Digital transformation in the Philippines has moved from being a goal to an essential part of how organisations operate, compete, and serve their communities. This shift is evident across sectors – from financial services and government to education, healthcare, and commerce – as digital platforms become integral to everyday life.

In recent years, the country has been recognised as a leading improver in the UN E-Government Development Index, reflecting steady advances in digital public service delivery. Yet, progress across all sectots has been uneven, influenced by a mix of geography, regulation, and existing infrastructure. Organisations continue to adapt, responding to fast-paced technological change, rising user expectations, and an increasingly interconnected global digital economy.

Through a series of roundtables with national leaders, Ecosystm examined the realities of digital transformation on the ground. What emerged were valuable insights into what’s working and where challenges and shifts are reshaping the definition of success in this evolving stage of digital maturity.

Theme 1: Strengthening the Foundations for Nationwide Digital Equity

The Philippines is advancing steadily in digitalisation, especially in Metro Manila and major urban centres, though the full benefits have yet to reach all regions evenly. Rural provinces and smaller islands face ongoing challenges with broadband access, latency, and mobile coverage, reflecting the country’s unique geography and historic underinvestment in digital infrastructure.

National programs like the National Broadband Plan and Free Wi-Fi for All have established important foundations. Fibre rollouts by private telecom providers are extending coverage, but last-mile connectivity in geographically isolated and disadvantaged areas (GIDAs) still needs attention. Bridging this gap is key not only for broader inclusion but also to enable widespread adoption of technologies such as cloud computing, AI, and edge solutions.

Achieving nationwide digital transformation requires a focused effort on regional infrastructure as a driver of inclusive growth. This involves co-investment, innovative public-private partnerships, and policies supporting shared towers, data centres, and satellite-backed connectivity. This benefits enterprises and critical citizen services like e-learning, e-health, and digital banking.

Theme 2: From Outsourcing Hub to Innovation Engine – The Next Chapter for Talent

The Philippines has established a strong global presence as a trusted centre for BPO and IT-enabled services, contributing nearly 9% to the national GDP and employing over 1.5 million professionals. In recent years, this foundation has rapidly evolved, with talent increasingly taking on complex roles in knowledge process outsourcing (KPO), AI annotation, fintech support, and cybersecurity operations.

This shift reflects a broader transformation – from a labour-cost-driven outsourcing model to a high-skill, innovation-focused services economy. However, this transition is placing growing demands on the talent pipeline. Skilled cloud engineers, AI developers, and cybersecurity experts remain in short supply, with demand surpassing the current capacity of training and reskilling programs.

To fully unlock its potential, the country needs to future-proof its talent ecosystem. This includes expanding technical education, strengthening collaboration between academia and industry, scaling national upskilling initiatives, and creating incentives that encourage tech professionals to build their careers locally. With targeted investment, the digital workforce can become a powerful competitive advantage on the global stage.

Theme 3: Government Digitalisation Is Accelerating – But Interoperability Remains a Challenge

The Philippines has made major progress in digitising government services – from online business registrations via Business Name Registration System (BNRS) to digital ID rollout through PhilSys (Philippine Identification System), and integrated platforms like eGov PH Super App. The pandemic accelerated adoption of e-payment systems, telemedicine, and virtual public services, driving faster digital transformation across agencies.

Despite this progress, interoperability challenges remain a key hurdle. Many government agencies still rely on siloed legacy systems that limit seamless data exchange. This fragmentation affects real-time decision-making, slows service delivery, and creates a fragmented experience for citizens and enterprises navigating multiple platforms.

Going forward, the priority is system-wide integration. Building a truly citizen-centric digital government requires interoperable data architectures, strong privacy-by-design frameworks for cross-agency collaboration, and scalable API-driven platforms that enable secure, real-time connections between national and local government systems. A connected digital state not only boosts efficiency but also strengthens public trust and paves the way for more adaptive, responsive services.

Theme 4: Cyber Resilience Is No Longer Optional – It’s Strategic

As digital transformation accelerates, the Philippines has become one of Southeast Asia’s most targeted countries for cyberattacks – particularly in sectors like financial services, critical infrastructure, and government. High-profile breaches at agencies such as PhilHealth, the Philippine Statistics Authority, and COMELEC have brought cybersecurity to the forefront of national priorities.

