future of Business: 7 Steps to Delivering Business Value with Data & AI as a PDF

Organisations are aware that they must reinvent themselves continually to remain relevant to their customers, engage their employees and be profitable – and yet they find it challenging to live with the present pace of change.

Achieving a new equilibrium requires organisations to have the right skills; execute effectively every day; drive the best priorities for change; and refresh and renew their capabilities. Organisations will require adaptable people, processes, technologies and data to position themselves to harness the future.

Here are 5 insights that will help you shape your change strategy.

- Productivity persists as a priority. Recruit, train and retain essential skills and look for partners who are leaders in their sphere to provide the other, less differentiating capabilities.

- Digital debt is not only technical. Continuous reinvention requires the identification of an organisation’s digital debt, and evolution of the processes, technology and data to reduce legacy constraints. This will support the reuse and refactoring of existing capabilities in new ways and the introduction of new capabilities.

- Both operations and the customer matter. Investment in both the customer experience and operational efficiency needs to be balanced keeping in mind organisations’ limited available resources.

- Technology must be adaptive. Establishing isolation zones between components to minimise the impact of changing components is becoming key to the rapid delivery of value.

- Tomorrow’s excellence will be driven by iterative reinvention. Iterative innovation will become easier with the adoption of intelligent automation and adaptive AI/ machine learning. However, not only will this require a debt-free technical environment, it will also need an adaptive and scalable infrastructure.

More insights are below.

Click here to download – The Future of Business: 5 Ways to Shape Your Change Strategy

In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

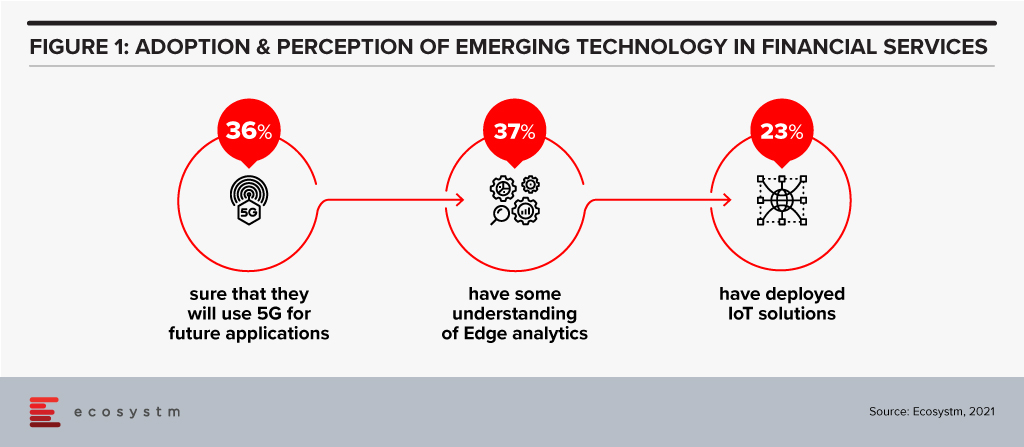

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

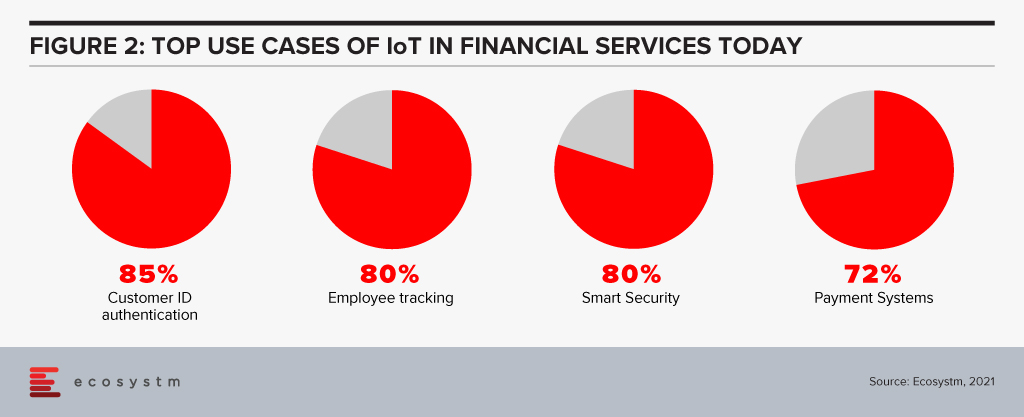

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.