Digital transformation in Malaysia has entered a new phase: less about bold roadmaps, more about fixing what’s broken. With the digital economy expected to reach 25.5% of GDP by 2025, the challenge now is turning strategy into results. Leaders aren’t chasing the next big thing – they are focused on integration bottlenecks, talent gaps, and showing real ROI.

The technology isn’t the problem; it’s making it stick. AI, cloud, and data platforms only deliver value when backed by the right systems, skills, and governance. From aviation to agriculture, organisations are being forced to rethink how they work, how they hire, and how they measure success.

Through a series of interviews and roundtable conversations with Malaysian business and tech leaders, Ecosystm heard firsthand what’s driving – and holding back – digital progress. These weren’t polished success stories, but honest reflections on what it really takes to move forward. The five themes below highlight where Malaysia’s transformation is gaining ground, where it’s getting stuck, and what’s needed to close the gap between ambition and execution.

Theme 1. Ecosystem Collaboration Is Driving Malaysia’s Digital Momentum

Malaysia’s digital transformation is being shaped not by individual breakthroughs, but by coordinated momentum across government, industry, and technology providers. This ecosystem-first approach is turning national ambitions into tangible outcomes. Flagship initiatives like JENDELA, Digital Nasional Berhad’s 5G rollout, and cross-agency digital infrastructure programs are laying the groundwork for smarter public services, connected industries, and inclusive digital access.

The Ministry of Digital (MyDigital) is taking a central role in aligning AI, 5G, and cybersecurity efforts under one roof – helping speed up policy execution and improve coordination between regulators and the private sector. Major tech players like Microsoft, Google, Nvidia, and AWS are responding with expanded investments in local cloud regions, chip design collaborations, and foundational AI services designed for Malaysian deployment environments.

What’s emerging is not just a policy roadmap, but a digitally integrated economy – where infrastructure rollouts, vendor innovation, and government leadership are advancing together. As Malaysia targets to create 500,000 new jobs and reach over 80% 5G population coverage, the strength of these partnerships will be critical in ensuring national strategies translate into sector-level execution.

Theme 2. Laying the Groundwork for Malaysia’s AI Economy

With over 90% of online content projected to be AI-generated by 2025, Malaysia faces growing urgency to ensure that the systems powering AI development are secure, interoperable, and locally relevant. This is about more than data sovereignty – it’s about building the infrastructure to support scalable, trusted, and sector-wide AI adoption.

The National AI Office (NAIO), under MyDigital, is leading efforts to align infrastructure with national priorities across healthcare, manufacturing, agriculture, and public services. Initiatives include supporting domestic data centres, enabling cross-sector cloud access, and establishing governance frameworks for responsible AI use.

The priority is no longer just adopting AI tools, but enabling Malaysia to develop, fine-tune, and deploy them on infrastructure that reflects local needs. Control over this ecosystem will shape how AI delivers value — from national security to inclusive fintech. To support this, Budget 2025 allocates USD 11.7 million for AI education and USD 4.2 million for the National AI Framework. Programs like AI Sandboxes, alongside emerging public-private partnerships, are helping bridge gaps in talent and tooling.

Together, these efforts are laying the foundation for an AI economy that is scalable, trusted, and anchored in Malaysia’s long-term digital ambitions.

Theme 3. Malaysia’s Enterprise AI Landscape: Still in Its Early Stages

Malaysian enterprises are actively exploring AI to drive competitiveness, but widespread, production-grade adoption remains limited. While leading banks are leveraging AI for fraud detection and digital onboarding, and manufacturers are exploring predictive maintenance and automation, many companies face barriers in scaling beyond pilots. Core challenges include siloed data systems, unclear return on investment, and limited in-house AI talent. Even when tools are available, businesses often lack the capacity to integrate them meaningfully into workflows.

Cost is another concern. AI implementation, especially when reliant on third-party platforms or cloud infrastructure, can be prohibitively expensive for mid-sized firms. Without a clear link to bottom-line improvement, AI investments are frequently deprioritised. There’s also lingering uncertainty around governance and compliance, which can further slow enterprise momentum.

