Global supply chains were impacted early and badly by the COVID-19 pandemic. The fact that the pandemic started in China – the leader in the Manufacturing industry – meant that many enterprises globally had to re-evaluate their supply chain and logistics. This was compounded by the impact on demand – for some sectors the demand went down significantly, while in others, especially for items required to fight the crisis, there was an unexpected spike in demand. There was also the need for many manufacturers and retailers to shift to eCommerce, to directly access the market and sustain their businesses. These sudden shifts that were required of the industry, opened up the need for a global supply chain that is more integrated, agile and responsive.

Last week, global heavyweights with a stake in the global supply chain, joined a consortium to work on creating that agility. This includes PepsiCo, BMW, Shopify, DHL, and the United States Postal Service and some emerging tech companies. The alliance will actively work on solutions to embed automation and digitalisation in the logistics and supply chain systems. While this consortium was formed last year, recent events have accelerated the need to fix a global problem.

Co-Creation and Innovation

LINK is a collaborative ecosystem, co-founded by Innovation Endeavors and Sidewalk Infrastructure Partners (SIP) to bring together emerging tech start-ups, institutions and global organisations to innovate and make supply chains resilient. The tech start-ups involved include the likes of Fabric, that has large automated micro-fulfillment centres for faster deliveries, and Third Wave Automation, that has developed automated forklifts with enhanced safety measures.

LINK aims to transform global supply chains, with the use of technologies such as automation, IoT, AI, and Robotics. The solutions developed by the start-ups will be tested in real-life situations, often in large organisations with complex operations. On the other hand, the start-ups will have access to the internal systems of these large organisations to understand the data and their organisational needs.

Ecosystm Principal Advisor, Kaushik Ghatak says, “COVID-19 has brought the need for supply chain agility and resilience to a completely new level of criticality. Companies in the ‘New Normal’ will need higher levels of nimbleness and flexibility to be able to recover from this crisis quickly and sustain in an increasing disruptive world. Increased ability to sense and respond to disruptions will be key to success. It will require better visibility of their entire supply chain, increasing efficiencies, building necessary redundancies (in form of inventory and capacity) where they are required the most – redundancy comes at a cost – and being flexible and innovative to cater to the rapid market and supply-side changes. Rapid digitalisation to build such capabilities will be a key to success.”

“Managing such rapid changes is usually a struggle for organisations with large and complex supply chains, because of the years of past practices, systems and culture. For them Innovation is a must, but the path to innovation is difficult. The LINK collaboration model is the right step towards addressing that challenge. Collaborating with start-ups can infuse new ideas, more innovative ways of solving a problem and rapid testing of use cases in the areas of IoT, AI and automation.”

Involving Start-ups for Innovation

This initiative is a great example of how larger enterprises are looking to leverage innovations by the start-up community. The Financial Services industry has been an early beneficiary, when it stopped competing with Fintech organisations, partnering with them instead. Other industries have started to recognise the benefits of fast pivots and the role start-ups can play.

Ecosystm Principal Advisor, Ravi Bhogaraju says, “Bringing together companies that have complementary and unique capabilities to solve industry issues is a great way to speed up experimentation and innovation.”

However, he recognises that forming alliances such as this, comes with its own set of challenges. “One of the key things to recognise in such a construct is that the team members from different possessions bring with them their unique belief systems, organisational and country cultural constructs. Expectations on how things should work, can become quite tricky to navigate. The talent and expertise in such an environment need to be facilitated be able to deliver high quality outcomes.”

Talking about how these constructs can work successfully, delivering what started out to deliver, Bhogaraju says, “An agile team setup can help tremendously as it uses two key principles – People and Interactions over processes; as well as Working models over documentation.”

“A clear expectation setting through contracting at the beginning of the project cycle can help establish the ways of working and rules of engagement. Increased regular feedback and problem solving should continuously fine tune the ways of working. This way teams can get through the norming process at pace and scale and eventually focus on outcomes, rather than fumble over each other and/or have ego flareups.”

“The key is to get to creative problem-solving working cohesively – the intent being to challenge the status quo – stepping outside the box and using all capabilities within the team. Blending the subcultures together using agile way of working and principles, can be a fantastic way to make that happen – failing which you have the challenge of trying to somehow bring together different work products, people and preferences.”

One of my Twitter followers who is stressing about her kids going back to school this Fall was wondering if hotels could start offering elearning assistance as part of the re-purposing of their facilities.

Is this part of a digital hotel of the future? This digital hotel is a facility that is welcoming, hospitable, warm and can be used as a multi-functional space. Traditional revenue generation is measured in revenue from room nights, but given that instability in current demand, the facility can be re-purposed to highlight its network-enabled footprint. This is where global design strategies that leverage technology come into play, with a focus on integrative design for use. Digital classrooms, art exhibitions, alternatives to working from home – many things are possible.

With travel restrictions and hygiene and health concerns, hotels and tourism locations globally are having to pivot to a different way of doing business this year. Agility is critical, and how we measure agility and employ agility differentiate us.

I will explore the alternative view on recovery looking at the impact of COVID-19 on organisations in the hospitality industry and how they are pivoting digital priorities to adapt to the New Normal.

This post will focus on two aspects of the use of digital technology – more innovative ways to view industry recovery, and re-imaging the use of the physical asset from its traditional uses to more creative, digitally enabled functions.

Moving Towards A Different View of Recovery

Since Online Travel Agents (OTA) entered the scene, the hotel industry became obsessed with simple adjustments of rates. Revenue managers focus on analysing, forecasting, and optimising hotel inventory through availability restrictions and dynamic rates. This has become key in measuring a hotel’s demand.

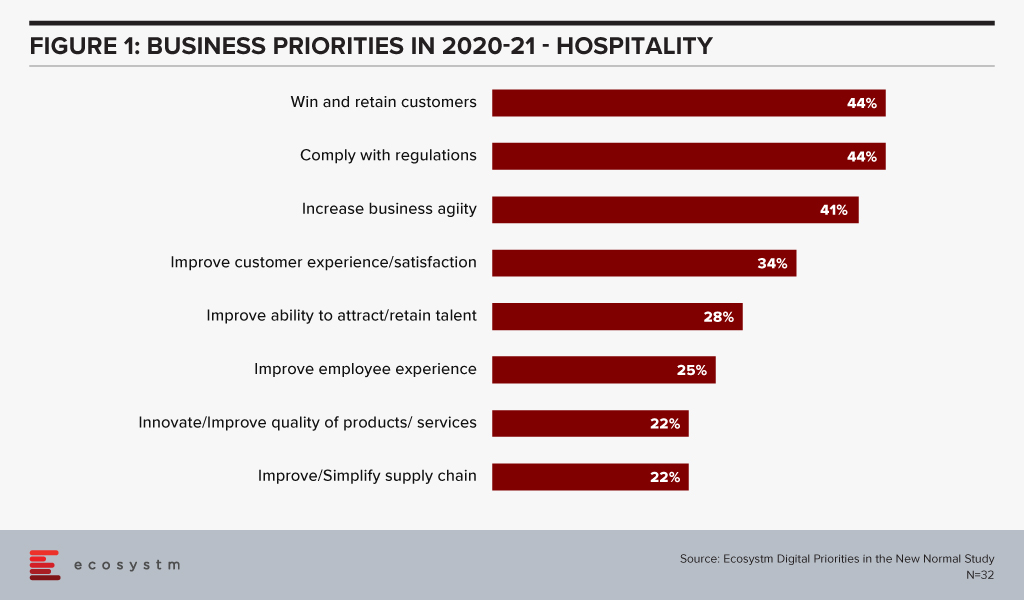

RevPAR, or revenue per available room, is one of the traditional and still the most instilled metrics in the industry. But given demand issues with the pandemic, is revenue forecasting per room the best way to examine hotel recovery? A traditional view on revenue fails when hotel closures and uncertainty on opening impact the ability to forecast and to determine capacity. As seen in Figure 1, both winning customers and increasing agility are paramount to recovery.

