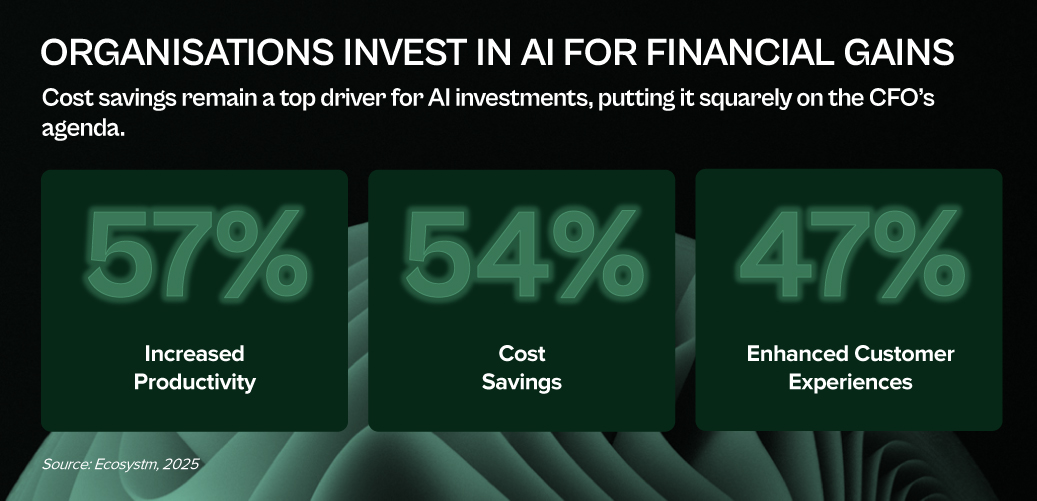

AI is not just reshaping how businesses operate — it’s redefining the CFO’s role at the centre of value creation, risk management, and operational leadership.

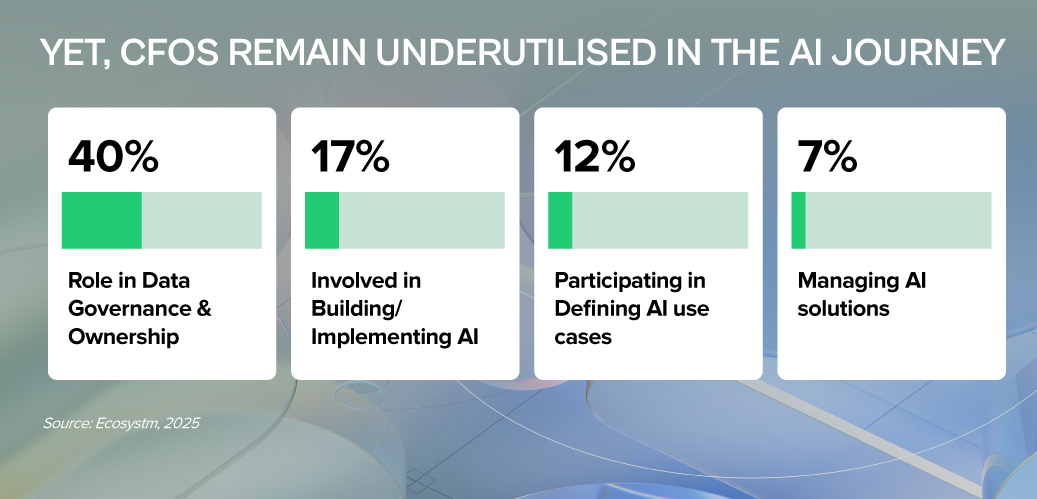

As stewards of capital, CFOs must cut through the hype and ensure AI investments deliver measurable business returns. As guardians of risk and compliance, they must shield their organisations from new threats — from algorithmic bias to data privacy breaches with heavy financial and reputational costs. And as leaders of their function, CFOs now have a generational opportunity to modernise finance, champion AI adoption, and build teams ready for an AI-powered future.