For AI to scale across Malaysia, enterprise strategies must align with operational realities – offering cost-effective, localised solutions that deliver measurable value and inspire long-term confidence in digital transformation.

Theme 4. Building on Regulation to Achieve True Cyber Resilience

Malaysia is ramping up its cybersecurity strategy with a stronger regulatory backbone and ecosystem-wide initiatives. The upcoming Cyber Security Bill introduces mandatory breach notifications, sector-specific controls, and licensing for Managed Security Operations Centres (SOCs). Agencies like NACSA are driving protections across 11 critical sectors, while the Cybersecurity Centre of Excellence (CCoE) in Cyberjaya is scaling SOC analyst training in partnership with international players. These efforts are complemented by Malaysia’s leadership role in IMPACT, the UN’s cybersecurity hub, and participation in ASEAN-wide resilience initiatives.

Despite this progress, enterprise readiness remains inconsistent. Malaysian businesses faced an average of 74,000 cyberattacks per day in 2023, yet many still rely on outdated playbooks and fragmented systems. Cybersecurity is often viewed through a compliance lens – meeting audit requirements rather than preparing for real-time recovery. Investments are still skewed toward perimeter defences, while response protocols, cross-team coordination, and real-time observability are underdeveloped.

True resilience requires a shift in mindset: cybersecurity must be treated as a board-level business function. It must be operationalised through simulations, automated response frameworks, and enterprise-wide drills. In a threat landscape that is both persistent and sophisticated, Malaysia must evolve from regulatory compliance to strategic continuity – where recovery speed, not just prevention, becomes the defining metric of cyber maturity.

Theme 5. Malaysia’s Digital Transformation Is Being Led by Industry, Not Policy

While national strategies like the New Industrial Master Plan 2030 set out broad ambitions, real AI-led transformation in Malaysia is taking shape from the ground up, driven by industrial leaders tackling operational challenges with data. Manufacturing and Energy firms, which together contribute over 30% of Malaysia’s GDP, are ahead of the curve. Leaders are using AI for predictive maintenance, digital twins, logistics optimisation, and emissions tracking, often outpacing regulatory requirements.

In some cases, cloud platforms now process millions of machine data points daily to reduce downtime and lower costs at scale. What sets these firms apart is their focus on well-integrated, usable data. Rather than running isolated pilots, they’re building interoperable systems with shared telemetry, open APIs, and embedded analytics, with a focus on enabling AI that adapts in real time.

Malaysia’s next leap in transformation will hinge on whether the data discipline seen in leading industries can be replicated across less-digitised sectors.

If we consider Agriculture – still contributing 7-8% of GDP and employing nearly 10% of the workforce – we find that it remains digitally fragmented. While drones and IoT devices are collecting NDVI and soil data, much of it remains siloed or underutilised. Without clean data pipelines or national integration standards, AI struggles to move from demonstration to deployment.

A Moment to Redefine Ambition

Malaysia stands at a point where digital ambition must evolve into digital maturity. This means asking harder questions – not about what can be built, but what should be prioritised, sustained, and scaled. As capabilities deepen, the challenge is no longer innovation for its own sake, but ensuring technology serves long-term national resilience, equity, and competitiveness. The decisions made now will shape not just digital progress – but the kind of economy and society Malaysia becomes in the decade ahead.

India’s digital economy is on a meteoric rise, expected to reach USD 1 trillion by 2025. This surge in digital activity is fuelling the rapid expansion of its data centre market, positioning the country as a global player. With a projected market value of USD 4.5 billion by 2025, India’s data centre industry is set to surpass traditional regional hubs like Malaysia, Hong Kong, and Singapore.

This growth is driven by factors such as the proliferation of smartphones, internet connectivity, and digital services, generating massive amounts of data that need storage and processing. Government initiatives like Digital India and the National e-Governance Plan have promoted digitalisation, while favourable market conditions, including cost-effective infrastructure, skilled talent, and a large domestic market, make India an attractive destination for data centre investments.

As companies continue to invest, India is solidifying its role as a critical hub for Asia’s digital revolution, driving economic development and creating new opportunities for innovation and job creation.

