The rapid adoption of technology in India is driving a surge in demand for AI solutions across sectors like finance, education, healthcare, and agriculture. AI is revolutionising these industries by making services more efficient, personalised, and accessible. This growing dependence on AI has created a fertile ground for innovation, propelling India’s emergence as a global hub for AI startups. With over 6,200 AI startups operating in the country, India offers a dynamic and challenging landscape for entrepreneurs seeking to make a meaningful impact.

Fuelling AI Innovation: India’s Strategic Investment

Earlier this year, the government allocated USD 1.3 billion for the India AI Mission, solidifying its commitment to AI. This comprehensive program is designed to catalyse the AI innovation ecosystem within the country. At the heart of this ecosystem’s development lies the expansion of compute infrastructure, a critical resource for AI startups. By providing access to powerful computing resources, the India AI Mission is empowering startups to scale their solutions and compete on a global level.

Beyond infrastructure, the initiative focuses on fostering collaborations between academia, industry, and startups to drive R&D. By creating a supportive environment that promotes knowledge sharing and resource accessibility, the India AI Mission aims to position India as a leader in the AI landscape.

A Spotlight on Indian Startups

Driving Industry Innovation

Healthcare. India’s vibrant AI startup ecosystem is driving innovation in healthcare, with companies leveraging AI to address critical challenges and improve patient outcomes.

- Cancer-Focused AI Startups. Several startups are revolutionising cancer care with AI-driven innovations. Niramai, globally recognised for its innovation, uses AI and thermal imaging for early breast cancer detection, particularly effective in younger women and dense breast tissue. Onward Assist provides predictive analytics for oncology, helping oncologists manage patient data and improve the accuracy of cancer care decisions. Similarly, Atom360 focuses on oral cancer screening with an AI-powered app that offers quick, affordable access to critical information, enhancing oral healthcare in underserved areas.

- AI-Driven Diagnostic Solutions. AI is significantly advancing diagnostics, enhancing accuracy, and reducing misdiagnosis. SigTuple develops AI-driven diagnostic solutions for medical imaging and pathology, improving accuracy and efficiency in disease detection. Endimension Technology, incubated at IIT Bombay, develops algorithms for detecting abnormalities in medical scans, aiming to reduce misdiagnosis and radiologist workload. Tricog Health delivers AI solutions for rapid heart attack diagnosis, reducing diagnosis time and improving outcomes, especially in underserved regions.

Financial Services. Fintechs have been at the forefront of AI-led innovations, offering innovative solutions for insurance, lending, and microfinance. Artivatic uses AI to transform traditional insurance systems into digital, personalised offerings, making coverage more accessible and affordable for a broader range of consumers. ZestMoney leverages AI for digital lending, providing credit to individuals without a credit history through easy EMI plans, and enhancing financial access. Meanwhile, mPokket offers instant micro-loans to students and young professionals, addressing short-term financial needs with flexible loan options and minimal documentation.

Other Industries. Beyond healthcare and financial services, AI startups are driving innovation across various industries, tackling critical challenges. Entropik uses AI to analyse human emotions and behaviour, helping businesses gain deeper insights into consumer preferences for market research and optimising user experiences. In agriculture, Intello Labs applies AI and computer vision to assess the quality of fresh produce, reducing food waste and improving supply chain efficiency. Similarly, AgNext enhances food value chains by offering AI-driven, real-time quality assessments through its SaaS platform, promoting safety and transparency in agribusiness.

Transforming Businesses

Technology for Security & Fraud. AI startups are offering innovative solutions tailored to organisations’ needs. SpoofSense combats deepfakes and identity fraud with advanced facial liveness detection, ensuring secure user verification by distinguishing between real users and spoofed images. Eagle Eye Networks provides cloud-based video surveillance solutions, using AI to offer real-time monitoring and analytics. In the e-commerce space, ThirdWatch uses AI to detect and prevent fraud in real-time by analysing user behaviour and transaction patterns, reducing financial losses for online retailers.

Tech Development. AI startups are empowering organisations to accelerate innovation and enhance productivity. Haptik helps businesses build intelligent virtual assistants, powering chatbots and voice bots across industries to improve customer engagement. DhiWise automates the development process, enabling faster app creation by converting designs into code. Additionally, Fluid AI provides advanced AI solutions like predictive analytics and natural language processing for sectors like finance, retail, and healthcare. Mihup enhances contact centre performance with its conversation intelligence platform, while Yellow.ai enables enterprises to automate customer engagement through its GenAI-powered platform, creating seamless and scalable customer service experiences.

