Two weeks ago, Michael Dell made the big announcement that Dell Technologies would spin off their shareholding in VMware, leading to a share price spike for both companies. A lot has already been written about the move – we would like to highlight a market-based view which we feel will be significant for the two companies going forward.

First let us break down the facts around the deal:

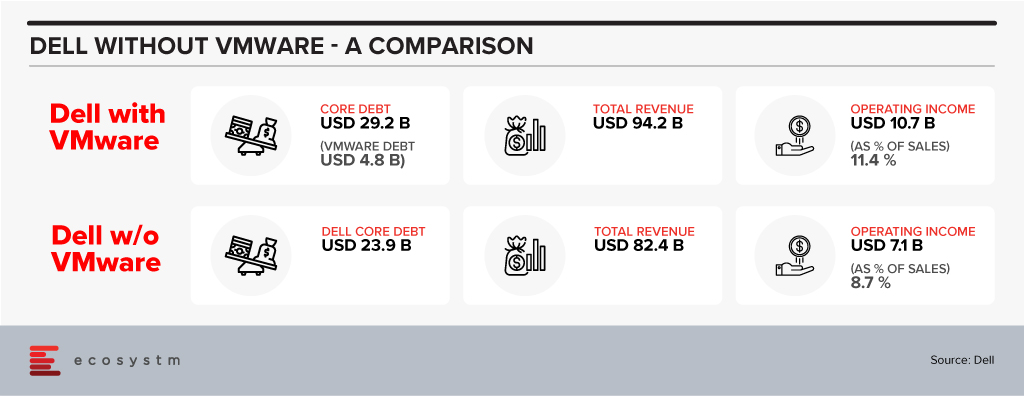

As has been analysed threadbare the deal reduces the total debt Dell is carrying and will even reduce the ratio of Dell debt to EBITDA. As a result, it is highly likely that Dell’s credit rating will move up from their current BB+ level to investment grade – which can have a lot of implications for future capital raising. There is also a buzz in the market that Dell Technologies may also sell off Boomi soon and write down another USD 3 Billion approximately in debt.

It is interesting to note that the company has been willing to let go off VMware even though it will dilute their profitability ratios – VMWare business being obviously more profitable than Dell’s traditional businesses which are heavily based on products.

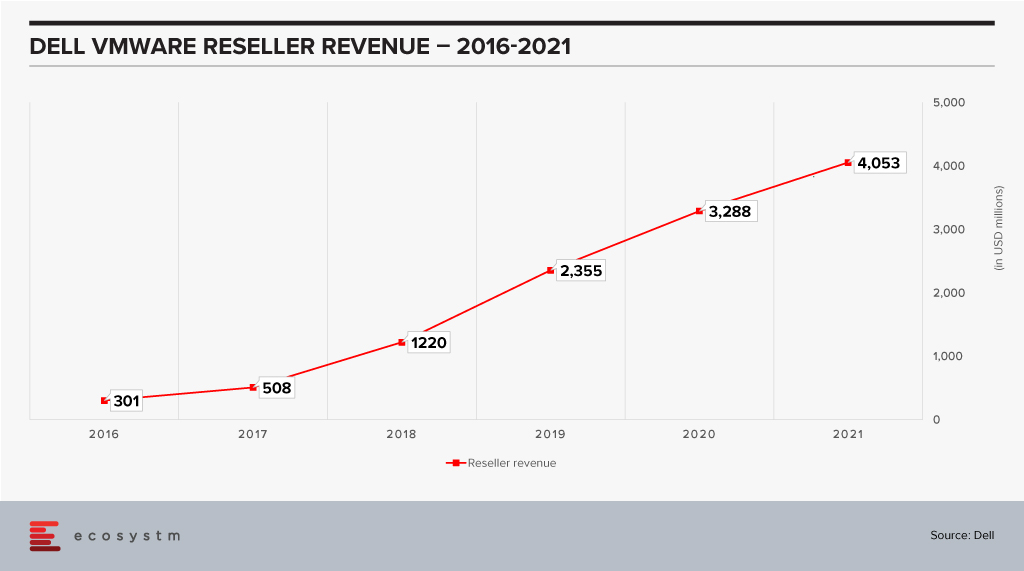

The last few years has seen Dell reselling a fair amount of VMware products. From a number of perspectives Dell has been a key reseller for VMware and now contributes almost 34% of VMware’s revenues.

