Over the past year of moderating AI roundtables, I’ve had a front-row seat to how the conversation has evolved. Early discussions often centred on identifying promising use cases and grappling with the foundational work, particularly around data readiness. More recently, attention has shifted to emerging capabilities like Agentic AI and what they mean for enterprise workflows. The pace of change has been rapid, but one theme has remained consistent throughout: ROI.

What’s changed is the depth and nuance of that conversation. As AI moves from pilot projects to core business functions, the question is no longer just if it delivers value, but how to measure it in a way that captures its true impact. Traditional ROI frameworks, focused on immediate, measurable returns, are proving inadequate when applied to AI initiatives that reshape processes, unlock new capabilities, and require long-term investment.

To navigate this complexity, organisations need a more grounded, forward-looking approach that considers not only direct gains but also enablement, scalability, and strategic relevance. Getting this right is key to both validating today’s investments and setting the stage for meaningful, sustained transformation.

Here is a summary of the key thoughts around AI ROI from multiple conversations across the Asia Pacific region.

1. Redefining ROI Beyond Short-Term Wins

A common mistake when adopting AI is using traditional ROI models that expect quick, obvious wins like cutting costs or boosting revenue right away. But AI works differently. Its real value often shows up slowly, through better decision-making, greater agility, and preparing the organisation to compete long-term.

AI projects need big upfront investments in things like improving data quality, upgrading infrastructure, and managing change. These costs are clear from the start, while the bigger benefits, like smarter predictions, faster processes, and a stronger competitive edge, usually take years to really pay off and aren’t easy to measure the usual way.

Ecosystm research finds that 60% of organisations in Asia Pacific expect to see AI ROI over two to five years, not immediately.

The most successful AI adopters get this and have started changing how they measure ROI. They look beyond just money and track things like explainability (which builds trust and helps with regulations), compliance improvements, how AI helps employees work better, and how it sparks new products or business models. These less obvious benefits are actually key to building strong, AI-ready organisations that can keep innovating and growing over time.

2. Linking AI to High-Impact KPIs: Problem First, Not Tech First

Successful AI initiatives always start with a clearly defined business problem or opportunity; not the technology itself. When a precise pain point is identified upfront, AI shifts from a vague concept to a powerful solution.

An industrial firm in Asia Pacific reduced production lead time by 40% by applying AI to optimise inspection and scheduling. This result was concrete, measurable, and directly tied to business goals.

This problem-first approach ensures every AI use case links to high-impact KPIs – whether reducing downtime, improving product quality, or boosting customer satisfaction. While this short-to-medium-term focus on results might seem at odds with the long-term ROI perspective, the two are complementary. Early wins secure executive buy-in and funding, giving AI initiatives the runway needed to mature and scale for sustained strategic impact.

Together, these perspectives build a foundation for scalable AI value that balances immediate relevance with future resilience.

3. Tracking ROI Across the Lifecycle

A costly misconception is treating pilot projects as the final success marker. While pilots validate concepts, true ROI only begins once AI is integrated into operations, scaled organisation-wide, and sustained over time.

Ecosystm research reveals that only about 32% of organisations rigorously track AI outcomes with defined success metrics; most rely on ad-hoc or incomplete measures.

To capture real value, ROI must be measured across the full AI lifecycle. This includes infrastructure upgrades needed for scaling, ongoing model maintenance (retraining and tuning), strict data governance to ensure quality and compliance, and operational support to monitor and optimise deployed AI systems.

A lifecycle perspective acknowledges the real value – and hidden costs – emerge beyond pilots, ensuring organisations understand the total cost of ownership and sustained benefits.

4. Strengthening the Foundations: Talent, Data, and Strategy

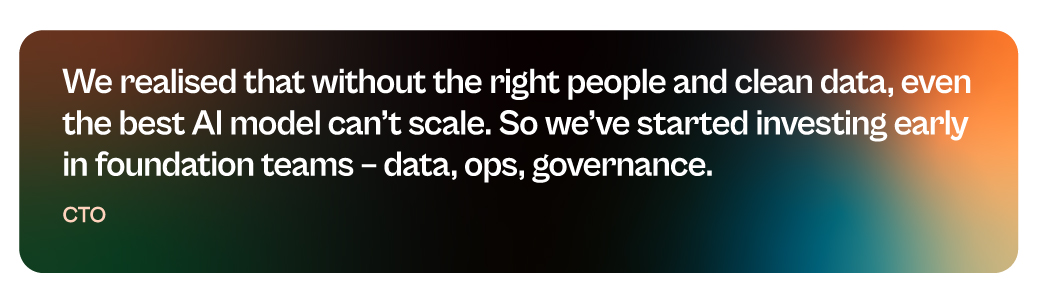

AI success hinges on strong foundations, not just models. Many projects fail due to gaps in skills, data quality, or strategic focus – directly blocking positive ROI and wasting resources.

Top organisations invest early in three pillars:

- Data Infrastructure. Reliable, scalable data pipelines and quality controls are vital. Poor data leads to delays, errors, higher costs, and compliance risks, hurting ROI.

- Skilled Talent. Cross-functional teams combining technical and domain expertise speed deployment, improve quality, reduce errors, and drive ongoing innovation – boosting ROI.

- Strategic Roadmap. Clear alignment with business goals ensures resources focus on high-impact projects, secures executive support, fosters collaboration, and enables measurable outcomes through KPIs.