Empowering People

AI startups are empowering individuals by providing personalised services that enhance learning, creativity, and financial management. SuperKalam and ZuAI offer students tailored learning experiences, using AI to create interactive lessons and assessments that adapt to individual learning styles, improving student engagement and outcomes. For creative professionals, Mugafi combines AI with human mentoring to assist writers in generating ideas and developing scripts, enabling them to create intellectual property with greater efficiency. Wright Research empowers individuals to make informed financial decisions through AI-powered investment advice, while Vahan simplifies job searches for blue-collar workers by using AI to match candidates with suitable employment opportunities via WhatsApp.

Promoting ESG

AI startups are driving meaningful change by optimising processes and creating economic opportunities. Ossus Biorenewables enhances biofuel production through AI, reducing waste and increasing efficiency in renewable energy generation, while Ishitva Robotic Systems promotes sustainability by automating waste sorting and recycling, contributing to a more efficient and circular economy. Karya connects rural workers with digital tasks, offering fair wages and skills development by matching them to tasks suited to their abilities using machine learning. In agriculture, KissanAI helps farmers improve crop yields and manage resources effectively through personalised, data-driven recommendations. ElasticRun improves last-mile delivery logistics in rural areas, enabling businesses to reach underserved markets.

Conclusion

Nvidia CEO Jensen Huang noted India’s potential to become the “largest exporter of AI,” signalling vast global opportunities. India’s AI startups are at the forefront of innovation but face hurdles such as fierce competition for skilled talent, navigating complex regulations, and securing funding. With strategic focus on these challenges and the backing of initiatives like Digital India and Startup India, India’s AI ecosystem can seize emerging market opportunities, accelerate tech advancements, and make a substantial impact on the global AI landscape.

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

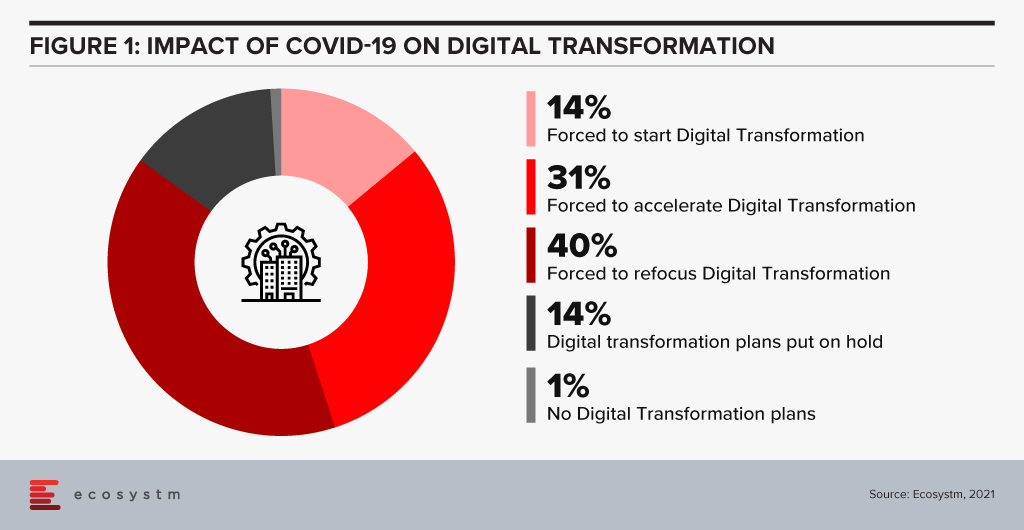

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

As the search for a COVID-19 vaccine intensifies, there is a global focus on the Life Sciences industry. The industry has been hit hard this year – having to deliver overtime through a disrupted supply chain, unexpected demand spikes, and reduction of revenues from their regular streams. Life sciences organisations are already challenged by the breadth of their focus – across R&D and clinical discovery; Manufacturing & Distribution; and Sales & Marketing. Increasingly, many pharmaceutical and medtech organisations choose to outsource some of these functions, which brings to fore the need for a robust compliance framework. In the Ecosystm Digital Priorities in the New Normal Study, two-thirds of life sciences organisations mention that they have either been forced to start, accelerate or refocus their Digital Transformation initiatives – the remaining one-third have put their Digital Transformation on hold. The industry is clearly at an inflection point.