What is Fuelling India’s Data Centre Growth?

India’s data centre industry is experiencing rapid growth in 2024, driven by a combination of strategic advantages and increasing demand. The country’s abundance of land and skilled workforce are key factors contributing to this boom.

- Digitisation push. The digital revolution is fueling the need for more sophisticated data centre infrastructure. The rise of social media, online gaming, and streaming apps has created a surge in demand for faster networks, better data storage options, and increased data centre services.

- Internet and mobile penetration. With 1.1 billion mobile phone subscribers, Indians use an average of 8.3 GB of data per month. As more people come online, businesses need to expand their data infrastructure to handle increased traffic, enhance service delivery, and support a growing digital economy.

- Increasing tech adoption. India’s AI market is projected to reach around USD 17 billion by 2027. As businesses integrate AI, IoT, cloud, and other technologies, data centres will become instrumental in supporting the vast computational and storage requirements.

- Government & regulatory measures. Apart from India being one of the world’s largest data consumption economies, government initiatives have also accelerated the ‘data based’ environment in the country. Additionally, states like Maharashtra, Karnataka, and Tamil Nadu have implemented favourable real estate policies that reduce the costs of setting up data centres.

A Growing Network of Hubs

India’s data centre landscape is rapidly evolving, with major cities and emerging hotspots vying for a piece of the pie.

Mumbai-Navi Mumbai remains the undisputed leader, boasting a combined 39 data centres. Its strategic location with excellent submarine cable connectivity to Europe and Southeast Asia makes it a prime destination for global and domestic players.

Bangalore, India’s IT capital, is not far behind with 29 data centres. The city’s thriving tech ecosystem and skilled talent pool make it an attractive option for businesses looking to set up data centres.

Chennai, located on the east coast, has emerged as a crucial hub with 17 data centres. Its proximity to Southeast Asia and growing digital economy make it a strategic location. The Delhi-NCR region also plays a significant role, with 27 data centres serving the capital and surrounding areas.

Smaller cities like Pune, Jaipur, and Patna are rapidly emerging as data centre hotspots. As businesses seek to serve a growing but distributed user base across India, these cities offer more cost-effective options. Additionally, the rise of edge data centres in these smaller cities is further decentralising the data centre landscape.

A Competitive Market

India ranks 13th globally in the number of operational data centres, with 138 facilities in operation and an additional 45 expected to be completed by the end of 2025. Key initiatives include:

- AWS. AWS is investing USD 12.7 billion to establish four new data centres over the next two years.

- Meta. Meta is set to build a small data centre, potentially focused on cache with a 10-20 MW capacity.

- AdaniConnex. In partnership with EdgeConneX, AdaniConnex aims to develop a 1 GW network of hyperscale data centres over the next decade, all powered by 100% renewable energy.

- Google. Google is set to build an 80-storey data centre by 2025 and is in advanced talks to acquire a 22.5-acre land parcel for its first captive data centre.

- NTT. NTT is investing USD 241 million in a data campus, which will feature three data centres.

Data Centres: Driving Digital India’s Success

The Digital India initiative has transformed government services through improved online infrastructure and increased connectivity. Data centres play a pivotal role in supporting this vision by managing, storing, and processing the vast amounts of data that power essential services like Aadhaar and BharatNet.

Aadhaar, India’s biometric ID system, relies heavily on data centres to store and process biometric information, enabling seamless identification and authentication. BharatNet, the government’s ambitious project to connect rural areas with high-speed internet, also depends on data centres to provide the necessary infrastructure and support.

The impact of data centres on India’s digital transformation is far-reaching. Here are some key areas where data centres have made a significant contribution:

- Enabling Remote Work and Education. Data centres have been instrumental in supporting the surge in remote work and online learning during the pandemic. By providing the necessary infrastructure and connectivity, data centres have ensured business continuity and uninterrupted education.

- Fostering Start-Up Innovation. Data centres provide the essential infrastructure for start-ups to thrive. By offering reliable and scalable computing resources, data centres enable rapid growth and innovation, contributing to the expansion of India’s SaaS market.

