GreenTech is reshaping finance by fusing technology with sustainability. From startups to large financial institutions, there’s a clear push to embed climate intelligence into financial decisions. In 2024, green fintech investments hit USD 2.7B – underscoring strong momentum and growing confidence in tech-led sustainability solutions.

The focus is sharp: drive financial innovation while delivering real environmental impact.

Here’s a look at key Green Finance trends that are reshaping the industry.

Click here to download “The Future of Finance is Digital – and Sustainable” as a PDF.

Catalysing Change: Impact Investing

Impact investing is going mainstream, especially in fast-growing emerging markets.

This shift reflects a growing realisation: private capital is critical to climate action, and tackling climate risks is a financial opportunity, not just an ethical choice.

AVPN (Asian Venture Philanthropy Network) has launched ImpactCollab – a platform linking finance professionals with verified impact organisations, due diligence tools, and monitoring resources. Initially used by private banks in Singapore to bolster philanthropy advisory, it will soon expand into blended finance and impact investing, backed by MAS.

Green bonds are also gaining momentum, driven by investor demand, regulatory tailwinds, and rising climate risk awareness. In Singapore, NUS, UOB, and Northern Trust piloted tokenised green bond reporting to boost transparency. India, meanwhile, opened its sovereign green bonds to foreign investors via the Fully Accessible Route (FAR), unlocking global capital for climate goals.

Empowering Customers with Carbon Insights

Carbon tracking is becoming a staple in digital banking, driven by a growing demand for transparency around environmental impact. Banks are responding by embedding carbon calculators into apps – enabling users to measure emissions, benchmark against national averages, and get actionable tips to reduce their footprint.

In Indonesia, Bank Mandiri has launched an in-app feature that helps customers track their personal carbon emissions, making it easy to understand the environmental impact of daily actions. The Royal Bank of Canada has partnered with a carbon management platform to offer businesses tools to monitor and manage their emissions.

These moves reflect a broader shift: banks are embedding sustainability into everyday financial behaviour and deepening customer engagement through purpose-driven services.

Blockchain-Enabled Carbon Trading

Blockchain is transforming carbon trading by enabling a decentralised, transparent, and secure way to verify and transact carbon credits.

This technology addresses long-standing issues of fraud and inefficiency, offering a more reliable and cost-effective approach to managing credits and meeting climate goals.

Thailand has eased crypto regulations to promote blockchain-based carbon trading, positioning itself as a leader in sustainable tech. Meanwhile, US-based financial services firm Northern Trust has launched a blockchain platform that allows project developers to generate, verify, and trade voluntary carbon credits in near real-time. Together, these moves signal a shift toward mainstream adoption of blockchain in carbon markets.

Addressing the Climate Risk Gap

As climate risks intensify, small and medium enterprises (SMEs) are seeking tools to assess and manage their exposure. Despite being highly vulnerable to climate events, SMEs often lack the resources to navigate complex risk landscapes.

Fintechs are stepping in with climate risk-scoring tools that help SMEs identify vulnerabilities and take proactive steps – such as securing insurance or adapting their strategies.

Marsh has highlighted the need for SME-focused climate assessments in New Zealand, particularly for high-risk sectors. Its Climate Risk Navigator helps businesses build resilience and make informed decisions on insurance and sustainability. In India, insurers like ICICI Lombard are using geospatial tech – GIS, satellite imagery, and AI – to power climate-linked products. For example, its satellite-based insurance for wheat farmers in Punjab enables faster, more accurate yield assessments and claim settlements.

Rise of Climate-Conscious Crypto

Once criticised for high energy use, crypto mining is undergoing a green makeover – fuelled by surplus renewable energy and optimised by AI.

What was seen as wasteful is now being reimagined as a tool for grid stability and sustainable growth.

In Switzerland’s Canton of Bern, Bitcoin mining is being explored as a way to absorb excess power and stabilise the grid. In the UK, mining firms are tapping into unused wind energy during off-peak hours to avoid waste. This shift is reaching emerging markets too – Pakistan is converting surplus electricity into value by launching state-backed Bitcoin mining and AI data centres, turning untapped power into economic opportunity.

Ecosystm Opinion

Becoming truly sustainable presents a unique challenge for financial organisations, as their responsibility extends beyond internal operational efficiencies to actively empowering customers and the wider ecosystem to embrace green practices. This is compounded by a growing reliance on increasingly compute-intensive and energy-inefficient technologies.

