The 28th United Nations Climate Change Conference (or COP28) took place at the end of 2023 in one of the most climate-vulnerable countries in the world – the UAE. The event brought together nations, leaders, and climate experts to unite around tangible climate action and deliver realistic solutions.

COP28 marked a watershed moment in the global effort to fight climate change because it concluded the first Global Stocktake – a routine assessment of progress under the Paris Agreement that occurs every five years. It is clear that we are not on track to meet the agreement’s goals, but the decisions and actions taken during COP28 can redefine the trajectory of climate action.

COP27: Laying the Foundation

COP27 laid the groundwork for this year’s conference. The summit focused on mitigation, adaptation, finance, and collaboration. The key outcomes of COP27 included the creation of the loss and damage fund, new pledges to the Adaptation Fund, and advancements in the Santiago Network focused on technical support for climate-affected regions. The conference also saw progress on the Global Stocktake and formal recognition of new issues such as water, food security, and forests within climate deliberations.

However, there was widespread criticism for failing to live up to the urgency of impending climate crisis. Despite being called the “implementation COP”, nothing decisive was done to ensure global warming is limited to 1.5 degrees celsius.

COP28: Milestones

Launching the first-ever Global Stocktake. The Global Stocktake was the spotlight of this year’s event and covered various climate issues, including energy, transport, and nature. Despite strong opposition from Oil & Gas interests, negotiators secured an agreement indicating the start of the end of the fossil fuel era – a much-needed conclusion to the hottest year in history. The next global assessment of Paris Agreement targets is expected to take place at COP33 in 2028.

Supporting sustainable agriculture. A landmark declaration on sustainable agriculture was adopted to address climate-related threats to global food systems. Signed by 160 countries, the declaration pledged a collective commitment by participating nations to expedite the integration of agriculture and food systems into national climate actions by 2025. For the first time ever, the summit also featured an entire day devoted to food and agriculture and saw a food systems roadmap laid out by the Food and Agriculture Organisation (FAO).

Operationalising the “Loss and Damage” fund. The conference saw the approval of the “loss and damage fund” that was first tabled at COP27 last year. The fund has been a long-requested support for developing nations facing the impact of climate change.

Tripling renewables and doubling energy efficiency by 2030. 118 countries signed a renewable energy pledge to triple the world’s green energy capacity to 11,000 GW by 2030, reducing the reliance on fossil fuels in generating energy. The pledge is expected to see global average annual rate of energy efficiency improvements from around 2% to over 4% every year until 2030. While the pledge spearheaded by the EU, the US, and the UAE is not legally binding, it is a step in the right direction.

Adapting to a warmer world. COP28 provided a framework for the ‘Global Goal on Adaptation’ to guide countries in their efforts to protect their people and ecosystems from climate change. An explicit 2030 date has been integrated into the text for targets on water security, ecosystem restoration, health, climate-resilient food systems, resilient human settlements, reduction of poverty, and protection of tangible cultural heritage.

Addressing methane. Methane took centre stage at COP28, reflecting its significant role in current global warming. US, Canada, Brazil, and Egypt announced more than USD 1 billion in funding to reduce methane emissions. Despite facing political challenges, these measures signify a shift towards concrete regulatory and pricing tools, marking a step forward in addressing methane’s impact on climate protection.

How COP28 Could Have Been More Impactful

Better funding allocations. Although the “loss and damage” funding agreement seems like a major outcome, the actual financial commitments fell far short. US and China, despite being the world’s largest emitters, extended only USD 17.5 million and USD 10 million to the fund, respectively. There is also debate about how funds should be distributed, with mature countries favouring aid allocation based on vulnerability. This approach might exclude middle-income countries that have suffered significant climate-related damage recently.

More focus on AI. While COP28 tackled critical climate issues, it overlooked a significant concern – the environmental impact of AI. While AI holds promise for improved sustainability, it is important to address the environmental consequences of AI model training and deployment. The absence of scrutiny on the ecological impact of AI represents a missed early opportunity, considering the widespread hype and significant investments in the technology.

Recognising climate refugees. The increase in climate-related displacement is a growing concern, with millions already affected and predictions of a significant rise by 2050. International law does not recognise those displaced by climate events as refugees. Despite this, the topic wasn’t adequately explored at COP28, highlighting the need for inclusive discussions and solutions for safe migration pathways.

