Across our conversations with marketing leads, sales heads, customer experience owners, and tech architects, one theme keeps coming up: It’s not about collecting more data. It’s about making sense of what we already have.

As customer journeys grow more fragmented, leaders are grappling with a big question: how do we unify data in a way that helps teams act fast, personally, and responsibly?

This is where CRM and CDP integration becomes critical. Not a technical afterthought, but a strategic decision.

Click here to download “Ground Realities: Conversations about Customer Data” as a PDF.

Why CRM and CDP Must Work Together

CRMs are relationship systems, built to track sales conversations, account history, support interactions, and contact details. CDPs are behaviour systems designed to unify signals from web, mobile, ads, apps, and third-party tools.

They each solve different problems, but the same customer is at the centre.

Without integration, CRMs miss the behavioural context needed for real-time decisions, while CDPs lack structured data about customer relationships like deal history or support issues. Each system works in isolation, limiting the quality of insights and slowing down effective action.

“Marketing runs on signals: clicks, visits, scrolls, app drops. If that data doesn’t talk to our CRM, our campaigns feel completely disconnected.” – VP, Growth Marketing

When CRM and CDP are Integrated

Sales gains visibility into customer behaviour, not just who clicked a proposal, but how often they return, what products they browse, and when interest peaks. This helps reps prioritise high-intent leads and time their outreach perfectly.

Marketing stops shooting in the dark. Integrated data enables them to segment audiences precisely, trigger campaigns in real time, and ensure compliance with consent and privacy settings.

Customer Experience teams can connect the dots across touchpoints. If a high-value customer reduces app usage, flags an issue in chat, and has an upcoming renewal, the team can step in proactively.

IT and Analytics benefit from a single source of truth. Fewer silos mean reduced data duplication, easier governance, and more reliable AI models. Clean, contextual data reduces alert fatigue and increases trust across teams.

Why It Matters Now

Fragmented Journeys Are the Norm. Customers interact across websites, mobile apps, social DMs, emails, chatbots, and in-store visits – often within the same day. No single platform captures this complexity unless CRM and CDP data are aligned.

Real-Time Expectations Are Rising. A customer abandons a cart or posts a complaint – and expects a relevant response within minutes, not days. Teams need integrated systems to recognise these moments and act instantly, not wait for weekly dashboards or manual pulls.

Privacy & Compliance Can’t Be Retrofitted. With stricter regulations (like India’s DPDP Act, GDPR, and industry-specific norms), disconnected systems mean scattered consent records, inconsistent data handling, and increased risk of non-compliance or customer mistrust.

“It’s not about choosing CRM or CDP. It’s about making sure they work together so our AI tools don’t go rogue.” – CTO, Retail Platform

The AI Layer Makes This Urgent

Agentic AI is no longer a concept on the horizon. It’s already reshaping how teams engage customers, automate responses, and make decisions on the fly. But it’s only as good as the data it draws from.

For example, when an AI assistant is trained to spot churn risk or recommend offers, it needs both:

- CDP inputs. Mobile session drop-offs, email unsubscribes, product page bounces, app crashes

- CRM insights. Contract renewal dates, support history, pricing objections, NPS scores

Without the full picture, it either overlooks critical risks, or worse, responds in ways that feel tone-deaf or irrelevant.

A Smarter Stack for Customer-Centric Growth

The CRM vs CDP debate is outdated – both are essential parts of a unified data strategy. Integration goes beyond syncing contacts; it requires real-time data flow, clear governance, and aligned teams. As AI-driven growth accelerates, this integrated data backbone is no longer just a technical task but a leadership imperative. Companies that master it won’t just automate, they’ll truly understand their customers, gaining a decisive competitive edge.

For decades, marketing has evolved alongside technology – from the rise of digital channels to the explosion of data and automation. The latest transformation began with GenAI, which gave marketers the power to scale content, personalise at speed, and experiment like never before.

