Juniper Networks has entered into an agreement to acquire Massachusetts-based 128 Technology for USD 450 million that will enhance its AI-driven enterprise networking portfolio. The deal is expected to close by the end of 2020. The combined portfolio of 128 Technology’s Session Smart™ networking and Juniper’s Mist AI platform will bolster Juniper’s AI expertise in SD-WAN technology.

Ecosystm Principal Advisor, Ashok Kumar says, “Juniper Networks has been a major player in enterprise networking from the core to the edge of the network with SD-WAN, WLAN, and AI-driven applications aware network products. Juniper had strengthened their enterprise networks portfolio with the acquisition of WLAN vendor Mist Systems in 2019 which provided cloud-based management and an AI engine. With Juniper’s acquisition of 128 Technology the network transformation process in the industry will continue.”

The platform created by 128 Technology bases decisions on real-time sessions instead of legacy static systems and networking approaches. The newer system created through this by Juniper will use AI to automate sessions and policies for a full AI-driven WAN operation – from initial configuration to customisable actions across various levels, and AI-driven support.

In addition to this, the automation is expected to reduce overheads, minimise IT costs and deliver better client and user-experience through automated network optimised for client-to-cloud. The two companies also aim to optimise the network and user experiences for voice, 5G and collaboration. Juniper continues to evolve the enterprise networking portfolio adding to the acquisition of WLAN start up Mist Systems for USD 405 million last year. Juniper’s AI -driven SD-WAN and networking products and services for enterprises and end-users is a step towards smart LAN and WAN environments.

A recent study on The Future of the Secure Office Anywhere, conducted by Ecosystm on behalf of Asavie found that 56% of global organisations are looking to improve employee experience, as they look beyond the COVID-19 crisis. The feedback from over 1,000 business and technology leaders globally, also finds that 55% of the organisations are also focused on digital transformation. This will require a re-evaluation of enterprise network solutions, to give employees seamless access to company resources as they continue to work remotely.

“Enterprise communications is being transformed to a user-centric, session-oriented distributed model from a legacy network-oriented centralised WAN model. In the new remote working environment of Office Anywhere, the traditional use of VPN in combination with first-generation SD-WAN will become an impediment going forward. Enterprises will need to re-design networks to address each end-user’s unique needs and their access to applications and all business resources as though they were a Branch of One.”

Telstra and Microsoft have extended their partnership to jointly build solutions harnessing the capabilities of AI, IoT, and Digital Twin technologies in Australia. The partnership will also enable both companies to work on sustainability, emission reduction, and digital transformation initiatives.

The adoption of cloud and 5G technology is already on the rise and creating opportunities across the globe. The Microsoft-Telstra partnership is set to bring together the capabilities of both providers for businesses in Australia and globally. Their focus on AI, IoT, cloud and 5G will enable Australia’s developers and independent software vendors (ISVs) to leverage AI with low latency 5G access to drive efficiency, and enhance decision making. This will also see practical applications and new solutions in areas like asset tracking, supply chain management, and smart spaces to enhance customer experience.

Technology Enhancing the Built Environment

Microsoft Azure and Telstra’s 5G capabilities will come together to develop new industry solutions – the combination of cloud computing power and telecom infrastructure will enable businesses and industries to leverage a unified IoT platform where they can get information through sensors, and perform real-time compute and data operations. Telstra and Microsoft will also build digital twins for Telstra’s customers and Telstra’s own commercial buildings which will be initially deployed at five buildings. Upon completion, the digital twin will enable Telstra to form a digital nerve centre and map physical environments in a virtual space based on real-world models and plot what-if scenarios.

Telstra CEO, Andy Penn says, “If you think about the physical world – manufacturing, cities, buildings, mining, logistics – the physical world hasn’t really been digitised yet. So, how do you digitise the physical world? Well, what you do is put sensors into physical assets. Those sensors can draw information around that physical asset, which you can then capture and then understand.”

Ecosystm Principal Advisor, Mike Zamora finds the comment interesting and says, “It isn’t so much that the physical world is digitized – it is more about how digital tools enhance and enable the physical world to be more effective to help the occupier of the space. This has been the history of the physical space. There have been many ‘tools’ over time to help the physical world – the elevator in the late 1880s enabled office buildings to be taller; the use of steel improved structural support, allowing structural walls to be thinner and buildings taller. These two ‘tools’ enabled the modern skyscraper to be born. The HVAC system developed in the early 1900s, enabled occupants to be more comfortable inside a building year-round in any climate.”

“Digital tools (sensors, etc) are just the latest to be used to enhance the physical space for the occupant. Digital twins enable an idea to be replicated in 3D – prior to having to spend millions of dollars and hundreds of man hours to see if a new idea is viable. Its advent and use enable more experimentation at a lower cost and faster set up. This equates into a lower risk. It is a welcomed tool which will propel the experimentation in the physical world.”

Talking about emerging technologies, Zamora says, “Digital twins along with other digital tools, such as 3D printing, AI, drones with 4K cameras and others will enable the built environment to develop at a very quick pace. It is the pace that will be welcomed, as the built environment is typically a slow-moving asset (pardon the pun).”

“Expect the Built Environment developers, designers, investors, and occupiers to welcome the concept. It will allow them to dream of the possible.”