A Call for Unified Action

While COP28 and similar forums highlight the severity of the climate crisis, the real power lies in continuous collective conversations that identify gaps, strive to bridge them, and drive meaningful change. Ecosystm, in collaboration with partners Kyndryl and Microsoft, conducted a Global Sustainability Barometer study, that reveals that while 85% of global organisations acknowledge the strategic importance of sustainability goals, only 16% have successfully integrated sustainability into their corporate and transformation strategies with tangible data.

While governments and policy makers continue to focus on building a sustainable future for the planet, this is time for a shift in mindset and action is pivotal for a unified global effort in addressing climate challenges and building a sustainable future – from organisations and individuals alike.

The expectations of the modern customer experience have evolved beyond the capabilities of traditional contact centers. Meeting customer needs goes far beyond just handling contact center calls. It’s all about surpassing the competition, providing excellent services, and nurturing steadfast customer loyalty.

In order to thrive in an ever-changing and unpredictable environment, businesses must prioritize and incorporate agility and adaptability into their strategies. They need to engage customers across multiple touchpoints throughout their journeys and offer proactive, hyper-personalized experiences. To meet market and customer demands, organizations must prioritize three critical aspects:

- Data and Systems

- Channels

- AI and Automation

Download this ebook authored by Audrey William, Principal Advisor, Ecosystm, for practical steps to deliver exceptional customer experiences across all channels.

(Clicking on this link will take you to the Khoros website where you can download the eBook)

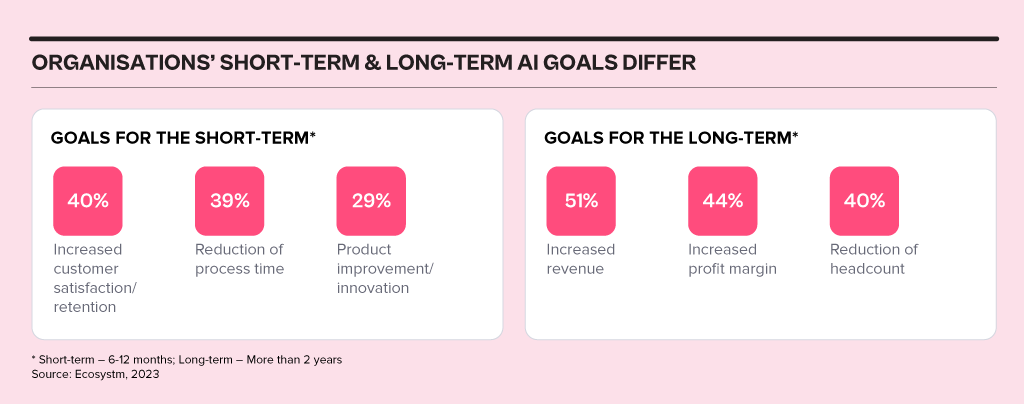

In 2024, business and technology leaders will leverage the opportunity presented by the attention being received by Generative AI engines to test and integrate AI comprehensively across the business. Many organisations will prioritise the alignment of their initial Generative AI initiatives with broader AI strategies, establishing distinct short-term and long-term goals for their AI investments.

AI adoption will influence business processes, technology skills, and, in turn, reshape the product/service offerings of AI providers.

Ecosystm analysts Achim Granzen, Peter Carr, Richard Wilkins, Tim Sheedy, and Ullrich Loeffler present the top 5 AI trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 AI Trends in 2024.

#1 By the End of 2024, Gen AI Will Become a ‘Hygiene Factor’ for Tech Providers

AI has widely been commended as the ‘game changer’ that will create and extend the divide between adopters and laggards and be the deciding factor for success and failure.

Cutting through the hype, strategic adoption of AI is still at a nascent stage and 2024 will be another year where companies identify use cases, experiment with POCs, and commit renewed efforts to get their data assets in order.

The biggest impact of AI will be derived from integrated AI capability in standard packaged software and products – and this will include Generative AI. We will see a plethora of product releases that seamlessly weave Generative AI into everyday tools generating new value through increased efficiency and user-friendliness.