When a destination becomes inaccessible to the traditional clientele, your actual location becomes relevant to a different set of customers. This is for different reasons – so hotels must find different ways to leverage the resources and assets of the business.

One way of looking at this is by re-imaging the use of the physical assets and a suggested approach is looking towards profit planning and management with ProfPASF or Profit per Available Square Feet. We look at hotel construction costs this way, so it stands to reason that utilisation of the asset might also be examined from a cost benefit perspective.

Impact on Digital Transformation

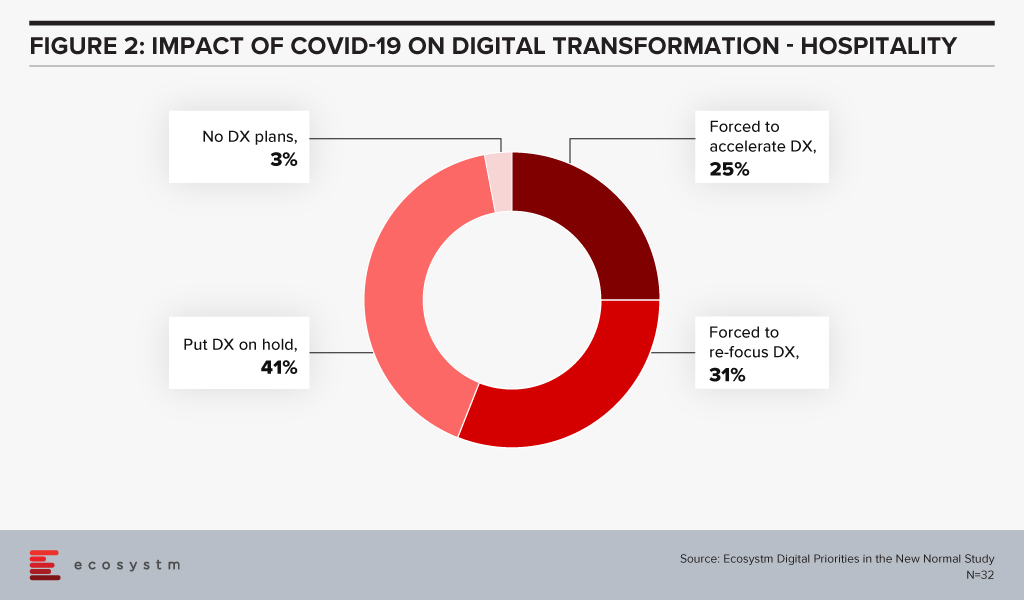

Where does technology play a role in re-imaging Hospitality? As an enabler, a facilitator, a business model supporter? How does the process of Hospitality need to change, and how can technology help? As seen in Figure 2, hotels have had to accelerate and modify their plans.

The structural assets of the business must either be repurposed or repackaged to take travel restrictions and hygiene and safety concerns into account.

There are several good examples of hotels who have had the ability financially to rethink and restructure the footprint to address issues that have come from the pandemic. The ones that already planned renovations prior to the crisis have added hygiene aspects such as improved ventilation and less porous floors and fabrics in the selection of materials used. And adding better spatial design to public spaces has allowed them to reinforce the concept of luxury. Documented renovation can be seen in innovative design work by Onyx Hospitality Group, Blink Design Group, independent brand View Hotels and Banyan Tree Holdings.

But this does not mean the hotel or destination must make the investment alone, or even all on-site. Using systems integrators and cloud resources to create digital enabled platforms for guest management, hygiene process management and physical mapping of the capacity of the facility using sensors and mobile are all methods for enabling the digital acceleration of tech investment in the property.

And personalisation of the experience is key, which leads to a discussion of personal data usage and management.

Social Distancing and the Hotel of the New Normal

Retailers, hoteliers and convention centres have the same thing in common, they are all physical locations trying to become safe yet contactless, socially distant yet memorable at the same time. As we have mentioned in previous reports, the comfort, safety and hygiene of the customer is paramount for their return to Hospitality. Using customer location data on a reliable online platform to track their movement, enable their facilities and services and limit the density of customers per square metre for health, safety and comfort are all aspects of tech-enabled social distancing.

Imagine that you are considering a day stay, for home working alternative or for having a local event. This needs to be within the sanctioned numbers of your locale. Guests want to know the population density of the location to determine their comfort level. Having a mobile app where potential visitors can see the state of the visitor density of the hotel would provide reassurance as to a safe visit.

Rich Contactless Content

With the encouragement of expanding the scope of technology and social distancing given priority, automated or contactless transaction technologies have seen an increase in implementation in the last six months. Having sensors and IoT technology implemented to see the footprint of the facility in use provides real-time insight for both the customer and the hotel, as to usage.

In order to be able to highlight the functions of both the room and the facility, augmented reality (AR) can demonstrate the use of interactive elements within hotel rooms without human contact.

AR applications within the hotel sector include offering in-house interactive elements (such as location maps and relevant points of interest). These provide digital history of the property and supply guests with relevant information when they are located within certain areas of the hotel (such as a menu if they happen to enter a restaurant).

Use of Space: Location & Hygiene for a Better Experience and as a Precaution

Hotel environments have evolved to add a healthcare layer, including well-being programs, and individual room controls. This includes materiality/ sanitised covering that protects against the spread of infection with clearly defined and explained roll-out cleaning protocols.

Accor has launched the Cleanliness & Prevention ALLSAFE label, and other brands like Hilton, Hyatt and IHG have tried to brand hygiene into the experience. But the challenge for many is how to restructure and re-image space utilisation to make it both pleasurable and secure.

Data for Purpose

With contact tracing in the news, many of us are already aware of the digital footprints we leave everywhere we go. And people have a wide variety of personal responses to this.

So how does a hotel use the information a guest either willingly offers or the hotel learns via services provided? If the hotel knows preferences prior to arrival, should they customise the room accordingly? Lighting, scent, preferred pillow choice, allergies – all are useful information. But what if preferences change or implementations are seen to be presumptuous?

Hilton is continually updating its guest technology offerings, from increasing in-app functionality to making further improvements to the entertainment system. One of their ideas is allowing guests to load personal or family pictures. These display on the TV, giving their hotel room more of a familiar sense of home.