The recent and growing emphasis on Green Finance offers a promising outlook, suggesting a positive shift in the industry’s trajectory towards a more sustainable future.

The increasing alignment between IT and business functions, while crucial for organisational success, complicates the management of enterprise systems. Tech leaders must balance rapidly evolving business needs with maintaining system stability and efficiency. This dynamic adds pressure to deliver agility while ensuring long-term ERP health, making management increasingly complex.

As tech providers such as SAP enhance their capabilities and products, they will impact business processes, technology skills, and the tech landscape.

At SAP NOW Southeast Asia in Singapore, SAP presented their future roadmap, with a focus on empowering their customers to transform with agility. Ecosystm Advisors Sash Mukherjee and Tim Sheedy provide insights on SAP’s recent announcements and messaging.

Click here to download SAP NOW Southeast Asia: Highlights

What was your key takeaway from the event?

TIM SHEEDY. SAP is making a strong comeback in Asia Pacific, ramping up their RISE with SAP program after years of incremental progress. The focus is on transitioning customers from complex, highly customised legacy systems to cloud ERP, aligning with the region’s appetite for simplifying core processes, reducing customisations, and leveraging cloud benefits. Many on-prem SAP users have fallen behind on updates due to over-customisation, turning even minor upgrades into major projects – and SAP’s offerings aim to solve for these challenges.

SASH MUKHERJEE. A standout feature of the session was the compelling customer case studies. Unlike many industry events where customer stories can be generic, the stories shared were examples of SAP’s impact. From Mitr Phol’s use of SAP RISE to enhance farm-to-table transparency to CP Group’s ambitious sustainability goals aligned with the SBTi, and Standard Chartered Bank’s focus on empowering data analytics teams, these testimonials offered concrete illustrations of SAP’s value proposition.

How is SAP integrating AI into their offerings?

TIM SHEEDY. SAP, like other tech platforms, is ramping up their AI capabilities – but with a twist.

They are not only highlighting GenAI but also emphasising their predictive AI features. SAP’s approach focuses on embedded AI, integrating it directly into systems and processes to offer low-risk, user-friendly solutions.

Joule, their AI copilot, is enterprise-ready, providing seamless integration with SAP backend systems and meeting strict compliance standards like GDPR and SOC-II. By also integrating with Microsoft 365, Joule extends its reach to daily tools like Outlook, Teams, Word, and Excel.

While SAP AI may lack the flash of other platforms, it is designed for SAP users – managers and board members – who prioritise consistency, reliability, and auditability alongside business value.

What is the value proposition of SAP’s Clean Core?

SASH MUKHERJEE. SAP’s Clean Core marks a strategic shift in ERP management.

Traditionally, businesses heavily customised SAP to meet specific needs, resulting in complex and costly IT landscapes. Clean Core advocates for a standardised system with minimal customisations, offering benefits like increased agility, lower costs, and reduced risk during upgrades. However, necessary customisations can still be achieved using SAP’s BTP.

The move to the Clean Core is often driven by CEO mandates, as legacy SAP solutions have become too complex to fully leverage data. For example, an Australian mining company reduced customisations from 27,000 to 200, and Standard Chartered Bank used Clean Core data to launch a carbon program within four months.

However, the transition can be challenging and will require enhanced developer productivity, expansion of tooling, and clear migration paths.

How is SAP shifting their partner strategy?

As SAP customers face significant transformations, tech partners – cloud hyperscalers, systems integrators, consulting firms and managed services providers – will play a crucial role in executing these changes before SAP ECC loses support in 2027.

TIM SHEEDY. SAP has always relied on partners for implementations, but with fewer large-scale upgrade projects in recent years, many partner teams have shrunk. Recognising this, SAP is working to upskill partners on RISE with SAP. This effort aims to ensure they can effectively manage and optimise the modern Cloud ERP platform, utilise assets, templates, accelerators, and tools for rapid migration, and foster continuous innovation post-migration. The availability of these skills in the market will be essential for SAP customers to ensure successful transitions to the Cloud ERP platform.

SASH MUKHERJEE. SAP’s partner strategy emphasises business transformation over technology migration. This shift requires partners to focus on delivering measurable business outcomes rather than solely selling technology. Given the prevalence of partner-led sales in Southeast Asia, there is a need to empower partners with tools and resources to effectively communicate the value proposition to business decision-makers. While RISE certifications will be beneficial for larger partners, a significant portion of the market comprises SMEs that rely on smaller, local partners – and they will need support mechanisms too.

