During this pandemic, shoppers who have experienced new forms of delivery direct from manufacturers, curbside pickup and eCommerce via wholesalers will likely adopt at least some of those habits in their everyday lives in future. Why? Ease of use, convenience, hygiene and guaranteed product availability, all factor into this shift.

Most retailers were not ready for a rush of online shoppers or structured for a Buy Online Pickup In-Store (BOPIS) model. They struggled to pivot with their own delivery set-up, both in terms of staffing and infrastructure. Delivery slots were rare and required midnight countdowns to the next day’s set of slots with online confusion. Many grocery retailers initially stopped curbside deliveries due to lack of resources for fulfilment in store.

And for SME retail outlets, square meterage limits the number of customers inside at a time and social distancing measures limit handling curbside pickups. Supply chain issues and inventory management also played a role, with local inventory visibility a real factor in determining order placement.

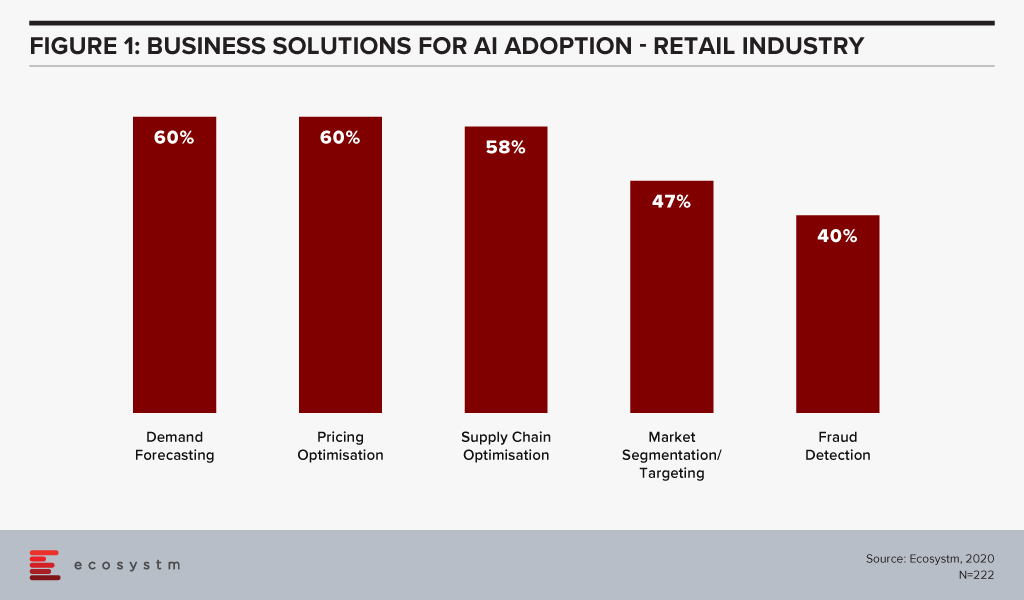

As shown in Figure 1, Ecosystm research shows that supply chain optimisation and demand forecasting are both listed in the top five business solutions that firms in retail consider using AI for.

Hybrid Operations

How can retail firms, with both perishable and non-perishable goods, use AI, automation and other infrastructural investments to develop the near-term future of curbside retail? We suggest the use of hybrid operations.

Retailers are starting to look at developing hybrid operations: part retail space and part fulfilment centre. Allowing customers to enter only part of the store or pulling inventory off the shelf to a different part of the store for deliveries expands reach and allows fulfilment without decreasing the experience for customers who prefer to shop in-store. But it requires an IT infrastructural upgrade to make it happen.

In the medium term, leveraging automation will be one of the ways supermarkets and other retailers evolve their models to remain viable and profitable.

What can be automated?

Let’s define these automated delivery infrastructural options:

- Curbside pickup is the endpoint of manual sorting and selecting operation, and then the goods are ready for pickup with a vehicle outside the store.

- Micro-fulfilment centres are locations with a logistics company to maximise space in traditional stores and expand online options. Micro-fulfillment helps retailers solve the labour and last-mile costs conundrum as it brings the goods closer to the end customer.

- Dark stores are traditional retail stores that have been converted to local fulfilment centres.

