Microsoft announced their intentions to acquire Activision Blizzard for USD 68.7 billion, creating quite a buzz in the Gaming and tech industry. The acquisition is set to be completed in 2023 and according to Microsoft is well set to fuel “growth in Microsoft’s gaming business across mobile, PC, console and cloud and will provide building blocks for the metaverse.”

There have been a few animated discussions at Ecosystm on Microsoft’s potential monopoly in the Gaming industry, whether it is aligned to their ‘Metaverse plans’ and the challenges that Microsoft is likely to face with the acquisition. Here is what our experts have to say.

Impact on the Gaming Industry

Activision Blizzard is the publisher of some of the most popular games around – loved by both hardcore and casual gamers. The acquisition of franchises such as Call of Duty, Overwatch, Warcraft and Diablo – as well as mobile games like Candy Crush and Hearthstone – demonstrates Microsoft’s commitment to what is now the largest medium of entertainment.

Microsoft is clearly focusing on growing their software revenue. But most importantly, they will be able to integrate these popular titles within Game Pass. This allows them to compete more actively with Steam and Epic Games Store but as a subscription-based model. The Game Pass model has proven extremely popular with gamers (with approximately 25 million gamers spending USD 10 per month to subscribe to the service), so this will continue to bolster their market position and increase users and revenue.

The latest Xbox Series X/S are the fastest-selling Xboxes ever – even with chip shortages and logistics challenges. The majority of Microsoft’s gaming revenue comes from hardware now. This acquisition will inevitably drive hardware growth, as well as increase gaming software revenue from both a subscription on Game Pass as well as outright purchases.

Microsoft’s Bigger Play

Microsoft made a great start by acquiring key titles like Doom in 2020. The go-to-market strategy through subscriptions and gaming as a cloud service is well managed. Last year when Microsoft relaunched Flight Simulator, the Ecosystm review spoke of how Microsoft wanted to be the “Netflix of Gaming”. They just fired another big shot in that battle by announcing their intention to acquire Activision. With a USD 69 billion price tag, it is probably more of a ballistic missile than a shot!

There has been a lot of conversation (including at Ecosystm!) on how this acquisition makes sense. Microsoft’s revenue from gaming sales is said to be USD 11.5 billion on an annualised basis – and Activision’s revenue is estimated to be USD 7.7 billion. The combination will obviously be huge, but is it worth so much? It is!

The reason for that is today’s leading buzzword – the Metaverse. As people live more of their lives in an online world and interact more with their peers online, being a leader in that “universe” is the key to the future. The Metaverse occupies the spaces of work, play and socialisation which have all gone increasingly virtual.

For Microsoft, this really translates into how relevant their cloud is to the Metaverse. This is a world where one can play using Game Pass, work on Office 365 and store everything on OneDrive. This pervasiveness is key to Microsoft’s consumer strategy. On the enterprise side, they have a dominant share, especially with Office 365. This will see them gaining strength in the consumer business.

Challenges for Microsoft

What a bargain for Microsoft! When Microsoft made the USD 95 per share offer this week Activision’s market value was about USD 51 billion. While the premium that they are offering was almost 50% of the share market close on the previous trading day, they are getting market-leading content for about 10% less than what Activision was worth in February 2021. A year in which the pandemic continued to increase demand for online gaming.

However, this leaves Microsoft with three significant challenges.

First, they have to get regulatory approval in the different markets in which the two companies operate. Microsoft has advised they expect the deal to close in late 2023, so it looks like they are expecting some interesting discussions over the next few months. This acquisition is a significant consolidation of the Gaming market, so regulators will look at the deal closely.

In addition, regulators will also look closely at the privacy implications, with Microsoft gaining access to millions of gamers’ personal details to add to the personal information they already hold from their other divisions.

Second, they have the challenge of addressing the sexual harassment issues that caused the drop in Activision’s market value. There are court settlements under appeal, and reports talk about 40 people leaving Activision since July. Integrating the large teams into Microsoft will need careful attention.

Third, retaining the talent in Activision may be a challenge for Microsoft as I would expect their competition to be actively approaching Activision’s key creatives.

Unless these challenges are handled well, the company they bid on may not be the company they acquire.

The process of developing advertising campaigns is evolving with the increasing use of artificial intelligence (AI). Advertisers want to optimise the amount of data at their disposal to craft better campaigns and drive more impact. Since early 2020, there has been a real push to integrate AI to help measure the effectiveness of campaigns and where to allocate ad spend. This now goes beyond media targeting and includes planning, analytics and creative. AI can assist in pattern matching, tailoring messages through AI-enabled hyper-personalisation, and analysing traffic to communicate through pattern identification of best times and means of communication. AI is being used to create ad copy; and social media and online advertising platforms are starting to roll out tools that help advertisers create better ads.