- Supporting Government Services. Data centres underpin key government initiatives, including e-governance platforms and digital identity systems. They enhance the accessibility, transparency, and efficiency of government services, bridging the urban-rural divide and improving public service delivery.

Securing India’s Data Centre Future

Data centres are the backbone of India’s digital transformation, fuelling economic growth, government services, innovation, remote work, and technological progress. The Indian government’s ambitious plan to invest over USD 1 billion in hyperscale data centres over the next five years underscores the country’s commitment to building a robust digital infrastructure.

To secure the long-term success of India’s data centre industry, alignment with global standards and strategic investment are crucial. Prioritising reliability, efficiency, and sustainability will attract global providers and position India as a prime destination for digital infrastructure investments. Addressing challenges like legacy upgrades, modernisation, and cybersecurity risks will require collaboration across stakeholders, with government support and technological innovation playing key roles.

A unified effort from central and state governments is vital to enhance competitiveness. By fostering a favourable regulatory environment and offering incentives, the government can accelerate the development of world-class data centres. As India advances digitally, data centres will be instrumental in driving economic growth, improving quality of life, and solidifying India’s status as a global digital leader.

Leaders Roundtable: Beyond the Breach: Building a Resilient and Innovative Bank

We’ve concluded another successful event! Thanks to everyone for their Valuable contributions.

->Click here to explore hightlights and key takeaways from this Roundtable session.

The global data protection landscape is growing increasingly complex. With the proliferation of privacy laws across jurisdictions, organisations face a daunting challenge in ensuring compliance.

From the foundational GDPR, the evolving US state-level regulations, to new regulations in emerging markets, businesses with cross-border presence must navigate a maze of requirements to protect consumer data. This complexity, coupled with the rapid pace of regulatory change, requires proactive and strategic approaches to data management and protection.

GDPR: The Catalyst for Global Data Privacy

At the forefront of this global push for data privacy stands the General Data Protection Regulation (GDPR) – a landmark legislation that has reshaped data governance both within the EU and beyond. It has become a de facto standard for data management, influencing the creation of similar laws in countries like India, China, and regions such as Southeast Asia and the US.

However, the GDPR is evolving to tackle new challenges and incorporate lessons from past data breaches. Amendments aim to enhance enforcement, especially in cross-border cases, expedite complaint handling, and strengthen breach penalties. Amendments to the GDPR in 2024 focus on improving enforcement efficiency. The One-Stop-Shop mechanism will be strengthened for better handling of cross-border data processing, with clearer guidelines for lead supervisory authority and faster information sharing. Deadlines for cross-border decisions will be shortened, and Data Protection Authorities (DPAs) must cooperate more closely. Rules for data transfers to third countries will be clarified, and DPAs will have stronger enforcement powers, including higher fines for non-compliance.

For organisations, these changes mean increased scrutiny and potential penalties due to faster investigations. Improved DPA cooperation can lead to more consistent enforcement across the EU, making it crucial to stay updated and adjust data protection practices. While aiming for more efficient GDPR enforcement, these changes may also increase compliance costs.

GDPR’s Global Impact: Shaping Data Privacy Laws Worldwide

Despite being drafted by the EU, the GDPR has global implications, influencing data privacy laws worldwide, including in Canada and the US.

Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) governs how the private sector handles personal data, emphasising data minimisation and imposing fines of up to USD 75,000 for non-compliance.

The US data protection landscape is a patchwork of state laws influenced by the GDPR and PIPEDA. The California Privacy Rights Act (CPRA) and other state laws like Virginia’s CDPA and Colorado’s CPA reflect GDPR principles, requiring transparency and limiting data use. Proposed federal legislation, such as the American Data Privacy and Protection Act (ADPPA), aims to establish a national standard similar to PIPEDA.