Challenges of the Life Sciences Industry

Continued Focus on R&D. Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and a global concern over rising healthcare expenditure. Apart from regulatory challenges, they also face immense competition from local manufacturers as they enter each new market.

Re-thinking their Distribution Strategy. Sales and distribution for many pharma and medtech organisations have been traditional – using agents, distributors, clinicians, and healthcare providers. But now they need to change their go-to-market strategies, target patients and consumers directly and package their product offerings into value-added services. This will require them to incorporate customer experience enhancers in their R&D, going beyond drug discovery and product innovation.

Tracking Global Regulations. Governments across the world are trying to manage their healthcare budgets. They are also more focused on chronic disease management. The focus has shifted to value-based medicine in general, but pharma and medtech products are being increasingly held accountable by health outcomes. Governments are increasingly implementing drug reforms around what clinicians can prescribe. Global Life Sciences organisations have to constantly monitor the regulations in the multiple countries where they operate and sell. They are also accountable for their entire supply chain, especially ensuring a high product quality and fraud prevention.

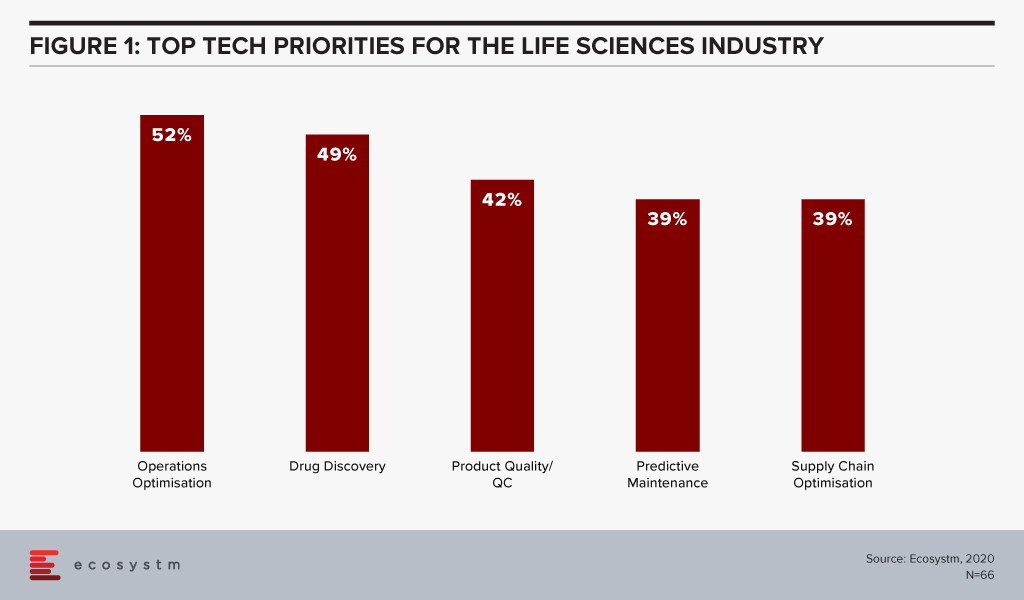

The global Ecosystm AI study reveals the top priorities for Life Sciences organisations, focused on adopting emerging technologies (Figure 1). They appear to be investing in emerging technology especially in their R&D and clinical discovery and Manufacturing functions.

Technology as an Enabler of Life Sciences Transformation

Discovery and Development

With the evolution of technology, Life Sciences organisations are able to automate much of the mundane tasks around drug discovery and apply AI and machine learning to transform their drug discovery and development process. They are increasingly leveraging their ecosystem of smaller pharma and medtech companies, research laboratories, academic institutions, and technology providers to make the process more time and cost efficient.

Using an AI algorithm, the researchers at the Massachusetts Institute of Technology have discovered an antibiotic compound that can kill many species of antibiotic-resistant bacteria. MIT’s algorithm screens millions of chemical compounds and chooses the antibiotics which have the potential to eliminate bacteria resistant to existing drugs. Harvard’s Wyss Institute for Biologically Inspired Engineering is manufacturing 3D printed organ-on-a-chip to give insights on cell, tissue, and organ biology to help the pharma sector with drug development, disease modelling and finally in the development of personalised medicine.

