Innovation is a driving force behind new approaches, often occurring at the point of adoption rather than technology development. As public sector organisations increasingly focus on improving citizen services through technology, it is important to adopt a strategic approach that considers innovation as a complex journey of systemic and cultural transformation. This strategic approach should guide the integration of technology into citizen services.

Here is a comprehensive look at what public sector organisations should consider when integrating technology into citizen services.

Download ‘Future-Proofing Citizen Services: Technology Strategies for the Public Sector‘ as a PDF

1. Immediate View: Foundational Technologies

The immediate view focuses on deploying technologies that are widely adopted and essential for current digital service provision. These foundational technologies serve as the backbone for enhancing citizen services.

Foundational Technologies

Web 2.0. Establishing a solid online presence is usually the first step, as it is the broadest channel for reaching customers. Web 2.0 refers to the current state of the internet, encompassing dynamic content and interactive websites.

Mobile Applications. Given that mobile usage has surpassed desktop, a mobile-responsive platform or a dedicated mobile app is crucial. Mobile apps provide a more specialised and immersive user experience by utilising device-specific features like GPS, document scanning, and push notifications.

2. Second-Generation Enablers: Emerging Technologies

As organisations establish foundational technologies, they should look towards second-generation enablers. Although less mature, these technologies offer emerging digital opportunities, and can significantly enhance service differentiation.

Emerging Technologies

Interactive Voice Response (IVR) systems improve the efficiency and effectiveness of digital services by routing callers to self-service options and providing relevant information without human intervention. These systems operate outside typical government agency working hours, ensuring continuous accessibility. Additionally, IVRs generate valuable data for future Voice of the Customer programs, improving overall service quality and responsiveness.

Digital Wallets facilitate transactions by expediting fund transfers and enhancing transparency through meticulous transaction records. They streamline administrative tasks, simplify transactions, and encourage service usage and adoption.

AI-driven Virtual Agents or chatbots revolutionise customer interactions by providing 24/7 support. They offer prompt, efficient, and personalised services, enhancing customer satisfaction and trust. In resource-limited public sectors, virtual agents are cost-effective, optimising resource allocation and meeting growing service demands. Specialised virtual agents for specific sectors can further differentiate service providers.

3. Futuristic View: Ambitious Innovations

The futuristic view focuses on forward-looking technologies that address long-term roadblocks and offer transformative potential. These technologies are currently speculative but hold the promise of significantly reshaping the market.

Innovations

Subscription Management models enable public sector information services to be accessed in highly personalised ways, thereby enhancing citizen engagement. This model supports regulatory oversight by providing common data insights and improves the management of services, ultimately benefiting the public by ensuring more responsive and tailored information delivery.

AI concierge leverages advanced technologies like Natural Language Processing, Computer Vision, and Speech Technologies to provide personalised and proactive customer service. They redefine customer management, ensuring a seamless and tailored experience.

Immersive reality technologies, such as augmented and virtual reality (AR/VR) create captivating customer experiences by allowing interactions in virtual environments. These technologies establish a shared virtual environment, helping customers to engage with businesses and each other in new and immersive ways. As an emerging customer management tool, immersive reality can transform the dynamics of customer-business relationships, adding substantial value to the service experience.

In my last Ecosystm Insights, I spoke about why organisations need to think about the Voice of the Customer (VoC) quite literally. Organisations need to listen to what their customers are telling them – not just to the survey questions they responded to, answering pre-defined questions that the organisations want to hear about.

The concept of customer feedback is evolving, and how organisations design and manage VoC programs must also change. Technology is now capable of enabling customer teams to tap into all those unsolicited, and often unstructured, raw feedback sources. Think contact centre conversations (calls, chats, chatbots, emails, complaints, call notes), CRM notes, online reviews, social media, etc. Those are all sources of raw customer feedback, waiting to be converted into customer insights.

Organisations can now find the capability of extracting customer insight from raw data across a wide range of solutions, from VoC platforms, data management platforms, contact centre solutions, text analytics players, etc. The expanding tech ecosystem presents opportunities for organisations to enhance their programs. However, navigating this breadth of options can also be confusing as they strive to identify the most suitable tools for their requirements.