But now, a more profound shift is underway. With Agentic AI, marketers can autonomously plan campaigns, optimise customer journeys, and drive decisions across the entire marketing lifecycle. We’re moving beyond faster execution toward truly adaptive, self-improving marketing engines. Where GenAI changed what marketing teams can do, Agentic AI changes how they operate.

The New Marketing Continuum

GenAI has fundamentally reshaped marketing by automating and enhancing creative and content-driven tasks. It enables marketers to produce content at unprecedented scale and speed. Blog posts, social media captions, email campaigns, and ad copy can now be generated in minutes, dramatically reducing production time.

GenAI also empowers teams to personalise messages based on user preferences, behaviours, and historical data, boosting engagement and relevance. Beyond text, it can generate images, videos, and audio, allowing marketers to rapidly develop a wide variety of creative assets. Many also use it as a brainstorming partner, ideating on campaign themes, taglines, or content formats. By taking on repetitive, time-consuming tasks, GenAI frees up marketing teams to focus on higher-value strategic and analytical work.

But while GenAI has transformed content creation, it still relies on human input to orchestrate campaigns and continuously optimise performance. That’s where agentic AI takes over, opening up the possibilities of autonomous marketing.

Unlike traditional GenAI tools, agentic AI is guided by strategic goals and capable of executing multi-step workflows independently.

These intelligent agents reason, plan, and learn from feedback, managing entire initiatives with minimal intervention. They don’t just generate content; they drive results.

Leading Use Cases of Agentic AI in Marketing

Campaign Orchestration. Agentic AI transforms campaign management from a sequence of manual tasks into a continuous, autonomous process. Once given a strategic goal, such as increasing product sign-ups, driving webinar attendance, or launching a regional campaign, the system independently plans and executes the end-to-end campaign. It determines the optimal mix of channels (email, paid social, display ads, etc.), generates creative assets tailored to each, sets targeting parameters, and initiates deployment. As results come in, it monitors performance metrics in real time and adjusts messaging, budget allocation, and channel focus accordingly.

For marketers, the shift is profound: they move from building and launching campaigns to supervising and steering them, focusing on goals, governance, and refinement rather than day-to-day execution.

Customer Journey Optimisation. Traditional customer journeys rely on pre-defined paths and segmentation rules. Agentic AI makes these journeys dynamic, responsive, and personalised at the individual level. By analysing behavioural data, such as browsing patterns, clickstream data, cart activity, and time-on-page, agentic systems adjust experiences in the moment.

For example, if a visitor shows sustained interest in a product category but doesn’t convert, the AI can trigger a personalised follow-up via email, offer a discount, or retarget them with tailored messaging. These interactions evolve continuously as more data becomes available, optimising for engagement, conversion, and long-term retention.

It’s no longer about mapping a linear funnel; it’s about orchestrating adaptive journeys at scale.

Martech Integration and Workflow Automation. Most marketing environments are fragmented across dozens of tools; from CRM and CMS to analytics dashboards and ad platforms. Agentic AI acts as the connective tissue across this stack. It reads signals from various tools, automates routine updates (e.g., adding leads to nurture flows, flagging sales-ready accounts, triggering re-engagement ads), and maintains data consistency across systems. Rather than relying on manual workflows or brittle APIs, agentic systems interpret context and sequence actions logically.

This unlocks both speed and reliability; campaigns launch faster, reporting becomes more accurate, and marketing teams waste less time on coordination overhead.

Continuous Experimentation and Optimisation. Most marketing teams run experiments manually and intermittently – A/B testing headlines, adjusting audience segments, or switching out creative. Agentic AI turns experimentation into a continuous, embedded capability.

It sets up and runs multivariate tests across copy, format, targeting, time slots, and more, simultaneously and at scale. Then, based on performance data, it autonomously selects winning combinations and rolls out adjustments in real time.

Importantly, it learns over time, building a knowledge base of what works for which audiences under which conditions. Optimisation becomes a learning loop – continuous, automated, and compounding in value.