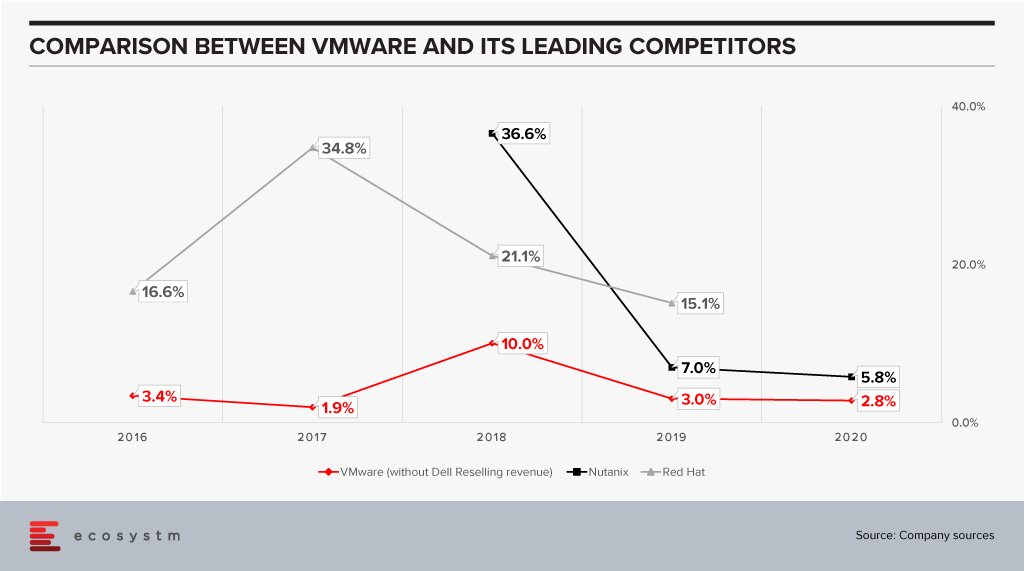

This chart is a testament to the power of execution that is inherent within Dell. This performance was aided by market growth – but even then it is remarkable how Dell has been able to scale up taking VMware to their customers. The two companies have very different sales cycles. A VMware sale typically has a longer cycle with a completely different set of touchpoints from the boxes that Dell is so good at selling – which have shorter cycles. The sales cycle for EMC products is closer to VMware’s which would have helped. The sales of the VXRail hyperconverged appliance have also jumped in recent times and this would have driven an equivalent spike in VMware revenues. It is still a remarkable achievement to be able to bring these three diverse groups together and grow revenue.

Market Impact of the Spin-Off

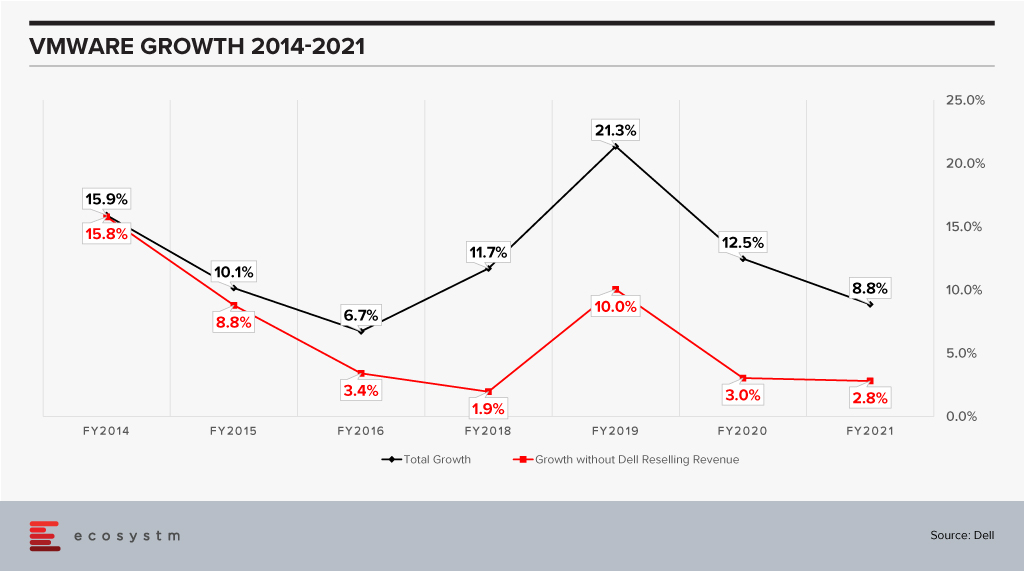

Does it make sense then for VMware to part with their largest reseller? Would it not be better for VMware to continue to drive this and use Dell’s execution skills to drive more growth? Data suggests that there could be another twist to this story.