Life Sciences are also engaging more with technology partners – whether emerging start-ups or established players. Pfizer and Saama are working together on AI clinical data mining. The companies are developing and deploying an AI-based analytical tool where Pfizer provides clinical data and domain knowledge to train models on the Saama Life Science Analytics Cloud (LSAC). Saama was identified as a partner at a hackathon. Sanofi and Google have established a new virtual Innovation Lab to develop scientific and commercial solutions, using multiple Google capabilities from cloud computing to AI.

Tech providers also keep evolving their capabilities in the Life Sciences industry for more efficient drug discovery and better treatment protocols. Microsoft’s Project Hanover uses machine learning to develop a personalised drug protocol to manage acute myeloid leukaemia. Similarly, Apple’s ResearchKit – an open-source framework is meant to help researchers and developers create iOS-based applications in the field of medical research.

Manufacturing and Logistics

The industry also faces the challenges faced by any Manufacturing organisation and has the need to deploy manufacturing analytics, and advanced supply chain technology for better process and optimisation and agility. There is also the need for complete visibility over their supply chain and inventory for traceability, safety, and fraud prevention. Emerging technologies such as Blockchain will become increasingly relevant for real-time track and trace capability.

The MediLedger Network was established as an open network to the entire pharma supply chain. The project brings a consortium of some of the world’s largest pharmaceutical companies, and logistics providers to improve drug supply chain management.

Since the data on the distributed ledger is encrypted, it creates a secure system without any vulnerabilities. This eliminates counterfeit products and ultimately ensures the quality of the pharma products and promotes increased patient safety. To foster security and improve the supply chain, the United States Food and Drug Administration (USFDA) successfully completed a pilot with a group including IBM, KPMG, Merck and Walmart to support U.S. Drug Supply Chain Security Act (DSCSA) to trace vaccines and prescription medicines throughout the country.

Diagnostics and Personalised Healthcare

As more devices (consumer and enterprise) and applications enter the market, people will take ownership and interest in their own health outcomes. This is seeing a continued growth in online communities and comparison sites (on physicians, hospitals, and pharmaceutical products). Increasingly, insurance providers will use data from wearable devices for a more personalised approach; promoting and rewarding good health practices.

Beyond the use of wearables and health and wellness apps, we will also see an exponential increase of home-based healthcare products and services – whether for primary care and chronic disease management, or long-term and palliative care. As patients become more engaged with their care, the life sciences industry is beginning to serve them through personalised approach, medicines, right diagnosis and through advanced medical devices and products.

An online tool developed by the University of Virginia Health Systems helps identify patients that have a high risk of getting a stroke and helps them reduce that risk. This tool calculates the patient’s probability of suffering a stroke by measuring the severity of their metabolic syndrome – taking into account a number of conditions that include high blood pressure, abnormal cholesterol levels and excess body fat. Life Sciences organisations are increasingly having to invest in customer-focused solutions such as these.

Wearables with special smart software to monitor health parameters, gauge drug compatibility and monitor complications are being implemented by Life Sciences organisations. The US FDA approved a pill called Abilify MyCite fitted with a tiny ingestible sensor that communicates with a patch worn by the patient to transmit data on a smartphone. Medtech companies continue to develop FDA approved health devices that can monitor chronic conditions. Smart continuous glucose monitoring (CGM) and insulin pens send blood glucose level data to smartphone applications allowing the wearer to easily check their information and detect trends.

Technologies such as AR/VR are also enabling Life Sciences companies with their diagnostics. Regeneron Pharmaceuticals has created an AR/VR app called “In My Eyes” to better diagnose vision impairment in patients.

What is interesting about these personalised products is that not only do they improve clinical outcomes, they also give Life Sciences companies access to rich data that can be used for further product development and improvement.

The Life Sciences industry will continue to operate in an unpredictable and competitive market. This is evident by the several mergers and acquisitions that we witness in the industry. As they continue to use cutting-edge technology for their R&D practices, they will leverage technology to transform other functions as well.

It can often be difficult to keep track of assets and transactions in a business, and that is where Blockchain is unleashing its potential. It is revolutionising enterprises with its shared ledger technology. There are numerous, and specialised, use cases of Blockchain but the adoption is nascent in most industries. There are a few early adoption use cases of Blockchain, however, which have the potential to replace traditional systems and processes.

