The last year has really pushed the Education sector into transforming both its teaching and learning practices. The urgency of the situation accelerated the use of networking to extend the reach and range of educational opportunities for remote learning.

Education technology has rushed to embrace opportunities to facilitate a new normal for Education. This new normal must enable and support education access, experiences, and outcomes as well as aid in developing strong relationships within Education ecosystems.

Education technology, commonly known as EdTech, focuses on leveraging emerging technologies like cloud and AI to deliver interactive and multimedia coursework over online platforms. This also requires a state-of-the-art network to support. 5G provides instantaneous access to cloud services. Use of 5G – as well as network function virtualisation (NFV), network slicing, and multi-access edge computing (MEC) – has the capability of delivering significant performance benefits across these emerging educational applications and use cases.

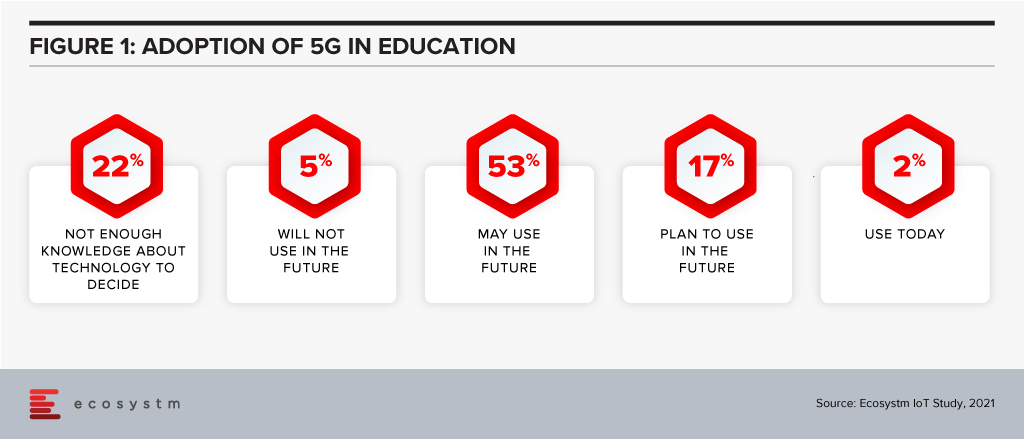

At present, many educational institutions are aware of the possibilities, but are not active users of 5G network infrastructure (Figure 1).

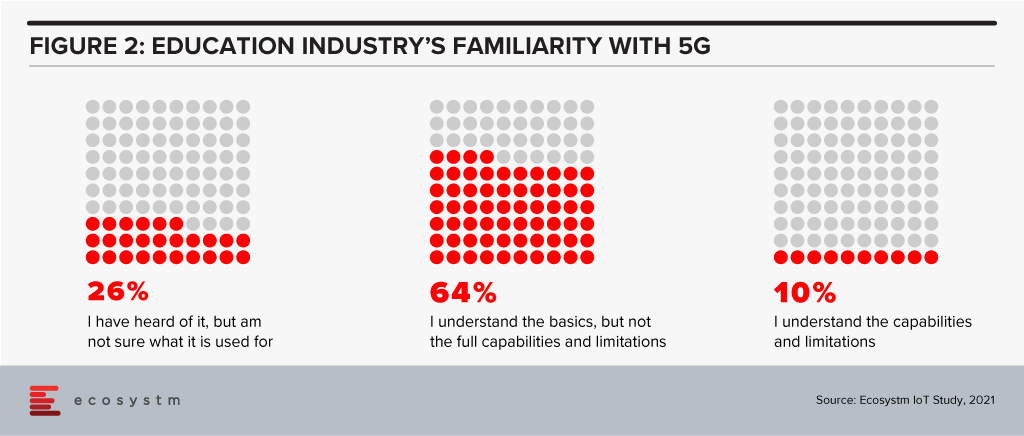

Educational institutions plan to do some near-term investments but are not clear in what areas to apply the enhanced capabilities (Figure 2).

