Despite an increase in energy efficiency investment, the construction sector’s energy consumption and CO₂ emissions have rebounded to an all-time high. Buildings currently contribute 39% of global energy-related carbon emissions – 28% from operational needs like heating and cooling, and 11% from construction materials.

In the next three decades, with the global population expected to reach 9.7 billion, the construction industry will face the pressure to meet growing infrastructure and housing demands while adapting to stricter environmental regulations.

The urgency of climate action demands that governments mandate low-carbon practices in urban development.

Increase Use of Low-Carbon Materials

Traditional building materials like concrete, steel, and brick are strong and durable but environmentally costly. This high embodied carbon footprint is prompting a shift towards low-carbon alternatives. Indonesia is using ‘green cement’ – made using environmentally friendly materials – in the development of its new futuristic capital Nusantara. This has led to an estimated reduction in carbon emissions of up to 38% per tonne of cement so far.

Nordic countries are setting ambitious targets for low-carbon materials. Starting in 2025, Finland will require life cycle assessments and material declarations in construction to reduce emissions, detailing building components and material origins. Denmark is also prioritising low-carbon materials through energy-efficient designs, sustainable materials, and stringent building codes.

Mandate Whole-Life Carbon Emission Assessments

Whole Life-Cycle Carbon (WLC) emissions encompass all the carbon a building generates throughout its lifespan, from material extraction to demolition and disposal. Assessing WLC gives a comprehensive understanding of a building’s total environmental impact.

The London Plan is a roadmap for future development and achieving the goal of a zero-carbon city. The plan includes provisions for WLC analysis, specific energy hierarchies, and strategies to reduce London’s carbon footprint.

With a bold vision of a fully circular city by 2050, the Amsterdam Circular Strategy 2020-2025 lays out a comprehensive roadmap to achieve this goal. Key elements include mapping material flows to reduce reliance on virgin resources and mandating WLC assessments.

Enforce Clean Construction Standards

From green building codes to tax incentives, governments around the world are implementing innovative strategies to encourage sustainable building practices.

The Philippines’ National Building Code requires green building standards and energy efficiency measures for new buildings.

Seattle offers expedited permits for projects meeting embodied carbon standards, speeding up eco-friendly construction, and reinforcing the city’s environmental goals.

New Jersey offers businesses a tax credit of up to 5% for using low-carbon concrete and an additional 3% for concrete made with carbon capture technology.

Promote Large-Scale Adaptive Reuse

Large-scale adaptive reuse includes reducing carbon emissions by making existing buildings and infrastructure a larger part of the climate solution.

London’s Battersea Power Station restored its iconic chimneys and Art Deco façade, transforming it into a vibrant hub with residential, commercial, and leisure spaces.

The High Line in New York has been transformed into a public park with innovative landscaping, smart irrigation, and interactive art installations, enhancing visitor experience and sustainability.

Singapore using adaptive reuse to rejuvenate urban and industrial spaces sustainably. The Jurong Town Corporation is repurposing a terrace factory for sustainable redevelopment and preserving industrial heritage. In Queenstown, historical buildings in Tanglin Halt are being reused to maintain historical significance and add senior-friendly amenities.

Establish Circular Economy

As cities worldwide start exploring ways to go circular, some are already looking into different ways to leverage innovative practices to implement circular initiatives.

Toronto is embedding circular criteria into procurement by requiring circular economy profiles, vendor action plans, and encouraging circular design for parklets. The city also recommends actions for transitioning to a circular economy and is developing e-learning on circular procurement for staff.

Japan uses Building Information Modeling to optimise resource consumption and reduce waste during construction, with a focus on using recycled materials to promote sustainability in building projects.

Adopt Electric Vehicles

The share of EVs increased from 4% in 2020 to 18% in 2023 and is expected to grow in 2024. This trend reflects a global shift toward cleaner transportation, driven by technological advancements and rising environmental awareness.

The Delhi EV Policy aims to expand charging infrastructure and incentives, targeting 18,000 charging points by 2024, with 25% EV registrations and one charging outlet per 15 EVs citywide.

Singapore is adopting EVs to reduce land transport emissions as part of its net-zero goal, aiming to cut emissions by 1.5 to 2 million tonnes. The EV Roadmap targets cost parity with internal combustion engine (ICE) vehicles and 60,000 charging points by 2030.