Regulatory steps such as the Cybercrime Prevention Act and the establishment of the Department of Information and Communications Technology (DICT) Cybersecurity Bureau have laid important groundwork. Yet, enterprise readiness remains uneven. Many organisations still rely on outdated defences, limited threat visibility, and ad hoc response plans that are outpaced by today’s threats. More importantly, many still look at cyber purely from a compliance angle.

As AI, IoT, and cloud-based platforms scale, so too does the attack surface. Cyber resilience now demands more than compliance – it requires dynamic risk management, skills development, intelligence sharing, and coordinated action across sectors. The shift from reactive to adaptive security is becoming a defining capability for both public and private institutions.

Theme 5: Financial Access at the Grassroots: The Digital Shift

One of the Philippines’ most notable digital transformation successes has been in fintech and digital financial services. Platforms like GCash, Maya, and the government’s Paleng-QR PH program have significantly expanded access to cashless payments, savings, and credit – especially among unbanked and underbanked communities.

By 2024, nearly 80% of Filipinos were using mobile financial apps – a striking milestone that reflects not only growing digital adoption but also evolving cultural and economic behaviours. From sari-sari stores to market vendors, digital wallets are reshaping everyday commerce and opening new avenues for financial empowerment at the grassroots level.

Still, digital inclusion is not automatic. Maintaining this momentum will require continued investment in digital literacy – particularly for older adults, rural communities, and lower-income groups – as well as stronger measures for cybersecurity, consumer protection, and interoperable ID and payment systems. Done right, digital finance can serve as the foundation for a more inclusive and resilient economy.

A Moment to Rethink What Progress Looks Like

As digital systems take root across the Philippines’ economy and institutions, the focus is shifting from speed to staying power. The next phase will depend on the country’s ability to translate broad adoption into long-term value – through strategies that are inclusive, resilient, and built to scale.

The financial services sector stands at a pivotal moment. Shaped by shifting customer expectations, fintech disruption, and rising demands for security and compliance, the industry is undergoing deep, ongoing transformation. From personalised digital engagement to AI-driven decisions and streamlined operations, BFSI is being fundamentally reshaped.

To thrive in this intelligent, interconnected future, financial organisations must embrace new strategies that turn challenges into opportunities.

Click here to download “Future Forward: Reimagining Financial Services” as a PDF.

Scaling for Impact

CreditAccess Grameen, a leading microfinance institution in India, struggled to scale its operations to meet the rising demand for microloans. Its manual processes were inefficient, causing delays and hindering its ability to serve an expanding customer base.

To overcome this, CreditAccess Grameen digitised its operations, automating processes to handle over 80,000 loans per day, streamlining loan approvals and improving operational efficiency.

This transformation significantly reduced loan processing times, from seven to ten days down to a more efficient, timely process. It also enhanced customer satisfaction, empowered financial independence, and strengthened CreditAccess Grameen’s position as a leader in financial inclusion, driving economic growth in rural India.

Seamless Operations, Improved Reporting

After merging three separate funds, Aware Super, one of Australia’s largest superannuation funds, faced fragmented operations, inconsistent documentation, and poor visibility into workflows. These inefficiencies hampered the organisation’s ability to optimise operations, ensure compliance, and deliver a seamless member experience.

To overcome this, Aware Super implemented a business process management suite to standardise and automate key processes, providing a unified platform for continuous improvement.

The transformation streamlined operations across all funds, improving reporting accuracy, reducing waste, and boosting procurement efficiency. The creation of a Centre of Excellence fostered a culture of ongoing process improvement and regulatory compliance, elevating Aware Super’s process maturity and solidifying its leadership in the financial services sector.

Empowering Employees and Improving Operations

The Norinchukin Bank, a major financial institution serving Japan’s agriculture, forestry, and fisheries sectors, struggled with outdated, paper-based processes and disconnected systems. Manual approvals and repetitive data entry were hindering operations and frustrating staff.

The digital team implemented a low-code platform that quickly automated approvals, integrated siloed systems, and streamlined processes into a single, efficient workflow.

The results were striking: approval times dropped, development cycles halved, and implementation costs fell by 30% compared to legacy upgrades. Employees gained real-time visibility over requests, cutting errors and speeding decisions. Crucially, the shift sparked a wave of digital adoption, with teams across the bank now embracing automation to drive further efficiency.

Eliminating Handoffs, Elevating Experience

Axis Bank, one of India’s largest private sector banks, struggled with slow, manual corporate onboarding processes, which hindered efficiency and customer satisfaction. The bank sought to streamline this process to keep up with growing demand for faster, digital services.