What strategies should SAP prioritise to maintain market leadership?

TIM SHEEDY. Any major platform change gives customers an opportunity to explore alternatives.

Established players like Oracle, Microsoft, and Salesforce are aggressively pursuing the ERP market. Meanwhile, industry-specific solutions, third-party support providers, and even emerging technologies like those offered by ServiceNow are challenging the traditional ERP landscape.

However, SAP has made significant strides in easing the transition from legacy platforms and is expected to continue innovating around RISE with SAP. By offering incentives and simplifying migration, SAP aims to retain their customer base. While SAP’s focus on renewal and migration could pose challenges for growth, the company’s commitment to execution suggests they will retain most of their customers. GROW with SAP is likely to be a key driver of new business, particularly in mid-sized organisations, especially if SAP can tailor offerings for the cost-sensitive markets in the region.

COVID-19 has been a major disruption for people-intensive industries and the BPO sector is no exception. However, some of the forward-looking BPO organisations are using this disruption as an opportunity to re-evaluate how they do business and how they can make themselves resilient and future-proof. In many of these conversations, technology and process reengineering are emerging as the two common themes in their journey to transform into a New Age BPO provider.

In 2022 BPO providers will focus on mitigating their key challenges around handling client expectations, better people management and investing in the right technologies for their own transformation journeys.

Read on to find out what Ecosystm Advisors Audrey William and Venu Reddy think will be the key trends for the New Age BPO in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for the New Age BPO in 2022 as PDF

It is true that the Retail industry is being forced to evolve the experiences they deliver to their customers. However, if Retail organisations are only focused on creating digital experiences, they are not creating the differentiation that will be required to leap ahead of the competition. It is time for Retail organisations to leverage data to empower multiple roles across the organisation to prepare for the different ways customers want to engage with their brands.

Another trend that is creating a shift in the industry is the rise of small and medium-sized retailers. Traditionally, larger retailers have made larger investments in technology – they simply had deeper pockets for the on-premise investments. However, with the rise of SaaS, size may no longer be such an advantage in Retail.

Here is how organisations such as Walmart, Adobe, GoDaddy and Google are empowering the SME retailer.

Customer experience (CX) is a key business priority for all organisations – irrespective of the organisation size.

Many of the contact centre solutions in the market can be complex and expensive and may not be suitable for a family-owned business or for a business requiring less than 30 agents. What these businesses look for in a solution include: inbound, outbound, call recording, workforce optimisation and basic analytics capabilities. SMEs tend to use contact centre solutions that come with telecom services and have a one-off implementation fee. The overall cost of the solution – including agent licenses and other associated costs such as training – has to be affordable for the SMEs.

This whitepaper provides CX decision makers in Australia’s SMEs with global best practices, to help them understand the priorities of SMEs in running their day-to-day contact centre operations, including case studies. The data mentioned in the paper is from the global Ecosystm CX Study that is live and ongoing on the Ecosystm platform.

Click below to download

(Clicking on this link will take you to MaxContact website where you can download the document )

In the recently published the Top 5 Cybersecurity & Compliance Trends for 2021 report Ecosystm predicts that 2021 is when M&As will ramp up in earnest to consolidate the fragmented cybersecurity market. The pandemic has slowed down M&A activities in 2020. Early signs of what we can expect from the market when we emerge from COVID-19 can be seen in the recent acquisition of Asavie by Akamai Technologies. The market is realising the full implication of the shift to remote working and the potential of increased cyber threats – and this acquisition is a sign that larger vendors will continue to strengthen their cybersecurity capabilities by acquiring vendors, with complementary capabilities.

Asavie Enabling the Secure Office Anywhere

Asavie, headquartered in Ireland, offers a global platform that manages the security, performance, and access policies for mobile and internet-connected devices. Asavie delivers secure access to business resources for a mobile workforce – without requiring installation and management of client software. Increasing mobile workloads and Office Anywhere trends mean that the enterprise private network is no longer just PCs/laptops. All enterprise endpoints must be considered to be a part of the enterprise network – and security and authentication solutions must be able to handle this. Organisations will need to explore options where they can give seamless access to their employees without straining their IT and cybersecurity teams – a rapidly installable, scalable, and cloud-managed solution will become a necessity.