Technology will be the first industry where AI becomes the deciding factor between success and failure; tech providers will be forced to deliver on their AI promises or be left behind.

#2 Gen AI Will Disrupt the Role of IT Architects

Traditionally, IT has relied on three-tier architectures for applications, that faced limitations in scalability and real-time responsiveness. The emergence of microservices, containerisation, and serverless computing has paved the way for event-driven designs, a paradigm shift that decouples components and use events like user actions or data updates as triggers for actions across distributed services. This approach enhances agility, scalability, and flexibility in the system.

The shift towards event-driven designs and advanced architectural patterns presents a compelling challenge for IT Architects, as traditionally their role revolved around designing, planning and overseeing complex systems.

Generative AI is progressively demonstrating capabilities in architectural design through pattern recognition, predictive analytics, and automated decision-making.

With the adoption of Generative AI, the role of an IT Architect will change into a symbiotic relationship where human expertise collaborates with AI insights.

#3 Gen AI Adoption Will be Confined to Specific Use Cases

A little over a year ago, a new era in AI began with the initial release of OpenAI’s ChatGPT. Since then, many organisations have launched Generative AI pilots.

In its second-year enterprises will start adoption – but in strictly defined and limited use cases. Examples such as Microsoft Copilot demonstrate an early adopter route. While productivity increases for individuals can be significant, its enterprise impact is unclear (at this time).

But there are impactful use cases in enterprise knowledge and document management. Organisations across industries have decades (or even a century) of information, including digitised documents and staff expertise. That treasure trove of information can be made accessible through cognitive search and semantic answering, driven by Generative AI.

Generative AI will provide organisations with a way to access, distill, and create value out of that data – a task that may well be impossible to achieve in any other way.

#4 Gen AI Will Get Press Inches; ‘Traditional’ AI Will Do the Hard Work

While the use cases for Generative AI will continue to expand, the deployment models and architectures for enterprise Generative AI do not add up – yet.

Running Generative AI in organisations’ data centres is costly and using public models for all but the most obvious use cases is too risky. Most organisations opt for a “small target” strategy, implementing Generative AI in isolated use cases within specific processes, teams, or functions. Justifying investment in hardware, software, and services for an internal AI platform is challenging when the payback for each AI initiative is not substantial.

“Traditional AI/ML” will remain the workhorse, with a significant rise in use cases and deployments. Organisations are used to investing for AI by individual use cases. Managing process change and training is also more straightforward with traditional AI, as the changes are implemented in a system or platform, eliminating the need to retrain multiple knowledge workers.

#5 AI Will Pioneer a 21st Century BPM Renaissance

As we near the 25-year milestone of the 21st century, it becomes clear that many businesses are still operating with 20th-century practices and philosophies.

AI, however, represents more than a technological breakthrough; it offers a new perspective on how businesses operate and is akin to a modern interpretation of Business Process Management (BPM). This development carries substantial consequences for digital transformation strategies. To fully exploit the potential of AI, organisations need to commit to an extensive and ongoing process spanning the collection, organisation, and expansion of data, to integrating these insights at an application and workflow level.

The role of AI will transcend technological innovation, becoming a driving force for substantial business transformation. Sectors that specialise in workflow, data management, and organisational transformation are poised to see the most growth in 2024 because of this shift.

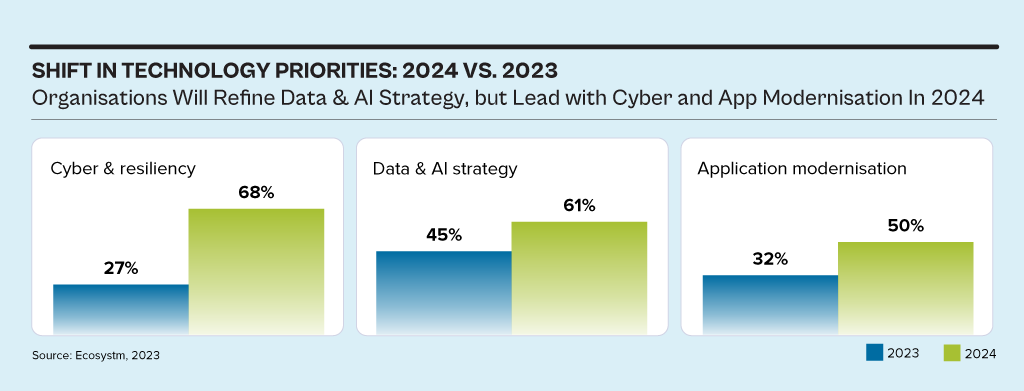

While the discussions have centred around AI, particularly Generative AI in 2023, the influence of AI innovations is extensive. Organisations will urgently need to re-examine their risk strategies, particularly in cyber and resilience practices. They will also reassess their infrastructure needs, optimise applications for AI, and re-evaluate their skills requirements.