The bank implemented a robust API management solution, automating document handling and onboarding tasks, enabling a fully digital and seamless corporate client experience.

This transformation reduced corporate onboarding time by over 50%, eliminated manual handoffs, and enabled real-time monitoring of API performance, resulting in faster service delivery. As a result, Axis Bank saw a significant increase in customer satisfaction, a surge in API traffic, and a deeper, more loyal corporate client base.

Taming Latency, Unleashing Bandwidth

WebSpace, renowned for its in-store payment systems, faced challenges as it expanded to wholesalers. The migration to a new architecture required low-latency cloud connectivity, but its legacy network, relying on hardware routers, caused performance slowdowns, complexity, and high costs.

WebSpace adopted a cloud-based routing solution, replacing physical routers with a virtual, automated system for multicloud connectivity, enabling on-demand configuration changes from a central control point.

With the new solution, WebSpace achieved faster cloud connectivity, reducing latency and increasing bandwidth. The modern, agile network reduced management costs and complexity, while usage-based billing ensured that WebSpace only paid for the resources it used, supporting its strategic expansion and enhancing overall efficiency.

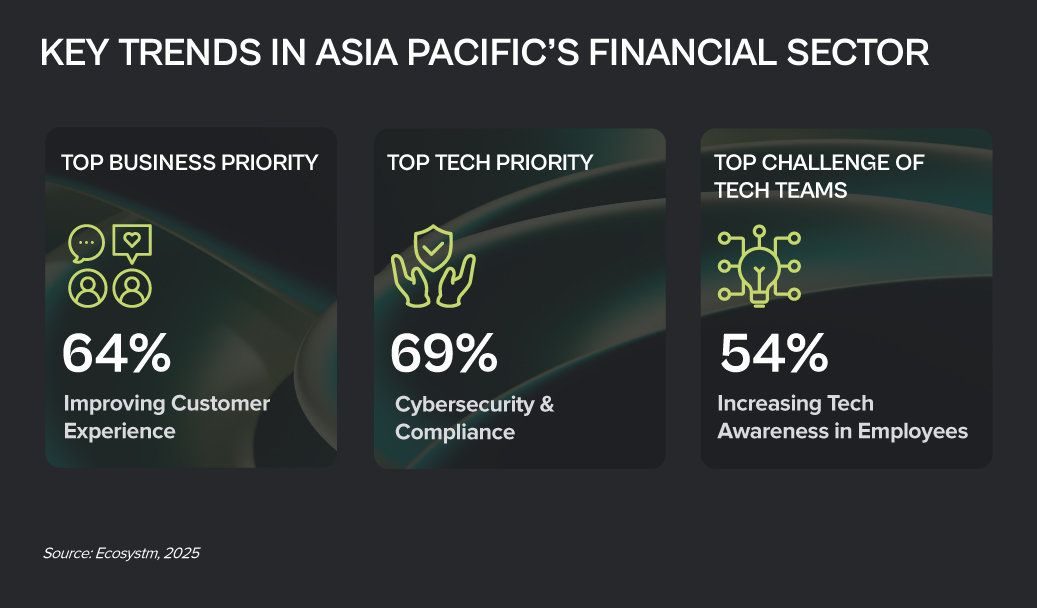

Southeast Asia’s banking sector is poised for significant digital transformation. With projected Net Interest Income reaching USD 148 billion by 2024, the market is ripe for continued growth. While traditional banks still hold a dominant position, digital players are making significant inroads. To thrive in this evolving landscape, financial institutions must adapt to rising customer expectations, stringent regulations, and the imperative for resilience. This will require a seamless collaboration between technology and business teams.

To uncover how banks in Southeast Asia are navigating this complex landscape and what it takes to succeed, Ecosystm engaged in in-depth conversations with senior banking executives and technology leaders as part of our research initiatives. Here are the highlights of the discussions with leaders across the region.

#1 Achieving Hyper-Personalisation Through AI

As banks strive to deliver highly personalised financial services, AI-driven models are becoming increasingly essential. These models analyse customer behaviour to anticipate needs, predict future behaviour, and offer relevant services at the right time. AI-powered tools like chatbots and virtual assistants further enhance real-time customer support.

Hyper-personalisation, while promising, comes with its challenges – particularly around data privacy and security. To deliver deeply tailored services, banks must collect extensive customer information, which raises the question: how can they ensure this sensitive data remains protected?