Role of the Network in Adaptive Learning

In their recent whitepaper, network provider Ciena talks about “the concept of an adaptive learning strategy – a technology-based teaching method that replaces the traditional one-size-fits-all teaching style with one that is more personalised to individual students. This approach leverages next-generation learning technologies to analyse a student’s performance and reactions to digital content in real-time, and modifies the lesson based on that data.”

To create an adaptive learning strategy that can be individualised, these learners need to be enabled by technology to be immersed in a learning experience, complete with multimedia and access to a knowledge base for information. And this is where a solid 5G network implementation can create access and bandwidth to the resources required.

Example of 5G and Immersive Learning

An example of adaptive learning where the technology not only supports but challenges the learner can be found in a BT-led new immersive classroom developed within the Muirfield Centre in Cumbernauld, North Lanarkshire, using innovative technology to transform a classroom into an engaging and digital learning environment.

Pupils at Carbrain Primary School, Cumbernauld, were the first to dive into the new experience with an underwater lesson about the ocean. The 360-degree room creates a digital projection that uses all four classroom walls and the ceiling to bring the real-world into an immersive experience for students. The concept aims to push beyond traditional methods of teaching to create an inclusive digital experience that helps explain abstract and challenging concepts through a 3D model. It will also have the potential to support students with learning difficulties in developing imagination, creative and critical thinking, and problem-solving skills. BT has deployed its 5G Rapid Site solution to support 5G innovation and digital transformation of UK’s Education sector. The solution is made possible through the EE 5G network which brings ultrafast speeds and enhanced reliability to classrooms.

Conclusion

5G is expected to provide network improvement in the areas of latency, energy efficiency, the accuracy of terminal location, reliability, and availability – therefore creating the ability to better leverage cloud capacity.

With the greater bandwidth that 5G provides, learners and instructors, can connect virtually from any location with minimal disruption with more devices than on previous networks. This allows students to enjoy a rich learning experience and not be disadvantaged by their location for remote learning, or by the uncertainty of educational access. This also provides more possibilities of exploration and discovery beyond the physical confines of the classroom and puts those resources in the hands of eager learners.

As educational institutions reopen, institutions are looking at ways to redesign the education experience. Connected devices are helping schools and universities expand the boundaries of education. Explore what the IoT-enabled future of education would look like

When I wrapped up my visit to this year’s Mobile World Congress (MWC) in Barcelona, I had wondered if my pre-trip question of what would the 5G story be after several years of being told that each preceding year was ‘the’ year. However, this year had a very distinct vibe to it, and I was rewarded for my pilgrimage to the Grand Fira.

Let’s not forget that technology takes longer to roll out that all of us want to think and 5G is no different. We have had no excuses since we only have to look at how long it took 3G and LTE to become mainstream and how long the transition from the prior technology took to move to the next generation.

However, the mobile and telecom industry is not the same as it was when earlier telecommunication tech was being upgraded. In the past hardware, benchmarks feeds and speeds dominated the marketing messages, but now it is about software, cloud and ecosystem collaboration. Gone are the days when the telecom equipment vendors ruled the conversation about their technology – that has clearly been replaced by IT companies leading the charge with topics such as virtualization, IoT, analytics and new services. Once there was a US automobile commercial that touted the latest edition of its cars was ‘This is not your father’s Oldsmobile’. Well, 5G is not your father’s telecom infrastructure!

This time around, operator and equipment vendors may have to take the collaborative partner role in any new digital solution. Instead of 5G projects being dominated by Ericsson or Huawei for example, there is a role for the likes of VMware, Microsoft, and Salesforce to be the lead company. In some cases, it could be Bosch, PTC, or Siemens while in others it could be Audi, BMW or Mercedes. The overall trend here is that all of these companies are being digitally driven to deliver new services to a customer that is firmly at the center of an ecosystem. The one industry sector who might lose out could be the telco operators who could be squeezed by the surge from IT vendor relevance, despite them investing heavily on 5G licenses. However, this time the operators are in a much stronger position to be the perfect channel for the massive amount of intelligence-laden data being created by smart connected devices that are not typical mobile devices.

So what was the outcome at MWC? I visited both the Huawei and Ericsson booths following pre-MWC briefing sessions to see if the customer buzz was there – and indeed it was.