This impacts the entire tech market, including tech skills, market opportunities, and innovations.

Ecosystm analysts Alea Fairchild, Darian Bird, Richard Wilkins, and Tim Sheedy present the top 5 trends in building an Agile & Resilient Organisation in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 Resilience Trends in 2024’ as a PDF.

#1 Gen AI Will See Spike in Infrastructure Innovation

Enterprises considering the adoption of Generative AI are evaluating cloud-based solutions versus on-premises solutions. Cloud-based options present an advantage in terms of simplified integration, but raise concerns over the management of training data, potentially resulting in AI-generated hallucinations. On-premises alternatives offer enhanced control and data security but encounter obstacles due to the unexpectedly high demands of GPU computing needed for inferencing, impeding widespread implementation. To overcome this, there’s a need for hardware innovation to meet Generative AI demands, ensuring scalable on-premises deployments.

The collaboration between hardware development and AI innovation is crucial to unleash the full potential of Generative AI and drive enterprise adoption in the AI ecosystem.

Striking the right balance between cloud-based flexibility and on-premises control is pivotal, with considerations like data control, privacy, scalability, compliance, and operational requirements.

#2 Cloud Migrations Will Make Way for Cloud Transformations

The steady move to the public cloud has slowed down. Organisations – particularly those in mature economies – now prioritise cloud efficiencies, having largely completed most of their application migration. The “easy” workloads have moved to the cloud – either through lift-and-shift, SaaS, or simple replatforming.

New skills will be needed as organisations adopt public and hybrid cloud for their entire application and workload portfolio.

- Cloud-native development frameworks like Spring Boot and ASP.NET Core make it easier to develop cloud-native applications

- Cloud-native databases like MongoDB and Cassandra are designed for the cloud and offer scalability, performance, and reliability

- Cloud-native storage like Snowflake, Amazon S3 and Google Cloud Storage provides secure and scalable storage

- Cloud-native messaging like Amazon SNS and Google Cloud Pub/Sub provide reliable and scalable communication between different parts of the cloud-native application

#3 2024 Will be a Good Year for Technology Services Providers

Several changes are set to fuel the growth of tech services providers (systems integrators, consultants, and managed services providers).

There will be a return of “big apps” projects in 2024.

Companies are embarking on significant updates for their SAP, Oracle, and other large ERP, CRM, SCM, and HRM platforms. Whether moving to the cloud or staying on-premises, these upgrades will generate substantial activity for tech services providers.

The migration of complex apps to the cloud involves significant refactoring and rearchitecting, presenting substantial opportunities for managed services providers to transform and modernise these applications beyond traditional “lift-and-shift” activities.

The dynamic tech landscape, marked by AI growth, evolving security threats, and constant releases of new cloud services, has led to a shortage of modern tech skills. Despite a more relaxed job market, organisations will increasingly turn to their tech services partners, whether onshore or offshore, to fill crucial skill gaps.

#4 Gen AI and Maturing Deepfakes Will Democratise Phishing

As with any emerging technology, malicious actors will be among the fastest to exploit Generative AI for their own purposes. The most immediate application will be employing widely available LLMs to generate convincing text and images for their phishing schemes. For many potential victims, misspellings and strangely worded appeals are the only hints that an email from their bank, courier, or colleague is not what it seems. The ability to create professional-sounding prose in any language and a variety of tones will unfortunately democratise phishing.

The emergence of Generative AI combined with the maturing of deepfake technology will make it possible for malicious agents to create personalised voice and video attacks. Digital channels for communication and entertainment will be stretched to differentiate between real and fake.

Security training that underscores the threat of more polished and personalised phishing is a must.