LEAD WITH RIGOUR. SAFEGUARD WITH VIGILANCE. CHAMPION WITH VISION.

That’s the CFO playbook for AI success.

Click here to download “AI Stakeholders: The Finance Perspective” as a PDF.

1. Investor & ROI Gatekeeper: Ensuring AI Delivers Value

CFOs must scrutinise AI investments with the same discipline as any major capital allocation.

- Demand Clear Business Cases. Every AI initiative should articulate the problem solved, expected gains (cost, efficiency, accuracy), and specific KPIs.

- Prioritise Tangible ROI. Focus on AI projects that show measurable impact. Start with high-return, lower-risk use cases before scaling.

- Assess Total Cost of Ownership (TCO). Go beyond upfront costs – factor in integration, maintenance, training, and ongoing AI model management.

Only 37% of Asia Pacific organisations invest in FinOps to cut costs, boost efficiency, and strengthen financial governance over tech spend.

2. Risk & Compliance Steward: Navigating AI’s New Risk Landscape

AI brings significant regulatory, compliance, and reputational risks that CFOs must manage – in partnership with peers across the business.

- Champion Data Quality & Governance. Enforce rigorous data standards and collaborate with IT, risk, and business teams to ensure accuracy, integrity, and compliance across the enterprise.

- Ensure Data Accessibility. Break down silos with CIOs and CDOs and invest in shared infrastructure that AI initiatives depend on – from data lakes to robust APIs.

- Address Bias & Safeguard Privacy. Monitor AI models to detect bias, especially in sensitive processes, while ensuring compliance.

- Protect Security & Prevent Breaches. Strengthen defences around financial and personal data to avoid costly security incidents and regulatory penalties.

3. AI Champion & Business Leader: Driving Adoption in Finance

Beyond gatekeeping, CFOs must actively champion AI to transform finance operations and build future-ready teams.

- Identify High-Impact Use Cases. Work with teams to apply AI where it solves real pain points – from automating accounts payable to improving forecasting and fraud detection.

- Build AI Literacy. Help finance teams see AI as an augmentation tool, not a threat. Invest in upskilling while identifying gaps – from data management to AI model oversight.

- Set AI Governance Frameworks. Define accountability, roles, and control mechanisms to ensure responsible AI use across finance.

- Stay Ahead of the Curve. Monitor emerging tech that can streamline finance and bring in expert partners to fast-track AI adoption and results.

CFOs: From Gatekeepers to Growth Drivers

AI is not just a tech shift – it’s a CFO mandate. To lead, CFOs must embrace three roles: Investor, ensuring every AI bet delivers real ROI; Risk Guardian, protecting data integrity and compliance in a world of new risks; and AI Champion, embedding AI into finance teams to boost speed, accuracy, and insight.

This is how finance moves from record-keeping to value creation. With focused leadership and smart collaboration, CFOs can turn AI from buzzword to business impact.

For many organisations migrating to cloud, the opportunity to run workloads from energy-efficient cloud data centres is a significant advantage. However, carbon emissions can vary from one country to another and if left unmonitored, will gradually increase over time as cloud use grows. This issue will become increasingly important as we move into the era of compute-intensive AI and the burden of cloud on natural resources will shift further into the spotlight.

The International Energy Agency (IEA) estimates that data centres are responsible for up to 1.5% of global electricity use and 1% of GHG emissions. Cloud providers have recognised this and are committed to change. Between 2025 and 2030, all hyperscalers – AWS, Azure, Google, and Oracle included – expect to power their global cloud operations entirely with renewable sources.

Chasing the Sun

Cloud providers are shifting their sights from simply matching electricity use with renewable power purchase agreements (PPA) to the more ambitious goal of operating 24/7 on carbon-free sources. A defining characteristic of renewables though is intermittency, with production levels fluctuating based on the availability of sunlight and wind. Leading cloud providers are using AI to dynamically distribute compute workloads throughout the day to regions with lower carbon intensity. Workloads that are processed with solar power during daylight can be shifted to nearby regions with abundant wind energy at night.