And to be both keyless and cashless means the hotel needs to be mobile data enabled. All of this data, including mobile data, should flow like fine wine. But to do that requires knowledge, and learning – gained from experience and AI. How can I check your preferences are still the same? How should I use information I collected on you from a previous stay? Is that data kept on your mobile device, or on my hotel server? Is this in the cloud or on-premise in some manner?

Using Data and Intelligence for Personalised Experiences

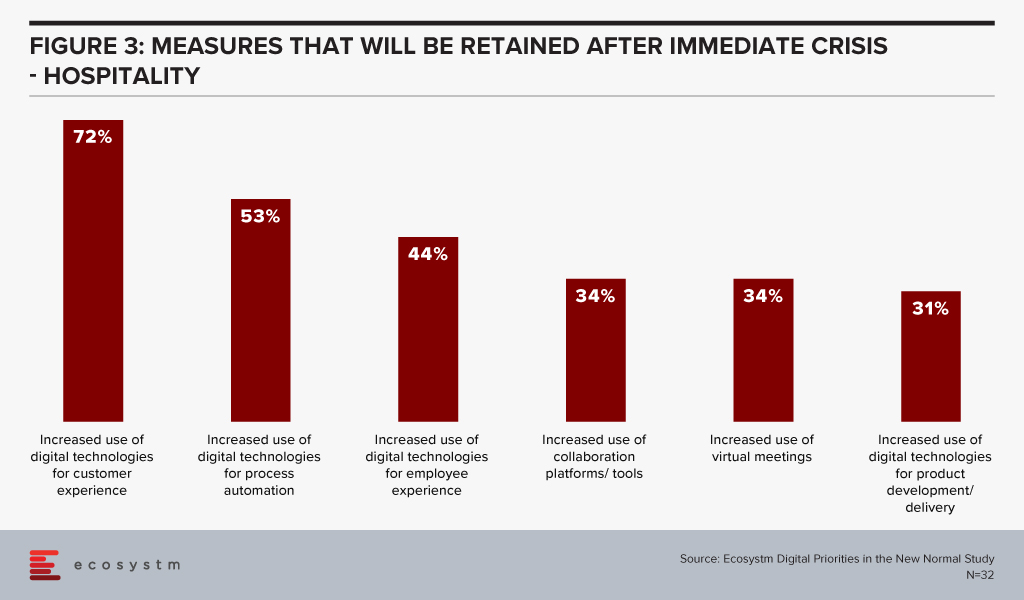

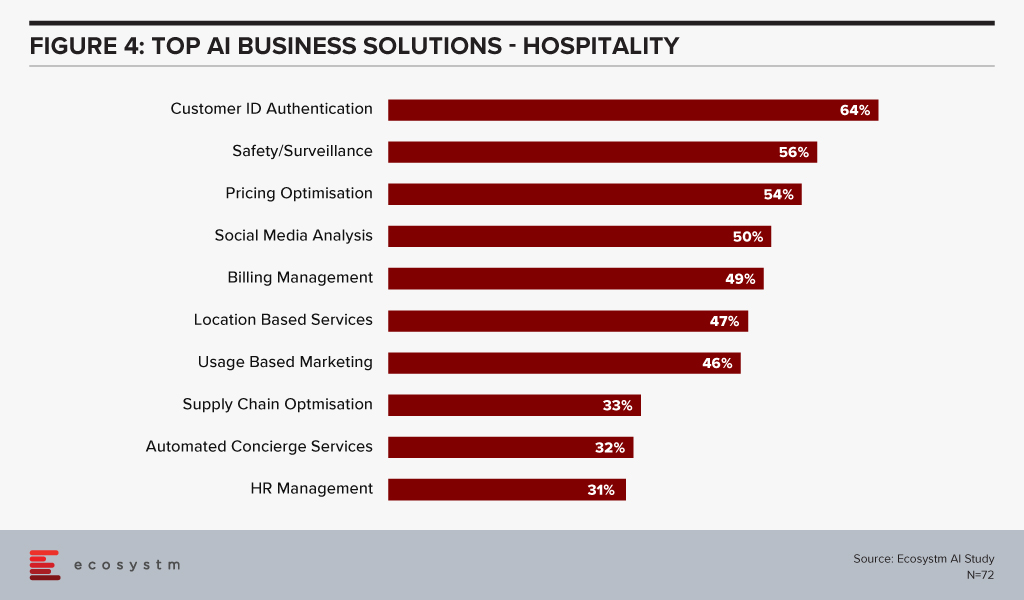

The final point shown in Figure 3 from the Ecosystm Digital Priorities in the New Normal study on technology direction from the pandemic, combined with Figure 4 from the Ecosystm AI Study showing the use of AI, highlights the need for technologies that support customer experiences and automate processes. Whether it is customer authentication at check-in, virtual customer assistance or rate pricing for appropriate engagement, technology can enable guest appreciation.

Summary – Three Post-Pandemic Takeaways

1. Demand for rooms will have to be viewed differently during this period, and cancellation policies already reflect this. To view recovery, use metrics that look at how the whole asset is being used on a physical basis.

2. Re-imagination of the physical asset will involve some agility and re-purposing within the business. Technology can help enable this, with some wise additions to add value. Voice, IoT and contactless mobile apps all are good candidates for enablement.

3. Data helps with understanding of guest preferences and can be used for staff learning and knowledge. But it must be held and used correctly. Listen carefully to what the guest is telling you and respond accordingly.

Never before has the world experienced a shutdown in both supply and demand which has effectively slammed the brakes on economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises and the telecommunications industry has been the pillar which has kept the world ticking over.

It is unthinkable just how the human race would have coped with such massive disruption, two decades ago in the absence of broadband internet. The technology and telecom sector has seen a rise in their visible importance in recent months. Various findings show that peak level traffic was about 20-30% higher than the levels before the pandemic. The rise in traffic coupled with the fervent growth of the digital economy augurs well for the technology and telecom sector in Southeast Asia.

Revenues Hit Despite Rise in Traffic

Unfortunately, the rise in network traffic has not translated to an increase in revenue for many operators in the region. The winners, that enjoyed YoY growth in Q1 2020 despite challenging circumstances were: Maxis (4.9%) and DiGi (3.4%) in Malaysia; dtac (3.3%) and True (5.7%) in Thailand; PDLT (7.5%) and Globe (1.4%) in the Philippines; and Indosat Ooredoo (7.9%) and XL Axiata (8.8%) in Indonesia. The telecom operators that struggled include: Celcom (-6.1%) and TM (-8.0%) in Malaysia; Singapore’s trio of Singtel (-6.5%), StarHub (-15.2%) and M1 (-10.3%); and AIS (-1.0%) in Thailand.

Key market trends include a dip in prepaid subscribers due to fall in tourist numbers, roaming income losses due to travel restrictions, and a general decline in average revenue per user (ARPU) due to weaker customer spend. The postpaid customer segment was resilient while the fixed broadband revenue stream was stable due to the increase in work from home (WFH) practices. With fixed tariffs, there are no incremental gains with an increase in usage. Voice revenue has been hit with the increase in collaboration-based communication applications such as Zoom and Microsoft Teams.

