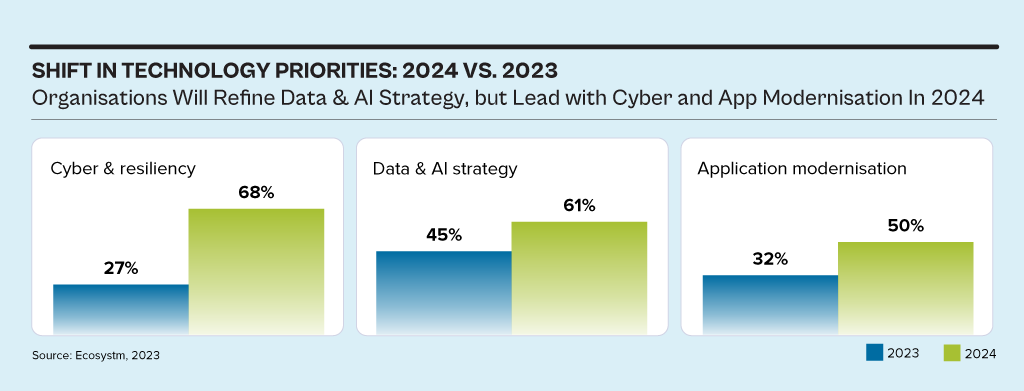

While the discussions have centred around AI, particularly Generative AI in 2023, the influence of AI innovations is extensive. Organisations will urgently need to re-examine their risk strategies, particularly in cyber and resilience practices. They will also reassess their infrastructure needs, optimise applications for AI, and re-evaluate their skills requirements.

This impacts the entire tech market, including tech skills, market opportunities, and innovations.

Ecosystm analysts Alea Fairchild, Darian Bird, Richard Wilkins, and Tim Sheedy present the top 5 trends in building an Agile & Resilient Organisation in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 Resilience Trends in 2024’ as a PDF.

#1 Gen AI Will See Spike in Infrastructure Innovation

Enterprises considering the adoption of Generative AI are evaluating cloud-based solutions versus on-premises solutions. Cloud-based options present an advantage in terms of simplified integration, but raise concerns over the management of training data, potentially resulting in AI-generated hallucinations. On-premises alternatives offer enhanced control and data security but encounter obstacles due to the unexpectedly high demands of GPU computing needed for inferencing, impeding widespread implementation. To overcome this, there’s a need for hardware innovation to meet Generative AI demands, ensuring scalable on-premises deployments.

The collaboration between hardware development and AI innovation is crucial to unleash the full potential of Generative AI and drive enterprise adoption in the AI ecosystem.

Striking the right balance between cloud-based flexibility and on-premises control is pivotal, with considerations like data control, privacy, scalability, compliance, and operational requirements.

#2 Cloud Migrations Will Make Way for Cloud Transformations

The steady move to the public cloud has slowed down. Organisations – particularly those in mature economies – now prioritise cloud efficiencies, having largely completed most of their application migration. The “easy” workloads have moved to the cloud – either through lift-and-shift, SaaS, or simple replatforming.

New skills will be needed as organisations adopt public and hybrid cloud for their entire application and workload portfolio.

- Cloud-native development frameworks like Spring Boot and ASP.NET Core make it easier to develop cloud-native applications

- Cloud-native databases like MongoDB and Cassandra are designed for the cloud and offer scalability, performance, and reliability

- Cloud-native storage like Snowflake, Amazon S3 and Google Cloud Storage provides secure and scalable storage

- Cloud-native messaging like Amazon SNS and Google Cloud Pub/Sub provide reliable and scalable communication between different parts of the cloud-native application

#3 2024 Will be a Good Year for Technology Services Providers

Several changes are set to fuel the growth of tech services providers (systems integrators, consultants, and managed services providers).

There will be a return of “big apps” projects in 2024.

Companies are embarking on significant updates for their SAP, Oracle, and other large ERP, CRM, SCM, and HRM platforms. Whether moving to the cloud or staying on-premises, these upgrades will generate substantial activity for tech services providers.

The migration of complex apps to the cloud involves significant refactoring and rearchitecting, presenting substantial opportunities for managed services providers to transform and modernise these applications beyond traditional “lift-and-shift” activities.