AI projects require a delicate balance between innovation and regulatory compliance. Regulations often serve as the right set of guardrails within which banks can innovate. However, banks – especially those with cross-border operations – must establish internal guidelines that consider the regulatory landscape of multiple jurisdictions.

#2 Beyond AI: Other Emerging Technologies

AI isn’t the only emerging technology reshaping Southeast Asian banking. Banks are increasingly adopting technologies like Robotic Process Automation (RPA) and blockchain to boost efficiency and engagement. RPA is automating repetitive tasks, such as data entry and compliance checks, freeing up staff for higher-value work. CIMB in Malaysia reports seeing a 35-50% productivity increase thanks to RPA. Blockchain is being explored for secure, transparent transactions, especially cross-border payments. The Asian Development Bank successfully trialled blockchain for faster, safer bond settlements. While AR and VR are still emerging in banking, they offer potential for enhanced customer engagement. Banks are experimenting with immersive experiences like virtual branch visits and interactive financial education tools.

The convergence of these emerging technologies will drive innovation and meet the rising demand for seamless, secure, and personalised banking services in the digital age. This is particularly true for banks that have the foresight to future-proof their tech foundation as part of their ongoing modernisation efforts. Emerging technologies offer exciting opportunities to enhance customer engagement, but they shouldn’t be used merely as marketing gimmicks. The focus must be on delivering tangible benefits that improve customer outcomes.

#3 Greater Banking-Fintech Collaboration

The digital payments landscape in Southeast Asia is experiencing rapid growth, with a projected 10% increase between 2024-2028. Digital wallets and contactless payments are becoming the norm, and platforms like GrabPay, GoPay, and ShopeePay are dominating the market. These platforms not only offer convenience but also enhance financial inclusion by reaching underbanked populations in remote areas.

The rise of digital payments has significantly impacted traditional banks. To remain relevant in this increasingly cashless society, banks are collaborating with fintech companies to integrate digital payment solutions into their services. For instance, Indonesia’s Bank Mandiri collaborated with digital credit services provider Kredivo to provide customers with access to affordable and convenient credit options.

Partnerships between traditional banks and fintechs are essential for staying competitive in the digital age, especially in areas like digital payments, data analytics, and customer experience.

While these collaborations offer opportunities, they also pose challenges. Banks must invest in advanced fraud detection, AI monitoring, and robust authentication to secure digital payments. Once banks adopt a mindset of collaboration with innovators, they can leverage numerous innovations in the cybersecurity space to address these challenges.

#4 Agile Infrastructure for an Agile Business

While the banking industry is considered a pioneer in implementing digital technologies, its approach to cloud has been more cautious. While interest remained high, balancing security and regulatory concerns with cloud agility impacted the pace. Hybrid multi-cloud environments has accelerated banking cloud adoption.

Leveraging public and private clouds optimises IT costs, offering flexibility and scalability for changing business needs. Hybrid cloud allows resource adjustments for peak demand or cost reductions off-peak. Access to cloud-native services accelerates innovation, enabling rapid application development and improved competitiveness. As the industry adopts GenAI, it requires infrastructure capable of handling vast data, massive computing power, advanced security, and rapid scalability – all strengths of hybrid cloud.

Replicating critical applications and data across multiple locations ensures disaster recovery and business continuity. A multi-cloud strategy also helps avoid vendor lock-in, diversifies cloud providers, and reduces exposure to outages.

Hybrid cloud adoption offers benefits but also presents challenges for banks. Managing the environment is complex, needing coordination across platforms and skilled personnel. Ensuring data security and compliance across on-prem and public cloud infrastructure is demanding, requiring robust measures. Network latency and performance issues can arise, making careful design and optimisation crucial. Integrating on-prem systems with public cloud services is time-consuming and needs investment in tools and expertise.

#5 Cyber Measures to Promote Customer & Stakeholder Trust

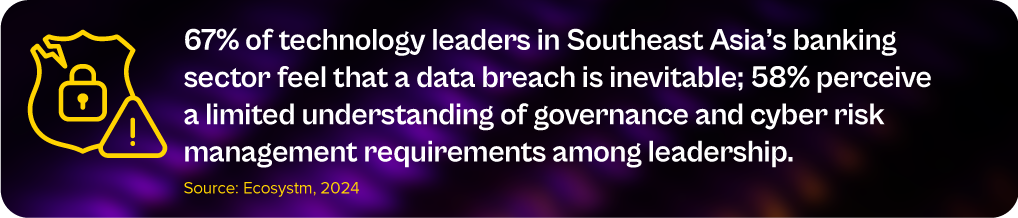

The banking sector is undergoing rapid AI-driven digital transformation, focusing on areas like digital customer experiences, fraud detection, and risk assessment. However, this shift also increases cybersecurity risks, with the majority of banking technology leaders anticipate inevitable data breaches and outages.

