We are in the midst of an economic and social crisis. COVID-19 will have far-reaching effects on organisations and how they do business. It is expected to drive more investments in Fintech, especially in digital payments, as more organisations and consumers adopt eCommerce. Countries will also have to re-think the ways they trade with other countries, as travel restrictions continue. This is expected to boost the Fintech industry and July was witness to how Fintech organisations, financial institutions and governments are gearing up to leverage Fintech in their path to economic and social recovery.

Financial Industry Seeing More Open Banking Initiatives

The banking industry is fast moving towards collaboration and openness. July saw several initiatives that take the industry closer to open banking.

Late last year, South Korea piloted an open banking system with participation from local banks and lenders. The Financial Services Commission (FSC), South Korea’s top financial regulator reported in July that the initiative had participation from 72 companies including commercial banks and Fintech firms with 20 million subscribers using the open banking services.

Australia introduced an open banking initiative, monitored by the Australian Competition and Consumer Commission (ACCC). From July, Australia’s banking customers can share their financial and banking data with accredited businesses under Consumer Data Right Act to access a better suite of financial applications.

There is global expansion as well. Railsbank, a global open banking platform with a presence in Southeast Asia introduced their services in the US market. The company will offer Banking-as-a Service, Cards-as-a Service and Credit Card-as-a-Service in the US market. Khaleeji Commercial Bank (KHCB), an Islamic bank in Bahrain, launched their open banking service enabling a customer to link their bank accounts with other banks and manage through the ‘Khaleeji 360’ platform. The portal allows clients to view all their bank accounts, automate operations and conduct banking through a unified platform.

Financial Institutions Increasing Partnerships with Fintech

Financial institutions no longer look at Fintech as competition. They appreciate that customers are at the centre of their entire operation – and Fintech services can and will provide them with the solutions they need. As financial institutions re-think their transformation journeys and face increasingly stringent regulations, they no longer have the option of ignoring Fintechs.

American Express, Visa, Mastercard and Discover came together to roll out a global standard. The big four’s advanced digital checkout solution Click to Pay is an online checkout system based on EMV Secure Remote Commerce (SRC) to make online payments across websites, mobile applications and connected devices, frictionless.

With an aim to unify payment solutions, a group of 16 major European banks launched the European Payment Initiative (EPI) to create a unified pan-European payment solution leveraging Instant Payments/SEPA Instant Credit Transfer (SCT Inst), including a card, e-wallet and P2P payments.

We also saw financial institutions strengthen their cross-border payment services in July. Deutsche Bank partnered with Airwallex to offer virtual account collections and API-enabled foreign exchange services in Japan and Hong Kong. The service will enable merchants and traders to transact through virtual accounts and APIs without opening bank accounts in foreign markets. Mastercard and Bank of China partnered to enhance cross-border business payments into China. This will enable global businesses to send payments to China while accessing real-time exchange rates, reduce the need for unnecessary documentation between merchants, and reduce transaction hassles and costs.

Fintechs Facilitating Cross-border Trade

Seamless cross-border financial transactions will be key to economic recovery, whether easy remittance or the ability to reach a larger market and be able to trade beyond borders.

July saw the formalisation of the Digital Economy Partnership Agreement (DEPA) between New Zealand, Chile and Singapore, to facilitate end-to-end digital trade, which includes establishing digital identities, paperless trade and the development of Fintech solutions to support it. The initiative also intends to allow cross-border data flow and give access to necessary government data to small and medium enterprises (SMEs) enabling them to be digital-ready to explore newer markets.

Dubai International Financial Centre (DIFC) signed an MoU with Jiaozi Fintech Dreamworks based in China opening new opportunities for innovation and trade. The agreement will enable Fintech companies based in both cities to access each other’s markets. Primarily established to facilitate the ‘Belt and Road’ initiative, it is a critical component of the DIFC’s 2024 strategy to strengthen relationships with the international financial community and increase access to the South-South corridor. Over the last few years, DIFC has been associated with over 200 Fintech organisations, and last month invested in four Fintech startups through their accelerator program. The agreement with Jiaozi will look at collaboration opportunities in Blockchain, AI and Cloud and will facilitate cross-border workshops and training programs.

Continuing Interests in Emerging Economies

Fintechs have been a means to bring about financial inclusion and are increasingly being used to target the unbanked and underbanked. Emerging economies continue to be attractive for Fintech organisations and global financial institutions.

With much of Malaysia’s economy dependent on foreign workers, Instapay, regulated by the Bank Negara Malaysia (BNM), announced a collaboration with Mastercard, to provide e-wallet accounts to the migrant workers. The widespread use of e-wallets by the migrant worker community will bring benefits to both workers, as well as their employers. Interestingly, Fintech providers in emerging economies are also looking to expand into other emerging markets. Malaysia’s GHL Group received approval from Philippines Securities and Exchange Commission to operate a lending business through their new unit, GHL Philippines Financing Services. GHL has been diversifying its business and has been operating its lending business in Malaysia and Thailand since 2019.