Strategic Decision Support: Where GenAI and Agentic AI Converge

The real power of AI in marketing emerges when generative intelligence meets agentic autonomy. Together, they move beyond content creation or task execution to support high-level strategic decision-making with speed, context, and adaptability.

Scenario Modelling. Agentic AI identifies potential decision points such as budget shifts, product launches, channel mix changes, while GenAI simulates and narrates the implications of each, turning complex trade-offs into clear, actionable insights for leadership teams.

Market Research Synthesis. Agentic systems continuously scan external sources, from competitor sites to analyst reports and social chatter. GenAI distils this noise into crisp summaries, opportunity maps, and trend briefings that inform strategy and messaging.

Persona and Journey Analysis. Agentic AI tracks behaviour patterns and detects emerging segments or friction points across touchpoints. GenAI contextualises this data, creating personas and journey narratives that help teams align content and campaigns to real-world user needs.

Content Localisation and Alignment. Agentic AI ensures local relevance by orchestrating updates across regions and personas. GenAI rapidly adapts messaging – tone, imagery, and language – while preserving brand voice, enabling consistent global storytelling at scale.

Together, they give marketing leaders a dual advantage: real-time situational awareness and the ability to act on it with clarity and confidence. Decisions aren’t just faster; they’re smarter, more contextual, and closer to the customer.

Responsible Intelligence: Operationalising AI in Marketing

The potential of AI in marketing is significant, but responsible adoption is key. Human oversight remains critical to ensure alignment with brand tone, strategic direction, and ethical standards. AI systems must also integrate seamlessly with existing martech stacks to avoid complexity and inefficiencies. Strong data foundations – well-structured, high-quality, and accessible – are essential to generate relevant and reliable outputs. Finally, transparency and trust must be built into every system, with explainable and auditable AI behaviours that support accountability and informed decision-making.

Agentic AI marks a step change in marketing; from faster execution to intelligent, autonomous operations. For marketing leaders, this is a moment to rethink workflows, redesign team roles, and build AI-native operating models. The goal isn’t just speed. It’s adaptability, intelligence, and sustained competitive advantage in a rapidly evolving landscape.

What if your bank could predict your financial needs before you even realised them? Imagine a financial institution that understands your behaviours, anticipates your needs, and engages with you meaningfully in real time. That’s the power of modern marketing. We’re not talking about one-size-fits-all campaigns; we’re talking about creating personalised experiences that resonate on an individual level. Financial institutions are increasingly recognising that when marketing is done right, it becomes a powerful driver of customer loyalty and growth.

Take Netflix, for example – the frontrunner in personalisation. They don’t just serve content; they study audience preferences to deliver exactly what each viewer wants. Now, picture banks doing the same. Banks can apply the same principles by building a complete view of each customer based on transactions, preferences, and lifestyle signals. This allows them to deliver personalised content, products, and nudges that help customers make smarter financial decisions – and feel more understood in the process.

The Opportunity: Marketing Beyond the Surface

The real opportunity for banks today is to reimagine marketing – not as a support function, but as a strategic growth engine. This means pulling marketing out of the back office and placing it at the heart of business decision-making. When marketing is deeply embedded in strategy, aligned with business goals, and backed by executive support, it becomes a force multiplier. Cross-functional teams start working in sync, campaigns become smarter and more personalised, and outcomes become measurable and meaningful. The impact? Rapid customer growth, stronger retention, and sharper product uptake. This reimagination hinges on two foundational shifts:

- Culture Shift. Agile, cross-functional teams that focus on delivering specific customer outcomes rather than managing marketing channels in silos. These teams are empowered to act quickly, experiment, and refine based on feedback.

- Tech-Enabled Precision. A well-governed MarTech stack that enables real-time personalisation by effectively using data, decisioning models, and delivery mechanisms. This means moving from siloed systems to unified, intelligent platforms.

When these shifts align, marketing transforms from a function into a growth engine – fuelling innovation and building deeper customer relationships.

Embracing Modern Marketing Principles

Modern marketing starts with a few foundational shifts.