Australia has set new rules to limit vehicle pollution, encouraging car makers to sell more electric vehicles and reduce transportation pollution.

Promote Circular Economy Marketplaces

Circular marketplaces play an important role in the new economy, changing the way we use, manufacture, and purpose materials and products.

The UK’s Material Reuse Portal aggregates surplus construction materials post-deconstruction, offering guidance and connections to service providers. It integrates with various data sources, can be customised for different locations, and provides free access to sustainable materials. Future plans include expanding marketplace partnerships to enhance material reuse.

Build Reuse is a US-based online marketplace specialising in salvaged and surplus building materials. It connects buyers and sellers for reclaimed items like wood, bricks, fixtures, and architectural elements, promoting resource efficiency and reducing construction waste.

Technology has been reshaping the Real Estate industry landscape. Advancements in manufacturing technologies, digital tools, AI & analytics, and IoT – coupled with customer and employee expectations – are revolutionising how properties are built, bought, sold, managed, and experienced.

The evolution of RealTech and PropTech has a far-reaching impact on the industry, streamlining processes, improving customer experiences, and driving innovation across the entire sector.

Read on to find out how technology impacts the entire value chain; the key drivers of Real Estate evolution; the strong influence of “smart consumers”; and what Ecosystm VP Industry Insights Sash Mukherjee thinks where the industry is headed.

Download ‘The Future of Real Estate’ as a PDF

Innovation is at the core of FinTechs. The Financial Services industry has been disrupted over the last few years because of the innovation and customer experience that FinTechs offer. But the FinTech world has become highly competitive, and there are many companies that do not make it, despite the innovations.

There are many factors that contribute to the success of a FinTech – and creating the right market differentiation is one of the key factors. This Ecosystm Snapshot looks at how FinTechs – such Earnest, Flock, Billd, Littlepay, Willa and AffiniPay – are disrupting industries as they build solutions targeted at those specific industries, to create the market differentiation required to succeed.

Telstra and Microsoft have extended their partnership to jointly build solutions harnessing the capabilities of AI, IoT, and Digital Twin technologies in Australia. The partnership will also enable both companies to work on sustainability, emission reduction, and digital transformation initiatives.

The adoption of cloud and 5G technology is already on the rise and creating opportunities across the globe. The Microsoft-Telstra partnership is set to bring together the capabilities of both providers for businesses in Australia and globally. Their focus on AI, IoT, cloud and 5G will enable Australia’s developers and independent software vendors (ISVs) to leverage AI with low latency 5G access to drive efficiency, and enhance decision making. This will also see practical applications and new solutions in areas like asset tracking, supply chain management, and smart spaces to enhance customer experience.

Technology Enhancing the Built Environment

Microsoft Azure and Telstra’s 5G capabilities will come together to develop new industry solutions – the combination of cloud computing power and telecom infrastructure will enable businesses and industries to leverage a unified IoT platform where they can get information through sensors, and perform real-time compute and data operations. Telstra and Microsoft will also build digital twins for Telstra’s customers and Telstra’s own commercial buildings which will be initially deployed at five buildings. Upon completion, the digital twin will enable Telstra to form a digital nerve centre and map physical environments in a virtual space based on real-world models and plot what-if scenarios.

Telstra CEO, Andy Penn says, “If you think about the physical world – manufacturing, cities, buildings, mining, logistics – the physical world hasn’t really been digitised yet. So, how do you digitise the physical world? Well, what you do is put sensors into physical assets. Those sensors can draw information around that physical asset, which you can then capture and then understand.”

Ecosystm Principal Advisor, Mike Zamora finds the comment interesting and says, “It isn’t so much that the physical world is digitized – it is more about how digital tools enhance and enable the physical world to be more effective to help the occupier of the space. This has been the history of the physical space. There have been many ‘tools’ over time to help the physical world – the elevator in the late 1880s enabled office buildings to be taller; the use of steel improved structural support, allowing structural walls to be thinner and buildings taller. These two ‘tools’ enabled the modern skyscraper to be born. The HVAC system developed in the early 1900s, enabled occupants to be more comfortable inside a building year-round in any climate.”

“Digital tools (sensors, etc) are just the latest to be used to enhance the physical space for the occupant. Digital twins enable an idea to be replicated in 3D – prior to having to spend millions of dollars and hundreds of man hours to see if a new idea is viable. Its advent and use enable more experimentation at a lower cost and faster set up. This equates into a lower risk. It is a welcomed tool which will propel the experimentation in the physical world.”