Telstra and Microsoft – Joint Goals

Telstra and Microsoft have partnered over the years over multiple projects. Last year, the companies partnered to bring Telstra’s eSIM functionality to Windows devices for data and wireless connectivity; they have also worked on Telstra Data Hub for secured data sharing between data producers, businesses and government agencies; and most recently collaborated on Telstra’s exclusive access to Xbox All Access subscription service to Australian gamers with the announcement of Microsoft’s Xbox Series X and Xbox Series S gaming consoles expected to release in November.

This announcement also sees them work jointly towards their sustainability goals. Both companies are committed to sustainability and addressing climate change. Earlier this year, Microsoft announced its plans to be carbon negative by 2030, while Telstra has also set a target to generate 100% renewable energy by 2025 and reducing its absolute carbon emissions by 50% by the same time. To enable sustainability, Telstra and Microsoft are exploring technology to reduce carbon emissions. This includes further adoption of cloud for operations and services, remote working, and piloting on real-time data reporting solutions.

Telstra also aims to leverage Microsoft technology for its ongoing internal digital transformation, adopting Microsoft Azure as its cloud platform to streamline operations, and infrastructure modernisation, including transition from legacy and on-premise infrastructure to cloud based applications.

AWS has been busy this year moving beyond its stronghold of public cloud to bring infrastructure closer to the enterprise and ultimately to where the end user needs computing most. The global availability of AWS Outposts, essentially AWS on prem, the launch of AWS Wavelength, edge computing embedded in 5G networks, and the extension of the AWS Snow Family of edge devices, have all combined to create a compelling hybrid cloud story. This evolution in AWS’ strategy has required a maturing of its partner ecosystem, building alliances with telcos, co-location providers, and integrators that are all still trying to cement their roles in the hybrid cloud space.

Outposts: The AWS Vision of Hybrid Could

Outposts launched late last year with availability extended to many mature countries in January 2020, in addition to India, Malaysia, New Zealand, Taiwan, Thailand, Israel, Brazil, and Mexico in June. The plug and play system delivers AWS compute and storage from the organisation’s own data centre with a rack that requires only power and network access. The system is managed with the same tools and APIs used in public AWS regions, providing a single hybrid cloud management console. Outposts is targeted primarily at the enterprise space, with the cheapest development and testing units coming in at $7-8k monthly or around $250-280k upfront, depending on the country. Other higher-end configurations include general purpose, compute optimised, graphics optimised, memory optimised, and storage optimised. Monthly installments attract a 10-15% premium over upfront payments.

The launch of hybrid cloud solutions by the major cloud providers and containerised services that allow workloads to be deployed in public and private environments will ensure enterprises are willing to continue their cloud journeys. Security concerns and data residency regulations have prevented many organisations from shifting sensitive workloads to the cloud. Moreover, as industries launch new customer-facing digital services or transform their manufacturing systems, latency will become a concern for some workloads. Hybrid cloud addresses each of these issues by employing either public or private resources depending on the data, location, or capacity needs.

AWS Outposts has two variants, namely Native AWS and VMware Cloud on AWS. Organisations already heavily invested in the AWS ecosystem will likely choose Native AWS and use Outposts as a means of migrating further workloads that require an on-prem environment over to a hybrid cloud environment. More traditional organisations, such as banks, may select the VMware Cloud on AWS variant as a means of retaining the same operational experience that they are accustomed to in their existing VMware environments today.

AWS will rely heavily on its network of enterprise partners for sales, management, and maintenance services for Outposts. AWS partners like Accenture, HCL, TCS, Deloitte, DXC, NTT Data, and Rackspace have all shifted in recent years to deliver the full stack from infrastructure to application services and now have a ready-made hybrid cloud platform to migrate on to. AWS is also in the process of recruiting co-location partners to serve Outposts from third-party data centres, providing another option that enterprises are familiar with. This will likely come as welcomed news for co-location providers that have been fighting uphill against AWS.

Wavelength: Embedding Cloud in 5G Networks

Another major announcement in AWS’s drive towards hybrid cloud and edge computing was the general availability of Wavelength in August. This service embeds AWS into the data centres of 5G network operators to reduce latency and bandwidth transmission. Data for applications residing in Wavelength Zones is not required to leave the 5G network. AWS is looking to attract mobile operators, who previously might have viewed it as a competitor while the public cloud space was more fragmented and open to telcos. These partnerships are another example of AWS expanding its ecosystem. Current Wavelength partners are Verizon, Vodafone Business, KDDI, and SK Telecom. With their own take on edge services, Microsoft has signed up the likes of Telstra and NTT Communications, while Google has enlisted AT&T and Telefónica. Edge computing in 5G networks will be the next battleground for cloud supremacy.

On a smaller scale, AWS has released new additions to its Snow Family of edge computing devices. AWS Snowcone is a compact, rugged computing device designed to process data on the network edge where cloud services may be insufficient. The processed data can then be uploaded to the cloud either through a network connection or by physically shipping the device to AWS. The convergence of IT and OT will drive the need for these edge devices in remote locations, such as mines and farms and in mobile environments for the healthcare and transportation industries.