Crown Agent Bank, a wholesale foreign exchange and cross-border payment services based in the UK, partnered with South Africa’s biometric-based payment company, Paycode. Together the companies are aiming to reach 100 million unbanked customers where Crown Agents Bank will use their FX and payment services to bolster Paycode’s product offering and support financial inclusion across Sub-Saharan Africa.

India and Indonesia in the Asia Pacific continue to be popular markets because of the huge proportion of the unbanked population. Rapyd, a UK based global B2B Fintech-as-as-service provider partnered with major Indian e-payment providers – including Paytm, PhonePe, PayU, Citibank, DBS Bank, HDFC Bank, BharatPay, and Unimoni to launch an all-in-one payments solution that spans credit and debit cards, UPI, wallets, and cash. New registrations for digital banking in Indonesia are on the rise and Fintech startup Akulaku is capitalising on the potential digital banking overhaul to offer affordable and comprehensive financial services to consumers.

Fintechs benefiting other industries

The Fintech revolution has shown the path to several other industries – Healthcare and Agriculture are some of the industries that are hoping to benefit from Fintech organisations and their innovations. The MoU between Alibaba Cloud, Pfizer and Singapore’s Fintech Academy announced earlier in July, promises to give early and necessary guidance to Healthtech start-ups, and shows the deep connection between Healthtech and Fintech. In the Philippines, in an effort to improve financial services for farmers, AgriNurture acquired Fintech firm Pay8. By leveraging Pay8 e-wallet services, farmers will be able to access online payment services. This will enable the largely unbanked farmer community to become an active part of the economy.

The technology that these industries are looking to benefit from is Blockchain. South Korea brought Blockchain to their healthcare industry for better data management and storage. The 3 major telecommunications providers in the country – KT, SK Telecom and mobile carrier LG U+ – have also collaborated with KB Insurance to launch the blockchain-based mobile notification service (MNS) by matching customer data to their mobile subscription information. Oxfam Ireland – a charity organisation based in Ireland, received a sum of USD 1.18 million from the European Commission for a Blockchain-based pilot. The company is working on a project -The UnBlocked Cash – to help disaster-affected communities receive cash-based entitlements with more efficiency and traceability.

Fintech will continue to be a cornerstone of economic and social recovery in the future, and the financial industry will see more collaborations between Fintech organisations, financial institutions and governments. Other industries will continue to take learnings from Fintech.

Agriculture is significant to New Zealand’s economy and the Government aims to create more efficient land usage, better environmental outcomes, and to drive sustainability for food and supply chain across domestic and international markets.

In an effort to grow the agritech sector into an even stronger economic contributor, increase agritech exports and advance sustainable production in New Zealand and globally, the Government of New Zealand has committed to spend USD 7.6 million on the implementation of an Agritech Industry Transformation Plan as part of a strategy for the food and fibre industry. The plan is the culmination of views and insights representing a cross-section of more than 130 members of New Zealand’s agritech ecosystem – the Government, industry, and the Māori and wider community – providing their collective vision to focus attention on the sector for a competitive edge.

Roadmap to Accelerate New Zealand’s Agritech

To further boost the innovation in agritech and upscale the Sustainable Food & Fibre Futures (SFF Futures), an additional USD 56 million has been earmarked for smaller grassroots community projects to large-scale industry development. This will support the Government’s Fit for a better world Roadmap – a 10-year roadmap for the primary industry; and add value across the agriculture, horticulture, fisheries and marine, and forestry sectors.

The Roadmap includes objectives such as:

- Adding USD 29 billion in export earnings over the next decade (2020 to 2030) through a focus on creating value

- Reducing the biogenic methane emissions to below 10% by 2030 and restoring New Zealand’s freshwater environments

- Employing 10% more New Zealanders in the food and fibres sector by 2030, and 10,000 more by 2024

Ecosystm Principal Advisor, Jannat Maqbool says, “In addition to the current environment with COVID-19, a new generation of consumers across the globe is becoming considerate that they buy what is good for the world in the face of climate change, biodiversity loss and the degradation of waterways. The ability to manage and assure quality and safety from ‘farm to fork’ is now more important than ever, leveraging technology for traceability, risk management, and rapid response capability to meet consumer demands and relevant legislative requirements.”

Through this Industry Transformation Plan (ITP), the Government seeks to attract investments in New Zealand’s agritech intellectual property (IP), develop the necessary infrastructure, focus on export opportunities, address current concerns related to connectivity and data, and ensure a skilled workforce that is able to both develop and effectively leverage agritech.

Maqbool says, “The success of the plan will depend on how well relevant stakeholders engage and ongoing support from government to help create the conditions required for the sector to realise its potential.”

Key Milestones

The Government of New Zealand is working to retain competitiveness in global agriculture. Some key initiatives include:

Farm 2050 Country Partnership. New Zealand became the first country partner of Farm2050- a global agritech initiative that brings together farmers, researchers, the market and investors to collaborate effectively.

Western Growers partnership. Western Growers and New Zealand signed a partnership agreement to develop agritech. It also opened doors for New Zealand’s agritech researchers and companies working in the robotics and automation space to enter the US Market.

