Healthcare delivery and healthtech have made significant strides; yet, the fundamental challenges in healthcare have remained largely unchanged for decades. The widespread acceptance and integration of digital solutions in recent years have supported healthcare providers’ primary goals of enhancing operational efficiency, better resource utilisation (with addressing skill shortages being a key driver), improving patient experience, and achieving better clinical outcomes. With governments pushing for advancements in healthcare outcomes at sustainable costs, the concept of value-based healthcare has gained traction across the industry.

Technology-driven Disruption

Healthcare saw significant disruptions four years ago, and while we will continue to feel the impact for the next decade, one positive outcome was witnessing the industry’s ability to transform amid such immense pressure. I am definitely not suggesting another healthcare calamity! But disruptions can have a positive impact – and I believe that technology will continue to disrupt healthcare at pace. Recently, my colleague Tim Sheedy shared his thoughts on how 2024 is poised to become the year of the AI startup, highlighting innovative options that organisations should consider in their AI journeys. AI startups and innovators hold the potential to further the “good disruption” that will transform healthcare.

Of course, there are challenges associated, including concerns on ethical and privacy-related issues, the reliability of technology – particularly while scaling – and on professional liability. However, the industry cannot overlook the substantial number of innovative startups that are using AI technologies to address some of the most pressing challenges in the healthcare industry.

Why Now?

AI is not new to healthcare. Many would cite the development of MYCIN – an early AI program aimed at identifying treatments for blood infections – as the first known example. It did kindle interest in research in AI and even during the 1980s and 1990s, AI brought about early healthcare breakthroughs, including faster data collection and processing, enhanced precision in surgical procedures, and research and mapping of diseases.

Now, healthcare is at an AI inflection point due to a convergence of three significant factors.

- Advanced AI. AI algorithms and capabilities have become more sophisticated, enabling them to handle complex healthcare data and tasks with greater accuracy and efficiency.

- Demand for Accessible Healthcare. Healthcare systems globally are striving for better care amid resource constraints, turning to AI for efficiency, cost reduction, and broader access.

- Consumer Demand. As people seek greater control over their health, personalised care has become essential. AI can analyse vast patient data to identify health risks and customise care plans, promoting preventative healthcare.

Promising Health AI Startups

As innovative startups continue to emerge in healthcare, we’re particularly keeping an eye on those poised to revolutionise diagnostics, care delivery, and wellness management. Here are some examples.

DIAGNOSTICS

- Claritas HealthTech has created advanced image enhancement software to address challenges in interpreting unclear medical images, improving image clarity and precision. A cloud-based platform with AI diagnostic tools uses their image enhancement technology to achieve greater predictive accuracy.

- Ibex offers Galen, a clinical-grade, multi-tissue platform to detect and grade cancers, that integrate with third-party digital pathology software solutions, scanning platforms, and laboratory information systems.

- MEDICAL IP is focused on advancing medical imaging analysis through AI and 3D technologies (such as 3D printing, CAD/CAM, AR/VR) to streamline medical processes, minimising time and costs while enhancing patient comfort.

- Verge Genomics is a biopharmaceutical startup employing systems biology to expedite the development of life-saving treatments for neurodegenerative diseases. By leveraging patient genomes, gene expression, and epigenomics, the platform identifies new therapeutic gene targets, forecasts effective medications, and categorises patient groups for enhanced clinical efficacy.

- X-Zell focuses on advanced cytology, diagnosing diseases through single atypical cells or clusters. Their plug-and-play solution detects, visualises, and digitises these phenomena in minimally invasive body fluids. With no complex specimen preparation required, it slashes the average sample-to-diagnosis time from 48 hours to under 4 hours.

CARE DELIVERY

- Abridge specialises in automating clinical notes and medical discussions for physicians, converting patient-clinician conversations into structured clinical notes in real time, powered by GenAI. It integrates seamlessly with EMRs such as Epic.

- Waltz Health offers AI-driven marketplaces aimed at reducing costs and innovative consumer tools to facilitate informed care decisions. Tailored for payers, pharmacies, and consumers, they introduce a fresh approach to pricing and reimbursing prescriptions that allows consumers to purchase medication at the most competitive rates, improving accessibility.

- Acorai offers a non-invasive intracardiac pressure monitoring device for heart failure management, aimed at reducing hospitalisations and readmissions. The technology can analyse acoustics, vibratory, and waveform data using ML to monitor intracardiac pressures.