The GDPR’s impact extends beyond EU borders, significantly influencing data protection laws in non-EU European countries. Countries like Switzerland, Norway, and Iceland have closely aligned their regulations with GDPR to maintain data flows with the EU. Switzerland, for instance, revised its Federal Data Protection Act to ensure compatibility with GDPR standards. The UK, post-Brexit, retained a modified version of GDPR in its domestic law through the UK GDPR and Data Protection Act 2018. Even countries like Serbia and North Macedonia, aspiring for EU membership, have modeled their data protection laws on GDPR principles.

Data Privacy: A Local Flavour in Emerging Markets

Emerging markets are recognising the critical need for robust data protection frameworks. These countries are not just following in the footsteps of established regulations but are creating laws that address their unique economic and cultural contexts while aligning with global standards.

Brazil has over 140 million internet users – the 4th largest in the world. Any data collection or processing within the country is protected by the Lei Geral de Proteção de Dados (or LGPD), even from data processors located outside of Brazil. The LGPD also mandates organisations to appoint a Data Protection Officer (DPO) and establishes the National Data Protection Authority (ANPD) to oversee compliance and enforcement.

Saudi Arabia’s Personal Data Protection Law (PDPL) requires explicit consent for data collection and use, aligning with global norms. However, it is tailored to support Saudi Arabia’s digital transformation goals. The PDPL is overseen by the Saudi Data and Artificial Intelligence Authority (SDAIA), linking data protection with the country’s broader AI and digital innovation initiatives.

Closer Home: Changes in Asia Pacific Regulations

The Asia Pacific region is experiencing a surge in data privacy regulations as countries strive to protect consumer rights and align with global standards.

Japan. Japan’s Act on the Protection of Personal Information (APPI) is set for a major overhaul in 2025. Certified organisations will have more time to report data breaches, while personal data might be used for AI training without consent. Enhanced data rights are also being considered, giving individuals greater control over biometric and children’s data. The government is still contemplating the introduction of administrative fines and collective action rights, though businesses have expressed concerns about potential negative impacts.

South Korea. South Korea has strengthened its data protection laws with significant amendments to the Personal Information Protection Act (PIPA), aiming to provide stronger safeguards for individual personal data. Key changes include stricter consent requirements, mandatory breach notifications within 72 hours, expanded data subject rights, refined data processing guidelines, and robust safeguards for emerging technologies like AI and IoT. There are also increased penalties for non-compliance.

China. China’s Personal Information Protection Law (PIPL) imposes stringent data privacy controls, emphasising user consent, data minimisation, and restricted cross-border data transfers. Severe penalties underscore the nation’s determination to safeguard personal information.

Southeast Asia. Southeast Asian countries are actively enhancing their data privacy landscapes. Singapore’s PDPA mandates breach notifications and increased fines. Malaysia is overhauling its data protection law, while Thailand’s PDPA has also recently come into effect.

Spotlight: India’s DPDP Act

The Digital Personal Data Protection Act, 2023 (DPDP Act), officially notified about a year ago, is anticipated to come into effect soon. This principles-based legislation shares similarities with the GDPR and applies to personal data that identifies individuals, whether collected digitally or digitised later. It excludes data used for personal or domestic purposes, aggregated research data, and publicly available information. The Act adopts GDPR-like territorial rules but does not extend to entities outside India that monitor behaviour within the country.