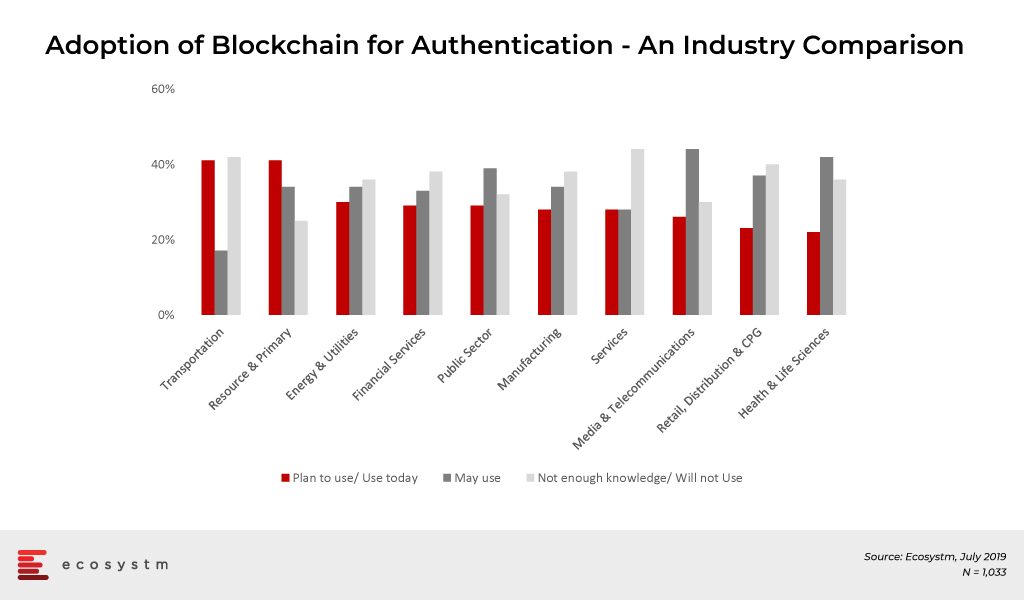

In the global Ecosystm Mobility study, organisations are asked about the adoption of Blockchain as a means of authentication. Industries that appear most open to Blockchain adoption are those that have also embraced IoT for tracking and traceability.

Adoption of Blockchain for Authentication – An Industry Comparison

Across industries Blockchain technology is being used primarily for these use cases:

Supply Chain Traceability

Supply chain traceability allows producers, retailers, and consumers to track products from source to consumer. It connects all points in the supply chain, creating transparency and trust in the product. When a business comprises complex processes, a large and dispersed workforce, multiple locations and different operations, a lot of administrative and regulatory frameworks are required to manage and control the supply chain. Functions such as order management, procurement, import, delivery, tracking, and invoicing have their own unique set of requirements and processes. In several cases, especially across primary and retail industries, business complexity has been reduced with the use of Blockchain. The technology allows for improving digital assets and inventory tracking for better services and processes.

Blockchain is ensuring food safety by providing a complete view of the supply chain and creating a real-time trail of products – allowing a ‘farm to fork’ view. Walmart is a good example of how retailers can use Blockchain technology to ensure that they sell fresh produce. Fresh produce shipments can be tracked as they change hands from the farmers to the middlemen, to the distributor and finally to the store. This can have an enormous impact on containing food-borne diseases and food contamination. Not only does Blockchain increase food safety, it ensures fresher food since it secures production and packing dates.

Intellectual Property Intermediary (IPI), an organisation established under Singapore’s Ministry of Trade and Industry, is an affiliate of Enterprise Singapore and focuses on technology innovations in the industry that can empower enterprises to develop new processes, products, and services. IPI has identified Blockchain Technology for Food as an area where the industry can benefit from innovation. The ecosystem will also benefit from the information gathered, with the potential to further improve the production chain.

Fraud Prevention

Taking supply chain visibility a step further, Blockchain technology is being used for fraud prevention – especially payment fraud. Financial transactions are complex and involve multi-step processes and human intervention – involving collaterals, settlement, currency denominations, third-party mediation, and so on. It is often the prime target for fraudsters. The most common instances of fraud involve bank to bank transactions, mobile payments, and digital identity fraud, essentially by tampering with ID or using it an unsanctioned way – providing unauthorised access to digital systems and falsifying information.

Blockchain helps automate preventive measures enabling real-time information sharing which is transmitted on a chain of connected devices where all the nodes in a system verify the transaction. Since it stores the data on several nodes and every other user on the network has a copy of the entire data on the Blockchain, it is virtually impossible to hack or destroy it completely.