1. Embedding Marketing into Business Strategy. Marketing needs to be part of business strategy from the start – not bolted on at the end. When marketers have a seat at the table during strategy planning, they can shape priorities, align efforts, and measure impact more effectively.

This requires:

- Early involvement in strategic decision-making

- Marketing scorecards derived from business KPIs

- A unified voice across product, marketing, and operations

Also, Internal teams must be in sync with customer promises made externally. This means training, communication, and shared understanding across departments to ensure every touchpoint reinforces a consistent message. Whether it’s a branch interaction, a call centre response, or a chatbot exchange – each moment becomes a reflection of the brand’s commitment.

By embedding marketing within the business from the outset and aligning it with internal delivery mechanisms, organisations are better positioned to deliver on their promises and build lasting trust.

2. Turning Data into Action: Using MarTech for Smarter Decisions and Delivery. Modern marketing runs on data – but it only matters if it drives action. Banks need a systematic approach to turning raw data into relevant, timely customer experiences.

- Organise. Cleanse and consolidate data to form a single view of each customer.

- Decide. Apply AI/ML models to extract insights, make predictions, and personalise offerings.

- Deliver. Communicate through the most effective channels at the right moment.

But a smart stack needs structure. MarTech governance is essential to ensure tech investments are strategic – not duplicative. A cross-functional steering committee, with voices from marketing, IT, compliance, and business leadership, should guide decisions. This keeps tools aligned with business goals and ensures interoperability.

Equally important is fostering a culture of experimentation. A/B testing and continuous learning should be baked into campaign design – not as add-ons, but as core capabilities. This sharpens performance and fuels innovation by quickly scaling what works. Each test becomes a feedback loop, feeding a smarter, more agile marketing engine.

Embedding these practices into the data-decisioning-delivery loop helps banks move from scattered insights to coordinated, high-impact engagement.

3. Outcome-Focused Teams and Operating Models. Rather than being structured around traditional channels, high-performing marketing teams operate around customer journeys and outcomes. Agile squads can be created for:

- Seamless onboarding

- Product activation and adoption

- Retention and cross-sell strategies

These squads have to be multidisciplinary – combining marketing, data science, engineering, and product. They need to be empowered to experiment, move fast, and own KPIs tied to customer impact.

Outcome-driven teams focus on delivering measurable value – not just activity. For instance, a squad working on onboarding might track completion rates and activation time, while a cross-sell squad may target conversion on tailored offers. The shift to outcome-oriented delivery ensures that efforts are tied to clear business metrics, with faster feedback loops and accountability.

By storing, organising, and analysing customer data, banks equip these teams to predict needs more accurately. Insights fuel smarter decisions – enabling real-time, context-aware offers. Paired with agile delivery, this data-led approach makes every interaction timely, relevant, and impactful.

This approach ensures agility, accountability, and focus. By reducing reliance on rigid departmental structures, teams can iterate quickly and deliver greater value across the customer lifecycle.

The Modern Marketing Imperative

As customer needs and expectations evolve, marketing must adapt to modern standards, with a tighter alignment between business and marketing to deliver delightful customer experiences and impactful outcomes. These are the new imperatives for growth.

These principles are not just theoretical – they’re actionable steps that enable banks to anticipate needs, deliver hyper-personalised experiences, and build lasting relationships. By embracing this shift, banks can move from reactive to proactive, empowering customers to make smarter financial decisions while driving loyalty and growth. Ultimately, the future of banking lies in a personalised, integrated, and data-driven experience for every customer.

In today’s competitive business landscape, delivering exceptional customer experiences is crucial to winning new clients and fostering long-lasting customer loyalty. Research has shown that poor customer service can cost businesses around USD 75 billion in a year and that 1 in 3 customers is likely to abandon a brand after a single negative experience. Organisations excelling at personalised customer interactions across channels have a significant market edge.