More than ever before, enterprises will have to treat all endpoints as branches of the organisation, and the Future of Work goes beyond enabling home offices. The Global CXO Study: The Future of the Secure Office Anywhere finds that 66% of IT and business leaders think of multiple locations, when they think of Office Anywhere. Employees will work wherever they get the best work experience and are most productive. Future work patterns will require that all endpoints are considered as extended branches of the organisation. This involves the ability to extend the enterprise WAN – with speed, flexibility, and security in mind – whether it is a temporary or a home office, an ad-hoc point of sales or an employee on the go. Every employee or device should be treated like a Branch of One.

Ecosystm Comments

“Akamai has been diversifying away from its well-known content delivery network (CDN) offering and has successfully built its security business offering in recent years. In 2019, the company nearly doubled its security revenue to USD 849 million from just USD 488 million in 2017. In their 3rd quarter financial results reported in end October 2020, the Cloud Security Solutions revenue was US$266 million, up 23% year-over-year.”

“The move into the mobile security segment has been timely for Akamai as enterprise application and content is moving from behind the firewall to the cloud; adding to the criticality of the cybersecurity threat management. The COVID-19 pandemic has further driven the onboarding of businesses and consumers alike, adding to significant addressable market opportunities.”

“The acquisition of Asavie is a strategic move. Asavie’s solution effectively extends the enterprise security management to incorporate mobile devices as a ‘Branch of One’ enabling CIOs and CISOs to manage security and policies the same way as traditional enterprise network resources. The growth of 5G will further drive IoT devices and a myriad of applications and use cases which will provide for a significant growth opportunity for Akamai – the acquisition of Asavie is a positive move to support this trend.”

Akamai Strengthens Intelligent Edge Capabilities

Asavie’s mobile, IoT and security solutions will integrate with Akamai’s Security and Personalisation Services (SPS) product line sold to carrier partners that embed the solution within the technology bundle sold to their subscribers. With the Asavie acquisition, Akamai intends to help their carrier partners address enterprise and mid-market customer demand for IoT and mobile device security and management services.

Ecosystm Comments

“The addition of Asavie to Akamai’s SPS product line provides synergy for the company to expand into new addressable markets for the remote workforce and internet-connected devices to deliver superior experience in a multi-cloud environment. The Global CXO Study conducted by Ecosystm found that three quarters of the organisations rate mobile security as an important or very important part of their digital transformation strategy. Secure mobile experiences will be a core element of the enterprise going forward in the post COVID-19 business environment – driven by employee needs for mobile services and corporate resources from remote locations, with superior identity and policy management, in a frictionless manner.”

“There is an opportunity for mobile service providers and mobile virtual network operators (MVNOs) to leverage the Asavie solution combined with Akamai’s strength at the edge with over 1,500 networks worldwide to offer cloud-based value-added cybersecurity services. The Global CXO Study also found that scaling of endpoint security was a major pain point for half the organisations with more than 100 branches. Service providers can become the enabler by offering services for small and medium enterprises (SMEs) to dynamically adapt their network and security services to fluctuating demand conditions.”

“Although Akamai does offer CDN services for the SME segment, the company heavily relies on service providers and carriers to address this segment in the CDN, cloud security and its burgeoning IoT Edge offerings. Asavie’s market approach is similar and its products and services portfolio appears to complement Akamai’s very well, making it a very good fit for the company. Not only will it enhance Akamai’s SME positioning on the secure connectivity space, but it will also boost its offerings for carriers in the IoT space.”

“Carriers have had a checkered history at best, in understanding and making the most of data services. Mobile Internet took off because of smartphone manufacturers (Apple) and Internet companies – not through carrier offerings. Although carriers appear to be more proactive and forward-looking with regards to IoT, they should not expect to have the foresight to see what services and business cases will make 5G and IoT truly profitable. Rather, their main focus should be on enabling the secure and flexible infrastructure that can ultimately enable others to develop the use cases. The next logical step would then be for carriers to develop IoT orchestration platforms that can manage much larger parts of the IoT value chain. If they succeed in this (and even if they don’t) it could result in a major boost for Akamai’s CDN business.”

“In other words, carriers need help with IoT and to that end, Akamai’s acquisition of Asavie may strengthen its ability to support carriers to reach that goal.”

The full findings and implications of The top 5 Cybersecurity & Compliance Trends For 2021 are available for download from the Ecosystm platform. Sign up for Free to download the report.