The Australia New Zealand Agritech Council. The Australia New Zealand Agritech Council was launched to help the countries work closely on agricultural practices and to cooperate on agritech.

New Zealand is fast becoming an example of how technology providers and food producers can collaborate on improving yields, optimising production methods and reducing waste, predicting demand, and safeguarding supply chains.

The 5G rollouts in Australia by Telstra, Optus and Vodafone will impact consumers and enterprises alike. It is expected that enterprises will see an uptick in IoT adoption, leveraging the lower latency to connect devices for real-time data transfer and insights. Industries, especially those that operate in remote and rural regions of the country such as Agriculture and Mining are expected to benefit immensely.

“However, there are challenges to leveraging digitalisation effectively, including a lack of awareness, knowledge and skills, and funding to support innovation and scale, in aligning with the growing pressure within sectors to meet increasing productivity and compliance requirements,” says Ecosystm Principal Advisor, Jannat Maqbool. “Adoption of IoT specifically is resulting in new data supply chains, that those operating in many industries cannot cater for with respect to infrastructure and also the skills necessary to process and extract valuable insights from the data.”

Ecosystm research shows that only 37% of organisations looking to adopt IoT in Australia have a strategic internal team to create the roadmap and manage the deployment. This indicates a lack of skills that organisations can utilise, depending on external resources such as consulting firms and ISVs instead. To cater to the expected growth in Australia’s IoT market, IoT Alliance Australia (IoTAA) – that represents more than 500 participating organisations and 1,000 individual participants – has come forward with the IoT Australia Skills Barometer survey.

The survey created in association with La Trobe University aims to gauge the IoT skills gap, to inform educators and adopters on the potential areas of focus for future skills development. It covers questions on IoT adoption, challenges expected, solutions being evaluated, and courses needed.

Addressing the Skills Gap

As the adoption of IoT increases, there will be added requirement for skills in data storage, infrastructure management and creating frameworks. The survey is expected to help the industry determine the skills gap, isolate training and re-skilling requirements and develop courses and hands-on sessions to address the end-to-end services requirements and better utilisation of data gathered from the devices.

There are some courses that are already available – mostly run in collaboration with industry. Last year, Rio Tinto, the Western Australia Government and South Metropolitan TAFE developed Australia’s first nationally-recognised remote operations course. Earlier this year, RMIT partnered with IBM to deliver the IoT and 5G business opportunity courses to equip business professionals with the right technology and business skills for IoT projects.

“Awareness of the potential of emerging technologies needs to target both non-technical and technical members of the organisation. This wider buy-in is needed to drive thinking around the ‘why’ from stakeholders across the business, enabling a more informed decision around the potential impact on existing resources, infrastructure, processes, products, required investment and business outcomes,” says Maqbool. “Any education and training program needs to allow for this focus on awareness, then provide opportunities to build on this for those that then want to gain the deeper knowledge and technical skills required to effectively leverage the IoT.”

“Education and training programs to support the uptake of digital technologies across the wider population and traditionally non-digital industries require a contextual learning and a flexible delivery approach.”

Government and Industry working together

“A digital divide exists in many countries – especially for those in rural communities. They are often not in a position to access the infrastructure necessary to support a real-world connection in a contextual learning environment, let alone having the digital literacy and scaffolding to get to a point where they can effectively consider leveraging emerging technologies,” says Maqbool.

This is where governments play a larger role. To accelerate innovation and make better use of technology the Australian Government is supporting clear communication and a better understanding of IoT, implementing standards and regulations, upgrading digital infrastructure, creating opportunities for economic and social benefits and collaborating with research and education institutes to deliver skills, innovation and growth in the IoT sector.