#5 A Holistic Approach to Risk and Operational Resilience Will Drive Adoption of VMaaS

Vulnerability management is a continuous, proactive approach to managing system security. It not only involves vulnerability assessments but also includes developing and implementing strategies to address these vulnerabilities. This is where Vulnerability Management Platforms (VMPs) become table stakes for small and medium enterprises (SMEs) as they are often perceived as “easier targets” by cybercriminals due to potentially lesser investments in security measures.

Vulnerability Management as a Service (VMaaS) – a third-party service that manages and controls threats to automate vulnerability response to remediate faster – can improve the asset cybersecurity management and let SMEs focus on their core activities.

In-house security teams will particularly value the flexibility and customisation of dashboards and reports that give them enhanced visibility over all assets and vulnerabilities.

In recent years, organisations have had to swiftly transition to providing digital experiences due to limitations on physical interactions; competed fiercely based on the customer experiences offered; and invested significantly in the latest CX technologies. However, in 2024, organisations will pivot their competitive efforts towards product innovation rather than solely focusing on enhancing the CX.

This does not mean that organisations will not focus on CX – they will just be smarter about it!

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 Customer Experience trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 CX Trends in 2024’ as a PDF.

#1 Customer Experience is Due for a Reset

Organisations aiming to improve customer experience are seeing diminishing returns, moving away from the significant gains before and during the pandemic to incremental improvements. Many organisations experience stagnant or declining CX and NPS scores as they prioritise profit over customer growth and face a convergence of undifferentiated digital experiences. The evolving digital landscape has also heightened baseline customer expectations.

In 2024, CX programs will be focused and measurable – with greater involvement of Sales, Marketing, Brand, and Customer Service to ensure CX initiatives are unified across the entire customer journey.

Organisations will reassess CX strategies, choosing impactful initiatives and aligning with brand values. This recalibration, unique to each organisation, may include reinvesting in human channels, improving digital experiences, or reimagining customer ecosystems.

#2 Sentiment Analysis Will Fuel CX Improvement

Organisations strive to design seamless customer journeys – yet they often miss the mark in crafting truly memorable experiences that forge emotional connections and turn customers into brand advocates.

Customers want on-demand information and service; failure to meet these expectations often leads to discontent and frustration. This is further heightened when organisations fail to recognise and respond to these emotions.

Sentiment analysis will shape CX improvements – and technological advancements such as in neural network, promise higher accuracy in sentiment analysis by detecting intricate relationships between emotions, phrases, and words.

These models explore multiple permutations, delving deeper to interpret the meaning behind different sentiment clusters.

#3 AI Will Elevate VoC from Surveys to Experience Improvement

In 2024, AI technologies will transform Voice of Customer (VoC) programs from measurement practices into the engine room of the experience improvement function.

The focus will move from measurement to action – backed by AI. AI is already playing a pivotal role in analysing vast volumes of data, including unstructured and unsolicited feedback. In 2024, VoC programs will shift gear to focus on driving a customer centric culture and business change. AI will augment insight interpretation, recommend actions, and predict customer behaviour, sentiment, and churn to elevate customer experiences (CX).

Organisations that don’t embrace an AI-driven paradigm will get left behind as they fail to showcase and deliver ROI to the business.

#4 Generative AI Platforms Will Replace Knowledge Management Tools

Most organisations have more customer knowledge management tools and platforms than they should. They exist in the contact centre, on the website, the mobile app, in-store, at branches, and within customer service. There are two challenges that this creates:

- Inconsistent knowledge. The information in the different knowledge bases is different and sometimes conflicting.

- Difficult to extract answers. The knowledge contained in these platforms is often in PDFs and long form documents.

Generative AI tools will consolidate organisational knowledge, enhancing searchability.

Customers and contact centre agents will be able to get actual answers to questions and they will be consistent across touchpoints (assuming they are comprehensive, customer-journey and organisation-wide initiatives).

#5 Experience Orchestration Will

Accelerate

Despite the ongoing effort to streamline and simplify the CX, organisations often implement new technologies, such as conversational AI, digital and social channels, as independent projects. This fragmented approach, driven by the desire for quick wins using best-in-class point solutions results in a complex CX technology architecture.