As CX programs mature and shift from survey feedback to truly listening to customers, the demand for tech solutions tailored to various needs increases.

Where are tech vendors headed?

As part of my job as CX Consultant & Tech Advisor, I spend a lot of time working with my clients. But I also spend a lot of time speaking with technology vendors, who provide the solutions my clients need. Over the last few weeks and months there’s been a flurry of activity across the CX technology market with lots of product announcements around one specific topic. You guessed it, GenAI.

So, I invested some time in finding out how tech vendors are evolving their offerings. From Medallia, InMoment, Thematic, LiquidVoice, Concentrix, Snowflake, Nice, to Tethr – a broad variety of different vendors, but all with one thing in common; they help analyse customer feedback data.

And I like what I hear. The conversation has not been about GenAI because of GenAI, but about use cases and real-life applications for CX practitioners, including Insights & Research team, Contact Centre, CX, VoC, Digital teams, and so on. The list is long when we include everyone who has a role to play in creating, maintaining, and improving customer experiences.

It’s no wonder that many different vendors have started to embed those capabilities into their solutions and launch new products or features. The tech landscape is becoming increasingly fragmented at this stage.

What are an organisation’s tech options?

- The traditional VoC platform providers typically offer some text analytics capabilities (although not always included in the base price) and have started to tap into the contact centre solutions as well. Some also offer some social media or online review analysis, leaving organisations with a relatively good understanding of customer sentiment and a better understanding of their CX.

- Contact centre solutions are traditionally focused on analysing calls for Quality Assurance (QA) purposes and use surveys for agent coaching. Many contact centre players have evolved their portfolios to include text analytics or conversational intelligence to extract broader customer insights. Although at this stage they’re not always shared with the rest of the organisation (one step at a time…).

- Conversational analytics/intelligence providers have emerged over the last few years and are a powerhouse for contact centre and chatbot conversations. The contact centre really is the treasure trove of customer insights, although vastly underutilised for it so far!

- CRMs are the backbone of the customer experience management toolkit as they hold a vast amount of metadata. They’ve also been able to send surveys for a while now. Analysing unstructured data however (whether survey verbatim or otherwise) isn’t one of their strengths. This leaves organisations with a lot of data but not necessarily insights.

- Social media listening tools are often standalone tools used by the social media teams. There are not many instances of them being used for the analysis of other unstructured feedback.

- Digital/website feedback tools, in line with some of the above, are centred around collecting feedback, not necessarily analysing the unstructured feedback.

- Pure text analytics players are traditionally focused on analysing surveys verbatim. As this is their core offering, they tend to be proficient in it and have started to broaden their portfolios to include other unstructured feedback sources.

- Customer Data Platforms (CDP)/ Data Management Platforms (DMP) are more focused on quantitative data about customers and their experiences. Although many speak about their ability to analyse unstructured feedback as well, it doesn’t appear to be their strengths.

Conclusion

But what does that leave organisations with? Apart from very confused tech users trying to find the right solution for their organisation.

At this stage, there is immense market fragmentation, with many vendors from different core capabilities starting to incorporate capabilities to analyse unstructured data in the wake of the GenAI boom. However, a market convergence is expected.

While we watch how the market unfolds, one thing is certain. Organisations and customer teams will need to adjust – and that includes the tech stack as well as the CX program set up. With customer feedback now coming from anywhere within or outside the organisation, there is a need for a consolidated source of truth to make sense of it all and move from raw data to customer insights. While organisations will benefit immensely from a consolidated customer data repository, it’s also crucial to break down organisational silos at the same time and democratise insights as widely as possible to enable informed decision-making.

Customer feedback is at the heart of Customer Experience (CX). But it’s changing. What we consider customer feedback, how we collect and analyse it, and how we act on it is changing. Today, an estimated 80-90% of customer data is unstructured. Are you able and ready to leverage insights from that vast amount of customer feedback data?