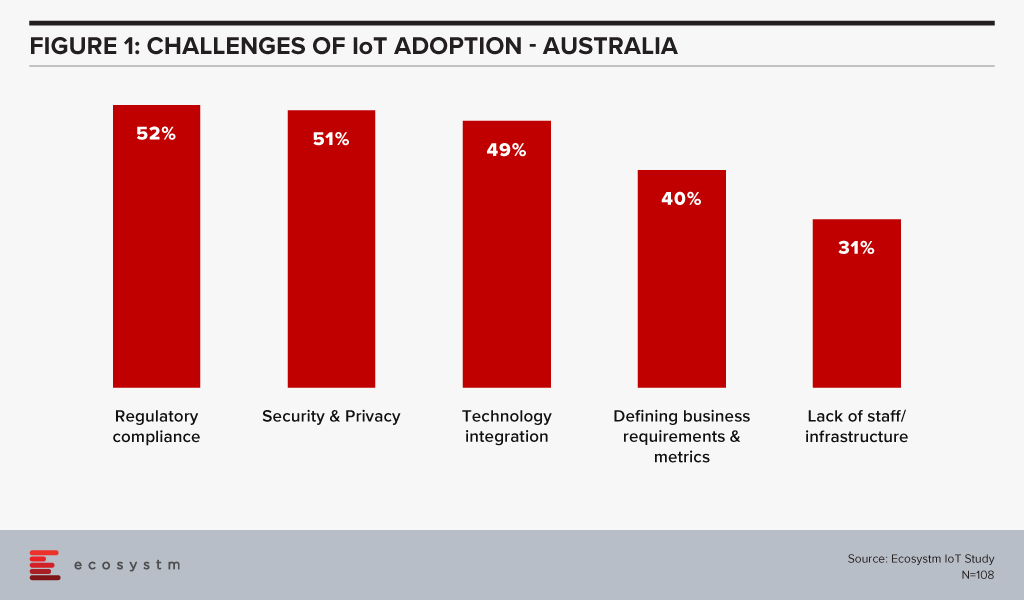

One of the key areas of focus will have to be cybersecurity. Regulatory compliance and security & privacy issues are the key barriers of IoT adoption in Australia (Figure 1).

Last year, the Australian government released a draft code of practice to enable businesses implementing IoT solutions to follow certain principles as a voluntary measure to defend against threats.

The Government is also seeing a larger potential for IoT in some industries. To support the Agriculture industry, the Australia Government has allocated USD 90 million to the Smart Farms program to support the development and uptake of best practices and technologies in farms, fisheries and forestry, with a special focus on regional communities. In its FY2019-20 federal budget, the Government announced plans to invest USD 1.4 million for a feasibility study and assess ways on improving digital on-farm connectivity. Similarly, Australia’s National Landcare Program (NLP) delivered by the Department of Agriculture, Water and the Environment (DAWE) is receiving financial support until June 2023.

Authored by attending Ecosystm analysts, Ullrich Loeffler (Chief Operating Officer), Kaushik Ghatak (Principal Advisor, Digital Transformation and Supply Chain) and Liam Gunson (Director, Product and Solutions)

Bosch Software Innovation (Bosch SI) hosted its annual analyst briefing in Singapore on 6th December 2019 to provide an update on its business, strategy and solution portfolio in the APAC region.

Bosch has expanded its capability and reshaped its go-to-market approach in a bid to not only position itself as a world leading IoT company, but also help move the IoT market forward.

A number of new solutions were demonstrated through the day. From tenants asking their building management if the gym was busy, to smartphones detecting a manufacturing fingerprint so you could avoid buying a counterfeit.

At the heart of the business updates though was a new organisational approach to prove markets and integrate user perspectives into solution development. Bosch is looking to achieve this by setting up dedicated, cross-divisional entities which can focus on user needs to drive growth while collating requirements for the Bosch SI centres.

Bosch SI essentially will perform a role of an IoT business incubator within Bosch Group, and once a vertical within Bosch SI has reached a certain level of business, it is spun off into a separate company focusing on that area. There are three business units that have met the threshold and have spun off so far.

Broader challenges still remain for IoT adoption. Patchy connectivity, varied regulation, and a lack of standardisation will continue to hamper the IoT market. However, from a user perspective the timing is right. Ecosystm research shows that while IoT uptake is limited, intention is strong. Enterprises will be looking for partners with a willingness to understand their needs and design around them, in order to help get initial projects off the ground.

Bosch Business Update – From Innovation to Commercialisation

Bosch SI was created to build Internet of Things (IoT) solutions, leveraging Bosch’s 133-year experience in developing and manufacturing products for the automotive, industrial and consumer segments. Founded in 2008, by 2019 Bosch SI has established 10 global offices, of which some have solution development capabilities, employing over 700 IoT experts. Four of the Bosch SI offices are located in Asia Pacific – Singapore, Nanjing, Shanghai and Tokyo.

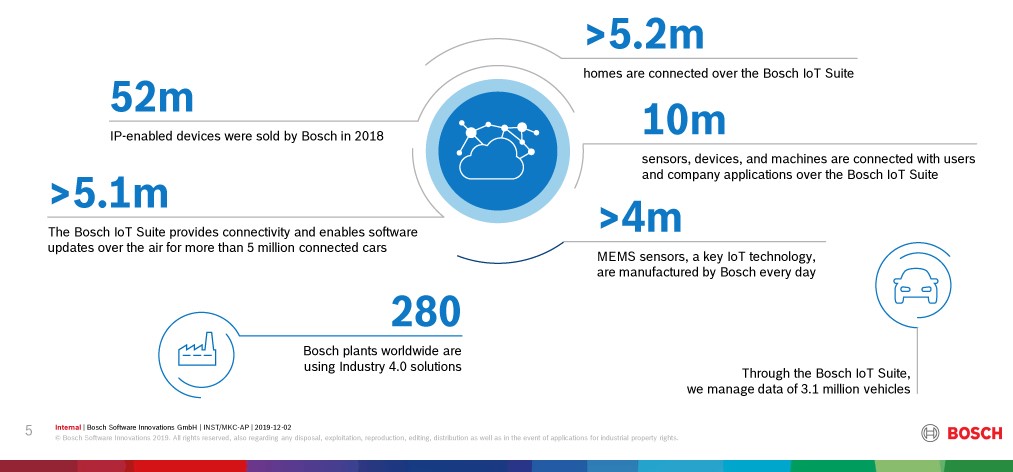

Figure 1: Bosch Software Innovations in Numbers

The Bosch IoT Vision and Strategy is not limited to Bosch SI’s but spans across the full Bosch Group. An indication of the dedication to the IoT story is that Bosch is committed to enabling connectivity for all existing product portfolios ranging across its industrial, automotive, manufacturing and consumer product lines by 2021.