Talking about emerging technologies, Zamora says, “Digital twins along with other digital tools, such as 3D printing, AI, drones with 4K cameras and others will enable the built environment to develop at a very quick pace. It is the pace that will be welcomed, as the built environment is typically a slow-moving asset (pardon the pun).”

“Expect the Built Environment developers, designers, investors, and occupiers to welcome the concept. It will allow them to dream of the possible.”

Telstra and Microsoft – Joint Goals

Telstra and Microsoft have partnered over the years over multiple projects. Last year, the companies partnered to bring Telstra’s eSIM functionality to Windows devices for data and wireless connectivity; they have also worked on Telstra Data Hub for secured data sharing between data producers, businesses and government agencies; and most recently collaborated on Telstra’s exclusive access to Xbox All Access subscription service to Australian gamers with the announcement of Microsoft’s Xbox Series X and Xbox Series S gaming consoles expected to release in November.

This announcement also sees them work jointly towards their sustainability goals. Both companies are committed to sustainability and addressing climate change. Earlier this year, Microsoft announced its plans to be carbon negative by 2030, while Telstra has also set a target to generate 100% renewable energy by 2025 and reducing its absolute carbon emissions by 50% by the same time. To enable sustainability, Telstra and Microsoft are exploring technology to reduce carbon emissions. This includes further adoption of cloud for operations and services, remote working, and piloting on real-time data reporting solutions.

Telstra also aims to leverage Microsoft technology for its ongoing internal digital transformation, adopting Microsoft Azure as its cloud platform to streamline operations, and infrastructure modernisation, including transition from legacy and on-premise infrastructure to cloud based applications.

Smarter buildings and public facilities have long been of interest to architects and developers. Innovators can see that the promise of intelligent data used for spatial design can transform how we work, live and play.

How can Big Data be used for intelligent building design? There are a consortia of companies trying to figure this out together. I will discuss the Building 4.0 Co-operative Research Centre (CRC) in Australia.

I have already been examining the new approaches to using big data in facilities management. This is done by developing smarter office spaces, embedded with devices employing Ambient Intelligence (AmI). Research looked at how the intelligent use of big data contributed to building an environment with greater energy efficiency, optimised space utilisation, enhanced workplace experience and occupants’ comfort. This includes sound masking, the use of lighting for enhance environments, and sensors for occupancy for hygiene controls.

Ambient Intelligence (AmI)

AmI refers to electronic environments that are sensitive and responsive to the presence of employees, residents or visitors. These environments can have ecosystems (pun intended) of different IoT devices communicating with each other.