In a recent webinar with Shivram Chandrasekhar, Solutions Architect at Twilio, we delved into strategies for creating this edge. How can contact centres optimise interactions to boost cost efficiency and customer satisfaction? We discussed the pivotal role of voice in providing personalised customer experiences, the importance of balancing AI and human interaction for enhanced satisfaction, and the operational advantages of voice intelligence in streamlining operations and improving agent efficiency.

The Voice Advantage

Despite the rise of digital channels, voice interactions remain crucial for organisations seeking to deliver exceptional customer experiences. Voice calls offer nuanced insights and strategic advantages, allowing businesses to address issues effectively and proactively meet customer needs, fostering loyalty and driving growth.

There are multiple reasons why voice will remain relevant including:

- In many countries it is mandatory in several industries such as Financial Services, Healthcare, & Government & Emergency Services.

- There are customers who simply favour it over other channels – the human touch is important to them.

- It proves to be the most effective when it comes to handling complex and recurrent issues, including facilitating effective negotiations and better sales closures; Digital and AI channels cannot do it alone yet.

- Analysing voice data reveals valuable patterns and customer sentiments, aiding in pinpointing areas for improvement. Unlike static metrics, voice data offers dynamic feedback, helping in proactive strategies and personalised opportunities.

AI vs the Human Agent

There has been a growing trend towards ‘agentless contact centres’, where businesses aim to pivot away from human agents – but there has also been increasing customer dissatisfaction with purely automated interactions. A balanced approach that empowers human agents with AI-driven insights and conversational AI can yield better results. In fact, the conversation should not be about one or the other, but rather about a combination of an AI + Human Agent.

Where organisations rely on conversational AI, there must be a seamless transitioning between automated and live agent interactions, maintaining a cohesive customer experience. Ultimately, the goal should be to avoid disruptions to customer journeys and ensure a smooth, integrated approach to customer engagement across different channels.

Exploring AI Opportunities in Voice Interactions

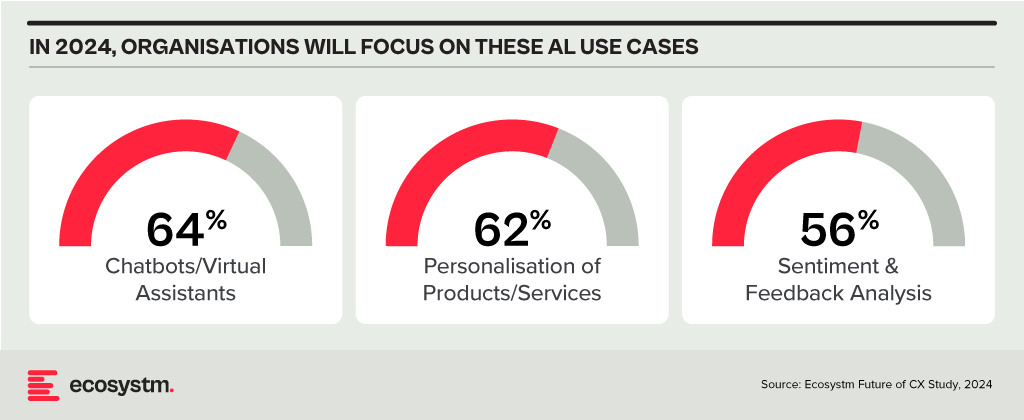

Contact centres in Asia Pacific are looking to deploy AI capabilities to enhance both employee and customer experiences.

Using predictive AI algorithms on customer data helps organisations forecast market trends and optimise resource allocation. Additionally, AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks. By automating transactional tasks, particularly FAQs, contact centre operations are streamlined, ensuring that critical calls receive prompt attention. AI-powered quality assurance processes provide insights into all voice calls, facilitating continuous improvement, while AI-driven IVR systems enhance the customer experience by simplifying menu navigation.

Agent Assist solutions, integrated with GenAI, offer real-time insights before customer interactions, streamlining service delivery and saving valuable time. These solutions automate mundane tasks like call summaries, enabling agents to focus on high-value activities such as sales collaboration, proactive feedback management, and personalised outbound calls.

