In 2020, much of the focus for organisations were on business continuity, and on empowering their employees to work remotely. Their primary focus in managing customer experience was on re-inventing their product and service delivery to their customers as regular modes were disrupted. As they emerge from the crisis, organisations will realise that it is not only their customer experience delivery models that have changed – but customer expectations have also evolved in the last few months. They are more open to digital interactions and in many cases the concept of brand loyalty has been diluted. This will change everything for organisations’ customer strategies. And digital technology will play a significant role as they continue to pivot to succeed in 2021 – across regions, industries and organisations.

Ecosystm Advisors Audrey William, Niloy Mukherjee and Tim Sheedy present the top 5 Ecosystm predictions for Customer Experience in 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Customer Experience Trends for 2021

- Customer Experience Will Go Truly Digital

COVID-19 made the few businesses that did not have an online presence acutely aware that they need one – yesterday! We have seen at least 4 years of digital growth squeezed into six months of 2020. And this is only the beginning. While in 2020, the focus was primarily on eCommerce and digital payments, there will now be a huge demand for new platforms to be able to interact digitally with the customer, not just to be able to sell something online.

Digital customer interactions with brands and products – through social media, online influencers, interactive AI-driven apps, online marketplaces and the like will accelerate dramatically in 2021. The organisations that will be successful will be the ones that are able to interact with their customers and connect with them at multiple touchpoints across the customer journey. Companies unable to do that will struggle.

- Digital Engagement Will Expand Beyond the Traditional Customer-focused Industries

One of the biggest changes in 2020 has been the increase in digital engagement by industries that have not traditionally had a strong eye on CX. This trend is likely to accelerate and be further enhanced in 2021.

Healthcare has traditionally been focused on improving clinical outcomes – and patient experience has been a byproduct of that focus. Many remote care initiatives have the core objective of keeping patients out of the already over-crowded healthcare provider organisations. These initiatives will now have a strong CX element to them. The need to disseminate information to citizens has also heightened expectations on how people want their healthcare organisations and Public Health to interact with them. The public sector will dramatically increase digital interactions with citizens, having been forced to look at digital solutions during the pandemic.

Other industries that have not had a traditional focus on CX will not be far behind. The Primary & Resources industries are showing an interest in Digital CX almost for the first time. Most of these businesses are looking to transform how they manage their supply chains from mine/farm to the end customer. Energy and Utilities and Manufacturing industries will also begin to benefit from a customer focus – primarily looking at technology – including 3D printing – to customise their products and services for better CX and a larger share of the market.

- Brands that Establish a Trusted Relationship Can Start Having Fun Again

Building trust was at the core of most businesses’ CX strategies in 2020 as they attempted to provide certainty in a world generally devoid of it. But in the struggle to build a trusted experience and brand, most businesses lost the “fun”. In fact, for many businesses, fun was off the agenda entirely. Soft drink brands, travel providers, clothing retailers and many other brands typically known for their fun or cheeky experiences moved the needle to “trust” and dialed it up to 11. But with a number of vaccines on the horizon, many CX professionals will look to return to pre-pandemic experiences, that look to delight and sometimes even surprise customers.

However, many companies will get this wrong. Customers will not be looking for just fun or just great experiences. Trust still needs to be at the core of the experience. Customers will not return to pre-pandemic thinking – not immediately anyway. You can create a fun experience only if you have earned their trust first. And trust is earned by not only providing easy and effective experiences, but by being authentic.

- Customer Data Platforms Will See Increased Adoption

Enterprises continue to struggle to have a single view of the customer. There is an immense interest in making better sense of data across every touchpoint – from mobile apps, websites, social media, in-store interactions and the calls to the contact centre – to be able to create deeper customer profiles. CRM systems have been the traditional repositories of customer data, helping build a sales pipeline, and providing Marketing teams with the information they need for lead generation and marketing campaigns. However, CRM systems have an incomplete view of the customer journey. They often collect and store the same data from limited touchpoints – getting richer insights and targeted action recommendations from the same datasets is not possible in today’s world. And organisations struggled to pivot their customer strategies during COVID-19. Data residing in silos was an obstacle to driving better customer experience.

We are living in an age where customer journeys and preferences are becoming complex to decipher. An API-based CDP can ingest data from any channel of interaction across multiple journeys and create unique and detailed customer profiles. A complete overhaul of how data can be segregated based on a more accurate and targeted profile of the customer from multiple sources will be the way forward in order to drive a more proactive CX engagement.