Addressing Water Scarcity

Many of the largest cloud data centres are situated in sunny locations to take advantage of solar power and proximity to population centres. Unfortunately, this often means that they are also in areas where water is scarce. While liquid-cooled facilities are energy efficient, local communities are concerned on the strain on water sources. Data centre operators are now committing to reduce consumption and restore water supplies. Simple measures, such as expanding humidity (below 20% RH) and temperature tolerances (above 30°C) in server rooms have helped companies like Meta to cut wastage. Similarly, Google has increased their reliance on non-potable sources, such as grey water and sea water.

From Waste to Worth

Data centre operators have identified innovative ways to reuse the excess heat generated by their computing equipment. Some have used it to heat adjacent swimming pools while others have warmed rooms that house vertical farms. Although these initiatives currently have little impact on the environmental impact of cloud, they suggest a future where waste is significantly reduced.

Greening the Grid

The giant facilities that cloud providers use to house their computing infrastructure are also set to change. Building materials and construction account for an astonishing 11% of global carbon emissions. The use of recycled materials in concrete and investing in greener methods of manufacturing steel are approaches the construction industry are attempting to lessen their impact. Smaller data centres have been 3D printed to accelerate construction and use recyclable printing concrete. While this approach may not be suitable for hyperscale facilities, it holds potential for smaller edge locations.

Rethinking Hardware Management

Cloud providers rely on their scale to provide fast, resilient, and cost-effective computing. In many cases, simply replacing malfunctioning or obsolete equipment would achieve these goals better than performing maintenance. However, the relentless growth of e-waste is putting pressure on cloud providers to participate in the circular economy. Microsoft, for example, has launched three Circular Centres to repurpose cloud equipment. During the pilot of their Amsterdam centre, it achieved 83% reuse and 17% recycling of critical parts. The lifecycle of equipment in the cloud is largely hidden but environmentally conscious users will start demanding greater transparency.

Recommendations

Organisations should be aware of their cloud-derived scope 3 emissions and consider broader environmental issues around water use and recycling. Here are the steps that can be taken immediately:

- Monitor GreenOps. Cloud providers are adding GreenOps tools, such as the AWS Customer Carbon Footprint Tool, to help organisations measure the environmental impact of their cloud operations. Understanding the relationship between cloud use and emissions is the first step towards sustainable cloud operations.

- Adopt Cloud FinOps for Quick ROI. Eliminating wasted cloud resources not only cuts costs but also reduces electricity-related emissions. Tools such as CloudVerse provide visibility into cloud spend, identifies unused instances, and helps to optimise cloud operations.

- Take a Holistic View. Cloud providers are being forced to improve transparency and reduce their environmental impact by their biggest customers. Getting educated on the actions that cloud partners are taking to minimise emissions, water use, and waste to landfill is crucial. In most cases, dedicated cloud providers should reduce waste rather than offset it.

- Enable Remote Workforce. Cloud-enabled security and networking solutions, such as SASE, allow employees to work securely from remote locations and reduce their transportation emissions. With a SASE deployed in the cloud, routine management tasks can be performed by IT remotely rather than at the branch, further reducing transportation emissions.

Setting and achieving Sustainability goals is complex in BFSI. To be truly sustainable, organisations need to:

- Reduce internal energy consumption and carbon footprint

- Fund the transition to decarbonisation in high emission industries

- Introduce “green” customer products and services

- Monitor carbon data for financed emissions

Data and AI have the potential to assist in achieving these objectives, provided they are used effectively. Here is how.

Download ‘Driving Sustainability with Data and AI in Financial Services’ as a PDF

Organisations in Asia Pacific are no longer only focused on employing a cloud-first strategy – they want to host the infrastructure and workloads where it makes the most sense; and expect a seamless integration across multiple cloud environments.