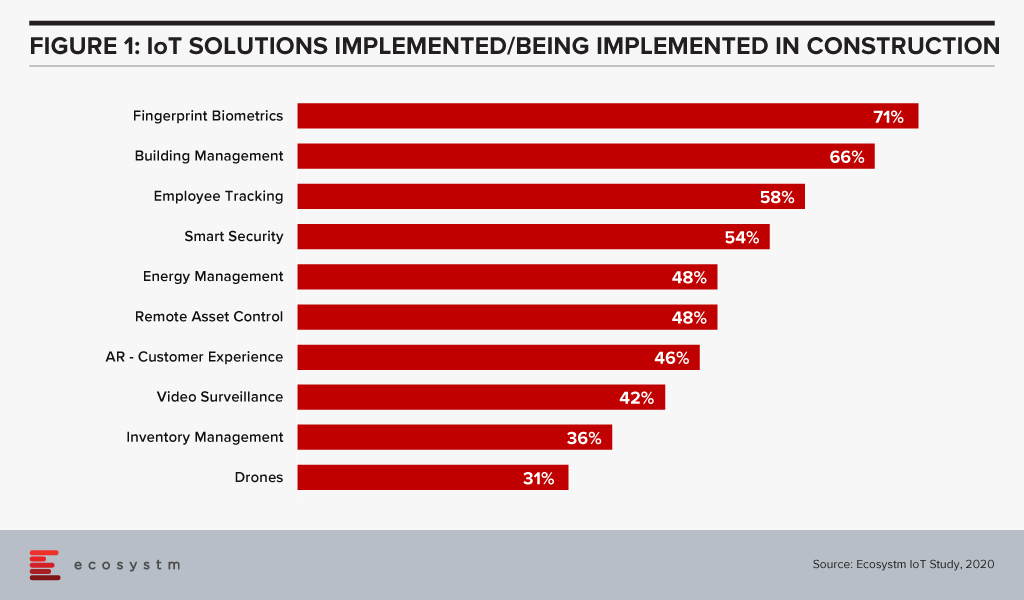

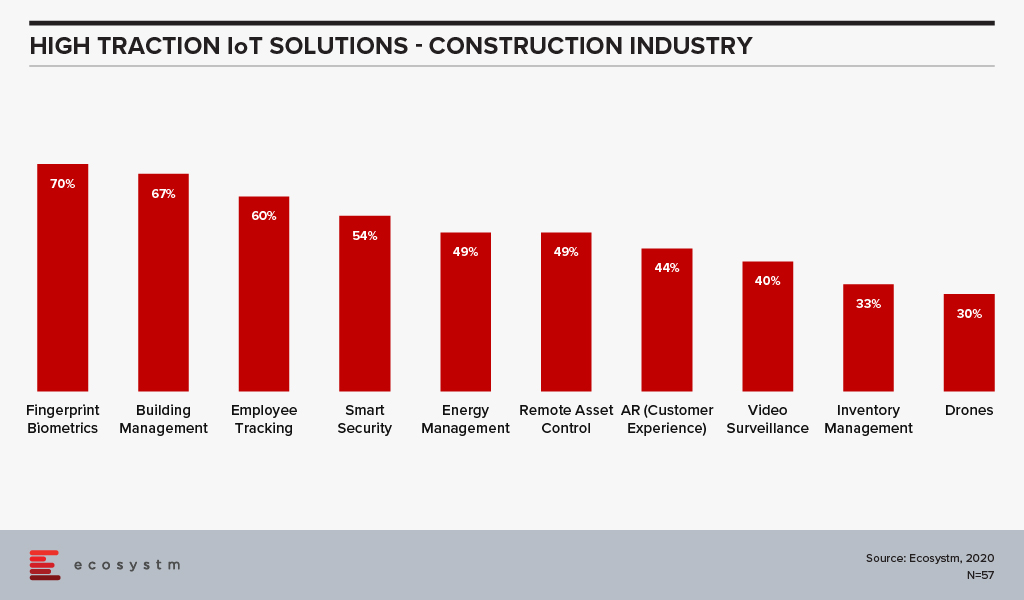

There is a real emphasis here on edge computing, sensors and other IoT devices, and building intelligence into the edge for near real-time decision making closer to where the problem may sit. Ecosystm research finds that construction firms focus a significant amount of IoT investment for building management and energy management (Figure 1).

