The Asia Pacific region is rapidly emerging as a global economic powerhouse, with AI playing a key role in driving this growth. The AI market in the region is projected to reach USD 244B by 2025, and organisations must adapt and scale AI effectively to thrive. The question is no longer whether to adopt AI, but how to do so responsibly and effectively for long-term success.

The APAC AI Outlook 2025 highlights how Asia Pacific enterprises are moving beyond experimentation to maximise the impact of their AI investments.

Here are 5 key trends that will impact the AI landscape in 2025.

Click here to download “The Future of AI-Powered Business: 5 Trends to Watch” as a PDF.

1. Strategic AI Deployment

AI is no longer a buzzword, but Asia Pacific’s transformation engine. It’s reshaping industries and fuelling growth. Initially, high costs and complex ROI pushed leaders toward quick wins. Now, the game has changed. As AI adoption matures, the focus is shifting from short-term gains to long-term, innovation-driven strategies.

GenAI is is at the heart of this shift, moving beyond the periphery to power core business functions and deliver competitive advantage.

Organisations are rethinking AI investments, looking beyond pure financials to consider the impact on jobs, governance, and data readiness. The AI journey is about balancing ambition with practicality.

2. Optimising AI: Tailored Open-Source Models

Smaller, open-source, and specialised AI models will gain momentum as organisations seek efficiency, flexibility, and sustainability in their AI strategies.

Unlike LLMs, which require high computational power, smaller, task-specific models offer comparable performance while being more resource-efficient. This makes them ideal for organisations working with proprietary data or limited computational resources.

Beyond cost and performance, these models are more energy-efficient, addressing growing concerns about AI’s environmental impact.

3. Centralised Tools for Responsible Innovation

Navigating the increasingly complex AI landscape demands unified management and governance. Organisations will prioritise centralised frameworks to tame the chaos of diverse AI solutions, ensuring compliance (think EU AI Act) while boosting transparency and security.

Automated AI lifecycle management tools will streamline oversight, providing real-time tracking of model performance, usage, and issues like drift.

By using flexible developer toolkits and vendor-agnostic strategies, organisations can accelerate innovation while maintaining adaptability, as the technology evolves.

4. Supercharging Workflows With Agentic AI

Organisations will embrace Agentic AI to automate complex workflows and drive business value. Traditional automation tools struggle with real-world dynamism, but AI-powered agents offer a flexible solution. They empower autonomous task execution, intelligent decision-making, and adaptability to changing circumstances.

These agents, often using GenAI, understand complex instructions and learn from experience. They collaborate with humans, boosting efficiency, and adapt to disruptions, unlike rigid traditional automation.

Agentic workflows are key to redefining work, enabling agility and innovation.

5. From Productivity to People

The focus of AI conversations will shift from simply boosting productivity to using AI for human-centric innovation that transforms both employee roles and customer experiences.

For employees, AI will handle routine tasks, enabling them to focus on creativity and innovation. Education and training will be crucial for a smooth transition to AI-powered workflows.

For customers, AI is evolving to offer more empathetic, personalised interactions by understanding individual emotions, motivations, and preferences. Organisations are recognising the need for transparent, explainable AI to build trust, tailor solutions, and deepen engagement.

Hit or miss AI experiments have leaders demanding results. In this breakneck AI landscape, strategy and realism are your survival tools. A pragmatic approach? High-impact, achievable goals. Know your capabilities, prioritise manageable projects, and stay flexible. The AI winners will be those who champion human-AI collaboration, bake in ethics, and never stop researching.

In 2024, technology vendors have heavily invested in AI Agents, recognising their potential to drive significant value. These tools leverage well-governed, small datasets to integrate seamlessly with applications like Workday, Salesforce, ServiceNow, and Dayforce, enhancing processes and outcomes.

2025 is poised to be the year of AI Agent adoption. Designed to automate specific tasks within existing workflows, AI Agents will transform customer experiences, streamline operations, and boost efficiency. Unlike traditional AI deployments, they offer a gradual, non-disruptive approach, augmenting human capabilities without overhauling processes. As organisations adopt new software versions with embedded AI capabilities, 2025 will mark a pivotal shift in customer experience delivery.

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 trends shaping customer experience in 2025.

Click here to download ‘AI-Powered Customer Experience: Top 5 Trends for 2025’ as a PDF

1. AI Won’t Wow Many Customers in 2025

The data is in – the real focus of AI over the next few years will be on productivity and cost savings.

Senior management and boards of directors want to achieve more with less – so even when AI is being used to serve customers, it will be focused on reducing back-end and human costs.

There will be exceptions, such as the adoption of AI agents in contact centres. However, AI agents must match or exceed human performance to see broad adoption.

However, the primary focus in contact centres will be on reducing Average Handling Time (AHT), increasing call volume per agent, accelerating agent onboarding, and automating customer follow-ups.

2. Organisations Will Start Treating CX as a Team Sport

As CX programs mature, 2025 will highlight the need to break down not only data and technology siloes but also organisational and cultural barriers to achieve AI-powered CX and business success.