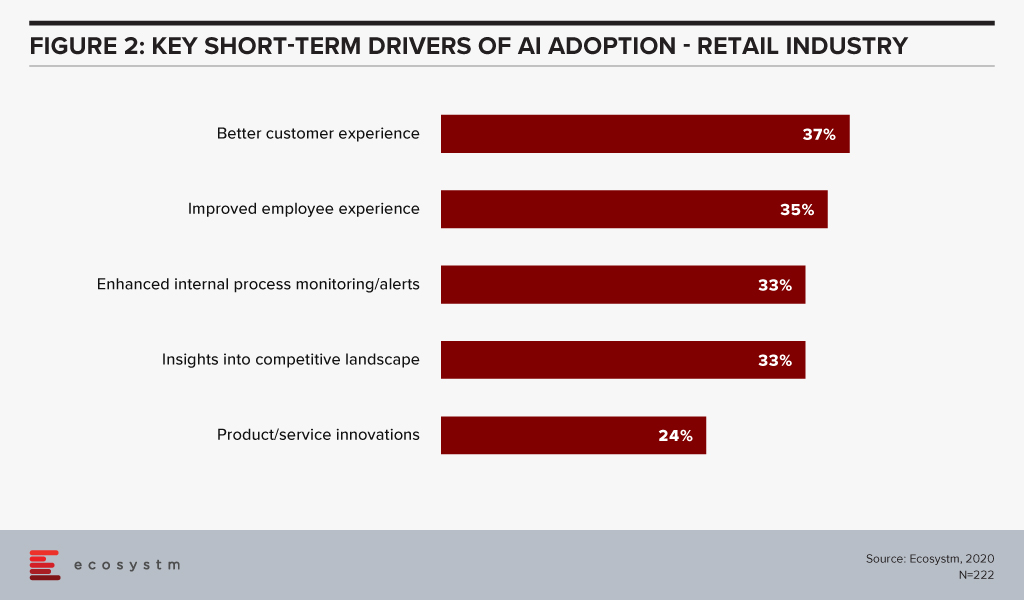

None of these concepts are new, but as alternatives to traditional retail in the current environment, they are viable options. Having curbside pickup, micro-fulfilment centres or dark stores help ease transitions towards traditional operations while still protecting customers and employees. Figure 2 from our AI research at Ecosystm shows that better customer experience is a top short-term driver in retail AI deployment.

Restructuring the three factors of production

By using AI and inventory automation, retailers can focus on rightsizing the three factors of production:

- Labour. Reducing the staffing cost to produce the same volume of sales.

- Inventory. Giving the retailer the tools to replenish stores with more specific information on consumption and wastage.

- Physical Space. Enabling dynamic adjustments of product display allows alignment more closely with sales patterns within the physical store. This can be adjusted for within the week and even by day.

Retailers are looking to speed delivery by dispersing inventory closer to customers. They use automation to build more compact distribution operations by using hybrid operations.

Designing hybrid operations with technology

To develop a hybrid operation, what IT infrastructural elements need to be addressed?

Store layout. Hybrid operations should drive efficiency in delivery, based on time and motion, but without impacting in-store shoppers. Order pulling should structurally happen towards the back of the store, both for efficiency and ease of access to move goods. To maintain product quality, networks and sensors need to be installed.

Process training. Hybrid operations are system dependent. Skilled staff who pick items for delivery require systems that implement standard procedures for selection and bundling. Processes require system automation for checks to mitigate high levels of wastage. Operational implementations need to include systems that manage cut-off times and back-room management.

Order management and inventory management systems. Analytics help retailers to stock popular items. They can then ensure these are easily accessible both front and back of the store. Retailers need to prioritise inventory management to make the most of inventory visibility across hybrid operations. SKUs and barcodes should be simple, consistent and unique.

Learning from innovative IT models in Grocery

In California, Sysco expanded its direct-to-the-consumer pop-up format to help give shoppers in the area access to fresh grocery items. Whole Foods expanded its dark store concept in Texas in combination with Amazon. Aldi in the UK rolled out an online program to distribute grocery parcels to consumers who were self-isolating, with 22 different goods in the bundle including toilet paper and anti-bacterial gel.

