Ransomware attacks have become a real threat to organisations world-wide – SonicWall reports that there were 304.7 million attacks globally in the first half of 2021, surpassing the full-year total for 2020. Organisations today are challenged with having the right cybersecurity measure in place, with cyber-attacks considered an inevitability.

This also challenges tech providers and cybersecurity vendors, as they have to constantly evolve their security offerings to protect their client organisations.

Ecosystm analysts, Alan Hesketh, Andrew Milroy and Claus Mortensen discuss the challenges tech providers face and how they are evolving their capabilities – organically, through acquisitions (Microsoft) and through partnerships (Google).

Last week AT&T announced a partnership with Fortinet to expand their managed security services portfolio. This partnership provides global managed Secure Access Service Edge (SASE) solutions at scale. The solution uses Fortinet’s SASE stack which unifies software-defined wide-area network (SD-WAN) and network security capabilities into AT&T managed cybersecurity framework. Additionally, AT&T SASE and Fortinet will integrate with AT&T Alien Labs Threat Intelligence platform, a threat intelligence unit to enhance detection and response. AT&T has plans to update its managed SASE service during the year and will continue to bring more options.

Talking about the AT&T-Fortinet partnership, Ecosystm Principal Advisor, Ashok Kumar says, “This move continues the trend of the convergence of networking and security solutions. AT&T is positioning themselves well with their integrated offer of network and security services to address the needs of global enterprises.”

Convergence of Network & Security

AT&T’s improved global managed security service includes features such as secure web gateway, firewall-as-a service, cloud access security broker (CASB) and zero-trust access, which provides security teams and analysts with unified capabilities across the cloud, networks and endpoints. The solution aims to enable enterprises to create a more resilient network bringing the core capabilities of the two companies that will reduce operational costs and deliver a unified offering.

Last year AT&T also partnered with Cisco to expand its SD-WAN solution and to support AT&T Managed Services using Cisco’s vManage controller through a single management interface. Over the past years multiple vendors including Fortinet have developed comprehensive SASE solution capabilities through partnerships or acquisitions to provide a unified offering. Last year Fortinet acquired Opaq, a SASE cloud provider to bolster their security capabilities through OPAQ’s patented Zero Trust Network Access (ZTNA) cloud solution and to strengthen SD-WAN, security and edge package.

The Push Towards Flexible Networking

Kumar says, “The pandemic has created a higher demand and value for secure networking services. Enterprises experienced greater number of phishing and malware attacks last year with the sudden increase in work-from-home users. The big question enterprises need to ask themselves is whether legacy networks can support their evolving business priorities.”

“As global economies look to recover, securing remote users working from anywhere, with full mobility, will be a high priority for all enterprises. Enterprises need to evaluate mobile SASE services that provide frictionless identity management with seamless user experiences, and be compatible with the growing adoption of 5G services in 2021 and beyond.”

The Top 5 Telecommunications & Mobility Trends that will dominate the telecom industry to watch out for in 2021. Signup for Free to download the report.

We have all felt the effects of the global pandemic and experienced the profound effects on the way we work – at least those of us who are fortunate enough to still be working despite the pandemic.

COVID-19 has – at least for a while – changed how we work and how IT systems can safely support this new work style.

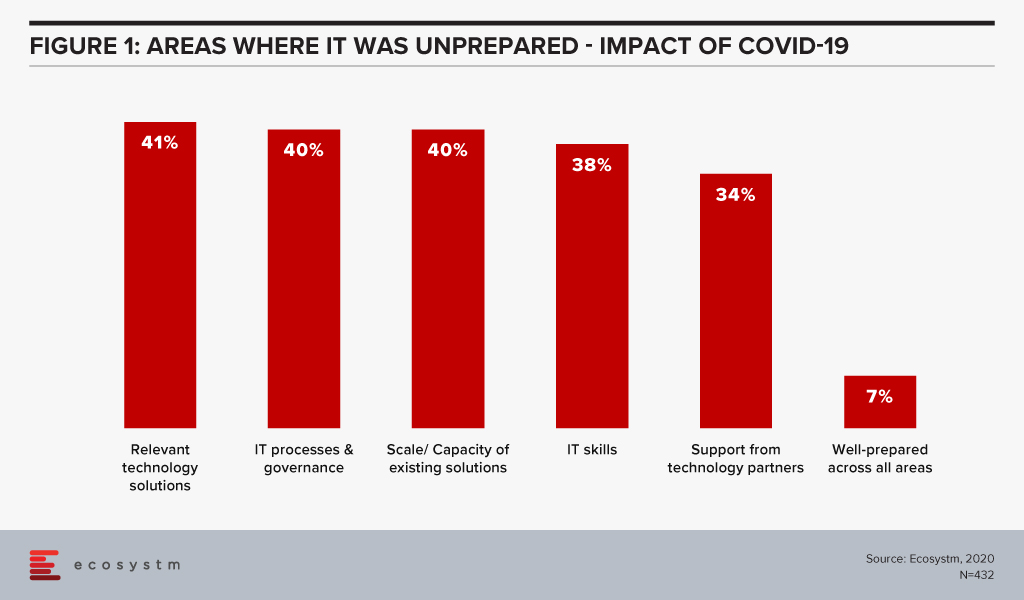

Our ongoing Ecosystm study on Digital Priorities in the New Normal shows how the crisis has forced organisations to re-evaluate their cybersecurity risks and measures. It also showed that the IT environment of most organisations was woefully unprepared for the changes that occurred (Figure 1). Perhaps unsurprisingly, fewer than 7% said that their IT environment was fully prepared and close to 40% reported lacking scale, capacity and IT skills in-house.