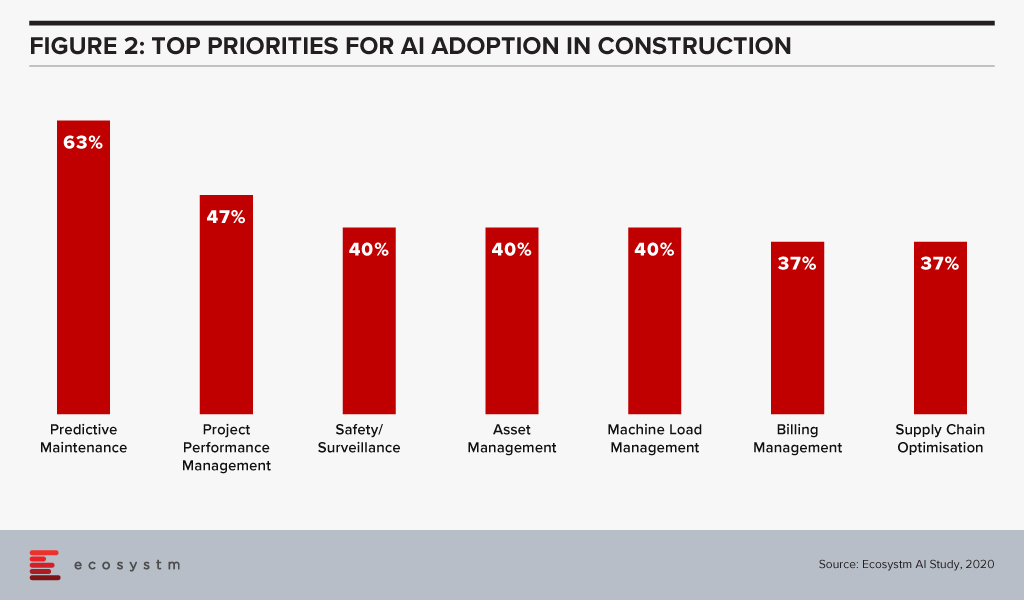

For example, if an HVAC system is on the verge of malfunction, the system could send a message for a repair intervention. When it comes to AI, predictive maintenance and surveillance are two of the leading use cases in the construction industry (Figure 2).

Building 4.0 Co-operative Research Centre (CRC)

In Australia, this push for sustainable and smarter building development is being driven by a consortium of companies looking at Big Data and infrastructure development for buildings. This year, the Building 4.0 Co-operative Research Centre (CRC) has been awarded a USD 19.5 million grant to focus on medium to long-term industry-led collaborations that can assist in driving the growth of new industries. The Australian building and construction industry is a major economic engine that contributes 13% of GDP and employs over 1.4 million Australians. Development of the Building 4.0 CRC makes sense and is timely given the current pandemic and economic conditions.

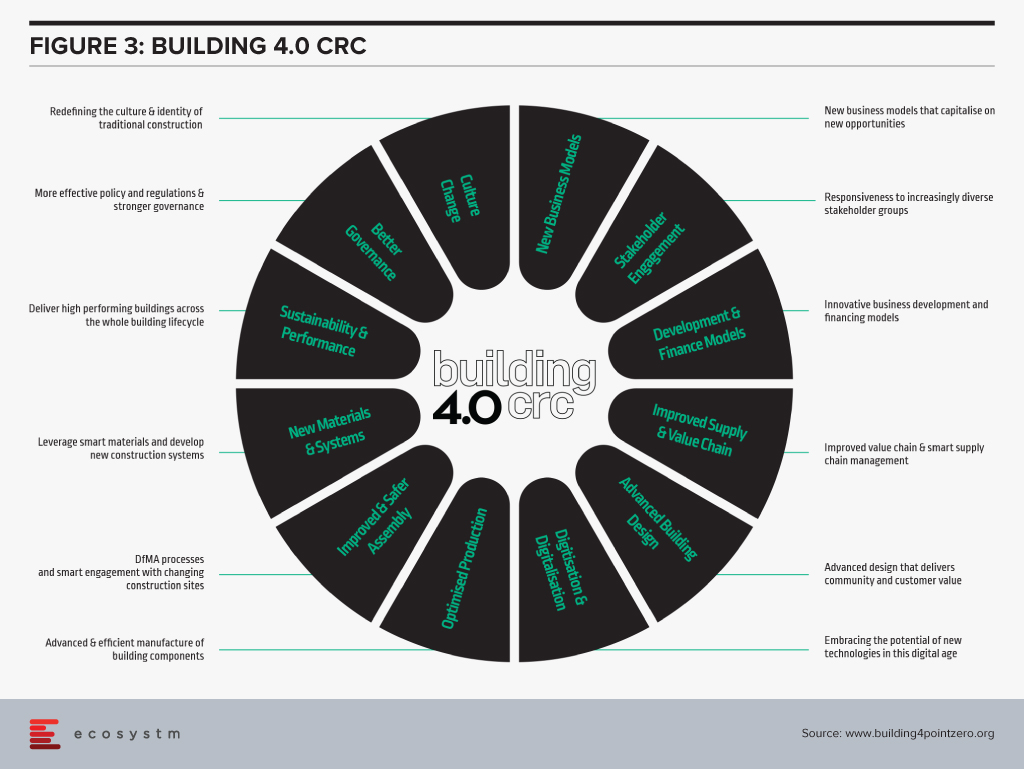

Part of its research program focus on develop new building processes and techniques through leveraging the latest technologies, data science and AI to ultimately improve all aspects of the key building phases. Their overall ecosystem is designed for enablement of several use cases (Figure 3).

The Building 4.0 CRC’s principle aims are “to decrease waste; create buildings that are faster, cheaper, and smarter; and capture new opportunities by facilitating collaborative work between stakeholders across the whole value chain in cooperation with government and research organisations.”

