2020 has seen extreme disruption – and fast. The socio-economic impact will probably outlast the pandemic, but several industries have had to transform themselves to survive during these past months and to walk the path to recovery.

Against this backdrop, the Retail industry has been impacted early due to supply chain disruptions, measures such as lockdowns and social distancing, demand spikes in certain products (and diminished demands in others) and falling margins. Moreover, it is facing changed consumer buying behaviour. In the short-term consumers are focusing on essential retail and conservation of cash. The impact does not end there – in the medium and long term, the industry will face consumers who have acquired digital habits including buying directly from home through eCommerce platforms. They will expect a degree of digitalisation from retailers that the industry is not ready to provide at the moment. This raises the question on how they should transform to adapt to the New Normal and what could be a potential game-changer for them.

Translating Business Needs into Technology Capabilities

In his report, The Path to Retail’s New Normal, Ecosystm Principal Advisor, Kaushik Ghatak says, “Satisfying their old consumers, now set in their new ways, should be the ‘mantra’ for the retailers in order to survive in the New Normal.” To be able to do so they have to evaluate what their new business requirements are and translate them into technological requirements. Though it may sound simple, it may prove to be harder than usual to identify their evolving business requirements. This is especially difficult because even before the pandemic, the Retail industry was challenged with consumers who are becoming increasingly demanding, providing enhanced customer experience (CX), offering more choices and lowering prices. The market was already extremely competitive with large retailers fighting for market consolidation and smaller and more nimble retailers trying to carve out their niche.

In the New Normal, retailers will struggle to retain and grow their customer base. They will also have to focus aggressively on cost containment. A robust risk management process will become the new reality. But above all else, they will have to innovate – in their product range as well as in their processes. These are all areas where technology can help them. This can come in the form of technology partnerships, adopting hybrid models, increased usage of technology across all channels and investing in reskilling or upskilling the technology capabilities of employees.

Re-evaluating the Supply Chain

One of the first business operation to get disrupted by the current crisis was the supply chain. Ecosystm Principal Advisor, Alea Fairchild says, “Retailers are finding themselves at the front-end of the broken supply chain in the current situation and there is an enormous gap between suppliers and buyers. Retailers will have to aim to combine inventory with local sourcing and become agile and adopt change quickly. This will highlight to them the importance of transparency of information, traceability, and information flow of goods.”