Strengthening these fundamentals turns AI investments into consistent growth and competitive advantage.

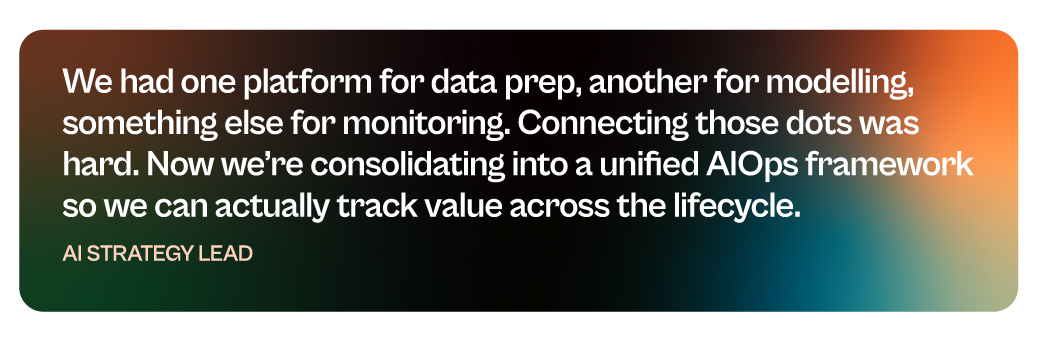

5. Navigating Tool Complexity: Toward Integrated AI Lifecycle Management

One of the biggest challenges in measuring AI ROI is tool fragmentation. The AI lifecycle spans multiple stages – data preparation, model development, deployment, monitoring, and impact tracking – and organisations often rely on different tools for each. MLOps platforms track model performance, BI tools measure KPIs, and governance tools ensure compliance, but these systems rarely connect seamlessly.

This disconnect creates blind spots. Metrics sit in silos, handoffs across teams become inefficient, and linking model performance to business outcomes over time becomes manual and error prone. As AI becomes more embedded in core operations, the need for integration is becoming clear.

To close this gap, organisations are adopting unified AI lifecycle management platforms. These solutions provide a centralised view of model health, usage, and business impact, enriched with governance and collaboration features. By aligning technical and business metrics, they enable faster iteration, responsible scaling, and clearer ROI across the lifecycle.

Final Thoughts: The Cost of Inaction

Measuring AI ROI isn’t just about proving cost savings; it’s a shift in how organisations think about value. AI delivers long-term gains through better decision-making, improved compliance, more empowered employees, and the capacity to innovate continuously.

Yet too often, the cost of doing nothing is overlooked. Failing to invest in AI leads to slower adaptation, inefficient processes, and lost competitive ground. Traditional ROI models, built for short-term, linear investments, don’t account for the strategic upside of early adoption or the risks of falling behind.

That’s why leading organisations are reframing the ROI conversation. They’re looking beyond isolated productivity metrics to focus on lasting outcomes: scalable governance, adaptable talent, and future-ready business models. In a fast-evolving environment, inaction carries its own cost – one that may not appear in today’s spreadsheet but will shape tomorrow’s performance.

Typically, business leaders rely on forecasts to secure budgets for achieving their goals and objectives. Forecasts take historical trends and project them forward, with added assumptions about what may or may not change in the market or operating environment.

But in today’s volatile economic and political climate, traditional forecasting is increasingly unreliable.

The threat of tariffs, actual tariffs, ongoing and emerging conflicts, political transitions and rising authoritarianism, along with the uncertain impact of AI on employment and productivity, are all undermining not just business and consumer confidence, but also supply chains and manufacturing capacity.

Look at the PC market in Asia Pacific. Shipments have traditionally been relatively straightforward to forecast; but in 2025, projections have swung from a 10% decline to 12% growth, and everything in between! These forecasts continue to shift month by month as market conditions evolve. The same applies to tech and non-tech products and services across many industries. Forecasts are no longer reliable or trustworthy.

So, if we cannot trust forecasts, what can we do to secure budget for our short-, medium- and longer-term initiatives? For many leaders, the answer is “Backcasting”.

When Forecasts Break Down, Backcasting Steps Up

Put simply, backcasting is creating a future vision, and building a plan to make that vision a reality.

For example, imagine you are the Asia Pacific Managing Director of a US-based software company aiming to move from the fifth to the second-largest provider in the region by 2030. To reach this goal, you’ll need to build specific capabilities such as adding distributors; expanding implementation and systems integration partners across ASEAN and India (which means strengthening your partner management team); increasing sales and account managers in tier 2 cities; and developing localised product versions and language support. You might also need to choose a different cloud provider to access certain markets like China and adapt your software to meet local regulations.

Backcasting helps you plan all these steps by starting with your 2030 goal and working backwards to create a clear roadmap to get there.

The benefit of backcasting over forecasting is that it gives your organisation defendable goals, targets and initiatives. It moves the thinking beyond the traditional quarterly targets to a longer-term vision. When global leaders ask you to cut budgets, it provides them with clear insight into how those cuts will affect the organisation’s success in Asia Pacific over the medium to long term. It also helps to understand which resources will help you achieve the longer-term goals and which will not.

Ultimately, backcasting is a better way of helping you defend your budgets from the tactical cuts and short-sighted strategies and sharpens your capability to deliver results in the longer term.

Want to Know More?