Another indication of Bosch’s IoT business maturing is that in 2018 Bosch it formed 3 new subsidiaries, each being a dedicated entity to take targeted IoT Industry solutions to market. The new business entities focus on

- Connected Industry

- Connected Mobility

- Residential IoT

with other areas such as Agriculture, Retail, Energy, Mobility, Manufacturing and Home & Building as potential future spin-offs. The announcement is significant as it separates the innovation and commercialisation functions. Bosch SI becomes the dedicated R&D and incubation engine to take new industry solutions to a defined threshold before a dedicated entity is formed to achieve commercial scale.

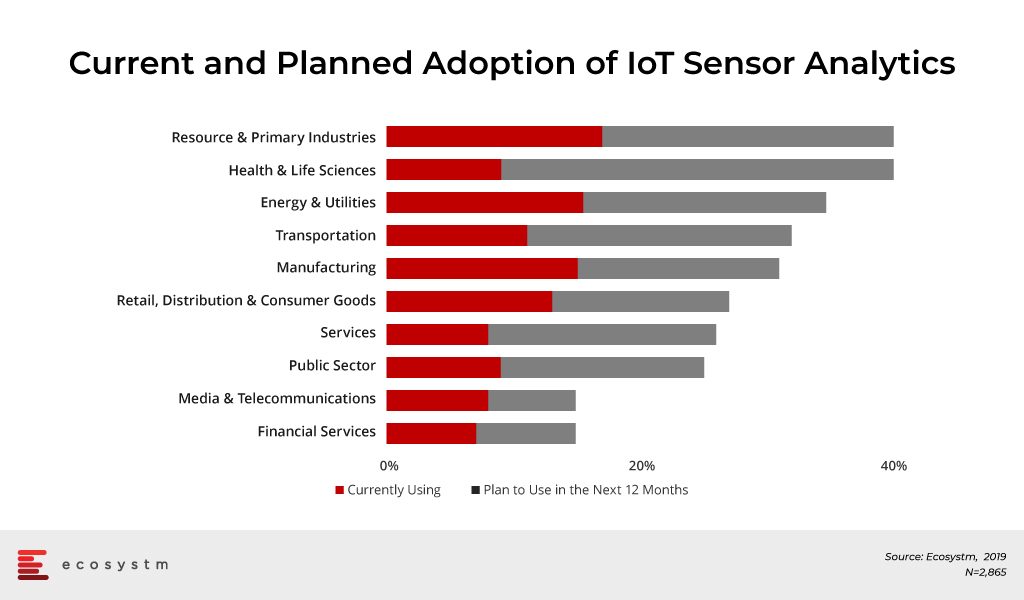

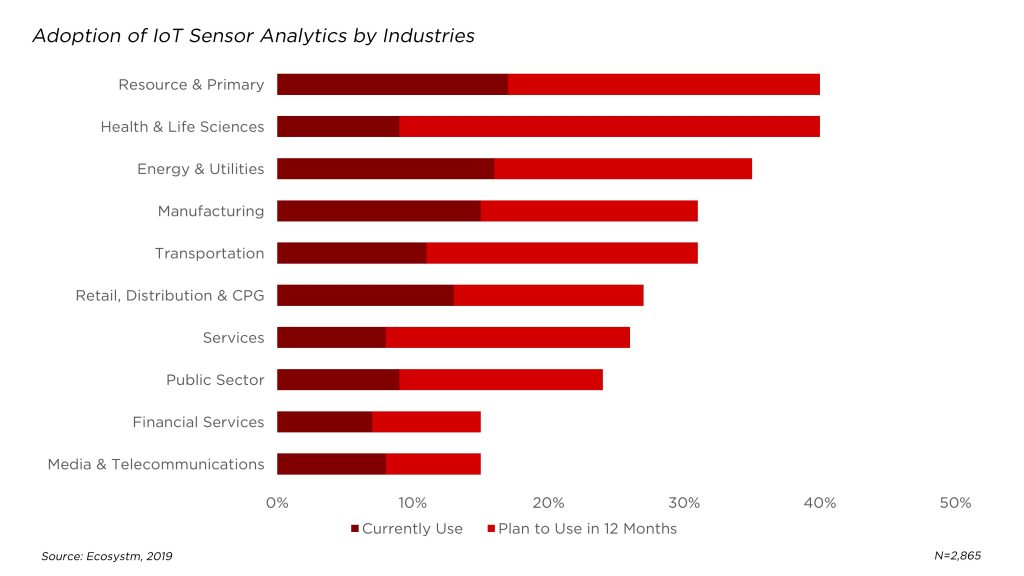

Despite the fact that IoT has been greatly overhyped since the term was coined by Kevin Ashton in 1999, Ecosystm research shows evidence that adoption is accelerating across the region. Figure 2 outlines the current and planned adoption of ‘sensor-based analytics’ within organisations. The research strongly supports Bosch’s timing for investments in scaling the commercialisation of its solutions.

