Financial institutions are being challenged by and collaborating with Fintech organisations in equal measures. As their focus on customers increase, they will collaborate and partner with these disruptors. Fintech is also getting attention from governments in both emerging and mature countries as a means to achieve their financial inclusion and digital economy goals. Fintech investments will continue to surge through 2020 across the solution areas.

The Top 5 Fintech Trends For 2020

The Top 5 Fintech Trends are based on the latest data from the global Ecosystm AI and Cybersecurity studies and is also based on qualitative research by Ecosystm CEO Amit Gupta and Principal Advisor Paul Gestro.

-

One for All and All for One

Fintech will have a much greater impact than we realise, and we will continue to see it drive the induction of the unbanked into the mainstream economy. The growth in mobile phone penetration, however, continues to grow at a faster pace than banking accessibility across emerging economies. We will continue to see Fintech play a significant role in driving greater inclusion, especially to bring in the underserved in the emerging economies and reducing the gender gap when it comes to adoption of financial services – creating greater inclusion overall.

The democratisation and accessibility of financial services will also result in far greater uptake of the sharing economy and we will continue to see non-traditional companies enter the payments and financial services markets. Fintechs that have environmental and social impact, beyond financial impact, will also find it easier to secure funds from Impact Investors.

-

The Year of the Banks

2020 is the year banks will need to embrace Fintech – fully. They know full well that customers are at the centre of their entire operation – and Fintech services can and will provide them with the solutions they need. They have been skeptical about adopting Fintech but as they begin their transformation journeys and face increasingly stringent regulations, they might no longer have the option of ignoring Fintechs.

Banks are already adopting, evaluating and developing strategies for AI, RPA, and Cybersecurity adoption – but they will feel the need for more innovation and speed in 2020.

-

Asia Becomes Middle Earth

Asia has fast become the centre for both innovation and investment. Asia’s fast pace of urbanisation and the increasing prosperity of the middle class is attracting investments. Venture capital-backed Fintech companies raised more than USD 40B in 2018 – with the bulk coming out of China. Investments in Asia is expected to grow, and will benefit later stage Fintech startups.

These investments, a lack of strict policies (yet!) and the large number of unbanked and underbanked are also fuelling innovation in Asia. Several large financial institutions in Asia have already made public announcements of the Fintech investments and this will cause a ripple effect.

-

Nothing Artificial About AI

AI sits at the heart of most Fintech solutions. And AI has slowly made its way in decision-making and process automation. The first step to AI is automation and robotic process automation (RPA) will transform customer experience and will allow integration of legacy systems in financial institutions. As IoT and Blockchain mature they will be increasingly integrated within AI solutions.

Another area which will see AI adoption in financial institutions is Cybersecurity – machine learning can predict the patterns of criminals (or rogue/irresponsible employees) to stop events before they start. Fintech solutions such as Regtech and Suptech has a definite play in this space.

-

Regtech Will Take Centre Stage

In 2020, Regtech will take the centre stage as the emerging Fintech solution. Together with AI, a better ability to use data and predict trends, Regtech will be used to fight financial crime and reduce costly compliance-related mistakes.

The old way of just employing more people to run the compliance tasks is not sustainable. routine tasks such as KYC, AML and compliance verification are ripe for automation. Moreover, Regtech ROI is relatively easier to set and measure.

Download Report: The top 5 Fintech trends for 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Fintech Trends for 2020’ are available for download from the Ecosystm platform. Signup for Free to download the report and gain insight into ‘the top 5 Fintech trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources. Download Link Below ?

According to a recently-released report, e-Conomy Southeast Asia 2019 by Google, Temasek Holdings Pte and Bain & Co., Southeast Asia’s Internet economy could exceed US$100 billion this year (a 39% increase from 2018) and will touch US$300 billion by 2025. The report states that Southeast Asian’s are ‘the most engaged mobile Internet users in the world’, and the region is becoming one of the world’s fastest-growing areas for Internet users – fueled by 360 million existing online users.

Analysing the current and future potential of the Southeast Asian Internet economy across its six largest markets – Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam – it has been a momentous time for online travel services, online media, ride-hailing services, eCommerce, and digital financial services to leverage digital tools.

Southeast Asia’s Internet Economy is expected to grow

Southeast Asia’s fundamental changes in consumer behaviour and engagement with mobile internet have grown demand for eCommerce and Ride-Hailing services.

eCommerce is the largest and fastest-growing sector with more than 150 million Southeast Asians engaged in online shopping, and this is indicative of the fundamental changes in the way people consume eCommerce services.