You can access a detailed report on backcasting: what it is, how it differs from traditional forecasting, and how it can be applied within your organisation. The report includes examples of companies using backcasting to shape strategic initiatives and support innovation, as well as a scenario outlining how an Asia Pacific tech vendor might use the approach to meet growing regional demands.

We have also helped clients start their backcasting journeys through targeted workshops, internal presentations, training programs and helping them set the backcasting strategy and processes in place. These services can support organisations at a strategic level, by aligning long-term plans with overarching goals; or at a team level, by helping functions like sales and marketing meet specific performance expectations.

We welcome your feedback – feel free to contact me or Alea Fairchild. If backcasting could support your organisation’s growth or budget planning, we’d be happy to connect via call or in person to discuss specific needs.

Here’s how we can help:

- Workshops. In-person or virtual workshops designed to build backcasting capabilities, such as setting long-term goals, creating roadmaps, and shifting focus from short-term tactics to strategic outcomes.

- Training (Internal Presentations & Webinars). Sessions to introduce teams to backcasting, explaining what it is, how it can be used, and why it supports more effective mid- to long-term planning.

- Client-Facing Presentations. Presentations tailored for clients and customers to show how backcasting can support their planning and investment decisions, potentially strengthening alignment with available solutions.

- Podcasts & Videos. Co-created audio or video content with leadership to explore how backcasting fits into current workflows, where the value lies, and how teams can tailor their efforts to organisational priorities.

The energy at ServiceNow’s Knowledge25 matched the company’s ambitious direction! ServiceNow is repositioning itself as more than just an IT service platform – aiming to be the orchestration layer for the modern enterprise. Over the past two days, I’ve seen a clear focus on platform extensibility, AI-driven automation, and a push into new functional territories like CRM and ERP.

Here are my key takeaways from Knowledge25.

Click here to download “ServiceNow Knowledge25: Big Moves, Bold Bets, and What’s Next” as a PDF.

AI Everywhere: Agents and Control Towers

ServiceNow goes all in on AI Agents – and makes it easy to adopt.

Like Google, Salesforce, and AWS, ServiceNow is betting big on agents. But with a key advantage: it’s already the enterprise layer where workflows live. Its AI Agents don’t just automate tasks; they amplify what’s already working, layer in intelligence, and collaborate with other agents across systems. ServiceNow becomes the orchestration hub, just as it already is for processes and change.

ServiceNow’s AI Control Tower is a critical accelerator for AI at scale. It enforces policies, ensures compliance with internal and regulatory standards, and provides the guardrails needed to deploy AI responsibly and confidently.

The bigger move? Removing friction. Most employees don’t know what agents can do – so they don’t ask. ServiceNow solves this with hundreds of prebuilt agents across finance, risk, IT, service, CRM, and more. No guesswork. Just plug and go.

Sitting Above Silos: ServiceNow’s Architectural Advantage

ServiceNow is finally highlighting its architectural edge.

It’s one of the few platforms that can sit above all systems of record – pulling in data as needed, delivering workflows to employees and customers, and pushing updates back into core systems. While most Asia Pacific customers use ServiceNow mainly for IT help desk and service requests, its potential extends much further. Virtually anything done in ERP, CRM, SCM, or HRM systems can be delivered through ServiceNow, often with far greater agility. Workflow changes that once took weeks or months can now happen instantly.

ServiceNow is leaning into this capability more forcefully than ever, positioning itself as the platform that can finally keep pace with constant business change.

Stepping into the Ring: ServiceNow’s CRM & ERP Ambitions

ServiceNow is expanding into CRM and ERP workflows – putting itself in competition with some of the industry’s biggest players.

ServiceNow is boldly targeting CRM as a growth area, despite Salesforce’s dominance, by addressing gaps traditional CRMs miss. Customer workflows extend far beyond sales and service, spanning fulfillment, delivery, supply chain, and compliance. A simple quoting process, for instance, often pulls data from multiple systems. ServiceNow covers the full scope, positioning itself as the platform that orchestrates end-to-end customer workflows from a fundamentally different angle.

Its Core Business Suite – an AI-powered solution that transforms core processes like HR, procurement, finance, and legal – also challenges traditional ERP providers, With AI-driven automation for tasks like case management, it simplifies workflows and streamlines operations across departments.

Closing the Skills Gap: ServiceNow University

To support its vision, ServiceNow is investing heavily in education.

The refreshed ServiceNow University aims to certify 3 million professionals by 2030. This is critical to build both demand (business leaders who ask for ServiceNow) and supply (professionals who can implement and extend the platform).

But the skills shortage is a now problem, not a 2030 problem. ServiceNow must go beyond online learning and push harder on in-person classes, tutorials, and train-the-trainer programs across Asia Pacific. Major cloud providers like AWS broke through when large enterprises started training their entire workforces – not just on usage, but on development. ServiceNow needs similar scale and commitment to hit the mainstream.

Asia Pacific: ServiceNow’s Next Growth Frontier

ServiceNow’s potential is massive – and its opportunities even bigger.

In Asia Pacific, many implementations are partner-led, but most partners are currently focused on the platform’s legacy IT capabilities. To unlock growth, ServiceNow needs to empower its partners to engage beyond IT and connect with business leaders.