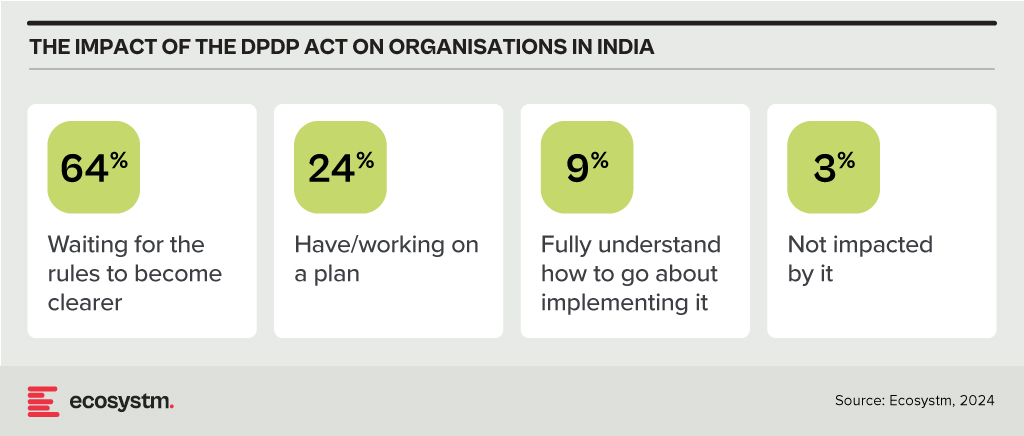

Consent under the DPDP Act must be free, informed, and specific, with companies required to provide a clear and itemised notice. Unlike the GDPR, the Act permits processing without consent for certain legitimate uses, such as legal obligations or emergencies. It also categorises data fiduciaries based on the volume and sensitivity of the data they handle, imposing additional obligations on significant data fiduciaries while offering exemptions for smaller entities. The Act simplifies cross-border data transfers compared to the GDPR, allowing transfers to all countries unless restricted by the Indian Government. It also provides broad exemptions to the State for data processing under specific conditions. Penalties for breaches are turnover agnostic, with considerations for breach severity and mitigating actions. The full impact of the DPDP Act will be clearer once the rules are finalised and the Board becomes operational, but 97% of Indian organisations acknowledge that it will affect them.

Conclusion

Data breaches pose significant risks to organisations, requiring a strong data protection strategy that combines technology and best practices. Key technological safeguards include encryption, identity access management (IAM), firewalls, data loss prevention (DLP) tools, tokenisation, and endpoint protection platforms (EPP). Along with technology, organisations should adopt best practices such as inventorying and classifying data, minimising data collection, maintaining transparency with customers, providing choices, and developing comprehensive privacy policies. Training employees and designing privacy-focused processes are also essential. By integrating robust technology with informed human practices, organisations can enhance their overall data protection strategy.

As AI evolves, the supporting infrastructure has become a crucial consideration for organisations and technology companies alike. AI demands massive processing power and efficient data handling, making high-performance computing clusters and advanced data management systems essential. Scalability, efficiency, security, and reliability are key to ensuring AI systems handle increasing demands and sensitive data responsibly.

Data centres must evolve to meet the increasing demands of AI and growing data requirements.

Equinix recently hosted technology analysts at their offices and data centre facilities in Singapore and Sydney to showcase how they are evolving to maintain their leadership in the colocation and interconnection space.

Equinix is expanding in Latin America, Africa, the Middle East, and Asia Pacific. In Asia Pacific, they recently opened data centres in Kuala Lumpur and Johor Bahru, with capacity additions in Mumbai, Sydney, Melbourne, Tokyo, and Seoul. Plans for the next 12 months include expanding in existing cities and entering new ones, such as Chennai and Jakarta.

Ecosystm analysts comment on Equinix’s growth potential and opportunities in Asia Pacific.

Small Details, Big Impact

TIM SHEEDY. The tour of the new Equinix data centre in Sydney revealed the complexity of modern facilities. For instance, the liquid cooling system, essential for new Nvidia chipsets, includes backup cold water tanks for redundancy. Every system and process is designed with built-in redundancy.

As power needs grow, so do operational and capital costs. The diesel generators at the data centre, comparable to a small power plant, are supported by multiple fuel suppliers from several regions in Sydney to ensure reliability during disasters.

Security is critical, with some areas surrounded by concrete walls extending from the ceiling to the floor, even restricting access to Equinix staff.

By focusing on these details, Equinix enables customers to quickly set up and manage their environments through a self-service portal, delivering a cloud-like experience for on-premises solutions.

Equinix’s Commitment to the Environment

ACHIM GRANZEN. Compute-intensive AI applications challenge data centres’ “100% green energy” pledges, prompting providers to seek additional green measures. Equinix addresses this through sustainable design and green energy investments, including liquid cooling and improved traditional cooling. In Singapore, one of Equinix’s top 3 hubs, the company partnered with the government and Sembcorp to procure solar power from panels on public buildings. This improves Equinix’s power mix and supports Singapore’s renewable energy sector.