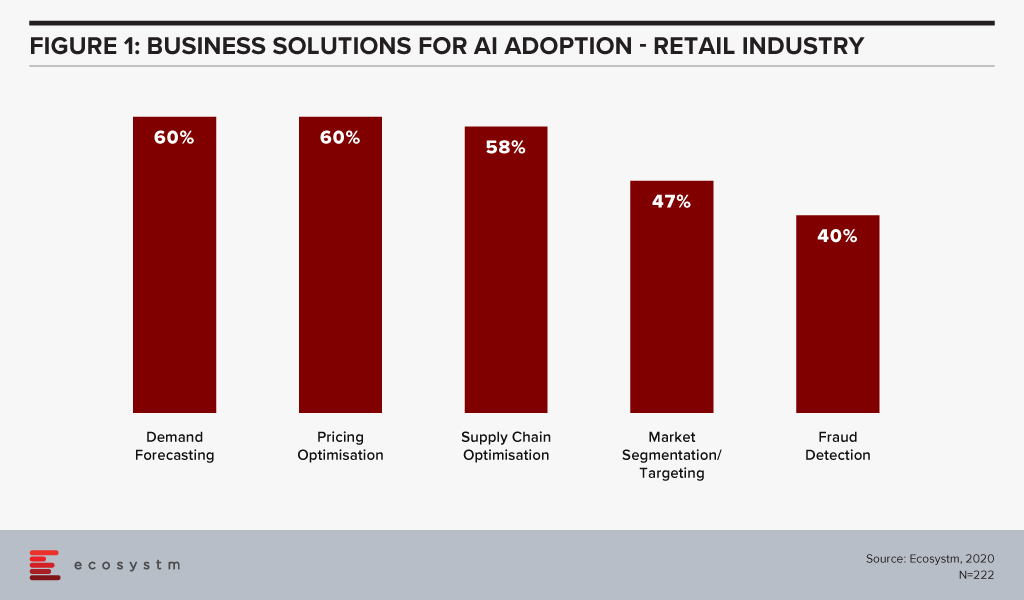

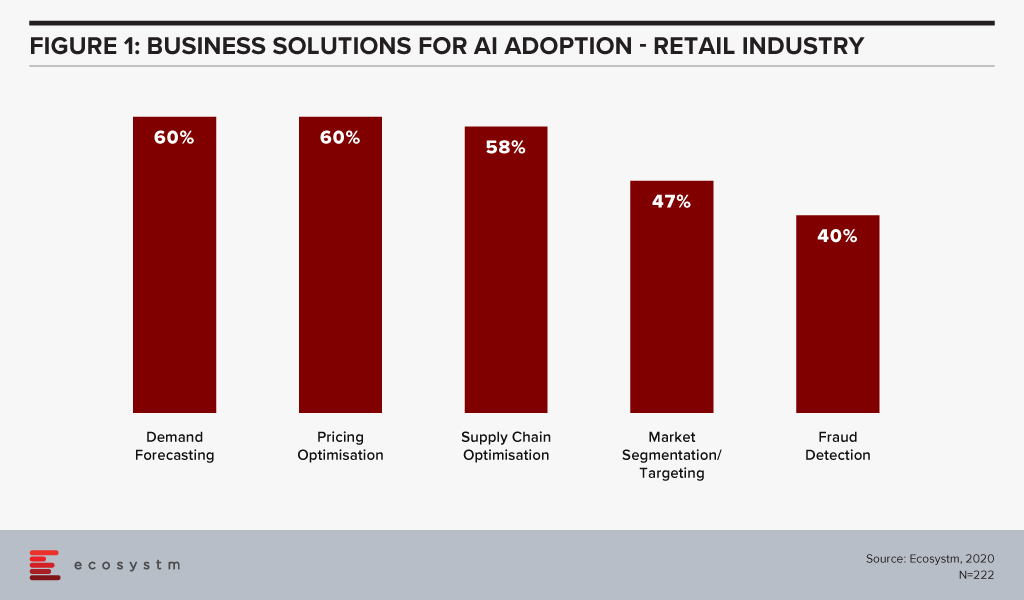

Ecosystm research shows that supply chain optimisation and demand forecasting among the top 5 business solutions that firms in Retail consider using AI for (Figure 1).

“In the New Normal, consumers are going to demand the same level of perfection that they have received and at the same cost. In order to make that possible, at the right time and at a lower cost, automation has to be implemented to improve the supply chain process, fulfill expectations and enhance visibility,” says Ghatak. “Providing differentiated CX is intimately dependent upon an aligned, flexible and efficient supply chain. Retailers will not only need to innovate at the store (physical or online) level and offer more innovative products – they will also need to have a high level of innovation in their supply chain processes.”

Digital Transformation in the Retail Industry

Ecosystm research reveals that only about 34% of global retailers had considered themselves to be digital-ready to face the challenges of the New Normal, before the pandemic. The vast majority of them admit that they still have a long way to go.