- Voice of the Customer Programs Will be Transformed

Designing surveys and Voice of Customer programs can be time-consuming and many organisations that have a routine of running these surveys use a fixed pattern for the data they collect and analyse. However, some organisations understand that just analysing results from a survey or CSAT score does not say much about what customers’ next plan of action will be. While it may give an idea of whether particular interactions were satisfactory, it gives no indication of whether they are likely to move to another brand; if they needed more assistance; if there was an opportunity to upsell or cross sell; or even what new products and services need to be introduced. Some customers will just tick the box as a way of closing off a feedback form or survey. Leading organisations realise that this may not be a good enough indication of a brand’s health.

Organisations will look beyond CSAT to other parameters and attributes. It is the time to pay greater attention to the Voice of the Customer – and old methods alone will not suffice. They want a 360-degree view of their customers’ opinions.

Artificial Intelligence (AI) is becoming embedded in financial services across consumer interactions and core business processes, including the use of chatbots and natural language processing (NLP) for KYC/AML risk assessment.

But what does AI mean for financial regulators? They are also consuming increasing amounts of data and are now using AI to gain new insights and inform policy decisions.

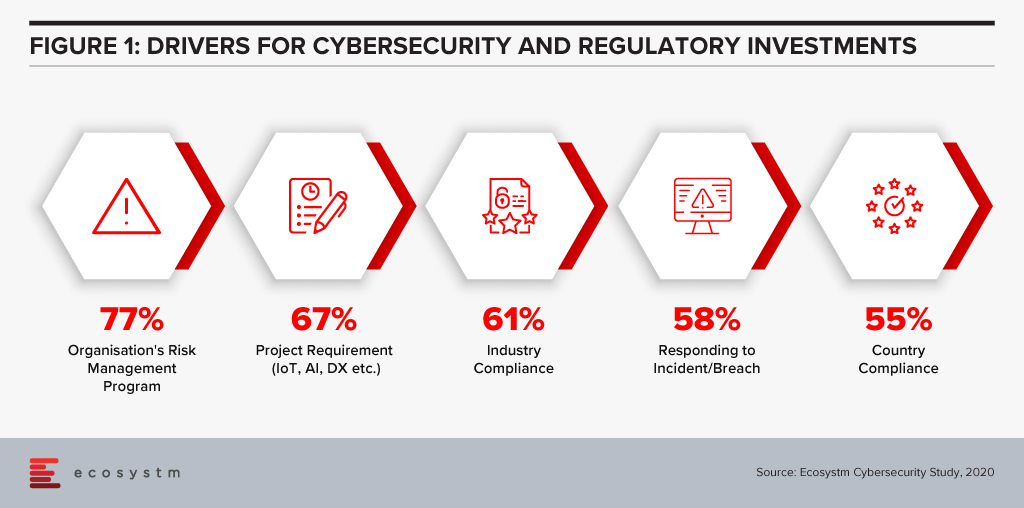

The efficiencies that AI offers can be harnessed in support of compliance within both financial regulation (RegTech) and financial supervision (SupTech). Authorities and regulated institutions have both turned to AI to help them manage the increased regulatory requirements that were put in place after the 2008 financial crisis. Ecosystm research finds that compliance is key to financial institutions (Figure 1).

SupTech is maturing with more robust safeguards and frameworks, enabling the necessary advancements in technology implementation for AI and Machine Learning (ML) to be used for regulatory supervision. The Bank of England and the UK Financial Conduct Authority surveyed the industry in March 2019 to understand how and where AI and ML are being used, and their results indicated 80% of survey respondents were using ML. The most common application of SupTech is ML techniques, and more specifically NLP to create more efficient and effective supervisory processes.

Let us focus on the use of NLP, specifically on how it has been used by banking authorities for policy decision making during the COVID-19 crisis. AI has the potential to read and comprehend significant details from text. NLP, which is an important subset of AI, can be seen to have supported operations to stay updated with the compliance and regulatory policy shifts during this challenging period.

Use of NLP in Policy Making During COVID-19

The Financial Stability Board (FSB) coordinates at the international level, the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. A recent FSB report delivered to G20 Finance Ministers and Central Bank Governors for their virtual meeting in October 2020 highlighted a number of AI use cases in national institutions.

We illustrate several use cases from their October report to show how NLP has been deployed specifically for the COVID-19 situation. These cases demonstrate AI aiding supervisory team in banks and in automating information extraction from regulatory documents using NLP.