Actionable Data

Organisations possess a wealth of customer data from various touchpoints, including voice interactions. Accessing real-time, accurate data is essential for effective customer and agent engagement. Advanced analytics techniques can uncover hidden patterns and correlations, informing product development, marketing strategies, and operational improvements. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

Integrating customer data with other organisational sources provides a holistic view of the customer journey, enabling personalised experiences and proactive problem-solving. A Customer Data Platform (CDP) breaks down data silos, providing insights to personalise interactions, address real-time issues, identify compliance gaps, and exceed customer expectations throughout their journeys.

Considerations for AI Transformation in Contact Centres

- Prioritise the availability of live agents and voice channels within Conversational AI deployments to prevent potential issues and ensure immediate human assistance when needed.

- Listen extensively to call recordings to ensure AI solutions sound authentic and emulate human conversations to enhance user adoption.

- Start with data you can trust – the quality of data fed into AI systems significantly impacts their effectiveness.

- Test continually during the solution testing phase for seamless orchestration across all communication channels and to ensure the right guardrails to manage risks effectively.

- Above all, re-think every aspect of your CX strategy – the engagement channels, agent roles, and contact centres – through an AI lens.

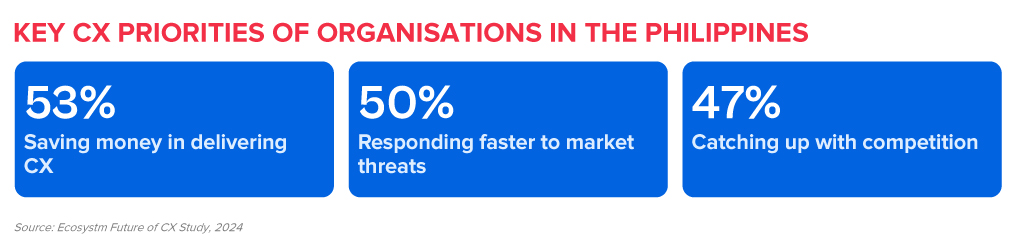

The Philippines, renowned as a global contact centre hub, is experiencing heightened pressure on the global stage, leading to intensified competition within the country. Smaller BPOs are driving larger players to innovate, requiring a stronger focus on empowering customer experience (CX) teams, and enhancing employee experience (EX) in organisations in the Philippines.

As the Philippines expands its global footprint, organisations must embrace progressive approaches to outpace rivals in the CX sector.

These priorities can be achieved through a robust data strategy that empowers CX teams and contact centres to glean actionable insights.

Here are 5 ways organisations in the Philippines can achieve their CX objectives.

Download ‘Securing the CX Edge: 5 Strategies for Organisations in the Philippines’ as a PDF.

#1 Modernise Voice and Omnichannel Orchestration

Ensuring that all channels are connected and integrated at the core is critical in delivering omnichannel experiences. Organisations must ensure that the conversation can be continued seamlessly irrespective of the channel the customer chooses, without losing the context.

Voice must be integrated within the omnichannel strategy. Even with the rise of digital and self-service, voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels.

Transition from a siloed view of channels to a unified and integrated approach.

#2 Empower CX Teams with Actionable Customer Data

An Intelligent Data Hub aggregates, integrates, and organises customer data across multiple data sources and channels and eliminates the siloed approach to collecting and analysing customer data.

Drive accurate and proactive conversations with your customers through a unified customer data platform.

- Unifies user history across channels into a single customer view.

- Enables the delivery of an omnichannel experience.

- Identifies behavioural trends by understanding patterns to personalise interactions.

- Spots real-time customer issues across channels.

- Uncovers compliance gaps and missed sales opportunities from unstructured data.

- Looks at customer journeys to proactively address their needs.