With the proliferation of point solution vendors, it is becoming critical to eliminate the silos. The fragmentation hampers CX teams from achieving their goals, leading to increased costs, limited insights, a weak understanding of customer journeys, and inconsistent services.

Embracing CX unification through an orchestration platform enables organisations to enhance the CX rapidly, with reduced concerns about tech debt and legacy issues.

The UN’s global stocktake synthesis report underscores the need for significant efforts to meet the ambitious goals of the Paris Agreement to keep the global warming limit to 1.5ºC, compared to pre-industrial levels. Achieving this requires collective action from governments, organisations, and individuals.

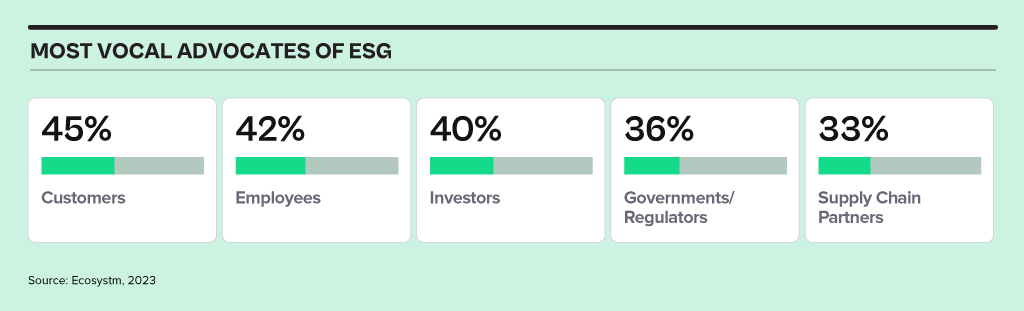

While regulators focus on mandates, organisations today are being influenced more by individual responsibility for positive impact. Customers and employees are leading ESG actions – another fast-emerging voice driving ESG initiatives are value chain partners looking to build sustainable supply chains.

Ecosystm research reveals that only 27% of organisations worldwide currently view ESG as a strategic imperative, yet we anticipate rapid change in the landscape.

Click below to find out what Ecosystm analysts Gerald Mackenzie, Kaushik Ghatak, Peter Carr and Sash Mukherjee consider the top 5 ESG trends that will shape organisations’ sustainability roadmaps in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 ESG Trends in 2024’ as a PDF.

#1 Organisations Will Evolve ESG Strategies from Compliance to Customer & Brand Value

Many of the organisations that we talk to have framed their ESG strategy and roadmaps primarily in relation to compliance and regulatory standards that they need to meet, e.g. in relation to emissions reporting and reduction, or in verifying that their supply chains are free from Modern Slavery.

However, organisations that are more mature in their journeys have realised that ESG is quickly becoming a strategic differentiator and compliance is only the start of their sustainability journey.

Customers, employees, and investors are increasingly selective about the brands they want to associate with and expect them to have a purpose and values that are aligned with their own.

#2 Sustainability Will Remain a Stepping-Stone to Full ESG

Heading into 2024, the corporate continues to navigate the nuances between Sustainability and Environmental, Social, and Governance (ESG) initiatives. Sustainability, focused on environmental stewardship, is a common starting point for corporate responsibility, offering measurable goals for a solid foundation.

Yet, the transition to comprehensive ESG, which includes broader social and governance issues alongside environmental concerns, demands broader scope and deeper capabilities, shifting from quantitative to qualitative measures. The trend of merging sustainability with ESG risks is blurring distinct objectives, potentially complicating reporting and compliance, and causing confusion in the market. Nevertheless, this conflation ultimately paves the way for more integrated, holistic corporate strategies.

By aligning sustainability efforts with wider ESG goals, companies will develop more comprehensive solutions that address the entire spectrum of corporate responsibility.

#3 ESG Consulting Will Grow – Till Industry Templates Take Over

At the end of 2022, LinkedIn buzzed with announcements of Chief Sustainability Officer appointments. However, the Global Sustainability Barometer Study reveals that only around one-third of global organisations have a dedicated sustainability lead. What changed?

Organisations have recognised that ESG is intricate, requiring a comprehensive focus and a capable team, not just a sustainability leader.