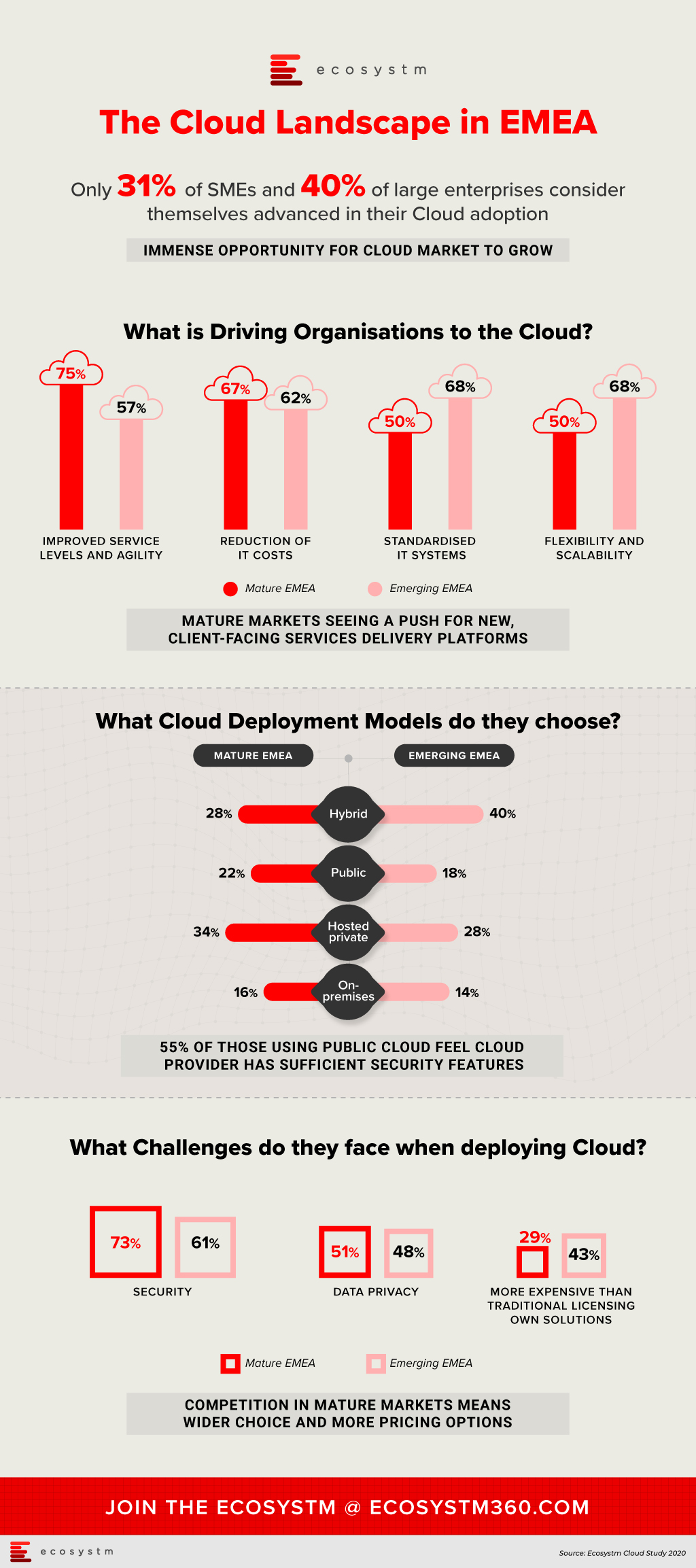

There has been a heightened interest in the cloud in EMEA in recent times, triggered by several regional and country level announcements.

The European Union (EU) founded the GAIA-X Foundation to build a unified system of cloud and data services to be protected by EU Laws – including GDPR, the free flow of non-personal data regulation and the Cybersecurity Act. France and Germany kicked off the GAIA-X cloud project last year and the system is open for participation to national and European initiatives for exchange of data across industries and services such as AI, IoT and data analytics. GAIA-X took another step towards becoming a real option for European organisations with the establishment as a legal entity in June. Founding members of GAIA-X include Atos, Bosch, BMW, Deutsche Telekom, EDF, German Edge Cloud, Orange, OVHcloud, SAP, and Siemens. Non-European providers, such as AWS, Microsoft, Google, and IBM will also have the opportunity to join GAIA-X. The UK Crown Commercial Service (CCS) has also been entering into agreements with public cloud platform providers to encourage increased cloud adoption in cash-strapped public sector organisations. It is a good time to evaluate organisations’ perception on cloud and their adoption patterns.