Market ownership will come from a better shopping experience. Streamlining processes and automating order fulfilment using IT in a hybrid retail operation could help lessen the financial and logistical strain of maintaining social distancing and proper hygiene measures.

Focused on Digital Transformation? It is now more about how fast you can react to market shifts by using specific infrastructural resources.

This period is about digital acceleration. Cloud automation, artificial intelligence (AI), robotic process automation (RPA) and machine learning are all means to accelerate using infrastructure scalability.

Digital acceleration addresses the pace of change

Enterprises are searching to find unique and innovative ways to leverage cloud infrastructures with automation and intelligence. This is both to modernise and to optimise business processes while decreasing expenses. The speed at which the economic landscape has changed during the pandemic has removed debates on cloud usage:

- Remote work from home (WFH) with the need for video conferencing and collaboration tools has been supported by cloud

- Record amounts of SPAM and hacking attempts during the pandemic have leveraged cloud implementations for key security controls

- Tracking apps and classification and encryption of personally identifiable information (PII) via mobile devices are using cloud technology for greater automation and use of AI

Bandwidth and capacity are needed now. The ability to pivot, turn and shoot forward is critical to surviving and thriving in today’s radically changed marketplace. Cloud enablement can deliver enhanced customer experiences, monetise data assets, and can create new revenue streams by enabling new business models.

Cloud enablement explained

Digital acceleration is driven by cloud enablement, amplifying the enterprise value in the infrastructural investment.

Cloud enablement is an ongoing operational model. It incorporates orchestration, correctly organising teams, and a shift away from thinking only about platforms. The cloud platform is now a launchpad, not the main choice that has to be made. Orchestration is around the business and the business model, not just the technology.

Creating a cloud enablement strategic vision can identify where you need to go. It can provide the necessary requirements for expertise along the journey and deliver rapid, meaningful automation services engagements to deliver unbreakable delivery pipelines and agile cloud operations.

But this also involves managing and adjusting on the fly. Initial platform decisions, rolling out countless configuration changes and adjusting to new cloud investments make cloud enablement a tricky road to manage. Enterprises need to be cloud-smart towards their own business model and their strategy. Whatever configuration (on-prem, hybrid, private, public) combination works is dependent on many factors, including industry, size of the enterprise, employee resources and location.

The goal is implementing secure, flexible, scalable, and cost-effective cloud solutions. To do this requires regular cloud enablement audits as to the state of play and measuring successes.

Building and maintaining modern IT

Modern IT is hybrid and all the pieces that collect and manage the data need to be properly and securely managed. Just as technological (and economic) disruption has generally led to automation and the elimination of outdated processes, it has also always created new ideas and innovations.

One way to make your organisation more data-centric and digital is to selectively invest in those technology choices that are most adaptable and flexible to business needs. Data is the most strategic of assets and can be empowered by increasingly sophisticated intelligent operations. Process automation and AI help put that data to work by adding valued intelligence and encapsulating information.

Hybrid cloud coordination automated

Hybrid cloud coordination is an increasing enterprise demand, particularly in the Asia Pacific region, leading to enhanced data centres with joint customer support like the new Tokyo interconnection with Oracle and Microsoft Azure. The key to successfully monitoring a distributed cloud ecosystem is not only in gathering data on usage; it’s about knowing which questions to ask to make it more efficient and effective. This includes tracking connectivity speeds, creating common technical support and using single sign-on for better security. Here both AI and automation can help.

In Asia Pacific, the multi-cloud theme is being promoted heavily among integration providers with solutions that can plug into multiple clouds with virtual machine usage. Enterprises value enabled automated orchestration between cloud platforms. There will be a continued need for integrated tools across public and private clouds. This includes advanced analytics and AI as important aspects of an IT infrastructural investment.

Your choice of vendor for AI & Automation

In my opinion, AWS has the broadest AI service capabilities in the Asia Pacific cloud/ AI space, when compared to Microsoft, Google, and IBM. AWS provides users with pre-trained AI services for computer vision, language, recommendations, and forecasting to build, train, and deploy machine learning models at scale.