TIM SHEEDY Building and operating data centres sustainably is challenging. While the basics – real estate, cooling, and communications – remain, adding proximity to clients, affordability, and 100% renewable energy complicates matters. In Australia, reliant on a mixed-energy grid, Equinix has secured 151 MW of renewable energy from Victoria’s Golden Plains Wind Farm, aiming for 100% renewable by 2029.

Equinix leads with AIA-rated data centres that operate in warmer conditions, reducing cooling needs and boosting energy efficiency. Focusing on efficient buildings, sustainable water management, and a circular economy, Equinix aims for climate neutrality by 2030, demonstrating strong environmental responsibility.

Equinix’s Private AI Value Proposition

ACHIM GRANZEN. Most AI efforts, especially GenAI, have occurred in the public cloud, but there’s rising demand for Private AI due to concerns about data availability, privacy, governance, cost, and location. Technology providers in a position to offer alternative AI stacks (usually built on top of a GPU-as-a-service model) to the hyperscalers find themselves in high interest. Equinix, in partnership with providers such as Nvidia, offers Private AI solutions on a global turnkey AI infrastructure. These solutions are ideal for industries with large-scale operations and connectivity challenges, such as Manufacturing, or those slow to adopt public cloud.

SASH MUKHERJEE. Equinix’s Private AI value proposition will appeal to many organisations, especially as discussions on AI cost efficiency and ROI evolve. AI unites IT and business teams, and Equinix understands the need for conversations at multiple levels. Infrastructure leaders focus on data strategy capacity planning; CISOs on networking and security; business lines on application performance, and the C-suite on revenue, risk, and cost considerations. Each has a stake in the AI strategy. For success, Equinix must reshape its go-to-market message to be industry-specific (that’s how AI conversations are shaping) and reskill its salesforce for broader conversations beyond infrastructure.

Equinix’s Growth Potential

ACHIM GRANZEN. In Southeast Asia, Malaysia and Indonesia provide growth opportunities for Equinix. Indonesia holds massive potential as a digital-savvy G20 country. In Malaysia, the company’s data centres can play a vital part in the ongoing Mydigital initiative, having a presence in the country before the hyperscalers. Also, the proximity of the Johor Bahru data centre to Singapore opens additional business opportunities.

TIM SHEEDY. Equinix is evolving beyond being just a data centre real estate provider. By developing their own platforms and services, along with partner-provided solutions, they enable customers to optimise application placement, manage smaller points of presence, enhance cloud interconnectivity, move data closer to hyperscalers for backup and performance, and provide multi-cloud networking. Composable services – such as cloud routers, load balancers, internet access, bare metal, virtual machines, and virtual routing and forwarding – allow seamless integration with partner solutions.

Equinix’s focus over the last 12 months on automating and simplifying the data centre management and interconnection services is certainly paying dividends, and revenue is expected to grow above tech market growth rates.

Governments worldwide struggle with intricate social, economic, and environmental challenges. Tight budgets often leave them with limited resources to address these issues head-on. However, innovation offers a powerful path forward.

By embracing new technologies, adapting to cultural shifts, and fostering new skills, structures, and communication methods, governments can find solutions within existing constraints.

Find out how public sector innovation is optimising internal operations, improving service accessibility, bridging the financial gap, transforming healthcare, and building a sustainable future.

Click here to download ‘Innovation in Government: Social, Economic, and Environmental Wins’ as a PDF

Optimising Operations: Tech-Driven Efficiency

Technology is transforming how governments operate, boosting efficiency and allowing employees to focus on core functions.

Here are some real-world examples.

Singapore Streamlines Public Buses. A cloud-based fleet management system by the Land Transport Authority (LTA) improves efficiency, real-time tracking, data analysis, and the transition to electric buses.

Dubai Optimises Utilities Through AI. The Dubai Electricity and Water Authority (DEWA) leverages AI for predictive maintenance, demand forecasting, and grid management. This enhances service reliability, operational efficiency, and resource allocation for power and water utilities.