Key challenges include expanding technology use, such as cloud adoption and AI integration, and employee-related vulnerabilities like phishing. Banks in Southeast Asia are investing heavily in modernising infrastructure, software, and cybersecurity.

Banks must update cybersecurity strategies to detect threats early, minimise damage, and prevent lateral movement within networks.

Employee training, clear security policies, and a culture of security consciousness are critical in preventing breaches.

Regulatory compliance remains a significant concern, but banks are encouraged to move beyond compliance checklists and adopt risk-based, intelligence-led strategies. AI will play a key role in automating compliance and enhancing Security Operations Centres (SOCs), allowing for faster threat detection and response. Ultimately, the BFSI sector must prioritise cybersecurity continuously based on risk, rather than solely on regulatory demands.

Breaking Down Barriers: The Role of Collaboration in Banking Transformation

Successful banking transformation hinges on a seamless collaboration between technology and business teams. By aligning strategies, fostering open communication, and encouraging cross-functional cooperation, banks can effectively leverage emerging technologies to drive innovation, enhance customer experience, and improve efficiency.

A prime example of the power of collaboration is the success of AI initiatives in addressing specific business challenges.

This user-centric approach ensures that technology addresses real business needs.

By fostering a culture of collaboration, banks can promote continuous learning, idea sharing, and innovation, ultimately driving successful transformation and long-term growth in the competitive digital landscape.

India is undergoing a remarkable transformation across various industries, driven by rapid technological advancements, evolving consumer preferences, and a dynamic economic landscape. From the integration of new-age technologies like GenAI to the adoption of sustainable practices, industries in India are redefining their operations and strategies to stay competitive and relevant.

Here are some organisations that are leading the way.

Download ‘From Tradition to Innovation: Industry Transformation in India’ as a PDF

Redefining Customer Experience in the Financial Sector

Financial inclusion. India’s largest bank, the State Bank of India, is leading financial inclusion with its YONO app, to enhance accessibility. Initial offerings include five core banking services: cash withdrawals, cash deposits, fund transfers, balance inquiries, and mini statements, with plans to include account opening and social security scheme enrollments.

Customer Experience. ICICI Bank leverages RPA to streamline repetitive tasks, enhancing customer service with its virtual assistant, iPal, for handling queries and transactions. HDFC Bank customer preference insights to offer tailored financial solutions, while Axis Bank embraces a cloud-first strategy to digitise its platform and improve customer interfaces.

Indian banks are also collaborating with fintechs to harness new technologies for better customer experiences. YES Bank has partnered with Paisabazaar to simplify loan applications, and Canara HSBC Life Insurance has teamed up with Artivatic.AI to enhance its insurance processes via an AI-driven platform.

Improving Healthcare Access

Indian healthcare organisations are harnessing technology to enhance efficiency, improve patient experiences, and enable remote care.

Apollo Hospitals has launched an automated patient monitoring system that alerts experts to health deteriorations, enabling timely interventions through remote monitoring. Manipal Hospitals’ video consultation app reduces emergency department pressure by providing medical advice, lab report access, bill payments, appointment bookings, and home healthcare requests, as well as home medication delivery and Fitbit monitoring. Omni Hospitals has also implemented AI-based telemedicine for enhanced patient engagement and remote monitoring.

The government is also driving the improvement of healthcare access. eSanjeevani is the world’s largest government-owned telemedicine system, with the capacity to handle up to a million patients a day.

Driving Retail Agility & Consumer Engagement

India’s Retail sector, the fourth largest globally, contributes over 10% of the nation’s GDP. To stay competitive and meet evolving consumer demands, Indian retailers are rapidly adopting digital technologies, from eCommerce platforms to AI.

Omnichannel Strategies. Reliance Retail integrates physical stores with digital platforms like JioMart to boost sales and customer engagement. Tata CLiQ’s “phygital” approach merges online and offline shopping for greater convenience while Shoppers Stop uses RFID and data analytics for improved in-store experiences, online shopping, and targeted marketing.