Growth of digital financial services

Currently, Southeast Asia lacks adequate financial services as out of nearly 400 million adults in the region an estimated 98 million are underbanked and 198 million are unbanked.

Commenting on the expanding Internet economy, Ecosystm Principal Advisor – Growth & Expansion, Paul Gestro said “Vietnam, Philippines, and Indonesia will be the markets that could benefit the most from the US$100 billion Internet economy. This is primarily because a large percentage of the population in these markets is unbanked. With the growth and access to some form of banking (traditional or virtual) and the ability to transact a payment, this will have a huge influence on Fintech solutions.”

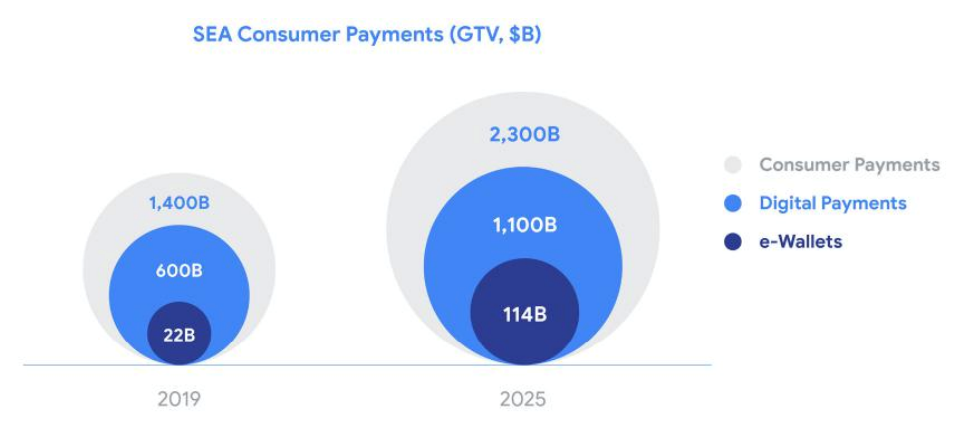

Another key trend is the growth of digital payment and financial services in the region. The growth of digital financial services will make the Internet economy more wide-ranging and consumers will enjoy greater access to Digital Payments and eCommerce.

Gestro added, “Insurance, payments and investment services will add to what we do now with ride-sharing and food delivery services. We will instantly make decisions on insurance and investment products and deals backed up by seamless payment mechanisms and different forms of payment.”

While most Digital Financial Services are still nascent, Digital Payments are expected to cross US$1 trillion by 2025 and this could open investment opportunities.

“The open investment opportunities for investors in Southeast Asia’s internet economy will be investing in applications that are mobile-ready. There will be a growth in mobile transactions and services, and companies that take a mobile-first approach will be the investors’ target,” said Gestro.

The report advises governments of Southeast Asian countries to align digital financial service regulations across the region to facilitate the development of regional business models and help channel resources towards investments in world-class tech and talent.

Despite the growing Internet economy, talent constraints remain a pressing concern as the Internet economy expands. Gestro said, “programmes in schools are required to promote a digital understanding and offer clear pathways to build knowledge and skills required for an Internet economy. This also includes companies who should be offering internships and working closely with universities to make sure the courses match where talent is needed.”

The use of mobile phones and mobile applications will connect consumers to a raft of services they previously lacked, and allow business owners and leaders to reach a whole new population of customers that was previously under-served. There’s still a lot of work to be done to ensure Southeast Asia’s Internet economy reaches its potential.

The global insurance industry today faces several challenges – starting from the shift in the demographic patterns and the disease burden, to managing an ever-growing agent ecosystem, to responding to customer expectations. The advancement in technologies and their adoption is creating opportunities for insurance companies to modernise and reinvent themselves through new product and services offerings and by evolving their business models.

Drivers of Transformation in the Insurance Industry

- Global Competition. Over the last few years, leading insurance providers have been looking for a share of the global market and are no longer content with their traditional domestic markets. They especially want to get into markets where there are fewer players and/or larger population. The Indian insurance industry, for example, has seen a number of new private entrants over the last decade, attracted by the large population base and by a high percentage of young population. Many of the leading global insurance providers have partnered with Indian counterparts for a presence in the market. The story is similar in several emerging economies. While the presence of insurance providers is good for the future sustainability of a country, the market is extremely competitive. Investing in technology can be the key differentiator in capturing a larger share of the pie.