De Nederlandsche Bank (DNB)

The DNB is developing an interactive reporting dashboard to provide insight for supervisors on COVID-19 related risks. The dashboard that is in development, enables supervisors to have different data views as needed (e.g. over time, by bank). Planned SupTech improvements include incorporating public COVID-19 information and/or analysing comment fields with text analysis.

Monetary Authority of Singapore (MAS)

MAS deployed automation tools using NLP to gather international news and stay abreast of COVID-19 related developments. MAS also used NLP to analyse consumer feedback on COVID-19 issues, and monitor vulnerabilities in the different customer and product segments. MAS also collected weekly data from regulated institutions to track the take-up of credit relief measures as the pandemic unfolded. Data aggregation and transformation were automated and visualised for monitoring.

US Federal Reserve Bank Board of Governors

One of the Federal Reserve Banks in the US is currently working on a project to develop an NLP tool used to analyse public websites of supervised regulated institutions to identify information on “work with your customer” programs, in response to the COVID-19 crisis.

Bank of England

The Bank developed a Policy Response Tracker using web scraping (targeted at the English versions of each authority/government website) and NLP for the extraction of key words, topics and actions taken in each jurisdiction. The tracker pulls information daily from the official COVID-19 response pages then runs it through specific criteria (e.g. user-defined keywords, metrics and risks) to sift and present a summary of the information to supervisors.

Market Implications

Even with its enhanced efficiencies, NLP in SupTech is still an aid to decision making and cannot replace the need for human judgement. NLP in policy decision is performing clearly defined information gathering tasks with greater efficiency and speed. But NLP cannot change the quality of the data provided, so data selection and choice are still critical to effective policy making.

For authorities, the use of SupTech could improve oversight, surveillance, and analytical capabilities. These efficiency gains and possible improvement in quality arising from automation of previously manual processes could be consideration for adoption.

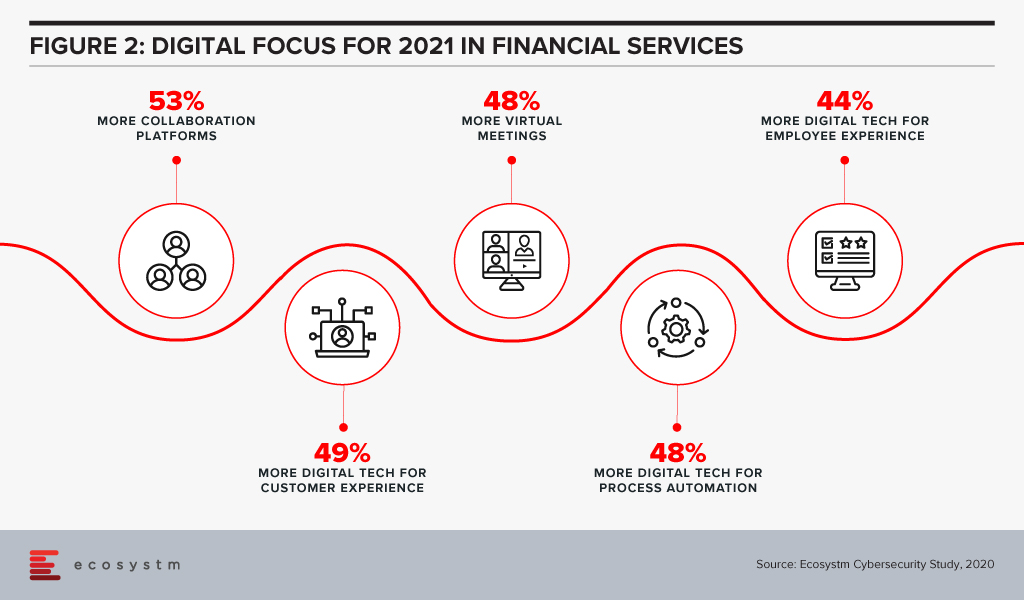

Attention will be paid in 2021 to focusing on automation of processes using AI (Figure 2).