Ericsson may have won the prize for the most crowded booth, while Huawei’s sprawling booth wins the most lavish and largest booth. The two company’s 5G messages could not have been more different.

The Big Two

For me, Huawei had invested heavily in making its hardware products very compelling for operators to install. Clearly, there had been a lot of research had gone into replacing existing infrastructure with massive performance upgrades and deployment friendly attributes e.g. size and weight of base stations that could be mounted by individuals rather than by cranes. The result of this strategy is that Huawei’s customers can quickly deploy 5G platforms with lower CapEx and OpEx thus creating significant incentives for operators to migrate to 5G networks.

Ericsson’s leading story was about migrating to 5G by highlighting its key enablers (i.e. carrier aggregation, LTE-NR spectrum sharing, and dual mode 5G cloud core). It appeared that Ericsson had moved its message off hardware (which, by the way, is still table stakes in any selection process and Ericsson had plenty of new 5G related offerings) and onto a strategy of smooth evolution and deployment at scale – a much more business leader discussion than a network, driven by software. Finally, both companies had strong messages around their AI capabilities to help their service providers make sense of the growing complexity of services that will be generated by the connected smart IoT devices.

The Importance of IT Software On 5G

IT and industrial companies played an increasingly important role at this year’s MWC as service providers and they became involved in deeper partnerships. 2019 was the year when the gaps for 5G between the network and IT services were being filled in. For example, I saw AR (augmented reality) solutions by PTC supported by Microsoft and being fed by data off a 5G network. This showed how industry, cloud and network service providers will accelerate new technologies.

In another example, Salesforce showed how Edge Computing events triggered Salesforce SaaS-based enterprise management services while being supported by AT&T’s 5G network and the modules being designed and tested at AT&T’s Foundry. Here, AT&T 5G network was being used as a high-value channel for Salesforce’s customers to run their business functions at the edge of the network.

Digital twins have shown up as a digital representation of a physical device or asset. However, this year, I saw a Wipro example of how 5G could drive digital twin concepts beyond physical assets and into the workflow, supply chain management, logistics and worker safety. Every ‘asset’ that was to be used in a factory floor was digitized into a digital twin and then a 5G network was used to monitor and manage every aspect of the factory. It seemed that Industry 4.0 had arrived in its full glory.

Finally, VMware continues to be the IT company that service providers will either love or dislike – I still don’t know which one it will be. VMware’s virtualization and cloud management capabilities have been extended right into 5G networks. For example, NFV (Network Function Virtualization) is critical to operators as they slice the 5G bandwidth into the appropriate services. VMware has its strategy correct when it says that it could virtualize the network just as it has with the cloud, but in doing so is making itself either a partner or a competitor of the operators for their 5G services revenues. 2018 was the year when VMware made a big splash at MWC, 2019 was the year when they showed that they have something to offer – will 2020 be the year when they take over the network software virtualization profit pools just as they did with the enterprise server virtualization market?

Crawl, Walk, Run

In conclusion, MWC 2019 was the year that the 5G gaps to make end-to-end infrastructure solutions where clearly being filled in. Service providers had stepped up their willingness to be part of the customer-centric ecosystem that is almost certainly being led by IT software companies. Telecom equipment vendors were offering technology solutions to speed up 5G deployments while making forward compatible solutions much easier. Finally, 5G-supported applications remain the last piece of the puzzle that MWC hasn’t addressed fully. As a result of the massively varied 5G use cases, there is still a look of curiosity on which industry will be the lead for 5G – will it be the auto industry with autonomous cars, will it be Industry 4.0 and the smart factory, or will it be smart cities with video surveillance. In addition, it is certain that IoT is still very much a necessary part of any 5G strategy just as AI outcomes continue to fuel IoT-based sensors in technologies such as the self-driving cars, AR, and digital twins. 2019 may have been the year that decided that it won’t matter whether the connected IoT device used licensed (NB-IoT) or unlicensed (LoRa) spectrum protocols as both will be seamlessly connected to a 5G network. IoT was not dead, it had simply grown up and was now integrated with more valuable solutions.