Retail AI. Flipkart’s AI-powered shopping assistant, Flippi uses ML for conversational product discovery and intuitive guidance. BigBasket employs IoT-led AI to optimise supply chain and improve product quality.

Reshaping the Automotive Landscape

Tech innovation, from AI/ML to connected vehicle technologies, is revolutionising the Automotive sector. This shift towards software-defined vehicles and predictive supply chain management underscores the industry’s commitment to efficiency, transparency, safety, and environmental sustainability.

Maruti Suzuki’s multi-pronged approach includes collaborating with over 60 startups through its MAIL program and engaging Accenture to drive tech change. Maruti has digitised 24 out of 26 customer touchpoints, tracking every interaction to enhance customer service. In the Auto OEM space, they are shifting to software-defined vehicles and operating models.

Tata Motors is leveraging cloud, AI/ML, and IoT to enhancing efficiency, improving safety, and driving sustainability across its operations. Key initiatives include connected vehicles, automated driving, dealer management, cybersecurity, electric powertrains, sustainability, and supply chain optimisation.

Streamlining India’s Logistics Sector

India’s logistics industry is on the cusp of a digital revolution as it embraces cutting-edge technologies to streamline processes and reduce environmental impact.

Automation and Predictive Analytics. Automation is transforming warehousing operations in India, with DHL India automating sortation centres to handle 6,000 shipments per hour. Predictive analytics is reshaping logistics decision-making, with Delhivery optimising delivery routes to ensure timely service.

Sustainable Practices. The logistics sector contributes one-third of global carbon emissions. To combat this, Amazon India will convert its delivery fleet to 100% EVs by 2030 to reduce emissions and fuel costs. Blue Energy Motors is also producing 10,000 heavy-duty LNG trucks annually for zero-emission logistics.

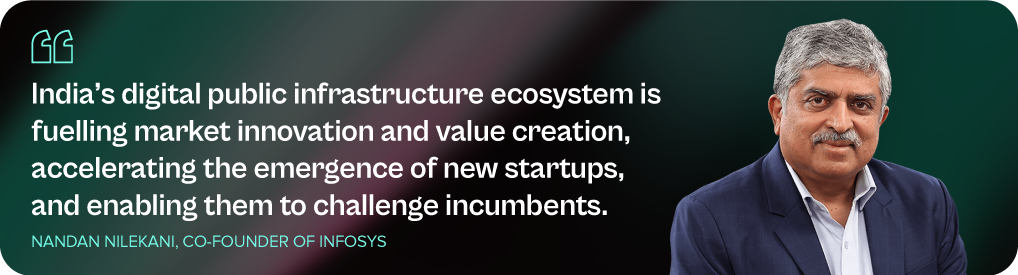

India’s digital journey has been nothing short of remarkable, driven by a robust Digital Public Infrastructure (DPI) framework known as the India Stack. Over the past decade, the government, in collaboration with public and private entities, has built this digital ecosystem to empower citizens, improve governance, and foster economic growth.

The India Stack is a set of open APIs and platforms that provide a foundation for large-scale public service delivery and innovation. It enables governments, businesses, startups, and developers to leverage technology to offer services to millions of Indians, especially those in underserved areas.

The India Stack is viewed as a layered infrastructure, addressing identity, payments, data, and services.

Click here to download The India Stack: A Foundation for Digital India as a PDF

Four Pillars of the Digital Stack

The four layers of India Stack include:

- Presenceless Layer. Aadhaar enables remote authentication, providing a digital ID that requires only a 12-digit number and a fingerprint or iris scan, eliminating the need for physical documents. It prevents duplicate and fake identities.

- Paperless Layer. Reliance on digital records, using Aadhaar eKYC, eSign, and Digital Locker. It enables secure digital storage and retrieval, creating a paperless system for verifying and accessing documents anytime, on any device.

- Cashless Layer. Led by NPCI, this aims to universalise digital payments. UPI enables instant, secure money transfers between bank accounts using a simple Virtual Payment Address (VPA), moving transactions into the digital age for transparency and ease of use.

- Consent Layer. Enables secure, user-controlled data sharing through electronic consent, allowing data to flow freely. The Account Aggregator ecosystem benefits most, with AA acting as a thin data aggregation layer between Financial Information Providers (FIPs) and Financial Information Users (FIUs).

The Impact of the India Stack

The India Stack has played a pivotal role in the country’s rapid digitalisation:

Financial Inclusion. Aadhaar-enabled payment systems (AePS) and UPI have significantly expanded financial access, increasing inclusion from 25% in 2008 to 80% in 2024, particularly benefiting rural and underserved communities.