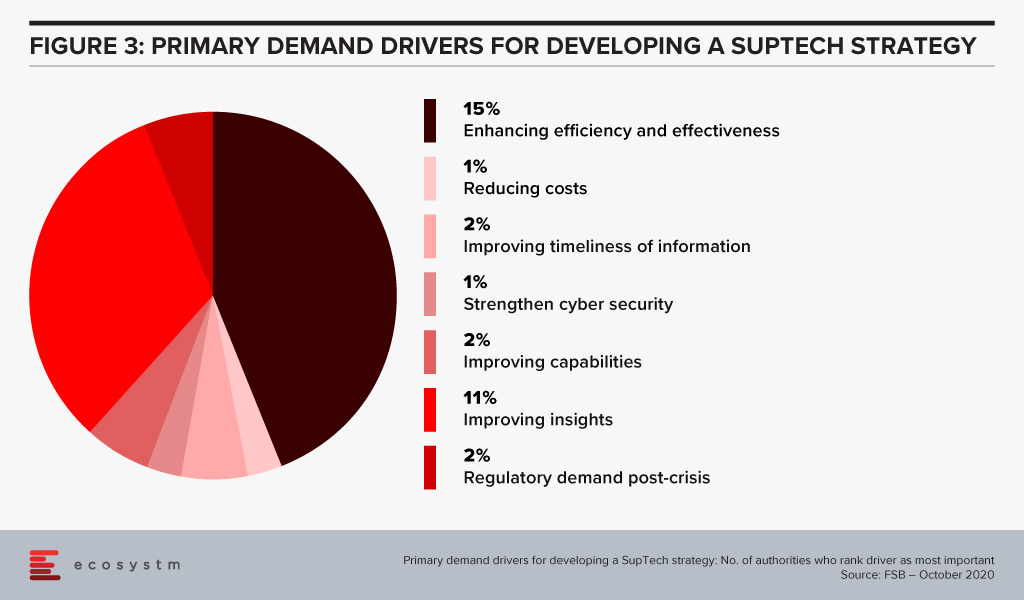

Based on a survey done by the FSB of its members (Figure 3), the majority of their respondents had a SupTech innovation or data strategy in place, with the use of such strategies growing significantly since 2016.

Summary

For more mainstream adoption, data standards and use of effective governance frameworks will be important. As seen from the FSB survey, SupTech applications are now used in reporting, data management and virtual assistance. But institutions still send the transaction data history in different reporting formats which results in a slower process of data analysing and data gathering. AI, using NLP, can help with this by streamlining data collection and data analytics. While time and cost savings are obvious benefits, the ability to identify key information (the proverbial needle in the haystack) can be a significant efficiency advantage.

Singapore FinTech Festival 2020: Infrastructure Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics tied to creating infrastructure for a digital economy; and RegTech and SupTech policies to drive innovation and efficiencies in a co-Covid-19 world.

Technologies to automate IT systems and relieve over-stretched IT operations teams have been moving into the mainstream over the last few years. Several factors, driven by the digital era, have made this necessary. Firstly, digital transformation is creating ever-larger IT environments and volumes of data that cannot be managed by manual processes. These distributed systems are also becoming more complex, incorporating IoT, mobile, multi-cloud, containers, and APIs. Moreover, for digital businesses, the financial impact of an outage makes time to resolution critical. Identifying and remediating issues before they affect the user is now paramount. AIOps provides intelligence to the IT operations team that allows them to proactively resolve events before they become outages.

Augmenting IT Operations with AIOps

AIOps allows IT operations teams to not only ensure observability of their systems and reduce noise but to also understand how events are interacting together to affect performance and take corrective action quickly. The primary features of AIOps are:

- Noise reduction. AIOps ingests systems data, surfaces priority anomalies and correlates them together. This brings the number of incidents to investigate back down to a human level. Rackspace recently announced that AIOps helped it reduce alert noise by 99% during the initial stage of its rollout. Successful vendor references typically cite similar figures between 95-99%.

- Root cause analysis. Once priority events have been correlated, AIOps identifies a root cause to enable the operations team to focus its efforts on a resolution. This is a task that proves challenging to perform at speed for a human operator considering the complexity of today’s systems.

- Proactive response. A range of responses is available with AIOps, from directing issues to the appropriate people, to recommending actions that can be taken by operators directly in a collaboration tool, to rules-based workflows performed automatically, such as spinning up additional AWS EC2 instances.

- Learning. By evaluating past failures and successes, AIOps can learn over time which events are likely to become critical and how to respond to them. This brings us closer to the dream of NoOps, where operations are completely automated.