Equipment sales fell as global supply chains were severely disrupted and impacted new sign-ups of the more premium customers. Most markets in Southeast Asia depend on retail outlets as a key channel to the market, which has been hampered.

With the job losses across the world, bad debts and weakened customer spend is inevitable and it is imperative that the operators provide for reflective pricing strategies, listen to new customer requirements to ensure customer retention and strengthening of their market position. In May, Verizon’s CEO Hans Vestberg said nearly 800,000 of their subscribers were unable to pay their monthly bills. Discussions with operators in Southeast Asia also highlighted this as a current concern.

Enterprise Segment Target for New Growth

Ecosystm research shows that enterprises in Southeast Asia are increasingly considering telecom operators as go-to-market partners (Figure 1). Enterprises are demanding more than just devices and connectivity and with the fervent digital transformation (DX) efforts underway, services such as managed services, business application services, cybersecurity and network services are in demand. Technology vendors have an opportunity to partner with the right telecom operator in each market to enhance their IT market offerings, ahead of the 5G rollouts.

The broad 5G ecosystem inculcates cross-sector innovation and greater collaboration leading to new business models and exciting new opportunities. Singtel is the leading operator in the region and has the enterprise segment contributing approximately 65% to its revenue in its domestic market. In the World Communications Award 2019, Singtel won both “Best Enterprise Service” and “The Broadband Pioneer” awards. This places Singtel in a fine position to capitalise on the 5G enterprise services.

5G Needed Now More Than Ever

The pandemic has seen a rise in network traffic, onboarding of the digital customer and rapid DX of businesses which has whetted the appetite for faster broadband speeds and new services. Southeast Asia countries stand to profit from the trade war between the US and China and 5G features of low latency and higher security can boost adoption of IoT, Smart Manufacturing and broader Industry 4.0 goals to drive the economy.

Fixed Wireless in Southeast Asia is expected to be very popular considering the low penetration of fibre to the home (with the exception of Singapore) and will provide enterprises with a viable secondary connection to the internet. Popular applications – including video streaming and gaming – which are speed, latency and volume hungry will also be a target market for operators. Mobile operators that do not have a fixed broadband offering can enter this space and provide a serious “wireless fibre” alternative to homes and businesses.

Governments and telecom regulators ought to make spectrum available to the major telecom operators as soon as possible in order to ensure that the cutting edge 5G communications services are made available to consumers and businesses. Many experts believe 5G can raise the competitiveness of a nation.

Recent research from World Economic Forum (WEF) has found that significant economic and social value can be gained from the widespread deployment of 5G networks, with 5G facilitating industrial advances, productivity and improving the bottom line while enabling sustainable cities and communities. GSMA notes that mobile technologies and services in the wider Asia Pacific region generated USD 1.6 trillion of economic value while the mobile ecosystem supported 18 million jobs as well as contributing USD 180 billion of funding to the public sector through taxation.

US-China Trade War Threatens to Change Equipment Supplier Landscape

Despite severe pressures caused by the US-China trade war, Huawei posted an impressive 13.1% YoY growth in 1H 2020 registering revenue of USD 64.88 billion. Both Huawei and ZTE generate approximately 60% of their business from their domestic markets which is critical with the current unfavourable global sentiments. Huawei has diversified its business and built its consumer devices business which should withstand the disruptions caused by the political challenges.

Ericsson and Nokia stand to benefit from Huawei’s current global position and this was evident with the wins for the 5G contracts by Singtel and JVCo (Singtel and M1). The JVCo announced it selected Nokia to build the Radio Access Network (RAN) for the 5G standalone (SA) mmWave network infrastructure in the 3.5GHz radio frequency band. Singtel selected Ericsson to provide for the RAN on the same mmWave network.

However, while there is an opportunity for NEC and Samsung to join the party, Huawei is expected to do well in most other countries in Southeast Asia.

The Rise of the Digital Economy in Southeast Asia

A recent Google report valued the internet economy in Southeast Asia at USD 100 billion in 2019, more than tripling since 2015, and the sector is expected to hit USD 300 billion in 2025. With a population of approximately 570 million people, the region has some of the fastest-growing internet economies in the world.

The Indonesia market is the largest in the region and is expected to hit USD 133 billion from USD 40 billion in 2025. Indonesia’s lack of a world-class telecom infrastructure coupled with their slowness in 5G adoption has not impeded the country’s attractiveness for global technology investors who see the 270 million population as an immense opportunity. US tech giants, Facebook, Google, and PayPal have invested in Indonesia to reap the benefits from the growing digital economy powered by unicorns such as Gojek, Bukalapak, Tokopedia. In June 2020, Google Cloud launched in Jakarta, only the second in the region after Singapore with the four big unicorns being anchor customers.

In 2025, Google predicts Thailand to be the second-largest internet economy worth USD 50 billion. The internet economy for Singapore, Malaysia and the Philippines are estimated to be over USD 27 billion each. Shopee and Lazada are the top eCommerce apps in the region and have seen an increase in sales due to the disruption in the Retail industry. In-store shopping contributes to more than 50% of Retail in Singapore and Malaysia – this provides a tremendous opportunity for eCommerce players.

While movement restrictions are gradually being lifted, some things may never return where they were before COVID-19. Public debts have risen with numerous aids and handouts impacting economic growth forecast and rising unemployment is impacting customer spending power. On the plus side, DX of businesses and sharp onboarding of customers have redefined interactions, and sectors such as Education, are going online which will boost the digital economy. While the challenges are evident, exciting times are ahead for the technology and telecom sector in Southeast Asia.

Last week, HPE announced that they will acquire Silver Peak – the wide area networks (WAN) specialist, including WAN optimisation and Software-Defined (SD-WAN) – in a deal worth USD 925 million. The move is in line with HPE’s Intelligent Edge strategy and their intention to provide a comprehensive edge-to-cloud networking solution.

HPE Building Intelligent Edge Capabilities

In 2018, HPE announced their intention to invest USD 4 billion over the next 4 years, to build an Intelligent Edge offering. This acquisition will give them the ability to combine the Aruba Edge Services platform with Silver Peak’s SD-WAN platform, to provide next-generation networking solutions.

In 2015, HPE acquired Aruba for USD 3 billion to strengthen capabilities on integrated and secure wireless technology and to support the access to cloud application, at a faster speed. Bringing together the innovation and technology capabilities of both units will accelerate HPE’s edge-to-cloud strategy to enhance distributed cloud models for application and data services for users.

Ecosystm Principal Advisor, Ashok Kumar says, “HPE leaped into the wireless local area networks (WLAN) space with the acquisition of a major enterprise Wi-Fi network vendor Aruba Networks, five years ago. With the acquisition of SD-WAN vendor Silver Peak last week, HPE extends enterprises’ reach with its Intelligent Edge portfolio. The synergy of Aruba and Silver Peak provides a fuller enterprise networking portfolio of solutions for HPE.”

The acquisition has been announced as markets are gearing towards recovery and organisations are opting for a more distributed working environments with remote employees. Kumar says, “The convergence area of networking and security at the enterprise edge is a high growth area that has accelerated due to the COVID-19 pandemic to address the remote worker’s needs.”