Let’s begin with the basics: What is VoC and why is there so much buzz around it now?

Voice of the Customer (VoC) traditionally refers to customer feedback programs. In its most basic form that means organisations are sending surveys to customers to ask for feedback. And for a long time that really was the only way for organisations to understand what their customers thought about their brand, products, and services.

But that was way back then. Over the last few years, we’ve seen the market (organisations and vendors) dipping their toes into the world of unsolicited feedback.

What’s unsolicited feedback, you ask?

Unsolicited feedback simply means organisations didn’t actually ask for it and they’re often not in control over it, but the customer provides feedback in some way, shape, or form. That’s quite a change to the traditional survey approach, where they got answers to questions they specifically asked (solicited feedback).

Unsolicited feedback is important for many reasons:

- Organisations can tap into a much wider range of feedback sources, from surveys to contact centre phone calls, chats, emails, complaints, social media conversations, online reviews, CRM notes – the list is long.

- Surveys have many advantages, but also many disadvantages. From only hearing from a very specific customer type (those who respond and are typically at the extreme ends of the feedback sentiment), getting feedback on the questions they ask, and hearing from a very small portion of the customer base (think email open rates and survey fatigue).

- With unsolicited feedback organisations hear from 100% of the customers who interact with the brand. They hear what customers have to say, and not just how they answer predefined questions.

It is a huge step up, especially from the traditional post-call survey. Imagine a customer just spent 30 min on the line with an agent explaining their problem and frustration, just to receive a survey post call, to tell the organisation what they just told the agent, and how they felt about the experience. Organisations should already know that. In fact, they probably do – they just haven’t started tapping into that data yet. At least not for CX and customer insights purposes.

When does GenAI feature?

We can now tap into those raw feedback sources and analyse the unstructured data in a way never seen before. Long gone are the days of manual excel survey verbatim read-throughs or coding (although I’m well aware that that’s still happening!). Tech, in particular GenAI and Large Language Models (LLMs), are now assisting organisations in decluttering all the messy conversations and unstructured data. Not only is the quality of the analysis greatly enhanced, but the insights are also presented in user-friendly formats. Customer teams ask for the insights they need, and the tools spit it out in text form, graphs, tables, and so on.

The time from raw data to insights has reduced drastically, from hours and days down to seconds. Not only has the speed, quality, and ease of analysis improved, but many vendors are now integrating recommendations into their offerings. The tools can provide “basic” recommendations to help customer teams to act on the feedback, based on the insights uncovered.

Think of all the productivity gains and spare time organisations now have to act on the insights and drive positive CX improvements.

What does that mean for CX Teams and Organisations?

Including unsolicited feedback into the analysis to gain customer insights also changes how organisations set up and run CX and insights programs.

It’s important to understand that feedback doesn’t belong to a single person or team. CX is a team sport and particularly when it comes to acting on insights. It’s essential to share these insights with the right people, at the right time.

Some common misperceptions:

- Surveys have “owners” and only the owners can see that feedback.

- Feedback that comes through a specific channel, is specific to that channel or product.

- Contact centre feedback is only collected to coach staff.

If that’s how organisations have built their programs, they’ll have to rethink what they’re doing.

If organisations think about some of the more commonly used unstructured feedback, such as that from the contact centre or social media, it’s important to note that this feedback isn’t solely about the contact centre or social media teams. It’s about something else. In fact, it’s usually about something that created friction in the customer experience, that was generated by another team in the organisation. For example: An incorrect bill can lead to a grumpy social media post or a faulty product can lead to a disgruntled call to the contact centre. If the feedback is only shared with the social media or contact centre team, how will the underlying issues be resolved? The frontline teams service customers, but organisations also need to fix the underlying root causes that created the friction in the first place.

And that’s why organisations need to start consolidating the feedback data and democratise it.

It’s time to break down data and organisational silos and truly start thinking about the customer. No more silos. Instead, organisations must focus on a centralised customer data repository and data democratisation to share insights with the right people at the right time.

In my next Ecosystm Insights, I will discuss some of the tech options that CX teams have. Stay tuned!