Ecosystm research finds that while most organisations have migrated at least some simple workloads to the cloud, the sophistication of these systems ranges from SaaS deployed as shadow IT, all the way up to cloud-native applications that are core to a digital business strategy. When asked about the maturity of their cloud deployments, 36% of organisations in EMEA consider themselves advanced, leaving the remaining 64% with more basic environments. These figures vary by business size with only 31% of SMEs considering their deployments advanced, rising to 40% for large enterprises.

Cloud technology providers should segment the market according to the maturity of their client’s systems. Those in the early stages of modernising their infrastructure will be seeking different benefits and will have different concerns than those already using cloud to underpin their digital transformation.

In the mature economies in the region, 75% of those with advanced deployments, considered improved service levels and agility as a key benefit of cloud. These organisations have moved beyond simply replacing legacy systems with cloud infrastructure and now look to the IT department to provide a platform on which new, client-facing services can be delivered. In the emerging economies, the most-reported benefits of cloud are flexibility and scalability, and standardised systems, both at 68% of respondents. These could be viewed as benefits expected from organisations not as far along in the cloud journey. The benefit of reduced IT costs was important in both mature EMEA (67%) and emerging EMEA (62%).

Looking at those who consider their cloud deployments as still basic, security is the leading challenge to greater adoption and by a large margin. Of those respondents in mature EMEA, 73% cited security as a key challenge, more than 20 percentage points higher than the next greatest difficulty. In emerging EMEA, a similar trend was evident, with 61% of respondents considering security as a key challenge. Moreover, data privacy is the second-most significant concern for those who do not consider their cloud deployments advanced. This was visible in both mature EMEA (51%) and emerging EMEA (48%). As organisations look to shift more critical workloads to the cloud, they will be increasing their attack surfaces and at the same time will face greater consequences if a breach does occur.

Services providers targeting organisations with less developed cloud environments should include security early in the conversation to push them along to the next stage of maturity.

The challenge that varied most according to market maturity and business size was the concern that cloud-based services were more expensive that traditional licencing or in-house solutions. Only 29% of respondents with basic cloud deployments in the mature economies, held this view, while in emerging economies the figure rose to 43%. Competition in those mature markets has in some cases put pressure on prices or at least resulted in wider choice. While 29% of SME respondents considered cost a key challenge, 41% of large enterprises did. Migrating larger, more complex environments to cloud will be viewed as more costly than the status quo due to organisational inertia.

The perception that cloud can be more costly, provides an opportunity for cloud management including expense optimisation services.

Organisations looking to move from a basic cloud environment to one that adopts a cloud-first model should begin with a maturity assessment. Understand what your systems will look like at the next stage, what the benefits will be, and what are the risks. More importantly, decide on the long-term business goal that you are trying to achieve, particularly how IT can be a critical player in the organisation’s digital strategy.

Note: Mature economies – France, Germany and the UK/ Emerging economies – Middle Eastern countries, Russia and South AfricaIdentify emerging cloud computing trends that can help you drive digital business decision making, vendor and technology platform selection and investment strategies.Gain access to more insights from the Ecosystm Cloud Study.

Last week, trading on the New Zealand Exchange (NZX) was disrupted on four consecutive days as a result of a sustained cyber-attack on to push market updates to the public as their website crashed and as a precautionary measure, NZX halted the trading sessions. Ecosystm Principal Advisor, Andrew Milroy says, “The recent NZX attack overwhelmed its public-facing NZX.com website and its Market Announcement Platform (MAP). This meant that investors could not see company announcements in real-time, preventing NZX from complying with regulatory requirements for continuous disclosure.”

The attacks which began on Tuesday came from overseas and made NZX struggle in recovering connectivity, over a five-day period. The cyber-attackers targeted NZX through distributed denial-of-service (DDoS) attacks which is a common way to overwhelm the network with sheer amount of traffic until it disrupts the services.

Milroy says, “It is not clear yet clear who launched the attack, but it is likely to be either an extortion attempt by a large cyber gang or a nation state attack. The attack was a very large, persistent, and sophisticated volumetric DDoS attack. A typical response to such an attack is to increase network bandwidth. However, additional bandwidth is becoming less effective at preventing DDoS attacks. DDoS attacks are getting larger and no amount of bandwidth can address the largest attacks, some of which exceed 1Tbps. DDoS attackers are increasingly focusing on the harder to protect application layer, rather than the network layers.”

The Government Communications Security Bureau (GCSB), network provider Spark, and international bodies provided assistance to NZX to mitigate the attack. Milroy adds, “NZX has also turned to Akamai for additional DDoS protection. Akamai’s Kona Site Defender is understood to be the solution being used. The product is designed to deflect network-layer DDoS traffic and absorb application-layer DDoS traffic at the edge. Mitigation capabilities aim to protect against attacks in the cloud.”