The Impact of COVID-19 on IT Operations

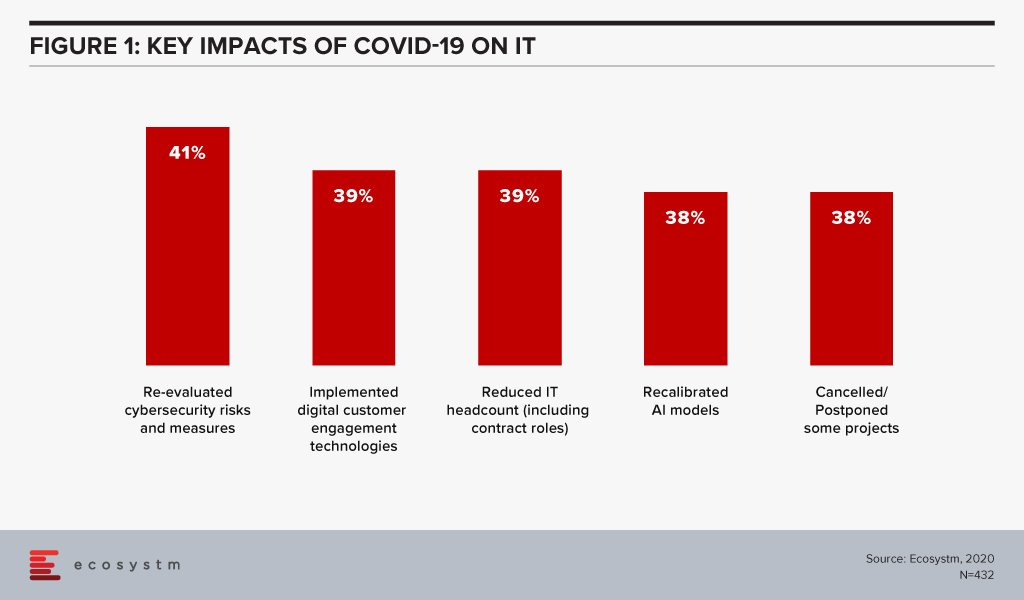

The Ecosystm Digital Priorities in the New Normal study launched this month, asks technology users about how their digital priorities have shifted during the pandemic. Despite pressure to shift to digital delivery, almost 40% of participants reported that their organisations cut headcount in the IT department (Figure 1). Furthermore, over one third had been forced to cut their employees’ salaries. As we have seen in previous crises, IT operations teams are being asked to do more with less and will need automation to bridge the gaps.

As we begin to move into the next phase of the COVID-19 reality and businesses continue to open, we will see many launch digital services that were conceived of during the crisis. One of the greatest challenges that IT departments face will be scalability as digital businesses grow. AIOps will be a go-to tool for IT operations to ensure uptime and improve user experience. It is likely that the next 12-18 months will be a watershed moment for AIOps.

NLP and the Democratisation of Data

Natural Language Processing (NLP) will be the next string in the bow of AIOps. While the ultimate goal of IT operations is to identify and remediate situations before they have an impact on the user, oftentimes it is the service desk that generates the initial barrage of alerts. AIOps equipped with NLP can extract relevant data from user tickets, correlate them with other system events and potentially even suggest a resolution to the user. Here, ChatOps can help to reduce the workload on the service desk and bring relevant events to the attention of the operations team faster. NLP will also help democratise IT operations data within the organisation. As they digitalise, lines of business (LoBs) besides IT will need access to system health and user experience data but business managers may not have the necessary technical skills to extract them. Chatbots that can return these metrics to non-technical users will begin to proliferate.

AIOps Recommendations

Most IT departments would have discovered the limitations of their current systems during the upheaval caused by recent lockdowns. Only about 7% of organisations in our study reported that they were well-prepared across all areas of IT, to handle the COVID-19 crisis. For those organisations that have yet to invest in AIOps, we recommend starting now but starting small. Develop a topology map to understand where you have reliable data sources that could be analysed by AIOps. Then select a domain by assessing the present level of observability and automation, IT skills gap, frequency of outages, and business criticality. As you add additional domains and the system learns, the value you realise from AIOps will grow.

The power of collaborative AIOps tools would have been undeniable as the COVID-19 crisis began and IT departments were forced to work in a distributed manner. When evaluating a system, carefully consider how it will integrate into your organisation’s preferred collaboration suite, whether it be the AIOps vendor’s proprietary situation tool or a third-party provider like Slack or Microsoft Teams. The ability for operations teams to collaborate effectively reduces time to resolution.