Figure 2: Industry Adoption of Sensor-Based Analytics

Market Pull over Technology Push is creating proven Industry Use Cases

The locations and specialisations of Bosch’s Innovation Centres across Asia are no accident and result directly from engagements with local clients. Each innovation centre specialises in certain solutions that have arisen from the productisation of solutions developed for customers. This ‘market pull’ strategy is a clear differentiation to the commonly practiced ‘technology push’ approach which has seen many vendors struggle to gain traction for their IoT solutions. Key industry solutions developed by Bosch SI are:

- Agriculture – Bosch Plantect: (Japan). Plantect is a sensor-based monitoring system for early detection and prevention of plant diseases in greenhouses. The current solution targets greenhouse farmers for tomatoes, cucumber and strawberries.

- Smart Building – Bosch Lift Manager (Singapore). Lift Manager is an AI-supported solution that can be retrofitted in existing lifts with set algorithms to monitor and predict lift malfunctions and enable predictive maintenance.

- Smart Building – Connected Buildings (Singapore). Bosch Connected Building leverages cameras and sensors to optimise business operations such as Air Quality, Light Monitoring & Control, Lift Monitoring, Occupancy Tracking, Asset Tracking, Carpark Monitoring, and Object Tracking.

- Manufacturing – Secure Product Fingerprint Solutions (China). Secure Product Fingerprint captures a unique fingerprint for products to combat counterfeits and connect manufacturers with their users.

The Bosch IoT Ecosystem – Open Source and API enabled Platform

Bosch has realised that IoT is a concept that cannot be owned and delivered by a single entity. As such Bosch aims to establish its Bosch IoT Suite as the platform to connect any Bosch or third party “things” to deliver targeted industry services and solutions.

Bosch IoT Suite can be deployed on Bosch’s own IoT Cloud or through Cloud partners such as AWS, Microsoft or Huawei (for China only). It is a PaaS offering that packages unified device APIs to connect things with device management, software updates over the air, data management and security capabilities. An inbuilt analytics engine assists with business logic tools to drive business value out of the data collected. The open source and open standards architecture promote the development of in-house or third-party industry applications as platform add-ons and use cases.

Bosch and Market Outlook

IoT has been one of the most hyped ‘buzz words’ for the last few years but true market adoption is yet to follow suit. Ecosystm research shows that market intention is positive with more industry-focused uses cases and simpler ‘plug and play’ style solutions available that require less CapEx and shorter time to value.

Bosch is well positioned to capitalise on this trend. Its focus on developing proven use cases for targeted industry sectors and then working with anchor customers and testing the solutions internally within Bosch, is a clear differentiator in the market. Commercially scaling these solutions will remain the key challenge as decision stakeholders may not be the key beneficiary of the solution. In the connected building example, tenants will be the key beneficiary of finding quiet gym slots or having better air quality but it remains questionable whether this will convince the building owner or operator to put pen to paper and sign-off on relevant IoT investments. An area that Bosch needs to focus on, is the articulation of its business proposition and more importantly connect this to the business value to prospects and customers. As solutions scale in the market, broader sales and partner teams will need to be enabled to bring this message to the relevant stakeholders. The fact that these stakeholders may sit outside Bosch’s traditional comfort zone will not make this endeavor easier.

Bosch will also face varying market regulations that could create road bumps in scaling its solutions. The Bosch Lift Manager solution as an example provides sensor diagnostics for predictive maintenance scheduling. Many existing lift maintenance contracts however follow local regulations that require ongoing scheduled servicing of elevators which reduces the cost savings potential.

The decision to establish standalone IoT entities is seen as a strong commitment and the right move to take advantage of the presented IoT opportunity. The high degree of customer advocacy and industry experience further makes Bosch a strong contender of the Industry 4.0 revolution.

To drive its digital transformation initiatives, the Government of New Zealand recently published a roadmap ‘Growing innovative industries in New Zealand: From the knowledge wave to the digital age’, which outlines the strategic objectives of the Government to uplift and drive innovation for the country’s industries. The policy is focused on achieving a sustainable and productive economy for the country. The central elements for the plan were developed in consultation with all the key industry players and include the ideas necessary for transitioning the economy.

The Government will primarily focus on four significant sectors for its Industry Transformation Plans: food and beverage, agritech, forestry and wood processing, and digital technologies. For this, the government will work with businesses, workforce, and Māori to determine the best path towards to achieve their goals.

Agritech Industry Transformation Plan

New Zealand’s agritech sector spans across a range of technologies including genetics, information and communications technology, machinery and equipment, including robotics. The government is working with industry body ‘Agritech NZ’ and other relevant entities to draft a strategy and action plan for agritech transformation in New Zealand. The objective is to support production, drive innovation and increase exports for New Zealand’s industry.