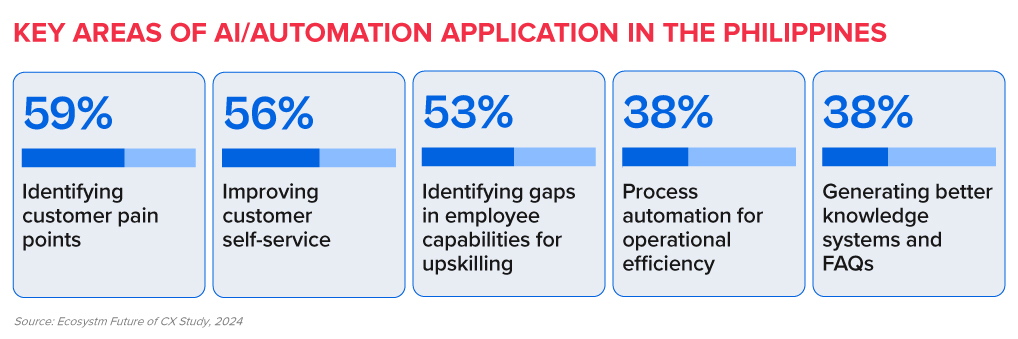

#3 Transform CX & EX with AI/Automation

AI and automation should be the cornerstone of an organisation’s CX efforts to positively impact both customers and employees.

Evaluate all aspects of AI/automation to enhance both customer and employee experience.

- Predictive AI algorithms analyse customer data to forecast trends and optimise resource allocation.

- AI-driven identity validation reduces fraud risk.

- Agent Assist Solutions offer real-time insights to agents, enhancing service delivery and efficiency.

- GenAI integration automates post-call activities, allowing agents to focus on high-value tasks.

#4 Augment Existing Systems for Success

Many organisations face challenges in fully modernising legacy systems and reducing reliance on multiple tech providers.

CX transformation while managing multiple disparate systems will require a platform that integrates desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This requires a re-evaluation of all aspects of CX delivery.

- Redefine the Contact Centre. Transforming it into an “Intelligent” Data Hub providing unified and connected experiences; leveraging intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empowering agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensuring consistent omnichannel experiences through unified and coherent data; using programmable APIs to personalise conversations and discern customer preferences for real-time or asynchronous messaging; integrating innovative technologies like video to enrich the channel experience.

In recent years, organisations have had to swiftly transition to providing digital experiences due to limitations on physical interactions; competed fiercely based on the customer experiences offered; and invested significantly in the latest CX technologies. However, in 2024, organisations will pivot their competitive efforts towards product innovation rather than solely focusing on enhancing the CX.

This does not mean that organisations will not focus on CX – they will just be smarter about it!

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 Customer Experience trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 CX Trends in 2024’ as a PDF.

#1 Customer Experience is Due for a Reset

Organisations aiming to improve customer experience are seeing diminishing returns, moving away from the significant gains before and during the pandemic to incremental improvements. Many organisations experience stagnant or declining CX and NPS scores as they prioritise profit over customer growth and face a convergence of undifferentiated digital experiences. The evolving digital landscape has also heightened baseline customer expectations.

In 2024, CX programs will be focused and measurable – with greater involvement of Sales, Marketing, Brand, and Customer Service to ensure CX initiatives are unified across the entire customer journey.

Organisations will reassess CX strategies, choosing impactful initiatives and aligning with brand values. This recalibration, unique to each organisation, may include reinvesting in human channels, improving digital experiences, or reimagining customer ecosystems.

#2 Sentiment Analysis Will Fuel CX Improvement

Organisations strive to design seamless customer journeys – yet they often miss the mark in crafting truly memorable experiences that forge emotional connections and turn customers into brand advocates.

Customers want on-demand information and service; failure to meet these expectations often leads to discontent and frustration. This is further heightened when organisations fail to recognise and respond to these emotions.

Sentiment analysis will shape CX improvements – and technological advancements such as in neural network, promise higher accuracy in sentiment analysis by detecting intricate relationships between emotions, phrases, and words.

These models explore multiple permutations, delving deeper to interpret the meaning behind different sentiment clusters.