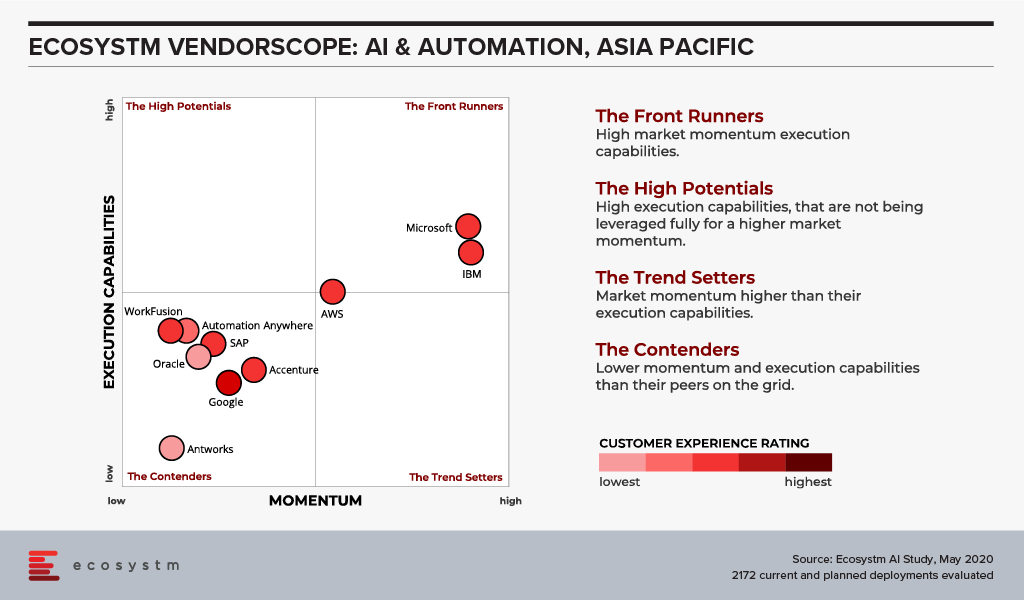

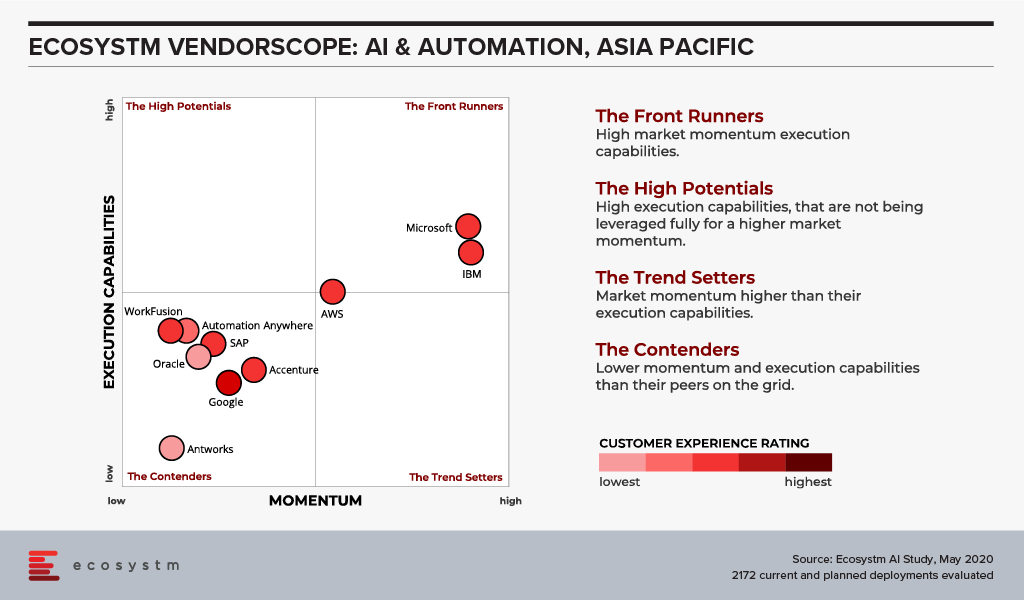

The Ecosystm VendorScope (Figure 1) rates the leading AI & Automation vendors in Asia Pacific based solely on quantifiable feedback from those who actually procure technology. It becomes clear from the responses that many organisations still start their AI journey through Automation.