The dynamic tech landscape, marked by AI growth, evolving security threats, and constant releases of new cloud services, has led to a shortage of modern tech skills. Despite a more relaxed job market, organisations will increasingly turn to their tech services partners, whether onshore or offshore, to fill crucial skill gaps.

#4 Gen AI and Maturing Deepfakes Will Democratise Phishing

As with any emerging technology, malicious actors will be among the fastest to exploit Generative AI for their own purposes. The most immediate application will be employing widely available LLMs to generate convincing text and images for their phishing schemes. For many potential victims, misspellings and strangely worded appeals are the only hints that an email from their bank, courier, or colleague is not what it seems. The ability to create professional-sounding prose in any language and a variety of tones will unfortunately democratise phishing.

The emergence of Generative AI combined with the maturing of deepfake technology will make it possible for malicious agents to create personalised voice and video attacks. Digital channels for communication and entertainment will be stretched to differentiate between real and fake.

Security training that underscores the threat of more polished and personalised phishing is a must.

#5 A Holistic Approach to Risk and Operational Resilience Will Drive Adoption of VMaaS

Vulnerability management is a continuous, proactive approach to managing system security. It not only involves vulnerability assessments but also includes developing and implementing strategies to address these vulnerabilities. This is where Vulnerability Management Platforms (VMPs) become table stakes for small and medium enterprises (SMEs) as they are often perceived as “easier targets” by cybercriminals due to potentially lesser investments in security measures.

Vulnerability Management as a Service (VMaaS) – a third-party service that manages and controls threats to automate vulnerability response to remediate faster – can improve the asset cybersecurity management and let SMEs focus on their core activities.

In-house security teams will particularly value the flexibility and customisation of dashboards and reports that give them enhanced visibility over all assets and vulnerabilities.

New ‘as-a-service’ products are continuing to expand the options that are available to organisations, fragmenting the functionality used across many technology providers. Choosing the right products is getting more and more difficult – kind of like trying to choose your VOD service at home.

How many VOD networks do you use?

Do you remember the time when your access to video content was through either broadcast TV or cable TV? And when a regular trip to the video store was part of life? And you had to watch programs when the networks scheduled them?

Most programming was only available through one of those media, particularly if you wanted to see the latest series or movies. In some countries, we paid a TV license fee that partly paid for the government-funded free-to-air network. For those with access to cable or satellite TV, we paid a monthly fee for a smorgasbord of channels, most of which we never watched.

Today, we still have those options, but an explosion of video-on-demand (VOD) options has occurred. Each of them requires a separate contract that users rarely read. So we have little knowledge of what these services have contracted to deliver or how they will use our data. But we have an amazing range of content available if we want.

At least most are monthly services that we can cancel at short notice unless you take advantage of the price reduction for subscribing for a year or longer.

How many as-a-service products are you choosing?

Translate this to an organisation that is increasingly using as-a-service products. Choosing a service to use has much more complex requirements, there are more options available and happens more frequently.

If we think the domestic landscape for video is complicated, the options for as-a-service are significantly more fragmented. The most frequently used approach to selecting VOD services is to choose those that offer the content you want to see.

Choosing the appropriate as-a-service offering is much harder as the functional, security, integration and pricing requirements are much more complex than wanting to see a particular movie or drama series.

Suppliers of these services do not make it easy to understand what you get for your money. They decide to bundle or unbundle functions depending on a mix of factors to differentiate themselves for customers. This makes value and price comparisons difficult.

For example, there is a myriad of CRM suppliers out there offering a complex matrix of pricing and functionality options. And in each case, there is often an ecosystem of suppliers providing different pieces of functionality. No one provider delivers all the functionality that we desire.

Organisations wanting to choose as-a-service products need to be very clear on which requirements are the most important to them, and how well each supplier meets those specific needs. They cannot afford to be distracted by less valuable features.

It is extremely unlikely that one tech vendor will be able to provide all the desired features. Increasingly, other vendors will supplement the core functionality with niche features. So the selection has to take into account the ecosystem around the core as-a-service functionality.

Recommendations

Tech buyers should make sure they have a clear definition and priority for the features that they require for each purpose. Added to this they need to be very clear what they want in a single package, and what they are prepared to purchase from a wider ecosystem. Both need to be part of the selection criteria.