In recent years, organisations have had to swiftly transition to providing digital experiences due to limitations on physical interactions; competed fiercely based on the customer experiences offered; and invested significantly in the latest CX technologies. However, in 2024, organisations will pivot their competitive efforts towards product innovation rather than solely focusing on enhancing the CX.

This does not mean that organisations will not focus on CX – they will just be smarter about it!

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 Customer Experience trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 CX Trends in 2024’ as a PDF.

#1 Customer Experience is Due for a Reset

Organisations aiming to improve customer experience are seeing diminishing returns, moving away from the significant gains before and during the pandemic to incremental improvements. Many organisations experience stagnant or declining CX and NPS scores as they prioritise profit over customer growth and face a convergence of undifferentiated digital experiences. The evolving digital landscape has also heightened baseline customer expectations.

In 2024, CX programs will be focused and measurable – with greater involvement of Sales, Marketing, Brand, and Customer Service to ensure CX initiatives are unified across the entire customer journey.

Organisations will reassess CX strategies, choosing impactful initiatives and aligning with brand values. This recalibration, unique to each organisation, may include reinvesting in human channels, improving digital experiences, or reimagining customer ecosystems.

#2 Sentiment Analysis Will Fuel CX Improvement

Organisations strive to design seamless customer journeys – yet they often miss the mark in crafting truly memorable experiences that forge emotional connections and turn customers into brand advocates.

Customers want on-demand information and service; failure to meet these expectations often leads to discontent and frustration. This is further heightened when organisations fail to recognise and respond to these emotions.

Sentiment analysis will shape CX improvements – and technological advancements such as in neural network, promise higher accuracy in sentiment analysis by detecting intricate relationships between emotions, phrases, and words.

These models explore multiple permutations, delving deeper to interpret the meaning behind different sentiment clusters.

#3 AI Will Elevate VoC from Surveys to Experience Improvement

In 2024, AI technologies will transform Voice of Customer (VoC) programs from measurement practices into the engine room of the experience improvement function.

The focus will move from measurement to action – backed by AI. AI is already playing a pivotal role in analysing vast volumes of data, including unstructured and unsolicited feedback. In 2024, VoC programs will shift gear to focus on driving a customer centric culture and business change. AI will augment insight interpretation, recommend actions, and predict customer behaviour, sentiment, and churn to elevate customer experiences (CX).

Organisations that don’t embrace an AI-driven paradigm will get left behind as they fail to showcase and deliver ROI to the business.

#4 Generative AI Platforms Will Replace Knowledge Management Tools

Most organisations have more customer knowledge management tools and platforms than they should. They exist in the contact centre, on the website, the mobile app, in-store, at branches, and within customer service. There are two challenges that this creates:

- Inconsistent knowledge. The information in the different knowledge bases is different and sometimes conflicting.

- Difficult to extract answers. The knowledge contained in these platforms is often in PDFs and long form documents.

Generative AI tools will consolidate organisational knowledge, enhancing searchability.

Customers and contact centre agents will be able to get actual answers to questions and they will be consistent across touchpoints (assuming they are comprehensive, customer-journey and organisation-wide initiatives).

#5 Experience Orchestration Will

Accelerate

Despite the ongoing effort to streamline and simplify the CX, organisations often implement new technologies, such as conversational AI, digital and social channels, as independent projects. This fragmented approach, driven by the desire for quick wins using best-in-class point solutions results in a complex CX technology architecture.

With the proliferation of point solution vendors, it is becoming critical to eliminate the silos. The fragmentation hampers CX teams from achieving their goals, leading to increased costs, limited insights, a weak understanding of customer journeys, and inconsistent services.

Embracing CX unification through an orchestration platform enables organisations to enhance the CX rapidly, with reduced concerns about tech debt and legacy issues.

Chris White, VP Marketing and Communities at Ecosystm, speaks with Melanie Disse, Principal Advisor, Ecosystm about what she is seeing in the world of Voice of Customer (VoC).