Most organisations understand the importance of leveraging AI to gain competitive advantage. But they do not necessarily know where to start. The secret is that AI is about intelligent process automation, and the firms who understand this are not the ones automating tasks. The use of RPA with vendors such as Antworks, WorkFusion, Arago and Automation Anywhere, leverages automated reasoning using knowledge-based problem-solving engines. These vendors add RPA to AI, not the other way around.

And domain-specific service providers have been creating the synergies for enterprises to link intelligent automation software and industry knowledge to create the necessary end-to-end workflows. An innate understanding of the specific business process is key to leveraging intelligent automation.

Focusing on developing a modern data supply chain process, with actionable analytics insights built into the infrastructure, can aid the development of self-service business intelligence capabilities along with visual data discovery solutions.

Cloud enablement solutions generate maximum business value by enabling IT with scalability and flexibility. This can reduce maintenance and security costs. A focus on cloud intelligence and scalability allows IT departments to concentrate more on innovative solutions, insights and systems that drive significant business growth. Now is the time, and speed is of the essence.

Ecosystm Vendorscope: AI & Automation

Sign up for Free to download the Ecosystm Vendorscope: AI & Automation report.

I’m really excited to launch our AI and Automation VendorScope! This new tool can help technology buyers understand which vendors are offering an exceptional customer experience, which ones have momentum and which are executing and delivering on their promised capabilities. The positioning of vendors in Ecosystm VendorScopes is independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

The Evolution of the AI Market

The AI market has evolved significantly over the past few years. It has gone from a niche, poorly understood technology, to a mainstream one. Projects have moved from large, complex, moonshot-style “change the world” initiatives to small, focused capabilities that look to deliver value quickly. And they have moved from primarily internally focused projects to delivering value to customers and partners. Even the current pandemic is changing the lens of AI projects as 38% of the companies we benchmarked in Asia Pacific in the Ecosystm Business Pulse Study, are recalibrating their AI models for the significant change in trading conditions and customer circumstances.

Automation has changed too – from a heavily fragmented market with many specific – and often very simple tools – to comprehensive suites of automation capabilities. We are also beginning to see the use of machine learning within the automation platforms as this market matures and chases after the bigger automation opportunities where processes are not only simplified but removed through intelligent automation.

Cloud Platform Providers Continue to Lead

But what has changed little over the years is the dominance of the big cloud providers as the AI leaders. Azure, IBM and AWS continue to dominate customer mentions and intentions. And it is in customer mentions that the frontrunners in the VendorScope – Microsoft and IBM – set themselves apart. Not only are they important players today – but existing customers AND non-customers plan to use their services over the next 12-24 months. This gives them the market momentum over the other players. Even AWS and Google – the other two public cloud giants – who also have strong AI offerings – didn’t see the same proportions of customers and prospects planning to use their AI platforms and tools.

While Microsoft and IBM may have stolen the lead for now, they cannot expect the challengers to sit still. In the last few weeks alone we have seen several major launches of AI capabilities from some providers. And the Automation vendors are looking to new products and partnerships to take them forward.

Without the market momentum, Microsoft and IBM would still stand above the rest of the pack – just not as dramatically! Both companies are not just offering the AI building blocks, but also offer smart applications and services – this is possibly what sets them apart in an era where more and more customers want their applications to be smart out-of-the-box (or out-of-the-cloud). The appetite for long, expensive AI projects is waning – fast time to value will win deals today.

The biggest change in AI over the next few years will hopefully be more buyers demanding that their applications are smart out-of-the-box/cloud. AI and Automation shouldn’t be expensive add-ons – they should form the core of smart applications – applications that work for the business and for the customer. Applications that will deliver the next generation of employee and customer experiences.

Ecosystm Vendorscope: AI & Automation

Signup for Free to access the Ecosystm Vendorscope: AI & Automation report.