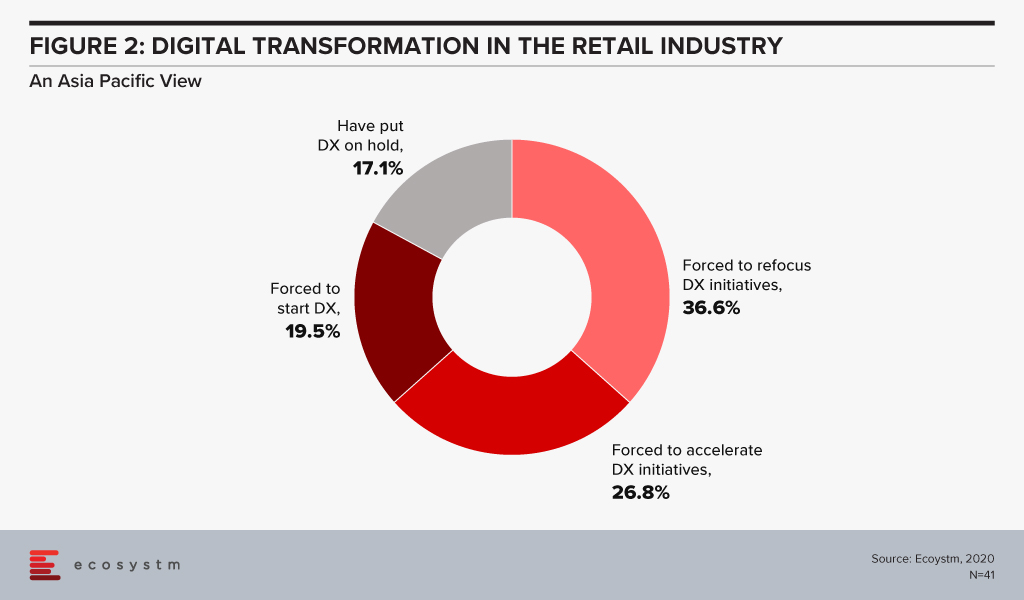

With COVID-19, the timeframes for digitalisation have imploded for most retailers. The study to evaluate the Digital Priorities in the New Normal reveals that in Asia Pacific nearly 83% of retailers have been forced to start, accelerate or refocus their Digital Transformation (DX) initiatives (Figure 2).

So, what technology areas will Retail see increased adoption oF?

Fairchild sees retailers adopt IoT, mobility, AI and solutions that deliver personalised experiences such as push notifications. What they are likely to do is blend different aspects of their physical and virtual environment to create a solution for customers. “To address in-store processing, hygiene, safety standards and compliance requirements, retailers will change their processes through a combination of resources, KPIs, automation, task management software and switching the information flow.”

Ghatak thinks automation has a significant role to play in improving both CX and the supply chain. “This is also an opportunity for retailers – both online and in-store – to create a solution experience where technologies such as Augment/Virtual Reality (AR/VR) can help. While retailers are adopting these technologies, with 5G rollouts, there is potential that the adoption will implode in a short time-frame.”

Those retailers that are not re-evaluating their business models and technology investments now will find themselves unprepared to handle the customer expectations when the global economy opens up.

During this pandemic, shoppers who have experienced new forms of delivery direct from manufacturers, curbside pickup and eCommerce via wholesalers will likely adopt at least some of those habits in their everyday lives in future. Why? Ease of use, convenience, hygiene and guaranteed product availability, all factor into this shift.

Most retailers were not ready for a rush of online shoppers or structured for a Buy Online Pickup In-Store (BOPIS) model. They struggled to pivot with their own delivery set-up, both in terms of staffing and infrastructure. Delivery slots were rare and required midnight countdowns to the next day’s set of slots with online confusion. Many grocery retailers initially stopped curbside deliveries due to lack of resources for fulfilment in store.

And for SME retail outlets, square meterage limits the number of customers inside at a time and social distancing measures limit handling curbside pickups. Supply chain issues and inventory management also played a role, with local inventory visibility a real factor in determining order placement.

As shown in Figure 1, Ecosystm research shows that supply chain optimisation and demand forecasting are both listed in the top five business solutions that firms in retail consider using AI for.

Hybrid Operations

How can retail firms, with both perishable and non-perishable goods, use AI, automation and other infrastructural investments to develop the near-term future of curbside retail? We suggest the use of hybrid operations.

Retailers are starting to look at developing hybrid operations: part retail space and part fulfilment centre. Allowing customers to enter only part of the store or pulling inventory off the shelf to a different part of the store for deliveries expands reach and allows fulfilment without decreasing the experience for customers who prefer to shop in-store. But it requires an IT infrastructural upgrade to make it happen.

In the medium term, leveraging automation will be one of the ways supermarkets and other retailers evolve their models to remain viable and profitable.

What can be automated?

Let’s define these automated delivery infrastructural options:

- Curbside pickup is the endpoint of manual sorting and selecting operation, and then the goods are ready for pickup with a vehicle outside the store.

- Micro-fulfilment centres are locations with a logistics company to maximise space in traditional stores and expand online options. Micro-fulfillment helps retailers solve the labour and last-mile costs conundrum as it brings the goods closer to the end customer.

- Dark stores are traditional retail stores that have been converted to local fulfilment centres.