The current situation, compounded by the 5G rollouts in several global markets, is also forcing telecom operators to transform their business models. Telecom providers will now have to increasingly target B2B opportunities. Last month also saw HPE announce their Edge Orchestrator, a SaaS offering bringing lower latency, optimised bandwidth and improved security and privacy for telecom providers and their own enterprise customers to take advantage of 5G. Aruba Networks also rolled out a cloud native platform, Aruba ESP that has AIOps, Zero Trust network security and a unified infrastructure for data centres capabilities, to support remote operations.

“HPE’s success in this area will be dependent upon the tight integration of the two product line portfolios, and the channels of distribution, to effectively address the needs of enterprises at the edge with smarter solutions,” says Kumar.

The Growing Importance of SD-WAN

In the report, The Top 5 Telecommunications & Mobility Trends for 2020, Ecosystm had noted the growing significance of SD-WAN for enterprises, as they undertake Digital Transformation (DX) journeys and require more responsive and self-sustaining networks. The entire network infrastructure will have to be software-centric allowing for agility, scalability, and normalising costs with business growth. This has proved to be especially true in the wake of the current crisis.

“The network is a foundation on which a significant amount of Digital Transformation (DX) becomes possible, so as companies move through their DX journeys, often changing course, the network will need to adapt with them. AI, virtualisation and SD-WAN will bring increasing levels of flexibility as they lessen the need for specialised hardware, centralise control, and speed up configuration changes.

The availability of high-bandwidth, low latency networks coupled with SD-WAN will allow enterprises to shift away from thinking of their network as a physical space and start seeing it as a set of capabilities, taking work beyond a physical address. Equipment will be increasingly centralised in data centres (possibly on the Edge) to provide the ability to truly work anywhere.”

Download Report: The Top 5 Cloud Trends For 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Cloud Trends For 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the top 5 Cloud trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources.

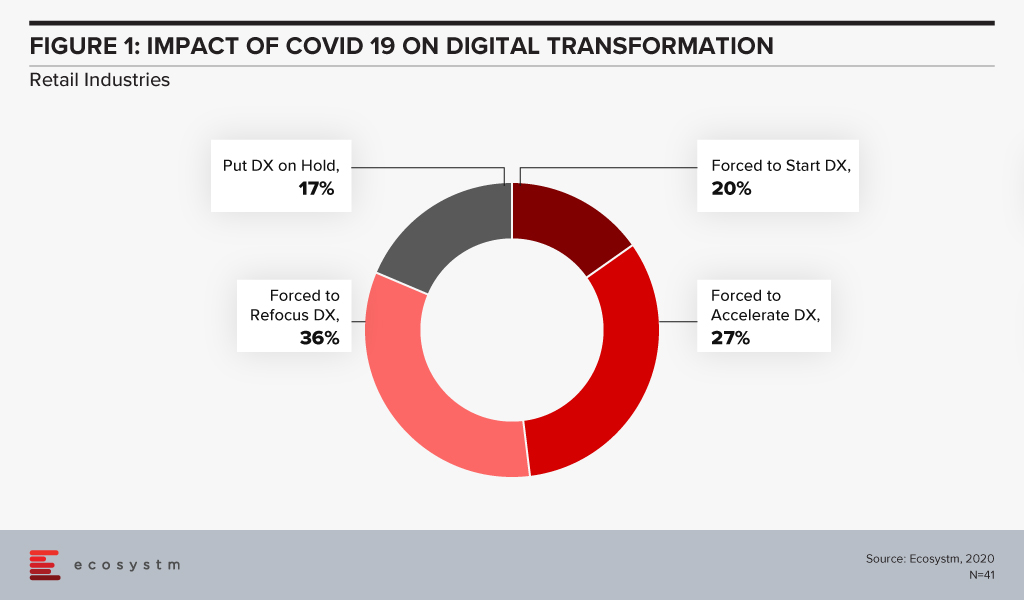

The Retail industry has been one of the hardest-hit industries during the COVID-19 crisis. The industry had to pivot faster than many to cater to an evolving market need and customer expectation, amidst social distancing measures and supply chain disruption. Ecosystm’s Digital Priorities in the New Normal study finds that nearly 83% of organisations in Asia Pacific’s Retail industries were forced to work on digital transformation (DX) in the aftermath of the crisis (Figure 1).

Retail organisations that had not walked the DX path found themselves struggling to cope in recent times. Ecosystm Principal Advisor, Alan Hesketh says, “Digital transformation in retail, as represented by deep customer understanding and omnichannel operations, is far from new. Industry leaders launched these activities almost 20 years ago and continue to aggressively develop these capabilities. Retailers not actively leveraging these capabilities to understand their customer preferences are at a massive competitive disadvantage.”

Anta Group Accelerates DX

The Anta Group, a sports products manufacturer based in China with over 12,500 stores, has launched a group-wide digital platform designed and deployed by IBM Services based on SAP S/4HANA. The initial phase of Anta Group’s DX included creating intelligent workflows and was completed in January 2020. This enabled the company to adjust its retail operations and switch to quickly to online channels during the COVID-19 pandemic.

Like any retail organisation, the Anta Group realised that their product offerings had to be diverse to cater to an evolving customer base. This growth required an upgrade to a group-level management platform to help the business run more efficiently across the entire value chain of procurement, supply, production and sales. The SAP S/4HANA platform gives the senior management a single view of data across business units to help with better decision making regarding production and sales optimisation. The company claims to have improved its supply chain efficiency by 80%, that has led to faster delivery and business growth even in these difficult times.

IBM Services has a role to play in providing the business intelligence required for agile decision-making. By integrating data from multiple sources – retail stores, multi-brand products, channels, customers, suppliers and finance teams – on the one platform can help Anta Group to settle accounts quickly and issue business analysis reports for different entities as well as a real-time view of the operation across the organisation.

Hesketh says, “Retailers must have an accurate, timely understanding of their customers’ behaviour and resulting sales performance. COVID-19 has dramatically increased the volatility of sales, making rapid recognition of changes essential. For those lagging in their digital transformation to acquire this understanding, an attractive option is partnering with organisations with demonstrated relevant capabilities; in this case with SAP, for the capabilities and performance of their in-memory product, and IBM for their configuration and implementation expertise.”

IBM and SAP evolving their partnership

In 2016, IBM and SAP had expressed intentions of increasing investments to help their customers on their DX journeys. As some economies move into the recovery phase, all businesses will be forced to transform – or keep transforming if they are already along that path. Last month saw IBM and SAP announce the evolution of their partnership with new offerings to help businesses transform faster. The next evolution of the IBM and SAP partnership aims to focus on faster DX time to value, innovation through industry-specific offerings, customer and employee experiences and providing flexibility and choice to organisations to run their workloads in hybrid cloud environments.

Hesketh adds, “But the product and implementation partners are, while important, not the real determinant of the success of DX activity and time to value. Retailers must recognise and commit to the strategic reshaping of their business, taking their large workforces with them on the journey. This is a high-risk change. A strong relationship between product vendor and implementation partner, as SAP and IBM demonstrate here, assists in reducing, not removing, this risk.”