- Customer Expectations. Today’s customers are tech-savvy and expect a certain level of service and at their fingertips too. Moreover, easy access to the internet equips them to do basic research to evaluate their best options. The Fintech revolution also impacts the customer base, as they expect services such as instant approval and prefer to purchase items only when they require them. This ‘on-demand’ market has fueled the microinsurance industry and opened the gates for smaller providers.

- Regulatory Requirements. In the aftermath of the financial crisis of the previous decade and with new entrants in several countries, regulatory authorities are working on an overdrive to bring better accountability to the insurance market. Moreover, in most countries the regulations have incorporated market conduct guidelines aimed at consumer protection. Reporting, service level and fraud prevention requirements will see an increased uptake of technologies that can assist in fulfilling compliance requirements.

Key InsureTech Technologies

- IoT. The auto insurance companies were the first to leverage IoT and telematics to enhance navigation, safety and communication features that could help customise the premiums payable. The home insurance sector has already leveraged it using sensors and connectivity to assess and reduce risks to the properties they insure – large providers such as Allianz, Aviva and AXA have been working on their IoT ecosystem. This has immense potential for ‘usage-based’, personalised product and premium offerings in the health and life insurance industries (provided they work within the purview of compliance requirements). Ultimately sensors are not the most important technology in an IoT solution – the analytics solutions that can derive intelligence from the sensor data are. IoT+AI will give that much-needed edge to insurance companies.

- AI – Machine Learning. AI and machine learning make it possible for insurance companies to mine both structured and unstructured data. The use cases range from underwriting, claims management and personalised offerings through behavioural data and sentiment analysis. There are examples of early adopters in the auto industry – but again there are obvious and wider use cases, that can benefit risk modelling, pricing, customer acquisition, and agent and channel efficiency.

- AI – Virtual assistants/Chatbots. This falls right in with managing customer experiences. As customers expect more self-service (yes, the future will see less agents!) several insurance providers are using chatbots at several customer touchpoints, covering departments such as Sales and Claims. This will increasingly be the norm as smart phone (and app) penetration increases and the target base becomes younger. There are online-only insurance providers where clients interact with chatbots services and they are able to cater to a larger, untapped, mass market. There are more advanced adoption examples such as USAA’s use of intelligent personal assistant equipped with an NLP engine that have been trained with a deeper knowledge of policies. Virtual insurance agents will become more of a norm in the near future.

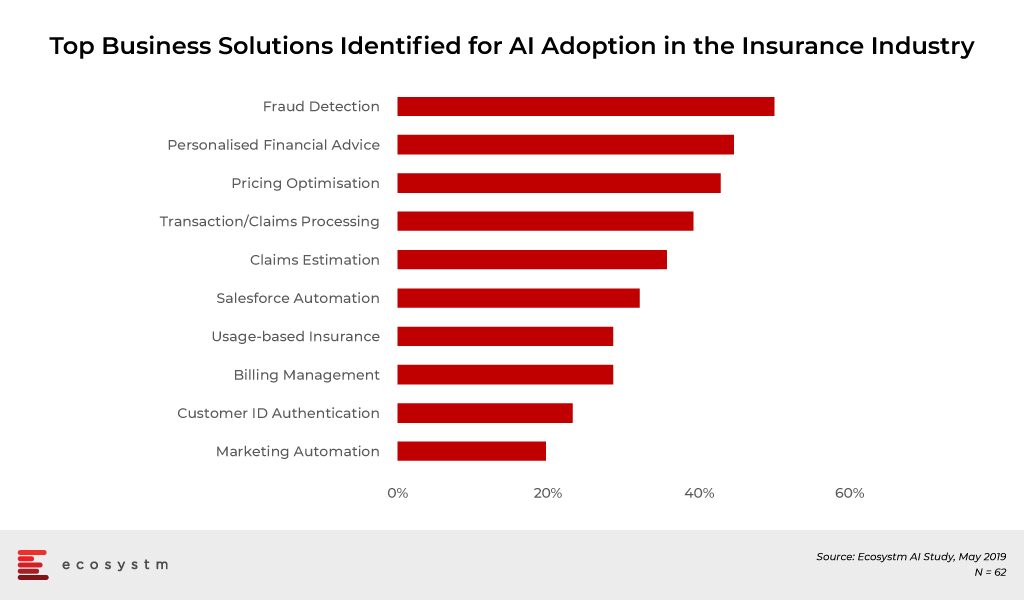

Which brings us to the important question on how insurance companies are planning to leverage InsureTech. Multiple stakeholders could benefit from InsureTech adoption. The Claims department appears to be a key stakeholder, focused both on fraud prevention and automation when it comes to transaction and processing. Sales and Customer Service appear to be next in line, where personalisation of product offerings would equip the teams better for a competitive market.