While cloud can provide the agile infrastructure that underpins application modernisation, innovative leaders recognise that it is only the first step on the path towards developing AI-powered organisations. The true value of cloud is in the data layer, unifying data around the network, making it securely available wherever it is needed, and infusing AI throughout the organisation.

Cloud provides a dynamic and powerful platform on which organisations can build AI. Pre-trained foundational models, pay-as-you-go graphics superclusters, and automated ML tools for citizen data scientists are now all accessible from the cloud even to start-ups.

Organisations should assess the data and AI capabilities of their cloud providers rather than just considering it an infrastructure replacement. Cloud providers should use native services or integrations to manage the data lifecycle from labelling to model development, and deployment.

In this Ecosystm Byte, sponsored by Oracle, Ecosystm Principal Advisor, Darian Bird presents the top 5 trends for Cloud in 2023 and beyond. Read on to find out more.

Download ‘The Top 5 Cloud Trends for 2023 & Beyond’ as a PDF

Leading Banking and Financial Services organisations play a crucial role in financing sustainability transition. They have the infrastructure and resources to kickstart their own sustainability journey. But beyond that, they also have a greater role in building a sustainable value chain.

This extends to helping the traditional economy to transition; green investments to promote organisations with the right intentions; and empowering their customers to make environmentally-friendly choices.

As a technology leader in BFSI, you are an integral part of your organisation’s sustainability journey. Here are 5 ways in which BFSI tech leaders can support their organisations to turn sustainability intentions into reality.

Align tech with business goals and strategy. Think like a business leader and understand larger goals beyond technology deployments to empower your team.

View reporting as more than a checklist. You are in an ideal position to demonstrate the value of data insights beyond reporting mandates to the leadership team – link them to larger business outcomes.

Build intelligence into your facilities and assets. Consider investing in an intelligent enterprise asset management solution to automate asset and infrastructure management, remotely monitor and manage asset operations, and achieve sustainable business outcomes.

Automate your infrastructure allocation. You are increasingly using FinOps tools and other predictive analytics dashboards for cost and resource optimisation – extend the use for greater energy efficiency.

Understand your organisation’s unique sustainability journey. Seek independent opinion from third parties to empower your organisation to take the first step in the sustainability strategy, derive insights from data assets, and create market differentiation.

Read on to find more.

Download 5 Sustainability Actions for BFSI Tech Leaders as a PDF

Digital transformation has been a key company objective over the last two years – and more than a third of enterprises in ASEAN have it as their key business priority in 2022-23. They are aiming to be agile and digital organisations – with access to real-time data insights at their core.

Businesses have learned that their technology systems need to be scalable, accessible, easy to manage, fast to deploy and cost effective. Cloud infrastructure, platforms and software has become key enablers of business agility and innovation.

But the expansion of cloud applications has also seen an infrastructure and applications sprawl – which makes it essential for organisation to re-evaluate their cloud strategy.

Here are 5 insights that will help you shape your Cloud Strategy.

- Technology Change Management. Your cloud strategy must define the infrastructure and data architecture, security and resiliency measures, the technology environment management model, and IT operations.

- Building Scalable Enterprises. Focus on seamless access to all organisational data, irrespective of where they are generated (enterprise systems, IoT devices or AI solutions) and where they are stored (public cloud, on-premises, Edge, or co-location facilities).

- A Hybrid Multicloud Environment. For a successful hybrid multi cloud environment, keep a firm eye on hybrid cloud management, a suitable FinOps framework that balances performance and cost, and integration.

- A Technology-Neutral Approach. Partnering with a technology-neutral cloud services provider that leverages the entire tech ecosystem, will be critical.

- “Hybrid Cloud” Can Mean Many Things. Work with a cloud services partner, that has broad and deep capabilities across multiple hyperscalers and is able to address the unique requirements of your organisation.

Read on for more insights

Download 5 Key Insights to Shape Your Cloud Strategy – An ASEAN View as a PDF