Technologies to automate IT systems and relieve over-stretched IT operations teams have been moving into the mainstream over the last few years. Several factors, driven by the digital era, have made this necessary. Firstly, digital transformation is creating ever-larger IT environments and volumes of data that cannot be managed by manual processes. These distributed systems are also becoming more complex, incorporating IoT, mobile, multi-cloud, containers, and APIs. Moreover, for digital businesses, the financial impact of an outage makes time to resolution critical. Identifying and remediating issues before they affect the user is now paramount. AIOps provides intelligence to the IT operations team that allows them to proactively resolve events before they become outages.

Augmenting IT Operations with AIOps

AIOps allows IT operations teams to not only ensure observability of their systems and reduce noise but to also understand how events are interacting together to affect performance and take corrective action quickly. The primary features of AIOps are:

- Noise reduction. AIOps ingests systems data, surfaces priority anomalies and correlates them together. This brings the number of incidents to investigate back down to a human level. Rackspace recently announced that AIOps helped it reduce alert noise by 99% during the initial stage of its rollout. Successful vendor references typically cite similar figures between 95-99%.

- Root cause analysis. Once priority events have been correlated, AIOps identifies a root cause to enable the operations team to focus its efforts on a resolution. This is a task that proves challenging to perform at speed for a human operator considering the complexity of today’s systems.

- Proactive response. A range of responses is available with AIOps, from directing issues to the appropriate people, to recommending actions that can be taken by operators directly in a collaboration tool, to rules-based workflows performed automatically, such as spinning up additional AWS EC2 instances.

- Learning. By evaluating past failures and successes, AIOps can learn over time which events are likely to become critical and how to respond to them. This brings us closer to the dream of NoOps, where operations are completely automated.

The Impact of COVID-19 on IT Operations

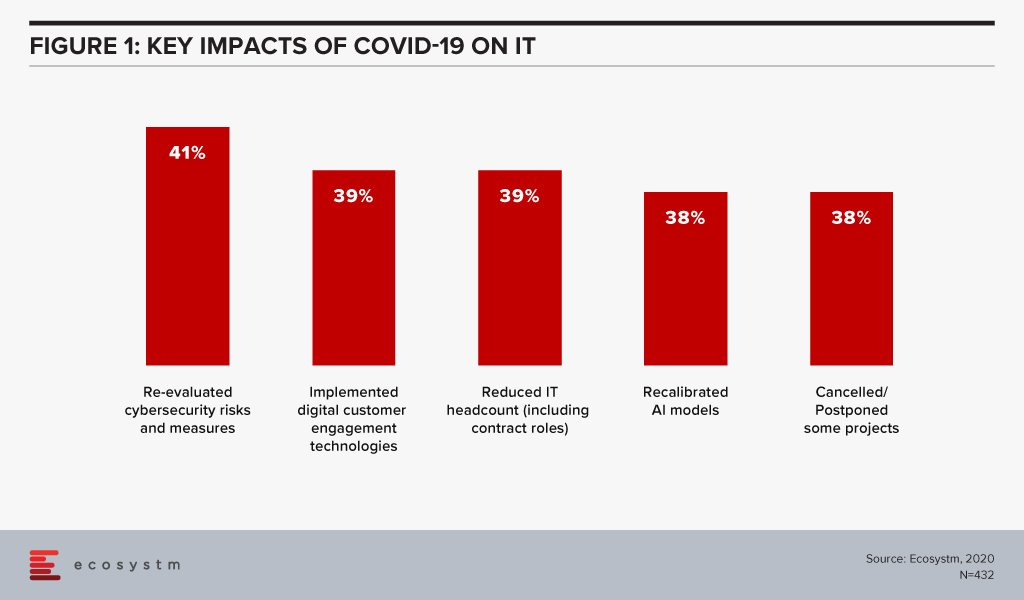

The Ecosystm Digital Priorities in the New Normal study launched this month, asks technology users about how their digital priorities have shifted during the pandemic. Despite pressure to shift to digital delivery, almost 40% of participants reported that their organisations cut headcount in the IT department (Figure 1). Furthermore, over one third had been forced to cut their employees’ salaries. As we have seen in previous crises, IT operations teams are being asked to do more with less and will need automation to bridge the gaps.

As we begin to move into the next phase of the COVID-19 reality and businesses continue to open, we will see many launch digital services that were conceived of during the crisis. One of the greatest challenges that IT departments face will be scalability as digital businesses grow. AIOps will be a go-to tool for IT operations to ensure uptime and improve user experience. It is likely that the next 12-18 months will be a watershed moment for AIOps.

NLP and the Democratisation of Data

Natural Language Processing (NLP) will be the next string in the bow of AIOps. While the ultimate goal of IT operations is to identify and remediate situations before they have an impact on the user, oftentimes it is the service desk that generates the initial barrage of alerts. AIOps equipped with NLP can extract relevant data from user tickets, correlate them with other system events and potentially even suggest a resolution to the user. Here, ChatOps can help to reduce the workload on the service desk and bring relevant events to the attention of the operations team faster. NLP will also help democratise IT operations data within the organisation. As they digitalise, lines of business (LoBs) besides IT will need access to system health and user experience data but business managers may not have the necessary technical skills to extract them. Chatbots that can return these metrics to non-technical users will begin to proliferate.

AIOps Recommendations

Most IT departments would have discovered the limitations of their current systems during the upheaval caused by recent lockdowns. Only about 7% of organisations in our study reported that they were well-prepared across all areas of IT, to handle the COVID-19 crisis. For those organisations that have yet to invest in AIOps, we recommend starting now but starting small. Develop a topology map to understand where you have reliable data sources that could be analysed by AIOps. Then select a domain by assessing the present level of observability and automation, IT skills gap, frequency of outages, and business criticality. As you add additional domains and the system learns, the value you realise from AIOps will grow.

The power of collaborative AIOps tools would have been undeniable as the COVID-19 crisis began and IT departments were forced to work in a distributed manner. When evaluating a system, carefully consider how it will integrate into your organisation’s preferred collaboration suite, whether it be the AIOps vendor’s proprietary situation tool or a third-party provider like Slack or Microsoft Teams. The ability for operations teams to collaborate effectively reduces time to resolution.