#3 AI Will Elevate VoC from Surveys to Experience Improvement

In 2024, AI technologies will transform Voice of Customer (VoC) programs from measurement practices into the engine room of the experience improvement function.

The focus will move from measurement to action – backed by AI. AI is already playing a pivotal role in analysing vast volumes of data, including unstructured and unsolicited feedback. In 2024, VoC programs will shift gear to focus on driving a customer centric culture and business change. AI will augment insight interpretation, recommend actions, and predict customer behaviour, sentiment, and churn to elevate customer experiences (CX).

Organisations that don’t embrace an AI-driven paradigm will get left behind as they fail to showcase and deliver ROI to the business.

#4 Generative AI Platforms Will Replace Knowledge Management Tools

Most organisations have more customer knowledge management tools and platforms than they should. They exist in the contact centre, on the website, the mobile app, in-store, at branches, and within customer service. There are two challenges that this creates:

- Inconsistent knowledge. The information in the different knowledge bases is different and sometimes conflicting.

- Difficult to extract answers. The knowledge contained in these platforms is often in PDFs and long form documents.

Generative AI tools will consolidate organisational knowledge, enhancing searchability.

Customers and contact centre agents will be able to get actual answers to questions and they will be consistent across touchpoints (assuming they are comprehensive, customer-journey and organisation-wide initiatives).

#5 Experience Orchestration Will

Accelerate

Despite the ongoing effort to streamline and simplify the CX, organisations often implement new technologies, such as conversational AI, digital and social channels, as independent projects. This fragmented approach, driven by the desire for quick wins using best-in-class point solutions results in a complex CX technology architecture.

With the proliferation of point solution vendors, it is becoming critical to eliminate the silos. The fragmentation hampers CX teams from achieving their goals, leading to increased costs, limited insights, a weak understanding of customer journeys, and inconsistent services.

Embracing CX unification through an orchestration platform enables organisations to enhance the CX rapidly, with reduced concerns about tech debt and legacy issues.

During tough economic times, organisations need to be even more attentive to their customers’ needs and find creative ways to deliver high-quality customer experiences while keeping costs under control.

Tim Sheedy – VP Research, Ecosystm presents the best practices that organisations can use to modify their customer experience during these uncertain times.

- Bring back the empathy. While people might have stopped worrying about their health, economic concerns are real.

- Focus on customer retention. Customer attraction takes more effort and investments than customer retention.

- Invest in customer support. This can be done through digital touchpoints as well as in-person interactions.

- Continue to simplify the purchasing process. Even the slightest friction in the purchase process is enough to drive potential customers away.

- Focus on value over discounts. Customers look for value more than they look for discounts.

Read on to find out more.

Download Modify Your CX for Tough Economic Times as a PDF

Over the last 2 years, the primary focus for Retail & eCommerce organisations has been on creating the right customer experience and digital engagements – mainly to survive.

In 2022 the focus will be on creating market differentiation. This will extend to business strategies and process optimisation. The Retail & eCommerce industry will explore ways to leverage data to empower multiple roles across the organisation and engage with customers irrespective of where they are on their customer journeys.

Read on to find out what Ecosystm Analysts Alan Hesketh, Niloy Mukherjee and Tim Sheedy think will be the leading trends in the Retail & eCommerce industry in 2022.

Since early 2020 nearly all organisations have strengthened their online presence and commerce abilities – irrespective of their industry. They have come to terms with the fact that the ability to win and retain customers, is largely linked to the digital customer experience (CX) they are able to deliver.

They have invested heavily in their CX roadmaps and technologies; but will find themselves solving for the same challenges they have faced the last 2 years – continued growth of digital experiences; gaining insights from customer data; customer churn; and catering to customer channel preferences.

2022 will be the time to consolidate and build the capabilities required to analyse the immense amount of customer data that they have access to – to finally be able to offer personalised customer experience.

Read on to find out what Ecosystm Advisors Audrey William and Tim Sheedy think will be the leading CX trends in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Customer Experience in 2022 as a PDF