Despite broader challenges like shrinking tech budgets, fragmented decision-making, and decentralised tech ownership, ServiceNow has a clear path forward. By upskilling partners, simplifying its narrative, and adapting quickly, it’s well-positioned to continue its growth and surpass the hurdles many other software vendors face.

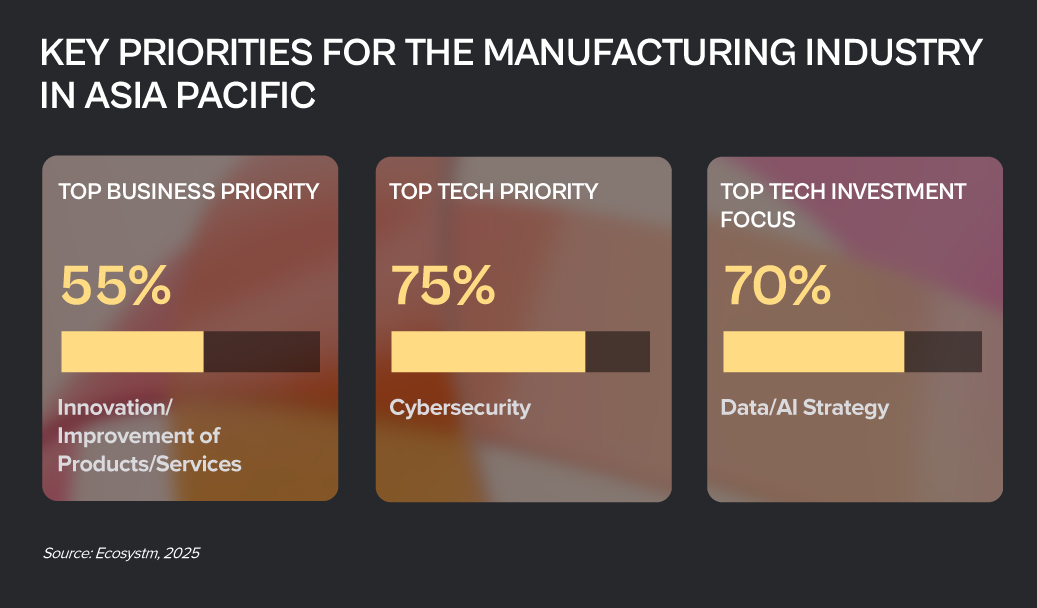

The Manufacturing sector, traditionally defined by stable processes and infrastructure, is now facing a pivotal shift. Rapid technological advancements and shifting global market dynamics have rendered incremental improvements inadequate for long-term competitiveness and growth. To thrive, manufacturers must fundamentally reimagine their entire value chain.

By embracing intelligent systems, enhancing agility, and proactively shaping future-ready operations, organisations can navigate today’s industrial complexities and position themselves for sustained success.

Here are recent examples of Manufacturing transformation in the Asia Pacific.

Click here to download “Future Forward: Reimagining Manufacturing” as a PDF.

Intelligent Automation & Efficiency

Komatsu Australia, a global industrial equipment manufacturer, tackled growing inefficiencies in its small parts department, where teams manually processed hundreds of PDF invoices daily from more than 250 suppliers.

To streamline this, the company deployed intelligent automation – AI now extracts and validates data from invoices against purchase orders and inputs it directly into the legacy mainframe.

The impact has been sharp: over 300 hours saved annually for one supplier, 1,100 invoices processed in three weeks, and a dramatic drop in manual errors. Employees have shifted to higher-value tasks, and a citizen developer program is enabling staff to build custom automation tools. With a scalable framework in place, Komatsu has not only transformed invoice processing but also set the stage for broader automation across the enterprise.

Data-Driven Insights & Agility

Berger Paints India Ltd., a leader in paints and coatings, needed to scale fast amid rising database loads and complex on-prem systems.

In response, Berger Paints migrated its mission-critical databases and core business applications – covering finance, manufacturing, sales, and asset management – to a high-performance cloud platform.

This shift boosted operational efficiency by 25%, doubled reporting and system response times, and enhanced scalability and disaster recovery with geographically distributed cloud regions. The move simplified access to data, driving faster, insight-driven decision-making. With streamlined infrastructure management and optimised costs, Berger Paints is now poised to leverage advanced technologies like AI/ML, setting the stage for continued innovation and growth.

Connected Operations & Customer Centricity

JSW Steel, one of India’s leading steel producers, set out to shift from a plant-centric model to a customer-first approach. The challenge: integrating complex systems like ERP, CRM, and manufacturing to streamline operations and improve order fulfillment.

With a robust integration platform, JSW Steel connected over 32 systems using 120+ APIs – automating processes and enabling real-time data flow across orders, inventory, pricing, and production.

The results speak for themselves: faster order fulfillment, reduced cost-to-serve, and real-time visibility that optimises scheduling. Scalable, composable APIs now support growth, while a 99.7% success rate across 7.2 million API calls ensures reliability. JSW Steel has transformed how it operates – running faster, serving smarter, and delivering better customer experiences across the entire order-to-cash journey.

Modernising Core Systems & Foundational Transformation

Fujitsu General, a global leader in air conditioning systems, was constrained by a 30-year-old COBOL-based mainframe and fragmented processes. The legacy system posed a Y2K-like risk and limited operational agility.

The company implemented a modern, unified ERP platform to eliminate risk, streamline operations, and boost agility.