WELLNESS MANAGEMENT

- Anya offers AI-driven support for women navigating life stages such as fertility, pregnancy, parenthood, and menopause. For eg. it provides support during the critical first 1,001 days of the parental journey, with personalised advice, tracking of developmental milestones, and connections with healthcare professionals.

- Dacadoo’s digital health engagement platform aims to motivate users to adopt healthier lifestyles through gamification, social connectivity, and personalised feedback. By analysing user health data, AI algorithms provide tailored insights, goal-setting suggestions, and challenges.

Conclusion

There is no question that innovative startups can solve many challenges for the healthcare industry. But startups flourish because of a supportive ecosystem. The health innovation ecosystem needs to be a dynamic network of stakeholders committed to transforming the industry and health outcomes – and this includes healthcare providers, researchers, tech companies, startups, policymakers, and patients. Together we can achieve the longstanding promise of accessible, cost-effective, and patient-centric healthcare.

As the search for a COVID-19 vaccine intensifies, there is a global focus on the Life Sciences industry. The industry has been hit hard this year – having to deliver overtime through a disrupted supply chain, unexpected demand spikes, and reduction of revenues from their regular streams. Life sciences organisations are already challenged by the breadth of their focus – across R&D and clinical discovery; Manufacturing & Distribution; and Sales & Marketing. Increasingly, many pharmaceutical and medtech organisations choose to outsource some of these functions, which brings to fore the need for a robust compliance framework. In the Ecosystm Digital Priorities in the New Normal Study, two-thirds of life sciences organisations mention that they have either been forced to start, accelerate or refocus their Digital Transformation initiatives – the remaining one-third have put their Digital Transformation on hold. The industry is clearly at an inflection point.

Challenges of the Life Sciences Industry

Continued Focus on R&D. Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and a global concern over rising healthcare expenditure. Apart from regulatory challenges, they also face immense competition from local manufacturers as they enter each new market.

Re-thinking their Distribution Strategy. Sales and distribution for many pharma and medtech organisations have been traditional – using agents, distributors, clinicians, and healthcare providers. But now they need to change their go-to-market strategies, target patients and consumers directly and package their product offerings into value-added services. This will require them to incorporate customer experience enhancers in their R&D, going beyond drug discovery and product innovation.

Tracking Global Regulations. Governments across the world are trying to manage their healthcare budgets. They are also more focused on chronic disease management. The focus has shifted to value-based medicine in general, but pharma and medtech products are being increasingly held accountable by health outcomes. Governments are increasingly implementing drug reforms around what clinicians can prescribe. Global Life Sciences organisations have to constantly monitor the regulations in the multiple countries where they operate and sell. They are also accountable for their entire supply chain, especially ensuring a high product quality and fraud prevention.

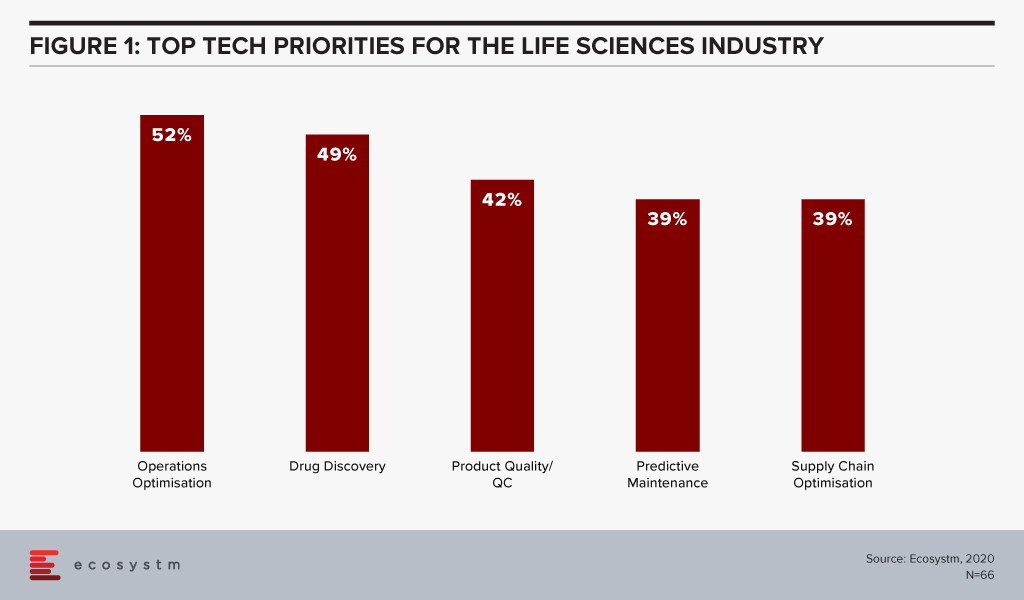

The global Ecosystm AI study reveals the top priorities for Life Sciences organisations, focused on adopting emerging technologies (Figure 1). They appear to be investing in emerging technology especially in their R&D and clinical discovery and Manufacturing functions.