AI and GenAI have unlocked new sources of customer data, prompting leaders to reorganise and adopt a mindset shift about CX. This involves redefining CX as a collective effort, engaging the entire organisation in the journey.

Technologies and KPIs must be aligned to drive customer AND business needs, not purely driving success in siloed areas.

3. The First “AGI Agents” Will Emerge

AI Agents are set to explode in 2025, but even more disruptive developments in AI are on the horizon.

As conversational computing gains traction, fuelled by advances in GenAI and progress toward AGI, “Complex AI Agents” will emerge.

These “AGI Agents” will mimic certain human-like capabilities, though not fully replicating human cognition, earning their “Agent” designation.

The first use cases will likely be in software development, where these agents will act as intelligent platforms capable of transforming a described digital process or service into reality. They may include design, inbuilt testing, quality assurance, and the ability to learn from existing IP (e.g., “create an app with the same capabilities as X”).

4. Intelligent AI Bots Will Enhance Contact Centre Efficiency

The often-overlooked aspect of CX is the “operational side”, where Operations Managers face significant challenges in maintaining a real-time pulse on contact centre activities.

For most organisations, this remains a highly manual and reactive process. Intelligent workflow bots can revolutionise this by acting as gatekeepers, instantly identifying issues and triggering real-time corrective actions. These bots can even halt processes causing customer dissatisfaction, ensuring problems are addressed proactively.

Operational inefficiencies, such as back-office delays, unanswered emails, and slow issue containment, create constant headaches. Integrating bots into contact centre operations will significantly reduce time wasted on these inefficiencies, enhancing both employee and customer experiences.

5. Employee Experience Will Catch Up to CX Maturity

Employee experience (EX) has traditionally lagged behind CX in focus and technology investment. However, AI-powered technologies are now enabling organisations to apply CX use cases to EX efforts, using advanced data analysis, summaries, and recommendations.

AI and GenAI tools will enhance understanding of employee satisfaction and engagement while predicting churn and retention drivers.

HR teams and leaders will leverage these tools to optimise performance management and improve hiring and retention outcomes.

Additionally, organisations will begin to connect EX with financial performance, identifying key drivers of engagement and linking them to business success. This shift will position EX as a strategic priority, integral to achieving organisational goals.

Over the past year, Ecosystm has conducted extensive research, including surveys and in-depth conversations with industry leaders, to uncover the most pressing topics and trends. And unsurprisingly, AI emerged as the dominant theme. Here are some insights from our research on the Retail industry.

Click here to download ‘AI in Retail: Success Stories & Insights’ as a PDF

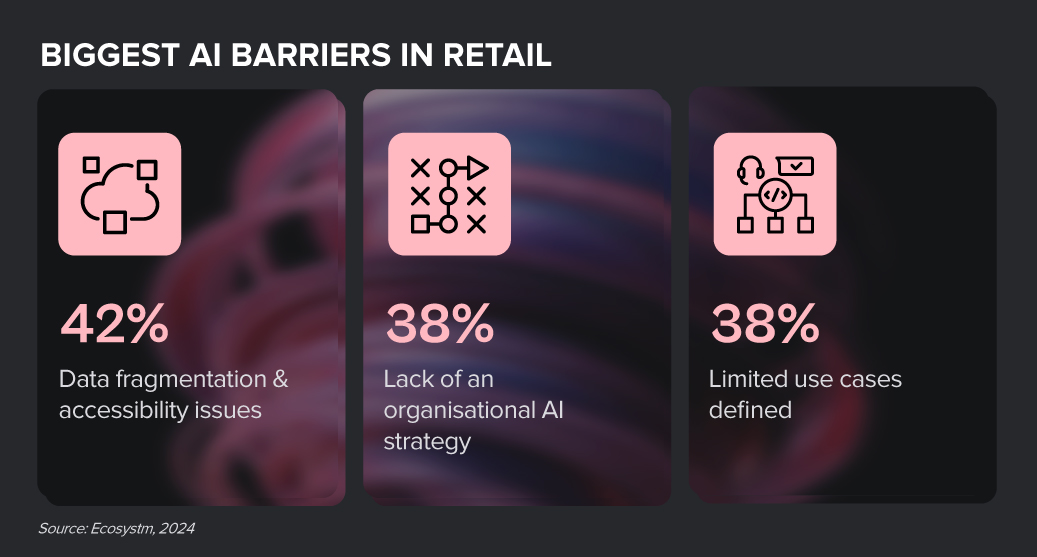

From personalised product recommendations to predictive analytics, AI is helping retailers deliver exceptional customer experiences and optimise their operations. However, many retailers are still grappling with the complexities of AI implementation. Those who can successfully navigate this challenge and harness the power of AI will emerge as industry leaders, driving innovation and shaping the future of retail.