VMware has been growing impressively as a company when one looks at the black line and while the growth has slowed in percentage terms, this is on a much higher revenue base. FY2021 revenue is close to 2x the revenue in FY2014. However, when one considers it without the Dell reselling revenue (the red line) it looks a lot less impressive especially in the last couple of years when it is an anemic 3%. When comparing this growth we also see a slowdown of sorts in recent years for VMware.

Til Dell acquired EMC – and VMware in consequence – they were working closely with other vendors such as Nutanix and driving solid growth for them. As they pivoted to doing more with VMware, did this then mean that other vendors – of either bare metal or cloud – drifted away from VMware?

Anecdotal evidence suggests that vendors such as HPE became more cautious and tried to diversify their business. It is entirely possible that if we looked at VMware as two separate businesses – one with Dell and one independent – the independent business has been losing share in the last few years.

The optical separation from Dell may then help VMware in rebuilding stronger relationships with the other players in the market including the hyperscalers. This may fuel further VMware growth. To do that VMware will have to manage a balancing act:

- On the one hand keep growing their reseller revenue with Dell. They are on a good wicket so far and need to make sure this continues. While the revenue from appliances – which come loaded with VMware – is a sure-fire proposition, other growth needs to be harvested carefully. Dell has a multitude of offerings and taking their eyes of the VMware ball is super easy.

- Build trust and closer ties with the other vendors to keep driving revenue. VMware’s leadership in the market means they already have ties with other industry leaders like HPE, AWS and so on. These will need to become much deeper; VMware will need to build the trust that they will give these vendors equal status even as they are building new appliances with Dell.

The one complicating factor here is that Michael Dell remains the Chairman of the Board of VMware. This may give other vendors pause and they may still want to keep their options open instead of putting all eggs into the VMware basket.

Ecosystm Comments

VMware is at a fairly critical inflection point in their business. The growth of cloud technologies still bodes well for virtual machines which has been their mainstay, but this is also likely to drive growth for more containerisation. They have great products for that part of the business also. However, as container adoption is likely to explode VMware would not want vendors to shift, to say Red Hat, and develop deeper partnerships with them or other competitors. They would like to keep the vendors on VMware – be it a virtual machine or a container. One does feel the future battle for VMware really rests on how well they will be able to grow in the container space. This will have to be done while continuing to innovate to keep the lead in the virtual machine space. Doing it will be quite a feat!!

Finally, what then of Dell? The company seems to have a talent for running businesses which are in long-term secular decline – but running those businesses well. Their PC business is delivering almost 7% operating income and has continued to show growth. The PC market last year was on fire thanks to the pandemic which dramatically increased the demand for devices – growth was double digits for a market which has declined almost every year since 2011. As Dell is fond of saying the PC industry has sold over 5 billion machines since the PC was declared dead!

The server market seems to have stagnated over the last couple of years which is a bit of a surprise given the growth in cloud. Dell’s revenue has declined two years in a row pointing to possible issues which need fixing in that part of the business.

As the company focuses on these key challenges in the market it probably makes sense for them to lower their debt and earn more freedom to operate. One never knows – given the number of surprises that Michael Dell has engineered over the last decade such as taking Dell private, acquiring EMC, stabilising it, then going public again, making a windfall in the process – if he has some other rabbits yet to be pulled out of his hat!!!

Access insights on adoption of key Cloud solutions in regions/countries and industries. Insights include drivers and inhibitors of adoption, budget allocation, and preferred implementation partners.

As organisations stride towards digitalisation, re-evaluating their business continuity plans and defining how the Future of Work will look for them, cloud adoption is expected to surge. Almost all technologies being evaluated by organisations today have cloud as their pillar. Cloud will the key enabler for ease of doing business, real-time data access for productivity increase, and process automation.

Ecosystm Advisors Claus Mortensen, Darian Bird and Tim Sheedy present the top 5 Ecosystm predictions for Cloud Trends in 2021. This is a summary of our cloud predictions – the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Cloud Trends for 2021

- 2021 Will be All About SaaS

2020 was a breakout year for SaaS providers – and a tough one for a lot of on-premises software vendors. SaaS (or mainly SaaS) providers like Salesforce, Zoom, Microsoft had record growth and some of the best quarters in their history, while other mainly on-premises software providers have had poor quarters. SAP is even accelerating the transition to a 100% cloud-based business as their revenue suffers. The race to deploy SaaS tools and platforms is well and truly happening. Many of the usual ROI models and business cases have been abandoned as the need for agility – to drive business change at pace trumps most other business needs. Ecosystm data validates this

This trend will continue in 2021 – in fact, we expect it to accelerate. Most SaaS solutions (such as CRM, ERP, SCM, HRM etc.) are implemented by less than 30% of businesses today – which means the upside for the SaaS providers is huge.