Technology as an Enabler of Life Sciences Transformation

Discovery and Development

With the evolution of technology, Life Sciences organisations are able to automate much of the mundane tasks around drug discovery and apply AI and machine learning to transform their drug discovery and development process. They are increasingly leveraging their ecosystem of smaller pharma and medtech companies, research laboratories, academic institutions, and technology providers to make the process more time and cost efficient.

Using an AI algorithm, the researchers at the Massachusetts Institute of Technology have discovered an antibiotic compound that can kill many species of antibiotic-resistant bacteria. MIT’s algorithm screens millions of chemical compounds and chooses the antibiotics which have the potential to eliminate bacteria resistant to existing drugs. Harvard’s Wyss Institute for Biologically Inspired Engineering is manufacturing 3D printed organ-on-a-chip to give insights on cell, tissue, and organ biology to help the pharma sector with drug development, disease modelling and finally in the development of personalised medicine.

Life Sciences are also engaging more with technology partners – whether emerging start-ups or established players. Pfizer and Saama are working together on AI clinical data mining. The companies are developing and deploying an AI-based analytical tool where Pfizer provides clinical data and domain knowledge to train models on the Saama Life Science Analytics Cloud (LSAC). Saama was identified as a partner at a hackathon. Sanofi and Google have established a new virtual Innovation Lab to develop scientific and commercial solutions, using multiple Google capabilities from cloud computing to AI.

Tech providers also keep evolving their capabilities in the Life Sciences industry for more efficient drug discovery and better treatment protocols. Microsoft’s Project Hanover uses machine learning to develop a personalised drug protocol to manage acute myeloid leukaemia. Similarly, Apple’s ResearchKit – an open-source framework is meant to help researchers and developers create iOS-based applications in the field of medical research.

Manufacturing and Logistics

The industry also faces the challenges faced by any Manufacturing organisation and has the need to deploy manufacturing analytics, and advanced supply chain technology for better process and optimisation and agility. There is also the need for complete visibility over their supply chain and inventory for traceability, safety, and fraud prevention. Emerging technologies such as Blockchain will become increasingly relevant for real-time track and trace capability.

The MediLedger Network was established as an open network to the entire pharma supply chain. The project brings a consortium of some of the world’s largest pharmaceutical companies, and logistics providers to improve drug supply chain management.

Since the data on the distributed ledger is encrypted, it creates a secure system without any vulnerabilities. This eliminates counterfeit products and ultimately ensures the quality of the pharma products and promotes increased patient safety. To foster security and improve the supply chain, the United States Food and Drug Administration (USFDA) successfully completed a pilot with a group including IBM, KPMG, Merck and Walmart to support U.S. Drug Supply Chain Security Act (DSCSA) to trace vaccines and prescription medicines throughout the country.

Diagnostics and Personalised Healthcare

As more devices (consumer and enterprise) and applications enter the market, people will take ownership and interest in their own health outcomes. This is seeing a continued growth in online communities and comparison sites (on physicians, hospitals, and pharmaceutical products). Increasingly, insurance providers will use data from wearable devices for a more personalised approach; promoting and rewarding good health practices.

Beyond the use of wearables and health and wellness apps, we will also see an exponential increase of home-based healthcare products and services – whether for primary care and chronic disease management, or long-term and palliative care. As patients become more engaged with their care, the life sciences industry is beginning to serve them through personalised approach, medicines, right diagnosis and through advanced medical devices and products.

An online tool developed by the University of Virginia Health Systems helps identify patients that have a high risk of getting a stroke and helps them reduce that risk. This tool calculates the patient’s probability of suffering a stroke by measuring the severity of their metabolic syndrome – taking into account a number of conditions that include high blood pressure, abnormal cholesterol levels and excess body fat. Life Sciences organisations are increasingly having to invest in customer-focused solutions such as these.

Wearables with special smart software to monitor health parameters, gauge drug compatibility and monitor complications are being implemented by Life Sciences organisations. The US FDA approved a pill called Abilify MyCite fitted with a tiny ingestible sensor that communicates with a patch worn by the patient to transmit data on a smartphone. Medtech companies continue to develop FDA approved health devices that can monitor chronic conditions. Smart continuous glucose monitoring (CGM) and insulin pens send blood glucose level data to smartphone applications allowing the wearer to easily check their information and detect trends.

