The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

Customer Experience (CX) has become a bit of a buzzword, which is fantastic! More and more businesses are recognising the importance of understanding their customers’ experiences and implementing a customer-centric organisational mindset. But how do organisations evaluate their success? Here are some tips on how the Voice of Customer (VoC) program can be used to assess whether your customer strategy is right and your improvement efforts are bearing fruit.

Understand who your customers are and what they experience

You will need to understand your customers’ experience during interactions, e.g. a visit to the website to find information, a call to the contact centre to get a query resolved, or a walk-in at the store to ask for help; and for specific life stages or journeys, e.g. how was their onboarding experience, what they value about the products and services etc.

There are different ways to form a rough or a more precise picture of your customers. Two popular approaches are:

- Data-based segmentations. This is based on behaviour seen in your backend system. It can be as basic as knowing your customer’s age bracket, gender, location, and annual spend.

- Research facilitated personas. These sophisticated personas will tell you things like, “Tech Savvy Joe is in his mid-20’s, lives in an affluent area, loves caramel frappuccinos with extra cream, uses your coffee shop app regularly to check for great deals and visits your cafe 13 times every month”, placing him in the “high value” category.

Once you have a rough, or precise idea of who your customers are, you can start thinking about the experiences your customers are having, and the experiences you’d like them to have.

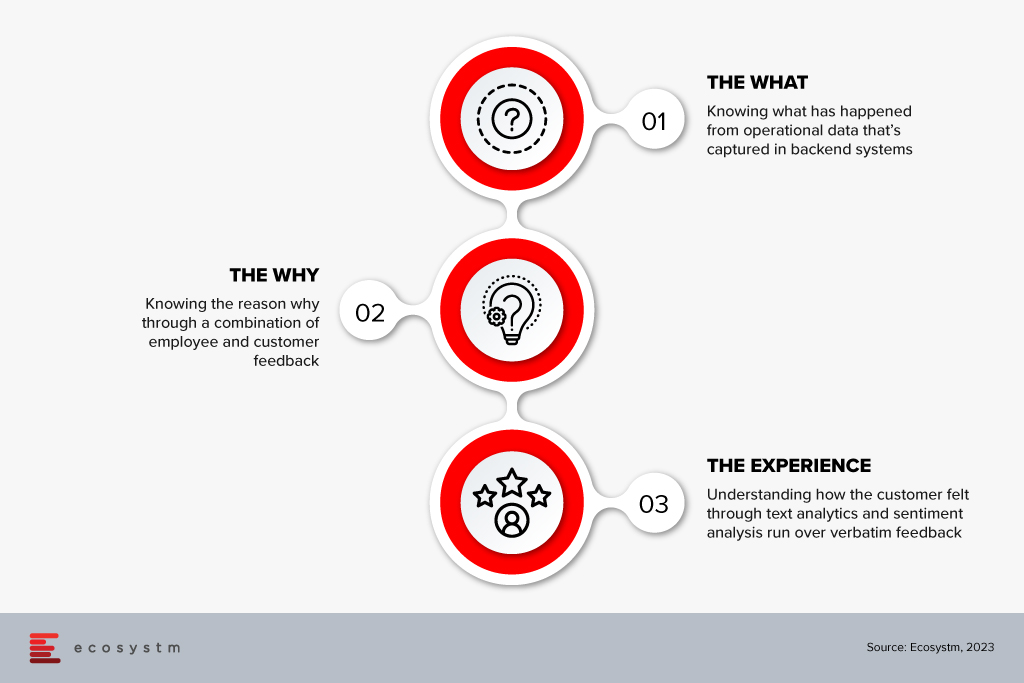

X & O Data: Completing the picture

Now, how do you know what an experience was like for your customer? You can ask them, and then you can observe them. We call this the X (experience) and the O (operational) data. And there are 3 fundamental things to understand within X & O data.

But how do we measure this experience? How do we capture, track and measure how the customer felt?

Let’s look into metrics.