By integrating functions across sales, production, procurement, accounting, and HR and addressing unique business needs with low-code development, the company created a clean, adaptable core system. Robust integration connected disparate data sources, while a central repository eliminated silos. The transformation delivered seamless end-to-end operations, standardised workflows, improved agility, and real-time insights – setting Fujitsu General up for continued innovation and long-term resilience.

Powering Growth with a Modern Network

As a critical supplier to India’s infrastructure boom, Hindalco needed to modernise its network across 55 sites – improving app performance, enabling real-time insights, and building a future-ready, sustainable foundation.

Hindalco replaced its ageing hub-and-spoke model with a modern mesh architecture using SD-WAN.

The new architecture prioritised key app traffic, simplified cloud access, and enabled segmentation. Centralised orchestration and SSE integration brought automation and robust security. The impact: 30% lower costs, 50% faster apps, real-time visibility, rapid deployment, and smarter bandwidth. Hindalco now runs on a lean, secure digital backbone – built for agility, performance, and scale.

As they continue to promote innovation in the Financial Services industry, the Monetary Authority of Singapore (MAS) introduced the Financial Sector Technology and Innovation Scheme 3.0 (FSTI 3.0) earlier this week, pledging up to SGD 150 million over three years. FSTI 3.0 aims to boost innovation by supporting projects that use cutting-edge technologies or have a regional scope, while strengthening the technology ecosystem in the industry. This initiative includes three tracks:

- Enhanced Centre of Excellence track to expand grant funding to corporate venture capital entities

- Innovation Acceleration track to support emerging tech based FinTech solutions, and

- Environmental, Social, and Governance (ESG) FinTech track to accelerate ESG adoption in fintech

Additionally, FSTI 3.0 will continue to support areas like AI, data analytics, and RegTech while emphasising talent development. We can expect to see transformative financial innovation through greater industry collaboration.

MAS’ Continued Focus on Innovation

Over the years, the MAS has consistently been a driving force behind innovation in the Financial Services industry. They have actively promoted and supported technological advancements to enhance the industry’s competitiveness and resilience.

The FinTech Regulatory Sandbox framework offers a controlled space for financial institutions and FinTech innovators to test new financial products and services in a real-world setting, with tailored regulatory support. By temporarily relaxing specific regulatory requirements, the sandbox encourages experimentation, while ensuring safeguards to manage risks and uphold the financial system’s stability. Upon successful experimentation, entities must seamlessly transition to full compliance with relevant regulations.

Innovation Labs serve as incubators for new ideas, fostering a culture of experimentation and collaboration. They collaborate with disruptors, startups, and entrepreneurs to develop groundbreaking solutions. Labs like Accenture Innovation Hub, Allianz Asia Lab, Aviva Digital Garage, ANZ Innovation Lab, and AXA Digital Hive drive create prototypes, and roll out market solutions.

Building an Ecosystem

Partnerships between financial institutions, technology companies, startups, and academia contribute to Singapore’s economic growth and global competitiveness while ensuring adaptive regulation in an evolving landscape. By creating a vibrant ecosystem, MAS has facilitated knowledge exchange, collaborative projects, and the development of innovative solutions. For instance, in 2022, MAS partnered with United Nations Capital Development Fund (UNCDF) to build digital financial ecosystems for MSMEs in emerging economies.

This includes supporting projects that address environmental, social, and governance (ESG) concerns within the financial sector. For instance, MAS worked with the People’s Bank of China to establish the China-Singapore Green Finance Taskforce (GFTF) to enhance collaboration in green and transition finance. The aim is to focus on taxonomies, products, and technology to support the transition to a low-carbon future in the region, co-chaired by representatives from both countries.

MAS has also promoted Open Banking and API Frameworks to encourage financial institutions to adopt open banking practices enabling easier integration of financial services and encouraging innovation by third-party developers. This also empowers customers to have greater control over their financial data while fostering the development of new financial products and services by FinTech companies.

Regulators in Asia Pacific Taking a Proactive Approach

While Singapore is at the forefront of financial innovations, other regulatory and government bodies in Asia Pacific are also taking on an increasingly proactive role in nurturing innovation. This stance is being driven by a twofold objective – to accelerate economic growth through technological advancements and to ensure that innovative solutions align with regulatory requirements and safeguard consumer interests.

Recognising the potential of fintech to enhance financial services and drive economic growth, the Hong Kong Monetary Authority (HKMA) established the Fintech Facilitation Office (FFO) to facilitate communication between the fintech industry and traditional financial institutions. The central bank’s Smart Banking Initiatives, including the Faster Payment System, Open API Framework, and the Banking Made Easy initiative that reduces regulatory frictions help to enhance the efficiency and interoperability of digital payments.

The Financial Services Agency of Japan (FSA) has been actively working on creating a regulatory framework to facilitate fintech innovation, including revisions to existing laws to accommodate new technologies like blockchain. In 2020, FSA launched the Blockchain Governance Initiative Network (BGIN) to facilitate collaboration between the government, financial institutions, and the private sector to explore the potential of blockchain technology in enhancing financial services.