Growing Importance of Government Advisories and Investments

In November 2019, CERT NZ warned financial organisations of several global attacks including ransomware. The attacks were reportedly from Russia-based hacking groups. In an advisory, CERT NZ suggested businesses should implement DDoS protection services, and check network ports connected to avoid vulnerabilities and not pay any ransom to cybercriminals.

Following the CERT NZ warning last year, and considering the recent cyberattacks, GCSB has issued a security advisory to all businesses in New Zealand to be cautious on cyber incidents such as DDoS and ransomware attacks. The advisory comes from the GCSB’s National Cyber Security Centre. This is particularly aimed at small businesses that might have limited cybersecurity resources. The agency has asked them to report such incidents to Cert NZ. Advice includes:

- Approaching cybersecurity services providers to immediately implement any responsive actions (warning that organisations might incur additional fees)

- Temporarily transferring online services to a cloud-based hosting service

- Avoiding the disclosure of the IP address of the origin web server, and using a firewall, if using a content delivery network

- Using a DDOS mitigation service for the duration of attacks, in case they face attacks

- Disabling functionality or removing content from vulnerable online services

As a part of the New Zealand government’s cybersecurity strategy, last year the Government announced the allocation of USD 5.38 million to focus on security over the next four years, on top of USD 6.26 million funding for CERT NZ. The attack landscape and frequency has since increased in the aftermath of COVID-19.

Milroy says, “It will become increasingly important for governments the world over to make a concerted effort to protect their critical infrastructure, data assets and especially empower their SME communities with the right cybersecurity measures and timely guidance.”

The COVID-19 pandemic is debilitating industries, and economies around the world are facing the prospect of a recession. Malaysia, like many other countries, is focussing on front-line medical efforts and security services to save lives and contain the deadly, rapidly spreading virus. Essential services such as food, water and energy supply, Telecommunications, Banking, eCommerce and logistics are working overtime in this new order to support basic functions. The measures put in place to mitigate the spread of the virus are obviously inhibiting other economic activities.

Until enough people develop an immunity to the virus – either through a vaccine or naturally – it is hard to envisage lifting these movement control measures and return to a pre COVID-19 state. Malaysia has a total of 4,987 positive cases, the highest in Southeast Asia and a death toll of 82 as of today. The number of the population tested remains low at 81,730 as reported by the Ministry of Health, mainly due to limited testing resources.

The biggest challenge is that this epidemic is unprecedented, and it is unclear when we can put this situation behind us. The Malaysian Industry of Economic Research (MIER) has predicted about 2.4 million job losses as well as the GDP to reduce by 2.9 percent in 2020. Public debt rise coupled by reduced income due to lower crude oil, natural gas and palm oil prices and demand, will hit the Government coffers hard. Interest rates are expected to be low through the current lockdown stage right up to the recovery stage to help support the economic recovery.

Government Initiatives for the Economy

Like many countries, Malaysia has announced economic stimulus packages to ensure help for the poor and needy, that workers do not lose their jobs and that companies avoid bankruptcy – albeit with an inevitably reduced output – to keep the economy functioning. The stimulus offered is short-term covering a few months, and more assistance will be required should the epidemic linger and for the recovery period.

The Government announced a stimulus package on the 27th February worth RM20 billion (US$4.5 billion) and another one on the 27th March worth RM230 billion (US$52.6 billion). The packages comprise of direct fiscal injection of RM25 billion (US$5.7 billion) as well as loan deferments, one-off cash assistance, credit facilities and rebates. The focus of the stimulus packages is to assist people in the lower-income (B40) and mid-income (M40) groups, aid for employees in the private sector and for traders during the movement control order (MCO) which is to run until 14th April 2020.

An additional COVID-19 stimulus package worth RM10 billion (US$2.2 billion) was announced on the 6th April to address the challenges of the small and medium enterprises (SMEs) that employ two-thirds of the workforce and contribute to 40 percent of the GDP. The wage subsidy is to benefit 4.8 million workers earning less than RM4,000 (US$915) per month. In addition, SMEs will have access to interest free loans of RM200 million (US$45.7 million) from the National Entrepreneur Group Economic Fund and a further RM500 million (US$114.4 million) via Bank Simpanan Nasional. The Government allowed 750,000 SMEs to postpone income tax payment for three months from 1st April – companies in the tourism sector are allowed to postpone income tax for six months.