Choose the right metric: NPS, CES or CSAT

Choosing the right metrics for the job is crucial for the success of the VoC program, as well as the ability to measure CX success overall. NPS, CSAT and CES are the 3 most frequently used customer feedback measures. They are complementary in nature, as they measure slightly different aspects of the customer experience.

- NPS (Net Promoter Score). How likely are customers to recommend the brand’s products and services to friends and family.

- CES (Customer Effort Score). How easy/difficult was it for the customer to get the query resolved.

- CSAT (Customer Satisfaction Score). How satisfied was the customer with the service received.

Using them in conjunction can be a great way to measure customer success. CSAT and CES are often used to explain the overall NPS number in more detail. While NPS is a rigid metric designed as an overall brand health measure for a business, CSAT and CES are more specific measures that can be adapted to a given situation, e.g. product reviews, service interactions with call centre agents, website interactions, store visits and so on.

NPS is a long-term measure, as the likelihood to recommend a brand isn’t based on a single interaction. A history of interactions, touchpoints, word of mouth, etc. form a brand perception. And all those interactions and touchpoints that form a customer’s recommendation can be tracked and measured through CSAT and CES – they are able to provide actionable insights to pinpoint pain points and detect opportunities for improvement.

Due to the long-term and high-level nature of the NPS score, this metric is best used in relationship or benchmark surveys. In a touchpoint environment, CES and CSAT are more powerful and insightful.

Identify and prioritise improvement initiatives

Equipped with customer and employee feedback on specific customer pain points you can then dig deeper into root causes and build initiatives to address those. But typically you will end up with a list of initiatives and face prioritisation challenge. Depending on the stakeholder you ask, you’ll get contradictory views on what’s most important. Some of the prioritisation metrics that you are likely to use will be cost, timeframe and resources required to implement change.

You can use your customer feedback metrics again to help with the prioritisation. Combining the score with the volume of feedback mentioning a specific pain point provides you with an “impact” for the customer. Combining the impact of the pain point on the customer, with the impact it has on the business provides a clear picture to form a priority list.

Some Real-life Examples

Problem. “Rude agent” – Low CSAT scores

- Root cause analysis. Agent not trained in dealing with difficult situations/customers; lacks the knowledge to deal with specific queries; feels undervalued; gets frustrated and overwhelmed

- Potential fix. CSR training

- Result. Reflected in an improved CSAT scores as the agent is equipped to handle difficult situations/customers and complex scenarios

Problem. “Hard to find things on the website” – High CES scores (high effort)

- Root cause analysis. Customer/UX research to understand what customers struggle with

- Potential fix. Website redesign for specific journeys/queries

- Result. Reflected in an improved CES as it’s now easier for customers to find what they want on the website

Conclusion

While you will see your CES and CSAT score improving quite quickly as a result of your changes, the NPS score is typically slower to respond. As mentioned earlier, a service interaction to get a query resolved is only one of many signals impacting the likelihood to recommend a brand. Just because one interaction was pleasant, doesn’t mean you’re out of the woods. You will need to deliver again and again to shift your NPS over time. Not just in terms of customer service, but also advertising, product design, quality of service, etc.

My return to CES, the Consumer Electronic Show, was something that I had been looking forward to for some time. After all, it had been almost 4 years since I attended the last CES when the Internet of Things (IoT) was the latest solution looking for problems to be solved. As an industry analyst whose passion for IoT is well known, I was frustrated at the weak offerings, poor quality demos and wasted money at the booths. CES had halls and halls of IoT ‘stuff’ that made little or no sense to me, with almost no chance of these startups being around in 2019. But, that’s what these shows are meant to do.

Roll forward to 2019 and my mission was very specific. I was only interested in two major things – 5G and autonomous/self driving vehicles. I was determined not to get soaked up in the awesome glory of 8K televisions, and kitchens that would even scare off Chef Gordon Ramsey! 5G has been positioned as the natural platform for IoT innovation – fast, high capacity connectivity for applications such as autonomous vehicles, video and medical services. However, at this year’s CES, it seemed that the technology world and the trade press had finally gotten into the same room and realized (just like IoT) that 5G can mean many things. To that point, businesses were keen to call their new technology offerings that can be called 5G, 5G. I could see history repeating itself – hype and confusion this year, followed by disillusion and disappointment next year.