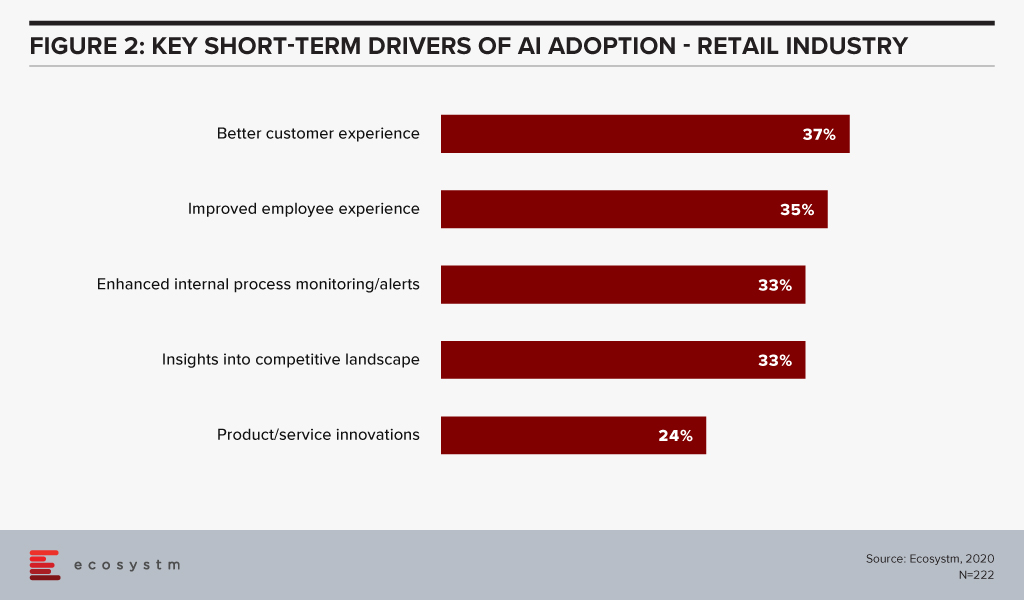

None of these concepts are new, but as alternatives to traditional retail in the current environment, they are viable options. Having curbside pickup, micro-fulfilment centres or dark stores help ease transitions towards traditional operations while still protecting customers and employees. Figure 2 from our AI research at Ecosystm shows that better customer experience is a top short-term driver in retail AI deployment.

Restructuring the three factors of production

By using AI and inventory automation, retailers can focus on rightsizing the three factors of production:

- Labour. Reducing the staffing cost to produce the same volume of sales.

- Inventory. Giving the retailer the tools to replenish stores with more specific information on consumption and wastage.

- Physical Space. Enabling dynamic adjustments of product display allows alignment more closely with sales patterns within the physical store. This can be adjusted for within the week and even by day.

Retailers are looking to speed delivery by dispersing inventory closer to customers. They use automation to build more compact distribution operations by using hybrid operations.

Designing hybrid operations with technology

To develop a hybrid operation, what IT infrastructural elements need to be addressed?

Store layout. Hybrid operations should drive efficiency in delivery, based on time and motion, but without impacting in-store shoppers. Order pulling should structurally happen towards the back of the store, both for efficiency and ease of access to move goods. To maintain product quality, networks and sensors need to be installed.

Process training. Hybrid operations are system dependent. Skilled staff who pick items for delivery require systems that implement standard procedures for selection and bundling. Processes require system automation for checks to mitigate high levels of wastage. Operational implementations need to include systems that manage cut-off times and back-room management.

Order management and inventory management systems. Analytics help retailers to stock popular items. They can then ensure these are easily accessible both front and back of the store. Retailers need to prioritise inventory management to make the most of inventory visibility across hybrid operations. SKUs and barcodes should be simple, consistent and unique.

Learning from innovative IT models in Grocery

In California, Sysco expanded its direct-to-the-consumer pop-up format to help give shoppers in the area access to fresh grocery items. Whole Foods expanded its dark store concept in Texas in combination with Amazon. Aldi in the UK rolled out an online program to distribute grocery parcels to consumers who were self-isolating, with 22 different goods in the bundle including toilet paper and anti-bacterial gel.

Market ownership will come from a better shopping experience. Streamlining processes and automating order fulfilment using IT in a hybrid retail operation could help lessen the financial and logistical strain of maintaining social distancing and proper hygiene measures.