The Central Bank of the Philippines (Bangko Sentral ng Pilipinas – BSP) has launched an e-payments project to overcome challenges hindering electronic retail purchases, such as limited interbank transfer facilities, high bank fees, and low levels of trust among merchants and consumers. The initiative included the establishment of the National Retail Payment System, a framework for retail payment, and the introduction of automated clearing houses like PESONet and InstaPay. These efforts have increased the percentage of retail purchases made electronically from 1% to over 10% within five years, demonstrating the positive impact of effective cooperation and innovative policies in driving a shift towards a cash-lite economy.

The promotion of fintech innovation highlights a collective belief in its potential to transform finance and boost economies. As regulations adapt for technologies like blockchain and open banking, the Asia Pacific region is promoting collaboration between traditional financial institutions and emerging fintech players. This approach underscores a commitment to balance innovation with responsible oversight, ensuring that advanced financial solutions comply with regulatory standards.

The ongoing Ecosystm State of ESG Study throws up some interesting data about organisations in Asia Pacific.

We see ESG more firmly entrenched in organisational strategies; organisations leading with Social and Governance initiatives that are easily integrated within their CSR policies; and supply chain partners driving change.

Download ‘Sustainable Asia Pacific: The ESG Growth Story’ as a PDF

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

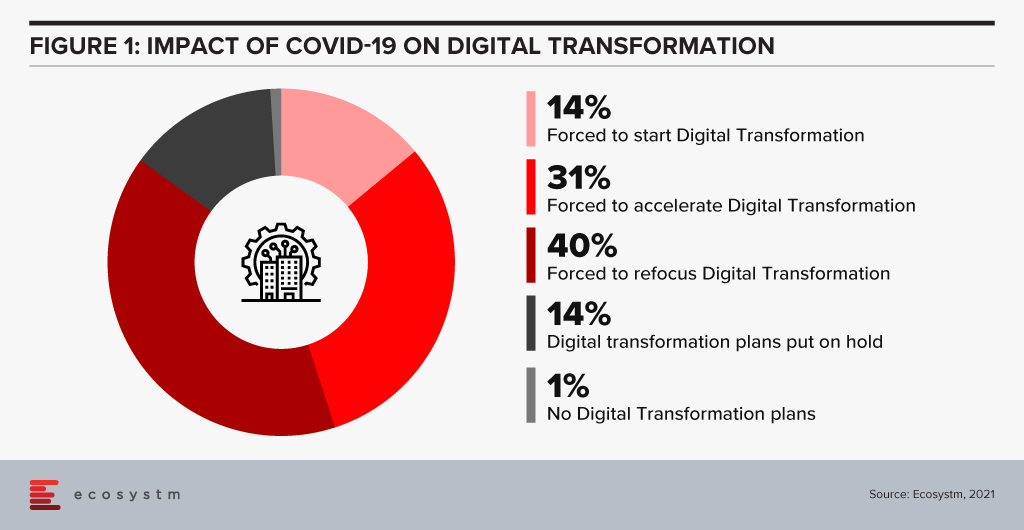

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Moving from a product or regional focus to an industry focus appears to be the “strategy du jour” for many technology vendors today. For some it is a new strategy – with the plan to improve customer focus and increase growth; for others it is the pendulum moving back to where they were five or ten years ago as they bounce from being industry-centric to product-centric to geography-centric and back again.

Getting your industry focus right is much harder than it seems – and has to be timed with client needs and market opportunity. The need to focus on the industry varies for different technology products, services and capabilities. For example, most technology buyers want their vendors to understand what their business does and how they add value to customers – that is a given and industry-aligned Sales teams make a lot of sense. Many tech buyers also want certain software functions to align directly to their processes – there is little appetite to customise ERP and financial suites to specific industry needs and processes – and tech vendors should support these out-of-the-box or cloud needs.

Industry Solutions May Not Drive Competitive Advantage

If the industry solution you are selling is the same as what any of their competitors can buy from you, then organisations get the exact same benefit as the market – no more, no less. For example, about 10-15 years ago, large telecom providers around the globe made significant investments in CRM platforms (often from Siebel) – bringing in one of a few large global systems integrators to deploy their standard processes and systems. These CRMs were supposed to provide business and customer benefit, and drive competitive advantage. And while they did deliver positive change (often at SIGNIFICANT cost!) when every telecom provider was using the same solution with the same or similar processes, any competitive advantage was lost.