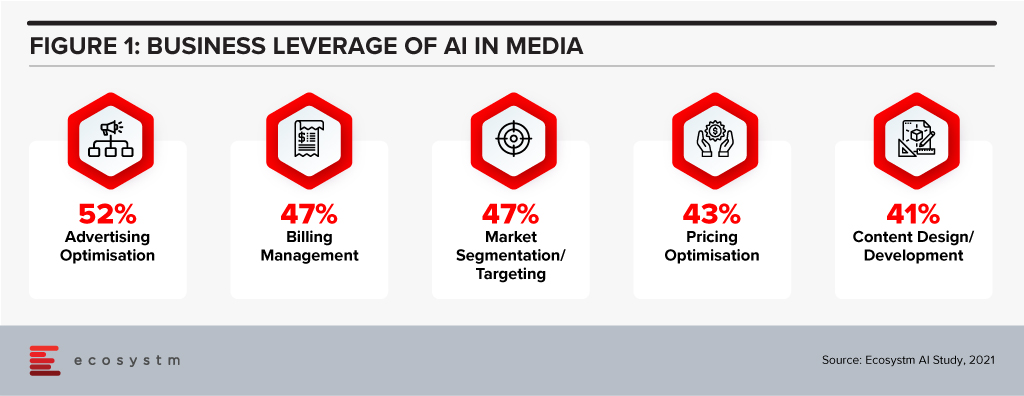

Ecosystm research shows that Media companies report optimisation, targeting and administrative functions such as billing are aided by AI use (Figure 1). However, the trend of Media companies leveraging AI for content design and media analysis is growing.

WPP Strengthening Tech Capabilities

This week, WPP announced the acquisition of Satalia, a UK-based company, who will consult with all WPP agencies globally to promote AI capabilities across the company and help shape the company’s AI strategy, including research and development, AI ethics, partnerships, talent and products.

It was announced that Satalia, whose clients include BT, DFS, DS Smith, PwC, Gigaclear, Tesco and Unilever, will join Wunderman Thompson Commerce to work on the technology division of their global eCommerce consultancy. Prior to the acquisition, Satalia had launched tools such as Satalia Workforce to automate work assignments; and Satalia Delivery, for automated delivery routes and schedules. The tools have been adopted by companies including PwC, DFS, Selecta and Australian supermarket chain Woolworths.

Like other global advertising organisations, WPP has been focused on expanding the experience, commerce and technology parts of the business, most recently acquiring Brazilian software engineering company DTI Digital in February. WPP also launched their own global data consultancy, Choreograph, in April. Choreograph is WPP’s newly formed global data products and technology company focused on helping brands activate new customer experiences by turning data into intelligence. This article from last year from the WPP CTO is an interesting read on their technology strategy, especially their move to cloud to enable their strategy.

Ethics & AI – The Right Focus

The acquisition of Satalia will give WPP and opportunity to evaluate important areas such as AI ethics, partnerships and talent which will be significantly important in the medium term. AI ethics in advertising is also a longer-term discussion. With AI and machine learning, the system learns patterns that help steer targeting towards audiences that are more likely to convert and identify the best places to get your message in front of these buyers. If done responsibly it should provide consumers with the ability to learn about and purchase relevant products and services. However, as we have recently discussed, AI has two main forms of bias – underrepresented data and developer bias – that also needs to be looked into.

Summary

The role of AI in the orchestration of the advertising process is developing rapidly. Media firms are adopting cloud platforms, making IP investments, and developing partnerships to build the support they can offer with their advertising services. The use of AI in advertising will help mature and season the process to be even more tailored to customer preferences.

Industries continue to innovate and disrupt to create and maintain a competitive edge – and their technology partners evolve their solution offerings to empower them.

We bring to you latest industry news from the Healthcare, Financial Services, Retail, Travel & Hospitality and Entertainment & Media industries to show you how organisations are leveraging technology. Find out more about organisations such as Services Australia, Paypal, Walmart, Zara and Amex – and how tech providers such as IBM, Oracle, Google and Uplift are supporting organisations across industries.

View the latest Ecosystm Bytes on Industries of the Future below, and reach out to our experts if you have questions.

For more ‘byte sized’ insights click on the link below