Artificial intelligence (AI) is perhaps the most electrifying and controversial of the so-called “disruptive” technologies. As AI becomes more sophisticated and the technology evolves, it will increasingly help to perform more complex tasks whether for personal or commercial use.

Today’s AI machines can replicate certain elements of intellectual ability and they are constantly striving to achieve more. This includes applications of autonomous vehicles, domestic and industrial robots, surveillance and security, automation, personal assistants, forecasting, data analysis and more.

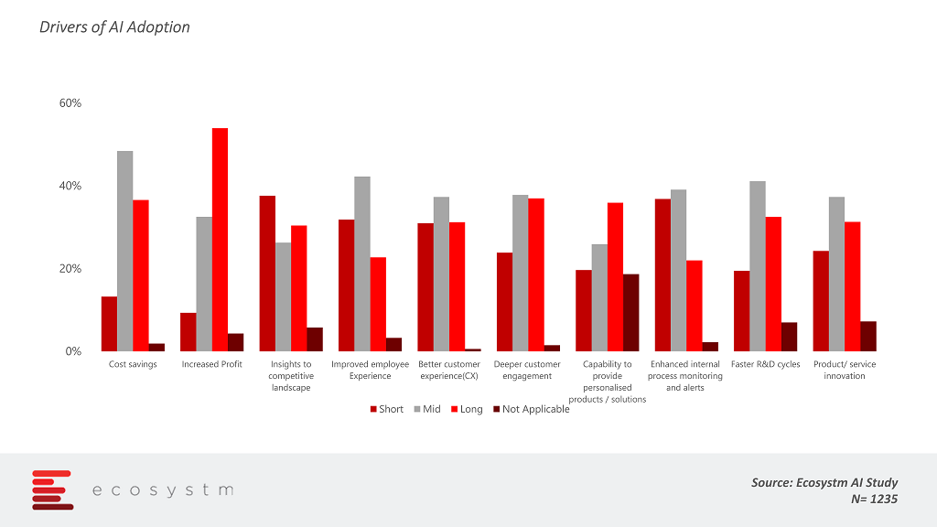

The global Ecosystm AI study reveals top drivers of AI adoption. Organisations are trying to incorporate AI in their existing processes for better competitor analysis and insights, cost-effectiveness, deeper customer engagement to provide personalised service/product offerings, and for process redesign or automation.

AI supporting technologies

AI is driving important technologies and processes and driving better, faster and more accurate decisions which help processes run more effectively and efficiently. With AI insights, business strategies will be more information-driven, efficient and consistent.

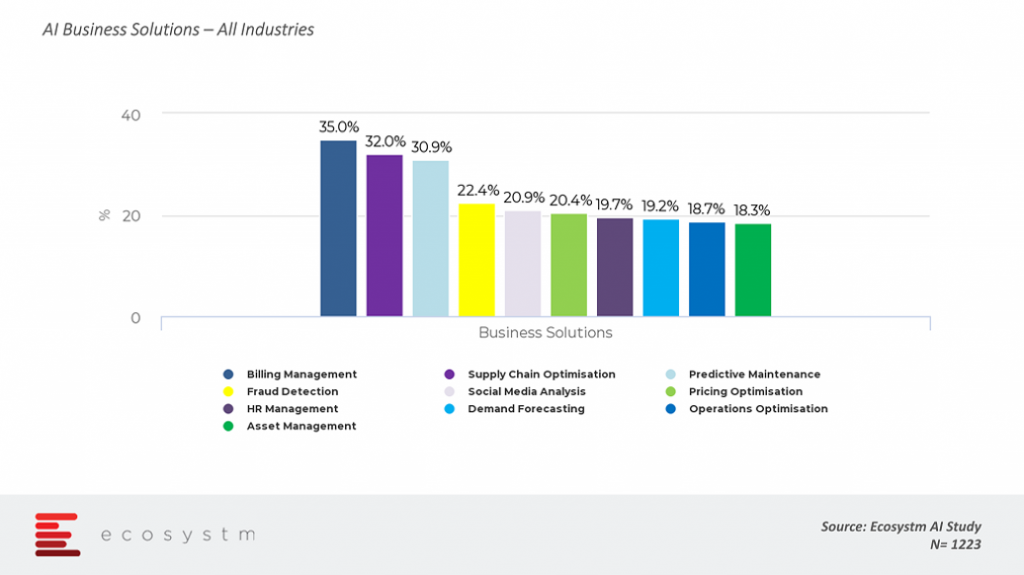

There are certainly many benefits that organisations are deriving from AI. Ecosystm AI study reveals that organisations implementing AI are using it to drive various business solutions including billing management, supply chain optimisation, predictive maintenance, enhancing operations and more.