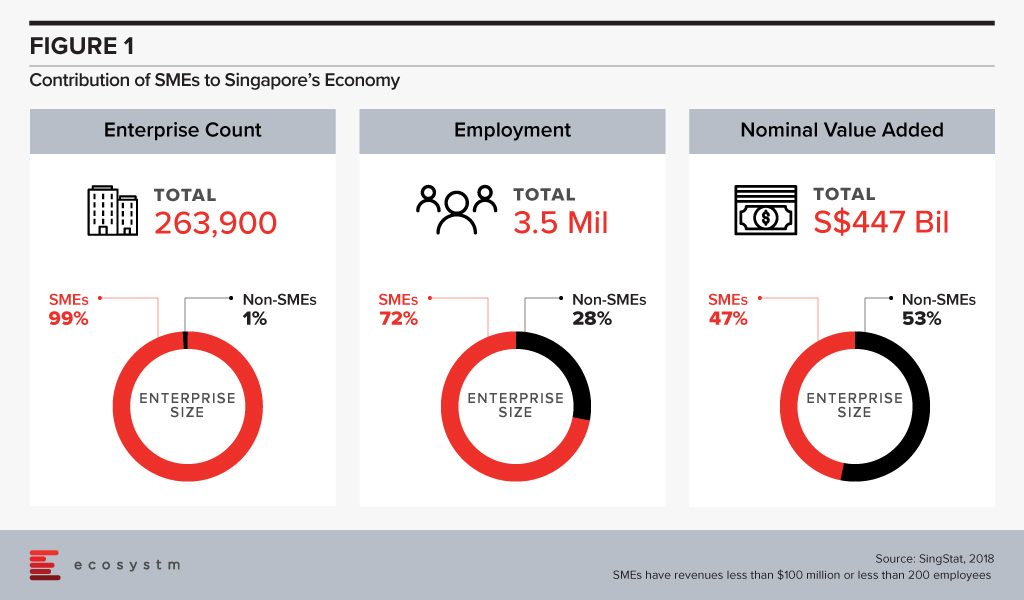

Singapore maintains its competitiveness through strong Government support and an environment that encourages trade and investments. The economy sees a huge contribution from start-ups and small and medium enterprises (SMEs), which receives financial incentives and technology guidance from the Government.

The success of SMEs in Singapore is at the core of national economic growth with approximately 261,000 SMEs contributing to nearly 50% of the country’s GDP.

A survey conducted by United Overseas Bank (UOB) in November 2019 illustrates that SMEs in Singapore are focusing on boosting productivity as they grapple with macro-economic and socio-political uncertainties this year. The UOB survey included 615 local SMEs with a revenue of less than S$100 million. Nearly half of the SMEs surveyed have a positive outlook for their business in 2020, while nearly a third are not so optimistic about it.