Once implemented, changing as-a-service products is a much more difficult proposition than switching VOD providers.

Tech vendors need to stay away from confusion marketing to make it possible for buyers to understand what they are getting. They need to help customers gain a clear understanding of any ecosystem they participate in, and what this means for the buyer.

The consequences of getting this choice right are dramatically more important than choosing the VOD provider with the programming you want.

And we know how difficult that choice has become.

This week, Vodafone New Zealand launched a contact centre solution known as Vodafone Connect that runs on AWS cloud infrastructure. The solution is designed for contact centres and customer service providers to reduce their operating cost and deliver an improved customer experience (CX).

The move comes as many businesses and governments are witnessing a spike in inbound contact centre volumes since the outbreak of the pandemic. The telecom company aims to help the contact centre industry through its on-demand contact centre suite of solutions that can be scaled up or down according to the organisations’ requirements. It can be combined with existing CRM platforms in a single dashboard for better access to data and resolution support.

Vodafone Connect is built on the AWS Connect cloud contact centre solution and uses data analytics and machine learning tools to automate customer interactions across multiple channels – email, messaging and social media – to support the contact centre agents with real-time information.

COVID-19 has accelerated the move to the cloud

The recent pandemic has seen many organisations make a leap almost overnight to cloud contact centre technologies. Many organisations that previously had concerns around data privacy, and securing customer data – and were thus hesitant about deploying cloud contact centre solutions – have moved to the cloud model. The cloud model helped get agents that were forced to work from home up and running in a short duration. The immediate urgency was primarily due to a massive spike in voice calls and non-voice activity such as emails. During the COVID-19 crisis, many organisations used Virtual Private Network (VPN) connections to their legacy on-premises phone system to enable the remote agents. However, there have been challenges reported by many organisations with that approach such as increases to IT budget, difficulty in scaling easily, and the requirement for more IT support that could have been avoided.

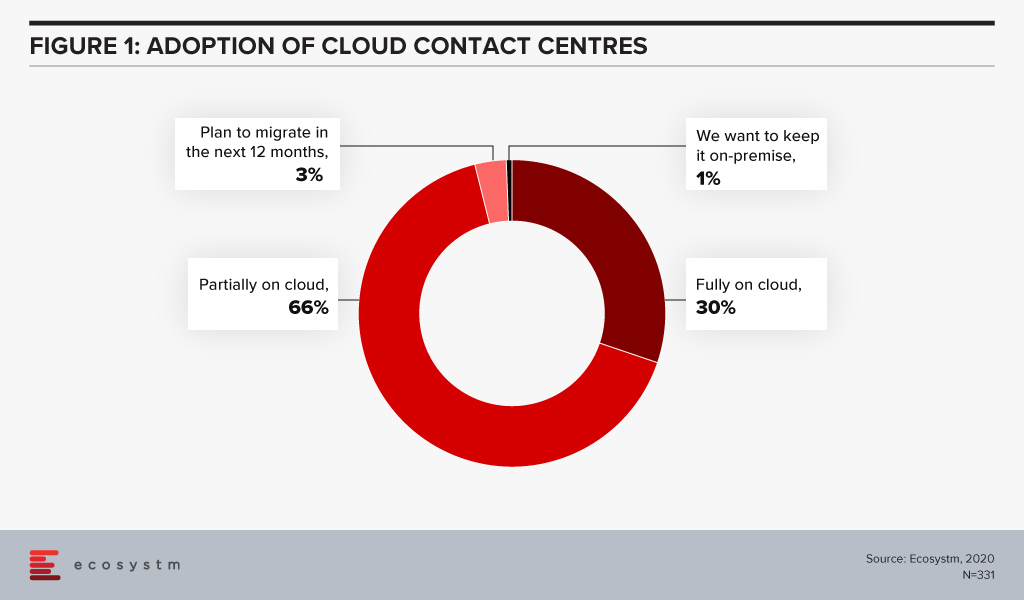

Ecosystm research finds that only 30% of organisations have fully migrated their cloud contact centre solutions on the cloud.

This indicates a market opportunity for vendors in the cloud contact centre space. The COVID-19 pandemic has definitely triggered a strong move towards the cloud model. It has become imperative for vendors and solutions providers to strengthen their cloud capabilities.