Below is a list of some hot technologies driven by AI.

Advanced Analytics

The proliferation of Big Data has led to the creation of massive data sets that can only be effectively analysed with AI tools and statistical models. AI can spot complex patterns in the data which is difficult for humans to understand. AI’s usefulness as an analytics tool is highly gaining importance in the use of predictive analytics and decision automation. Once sufficient data is available for use by AI, which is further filtered and processed thoroughly, the system can suggest actions or outcomes based on various parameters such as trends, patterns, historical information, frequency and more.

For example, the financial services industry is using advanced analytics to evaluate how customers earn, invest, spend and make financial decisions, which is useful for the organisations to customise their customers’ preference and offerings accordingly.

Natural Language Processing (NLP) and speech recognition

NLP involves the learning of languages by machine through the means of interaction between computers and unstructured speech/text. NLP requires massive processing power and complex algorithms to reinforce learning mechanisms. To help in NLP, AI generates models, which are further improved to create NLP and speech simulations. Nowadays, Natural language is being implemented and used in various conversational interfaces, such as those with bots, artificial learning agents that can generalise to new environments, and autonomous vehicles.

Cognitive processing

Otherwise known as semantic computing, refers to a digital processing that attempts to mimic the operation of the human brain. In general, semantics means the meaning and interpretation of words and sentence structure and how words relate to other words. So, how is semantic related and what is the semantic analysis used for in AI? Semantic technology processes the logical structure of sentences to identify the most relevant elements in the text to understand the topic. It is especially suited to the analysis of large unstructured datasets with high efficiency.

Vantagepoint has an artificial intelligence tool to improve their trading results. It has a patented tool which can forecast stocks, futures, commodities, Forex and ETFs and claims an accuracy of up to 86%. The tool can predict changes in market trend direction up to three days in advance thus enabling traders to get in and out of trades at optimal times with confidence.

Robotic Process Automation (RPA)

RPA has grown out of Business Process Automation (BPA) and refers to the use of AI to automate workflow and business processes. The advantages of RPA demonstrate it to be a solid tool in attaining higher quality output at lower costs which is much quicker than traditional methods. RPA can be used in IT support processes, back-office work, and workflow processes. The rules are programmed, and bots extract structured inputs from applications like Excel and enter them into other software such as CRM, SCM or accounting. A good example is the use of NLP to scan incoming emails and undertake the appropriate action, such as generating an invoice or flagging a complaint in an automated manner.

Machine Learning

Machine learning is an application of artificial intelligence (AI) which involves a combination of raw computing power and logic-based models to simulate the human learning process. Machine Learning is proving to be a successful approach to AI. When humans learn, they alter the way they relate information and the world, similarly when machines learn, they alter the data and form it into a piece of information.

An example, Image recognition is a popular application of machine learning in which images are fed into an algorithm, which attempts to recognise the contents of the image based on patterns. For instance, Yelp’s machine learning algorithms help the company’s human staff deal with tens of millions of photos to compile, categorise, and label the images more efficiently.

Chatbots and virtual assistants

Chatbots are robotic processes which simulate human conversation and automate functions. The technology is also used for so-called ‘virtual assistants’, which uses AI to interact with humans and aid with specific queries. They are increasingly being used to handle simple conversation and tasks in B2B and B2C environments. The addition of chatbots reduces human assistants and they can work throughout the clock. Chatbots and Virtual assistants improve with AI and can be trained to review conversations, past transactions and to draft a response based on context. If the user interacts with the bot through voice, then the chatbot requires a speech recognition engine.

Chatbots have been used in instant messaging (IM) applications and online interactive platforms. To exemplify, chatbots are deployed to assist online shoppers by answering noncomplex product questions, pricing, FAQ’s, order processing steps or forwarding information to human agents on complicated questions such as shipping delays or faults.

With AI technology evolving and improving so rapidly, many organisations are looking to use AI in their business, but there are still many questions to which adopters are seeking answers such as how to integrate AI into their existing systems, how to get access to data that will enable AI as well as the persistent technology concerns around cybersecurity and cost. The goal of many AI providers is to reach a stage where AI will support humans, control machines for us and automate repetitive tasks and processes.