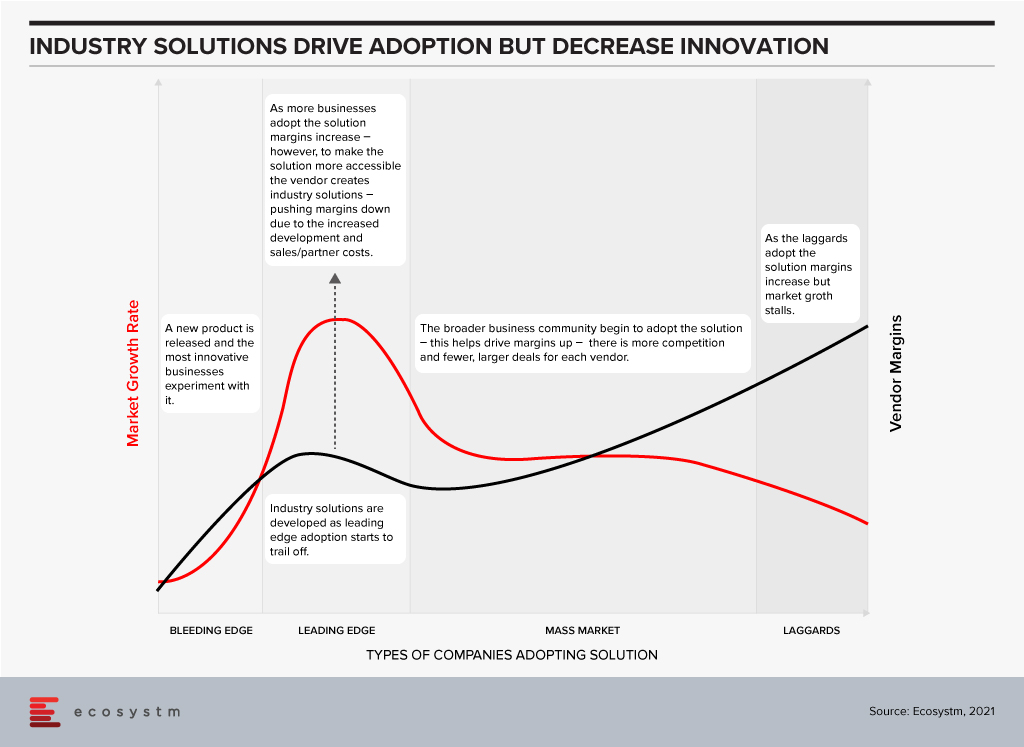

Industry Solutions are Often the Sign of a Mature Market

The widely accepted hypothesis is that the technology innovation and adoption happens in waves. The market has 5-7 year waves of innovation, followed by 5-7 year waves of deployment, adoption and consolidation.

The Innovation Phase. In this stage new companies emerge, new products or services are launched and leading/bleeding edge companies embrace these new technologies to drive competitive advantage and business growth. They experiment with new technologies that drive new business capabilities – sometimes failing, but always pushing the envelope for business innovation and forging the path for mass market adoption. In this stage there is often little demand for industry solutions – as both the providers and buyers of the solutions are still working out where the business benefit is; where the technology might be able to drive change or help them get ahead of competitors. If you examine the growth of a company such as Salesforce, you see that the early stage products are targeted towards a generic market – customers are expected to customise the solution based on their needs and individual requirements. In 2002 I worked for a challenger telecom provider that had deployed a traditional Peoplesoft CRM capability, and I was part of the team that brought Salesforce into the business – and as a cloud-based solution, we saw the competitive advantage was the pace at which we could customise the product (by excluding IT teams and processes). However, the solution was a “one-size-fits-all” product. The innovation stage is typically characterised by high growth of smaller vendors and technology service providers who challenge the status quo.

The Deployment, Adoption and Consolidation Phase. This stage of market growth is when the mass market starts to adopt these solutions. Many of these buyers walk the paths that have been forged before them by the more innovative, leading edge businesses. This stage typically sees less innovation, less experimentation, and more standard deployments. To make the solutions more palatable and easier to sell to the mass market tech vendors typically pre-configure or customise the solutions to specific needs – for business teams, roles or industries. It is usually in this stage of market growth and deployment that the industry solutions see significant interest and adoption. This is where the mass market gets access to the business benefits the more innovative businesses received many years earlier (and often profited from in this time). In my example of the Salesforce deployment in 2002, over the following years many partners started to create industry solutions, and eventually Salesforce themselves sold industry-specific solutions – or at least targeted certain products and capabilities at specific industries and provided accelerated deployment models to drive advantage at a faster rate. The deployment and consolidation stage of market growth is typically characterised by steady, slow growth across the entire market as benefits are being driven to all providers (product vendors and solutions or implementation providers). Legacy providers either play catch up or suffer declining business as they realise the solution they sell no longer provides the business and customer the benefits that it used to.

Industry Focus Should be Aligned to Customer Segments, Solution Type and Geography

The decision to sell industry-focused solutions should be driven by the type of solution you are selling; the business benefit you are promising; and the type of business you are targeting the solution towards. Businesses that are more innovative will still buy some pre-configured, industry-specific solutions that don’t differentiate their business or drive competitive advantage. But where they expect competitive advantage, they need to stand apart – to be the only business with that capability.

It is also worth understanding that an innovation in one market might be standard practice in another (and vice-versa). Countries across the globe and specifically here in Asia Pacific have different approaches to technology and innovation. China and parts of Southeast Asia are often innovators – pushing the boundaries of new and emerging tech to do things we never thought possible (in the same way Silicon Valley traditionally has done). Australia and India are traditional markets that adopt industry solutions after they have been tried and tested by others. Innovation in Japan seems to happen in stages and at pace but only once every 10-15 years or so. New Zealand and Singapore are generally more nimble economies where businesses often have to be innovative to gain global competitive advantage quickly.

Evidence indicates that the rate of innovation is increasing across the entire region – even in the less innovative economies. The window for industry solutions is much smaller regardless of location – as the next new innovation is just around the corner. Even the large, traditionally less agile businesses are driving innovation programs – for example, many of the big financial services “dinosaurs” such as DBS and Commonwealth Bank often win tech innovation awards and offer market-leading customer experiences.

Use this lens to better develop your industry approach. The depth of your industry solution or capability will dictate the opportunities that you will drive based on the type of customer and technology stage. Do you want to drive innovation or efficiency in your clients? Do you want to win the big “safer” deals – but be thought of as a technology solution provider; or win the smaller deals in companies that will become the market leaders of tomorrow – and be considered a market leader and king maker? Understanding your own business goals, the current sales and delivery capabilities, and the capacity to change will help your company create a go-to-market strategy that suits your current and future customers and will likely dictate the growth rate of your business over the next 5-7 years.