Driving an Omni-Channel Experience has become increasingly difficult

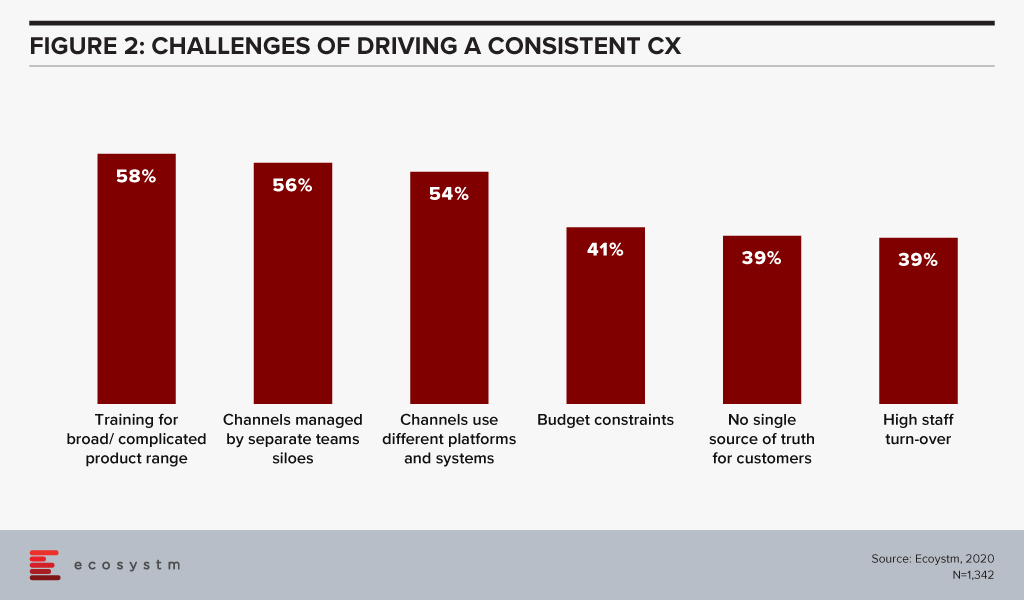

Ecosystm research also finds that organisations find siloed organisational data as one of the biggest challenges in driving consistent customer experience.

This has been further exacerbated by the high volume of interactions that organisations have been having with their customers, and the need to accommodate work-from-home policies for their customer care agents. At the same time, nearly 60% of organisations want to drive an omni-channel experience to improve CX. This provides a huge opportunity for contact centre vendors and partners to offer consulting services to help organisations bridge the gaps in achieving an omni-channel experience. For many organisations there has been a greater push to integrate CRM, the voice of the customer/surveys, customer journey analytics to the contact centre technologies and this is not an easy task as it involves different stakeholders with different sets of KPIs. Having a single platform that can manage this omni-channel experience will be a huge benefit for many organisations.

New Players in the Competitive Landscape

AWS is a relatively new player in the contact centre market, but it is starting to disrupt the existing players, with a global installed base. However, it is worth noting that Avaya, Cisco and Genesys have a higher installed base and they continue to win new deals. The move to the cloud is witnessing more service providers, telecom providers and other contact centre partners push more cloud-based solutions in the market. Apart from AWS, other important players include NICEinContact, 8×8, Talkdesk, Twillio, Five9, and UJet. The competitive battleground is heating up and there are a lot of options for customers to choose from. It will all come down to working with a vendor that can help them achieve their desired CX outcomes.

There are other important elements in CX that are growing in importance and these include conversational AI, voice biometrics, knowledge management systems, machine learning and CX management solutions. Contact centre solution providers are having discussions around these areas with tech buyers. This will mean that we can expect deeper partnerships and acquisitions in the short to medium term. Security has also emerged as an important issue to be resolved, especially with agents working from home. This is from a compliance perspective and pertaining to how agents are viewing and handling customer data. These new trends indicate that customers will need to work with different vendors to solve the variety of issues they are facing.

The Vodafone Connect solution on AWS Connect is one of the many examples of how more partners of contact centre solutions are gearing up for the rapid move to the cloud. Globally, Vodafone also sells contact centre solutions from Cisco and Genesys. The next 3 years will see a great movement in the market and this will include vendors from North America that will set up operations to push their offerings across Europe and the Asia Pacific.