Automation Boosts Hospital Efficiency. Singapore hospitals are using automation to save man-hours and boost efficiency. Tan Tock Seng Hospital automates bacteria sample processing, increasing productivity without extra staff, while Singapore General Hospital tracks surgical instruments digitally, saving thousands of man-hours.

Tech for Citizens

Digital tools and emerging technologies hold immense potential to improve service accessibility and delivery for citizens. Here’s how governments are leveraging tech to benefit their communities.

Faster Cross-Border Travel. Malaysia’s pilot QR code clearance system expedites travel for factory workers commuting to Singapore, reducing congestion at checkpoints.

Metaverse City Planning. South Korea’s “Metaverse 120 Center” allows residents to interact with virtual officials and access services in a digital environment, fostering innovative urban planning and infrastructure management.

Streamlined Benefits. UK’s HM Revenue and Customs (HMRC) launched an online child benefit claim system that reduces processing time from weeks to days, showcasing the efficiency gains possible through digital government services.

Bridging the Financial Gap

Nearly 1.7 billion adults or one-third globally, remain unbanked.

However, innovative programs are bridging this gap and promoting financial inclusion.

Thailand’s Digital Wallet. Aimed at stimulating the economy and empowering underserved citizens, Thailand disburses USD 275 via digital wallets to 50 million low-income adults, fostering financial participation.

Ghana’s Digital Success Story. The first African nation to achieve 100% financial inclusion through modernised platforms like Ghana.gov and GhanaPay, which facilitate payments and fee collection through various digital channels.

Philippines Embraces QR Payments. The City of Alaminos leverages the Paleng-QR Ph Plus program to promote QR code-based payments, aligning with the central bank’s goal of onboarding 70% of Filipinos into the formal financial system by 2024.

Building a Sustainable Future

Governments around the world are increasingly turning to technology to address environmental challenges and preserve natural capital.

Here are some inspiring examples.

World’s Largest Carbon Capture Plant. Singapore and UCLA joined forces to build Equatic-1, a groundbreaking facility that removes CO2 from the ocean and creates carbon-negative hydrogen.

Tech-Enhanced Disaster Preparedness. The UK’s Lincolnshire County Council uses cutting-edge geospatial technology like drones and digital twins. This empowers the Lincolnshire Resilience Forum with real-time data and insights to effectively manage risks like floods and power outages across their vast region.

Smart Cities for Sustainability. Bologna, Italy leverages the digital twins of its city to optimise urban mobility and combat climate change. By analysing sensor data and incorporating social factors, the city is strategically developing infrastructure for cyclists and trams.

Tech for a Healthier Tomorrow

Technology is transforming healthcare delivery, promoting improved health and fitness monitoring.

Here’s a glimpse into how innovation is impacting patient care worldwide.

Robotic Companions for Seniors. South Korea tackles elder care challenges with robots. Companion robots and safety devices provide companionship and support for seniors living alone.

VR Therapy for Mental Wellness. The UAE’s Emirates Health Services Corporation implements a Virtual Reality Lab for Mental Health, that creates interactive therapy sessions for individuals with various psychological challenges. VR allows for personalised treatment plans based on data collected during sessions.

Ecosystm research shows that customer engagement is emerging as the main beneficiary of AI implementations in Malaysia with 44% of AI investments being led by CX/Marketing/Sales teams.

Explore the key trends that are transforming the Malaysian technology landscape and stay tuned for more data-backed insights on Southeast Asia’s tech markets.

Technology is reshaping the Public Sector worldwide, optimising operations, improving citizen services, and fostering data-driven decision-making. Government agencies are also embracing innovation for effective governance in this digital era.

Public sector organisations worldwide recognise the need for swift and agile interventions. With citizen expectations resembling those of commercial customers, public sector organisations face mounting pressure to break down the barriers to provide seamless service experiences.

Read on to find out how public sector organisations in countries such as Australia, Vietnam, the Philippines, South Korea, and Singapore are innovating to stay ahead of the curve; and what Ecosystm VP Consulting, Peter Carr sees as the Future of Public Sector.

Click here to Download ‘The Future of the Public Sector’ as a PDF