In this conversation, Melanie talks about the pivotal role of data in understanding customers’ requirements, preferences, and pain points; enabling businesses to enhance their overall customer experience, and build stronger connections with their customers.

Melanie also shares insights on the essential tools and methodologies for gathering customer feedback; as well as emerging trends in VoC.

Podcast: Play in new window | Download (Duration: 14:52 — 5.1MB)

Subscribe Spotify | Amazon Music | JioSaavn | Podchaser | RSS | More

The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

In her earlier Ecosystm Insight Melanie Disse spoke about how to measure customer experience (CX) success through an effective Voice of Customer (VoC) program.

In this Ecosystm byte, Melanie talks about why every VoC program needs to have an Insight to Action framework at its core, to detect and drive continuous improvement opportunities and positively impact organisations’ bottom line.

Read on to find out more about the “Listen – Analyse – Act” VoC Insights to Action framework. Each phase of the framework has its own challenges, and the success of the entire framework depends on the quality of each phase.

Download 3-Phases-from-VoC-Insights-to-Action as a PDF

Customer Experience (CX) has become a bit of a buzzword, which is fantastic! More and more businesses are recognising the importance of understanding their customers’ experiences and implementing a customer-centric organisational mindset. But how do organisations evaluate their success? Here are some tips on how the Voice of Customer (VoC) program can be used to assess whether your customer strategy is right and your improvement efforts are bearing fruit.

Understand who your customers are and what they experience

You will need to understand your customers’ experience during interactions, e.g. a visit to the website to find information, a call to the contact centre to get a query resolved, or a walk-in at the store to ask for help; and for specific life stages or journeys, e.g. how was their onboarding experience, what they value about the products and services etc.

There are different ways to form a rough or a more precise picture of your customers. Two popular approaches are:

- Data-based segmentations. This is based on behaviour seen in your backend system. It can be as basic as knowing your customer’s age bracket, gender, location, and annual spend.

- Research facilitated personas. These sophisticated personas will tell you things like, “Tech Savvy Joe is in his mid-20’s, lives in an affluent area, loves caramel frappuccinos with extra cream, uses your coffee shop app regularly to check for great deals and visits your cafe 13 times every month”, placing him in the “high value” category.

Once you have a rough, or precise idea of who your customers are, you can start thinking about the experiences your customers are having, and the experiences you’d like them to have.