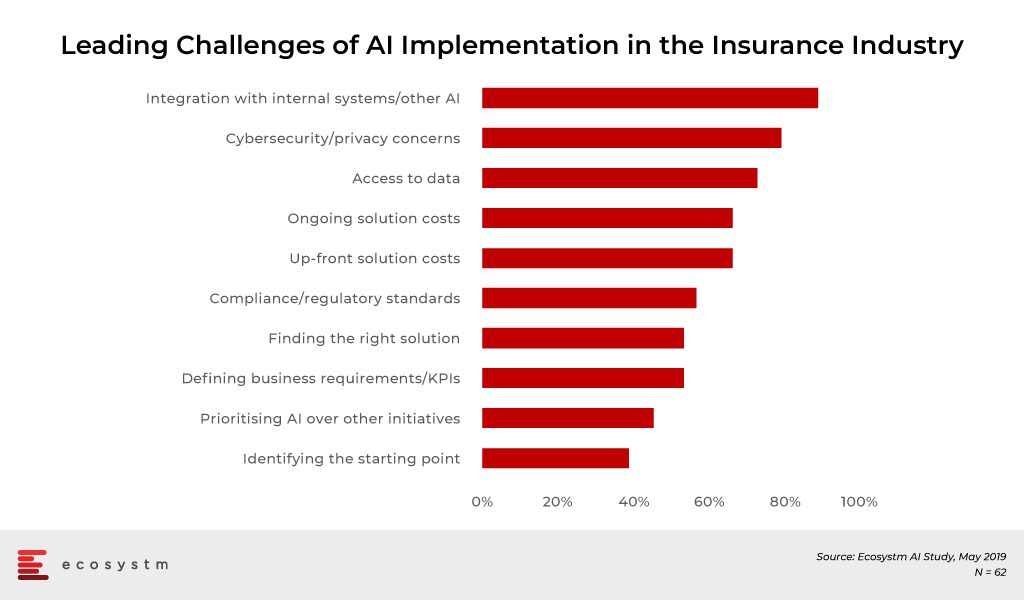

Challenges of AI Adoption in Insurance

It is obvious that the insurance companies are still at a nascent stage of adoption of AI and InsureTech. While cybersecurity is a recurrent concern (as it should be), it is a common concern across any technology area. The biggest challenge that the insurance industry faces in adoption of AI and other data-driven technologies is the actual data management – from access to integration. The industry may be data-intensive, but the data exists in silos. In the end an InsureTech implementation should benefit multiple departments – Underwriting, Claims, Sales and so on.

Several insurance companies will look to consulting firms and systems integrators to create a roadmap to their transformation journey and enable the data integration – especially as technologies evolve and when internal IT lack the right skills to manage these projects.

The technology that will be the key component of InsureTech and transform the insurance industry is AI. In spite of the challenges of adoption, the industry will be forced to transform to survive in the highly competitive market. Companies in emerging economies will especially benefit from investing in AI – in fact, India and especially China will see a surge in InsureTech investments.

AI is powering products, processes, strategies and customer experience in the Banking industry.

The banking industry is all geared up to embrace Artificial Intelligence (AI), to address its business requirements. In general, banks are struggling to implement smart services within their compliance framework, and have an incomplete view of their customer needs from their legacy systems. However, the industry continues to be reliant on legacy systems, largely because of the involvement of too many complex platforms, technologies, and systems which make migration or integration cumbersome.

Meanwhile, modern Digital Banks are aligning their services to customer needs by embedding AI and machine learning within their existing systems. The banking industry’s experimentation with AI is opening new opportunities for improving customer experience (CX).

“We are not too far away from a day where traditional enterprise applications are no longer relevant. The purpose of those traditional systems was to simplify, codify, and automate business and customer processes. But in the mid-term future, we will have a time where the entire process is intelligent – where the system/application creates the best business process for the customer on the fly”, says Tim Sheedy, Principal Advisor, Ecosystm.