Competitive Strategies

Openness will become a critical difference between how cloud platform providers approach hybrid cloud and edge computing. While AWS is certainly extending its ecosystem to include partners that it previously would have viewed as rivals, as the dominant player, it will be less compelled to open up to its largest competitors. If it can control the full system from ultraportable device, to $1M server rack, to cloud management console, it can potentially deliver a better experience for clients. Conversely, the likes of Microsoft, Google, and IBM, all need to be willing to provide whichever service the client desires, whether that is an end-to-end solution, management of a competitor’s cloud service, or an OEM’s hardware.

In June, the Infocomm Media Development Authority (IMDA) awarded 5G licenses to Singtel and JVCo (formed by Starhub and M1), after they completed the required regulatory processes – including the selection of their preferred frequency spectrums, vendor partners and other technical matters such as performance, coverage, resilience, and cybersecurity. They will be required to provide coverage for at least half of Singapore by end-2022, scaling up to nationwide coverage by end 2025. While Singtel and JVCo were allocated radio frequency spectrum to deploy nationwide 5G networks, other mobile operators, including MVNOs, can access these network services through a wholesale arrangement. The networks will also be supplemented by TPG who has been allocated the remaining mmWave spectrum and will be allowed to roll out localised 5G networks.

Ecosystm Principal Advisor, Shamir Amanullah says, “Singapore, along with Thailand, leads 5G adoption in Southeast Asia and major telecom operators Singtel and StarHub launched trials which gives customers an opportunity to experience 5G speeds and potential new services.”

Singtel’s Journey Forward

Earlier this month Singtel launched its 5G NSA infrastructure on a 3-month trial promising speeds of 1Gbps by use of 3.5GHz frequency coupled with the existing 2100 MHz spectrum. It has made it free for the first 20,000 customers with 5G-compatible smartphones. While the 5G signals initially cover certain central and southern parts of Singapore, the coverage is expected to increase over the trial period. Singtel is also working on the development of other 5G services and integrating its network with technologies such as AI, IoT, Cloud, AR and data technologies, in line with the Government’s vision for 5G.

Last week, Singtel unveiled a 24×7 unmanned 5G powered stall to transform and reshape the retail experience. Labelled as 5G NOW @ UNBOXED, the hyper-connected store is designed to provide a first-hand experience of 5G services and possibilities to retailers and consumers. The store aims to offer seamless service experience to visitors looking for services such as SIM card replacements, and device collection through self-service kiosks. To create a more personalised experience for visitors, a 5G virtual assistant Stella is deployed at the store, integrated with facial recognition and emotion reading capabilities which will work in tandem with UNBOXED’s 5G rover Stanley. The rover is connected with the kiosk’s security system and will manage the contactless experience for visitors through temperature checks and maintaining social distancing measures. The 5G service with wireless connectivity and high speeds makes the store movable in a sort of hybrid online and offline retail model.

Amanullah says, “Singtel has ramped up its digitalisation efforts and increased adoption of digital channels and services to improve their customer experience. The 5G NOW @ UNBOXED phygital experience is cutting edge and brings the physical and digital experience in a seamless fashion for its customers. Singtel will be able to integrate physical and digital marketing efforts which should increase sales opportunity. In a recent report, Singtel announced that more than 70% of customer service transactions are online while only 30% of sales are transacted online. The unmanned 5G powered phygital experience should see online sales rising.”

The 5G powered pop-up store follows the launch of Singtel’s 5G non-standalone (NSA) network in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum integrating technologies such as dual connectivity. The trial based 5G network offers Singtel customers a sense of 5G services such as high-speed internet of more than 1Gbps, video streaming, cloud gaming, AR/VR and other consumer use-cases.

JVCo’s 5G Initiatives

JVCo has also launched its 5G connectivity services using the NSA 5G architecture in the country in partnership with Nokia. StarHub launched its trials in August 2020 which will end on 16 February 2021. The trial runs on an NSA 5G infrastructure on the 2100 MHz spectrum with the SA 5G infrastructure operating on the 3.5 GHz expected to be ready in mid-2021. The StarHub Mobile+ or Biz+ mobile plans, allows customers to automatically experience some early 5G benefits using compatible mobile devices. The 6-month, free trial is a lead up to the full commercial launch of 5G standalone services next year. The telecom operator has a planned investment of USD 146.4 million in 5G infrastructure over a five-year period.

Meanwhile, M1 is working closely with IMDA and is expected to roll out 5G trial services, soon.

Amanullah says, “In the challenging financial times due to the COVID-19 pandemic which has impacted roaming, prepaid segment, equipment sales among others, it is impressive that the leading operators in Singapore are bringing cutting-edge connectivity services which should drive digitalisation of consumers and enterprises.”

Earlier this month, Telefónica Germany announced it will use Amazon Web Services (AWS) to virtualise its 5G core for a proof of concept (POC) in an industrial use case and plans to move to commercial deployment in 2021. Part of the POC process is to ensure compliance with all applicable data protection guidelines and certifying them according to relevant industry standards.

“With the virtualisation of our 5G core network, we are laying the foundation for the digital transformation of the German economy. This collaboration with AWS is an important part of our strategy for building industrial 5G networks”, said Markus Haas, CEO of Telefónica Germany.

Sentiment about cloud – especially public cloud – has been on a slight roller-coaster ride since they emerged back in the “noughties”: From initial reluctance to reluctant acceptance – to customer driven enthusiasm to scaling back and migrating back data and apps to on-premises data centres or private clouds to a more recent acceptance, that most enterprise resources may work best in a hybrid or public cloud environment.