Boost to Digital Payments. The India Stack has fuelled exponential growth in digital payments, with UPI processing 10 billion monthly transactions. This has driven the rise of digital wallets, fintech platforms, and digitisation of small businesses.

Better Government Services. Aadhaar authentication has improved the delivery of government schemes like Direct Benefit Transfers (DBTs), Public Distribution System (PDS), and pensions, ensuring transparency and reducing leakages.

The India Stack: A Catalyst for Startup Success

The India Stack is fuelling startup innovation by providing a robust digital infrastructure. It enables entrepreneurs to build services like digital payments, eCommerce, and financial solutions for underserved populations. Platforms such as Aadhaar and UPI have paved the way for businesses to offer secure, seamless transactions, allowing startups like Paytm and BharatPe to thrive. These innovations are driving financial inclusion, empowering rural entrepreneurs, and creating opportunities in sectors like lending and healthtech, supported by global and domestic investments.

From Local Success to Global Inspiration

The impact of the India Stack’s success is being felt worldwide. Global giants such as Google Pay, WhatsApp, and Amazon Pay are drawing inspiration from it to enhance their global payment systems. Alphabet CEO Sundar Pichai plans to apply lessons from Google Pay’s Indian experience to other markets.

While India Stack has achieved significant success, there is still room for improvement. Strengthening data privacy and security is crucial as personal data collection continues to expand. The Digital Personal Data Protection Act aims to address these issues, but balancing innovation with privacy protection remains a challenge.

Bridging the digital divide by expanding Internet access and improving digital literacy, especially for rural and older populations, is key to ensuring that everyone can benefit from the India Stack’s advantages.

Governments worldwide struggle with intricate social, economic, and environmental challenges. Tight budgets often leave them with limited resources to address these issues head-on. However, innovation offers a powerful path forward.

By embracing new technologies, adapting to cultural shifts, and fostering new skills, structures, and communication methods, governments can find solutions within existing constraints.

Find out how public sector innovation is optimising internal operations, improving service accessibility, bridging the financial gap, transforming healthcare, and building a sustainable future.

Click here to download ‘Innovation in Government: Social, Economic, and Environmental Wins’ as a PDF

Optimising Operations: Tech-Driven Efficiency

Technology is transforming how governments operate, boosting efficiency and allowing employees to focus on core functions.

Here are some real-world examples.

Singapore Streamlines Public Buses. A cloud-based fleet management system by the Land Transport Authority (LTA) improves efficiency, real-time tracking, data analysis, and the transition to electric buses.

Dubai Optimises Utilities Through AI. The Dubai Electricity and Water Authority (DEWA) leverages AI for predictive maintenance, demand forecasting, and grid management. This enhances service reliability, operational efficiency, and resource allocation for power and water utilities.

Automation Boosts Hospital Efficiency. Singapore hospitals are using automation to save man-hours and boost efficiency. Tan Tock Seng Hospital automates bacteria sample processing, increasing productivity without extra staff, while Singapore General Hospital tracks surgical instruments digitally, saving thousands of man-hours.

Tech for Citizens

Digital tools and emerging technologies hold immense potential to improve service accessibility and delivery for citizens. Here’s how governments are leveraging tech to benefit their communities.

Faster Cross-Border Travel. Malaysia’s pilot QR code clearance system expedites travel for factory workers commuting to Singapore, reducing congestion at checkpoints.

Metaverse City Planning. South Korea’s “Metaverse 120 Center” allows residents to interact with virtual officials and access services in a digital environment, fostering innovative urban planning and infrastructure management.

Streamlined Benefits. UK’s HM Revenue and Customs (HMRC) launched an online child benefit claim system that reduces processing time from weeks to days, showcasing the efficiency gains possible through digital government services.

Bridging the Financial Gap

Nearly 1.7 billion adults or one-third globally, remain unbanked.

However, innovative programs are bridging this gap and promoting financial inclusion.

Thailand’s Digital Wallet. Aimed at stimulating the economy and empowering underserved citizens, Thailand disburses USD 275 via digital wallets to 50 million low-income adults, fostering financial participation.

Ghana’s Digital Success Story. The first African nation to achieve 100% financial inclusion through modernised platforms like Ghana.gov and GhanaPay, which facilitate payments and fee collection through various digital channels.