Commenting on the NZ’s digital transformation Ecosystm Principal Advisor, New Zealand-based Jannat Maqbool, said “the agriculture sector needs to focus on innovation in order to compete and thrive as global trends and consumer demand presents challenges in feeding the growing global population. Investment in programmes driving investment in technologies and related initiatives to boost innovation and productivity in the sector will support the growing Agritech sector including work to scale Agritech businesses internationally.”

Digital technology opportunities

To support the ongoing development of New Zealand’s technology and industrial sector, the NZ government is taking several actions. The government has plans for more coordinated action between industry and the Government. Including:

- Continuing work with the IoT Alliance and the AI Forum to drive applications of digital technologies;

- Implementing Industry 4.0 programmes to increase uptake technologies and processes across manufacturing sectors, improving productivity and competitiveness;

- Coordinating, developing and rolling out a National Digital Infrastructure Model to generate value from data for all aspects of the economy–e.g. infrastructure management and development;

- Supporting New Zealand digital technology firms by providing a level playing field for New Zealand firms to compete for government business;

- Working through the Digital Skills Forum to ensure the digital technology sector, and the industries that rely on digital technology workers, can access the tech talent needed to support the growth of these sectors and the economy.

With Government setting itself for the fourth industrial revolution, there will be certain challenges and opportunities in the implementation, “the opportunity is for increased productivity and to focus more on value add to compete internationally whereas a key challenge will be finding the skilled employees that will be required as industry 4.0 is adopted” said Maqbool.

Journey of NZ industries for digital transformation

SMEs make up over 97 percent of enterprises in New Zealand and digital transformation presents an opportunity for accelerated growth and competitiveness, potentially contributing US$7 billion to New Zealand’s GDP. “Digital transformation requires awareness, adoption and effective change management but before all of this there needs to be a shift in mindset of those in charge or a changing of the guard so to speak to understand and appreciate that the move is necessary, not only for the business itself but for bridging the digital skills gap and supporting a region’s productivity and economic growth ” said Maqbool.

The Government has also created plans for tourism, creative industries, aerospace, renewable energy and health technologies for the digital push. These advances will facilitate the development of new industries in New Zealand.

“It essential that efforts through government initiatives align with other approaches already driving the move to digital in order to ensure available resources are effectively utilised and for ongoing sustainability,” says Maqbool.

The largest agricultural event in the southern hemisphere has just come to a close in Waikato New Zealand, across 114 hectares, with over 1,050 exhibitors, more than 125,000 visitors, including delegates from over 40 countries, and total sales revenue of around half a billion over the four days. Fieldays, an idea from the late 1960s focused on connecting farmers with innovative products and services, was officially opened by the Rt. Hon. Jacinda Ardern who spoke of the strength of New Zealand’s primary industry and its importance to the people of New Zealand. Of specific interest to me as I joined the crowds on day two, was the emerging technology innovations in agriculture on show at the Innovation Centre.

A preview of the New Zealand Agritech Story, developed along with New Zealand Trade and Enterprise (NZTE), was kicked off on a foggy Waikato morning on day two of Fieldays, providing insights into the country’s competitive advantage in Agritech along with perceptions of key global players. This was then followed by the New Zealand government announcing a new $20 million Agritech investment venture fund.

NZ Tech reports that the tech sector in New Zealand is the third largest and fastest growing export sector, worth $6.3 billion in 2015, and according to the TIN100, the Waikato, has had the fastest growing tech sector in the country two years in a row. New Zealand Agritech exports stand at $1.4 billion in 2018 and is growing – and together with a strong tech sector overall, the investment will help position New Zealand at the forefront of Agritech innovation globally.

Day two also revealed Fieldays Innovation Award winners across a range of categories including Modusense who took out the Gait International Innovation Award for Product Design and Scalability. Modusense, developed here in the Waikato, is a secure, scalable and reliable Internet of Things (IoT) device platform that provides everything needed to deploy remote data collection. In the primary industries sector, Modusense enables complete apiary health monitoring.

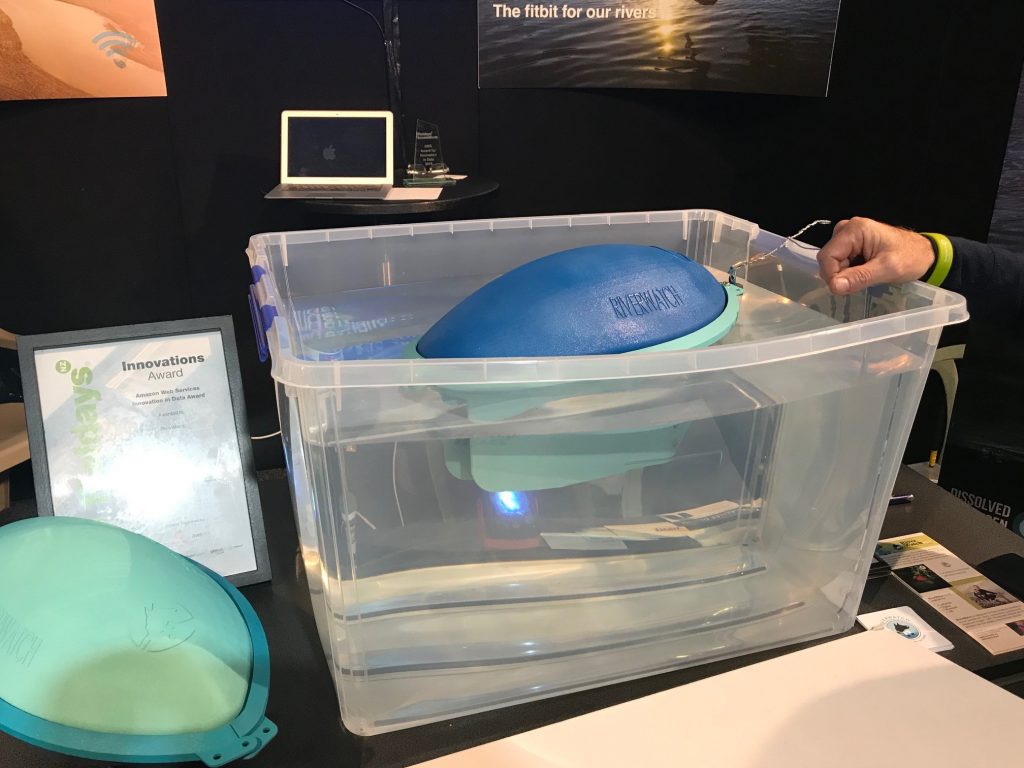

Another IoT enabled solution, RiverWatch, was awarded the AWS Innovation Award in Data for their “Fitbit for water” – an inexpensive water quality monitoring device. RiverWatch is currently running trials in the upper Waikato River in partnership with Te Arawa River Iwi Trust to look at the impacts of industry and farming on water health.

Agritech will transform the industry, and innovations such as those mentioned will further advance New Zealand’s position in the agriculture industry. The true value of Agritech will be realised when AI-enabled IoT is leveraged for cost savings through process automation, and for greater visibility of the entire supply chain. And leading organisations in the industry are aware of it. In the global Ecosystm AI study, Resource & Primary industries (including Agriculture) emerged as a leader when it comes to current and future deployments of IoT Sensor Analytics.

Innovations in IoT

Shipping and logistics in the agricultural sector present unique challenges including a lack of transparency, something that Sparrows.io is working to solve with a hardware and software solution that provides actionable insights using custom sensor modules and live tracking to enable visibility over the supply chain.

The recently launched TRex – IoT, Telemetry, Data and Messaging I/O Transceiver, was also being showcased in the Innovation Centre. Designed to be used for long range monitoring and control, the solution enables two-way messaging and is customisable to meet the needs of applications across various industry sectors including agriculture and farming.

Another innovation that caught my attention at the Innovation Centre was a water monitoring and management device designed to be connected to the irrigation system to enable effective management of water through a mesh network. Hailing from the deep south Next Farm has developed two solutions, with their Remote Irrigation Mesh (RIM) product utilising integrated farm sensor technology together with cloud-based dashboards allowing farmers to maximise the efficiency of water usage while minimising runoff.

Innovations in AI

One of my favourites from last year, Halter, were in the Mystery Creek Pavillion this year and after raising $8 million in funding to refine and further trial their solar-powered collar, for herding cows and monitoring their health, in the Waikato they are close to hitting the open market. Head of Data Science at Halter, Harry She, previously employed by NASA, oversees the development of what the team calls “cowgorithms” which form the basis of the AI underpinning much of the product functions. The collars, which can receive signals up to 8 kms away, is available free and farmers then subscribe on a monthly basis, at a cost per cow, to enable the features they require.

Another product back for another year was the PAWS® Pest Identification Sensor Pad from Lincoln Agritech which is able to identify pests, differentiating these from native species, and transmit the result to the Department of Conservation staff. Utilising machine learning and AI, amongst other technologies, the device greatly reduces surveillance workload and enables staff to detect and respond to re-invasion more rapidly.

However, as exciting as the idea of a Fitbit for cows and innovation in the pursuit of a predator-free New Zealand is, I must admit the highlight of my Fieldays visit was a team of Agribusiness students from Hamilton’s St Paul’s Collegiate school who were awarded the Fieldays Innovations Young Innovator of the Year Award for their floating electro unit “Bobble Trough” designed to keep animal water troughs clean by preventing the growth of algae and microorganisms through the release of copper ions into the water.

I am now working to secure the team’s innovation as a display in a Smart Space being launched in July as part of the Hamilton City Council’s smart cities initiative, Smart Hamilton. A space designed to provide an opportunity for the wider community to engage with technology innovation and be involved in co-creating solutions that enhance the wellbeing of Hamiltonians.

For information on emerging technology innovation in the agriculture sector in New Zealand access my other reports on technology in agriculture in New Zealand.