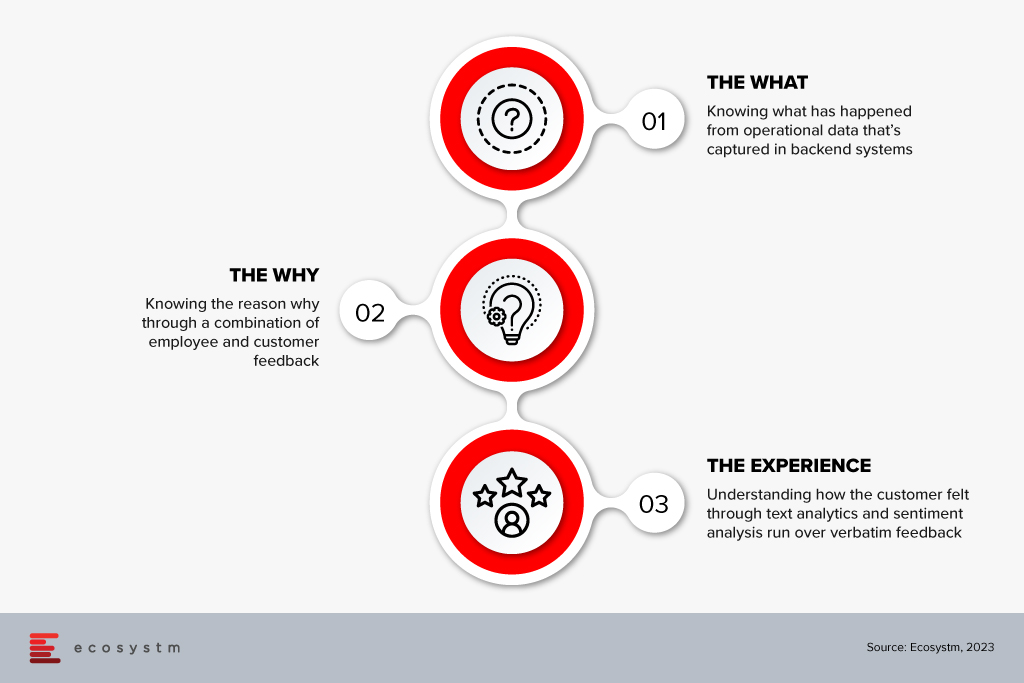

X & O Data: Completing the picture

Now, how do you know what an experience was like for your customer? You can ask them, and then you can observe them. We call this the X (experience) and the O (operational) data. And there are 3 fundamental things to understand within X & O data.

But how do we measure this experience? How do we capture, track and measure how the customer felt?

Let’s look into metrics.

Choose the right metric: NPS, CES or CSAT

Choosing the right metrics for the job is crucial for the success of the VoC program, as well as the ability to measure CX success overall. NPS, CSAT and CES are the 3 most frequently used customer feedback measures. They are complementary in nature, as they measure slightly different aspects of the customer experience.

- NPS (Net Promoter Score). How likely are customers to recommend the brand’s products and services to friends and family.

- CES (Customer Effort Score). How easy/difficult was it for the customer to get the query resolved.

- CSAT (Customer Satisfaction Score). How satisfied was the customer with the service received.

Using them in conjunction can be a great way to measure customer success. CSAT and CES are often used to explain the overall NPS number in more detail. While NPS is a rigid metric designed as an overall brand health measure for a business, CSAT and CES are more specific measures that can be adapted to a given situation, e.g. product reviews, service interactions with call centre agents, website interactions, store visits and so on.

NPS is a long-term measure, as the likelihood to recommend a brand isn’t based on a single interaction. A history of interactions, touchpoints, word of mouth, etc. form a brand perception. And all those interactions and touchpoints that form a customer’s recommendation can be tracked and measured through CSAT and CES – they are able to provide actionable insights to pinpoint pain points and detect opportunities for improvement.

Due to the long-term and high-level nature of the NPS score, this metric is best used in relationship or benchmark surveys. In a touchpoint environment, CES and CSAT are more powerful and insightful.

Identify and prioritise improvement initiatives

Equipped with customer and employee feedback on specific customer pain points you can then dig deeper into root causes and build initiatives to address those. But typically you will end up with a list of initiatives and face prioritisation challenge. Depending on the stakeholder you ask, you’ll get contradictory views on what’s most important. Some of the prioritisation metrics that you are likely to use will be cost, timeframe and resources required to implement change.

You can use your customer feedback metrics again to help with the prioritisation. Combining the score with the volume of feedback mentioning a specific pain point provides you with an “impact” for the customer. Combining the impact of the pain point on the customer, with the impact it has on the business provides a clear picture to form a priority list.

Some Real-life Examples

Problem. “Rude agent” – Low CSAT scores

- Root cause analysis. Agent not trained in dealing with difficult situations/customers; lacks the knowledge to deal with specific queries; feels undervalued; gets frustrated and overwhelmed

- Potential fix. CSR training

- Result. Reflected in an improved CSAT scores as the agent is equipped to handle difficult situations/customers and complex scenarios

Problem. “Hard to find things on the website” – High CES scores (high effort)

- Root cause analysis. Customer/UX research to understand what customers struggle with

- Potential fix. Website redesign for specific journeys/queries

- Result. Reflected in an improved CES as it’s now easier for customers to find what they want on the website

Conclusion

While you will see your CES and CSAT score improving quite quickly as a result of your changes, the NPS score is typically slower to respond. As mentioned earlier, a service interaction to get a query resolved is only one of many signals impacting the likelihood to recommend a brand. Just because one interaction was pleasant, doesn’t mean you’re out of the woods. You will need to deliver again and again to shift your NPS over time. Not just in terms of customer service, but also advertising, product design, quality of service, etc.