Philippines Embraces QR Payments. The City of Alaminos leverages the Paleng-QR Ph Plus program to promote QR code-based payments, aligning with the central bank’s goal of onboarding 70% of Filipinos into the formal financial system by 2024.

Building a Sustainable Future

Governments around the world are increasingly turning to technology to address environmental challenges and preserve natural capital.

Here are some inspiring examples.

World’s Largest Carbon Capture Plant. Singapore and UCLA joined forces to build Equatic-1, a groundbreaking facility that removes CO2 from the ocean and creates carbon-negative hydrogen.

Tech-Enhanced Disaster Preparedness. The UK’s Lincolnshire County Council uses cutting-edge geospatial technology like drones and digital twins. This empowers the Lincolnshire Resilience Forum with real-time data and insights to effectively manage risks like floods and power outages across their vast region.

Smart Cities for Sustainability. Bologna, Italy leverages the digital twins of its city to optimise urban mobility and combat climate change. By analysing sensor data and incorporating social factors, the city is strategically developing infrastructure for cyclists and trams.

Tech for a Healthier Tomorrow

Technology is transforming healthcare delivery, promoting improved health and fitness monitoring.

Here’s a glimpse into how innovation is impacting patient care worldwide.

Robotic Companions for Seniors. South Korea tackles elder care challenges with robots. Companion robots and safety devices provide companionship and support for seniors living alone.

VR Therapy for Mental Wellness. The UAE’s Emirates Health Services Corporation implements a Virtual Reality Lab for Mental Health, that creates interactive therapy sessions for individuals with various psychological challenges. VR allows for personalised treatment plans based on data collected during sessions.

Zurich will be the centre of attention for the Financial and Regulatory industries from June 26th to 28th as it hosts the second edition of the Point Zero Forum. Organised by Elevandi and the Swiss State Secretariat for International Finance, this event serves as a platform to encourage dialogue on policy and technology in Financial Services, with a particular emphasis on adopting transformative technologies and establishing the necessary governance and risk frameworks.

As a knowledge partner, Ecosystm is deeply involved in the Point Zero Forum. Throughout the event, we will actively engage in discussions and closely monitor three key areas: ESG, digital assets, and Responsible AI.

Read on to find out what our leaders — Amit Gupta (CEO, Ecosystm Group), Ullrich Loeffler (CEO and Co-Founder, Ecosystm), and Anubhav Nayyar (Chief Growth Advisor, Ecosystm) — say about why this will be core to building a sustainable and innovative future.

Download ‘Building Synergy Between Policy & Technology’ as a PDF

Recognising FinTechs that are changing lives, creating impact, demonstrating innovation, and building ecosystems to shape the Digital Future.

CATEGORIES:

Global Platform. Organisations that provide a platform to bring together industry stakeholders such as financial services institutions and FinTechs to drive ease of collaboration and innovation by accelerating proof of concept deployments

Financial Inclusion Impact. Organisations that promote financial inclusion in the unbanked and the underbanked with a focus on bridging the economic divide

Sustainable Finance Impact. Organisations that promote sustainable finance and have ESG values

Global Banking. Banks and financial services organisations that embrace digital technology for excellence in customer experience, process efficiency and/or compliance

Global Payments. Innovative use of technology and business models in payment areas

Global Lending. Innovation in alternative finance in areas such as microfinance for individuals and small & medium enterprises, P2P lending and crowdfunding

Customer Experience. Organisations that are driving an exceptional experience for their customers and setting new benchmarks within the industry

Global InsureTech. Excellence and innovation in InsureTech in areas such as micro-insurance, usage-based pricing, process optimisation and underwriting efficiency

To find out about the winners, read on.

To download Ecosystm Red: Global Digital Futures Awards for FinTech Awards Winners as a PDF, please click here.

It is estimated that nearly 1.7 billion adults remain unbanked globally. Besides the unbanked there are large sections of the world that are underbanked or underserved because of geographical, educational and gender divides. And then there are the entrepreneurs and small and medium enterprises that find it harder to secure funds.

There are several ongoing initiatives by policy organisations, governments, corporates and FinTechs that aim to fulfil the goal of creating an inclusive world.

This Ecosystm Snapshot looks at some recent examples from central banks such as MAS, RBI, BSP Philippines, the Royal Monetary Authority of Bhutan; financial services providers such as Mastercard and Citi; and FinTechs such as Microchip Payments and Sempo.

To download this VendorSphere as a PDF for easier sharing, please click here.