Impact on Industries

Banking & Financial Services. Banking institutions will support the Government’s stimulus initiatives by providing a six months’ loan repayment moratorium, corporate loan restructuring and conversion of credit card balance to long term loans. Banking and financial institutions are focussing on business continuity planning to ensure minimal disruption to their business and customer support. Many key business processes are now being put to test in-home working with scaled-down office operations. Digital Transformation (DX) has been accelerated as a result.

Contactless payments have seen a boost and many financial institutions have increased payment limits for such payments. Early last month the World Health Organisation (WHO) and the Bank of England had issued advisories against the use of banknotes, as it could increase the chances of the virus spread, instead recommending the use of contactless payment where possible. This might give a boost to the use of Cryptocurrency and cross-border payment services in Malaysia. In 2019, cryptocurrency start-ups received an estimated 12 percent of Fintech funding – but, only three cryptocurrency exchanges were given conditional approval by the Securities Commission. The current situation may well see that changing.

Insurance. The Prime Minister announced that the Insurance industry is to create a fund of RM8 million (US$1.8 million) to cover the cost of RM300 (US$68.6) per policyholder to undergo COVID-19 tests. In addition to this, insurance companies are to offer a 3-month suspension on premiums for policyholders whose income is affected by the pandemic.

Agriculture. Even prior to COVID-19, there has been a brewing narrative against globalisation, favouring a nationalistic emphasis as reflected globally by Brexit and the China-US trade wars tension. Food security is key, and COVID-19 has further highlighted its importance with priorities shifting to local requirements over exports. The Government intends to distribute a food security fund of RM1 billion (US$228.8 million) to increase the local production of farms, fisheries and livestock. According to the Department of Statistics, Malaysia’s food and beverage imports amounted to RM54 billion (US$12.3 billion) in 2018 while food exports stood at RM35 billion (US$8.0 billion) resulting in a trade deficit of RM18.8 billion (US$4.3 billion). As countries focus on internal supplies instead of exports in the current scenario, Malaysia needs to address this risk by producing more locally.

Impact on Industry Transformation

Amidst the gloomy outlook, there are plenty of opportunities, especially to the country’s Digital Economy. Malaysia has been committed to the Digital Economy vision with the Malaysia Digital Economy Corporation (MDEC) estimating that the country’s Digital Economy is worth US$3 trillion. The COVID-19 crisis may well be the key driver in achieving that vision. DX efforts are being accelerated with businesses adopting more cloud and mobility solutions. More workloads have to be digitalised and there is greater adoption of Cloud for storage and services. AWS, Microsoft Azure and Google Cloud will be beneficiaries in this area.

I have already spoken about the Financial Services industry – other industries are also getting transformed out of a necessity to survive this crisis. The Education sector has seen an increase in access to educational content and traffic to education portals and blogs. Some schools have implemented online lessons and group chats between teachers, students and parents to ensure education continues through this pandemic. Many universities have used their e-learning platforms to move lectures online.

The Telecommunications industry is being appreciated more than ever and it is the backbone to normal life, in both a social and business sense. The Government’s stimulus package includes offers of free internet to all customers until the MCO is over at RM600 million (US$137.3 million) and an investment of about RM400 million (US$91.5 million) to improve coverage and quality of service. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period. The Axiata Group recently announced a cash fund of RM150 million (US$34.3 million) to assist micro-SMEs within the ecosystem providing eCommerce, digital payments and related services.

Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been the biggest winners so far. The home working trend should continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and the impending rollout of 5G.

The eCommerce sector should see a major improvement in Malaysia with physical channels to the market being suspended. Malaysians have not embraced eCommerce like mature economies have, and it has significant room for improvement. Development of the SME sector and eCommerce are twin focus areas for the Digital Economy vision. Statista reports that the average Malaysian eCommerce shopper spent just US$159 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for necessities such as online grocery, food and delivery of goods. As a consequence, the Transport & Logistics sector will have to adapt their business operations in order to ride this wave successfully.

Video streaming and gaming has also seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. There provides a tremendous opportunity for both telecom operators and content providers to increase their number of services in this area.

Malaysia, like all other countries, will have to ride out this wave. It has made a positive step in the direction with the stimulus packages, especially for the SME sector. How well the country rides this wave out will depend on how targeted the future stimulus packages are and how fast industries can transform to handle the new world order that will emerge after the COVID-19 crisis.