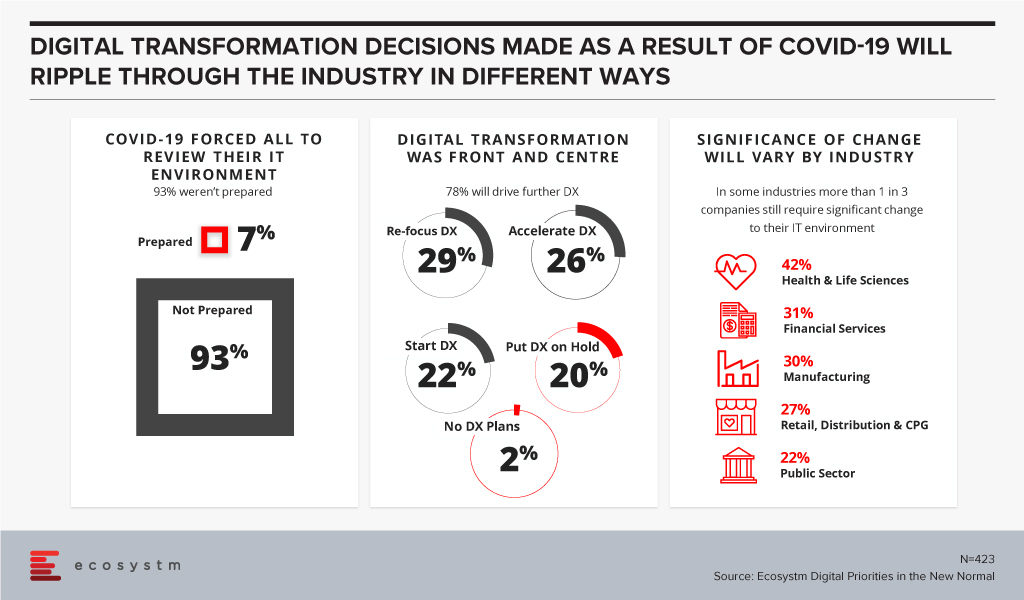

COVID-19 has impacted the Digital Transformation initiatives of 98% of organisations. This is according to Ecosystm’s ongoing “Digital Priorities in the New Normal” study.

Ecosystm continues to evaluate the business and technological pulse of the market with this new study which aims to find out the impact of the COVID-19 pandemic on organisations, and how digital priorities are being initiated or aligned to adapt to the New Normal that has emerged. Ecosystm’s ongoing real-time research platform helps businesses navigate recovery plans.

Currently spanning industries and countries across the Asia Pacific region, it finds that in 78% of organisations, DX initiatives have either started, re-focused or accelerated, whereas 20% have it put on hold.

2020 has seen extreme disruption – and fast. The socio-economic impact will probably outlast the pandemic, but several industries have had to transform themselves to survive during these past months and to walk the path to recovery.

Against this backdrop, the Retail industry has been impacted early due to supply chain disruptions, measures such as lockdowns and social distancing, demand spikes in certain products (and diminished demands in others) and falling margins. Moreover, it is facing changed consumer buying behaviour. In the short-term consumers are focusing on essential retail and conservation of cash. The impact does not end there – in the medium and long term, the industry will face consumers who have acquired digital habits including buying directly from home through eCommerce platforms. They will expect a degree of digitalisation from retailers that the industry is not ready to provide at the moment. This raises the question on how they should transform to adapt to the New Normal and what could be a potential game-changer for them.

Translating Business Needs into Technology Capabilities

In his report, The Path to Retail’s New Normal, Ecosystm Principal Advisor, Kaushik Ghatak says, “Satisfying their old consumers, now set in their new ways, should be the ‘mantra’ for the retailers in order to survive in the New Normal.” To be able to do so they have to evaluate what their new business requirements are and translate them into technological requirements. Though it may sound simple, it may prove to be harder than usual to identify their evolving business requirements. This is especially difficult because even before the pandemic, the Retail industry was challenged with consumers who are becoming increasingly demanding, providing enhanced customer experience (CX), offering more choices and lowering prices. The market was already extremely competitive with large retailers fighting for market consolidation and smaller and more nimble retailers trying to carve out their niche.

In the New Normal, retailers will struggle to retain and grow their customer base. They will also have to focus aggressively on cost containment. A robust risk management process will become the new reality. But above all else, they will have to innovate – in their product range as well as in their processes. These are all areas where technology can help them. This can come in the form of technology partnerships, adopting hybrid models, increased usage of technology across all channels and investing in reskilling or upskilling the technology capabilities of employees.

Re-evaluating the Supply Chain

One of the first business operation to get disrupted by the current crisis was the supply chain. Ecosystm Principal Advisor, Alea Fairchild says, “Retailers are finding themselves at the front-end of the broken supply chain in the current situation and there is an enormous gap between suppliers and buyers. Retailers will have to aim to combine inventory with local sourcing and become agile and adopt change quickly. This will highlight to them the importance of transparency of information, traceability, and information flow of goods.”

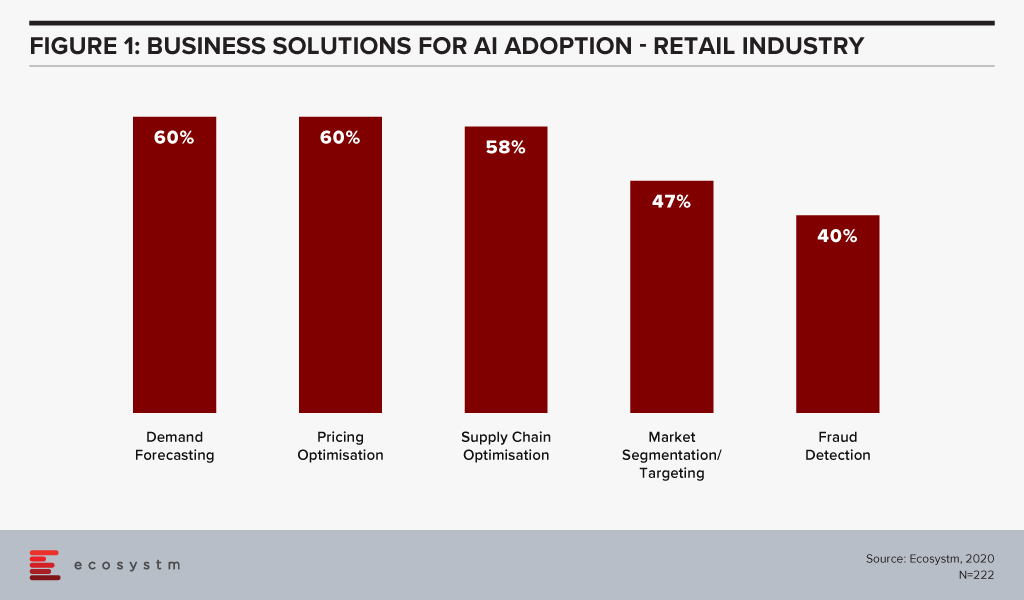

Ecosystm research shows that supply chain optimisation and demand forecasting among the top 5 business solutions that firms in Retail consider using AI for (Figure 1).

“In the New Normal, consumers are going to demand the same level of perfection that they have received and at the same cost. In order to make that possible, at the right time and at a lower cost, automation has to be implemented to improve the supply chain process, fulfill expectations and enhance visibility,” says Ghatak. “Providing differentiated CX is intimately dependent upon an aligned, flexible and efficient supply chain. Retailers will not only need to innovate at the store (physical or online) level and offer more innovative products – they will also need to have a high level of innovation in their supply chain processes.”

Digital Transformation in the Retail Industry

Ecosystm research reveals that only about 34% of global retailers had considered themselves to be digital-ready to face the challenges of the New Normal, before the pandemic. The vast majority of them admit that they still have a long way to go.