Let’s start with AT&T. When is 5G not 5G – when it is 5G E? AT&T insists on using the term 5G for its advanced 4G LTE network. I assume that if AT&T’s commercials say that 5G E is 5G then who are we to doubt them! In my humble opinion it is misleading and muddies the waters into convincing customers that they already have 5G. (By the way the ‘E’ stands for Evolution, or as one journalist put it “it’s a work in progress towards 5G’. Other global operators also made claims that they too were the first to market or the first to have a customer. However, 5G from a marketing aspect was a bust at this year’s CES. It was supposed to be a leading theme, but in reality it lacked reality. Perhaps selling to consumers is easier than selling to enterprise customers who know that 5G will require an upgrade of the entire network infrastructure, which in turn will take time.

Despite the marketing and messaging confusion, 5G is the underpinning technology of some very exciting technologies being shown at CES – in particular in the transportation industry. Here there was proof that progress has been made in the last 4 years. It was clear that core technologies such as mapping and location tracking have made it possible for the auto industry to think about services both inside the vehicle and outside it. Companies such as TomTom, Naver Labs and HERE showed the levels of progress that they have made in navigation, mobility services, and fleet management. Adjacent technologies for EV (Electric Vehicle) combined with advanced high quality mapping, make it possible to know better where to recharge and how to accurately navigate highways as efficiently as possible.

Innovation in this space takes on a new meaning when the vehicle isn’t a concept car, but rather a fully laden truck. At CES there was no shortage of trucking companies showing off their highly connected vehicles. For example, Paccar Inc., the parent of Peterbilt Motors Co. and Kenworth Truck Co. had an exhibit that featured a pair of battery-electric Peterbilt models and a hydrogen-electric truck from Kenworth and Toyota. Autonomous truck startup TuSimple also returned to CES, where it offered demonstrations of the sensors and machine vision behind its self-driving technology and announced plans to expand its US fleet to 40 trucks by June.

At CES, autonomous vehicle concepts from all of the global car brands were on display. Typically the German and Asian manufacturers showed a wide range of vehicles that continued to look like ‘travel pods’ or people movers rather than traditional automobiles, while US-based brands tended to focus on the infotainment services within the car. In summary, CES’s auto offerings showed that there is a very strong ecosystem of partners determined to change the way that we get from point A to point B in a safe and sustainable manner. In parallel, the ability to extend vehicle ride sharing across multiple modes of transportation including bicycles and helicopters (Bell’s Nexus product) is driven by high speed, real-time and accurate data fed from thousands of intelligent sensors.

At CES, autonomous vehicle concepts from all of the global car brands were on display. Typically the German and Asian manufacturers showed a wide range of vehicles that continued to look like ‘travel pods’ or people movers rather than traditional automobiles, while US-based brands tended to focus on the infotainment services within the car. In summary, CES’s auto offerings showed that there is a very strong ecosystem of partners determined to change the way that we get from point A to point B in a safe and sustainable manner. In parallel, the ability to extend vehicle ride sharing across multiple modes of transportation including bicycles and helicopters (Bell’s Nexus product) is driven by high speed, real-time and accurate data fed from thousands of intelligent sensors.

In conclusion, CES confirmed for me that despite the technical greatness of 5G, telecom operators continue to appear to be lost in their positioning of the product. Part of this may be stemming from the significant investment and consequently the risk of return on that investment. Part of it may be – like IoT – defining what 5G is really all about. Early IoT success stories have shown that it’s as much about positioning the business value around the data as it is about connectivity. Finally, CES showed me that while fully autonomous driving societies are several decades away, the strong industrial ecosystems that exist today are making significant progress towards that future.