Despite the challenges, Retail organisations are witnessing early AI success in these 3 areas:

- 1. Customer Experience & Engagement

- 2. Supply Chain Optimisation

- 3. Fraud & Risk Analysis

Customer Experience & Engagement

- Conversational AI. Providing real-time customer support and answering queries

- Personalisation. Offering tailored product suggestions based on customer preferences and behaviour

- Virtual Try-On. Allowing customers to visualise products in different settings using AR

“AI has helped us to refine our customer chatbots to allow for more self-service. We’ve experienced faster customer order processing and quicker resolution of issues, putting control directly in the hands of our customers.” – CX LEADER

Supply Chain Optimisation

- Inventory Management. Automating inventory management processes to ensure optimal stock levels

- Supply Chain Visibility. Monitoring and optimising supply chain operations, including logistics and distribution

- Demand Forecasting. Predicting sales and demand trends to optimise inventory and production planning

“We use AI to optimise the supply chain, saving operational costs. Digital supply chains and cloud-based tracking systems streamline operations and enhance efficiency.” – CFO

Fraud & Risk Analysis

- Fraud Detection. Identify and prevent fraudulent activities, such as online fraud and chargebacks

- Risk Assessment. Assessing risk factors associated with customer transactions and preventing losses

- Customer & Market Insights. Understanding customer behaviour, market trends, and growth opportunities

“With eCommerce as a key market force, understanding customer habits is crucial to ensuring we have the right products in stock and optimising our pricing strategy.” – COO

Southeast Asia’s banking sector is poised for significant digital transformation. With projected Net Interest Income reaching USD 148 billion by 2024, the market is ripe for continued growth. While traditional banks still hold a dominant position, digital players are making significant inroads. To thrive in this evolving landscape, financial institutions must adapt to rising customer expectations, stringent regulations, and the imperative for resilience. This will require a seamless collaboration between technology and business teams.

To uncover how banks in Southeast Asia are navigating this complex landscape and what it takes to succeed, Ecosystm engaged in in-depth conversations with senior banking executives and technology leaders as part of our research initiatives. Here are the highlights of the discussions with leaders across the region.

#1 Achieving Hyper-Personalisation Through AI

As banks strive to deliver highly personalised financial services, AI-driven models are becoming increasingly essential. These models analyse customer behaviour to anticipate needs, predict future behaviour, and offer relevant services at the right time. AI-powered tools like chatbots and virtual assistants further enhance real-time customer support.

Hyper-personalisation, while promising, comes with its challenges – particularly around data privacy and security. To deliver deeply tailored services, banks must collect extensive customer information, which raises the question: how can they ensure this sensitive data remains protected?

AI projects require a delicate balance between innovation and regulatory compliance. Regulations often serve as the right set of guardrails within which banks can innovate. However, banks – especially those with cross-border operations – must establish internal guidelines that consider the regulatory landscape of multiple jurisdictions.

#2 Beyond AI: Other Emerging Technologies

AI isn’t the only emerging technology reshaping Southeast Asian banking. Banks are increasingly adopting technologies like Robotic Process Automation (RPA) and blockchain to boost efficiency and engagement. RPA is automating repetitive tasks, such as data entry and compliance checks, freeing up staff for higher-value work. CIMB in Malaysia reports seeing a 35-50% productivity increase thanks to RPA. Blockchain is being explored for secure, transparent transactions, especially cross-border payments. The Asian Development Bank successfully trialled blockchain for faster, safer bond settlements. While AR and VR are still emerging in banking, they offer potential for enhanced customer engagement. Banks are experimenting with immersive experiences like virtual branch visits and interactive financial education tools.

The convergence of these emerging technologies will drive innovation and meet the rising demand for seamless, secure, and personalised banking services in the digital age. This is particularly true for banks that have the foresight to future-proof their tech foundation as part of their ongoing modernisation efforts. Emerging technologies offer exciting opportunities to enhance customer engagement, but they shouldn’t be used merely as marketing gimmicks. The focus must be on delivering tangible benefits that improve customer outcomes.

#3 Greater Banking-Fintech Collaboration

The digital payments landscape in Southeast Asia is experiencing rapid growth, with a projected 10% increase between 2024-2028. Digital wallets and contactless payments are becoming the norm, and platforms like GrabPay, GoPay, and ShopeePay are dominating the market. These platforms not only offer convenience but also enhance financial inclusion by reaching underbanked populations in remote areas.

The rise of digital payments has significantly impacted traditional banks. To remain relevant in this increasingly cashless society, banks are collaborating with fintech companies to integrate digital payment solutions into their services. For instance, Indonesia’s Bank Mandiri collaborated with digital credit services provider Kredivo to provide customers with access to affordable and convenient credit options.

Partnerships between traditional banks and fintechs are essential for staying competitive in the digital age, especially in areas like digital payments, data analytics, and customer experience.

While these collaborations offer opportunities, they also pose challenges. Banks must invest in advanced fraud detection, AI monitoring, and robust authentication to secure digital payments. Once banks adopt a mindset of collaboration with innovators, they can leverage numerous innovations in the cybersecurity space to address these challenges.

#4 Agile Infrastructure for an Agile Business

While the banking industry is considered a pioneer in implementing digital technologies, its approach to cloud has been more cautious. While interest remained high, balancing security and regulatory concerns with cloud agility impacted the pace. Hybrid multi-cloud environments has accelerated banking cloud adoption.