Each organisation’s path to sustainability is unique, shaped by factors like size, industry, location, stakeholders, culture, and values. Successfully integrating ESG requires a nuanced understanding of an organisation’s barriers, opportunities, and risks, making it challenging to navigate the sustainability journey alone. This is complicated by the absence of clear government/industry mandates and guidelines that frame best practices.

#4 Sustainability Tech Will Finally Gain Traction

Many organisations initiate sustainability journeys with promises and general strategies. While the role of technology in accelerating goals is recognised, alignment has been lacking. In 2024 sustainability tech will gain traction.

Environmental Tech. Improved sensors and analytics will enhance monitoring of air and water quality, carbon footprint, biodiversity, and climate patterns.

Carbon-Neutral Transportation. Advancements in electric and hydrogen vehicles, batteries, and clean mobility infrastructure will persist.

Circular Economy. Innovations like reverse logistics and product lifecycle tracking will help reduce waste and extend product/material life.

Smart Grids and Renewable Energy. Smart grid tech and new solutions for renewable energy integration will improve energy distribution.

#5 Cleantech Innovation Will See Increased Funding

Cleantech is the innovation that is driving our adaptation to climate change. We expect that investments into, and the pace of innovation and adoption of Cleantech will accelerate into 2024.

As companies commit to their net-zero targets, the need to operationalise the technologies required to fuel this transition becomes all the more urgent. BloombergNEF reported that for Europe alone, nearly USD 220 billion was invested in Cleantech in 2022.

But to meet net-zero ambitions, annual investments in Cleantech will need to triple over the rest of this decade and quadruple in the next.

2023 has been an eventful year. In May, the WHO announced that the pandemic was no longer a global public health emergency. However, other influencers in 2023 will continue to impact the market, well into 2024 and beyond.

Global Conflicts. The Russian invasion of Ukraine persisted; the Israeli-Palestinian conflict escalated into war; African nations continued to see armed conflicts and political crises; there has been significant population displacement.

Banking Crisis. American regional banks collapsed – Silicon Valley Bank and First Republic Bank collapses ranking as the third and second-largest banking collapses in US history; Credit Suisse was acquired by UBS in Switzerland.

Climate Emergency. The UN’s synthesis report found that there’s still a chance to limit global temperature increases by 1.5°C; Loss and Damage conversations continued without a significant impact.

Power of AI. The interest in generative AI models heated up; tech vendors incorporated foundational models in their enterprise offerings – Microsoft Copilot was launched; awareness of AI risks strengthened calls for Ethical/Responsible AI.

Click below to find out what Ecosystm analysts Achim Granzen, Darian Bird, Peter Carr, Sash Mukherjee and Tim Sheedy consider the top 5 tech market forces that will impact organisations in 2024.

Click here to download ‘Ecosystm Predicts: Tech Market Dynamics 2024’ as a PDF

#1 State-sponsored Attacks Will Alter the Nature Of Security Threats

It is becoming clearer that the post-Cold-War era is over, and we are transitioning to a multi-polar world. In this new age, malevolent governments will become increasingly emboldened to carry out cyber and physical attacks without the concern of sanction.

Unlike most malicious actors driven by profit today, state adversaries will be motivated to maximise disruption.

Rather than encrypting valuable data with ransomware, wiper malware will be deployed. State-sponsored attacks against critical infrastructure, such as transportation, energy, and undersea cables will be designed to inflict irreversible damage. The recent 23andme breach is an example of how ethnically directed attacks could be designed to sow fear and distrust. Additionally, even the threat of spyware and phishing will cause some activists, journalists, and politicians to self-censor.

#2 AI Legislation Breaches Will Occur, But Will Go Unpunished

With US President Biden’s recently published “Executive order on Safe, Secure and Trustworthy AI” and the European Union’s “AI Act” set for adoption by the European Parliament in mid-2024, codified and enforceable AI legislation is on the verge of becoming reality. However, oversight structures with powers to enforce the rules are currently not in place for either initiative and will take time to build out.

In 2024, the first instances of AI legislation violations will surface – potentially revealed by whistleblowers or significant public AI failures – but no legal action will be taken yet.