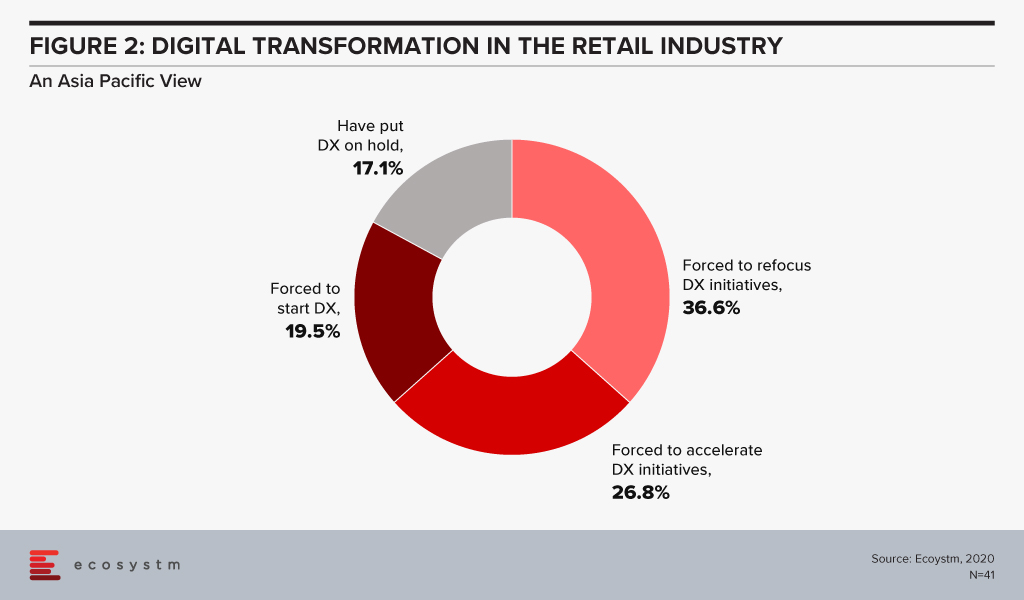

With COVID-19, the timeframes for digitalisation have imploded for most retailers. The study to evaluate the Digital Priorities in the New Normal reveals that in Asia Pacific nearly 83% of retailers have been forced to start, accelerate or refocus their Digital Transformation (DX) initiatives (Figure 2).

So, what technology areas will Retail see increased adoption oF?

Fairchild sees retailers adopt IoT, mobility, AI and solutions that deliver personalised experiences such as push notifications. What they are likely to do is blend different aspects of their physical and virtual environment to create a solution for customers. “To address in-store processing, hygiene, safety standards and compliance requirements, retailers will change their processes through a combination of resources, KPIs, automation, task management software and switching the information flow.”

Ghatak thinks automation has a significant role to play in improving both CX and the supply chain. “This is also an opportunity for retailers – both online and in-store – to create a solution experience where technologies such as Augment/Virtual Reality (AR/VR) can help. While retailers are adopting these technologies, with 5G rollouts, there is potential that the adoption will implode in a short time-frame.”

Those retailers that are not re-evaluating their business models and technology investments now will find themselves unprepared to handle the customer expectations when the global economy opens up.

The current state of the world is alarming. The COVID-19 virus is not only disrupting businesses and economies – it is taking away loved ones, it is separating friends and families, it is disrupting the education of young adults and children and it is seeding fear in communities. But while the media is dominated with doom and gloom at the moment – and we do need these reports – I believe it is worth stopping for a moment to consider the fact that if the pandemic happened ten or fifteen years ago, many businesses – and government agencies – would have closed down. You could argue that the world wasn’t as globally connected then as it is now. And to an extent that is correct – the numbers of air travellers increased up until the end of 2019. But even in 2005, the world was still a very global place – economies relied on cross-border commerce as much then as they do now.

Depending on your business or industry 10-15 years ago:

- Staff couldn’t have effectively worked from home. And if they did, collaboration would have been hard (if not impossible outside of the usual voice services). Teleconference services would have needed to be booked.

- Remote access would have been painful and slow – relying heavily on VPNs over slower internet connections.

- Software would have mainly been running in company datacentres – with very little SaaS-based applications. These applications were often designed for LAN access…

- Those lucky few with a Blackberry or iPhone might have had access to email – everyone else would have needed to go into the office to get work done.

But worse than this would have been our customer engagements. While eCommerce had healthy adoption by 2005, it often relied on very manual processes – and it was mainly focused on consumer products and services – B2B adoption was still a number of years away. And, for many businesses, it represented a tiny proportion of their revenue. Small companies didn’t often have the web presence to compete with the big players. But if I look at the big fast-food giants in Australia (e.g. McDonalds and KFC) – these companies didn’t have a web or mobile ordering until a few years ago, and even more recently for home delivery services. Any company that had to shut down their face-to-face contact would have likely fallen back on their contact centres – but even these would have been impacted as the ability to route calls to remote or home-working call centre agents barely existed then – so they would have been understaffed or closed due to an infection being discovered…

Today’s digital connectivity has the opportunity to save lives. Less physical contact means less people being exposed to – and spreading – the virus.

If this pandemic had happened 10-15 years ago, many small AND large businesses would have had to shut their doors very quickly. Very early in the cycle, businesses would have had to make the decision to shut their doors straight away, or risk accelerating the infection rates by having staff continue to attend the office or contact centre. So if there is one small positive we can take away, it is that our digital investments are paying off very quickly. The ability to continue to trade, continue to sell, continue to do business in such a market as we are facing today and tomorrow is priceless. I can purchase goods and services online, register my car without leaving my desk, upgrade or change my health insurance without speaking to a single human being. Most businesses have the ability to have their employees access many of their critical applications wherever they are located. Our accountants can still pay and send bills, HR can hire for open positions, product teams can continue to innovate on the products and services they offer.

Don’t get me wrong – business survival is not guaranteed. This is why I implored governments to aim their stimulus spending towards small and medium businesses digital initiatives – as cafes, retailers, bars and restaurants close down across cities, states and countries, many are now lamenting their immature online presence, their lack of delivery and their lack of pre-ordering. If you have any doubt about this, check your local Facebook group – it is full of small businesses putting up images of menus in the hope that customers will reach out directly to keep their businesses running. If these businesses are given incentives to build digital services quickly, they might see less of a slowdown in business.

COVID-19 will definitely stress test our digital assets and strategies. Just recently, the Australian government’s citizen-facing portal crashed as too many citizens logged on to register for welfare. This forced many people out into government shop-fronts – putting themselves, the staff and all connected families and friends at risk of catching the virus. I also heard today of a bank that called many of its staff back to the office as the VPN could not cope with the number of users and volume of traffic! If you have not already, you will quickly find out how your digital capabilities are performing – where you need extra capacity, where services are running smoothly, where you need to rethink process design or where you need to consider re-crafting this approach for the fully digital era.

But stay safe – listen to the advice of medical experts and act on that advice. A senior medical officer recently stated that social distancing is the only way that we will overcome this virus – so stay safe and stay home (if you can!). But also take the time to review your digital capabilities – start making moves now to ensure they help your business stay afloat – or your government agency to keep serving citizens in times of restricted trading or shutdowns.