Earlier this year, Standard Chartered Singapore showcased their cross-border trade finance transaction which digitalises trade processes and financing documentation. Blockchain enabled the transaction between parties by digitally streamlining the documentation process while providing security and transparency between the partners. Not only does it support the clients’ entire supply chain, but it also creates a transparent way to provide same-day trade financing.

Non-profit organisation BitGive Foundation uses Blockchain technology to provide greater visibility to their donors into the receipt of funds and how they are used by sharing financial information and project results in real-time. The GiveTrack project is built on Bitcoin and Blockchain and is a user-friendly, data-centered and comprehensive user interface. People making donations can precisely track the donations and how the funds were used.

Legal & Compliance

In industries that have higher Compliance & Regulatory requirements, Blockchain can enable safe, secure, and scalable data-sharing. The industry is seeing instances of self-executing contracts, smart registries, secure and time-stamped documents with Blockchain. Blockchain is introducing abilities to record events for a long duration which might include indisputable claims, criminal records, case procedures to support the potential legal work.

Dubai launched a city wide blockchain strategy. Dubai Land Department is implementing blockchain to make property transactions secure, transparent and immutable, thereby reducing fraud and eliminating reams of physical documents. This impacts the entire ecosystem – customers, developers, the land department, utility providers, payment channels, and municipalities – to work in collaboration.

Shipping companies that need to enforce global contracts daily are also benefitting from Blockchain. However, the biggest use cases will eventually come from the Public Sector – across citizen services and criminal justice systems. For instance, National Stock Exchange of India (NSE) is testing Blockchain e-voting facilities. The project is still at the pilot stage and aims to tokenised voting which makes it easy to conduct test and audit for the votes. This allows the regulating authorities to access real-time data, and at the same time, provides means to audit the regulators.

Cybersecurity

73% of global organisations believe that a data breach is inevitable, according to the Ecosystem Cybersecurity Study, and only 18% of them use some form of tokenisation and other cryptographic tools. Blockchain technology offers several capabilities in mitigating cybersecurity risks and detecting and combating cyber attacks. For example, Blockchain can be used to prevent DDoS attacks, and crypto secured biometric keys can replace passwords providing robust ID authentication systems, more secure DNS and decentralised storage. Blockchain implementation can also prevent man-in-the-middle (MITM) attacks by encrypting the data in transit so it is not manipulated during the transmission or accessed by unauthorised parties – thus maintaining data integrity and confidentiality.

Lockheed Martin, a US security company, is implementing Blockchain into their protocol. The company is enhancing Blockchain cybersecurity protocol measures in engineering systems, supply chain risk management, and software development. This includes researching on expanding on Blockchain capabilities protect their weapons development unit and make it incorruptible.

eGovernment initiatives will also benefit from Blockchain. The biggest stumbling block for providing eservices has always been cybersecurity, where the Government cannot be sure that the citizens are able to access their own records in a secure manner. It has always been a question of responsibility and liability – is the Government liable for a data breach that happens because of a citizen’s fault? Estonia is using Blockchain to protect their digital services such as electronic health records, legal records, police records, banking information, covering data and devices from attacks, misuse, and corruption.

Customer Experience

The ultimate benefit of Blockchain will be realised when it is used to enhance Customer Experience (CX). It brings transparency in doing business, gives on-demand data visibility and fosters trust in customers. A company that shows all transactions between the company and the customer, and in a secure manner, can create a better relationship, increase overall customer satisfaction and retain their customers in a competitive market. For example, Blockchain technology can allow more secure and transparent loyalty programmes, through token creation that can be redeemed on-demand, without customer service intervention. Singapore Airlines’ KrisFlyer structures their payments and loyalty programme with Blockchain. Their digital wallet enables members to convert KrisFlyer miles into KrisPay miles instantly to pay for their purchases at partner merchants. The users can pay through an application by scanning a QR code at a merchant’s location .

Customers will increasingly look for ease of use and security in their transactions. Bank of America has filed a patent for Blockchain powered ATM, for securing records and authenticating business and personal data. This will boost the transaction rate and facilitate various transaction experience with full encryption and security. Blockchain-enabled transactions can be registered and completed with greater easy while lowering the transaction costs for customers and keeping the network safe.

While Blockchain technology is continuing to evolve for a range of applications and industries, it comes with its own share of risks. Adoption should not be based on the hype around the technology but should be evaluated carefully. The starting point should obviously be a real business needs analysis.

Speak with an expert today to evaluate whether your organisation can benefit from Blockchain.