Green Star, the rating system which was created by Green Building Council of Australia (GBCA) in 2003, rates the sustainability of buildings, fit outs and communities through Australia’s largest national, voluntary, holistic rating system. The GBCA is a partner organisation in the Building 4.0 CRC – as are many other major organisations in construction and trade, all pulling together here, for innovative efforts for the industry.

Where might the Building 4.0 CRC effort make an impact? Its collaborative structure of industry, academia, vocational trade organisation and governmental bodies harness innovative ideas to transmit them to transformative practices of industry and construction partners.

To be smarter, one must work smarter and more efficiently. A consortia such as this pulls the best minds together to try to accelerate industry efforts for intelligent design with data.

COVID-19 is accelerating digital transformation activities across industries. Remote working is now standard practice and digital engagement is replacing face-to-face interaction. Cloud technology has become essential rather than an option, and rollouts of new technologies such as augmented reality (AR) and intelligent automation are being expedited.

One of the industries that offer great potential for technology-driven transformation is the property sector.

Many activities within the property ecosystem have remained unchanged for decades. There are several opportunities for digital engagement and automation in this sector, ranging from the use of robots in construction to the ‘uberisation’ of the residential property customer journey.

The processes associated with buying or renting property remain cumbersome and complex for customers. Indeed, customers engage with many different organisations throughout their residential property lifecycles. When compared to some other industries, the customer experience can be poor. Components of the journey – such as property search – offer some great experiences but other parts such as exchanging contracts can rarely be described as positive customer experiences.

Although AR and virtual reality (VR) technologies can facilitate property inspection, most inspections are still undertaken on-premise, together with a real estate agent. Contract exchanges often involve interactions with legal professionals in-person. Securing a mortgage or a rental agreement also typically requires face-to-face interaction. Deposits commonly necessitate the physical presentation of a cheque.

The Uberisation of the Property Sector

So, in the residential sector, there are clear opportunities for start-ups and property search platforms to offer greatly enhanced customer experiences. The COVID-19 crisis will speed up the rate at which digital technologies are used to automate activities throughout the residential property customer journey and to engage customers digitally.

Property search platforms such as Singapore-based PropertyGuru, have been creating innovative ways of engaging customers and extending their range of services, for many years. For PropertyGuru, its news features, mortgage calculator, and ability to search for investment properties overseas, have enabled it to offer customers more value from its platform. Its PropertyGuru Lens feature uses AR and artificial intelligence (AI) to give customers a more immersive and improved experience. In common with other real estate platforms, it offers AR and VR tools for inspections.

Today’s crisis creates opportunities for platforms such as ProperyGuru to engage customers throughout their journey. It can potentially transform the residential property business, by becoming an Uber-style platform for agents, movers, shippers, storage companies, interior designers, renovation firms and all other stakeholders within the residential property ecosystem. Subject to regulation, it could also act as a mortgage broker and an agency for the exchange of contracts. In other words, it could ‘own’ the customer journey and act as a platform for all services associated with residential property. From the customer perspective, such a platform would be a welcome way of enhancing the experience associated with buying, renting, maintaining, improving, managing, and selling residential property.

IoT and the Commercial Property Sector

From a commercial property perspective, the COVID-19 crisis can also be expected to accelerate the digitalisation of many activities associated with the construction, maintenance, and management of buildings.

According to the findings of the Ecosystm IoT Study, the Construction industry is evaluating several technology solutions that are expected to benefit the industry (Figure 1).

While the industry views these solutions as beneficial, the adoption has so far been low. This will change. Drones have been used to inspect the outside of tall buildings for several years, but this is not yet standard practice. Structural inspections and maintenance of buildings will be automated at a much faster rate post COVID-19. IoT technology will be used for building management. Using IoT technology for the predictive maintenance and management of lighting, climate control, elevators, security, windows and doors will become standard as firms seek to reduce human interactions. Technology that measures footfall, manages safe distancing, takes peoples’ temperatures and identifies those who enter and leave buildings will be introduced, as organisations guard against disease clusters developing within or around their premises.

In essence, the COVID-19 crisis will act as a catalyst for the digital transformation of the property sector. There is a huge opportunity to create new business models not least by offering customers a digital platform on which all of their property-related needs can be addressed. For the commercial property sector, a similar platform can be offered. Additionally, many core activities ranging from construction to building management will be automated, fully leveraging robot, AI and IoT technologies.