Leveraging public and private clouds optimises IT costs, offering flexibility and scalability for changing business needs. Hybrid cloud allows resource adjustments for peak demand or cost reductions off-peak. Access to cloud-native services accelerates innovation, enabling rapid application development and improved competitiveness. As the industry adopts GenAI, it requires infrastructure capable of handling vast data, massive computing power, advanced security, and rapid scalability – all strengths of hybrid cloud.

Replicating critical applications and data across multiple locations ensures disaster recovery and business continuity. A multi-cloud strategy also helps avoid vendor lock-in, diversifies cloud providers, and reduces exposure to outages.

Hybrid cloud adoption offers benefits but also presents challenges for banks. Managing the environment is complex, needing coordination across platforms and skilled personnel. Ensuring data security and compliance across on-prem and public cloud infrastructure is demanding, requiring robust measures. Network latency and performance issues can arise, making careful design and optimisation crucial. Integrating on-prem systems with public cloud services is time-consuming and needs investment in tools and expertise.

#5 Cyber Measures to Promote Customer & Stakeholder Trust

The banking sector is undergoing rapid AI-driven digital transformation, focusing on areas like digital customer experiences, fraud detection, and risk assessment. However, this shift also increases cybersecurity risks, with the majority of banking technology leaders anticipate inevitable data breaches and outages.

Key challenges include expanding technology use, such as cloud adoption and AI integration, and employee-related vulnerabilities like phishing. Banks in Southeast Asia are investing heavily in modernising infrastructure, software, and cybersecurity.

Banks must update cybersecurity strategies to detect threats early, minimise damage, and prevent lateral movement within networks.

Employee training, clear security policies, and a culture of security consciousness are critical in preventing breaches.

Regulatory compliance remains a significant concern, but banks are encouraged to move beyond compliance checklists and adopt risk-based, intelligence-led strategies. AI will play a key role in automating compliance and enhancing Security Operations Centres (SOCs), allowing for faster threat detection and response. Ultimately, the BFSI sector must prioritise cybersecurity continuously based on risk, rather than solely on regulatory demands.

Breaking Down Barriers: The Role of Collaboration in Banking Transformation

Successful banking transformation hinges on a seamless collaboration between technology and business teams. By aligning strategies, fostering open communication, and encouraging cross-functional cooperation, banks can effectively leverage emerging technologies to drive innovation, enhance customer experience, and improve efficiency.

A prime example of the power of collaboration is the success of AI initiatives in addressing specific business challenges.

This user-centric approach ensures that technology addresses real business needs.

By fostering a culture of collaboration, banks can promote continuous learning, idea sharing, and innovation, ultimately driving successful transformation and long-term growth in the competitive digital landscape.

India is undergoing a remarkable transformation across various industries, driven by rapid technological advancements, evolving consumer preferences, and a dynamic economic landscape. From the integration of new-age technologies like GenAI to the adoption of sustainable practices, industries in India are redefining their operations and strategies to stay competitive and relevant.

Here are some organisations that are leading the way.

Download ‘From Tradition to Innovation: Industry Transformation in India’ as a PDF

Redefining Customer Experience in the Financial Sector

Financial inclusion. India’s largest bank, the State Bank of India, is leading financial inclusion with its YONO app, to enhance accessibility. Initial offerings include five core banking services: cash withdrawals, cash deposits, fund transfers, balance inquiries, and mini statements, with plans to include account opening and social security scheme enrollments.

Customer Experience. ICICI Bank leverages RPA to streamline repetitive tasks, enhancing customer service with its virtual assistant, iPal, for handling queries and transactions. HDFC Bank customer preference insights to offer tailored financial solutions, while Axis Bank embraces a cloud-first strategy to digitise its platform and improve customer interfaces.

Indian banks are also collaborating with fintechs to harness new technologies for better customer experiences. YES Bank has partnered with Paisabazaar to simplify loan applications, and Canara HSBC Life Insurance has teamed up with Artivatic.AI to enhance its insurance processes via an AI-driven platform.

Improving Healthcare Access

Indian healthcare organisations are harnessing technology to enhance efficiency, improve patient experiences, and enable remote care.

Apollo Hospitals has launched an automated patient monitoring system that alerts experts to health deteriorations, enabling timely interventions through remote monitoring. Manipal Hospitals’ video consultation app reduces emergency department pressure by providing medical advice, lab report access, bill payments, appointment bookings, and home healthcare requests, as well as home medication delivery and Fitbit monitoring. Omni Hospitals has also implemented AI-based telemedicine for enhanced patient engagement and remote monitoring.

The government is also driving the improvement of healthcare access. eSanjeevani is the world’s largest government-owned telemedicine system, with the capacity to handle up to a million patients a day.

Driving Retail Agility & Consumer Engagement

India’s Retail sector, the fourth largest globally, contributes over 10% of the nation’s GDP. To stay competitive and meet evolving consumer demands, Indian retailers are rapidly adopting digital technologies, from eCommerce platforms to AI.