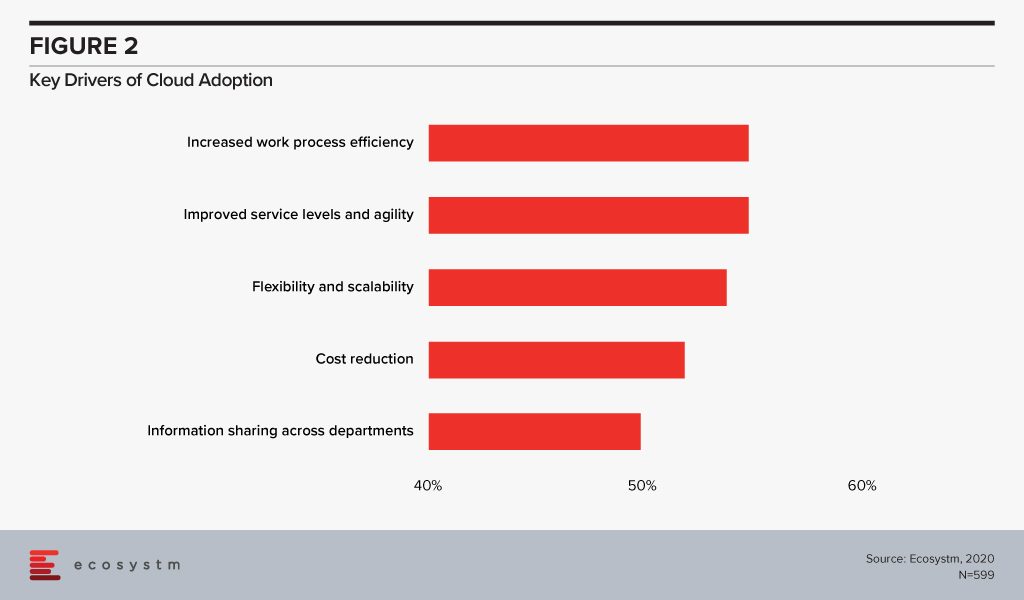

While cost reduction and new streams of revenue generation are top business priorities, more than half of the SMEs polled, mentioned increasing productivity as their top priority. Technology adoption has often been linked to an increase in productivity. SMEs in Singapore appear to be on the right track as currently 65% use digital solutions, mostly geared towards accounting, HR and customer relationship management. Digitalisation involves a widespread adoption of cloud and automation solutions. If we look at the key drivers of cloud adoption across all global organisations (Figure 2), we find that optimisation and productivity are key incentives.

Interestingly, the UOB survey also finds that more than half of SMEs in Singapore have sustainability goals. Resource optimisation and energy efficiency will also see higher adoption of technology in the future.

Government Initiatives Empowering SMEs

Government agencies and industry bodies have always been proactive in empowering SMEs with technological knowledge. There are various programs and initiatives to promote digitalisation, which have made Singapore SMEs competitive at a global level.

The Infocomm Media Development Authority (IMDA) is helping Singapore SMEs to scale and improve their digital capabilities, expand their network and go global through collaboration with multinational companies (MNCs). The SMEs Go Digital program launched in 2017, has seen an estimated 4,000 SMEs adopting pre-approved digital solutions.

Several organisations in Singapore – such as A*Star and Enterprise Singapore – have targeted programs for the SME community. One of the key challenges for SMEs that impacts their ability to invest in technology is a lack of internal IT skills. Initiatives such as the Technology Adoption Programme (TAP) recognise this and bring in multiple industry and technology stakeholders to translate new technologies into Ready-to-Go (RTG) solutions, aimed at SMEs.

Apart from technology, access to financing is a key factor that determines the success of an SME and remains a key focus of Singapore’s banking and financial sector. The digital wholesale licenses are also aimed at SME financing, especially targeting those that are unable to procure funds from traditional sources.

Technologies Enabling Digitalisation in Singapore SMEs

Cloud

As mentioned earlier, cloud is the key enabler of digitalisation, giving organisations the ability to access solutions anywhere and anytime. Ecosystm research shows that 80% of SMEs in Singapore use an IaaS solution, while more than 75% use a SaaS solution.

There are programs that boost cloud adoption in Singapore SMEs as well. As an example, SMECEN, developed by the Association of Small & Medium Enterprises (ASME), and supported by Enterprise Singapore, Accounting and Corporate Regulatory Authority (ACRA) and Inland Revenue Authority of Singapore (IRAS) is a SaaS solution with accounting, HR and compliance modules – integration with other business tools is on the cards.

AI/Automation

Digitalisation will eventually involve investments in Automation and AI. For Singapore, AI is a key technology as it continues to focus on IoT, smart buildings, smart electricity, autonomous electric vehicles and other smart city solutions. The Government is working to open up access to data and AI tools so everyone can experiment. It especially wants to encourage SMEs to adopt AI and work on government use cases.

Singapore SMEs are ramping up their AI investments, especially in IoT sensor analytics (27%), machine learning (21%) and robotic process automation (16%), according to the Ecosystm AI study. Their key short-term drivers are insights into the competition and enhanced internal process monitoring. However, in the longer term, they are looking at cost reduction and better profit margins.

Fintech

According to an OCBC survey in 2018, which polled 200 such companies, two-thirds of SMEs in Singapore are likely to go cashless by 2023. It is estimated that over 75% of Fintech transactions in Singapore are digital payments and it receives over a quarter of Fintech funding. Government initiatives such as FAST and SGQR, have opened up digital payment options for consumer use as well as for SMEs.

However, the UOB survey notes some concerns that SMEs have over digital payments adoption, including customer/supplier acceptance and security. This is an encouraging sign, which indicates that SMEs are not just adopting technology because of the hype – but are evaluating the pros and cons of tech adoption before embarking on a digitalisation project.