Elevating CX and Security

Banks are being transformed through AI adoption, especially in areas such as process automation, cyber security (especially in threat analysis and intelligence, and fraud/transaction security) and better information sharing systems for both their corporate and retail customers.

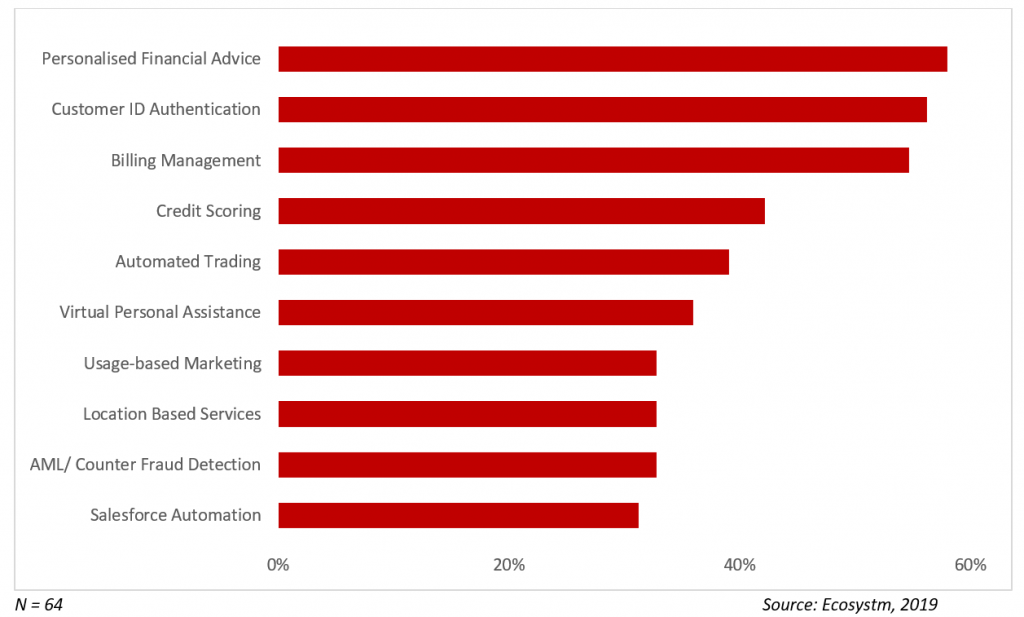

Business Solutions being Addressed by AI in Banking

Customer Experience

Customer Service is one of the core banking applications. Adoption of technologies such as virtual assistants and natural language processing (NLP) techniques is redefining CX in the banking industry.

“With emerging technologies setting a new bar for personalisation and value-add, banks looking to stay ahead of the curve simply cannot afford to ignore them,” says Jannat Maqbool, Principal Advisor, Ecosystm.

Personalised financial advice is another area where banks are taking advantage of AI applications. While it might be a perception that AI will reduce the human touch when it comes to CX, in reality, it provides more accurate and timely assistance. For instance, Bank of America has built an AI virtual assistant, “Erica” which actively assists 25 million clients on its mobile platform. Erica searches for past transactions and informs customers on their credit scores and connects with them to provide analytics and information on their account.

Marketing Automation

As profit margins decrease in the Banking sector, and Fintech technologies become more mainstream, banks need to ramp up their marketing initiatives, to remain competitive. AI is helping banks to optimise their marketing dollars. Machine learning algorithms can analyse customers’ entire banking journey involving interactions, transactions, location history, and usage patterns to develop insights and make marketing decisions with unprecedented accuracy. Decisions on a range of marketing initiatives across product improvement, new products and services offerings, and targeted marketing keeping in view customers’ financial goals will be automated. This will impact the profit margin as sales cycles shorten, and customers banking journeys become more satisfying.

Process Automation

There are certain functions in banks which require a lot of manual labour such as billing, generation of reports, account opening operations, KYC, etc. AI is transforming the banking industry with data-driven processes and decision making to automate tasks such as billings, credit scoring, compliance reports and so on. This not only reduces the dependence on tedious manual processes but also creates mechanisms to reduce errors. These errors not only make the organisation less efficient but also has financial ramifications. UBS, as an example, has introduced robots to its workforce, mainly at the back offices, designed to execute more manual and repetitive tasks. This essentially means meeting the right tasks with more speed and accuracy.