Omnichannel Strategies. Reliance Retail integrates physical stores with digital platforms like JioMart to boost sales and customer engagement. Tata CLiQ’s “phygital” approach merges online and offline shopping for greater convenience while Shoppers Stop uses RFID and data analytics for improved in-store experiences, online shopping, and targeted marketing.

Retail AI. Flipkart’s AI-powered shopping assistant, Flippi uses ML for conversational product discovery and intuitive guidance. BigBasket employs IoT-led AI to optimise supply chain and improve product quality.

Reshaping the Automotive Landscape

Tech innovation, from AI/ML to connected vehicle technologies, is revolutionising the Automotive sector. This shift towards software-defined vehicles and predictive supply chain management underscores the industry’s commitment to efficiency, transparency, safety, and environmental sustainability.

Maruti Suzuki’s multi-pronged approach includes collaborating with over 60 startups through its MAIL program and engaging Accenture to drive tech change. Maruti has digitised 24 out of 26 customer touchpoints, tracking every interaction to enhance customer service. In the Auto OEM space, they are shifting to software-defined vehicles and operating models.

Tata Motors is leveraging cloud, AI/ML, and IoT to enhancing efficiency, improving safety, and driving sustainability across its operations. Key initiatives include connected vehicles, automated driving, dealer management, cybersecurity, electric powertrains, sustainability, and supply chain optimisation.

Streamlining India’s Logistics Sector

India’s logistics industry is on the cusp of a digital revolution as it embraces cutting-edge technologies to streamline processes and reduce environmental impact.

Automation and Predictive Analytics. Automation is transforming warehousing operations in India, with DHL India automating sortation centres to handle 6,000 shipments per hour. Predictive analytics is reshaping logistics decision-making, with Delhivery optimising delivery routes to ensure timely service.

Sustainable Practices. The logistics sector contributes one-third of global carbon emissions. To combat this, Amazon India will convert its delivery fleet to 100% EVs by 2030 to reduce emissions and fuel costs. Blue Energy Motors is also producing 10,000 heavy-duty LNG trucks annually for zero-emission logistics.

As AI adoption continues to surge, the tech infrastructure market is undergoing a significant transformation. Traditional IT infrastructure providers are facing increasing pressure to innovate and adapt to the evolving demands of AI-powered applications. This shift is driving the development of new technologies and solutions that can support the intensive computational requirements and data-intensive nature of AI workloads.

At Lenovo’s recently held Asia Pacific summit in Shanghai they detailed their ‘AI for All’ strategy as they prepare for the next computing era. Building on their history as a major force in the hardware market, new AI-ready offerings will be prominent in their enhanced portfolio.

At the same time, Lenovo is adding software and services, both homegrown and with partners, to leverage their already well-established relationships with client IT teams. Sustainability is also a crucial message as it seeks to address the need for power efficiency and zero waste lifecycle management in their products.

Ecosystm Advisor Darian Bird comment on Lenovo’s recent announcements and messaging.

Click here to download Lenovo’s Innovation Roadmap: Takeaways from the APAC Analyst Summit as a PDF

1. Lenovo’s AI Strategy

Lenovo’s AI strategy focuses on launching AI PCs that leverage their computing legacy.

As the adoption of GenAI increases, there’s a growing need for edge processing to enhance privacy and performance. Lenovo, along with Microsoft, is introducing AI PCs with specialised components like CPUs, GPUs, and AI accelerators (NPUs) optimised for AI workloads.

Energy efficiency is vital for AI applications, opening doors for mobile-chip makers like Qualcomm. Lenovo’s latest ThinkPads, featuring Qualcomm’s Snapdragon X Elite processors, support Microsoft’s Copilot+ features while maximising battery life during AI tasks.

Lenovo is also investing in small language models (SLMs) that run directly on laptops, offering GenAI capabilities with lower resource demands. This allows users to interact with PCs using natural language for tasks like file searches, tech support, and personal management.

2. Lenovo’s Computer Vision Solutions

Lenovo stands out as one of the few computing hardware vendors that manufactures its own systems.

Leveraging precision engineering, Lenovo has developed solutions to automate production lines. By embedding computer vision in processes like quality inspection, equipment monitoring, and safety supervision, Lenovo customises ML algorithms using customer-specific data. Clients like McLaren Automotive use this technology to detect flaws beyond human capability, enhancing product quality and speeding up production.

Lenovo extends their computer vision expertise to retail, partnering with Sensormatic and Everseen to digitise branch operations. By analysing camera feeds, Lenovo’s solutions optimise merchandising, staffing, and design, while their checkout monitoring system detects theft and scanning errors in real-time. Australian customers have seen significant reductions in retail shrinkage after implementation.

3. AI in Action: Autonomous Robots

Like other hardware companies, Lenovo is experimenting with new devices to futureproof their portfolio.

Earlier this year, Lenovo unveiled the Daystar Bot GS, a six-legged robotic dog and an upgrade from their previous wheeled model. Resembling Boston Dynamics’ Spot but with added legs inspired by insects for enhanced stability, the bot is designed for challenging environments. Lenovo is positioning it as an automated monitoring assistant for equipment inspection and surveillance, reducing the need for additional staff. Power stations in China are already using the robot to read meters, detect temperature anomalies, and identify defective equipment.