Technologies such as AR/VR are also enabling Life Sciences companies with their diagnostics. Regeneron Pharmaceuticals has created an AR/VR app called “In My Eyes” to better diagnose vision impairment in patients.

What is interesting about these personalised products is that not only do they improve clinical outcomes, they also give Life Sciences companies access to rich data that can be used for further product development and improvement.

The Life Sciences industry will continue to operate in an unpredictable and competitive market. This is evident by the several mergers and acquisitions that we witness in the industry. As they continue to use cutting-edge technology for their R&D practices, they will leverage technology to transform other functions as well.

In the report, Ecosystm Predicts: The Top Healthcare Trends for 2020, we had noted the similarities between the healthcare and the financial services industries and that Healthtech will take lessons from the Fintech industry.

In the report, Ecosystm Principal Analyst, Sash Mukherjee said, “Fintech plays a significant role in driving greater inclusion, especially to drive the induction of the unbanked into the mainstream economy, give the underbanked more options to leverage the broader financial services available, and reduce disparity in the adoption of financial services by bridging the gender gap and differences based on ethnicity and socio-economic status. It is not hard to imagine a similar fate for Healthtech. As the industry focuses on value-based outcomes, governments put in more regulations around accountability and transparency in the industry, and people expect the customer experience that they get out of their retail interactions, Healthtech start-ups will become as mainstream as Fintech start-ups.”

However, Mukherjee notes that there might be some pitfalls in this journey, especially when organisations focus more on the technology and less on the actual application and benefits of the technology. “Innovators and start-ups need to align themselves early, with corporates and technology providers to gain a better understanding of the market and regulatory landscape.”

Singapore bringing key industry stakeholders together

The MoU between Alibaba Cloud, Pfizer and Singapore’s Fintech Academy announced yesterday, is a move in the right direction that promises to give early and necessary guidance to Healthtech start-ups. Under the newly formed Healthcare Fintech Alliance (HFA), Alibaba will provide infrastructural support and technological mentorship to the Healthtech and Fintech start-ups to help them leverage cloud, AI and other technologies for their future requirements. The Fintech Academy will guide these start-ups through talent management and venture building programs. Pfizer will provide thought leadership through its network of healthcare experts and opinion leaders, including guidance on commercialisation of the products and services. The Healthcare Fintech Alliance initiative will begin with a pilot in Singapore, Indonesia, and Vietnam before expanding to other regions – Malaysia and the Philippines.

Mukherjee says, “The healthcare industry, for all the cutting-edge research, that it represents, has been remarkably slow to transform. But the COVID-19 crisis has forced the industry to transform, without the luxury or time to think about it. While the implications on the life sciences and provider organisations is clearer, there has simultaneously emerged a need for transformation in the healthcare payer industry. There will be greater demand from consumers for micro-financing to tide over sudden healthcare crises and greater transparency in how these funds are managed. Again, there is an immense potential here for the industry to learn from Fintech.”

Healthcare Fintech Alliance Focus Areas

The focus areas for Healthcare Fintech Alliance shows the deep connection between Healthtech and Fintech.

- Healthcare Affordability. Micro-financing and other financial models involving patients, family members, payers, and other healthcare stakeholders

- Value Based Healthcare. Linking payment schemes to a drug’s effectiveness, health outcomes or utilisation

- Outcome Monitoring. Tracking and reporting of outcomes derived from patients, wearables, healthcare providers, R&D databases and real-world evidence.

- Personalised Healthcare. Using digital technology to tailor healthcare to individual needs

- Innovative Healthtech Devices. Driving adoption in digital tools, such as diagnostic tools linked to medicine access and reimbursement

- Population Health Management. Leveraging patient and associated data in a compliant way to better understand population health characteristics, for effective wellness programs, treatment protocols and cost management.

“Alliances such as these have potential benefits for the industry stakeholders such as Alibaba and Pfizer. Alibaba has been focusing on the Southeast Asia market – earlier in the month the Alibaba Cloud Philippines Ecosystem Alliance was formed to support digital transformation in start-ups and small and medium enterprises. Initiatives such as this is an effective way to associate themselves with the evolving start-up community in the region,” says Mukherjee. “Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and global concern over rising healthcare expenditure. Against that backdrop, this alliance is the right go-to-market messaging for Pfizer as well.”

“However, the deepest positive impact of alliances such as these will be on the Healthcare industry as a whole. It makes concepts such as value-based healthcare, remote care and personalised healthcare achievable in the near future.”