“SaaS is dead!” – this paraphrased comment from Satya Nadella during an interview was taken wildly out of context. It reminded me of those 2014-2017 industry reports predicting that voice commerce would be a USD 500B market by 2025, or that self-driving cars would be everywhere by 2027 – just two years from now. As it turns out, people still prefer ordering groceries themselves rather than relying on smart speakers connected to IoT fridges. And those early chatbot pop-ups? More annoying than intelligent. As for autonomous cars, we might still be better drivers – though that’s starting to shift. But I digress.

Back to SaaS. A global industry with over 30,000 companies, mostly in the US, now finds itself under the shadow of the latest buzz: AI agents (still software, not humanoid robots). These agents – programs built on top of LLMs – take actions within set parameters, showing a degree of autonomy.

But to make AI agents enterprise-ready, we’ll need to rethink access control, ethics, authentication, and compliance. So far, they’ve mostly tackled low-value, repetitive tasks. And despite the hype, we’re still some distance from real, meaningful impact.

Predictions Are Fine – But Best Taken with a Pinch of Salt

Salesforce, the world’s largest SaaS company, has played its part in driving this shift — alongside, of course, Microsoft. Microsoft’s aggressive push into AI, with a massive USD 80 billion CapEx on AI data centres and a flurry of product launches like Copilot chat, may just be the beginning. Microsoft even describes Copilot as the “UI for AI.” Despite its size, Salesforce has moved quickly, rolling out Agentforce, its enterprise AI agent suite. While still early days, Salesforce is leveraging its formidable sales and marketing muscle to push the AI agent narrative — while upselling Agentforce to thousands of existing customers.

For context: Salesforce, the largest player, generates around USD 35 billion in annual revenue. Across the industry, there are roughly 300 SaaS unicorns – but even combined, the entire global SaaS sector brings in only about USD 300B a year. Beyond big names like Salesforce, HubSpot, and Atlassian, the market is dominated by a long tail of smaller, vertical SaaS firms that serve niche sub-industries and specialised use cases.

Today, about 70% of enterprise software is delivered through SaaS. But beyond the top 30 vendors, the landscape is highly fragmented — and arguably primed for disruption by AI agents that can automate and streamline more bespoke, industry-specific workflows.

But the thousands of smaller SaaS firms haven’t all moved as quickly as Salesforce has. Most will likely stick to announcements and incremental upgrades rather than radical deployments – especially as enterprises tread carefully while every vendor suddenly becomes “AI-inside”, the new “Intel-inside.”

AI Washing, Hype, and a Flood of Start-Ups

Since ChatGPT’s historic launch in late 2022, the GenAI AI hype curve hasn’t slowed. In SaaS, the early impact has largely been “AI washing”: companies hastily sprinkling “Generative AI” across their websites, collateral, and social feeds while snapping up .ai domains at premium prices.

Meanwhile, over 3,000 AI-first start-ups have emerged, building wrappers around foundational models to deliver bespoke inferences and niche services. Thanks to ongoing hype, some of these are flush with venture capital – even without revenue. At the same time, traditional SaaS firms face tough investor scrutiny over profitability and free cash flow. The contrast couldn’t be starker.

Yet, both the AI upstarts and the older SaaS players face similar go-to-market challenges. Early product-market fit (PMF) is no guarantee of real traction, especially as most enterprise clients are still experimenting, rather than committing, to AI agents. That’s prompting start-ups to build agentic layers atop inference services to bridge the gap.

The Real Race: Embedding AI with Real Impact

It’s too early to call winners. Whether it’s cloud-first SaaS firms evolving into “AI-inside” platforms, or AI agent start-ups challenging the status quo, success will hinge on more than just AI. It will come down to who can combine proprietary data, compelling use cases, and proven workflow impact.

McKinsey sees AI agents serving two broad patterns: the “factory” model for predictable, routine tasks, and the “artisan” model for augmenting more strategic, executive functions. Another compelling narrative does not make the distinction between the earlier crop of cloud-first and the recent crop of AI-first companies. They see this as a natural progression of the SaaS business model, with VSaaS or “vertical Saas with AI-inside” becoming the broader industry.

I’d argue the original cloud-first SaaS firms might actually be better positioned. Their biggest moat? Existing customer relationships. AI start-ups haven’t yet faced the reality of renewing their first multi-year enterprise contracts. That’s where theory meets enterprise buying behaviour – and where this battle will get interesting.

The Playbook for SaaS Winners in the Age of AI Agents

The SaaS companies that will thrive over the next few years will, in my view, focus on these key elements:

- Leverage Early Clients as a Moat. Invest in the success of your first enterprise clients, ensuring they extract real, sustainable value before chasing new logos. Build enough trust, and you could co-create AI agents trained on their proprietary data, enhancing your core product in the process. Snowflake, with its broad enterprise footprint, has a head start here, but start-ups like Collectivei and Beam are targeting similar use cases, while platforms like Letta help companies deploy their own agents.