Although it is likely to remain a niche product in the short term, the robot is an avenue for Lenovo to showcase their AI wares on a physical device, incorporating computer vision and self-guided movement.

Considerations for Lenovo’s Future Growth

Lenovo outlined an AI vision leveraging their expertise in end user computing, manufacturing, and retail. While the strategy aligns with Lenovo’s background, they should consider the following:

Hybrid AI. Initially, AI on PCs will address performance and privacy issues, but hybrid AI – integrating data across devices, clouds, and APIs – will eventually dominate.

Data Transparency & Control. The balance between convenience and privacy in AI is still unclear. Evolving transparency and control will be crucial as users adapt to new AI tools.

AI Ecosystem. AI’s value lies in data, applications, and integration, not just hardware. Hardware vendors must form deeper partnerships in these areas, as Lenovo’s focus on industry-specific solutions demonstrates.

Enhanced Experience. AI enhances operational efficiency and customer experience. Offloading level one support to AI not only cuts costs but also resolves issues faster than live agents.

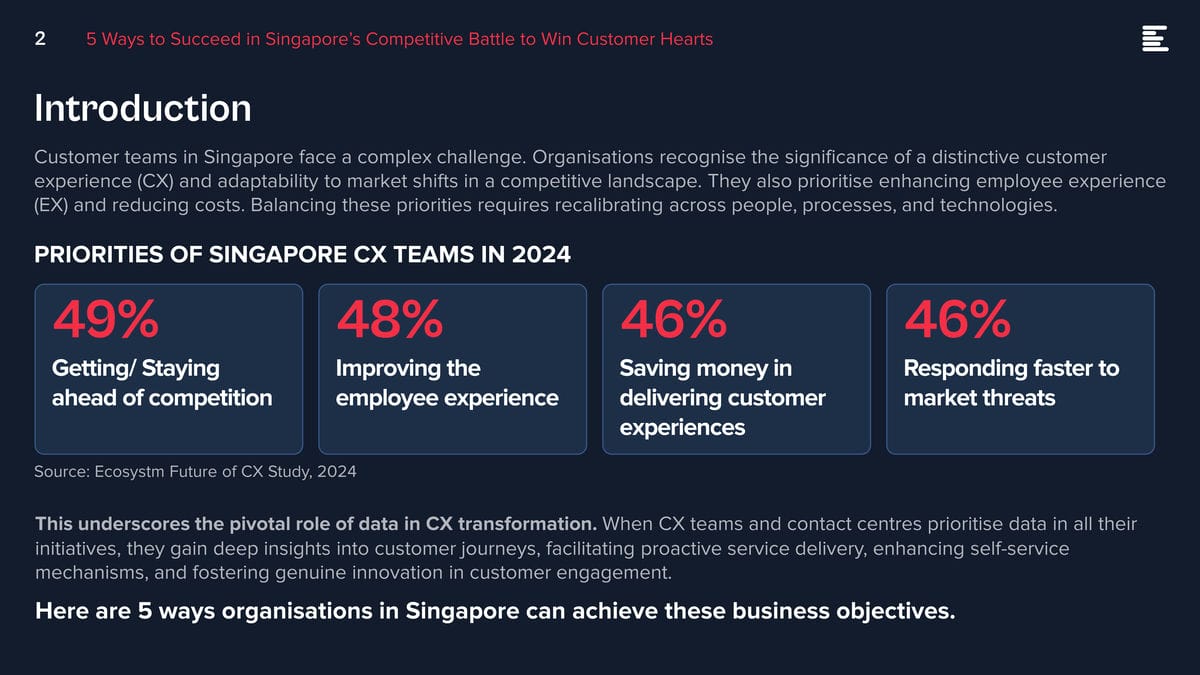

Customer teams in Singapore face a complex challenge. Organisations recognise the significance of a distinctive customer experience (CX) and adaptability to market shifts in a competitive landscape. They also prioritise enhancing employee experience (EX) and reducing costs. Balancing these priorities requires recalibrating across people, processes, and technologies.

This underscores the pivotal role of data in CX transformation. When CX teams and contact centres prioritise data in all their initiatives, they gain deep insights into customer journeys, facilitating proactive service delivery, enhancing self-service mechanisms, and fostering genuine innovation in customer engagement.

Here are 5 ways organisations in Singapore can achieve these business objectives.

Download ‘5 Ways to Succeed in Singapore’s Competitive Battle to Win Customer Hearts’ as a PDF.

#1 Build a Strategy around Voice & Omnichannel Orchestration

Customers seek flexibility to choose channels that suit their preferences, often switching between them. When channels are well-coordinated, customers enjoy consistent experiences, and CX teams and contact centre agents gain real-time insights into interactions, regardless of the chosen channel. This boosts key metrics like First Call Resolution (FCR) and reduces Average Handle Time (AHT).

This doesn’t diminish the significance of voice. Voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels. Regardless of the channel chosen, prioritising omnichannel orchestration is essential.

Ensure seamless orchestration from voice to back and front offices, including social channels, as customers switch between channels.

#2 Unify Customer Data through an Intelligent Data Hub

Accessing real-time, accurate data is essential for effective customer and agent engagement. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

A Customer Data Platform (CDP) can eliminate data silos and provide actionable insights.

- Identify behavioural trends by understanding patterns to personalise interactions.

- Spot real-time customer issues across channels.

- Uncover compliance gaps and missed sales opportunities from unstructured data.

- Look at customer journeys to proactively address their needs and exceed expectations.

#3 Transform CX & EX with AI

GenAI and Large Language Models (LLMs) is revolutionising how brands address customer and employee challenges, boosting efficiency, and enhancing service quality.

Despite 62% of Singapore organisations investing in virtual assistants/conversational AI, many have yet to integrate emerging technologies to elevate their CX & EX capabilities.

Agent Assist solutions provide real-time insights before customer interactions, optimising service delivery and saving time. With GenAI, they can automate mundane tasks like call summaries, freeing agents to focus on high-value tasks such as sales collaboration, proactive feedback management, personalised outbound calls, and upskilling.

Going beyond chatbots and Agent Assist solutions, predictive AI algorithms leverage customer data to forecast trends and optimise resource allocation. AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks.

#4 Augment Existing Systems for Success

Despite the rise in digital interactions, many organisations struggle to fully modernise their legacy systems.

For those managing multiple disparate systems yet aiming to lead in CX transformation, a platform that integrates desired capabilities for holistic CX and EX experiences is vital.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This will require organisations to re-evaluate all aspects of their CX delivery.

- Redefine the Contact Centre. Transform it into an “Intelligent” Data Hub providing unified and connected experiences. Leverage intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empower agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensure consistent omnichannel experiences through data unification and coherency. Use programmable APIs to personalise conversations and identify customer preferences for real-time or asynchronous messaging. Incorporate innovative technologies such as video to enhance the channel experience.

Customer feedback is at the heart of Customer Experience (CX). But it’s changing. What we consider customer feedback, how we collect and analyse it, and how we act on it is changing. Today, an estimated 80-90% of customer data is unstructured. Are you able and ready to leverage insights from that vast amount of customer feedback data?

Let’s begin with the basics: What is VoC and why is there so much buzz around it now?

Voice of the Customer (VoC) traditionally refers to customer feedback programs. In its most basic form that means organisations are sending surveys to customers to ask for feedback. And for a long time that really was the only way for organisations to understand what their customers thought about their brand, products, and services.

But that was way back then. Over the last few years, we’ve seen the market (organisations and vendors) dipping their toes into the world of unsolicited feedback.

What’s unsolicited feedback, you ask?

Unsolicited feedback simply means organisations didn’t actually ask for it and they’re often not in control over it, but the customer provides feedback in some way, shape, or form. That’s quite a change to the traditional survey approach, where they got answers to questions they specifically asked (solicited feedback).

Unsolicited feedback is important for many reasons:

- Organisations can tap into a much wider range of feedback sources, from surveys to contact centre phone calls, chats, emails, complaints, social media conversations, online reviews, CRM notes – the list is long.

- Surveys have many advantages, but also many disadvantages. From only hearing from a very specific customer type (those who respond and are typically at the extreme ends of the feedback sentiment), getting feedback on the questions they ask, and hearing from a very small portion of the customer base (think email open rates and survey fatigue).

- With unsolicited feedback organisations hear from 100% of the customers who interact with the brand. They hear what customers have to say, and not just how they answer predefined questions.

It is a huge step up, especially from the traditional post-call survey. Imagine a customer just spent 30 min on the line with an agent explaining their problem and frustration, just to receive a survey post call, to tell the organisation what they just told the agent, and how they felt about the experience. Organisations should already know that. In fact, they probably do – they just haven’t started tapping into that data yet. At least not for CX and customer insights purposes.

When does GenAI feature?

We can now tap into those raw feedback sources and analyse the unstructured data in a way never seen before. Long gone are the days of manual excel survey verbatim read-throughs or coding (although I’m well aware that that’s still happening!). Tech, in particular GenAI and Large Language Models (LLMs), are now assisting organisations in decluttering all the messy conversations and unstructured data. Not only is the quality of the analysis greatly enhanced, but the insights are also presented in user-friendly formats. Customer teams ask for the insights they need, and the tools spit it out in text form, graphs, tables, and so on.

The time from raw data to insights has reduced drastically, from hours and days down to seconds. Not only has the speed, quality, and ease of analysis improved, but many vendors are now integrating recommendations into their offerings. The tools can provide “basic” recommendations to help customer teams to act on the feedback, based on the insights uncovered.

Think of all the productivity gains and spare time organisations now have to act on the insights and drive positive CX improvements.

What does that mean for CX Teams and Organisations?

Including unsolicited feedback into the analysis to gain customer insights also changes how organisations set up and run CX and insights programs.

It’s important to understand that feedback doesn’t belong to a single person or team. CX is a team sport and particularly when it comes to acting on insights. It’s essential to share these insights with the right people, at the right time.

Some common misperceptions:

- Surveys have “owners” and only the owners can see that feedback.

- Feedback that comes through a specific channel, is specific to that channel or product.

- Contact centre feedback is only collected to coach staff.

If that’s how organisations have built their programs, they’ll have to rethink what they’re doing.

If organisations think about some of the more commonly used unstructured feedback, such as that from the contact centre or social media, it’s important to note that this feedback isn’t solely about the contact centre or social media teams. It’s about something else. In fact, it’s usually about something that created friction in the customer experience, that was generated by another team in the organisation. For example: An incorrect bill can lead to a grumpy social media post or a faulty product can lead to a disgruntled call to the contact centre. If the feedback is only shared with the social media or contact centre team, how will the underlying issues be resolved? The frontline teams service customers, but organisations also need to fix the underlying root causes that created the friction in the first place.

And that’s why organisations need to start consolidating the feedback data and democratise it.

It’s time to break down data and organisational silos and truly start thinking about the customer. No more silos. Instead, organisations must focus on a centralised customer data repository and data democratisation to share insights with the right people at the right time.

In my next Ecosystm Insights, I will discuss some of the tech options that CX teams have. Stay tuned!

In recent years, organisations have had to swiftly transition to providing digital experiences due to limitations on physical interactions; competed fiercely based on the customer experiences offered; and invested significantly in the latest CX technologies. However, in 2024, organisations will pivot their competitive efforts towards product innovation rather than solely focusing on enhancing the CX.

This does not mean that organisations will not focus on CX – they will just be smarter about it!

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 Customer Experience trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 CX Trends in 2024’ as a PDF.

#1 Customer Experience is Due for a Reset

Organisations aiming to improve customer experience are seeing diminishing returns, moving away from the significant gains before and during the pandemic to incremental improvements. Many organisations experience stagnant or declining CX and NPS scores as they prioritise profit over customer growth and face a convergence of undifferentiated digital experiences. The evolving digital landscape has also heightened baseline customer expectations.

In 2024, CX programs will be focused and measurable – with greater involvement of Sales, Marketing, Brand, and Customer Service to ensure CX initiatives are unified across the entire customer journey.

Organisations will reassess CX strategies, choosing impactful initiatives and aligning with brand values. This recalibration, unique to each organisation, may include reinvesting in human channels, improving digital experiences, or reimagining customer ecosystems.

#2 Sentiment Analysis Will Fuel CX Improvement

Organisations strive to design seamless customer journeys – yet they often miss the mark in crafting truly memorable experiences that forge emotional connections and turn customers into brand advocates.

Customers want on-demand information and service; failure to meet these expectations often leads to discontent and frustration. This is further heightened when organisations fail to recognise and respond to these emotions.

Sentiment analysis will shape CX improvements – and technological advancements such as in neural network, promise higher accuracy in sentiment analysis by detecting intricate relationships between emotions, phrases, and words.

These models explore multiple permutations, delving deeper to interpret the meaning behind different sentiment clusters.

#3 AI Will Elevate VoC from Surveys to Experience Improvement

In 2024, AI technologies will transform Voice of Customer (VoC) programs from measurement practices into the engine room of the experience improvement function.

The focus will move from measurement to action – backed by AI. AI is already playing a pivotal role in analysing vast volumes of data, including unstructured and unsolicited feedback. In 2024, VoC programs will shift gear to focus on driving a customer centric culture and business change. AI will augment insight interpretation, recommend actions, and predict customer behaviour, sentiment, and churn to elevate customer experiences (CX).

Organisations that don’t embrace an AI-driven paradigm will get left behind as they fail to showcase and deliver ROI to the business.

#4 Generative AI Platforms Will Replace Knowledge Management Tools

Most organisations have more customer knowledge management tools and platforms than they should. They exist in the contact centre, on the website, the mobile app, in-store, at branches, and within customer service. There are two challenges that this creates:

- Inconsistent knowledge. The information in the different knowledge bases is different and sometimes conflicting.

- Difficult to extract answers. The knowledge contained in these platforms is often in PDFs and long form documents.

Generative AI tools will consolidate organisational knowledge, enhancing searchability.

Customers and contact centre agents will be able to get actual answers to questions and they will be consistent across touchpoints (assuming they are comprehensive, customer-journey and organisation-wide initiatives).

#5 Experience Orchestration Will

Accelerate

Despite the ongoing effort to streamline and simplify the CX, organisations often implement new technologies, such as conversational AI, digital and social channels, as independent projects. This fragmented approach, driven by the desire for quick wins using best-in-class point solutions results in a complex CX technology architecture.

With the proliferation of point solution vendors, it is becoming critical to eliminate the silos. The fragmentation hampers CX teams from achieving their goals, leading to increased costs, limited insights, a weak understanding of customer journeys, and inconsistent services.

Embracing CX unification through an orchestration platform enables organisations to enhance the CX rapidly, with reduced concerns about tech debt and legacy issues.