Still, the viewpoint of many is still that core resources for the most part belong on-premises – especially if they are essential for the running of the business or involves sensitive data.

It is in this light that the Telefónica Germany announcement is interesting. On the face of it, it may appear that this is a possible major validation of public cloud as a platform for core systems and sensitive data. Although the core network components will remain on a different platform delivered by Ericsson, there is clearly an element of that.

Perception on Public Cloud

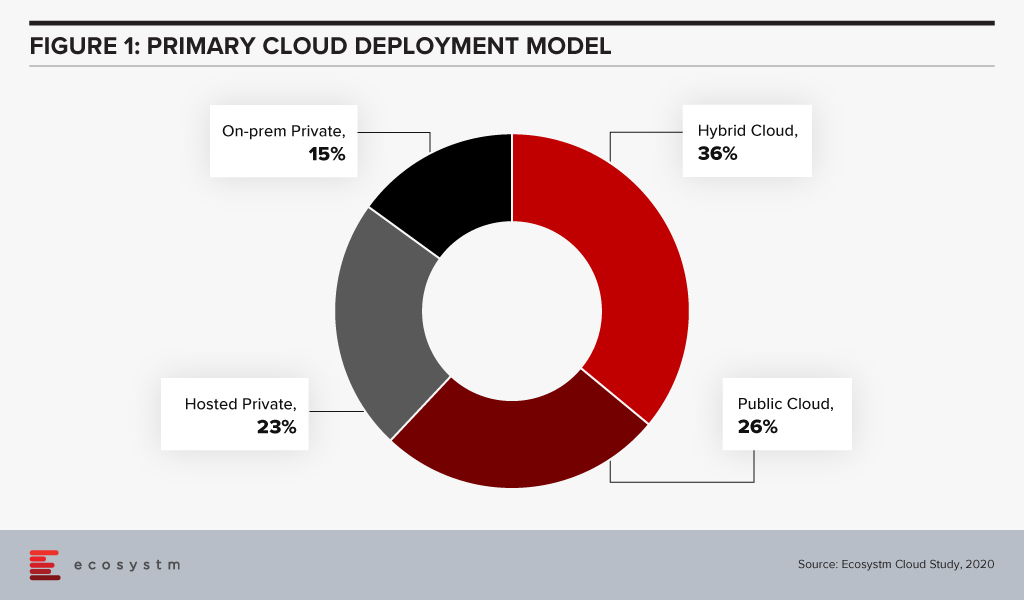

Many organisations remain sceptical with regards to public cloud. Ecosystm data shows that almost 40% have private cloud as their primary cloud deployment model (Figure 1); roughly a third have gone for a hybrid model and only around one quarter have chosen a public cloud model.

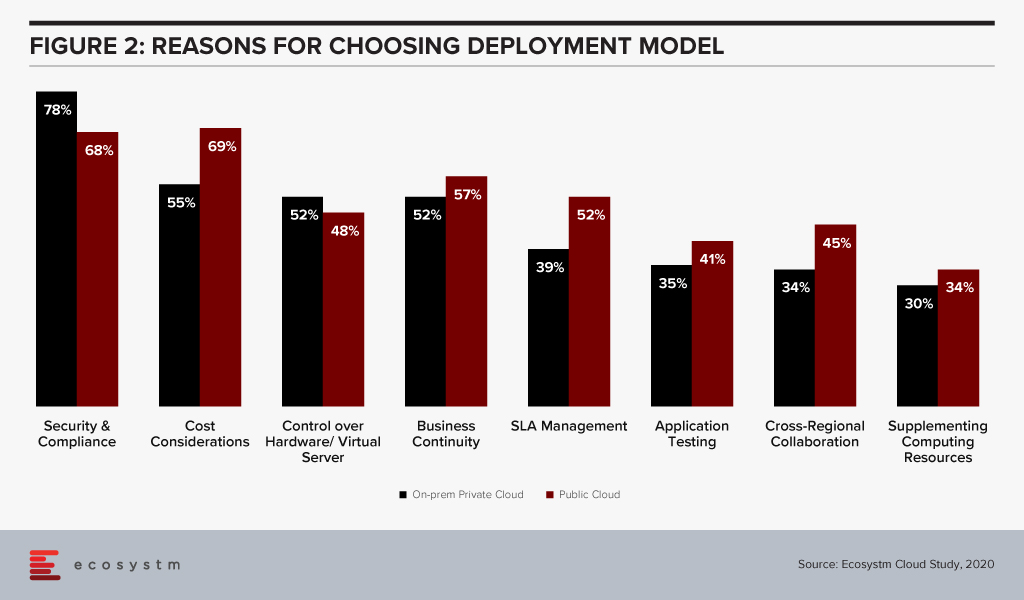

Most cloud deployment strategies ultimately come down to an evaluation of cost vs. risk and this evaluation is clearly demonstrated in Ecosystm data. Close to 80% of those choosing an on-premises private cloud model mention security and compliance as a main reason whereas cost considerations are the main reason for those opting for a public cloud model (Figure 2). What our data also shows is that public cloud providers are not necessarily winning the argument of cost savings among users.

For many organisations today, security and compliance concerns are still a valid point against public cloud as a primary deployment model. However, as we see more and more initiatives like Telefónica Germany, this argument diminishes – and it will become harder for IT organisations to convince senior management that this is still the way to go.

The Edge Complements the Cloud

The other noteworthy take-away from the Telefónica Germany initiative is how cloud-enabled edge computing is being embraced by the network design to ensure lower latencies for those who need it. The company states, “If companies use 5G network functions based on the cloud-based 5G core network of Telefónica Germany / O2 in the future, they will no longer need a physical core network infrastructure at their logistics and production sites, for example, but only a 5G radio network (RAN) with corresponding antennas.”

As I’m sure that you are an avid reader of Ecosystm Predicts every year, this should not come as a surprise as we wrote about something like this in the Top 5 Cloud Trends for 2020. Although some are touting Edge computing as the ultimate replacement of Cloud, we then believed – and still do – that it will be complimentary rather than competing technology. Cloud-based setups can benefit from pushing computing heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the Edge computing endpoints.

But to go back to the private cloud bit – while private cloud is not going away in the foreseeable future, we may be starting to see its demise in the more distant future.

To paraphrase a famous Brit: Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning for private cloud.

Identifying emerging cloud computing trends can help you drive digital business decision making, vendor and technology platform selection and investment strategies.Gain access to more insights from the Ecosystm Cloud Study.

Never before has the world experienced a shutdown in both supply and demand which has effectively slammed the brakes on economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises and the telecommunications industry has been the pillar which has kept the world ticking over.

It is unthinkable just how the human race would have coped with such massive disruption, two decades ago in the absence of broadband internet. The technology and telecom sector has seen a rise in their visible importance in recent months. Various findings show that peak level traffic was about 20-30% higher than the levels before the pandemic. The rise in traffic coupled with the fervent growth of the digital economy augurs well for the technology and telecom sector in Southeast Asia.

Revenues Hit Despite Rise in Traffic

Unfortunately, the rise in network traffic has not translated to an increase in revenue for many operators in the region. The winners, that enjoyed YoY growth in Q1 2020 despite challenging circumstances were: Maxis (4.9%) and DiGi (3.4%) in Malaysia; dtac (3.3%) and True (5.7%) in Thailand; PDLT (7.5%) and Globe (1.4%) in the Philippines; and Indosat Ooredoo (7.9%) and XL Axiata (8.8%) in Indonesia. The telecom operators that struggled include: Celcom (-6.1%) and TM (-8.0%) in Malaysia; Singapore’s trio of Singtel (-6.5%), StarHub (-15.2%) and M1 (-10.3%); and AIS (-1.0%) in Thailand.

Key market trends include a dip in prepaid subscribers due to fall in tourist numbers, roaming income losses due to travel restrictions, and a general decline in average revenue per user (ARPU) due to weaker customer spend. The postpaid customer segment was resilient while the fixed broadband revenue stream was stable due to the increase in work from home (WFH) practices. With fixed tariffs, there are no incremental gains with an increase in usage. Voice revenue has been hit with the increase in collaboration-based communication applications such as Zoom and Microsoft Teams.

Equipment sales fell as global supply chains were severely disrupted and impacted new sign-ups of the more premium customers. Most markets in Southeast Asia depend on retail outlets as a key channel to the market, which has been hampered.

With the job losses across the world, bad debts and weakened customer spend is inevitable and it is imperative that the operators provide for reflective pricing strategies, listen to new customer requirements to ensure customer retention and strengthening of their market position. In May, Verizon’s CEO Hans Vestberg said nearly 800,000 of their subscribers were unable to pay their monthly bills. Discussions with operators in Southeast Asia also highlighted this as a current concern.

Enterprise Segment Target for New Growth

Ecosystm research shows that enterprises in Southeast Asia are increasingly considering telecom operators as go-to-market partners (Figure 1). Enterprises are demanding more than just devices and connectivity and with the fervent digital transformation (DX) efforts underway, services such as managed services, business application services, cybersecurity and network services are in demand. Technology vendors have an opportunity to partner with the right telecom operator in each market to enhance their IT market offerings, ahead of the 5G rollouts.

The broad 5G ecosystem inculcates cross-sector innovation and greater collaboration leading to new business models and exciting new opportunities. Singtel is the leading operator in the region and has the enterprise segment contributing approximately 65% to its revenue in its domestic market. In the World Communications Award 2019, Singtel won both “Best Enterprise Service” and “The Broadband Pioneer” awards. This places Singtel in a fine position to capitalise on the 5G enterprise services.

5G Needed Now More Than Ever

The pandemic has seen a rise in network traffic, onboarding of the digital customer and rapid DX of businesses which has whetted the appetite for faster broadband speeds and new services. Southeast Asia countries stand to profit from the trade war between the US and China and 5G features of low latency and higher security can boost adoption of IoT, Smart Manufacturing and broader Industry 4.0 goals to drive the economy.

Fixed Wireless in Southeast Asia is expected to be very popular considering the low penetration of fibre to the home (with the exception of Singapore) and will provide enterprises with a viable secondary connection to the internet. Popular applications – including video streaming and gaming – which are speed, latency and volume hungry will also be a target market for operators. Mobile operators that do not have a fixed broadband offering can enter this space and provide a serious “wireless fibre” alternative to homes and businesses.

Governments and telecom regulators ought to make spectrum available to the major telecom operators as soon as possible in order to ensure that the cutting edge 5G communications services are made available to consumers and businesses. Many experts believe 5G can raise the competitiveness of a nation.

Recent research from World Economic Forum (WEF) has found that significant economic and social value can be gained from the widespread deployment of 5G networks, with 5G facilitating industrial advances, productivity and improving the bottom line while enabling sustainable cities and communities. GSMA notes that mobile technologies and services in the wider Asia Pacific region generated USD 1.6 trillion of economic value while the mobile ecosystem supported 18 million jobs as well as contributing USD 180 billion of funding to the public sector through taxation.

US-China Trade War Threatens to Change Equipment Supplier Landscape

Despite severe pressures caused by the US-China trade war, Huawei posted an impressive 13.1% YoY growth in 1H 2020 registering revenue of USD 64.88 billion. Both Huawei and ZTE generate approximately 60% of their business from their domestic markets which is critical with the current unfavourable global sentiments. Huawei has diversified its business and built its consumer devices business which should withstand the disruptions caused by the political challenges.

Ericsson and Nokia stand to benefit from Huawei’s current global position and this was evident with the wins for the 5G contracts by Singtel and JVCo (Singtel and M1). The JVCo announced it selected Nokia to build the Radio Access Network (RAN) for the 5G standalone (SA) mmWave network infrastructure in the 3.5GHz radio frequency band. Singtel selected Ericsson to provide for the RAN on the same mmWave network.

However, while there is an opportunity for NEC and Samsung to join the party, Huawei is expected to do well in most other countries in Southeast Asia.

The Rise of the Digital Economy in Southeast Asia

A recent Google report valued the internet economy in Southeast Asia at USD 100 billion in 2019, more than tripling since 2015, and the sector is expected to hit USD 300 billion in 2025. With a population of approximately 570 million people, the region has some of the fastest-growing internet economies in the world.

The Indonesia market is the largest in the region and is expected to hit USD 133 billion from USD 40 billion in 2025. Indonesia’s lack of a world-class telecom infrastructure coupled with their slowness in 5G adoption has not impeded the country’s attractiveness for global technology investors who see the 270 million population as an immense opportunity. US tech giants, Facebook, Google, and PayPal have invested in Indonesia to reap the benefits from the growing digital economy powered by unicorns such as Gojek, Bukalapak, Tokopedia. In June 2020, Google Cloud launched in Jakarta, only the second in the region after Singapore with the four big unicorns being anchor customers.

In 2025, Google predicts Thailand to be the second-largest internet economy worth USD 50 billion. The internet economy for Singapore, Malaysia and the Philippines are estimated to be over USD 27 billion each. Shopee and Lazada are the top eCommerce apps in the region and have seen an increase in sales due to the disruption in the Retail industry. In-store shopping contributes to more than 50% of Retail in Singapore and Malaysia – this provides a tremendous opportunity for eCommerce players.

While movement restrictions are gradually being lifted, some things may never return where they were before COVID-19. Public debts have risen with numerous aids and handouts impacting economic growth forecast and rising unemployment is impacting customer spending power. On the plus side, DX of businesses and sharp onboarding of customers have redefined interactions, and sectors such as Education, are going online which will boost the digital economy. While the challenges are evident, exciting times are ahead for the technology and telecom sector in Southeast Asia.

The telecom industry in India was in a pretty tight spot due to various challenges led by the Adjusted Gross Revenue (AGR) contention. AGR is a fee-sharing mechanism between the Government and the telecom providers who shifted to ‘revenue-sharing fee’ model in 1999, from the ‘fixed license fee’ model. Telecom providers are supposed to share a percentage of their AGR with the Government. While the government says that AGR includes all revenues from both telecom as well as non-telecom services, the operators contend that it should include only the revenue from core services. While the legal proceedings continue, India’s telecom industry continued facing other challenges such as one of the lowest ARPUs in the world and intense competition.

However, COVID-19 has given the industry a boost, changing the market dynamics and due to the increased interests of global investors. In his report, The New Normal for Telecom Providers in Southeast Asia, Ecosystm Principal Advisor, Shamir Amanullah talks about how the telecom sector has fast evolved as the backbone of business and social interactions as the adoption of applications such as video conferencing and collaborative tools surge. Streaming services such as Netflix have become the go-to source for entertainment, putting the telecom sector in the spotlight today.

India’s monthly active internet user base is estimated to touch 639 million by the end of December, thanks to the COVID-19-induced measures that have forced people to stay indoors. Currently estimated at 574 million, the number of monthly active internet users has grown 24% over that of 2019, indicating an overall penetration of 41% last year. Further, It is estimated that India will have more than 907 million internet users by 2023, accounting for nearly 64% of the population. There are also around 71 million children aged 5-11 years, who go online using devices of family members exhibiting high future digital adoption in the Gen Z.

India’s rural areas are driving the country’s digital revolution, with a 45% growth in internet penetration in 2019 as compared to 11% in urban India. Rural India has an estimated 264 million internet users and is expected to reach 304 million in 2020. Local language content and video drive the internet boom in rural India, with a 250% rise in penetration in the last four years. Mobile is the device of choice for 100% of active users to browse the internet.