- Codify the Use Case. Build products that go deep – not broad. Focus on specific use cases or verticals that a horizontal SaaS company is unlikely to prioritise. Eventually, most enterprise users will care less about which foundation model powers your tool and more about the outcomes.

- Operate with a GTM-First Mindset. Many SaaS firms struggle with margins because of high sales and marketing costs, often wavering between sales-led and product-led growth without a clear go-to-market (GTM) plan. AI start-ups, too, are learning that pure product-led growth doesn’t scale in crowded markets and often pivot to sales-led motions too late. Companies like Chargeflow show why a GTM-first approach is key to building real traction and a growth flywheel.

- Rethink Bundling. Bundling has long been a SaaS pricing play – slicing features into tiers. AI-first start-ups are poised to disrupt this. The shift will be towards outcome-based pricing rather than packaging features. Winners will iterate constantly, tuning bundles to different user cohorts and business goals.

- Charge for Success, Not Seats. AI’s biggest impact may be on pricing. Traditional seat-based models will give way to success or outcome-based pricing, with minimal or no set-up fees. Professional services for customisation will still have value, especially where products align deeply with client workflows and outcomes.

- Prioritise Renewal Over Acquisition. Many AI-first start-ups focus on acquiring logos but underestimate that enterprises are still experimenting – switching costs are low, and loyalty is thin. Building for retention, renewal, and upselling will separate winners from the rest. Focus on churn early.

The Next Chapter in Enterprise Automation

Automation has always been a continuum. Remember when cloud vs. on-prem dominated enterprise debates? Or when RPA was expected to replace most workflows as we knew them? The reality was more measured, and we’re seeing a similar pattern with AI today. Enterprises will first focus on making AI co-pilots work safely, reliably, and effectively before they’re ready to hand over the keys to AI agents running workflows on autopilot. This shift won’t happen overnight.

We’re already seeing early winners capable of negotiating this shift, on both sides: established SaaS giants adapting and AI-native start-ups rising. But make no mistake, this will be a long, hard-fought race. Sustained value capture will demand more than just better tech; it will require a fundamental shift in mindset, go-to-market strategies, and sales motions.

Don’t be surprised if the acronym flips along the way – with Software-as-a-Service giving way to Service-as-Software, as AI agents begin to run entire business processes end to end.

Through it all, one principle will remain timeless: an obsession with customer success – whether the agent is human or machine.

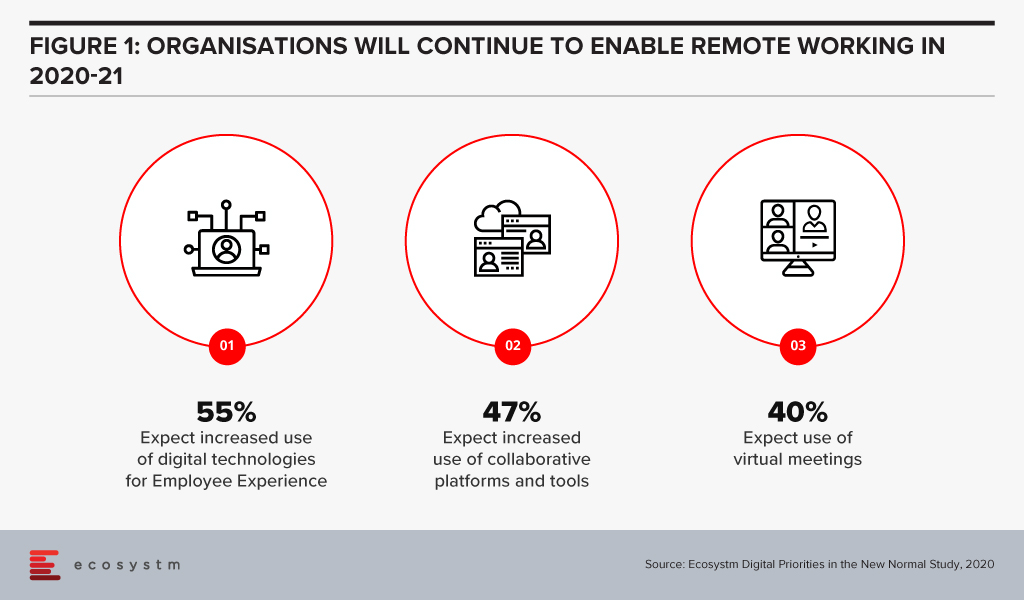

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.