Fraud Management

AI improves with data and learns behavioural patterns. Banks are utilising this data or claims management and fraud detection. The AI platform evaluates on certain parameters such as when and how a customer typically accesses services and manage their money – more importantly, how they do not. They are designed to flag transactions with missing information and can alert the bank staff to irregular transactions and suspicious activities to prevent fraud. Increasingly this is evolving a chain of an automated process, without the involvement of banking staff or customer complaints.

Banks have a difficult job delivering better service while remaining compliant, and AI-driven AML and KYC initiatives, helps prevent fraud, and flag suspicious activities such as money laundering.

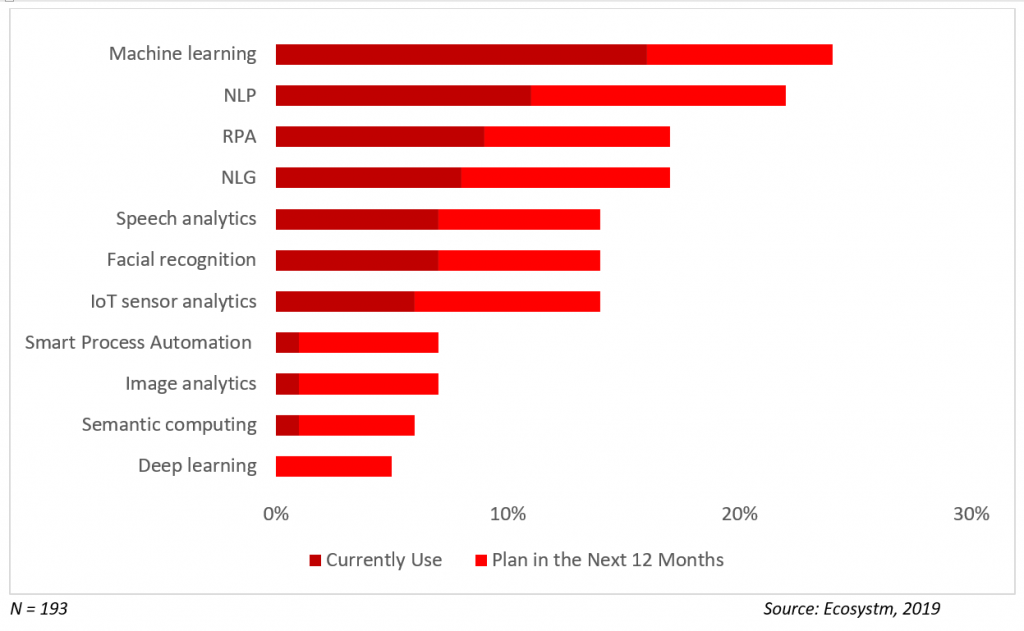

Market Trends

Current Focus on AI – The banking industry’s focus on customer service and automating manual processes is reflected in the top AI solutions that they are currently adopting. Chatbots and virtual assistants are being improved through natural language generation (NLG) and speech analytics capabilities. Process automation through RPA is being integrated into the organisations’ digital journeys due to its relative ease of deployment and measurable ROI.

Current & Planned Adoption of AI Solutions in Banking

Future Focus on AI – Banks will continue to focus on CX and strengthening the capabilities of their customer service team through AI. Niche solutions such as facial recognition will also improve their front-end operations, especially in customer identity authentication. Banks will also go beyond customer management to asset management, with AI-enabled IoT systems.

What’s Next?

AI is fast evolving and there are some excellent opportunities for banks to explore on what AI has to offer. Banks are working on feeding data into AI systems with advanced algorithms to better understand their customers and improve their services. Banks should focus on getting quality inputs on inquiries, interactions, transactions or another way that can collect insights.

Consumers are looking for operations and systems that are simple to operate and directed towards them. The greatest potential for AI in banking is to deliver personalised and automated services to consumers in a cost-effective and efficient way.

AI is allowing banks to do quicker operations at much lower cost, what remains to be seen is how banks further leverage AI to extend its products and services offerings.

The term ‘FinTech’ has arguably taken the world by storm, but the application of technology in financial services ecosystem is not new. What is new are the possibilities being realized as the industry evolves. As technology rapidly develops and advances, more companies are building upon the efficiencies gained with FinTech 1.0 to be more adventurous, pushing the boundaries of current regulatory frameworks and leveraging emerging technologies to redefine the financial product and services ecosystem.