Global Interest in the Indian Market

Reliance Jio

Jio Platforms, a subsidiary of Reliance Industries (India’s most valued firm) has raised an estimate of USD 20.2 billion in the past four months from 13 investors by selling about 33% stake in the firm. To put this into context, India’s entire start-up ecosystem raised USD 14.5 billion last year! Besides Google and Facebook, the list of investors includes Qualcomm Investment Ventures, Intel Capital, KKR, TPG, General Atlantic, Silver Lake, L Catterton, Vista Equity Partners, the Abu Dhabi Investment Authority and Saudi Arabia’s Public Investment Fund.

Google’s new investment gives Jio Platforms an equity valuation of USD 58 billion. The investment today from Google is one of the rare instances when it has joined its global rival Facebook in backing a firm. Google and Reliance Jio Platforms will work on a customised version of the Android operating system to develop low-cost, entry-level smartphones to serve the next hundreds of millions of users, according to Mukesh Ambani, Chairman and MD of Reliance Industries. These phones will support Google Play and future wireless standard 5G, he said.

Jio is increasing its focus on the development of areas such as digital services, education, healthcare and entertainment that can support economic growth and social inclusion at a critical time for the economy. At the Reliance Annual General meet, it was announced that Jio has developed a complete 5G solution from scratch that will enable us the launch of a world-class 5G service in India. Jio also revealed that the company is developing Jio TV Plus, Jio Glass, and more.

With an estimated 387 million subscribers as on 31st March 2020 making them the largest in the country, Jio Platforms provides telecom, broadband, and digital content services. Leveraging advanced technologies like Big Data Analytics, AI, IoT, Augmented and Mixed Reality, and Blockchain, this platform is focused on providing affordable internet connectivity with the content to match.

Bharti Airtel

Bharti Telecom, the promoter of Bharti Airtel, has sold a 2.75% stake in the telecom operator for an estimated USD 1.15 billion in May 2020 to a healthy mix of investors – long-only and hedge fund – across Asia, Europe and the US. The promoter entity will use the proceeds of the stake sale to pare debt and become a “debt-free company”.

It was reported that Amazon is in early-stage talks to buy a stake worth USD 2 billion in Bharti Airtel. This translates to a 5% stake based on the current market valuation of the telecom operator. There have also been conversations about the possibility of an agreement on a commercial transaction where Airtel would offer Amazon’s products at cheaper rates. However, Bharti Airtel has clarified that it works with digital and OTT platforms from time-to-time but has no other activity to report.

Airtel has also shared plans to integrate technology and telecom to build a digital platform to take on Jio’s ambitions of evolving into a tech and consumer company. To scale up its digital platforms business, Airtel has been betting on four pillars: data, distribution, payments, and network.

Bharti Airtel also announced it has partnered with Verizon to launch the BlueJeans video-conferencing service in India to serve business customers in the world’s second-largest internet market. They have an estimated 328 million subscribers as on 31st March 2020 making them the 2nd largest in the country.

The Third Player

Vodafone Idea Limited

Vodafone has an estimated 319 million subscribers as on 31st March 2020 making them the 3rd largest telecom provider in the country. There was unvalidated news that Google had shown interest in Vodafone but that does not seem relevant now given their investment in Jio.

The AGR case remains a significant factor for the telecom sector, particularly for Vodafone given their precarious financial position.

However, in recent times, their ARPU is expected to increase by over 40% from USD 1.23 to USD 1.88, through increased pricing. The stock market is responding positively to Vodafone with the stock almost doubling in the last 1 month

Last week, HPE announced that they will acquire Silver Peak – the wide area networks (WAN) specialist, including WAN optimisation and Software-Defined (SD-WAN) – in a deal worth USD 925 million. The move is in line with HPE’s Intelligent Edge strategy and their intention to provide a comprehensive edge-to-cloud networking solution.

HPE Building Intelligent Edge Capabilities

In 2018, HPE announced their intention to invest USD 4 billion over the next 4 years, to build an Intelligent Edge offering. This acquisition will give them the ability to combine the Aruba Edge Services platform with Silver Peak’s SD-WAN platform, to provide next-generation networking solutions.

In 2015, HPE acquired Aruba for USD 3 billion to strengthen capabilities on integrated and secure wireless technology and to support the access to cloud application, at a faster speed. Bringing together the innovation and technology capabilities of both units will accelerate HPE’s edge-to-cloud strategy to enhance distributed cloud models for application and data services for users.

Ecosystm Principal Advisor, Ashok Kumar says, “HPE leaped into the wireless local area networks (WLAN) space with the acquisition of a major enterprise Wi-Fi network vendor Aruba Networks, five years ago. With the acquisition of SD-WAN vendor Silver Peak last week, HPE extends enterprises’ reach with its Intelligent Edge portfolio. The synergy of Aruba and Silver Peak provides a fuller enterprise networking portfolio of solutions for HPE.”

The acquisition has been announced as markets are gearing towards recovery and organisations are opting for a more distributed working environments with remote employees. Kumar says, “The convergence area of networking and security at the enterprise edge is a high growth area that has accelerated due to the COVID-19 pandemic to address the remote worker’s needs.”

The current situation, compounded by the 5G rollouts in several global markets, is also forcing telecom operators to transform their business models. Telecom providers will now have to increasingly target B2B opportunities. Last month also saw HPE announce their Edge Orchestrator, a SaaS offering bringing lower latency, optimised bandwidth and improved security and privacy for telecom providers and their own enterprise customers to take advantage of 5G. Aruba Networks also rolled out a cloud native platform, Aruba ESP that has AIOps, Zero Trust network security and a unified infrastructure for data centres capabilities, to support remote operations.