We are here to help you!

The combination of these shortcomings may very well push more organisations to outsource their security management to Managed Security Service Providers (MSSPs) – a service space that has been growing rapidly in recent years.

Many IT organisations are fairly familiar with MSSPs, but COVID-19 may have forced many to re-evaluate their choices as the work and threat landscapes have changed.

To help organisations evaluate their options going forward, we at Ecosystm are extremely excited to launch our Managed Security Service Providers VendorScope for the Asia Pacific region.

This new tool can help technology buyers understand which vendors are leading this space, which are the ones that have market momentum and which are executing and delivering on their promised capabilities. Unlike similar vendor evaluations on the market, the positioning of vendors in Ecosystm VendorScopes is based solely on quantifiable feedback given by the Tech Buyer community, in the global Ecosystm Cybersecurity Study, that is live and ongoing on the Ecosystm platform. It is thus independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

It is also free to access and share for all Ecosystm subscribers!

Fragmented Asia Pacific MSSP Market

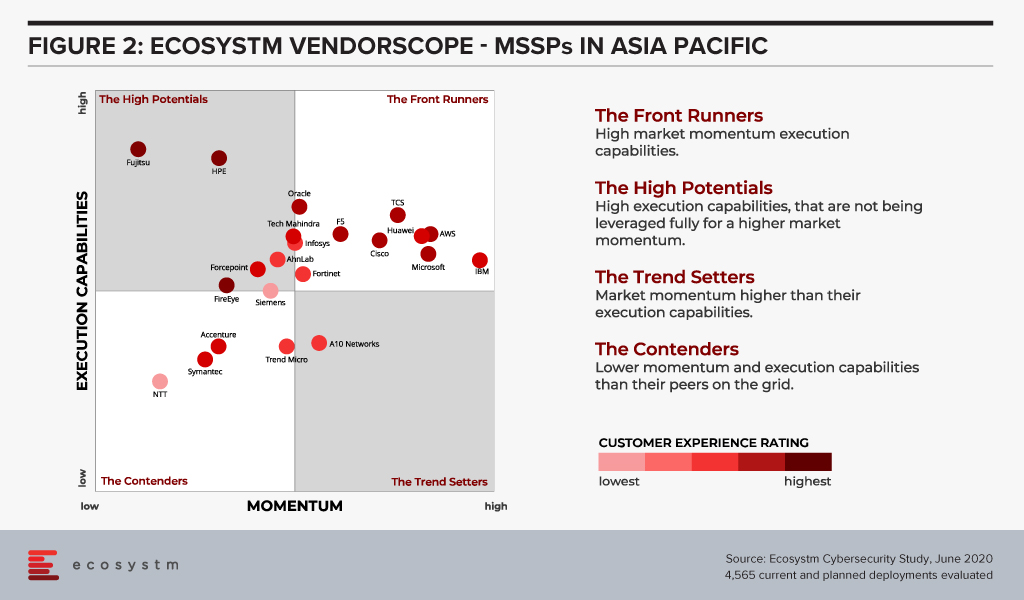

The VendorScope clearly shows how fragmented the MSSP market is. Not only is the number of vendors that have a customer base significant enough to appear on the grid very large (22) – but about half of them are in, or verging on being in, the “Front Runner” segment (Figure 2).

There are a few key factors that contribute to this picture:

- The services they offer tend to align well with the customers’ organisational strategies and to integrate well with existing systems. This, basically, can be boiled down to one word: Cloud. Most organisations have IT strategies revolving around multiple and/hybrid cloud deployments and using MSSPs makes a lot of sense.

- Momentum for this service segment is generally high. The MSSP space is experiencing high growth these days and we see a fairly high number of mentions for both current and planned deployments with many of the vendors in the study.

Despite the large number of vendors in the “Front Runner” segment, a famous few stick out. IBM appears to have a higher market momentum than its competitors and together with Microsoft, they have the largest share of mind with potential customers in this space.

But other vendors are hot on their heels. AWS and F5 stand out with their relatively high presence in the region, and TCS and Huawei appear to have stronger than average pipelines.

Where we do see weak spots with most vendors is in quality of service and the connected customer experience, which historically have proven to be a potential Achilles’ heel for many vendors in high growth areas. As the MSSP space matures, we would expect customer experience to become increasingly important when customers choose a service provider.

We would certainly encourage any organisation that is looking into managed security to not ignore or downplay the customer service and support aspect. IT security is a complex area – even if it is managed by a service provider – and the service providers’ ability and flexibility in this area can make a huge difference.

Fujitsu and HPE stick out with regards to QoS and customer service. These two are also good examples of how the vendors differ and seemingly could complement each other. In a sense, one could almost see the MSSP VendorScope as an early blueprint for which mergers and acquisitions (M&As) would make sense – at least for those that are driven by the pursuit of skill sets and competencies and not just market share.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in M&A activities in the cybersecurity market. Of course, with the global pandemic, all bets are off, and the predicted M&A wave may have been delayed by a year or so.

But the MSSP space certainly appears ripe for consolidation.

Ecosystm Vendorscope: Managed Security Service Providers

Signup for Free to download the Ecosystm Vendorscope: Managed Security Service Providers report