- Hybrid Cloud Will Finally Become Mainstream

The sudden move to remote working in 2020 forced most organisations to increase their use and reliance on cloud-based applications. Employees have relied on collaborative tools such as Zoom, Microsoft Teams and WebEx to conduct virtual meetings, call centre workers had to respond to calls from home – most if not all relying on cloud-based apps and platforms. This trend is set to continue going forward. Ecosystm research finds that 44% of organisations will spend more on cloud-based collaboration tools in the next 6-12 months.

But the forced adoption of these tools has also prompted many – especially larger organisations – to worry about losing control of their IT resources, including worries related to security and compliance, cost, and reliability. As for the latter, both Microsoft Azure and Zoom experienced outages after the pandemic hit and this has made many organisations wary of relying too much on a single public cloud platform. Ecosystm therefore expects a sharp increase in focus on hybrid cloud platforms in 2021 as IT Teams seek to regain control of the apps and services their employees rely the most upon.

- Carrier Investment in 5G Will Give Edge Computing a Boost

The gap between the hype around edge computing and the actual capabilities it offers will narrow in 2021 as 5G networks are built out. One of the most promising methods of deploying edge computing involves carriers embedding cloud capacity in their own data centres connected to their 5G networks. This ensures data does not unnecessarily leave the network, reducing latency and preserving bandwidth. This combination of 5G and the Edge will be of particular benefit to applications that until now have faced a trade-off between mobility and connectivity. Over the last twelve months, the major hyperscalers announced their 5G edge computing offerings, and some of the major global telecom providers have served as test cases by partnering with at least one hyperscaler and will likely add more over the next year. Expect this ecosystem to expand greatly in 2021.

Cloud environments can benefit from pushing computing-heavy workloads to the Edge in much the same way as IoT and provides a great platform for managing the edge computing endpoints. The flipside of pushing containers to the Edge will be the increased complexity and the fact that the number of attack surfaces will increase. Containerisation must therefore be deployed with security at its core.

- Stateful Applications Will Move to the Cloud with Containers and Orchestration

As organisations seek to migrate workloads and applications between platforms in an increasingly hybrid cloud environment, the need for “lifting and shifting”, refactoring and partitioning applications will increase. These approaches all have their shortcomings, however. Lifting and shifting an application may limit its functionality now or in the future; refactoring may take too long or be too costly; and partitioning is often not feasible or possible. A better approach to this task is to modernise the applications to make use of application containers like Docker, Windows Server Containers, Linux VServer and so on, to enable a faster and more seamless way to migrate applications between platforms. We also see container orchestration environments like Kubernetes and containerised development and deployment platforms like IBM’s Cloud Paks.

How these technologies are used to deploy stateful applications in multicloud environments will evolve. A raft of container management platforms, based on Kubernetes, are being released to simplify what was once a complex DIY process. New entrants will look to challenge the cloud hyperscalers, virtualisation giants, and Kubernetes specialists. The emerging features that previously required cobbling together third-party tools, like service mesh, data fabric, and machine learning, will speed up containerisation of stateful core applications. The deployment of containers on bare metal rather than in virtualised environments will also gather pace. The most challenging task will be delivering containerised applications at the Edge, forcing developers and platform providers to create inventive solutions.

- Serverless will take us a step closer to NoOps

As the application lifecycle speeds up and the distinction between development and operations shrinks, the motivation to adopt serverless computing will grow in 2021. While NoOps, the concept that operations could become so automated that it fades into the background, is still a distant goal, serverless computing will make a stride in that direction by abstracting the application from the infrastructure. Having seen the agility benefits of a microservices architecture, many DevOps teams will experiment with breaking services down further into functions. Moreover, the pay-as-you-go model of serverless will appeal to OpEx driven organisations. Expect stories of bill shock, however, as were seen in the early days of cloud adoption. While AWS Lambda is currently considered the serverless industry standard, it is likely that in 2021, Microsoft, Google, and IBM will ramp up efforts in this space. Each of these providers will build out their offering in terms of languages supported, event triggers, consumption plans, machine learning/AI options, observability, and user experience.