Entering the era of FinTech 2.0, we’re seeing a progressive trend from purely focusing on making things easier, to focus on true innovation. The question is no longer ‘How can I make this process more efficient?’ alone, but more so ‘Where can we make greater positive impact?’ and ‘How can we add real value?’. This is leading to greater financial inclusion, the redefining of stakeholder roles, and improved customer experiences across the board.

For example the Pacific Financial Inclusion Programme and Rocket Remit are leveraging digital technology and out of the box thinking to offer new products and solutions tailored to a mass market of unbanked communities.

Choice in New Zealand, utilizing the Singapore based Nem.io blockchain platform and participants in the second round of the Kiwibank Fintech Accelerator, has replaced traditional merchant transaction fees with a small donation that is redirected to a charity, essentially eliminating the need for credit or debit cards at participating retailers.

Japan-based WealthNavi, an automated wealth management service and ‘robo-advisory’ of sorts, is a platform targeted at people aged 30-50 to help them develop their own optimised investment portfolio. In a market where traditionally, cash and FX are king, WealthNavi is providing a step-by-step guide to help users understand the best way to invest their money while hedging risk.

Meanwhile, the rise of crowdfunding platforms is providing businesses and individuals alike with additional funding sources. In New Zealand, micro-lending platform Ta Koha is looking to ensure more diversity in the business community by supporting Maori entrepreneurs, change makers and communities in their efforts to raise capital. There have also been calls for legislative changes to be made in Australia in order to empower SMEs and allow them to more readily access funds that are fundamental for growth.

FinTech 2.0 is firmly placing power in the hands of the customer, and their focus on the greater good, with new financial ecosystem players carefully aligning themselves to the needs of the day. The question that then comes to mind is, what does this mean for banks and traditional financial institutions?

Banks are at a crossroads – it’s clear that they can’t stand still, or they risk losing market share. But what is the way forward? Do they collaborate and/or acquire or dare to go it alone?

Collaboration in particular poses an interesting dilemma. Banks are essentially faced with partnering with and supporting the growth of their competitors. However, while in doing so they offer startups the chance to scale, in exchange, banks gain fresh perspectives and insights into market opportunities and customer demands. This leads to quicker advancements in an industry that has otherwise previously been limited by legacy.

There are several examples of this – in Australia, the Westpac bank is investing in fintech startups through a $150 million venture capital fund, while HSBC in Hong Kong launched a FinTech R&D lab in 2016, bringing the city’s total to twelve, including initiatives from Accenture and Australia’s Commonwealth Bank. A number of Singaporean brands, including DBS and OCBC have also introduced open banking, enabling third-party developers to access their APIs for greater innovation. A trend that is making its way to Australia and New Zealand.

The result? Very often, a clever application of emerging technologies to solve broader financial challenges and create new opportunities for players in the ecosystem as well as consumers and the public.

From artificial intelligence supporting risk management and fraud detection initiatives; connected devices enabling seamless and tailored processing of procedures and transactions based on an individual’s lifestyle; and blockchain enabling greater trust as well as its application in offering transparency throughout the supply chain; what’s certain is that emerging technologies are rapidly being integrated into financial product and service offerings. With emerging technologies setting a new bar for personalisation and value-add, banks looking to stay ahead of the curve simply cannot afford to ignore them.

However, whether banks choose to collaborate or develop their own offerings, what’s essential is that this innovation isn’t limited by narrow visions of the financial product and service ecosystem or driven by the application of technology for technology’s sake. In our increasingly international landscape, institutions should be proactively learning from other leading markets across the globe, and utilizing resources such as the World Economic Forum’s decision support questions for Blockchain, to identify both good practices to adopt, and approaches to avoid for a more lucrative system for all.

We’re already seeing ideas-sharing taking place – FintechNZ recently hosted a delegation led by the Lord Mayor of London, before sending a group to London FinTech Week. Hong Kong and Shenzhen will be hosting the world’s first cross-border FinTech event later this year. Meanwhile, Singapore’s FinTech festival counterpart is slated to have a pan-ASEAN focus. And larger, traditional banks with often greater reach than fintech startups are well-placed to offer their learnings and insights.

Ultimately, FinTech 2.0 equals change – with customers more empowered than ever before, banks will need to up their game to cater to savvier audiences. The difference is whether traditional institutions embrace the evolution, or whether the evolution forces their hand.