“HPE’s success in this area will be dependent upon the tight integration of the two product line portfolios, and the channels of distribution, to effectively address the needs of enterprises at the edge with smarter solutions,” says Kumar.

The Growing Importance of SD-WAN

In the report, The Top 5 Telecommunications & Mobility Trends for 2020, Ecosystm had noted the growing significance of SD-WAN for enterprises, as they undertake Digital Transformation (DX) journeys and require more responsive and self-sustaining networks. The entire network infrastructure will have to be software-centric allowing for agility, scalability, and normalising costs with business growth. This has proved to be especially true in the wake of the current crisis.

“The network is a foundation on which a significant amount of Digital Transformation (DX) becomes possible, so as companies move through their DX journeys, often changing course, the network will need to adapt with them. AI, virtualisation and SD-WAN will bring increasing levels of flexibility as they lessen the need for specialised hardware, centralise control, and speed up configuration changes.

The availability of high-bandwidth, low latency networks coupled with SD-WAN will allow enterprises to shift away from thinking of their network as a physical space and start seeing it as a set of capabilities, taking work beyond a physical address. Equipment will be increasingly centralised in data centres (possibly on the Edge) to provide the ability to truly work anywhere.”

Download Report: The Top 5 Cloud Trends For 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Cloud Trends For 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the top 5 Cloud trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources.

Thailand has emerged as a key player in the 5G space in Southeast Asia. In February 2020, Thailand’s telecom regulator, NBTC auctioned 48 5G licenses to boost the development of Thailand’s digital economy. Later in the year, Thailand also announced the formation of the National 5G Committee to coordinate the 5G development roadmap with the digital economy vision.

The Future of 5G in Thailand

Ecosystm Principal Advisor, Shamir Amanullah says, “The transformational nature of 5G, unlike its predecessors, is expected to boost adoption of IoT, smart manufacturing and broader Industry 4.0 initiatives to drive the economy. NBTC expects 5G technology to contribute over US$ 15 billion to the GDP in 2022. Key sectors expected to adopt are Healthcare, Manufacturing, Education and Agriculture.”

We are already seeing initial applications of 5G. “AIS and True have been launching 5G networks in hospitals across Thailand to support medical personnel in their fight against COVID-19. Telemedicine and robots using 5G are being used to prevent contact between affected patients and medical personnel. AIS has launched 5G networks in 158 hospitals in Bangkok and other major cities.”

Amanullah adds, “The changing landscape of remote working caused by COVID-19 has increased network traffic, especially a spike in the video, further amplifying the need for 5G infrastructure. The onboarding of many new digital users and increased adoption of digital solutions by businesses has whet the appetite for more speed, latency and more innovative services. 5G first-mover advantage is key especially for the major operators who can achieve significant scale in their new service offerings.”

The Thailand 5G Landscape

The major telecom providers bid for multiple licenses across different bands. While AIS and True bid for and won more licenses, other telecom providers such as DTAC are aiming more for a niche presence. They only bid for the high band 26 GHz auction, winning two out of the possible 26 licenses for 100 MHz blocks.

Amanullah discusses the benefits of different 5G bands. “The 700 MHz band covers large geographic areas while also being able to penetrate walls easily making it a highly valuable spectrum asset. The 2600 MHz band is attractive as most smartphones already have this radio.”

“The 26 GHz band provides for high-frequency spectrum, also known as mmWave spectrum. This band offers high-speed data and capacity but with a limited range. Applications expected to be used in the mmWave include virtual and augmented reality and remote health services. While DTAC has a smaller spectrum holding compared to AIS and True, they plan to complement with their coverage band to offer 5G services. The company is also believed to be keen in the 3500 MHz mid-range band when it becomes available. This band is currently occupied by satellite operator Thaicom.”

DTAC-NetFoundry Partnership

DTAC and NetFoundry recently announced a collaboration, to introduce a new network service dubbed as SmartConnect. SmartConnect is a network service which allows organisations to manage the network and cloud computing in a unified platform thus increasing efficiency, speed and security.

The partnership will enable both small and medium enterprises (SMEs) and large enterprises to leverage cloud-native networking capabilities to boost performance while increasing security when connecting to a cloud environment. SmartConnect service will replace traditional set-ups involving hardware, VPN devices by providing a new virtual network for organisations. This is expected to empower business users to access cloud-based data quicker – with eight to ten folds speed – than a conventional network in a highly secured environment at a fraction of a cost.

Amanullah says, “The Network-as-a-Service (NaaS) features in 5G – where a customised network service based on bandwidth speed or latency, specific to a variety of 5G use cases – brings an exciting new business and potentially lucrative opportunities. Network slicing allows for many virtual networks on a single physical network and NaaS theoretically allows for a customer to request for a tailored network service required. NaaS delivers virtual network services on a subscription basis which has the potential to be an exciting game-changer.”

DTAC is clearly gearing up for the changes in the industry. The SmartConnect service can become a true differentiator for them. It also gives an opportunity to DTAC to leverage NetFoundry’s integration with Azure, AWS and GCP to enhance cloud connectivity services and provide value to their enterprise users.

As the telecom industry transforms, it will see more such partnerships between telecom providers and technology vendors.