#3 AI Will Increase Net-New Carbon Emissions

In an age focused on reducing carbon and greenhouse gas emissions, AI is contributing to the opposite. Organisations often fail to track these emissions under the broader “Scope 3” category. Researchers at the University of Massachusetts, Amherst, found that training a single AI model can emit over 283T of carbon dioxide, equal to emissions from 62.6 gasoline-powered vehicles in a year.

Organisations rely on cloud providers for carbon emission reduction (Amazon targets net-zero by 2040, and Microsoft and Google aim for 2030, with the trajectory influencing global climate change); yet transparency on AI greenhouse gas emissions is limited. Diverse routes to net-zero will determine the level of greenhouse gas emissions.

Some argue that AI can help in better mapping a path to net-zero, but there is concern about whether the damage caused in the process will outweigh the benefits.

#4 ESG Will Transform into GSE to Become the Future of GRC

Previously viewed as a standalone concept, ESG will be increasingly recognised as integral to Governance, Risk, and Compliance (GRC) practices. The ‘E’ in ESG, representing environmental concerns, is becoming synonymous with compliance due to growing environmental regulations. The ‘S’, or social aspect, is merging with risk management, addressing contemporary issues such as ethical supply chains, workplace equity, and modern slavery, which traditional GRC models often overlook. Governance continues to be a crucial component.

The key to organisational adoption and transformation will be understanding that ESG is not an isolated function but is intricately linked with existing GRC capabilities.

This will present opportunities for GRC and Risk Management providers to adapt their current solutions, already deployed within organisations, to enhance ESG effectiveness. This strategy promises mutual benefits, improving compliance and risk management while simultaneously advancing ESG initiatives.

#5 Productivity Will Dominate Workforce Conversations

The skills discussions have shifted significantly over 2023. At the start of the year, HR leaders were still dealing with the ‘productivity conundrum’ – balancing employee flexibility and productivity in a hybrid work setting. There were also concerns about skills shortage, particularly in IT, as organisations prioritised tech-driven transformation and innovation.

Now, the focus is on assessing the pros and cons (mainly ROI) of providing employees with advanced productivity tools. For example, early studies on Microsoft Copilot showed that 70% of users experienced increased productivity. Discussions, including Narayana Murthy’s remarks on 70-hour work weeks, have re-ignited conversations about employee well-being and the impact of technology in enabling employees to achieve more in less time.

Against the backdrop of skills shortages and the need for better employee experience to retain talent, organisations are increasingly adopting/upgrading their productivity tools – starting with their Sales & Marketing functions.

Technological advancements have paved the way for banks and financial institutions to broaden their services globally. However, despite ongoing efforts to tackle disparities in access, systemic biases persist, including those related to race, gender, income disparities, and unequal lending practices, contributing to financial inequality.

Prioritising financial inclusion is crucial for fostering global economic growth and AI plays a significant role in achieving this objective.

AI is enhancing financial inclusion by providing financial education and minimising fraud in transactions, empowering previously underserved populations.

The Impact of Financial Inclusion

Impact on Individuals

It is transformative for poverty reduction, empowering marginalised populations to save and invest, providing a tangible path out of poverty. Additionally, access to insurance and savings accounts enhances personal resilience, helping individuals navigate financial risks associated with unforeseen events like health crises, natural disasters, and economic downturns. Financial inclusion is the first step towards social equity.

Impact on the Economy

It fuels economic growth by supporting small businesses and entrepreneurs, fostering innovation, job creation, and overall development. Beyond individual empowerment, it plays a crucial role in addressing global challenges, particularly by facilitating climate action in communities most affected by climate change.

Many market participants recognise the profound impact that financial inclusion can have on the economy and are collectively taking action.

Here are some examples of how they are leveraging AI to promote financial inclusion.

Click here to download ‘Bridging Gaps: AI’s Role in Financial Inclusion’ as a PDF

Ecosystm conducted the Global Sustainability Barometer Study in the final quarter of 2023 in collaboration with Kyndryl and Microsoft, to assess the disparity between sustainability commitments and actual actions in organisations across the world. The highlights from the study drove some meaningful discussions at COP28.

Read the report based on the study that captured the sentiments of more than 1,500 technology and sustainability leaders across 16 countries.

Download Whitepaper – From Vision to Impact: The Global Sustainability Barometer

(Clicking on this link will take you to the Kyndryl website where you can download the whitepaper)