Keep yourself abreast with the latest industry trends

Ecosystm market insights, data, and reports are jam-packed with industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.

Five9, a cloud-based contact centre solutions provider announced the acquisition of intelligent virtual agent (IVA) platform provider, Inference Solutions for about USD 172 million. Five9 and Inference Solutions have been partnering for the last couple of years, with Five9 being a reseller for Inference Solutions’ IVA platform. The acquisition is expected to provide a boost to Five9’s AI portfolio, automate contact centre agent activities and provide AI-based omnichannel self-service solutions.

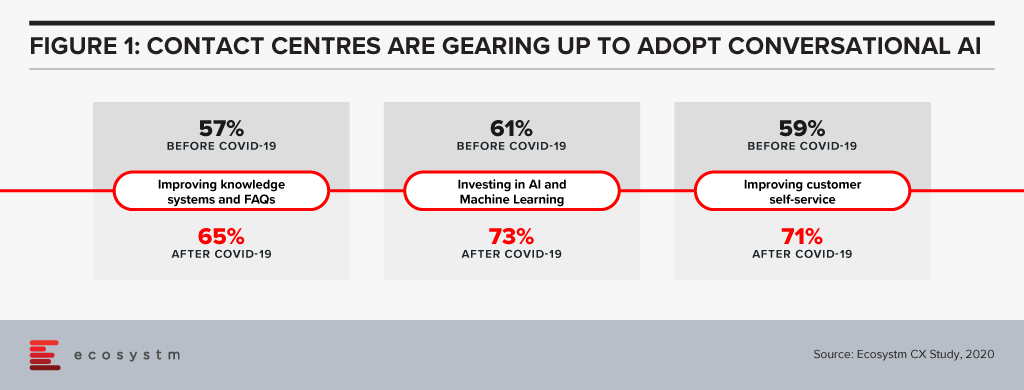

The need to drive greater automation in the contact centre is high on the agenda, and this acquisition demonstrates how important AI and automation is to contact centre modernisation. The old-fashioned ways of long wait times, being passed on through different menus on the IVR and being asked to repeat yourself through the older speech recognition engines is starting to not only frustrate customers but will become obsolete. Based on Ecosystm’s research, close to 60% of contact centres globally stated that investing in machine learning and AI is a top customer experience priority in the next 12 months.

Inference has come a long way since its inception at Telstra Labs

Inference Solutions (founded in 2005) was spun out of Telstra Labs. It has since expanded to the US and developed a suite of solutions in the IVA segment. They have a good partnership strategy with the leading telecom providers globally as well as the UC/contact centre vendors. Inference Solutions uses resellers such as service providers, UC, and contact centre software providers – and these include AT&T, Cisco (Broadsoft), Momentum Telecom, Nextiva, 8×8 and many others. The Inference Studio solution will see a new release in the next few months where the solution will come pre-built with the ability for the contact centre team to pre-load the contact centre conversations. These can be conversations that have been going on for 6 months or longer. The Studio solution will then be able to analyse and understand the underlying intent of the conversation, match the intent so that it can be used to auto train the bots accurately. That process of matching the intent and training is expensive and if you can automate some elements of that, it will bring the cost of the deployment down. Its solution integrates into NLP engines from Google, AWS, and IBM. In Australia they continue to work on patents in close partnerships with Melbourne University and RMIT. Throughout its journey, Inference has built a good base of customers in the US, UK, and Australia.

Five9 to accelerate on its vision of AI and Cloud

Contact centre modernisation is high on the agenda for many organisations and this will lead them to build AI and automation at the core of their customer strategies. The discussion spans across the CEO, Digital and Innovation, and the Contact Centre teams.

Five9 had acquired Whendu, an iPaaS platform provider empowering businesses and developers with no-code, visual application workflow tool, optimised for contact centres in November 2019, and Virtual Observer, an innovative provider of cloud-based workforce optimisation, also known as Workforce Engagement Management (WEM) in February of this year.

The pandemic has resulted in increased engagement of contact centres with customers. Companies are gradually looking for ways to automate tasks, deliver better communication, speech and text recognition, decipher languages, and implement solutions mimicking humans. As a solution to these challenges, IVAs are being viewed as efficient and effective digital workers for a modern contact centre. IVAs represent increased throughput, more accurate results, and better-informed agents.

Successful use cases have shown that conversational AI can reduce calls and repetitive queries by 70-90%. IVRs with monolithic, complicated menus will start becoming unpopular and force contact centres to embark on a modernisation and automation strategy. If we evaluate the shift in priorities after COVID-19, we see that organisations are ramping up their self-service capabilities and their adopt of AI and machine learning (Figure 1).

The acquisition will give Five9 a foothold in the Asia Pacific region with an initial focus on the Australia market. The Australia market is by far the most advanced cloud contact centre market in the Asia Pacific. Five9 gains a team of staff that will help them fuel the contact centre modernisation discussion across the Asia Pacific. As the region has a complex market, the need to work with local carriers and partners will be critical for further expansion. Five9 has made an important acquisition in building in IVA capability into its CCaaS solution.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated