Cisco has recently announced their intention to acquire Socio Labs, a US-based event technology platform – the latest in a series of acquisitions. Cisco’s Webex Events provides meeting, webinar and webcast capabilities, including polling, Q&A, chat and real-time translation. This acquisition will allow Webex Events to cater to large-scale, hybrid events and conferences. Solution capabilities will include live streaming, sponsorship, networking, and advanced analytics – including for pre-event and post-event activities.

Collaboration Platforms are Here to Stay

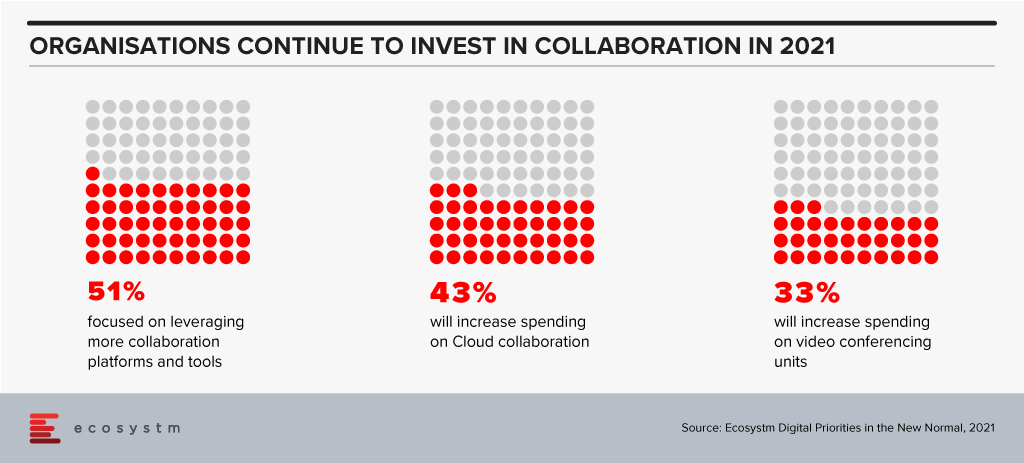

2020 was the year video conferencing and collaboration finally became mainstream. With the exponential rise of remote and hybrid working, the investments in collaboration technologies has increased – and Ecosystm research shows that the trend is continuing well into 2021.

The other aspect that has been impacted by the pandemic is the Events business. With social distancing regulations, Events and Marketing teams are being challenged in their outreach and go-to-market initiatives. Even when countries allow in-person events, it is becoming increasingly difficult to get people to attend events. With most organisations allowing remote working many attendees are away from the CBD/ commercial areas and are reluctant to commute to attend events. This has seen the rise of a hybrid event model that caters to both in-person and virtual attendees.

While some countries are beginning to bring back in-person events, they will remain largely virtual. Event organisers will have to cater for those who are happy to attend in-person and those who want to access the event virtually. Providing a better experience for hybrid events, will require richer features using video and collaboration platforms to allow live streaming, chat, feedback, analytics – to gauge audience engagement – polling and other interesting ways to retain audience attention. Additionally, it will be important for these platforms to facilitate sponsorship, registrations and even ticketing capabilities directly from within the platform. These new dimensions to step up engagements for both virtual and in-person events have become necessary for the world we are living in.

Cisco Strengthening Collaboration Capabilities

Cisco is enhancing the virtual/hybrid meeting and events experience they provide and this has been evident from their recent acquisitions. They clearly see the need to enhance audience participation and engagement from pure static video and collaboration environments. Socio Labs’ business accelerated during the pandemic and they built a platform that offers a deeper engagement with the audience. Their customers include Google, Microsoft, PepsiCo and Hyundai.

Last year Cisco acquired BabbleLabs, a noise removal technology provider and the product has been integrated into their Webex platform, to improve the audio experience. Earlier this month Cisco also completed their acquisition of Slido. This means that Webex users can now leverage Slido’s capability of gathering real-time audience feedback, rather than just asking questions via text or chat. The solution can also enhance the learning experience during team training sessions and offers built-in analytics to gauge audience participation and where the gaps are. These acquisitions are an indication that Cisco is serious about their market presence in the video and collaboration space – and is keen on making a mark in the Events market.

Uniphore, a Conversational Service Automation (CSA) provider in the contact centre space announced two new services – U-Trust portfolio and U-Assist Assurance solution to support call centre agents and operations. The U-Trust portfolio includes U-Trust Agent to authenticate agents using unique voiceprints and U-Trust Environment to protect sensitive data. The other offering, U-Assist Assurance integrates RPA along with conversations AI and machine learning to track and deliver commitments made by agents in real-time during the call, to align with customer expectations and manages fulfilment post calls.

Security and Automation Driving Investments in Contact Centres

With agents working from both their home and the office, security is a bigger issue today than ever before. In 2021, contact centres will be under pressure to ensure all security requirements are met. For example: agents taking screenshots and photos of confidential information; family members having access to customer conversations and data; how agents access customer data. These are pertinent concerns that must be addressed and mechanisms around securing customer data will be of utmost priority. Any form of misuse of customer’s private information can have negative implications on the brand of a company.

With security efforts high on the agenda for contact centres, Uniphore is addressing critical issues faced by contact centres. The U-Trust portfolio aims to leverage biometrics for voice authentication and ensure safety in customer data handling. Uniphore is clearly listening to the market and have identified “problematic areas” that must be addressed. Ramping up security efforts especially with the work from anywhere model will be high on the agenda for every contact centre.

What is sometimes not talked about often enough in contact centres, is the integration to the back office. There are often follow ups required after the customer interaction – for example when a product needs to be ordered or serviced, the back office has an integral part to play in delivering customer experience. As contact centres realise that back office integration is critical there will be greater Investments in workplace collaboration, robotic process automation (RPA) and other automation technologies.

Uniphore is carving out a name in Conversational Service Automation. They are investing heavily in building an end-to-end automation solution for contact centres across Conversational AI, RPA and security capabilities. Cost pressures are rising and the need to automate will be greater than ever in 2021.

Uniphore focused on Growing AI/Automation Capabilities through Acquisitions & Partnerships

The last 12 months have been impressive for the company in terms of partnerships and acquisitions. For example, last October they partnered with NTT Data and will license NTT’s RPA technology for contact centres. The company issued a press release saying based on internal projections and the opportunities currently underway, this partnership could generate more than USD 50 million in revenue over the next five years. They also announced a partnership with Sitel. Through the partnership, Sitel will deploy Uniphore’s solution to its customer base. These are global partnerships that will help Uniphore scale its presence with outsourcers and in-house contact centres and help them with their customer experience transformation efforts.

Last month saw Uniphore collaborating with Idiap Research Institute, and joined World Economic Forum’s (WEF) Global Innovators Community. Uniphore and Idiap will work on the development of speech recognition algorithms, spoken language and signals for detection of emotions and semantic and pragmatic applications to generate insights and enhance customer experience. As a member of WEF, Uniphore will focus on co-designing and developing policy frameworks, standards for protecting children, creating an AI regulator for the 21st century and addressing concerns of facial recognition technology.

They also acquired Spanish video and emotion AI start-up Emotion Research Lab. Through this acquisition, Uniphore is looking to create advanced AI-based voice and video products for innovations in conversations service automation services and to expand its footprints in the European market. Moreover, combining voice and video AI with automation and machine learning will open up new use cases, including customer experience, sales, marketing, HR and other critical areas of business.

The comprehensive portfolio solution aims to strengthen overall contact centre interactions between customers and agents, optimise the connection through RPA and improve the contact centre security aspects through agent verification and data security.

2021 will see contact centres, dealing with new ways of working by employing various AI and Automation capabilities. See how you can empower your teams and agents to deliver exceptional customer experience in 2021. We outline the contact centre trends for 2021 in our Ecosystm Predicts: The Top 5 Contact Centre Trends for 2021 report.

Five9, a cloud-based contact centre solutions provider announced the acquisition of intelligent virtual agent (IVA) platform provider, Inference Solutions for about USD 172 million. Five9 and Inference Solutions have been partnering for the last couple of years, with Five9 being a reseller for Inference Solutions’ IVA platform. The acquisition is expected to provide a boost to Five9’s AI portfolio, automate contact centre agent activities and provide AI-based omnichannel self-service solutions.

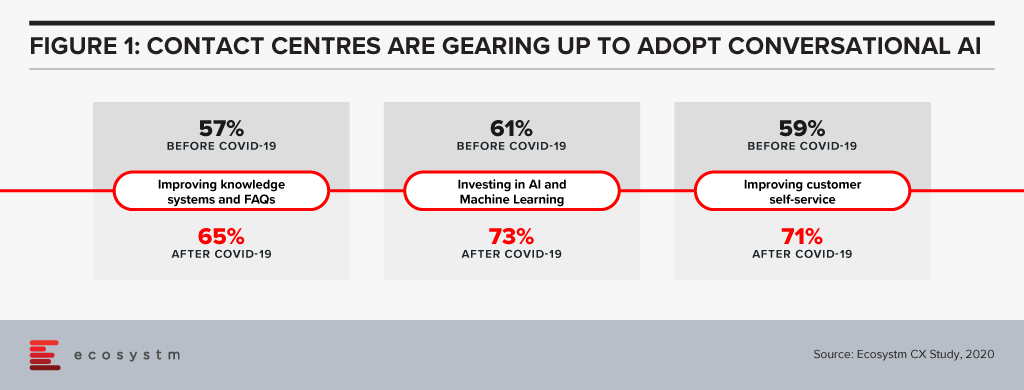

The need to drive greater automation in the contact centre is high on the agenda, and this acquisition demonstrates how important AI and automation is to contact centre modernisation. The old-fashioned ways of long wait times, being passed on through different menus on the IVR and being asked to repeat yourself through the older speech recognition engines is starting to not only frustrate customers but will become obsolete. Based on Ecosystm’s research, close to 60% of contact centres globally stated that investing in machine learning and AI is a top customer experience priority in the next 12 months.

Inference has come a long way since its inception at Telstra Labs

Inference Solutions (founded in 2005) was spun out of Telstra Labs. It has since expanded to the US and developed a suite of solutions in the IVA segment. They have a good partnership strategy with the leading telecom providers globally as well as the UC/contact centre vendors. Inference Solutions uses resellers such as service providers, UC, and contact centre software providers – and these include AT&T, Cisco (Broadsoft), Momentum Telecom, Nextiva, 8×8 and many others. The Inference Studio solution will see a new release in the next few months where the solution will come pre-built with the ability for the contact centre team to pre-load the contact centre conversations. These can be conversations that have been going on for 6 months or longer. The Studio solution will then be able to analyse and understand the underlying intent of the conversation, match the intent so that it can be used to auto train the bots accurately. That process of matching the intent and training is expensive and if you can automate some elements of that, it will bring the cost of the deployment down. Its solution integrates into NLP engines from Google, AWS, and IBM. In Australia they continue to work on patents in close partnerships with Melbourne University and RMIT. Throughout its journey, Inference has built a good base of customers in the US, UK, and Australia.

Five9 to accelerate on its vision of AI and Cloud

Contact centre modernisation is high on the agenda for many organisations and this will lead them to build AI and automation at the core of their customer strategies. The discussion spans across the CEO, Digital and Innovation, and the Contact Centre teams.

Five9 had acquired Whendu, an iPaaS platform provider empowering businesses and developers with no-code, visual application workflow tool, optimised for contact centres in November 2019, and Virtual Observer, an innovative provider of cloud-based workforce optimisation, also known as Workforce Engagement Management (WEM) in February of this year.

The pandemic has resulted in increased engagement of contact centres with customers. Companies are gradually looking for ways to automate tasks, deliver better communication, speech and text recognition, decipher languages, and implement solutions mimicking humans. As a solution to these challenges, IVAs are being viewed as efficient and effective digital workers for a modern contact centre. IVAs represent increased throughput, more accurate results, and better-informed agents.

Successful use cases have shown that conversational AI can reduce calls and repetitive queries by 70-90%. IVRs with monolithic, complicated menus will start becoming unpopular and force contact centres to embark on a modernisation and automation strategy. If we evaluate the shift in priorities after COVID-19, we see that organisations are ramping up their self-service capabilities and their adopt of AI and machine learning (Figure 1).

The acquisition will give Five9 a foothold in the Asia Pacific region with an initial focus on the Australia market. The Australia market is by far the most advanced cloud contact centre market in the Asia Pacific. Five9 gains a team of staff that will help them fuel the contact centre modernisation discussion across the Asia Pacific. As the region has a complex market, the need to work with local carriers and partners will be critical for further expansion. Five9 has made an important acquisition in building in IVA capability into its CCaaS solution.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

Probe Group, a Business Process Outsourcing (BPO) solutions provider and Stellar – a customer experience (CX) management organisation announced a merger to create Australia’s largest and most diverse CX provider group. The partnership will combine the experience and expertise of both companies and will employ 12,600 people to provide outsourcing of business process services for customers across six countries. Probe Group is backed by Quadrant Private Equity and Five V Capital.

Probe Group has been expanding its business presence since being acquired by Five V Capital in early 2018. At the time, Probe acquired Salmat’s Contact business, a broad-based CX operation which helped Probe expand their presence in Australia, New Zealand and the Philippines. Looking out for further opportunities, in December last year Probe Group acquired Australia-based and Philippines-focused Beepo and quickly followed this with an acquisition in January this year of the Philippines outsourcing agency MicroSourcing, a counterpart to Beepo which greatly expanded Probe’s Philippines offering. These acquisitions helped Probe extend their service offering from CX into Shared Services and Knowledge Services.

This is a brilliant move as Stellar is one of the most successful contact centre outsourcing providers in Australia. With successive growth for 22 years and having a strong footprint in both the public and private sectors, the acquisition will give Probe Group entry into some large accounts. Additionally, Probe will gain a large pool of well-trained agents in Australia and other locations across the globe.

The merger comes at an interesting time when we are seeing several organisations re-evaluate their outsourcing strategy. There is also an active interest in enhancing CX through AI/automation. Both the Probe Group and Stellar understand the Australian market and consumer sentiments and the merger is expected to drive better customer outcomes in the Australia market.

Prior to COVID-19, Probe Group employed 8,500 agents. With this acquisition, they will have 12,600 agents and an expected turnover of USD 420 million. That is not only impressive but will help Probe offer a variety of services including both onshore and offshore, to take on their rivals.

Rise of Onshore Activity will see New Shifts in CX Delivery Models

The COVID-19 pandemic has brought about several changes to the outsourcing sector. The disruption caused by services in many key offshore markets led to organisations re-evaluating their contact centre outsourcing strategy and some have started moving contact centre jobs back to Australia. Westpac is the latest organisation to announce that they are moving 1,000 jobs back to Australia. They have stated that while they expect productivity benefits over time, there is clearly a cost to adding 1,000 roles – likely an uplift of around $45 million per annum in its costs by the end of 2021.

The cost element is bound to creep in over time and contact centres will ask outsourcing providers to help drive costs down. Options would include moving some services offshore, while the critical remain onshore. Striking that balance to manage costs will be important and so will be the ability to offer various options for customers. Additionally, we can expect to see an increased demand for self-service technologies. Many organisations are in the midst of re-evaluating the use of AI and automation technologies not only as a way to drive great CX but as a way to also reduce costs (Figure 1).

Contact centres are starting to realise that to modernise their contact centre, the ability to lead with machine learning and AI technologies are critical. It will drive the deployment of natural language understanding (NLU) and conversational AI, sentiment analysis, transcription capabilities – and ultimately provide intelligence about the call even prior to the call being fielded. However, it is worth noting that whilst automation is on the rise, the role of the agent is not going away anytime soon and will grow in importance. We will see the rise of the “super-agent’’ and the agent’s role will evolve over time and AI/automation will generate rich insights to help aid the agent and the contact centre team to better predict customer behaviour and patterns.

The Next Generation of Outsourcing Providers must Drive Innovation for their Customers

Companies today are not outsourcing just to save labour costs. While cost remains an important angle, it will not often be the main driver for outsourcing in the future. The next generation of outsourcing providers will have to build rich solution capabilities, customer journey maps and help customers understand how to align all channels. This involves working with many different technology providers to build the right capabilities for their client organisations. Organisations are keen to modernise their contact centre operations to achieve excellence in CX. Outsourcing providers must have the capability to deliver that innovation.

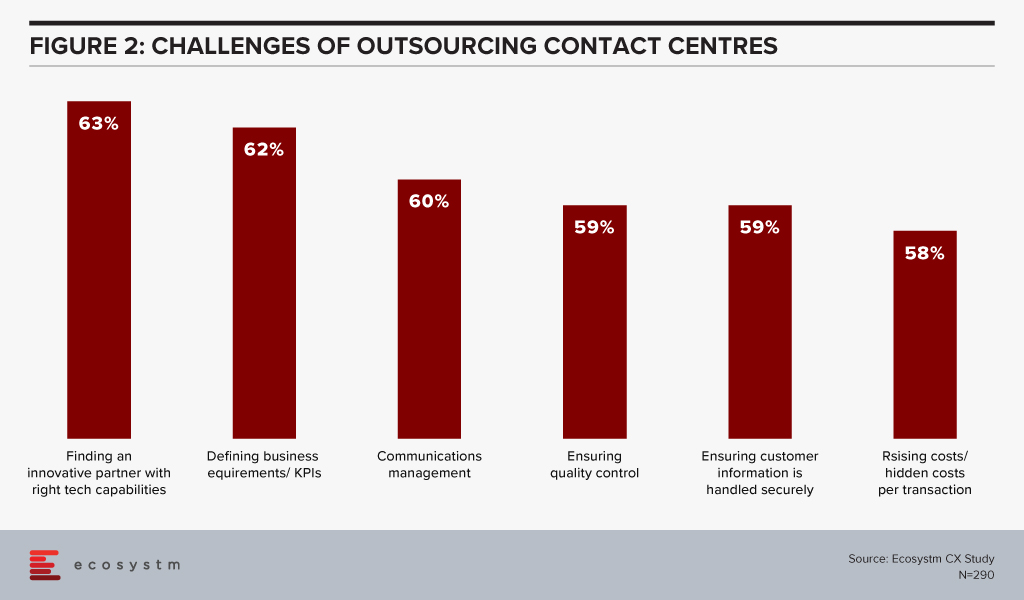

Ecosystm research finds that 63% of organisations that outsource their contact centre functions are challenged with finding the right partner that can drive innovations (Figure 2).

Contact centre outsourcing providers have a role to play in some of the following areas:

- The ability to adapt to change and take on risks together with the client

- Ensuring that all forms of security and governance measures are in place. This includes considering factors such as data security, data handling, and security features enabled across devices, applications, and the network. This is especially true for Government and Financial services contracts. Additionally, with some organisations preferring the work from a home model, there are security issues that must be addressed for the scenario.

- Helping the move from a traditional contact centre to a contact centre that delivers the highest levels of CX for its customers. Applying technologies such as AI and machine learning, NLU, biometrics, speech analytics, customer journey analytics and robotic process automation (RPA) will be key to modernisation.

- Being able to build a business continuity plan (BCP) for their customers in the event of another crisis.

Ecosystm Comment

Probe Group started off as a business specialising in outsourcing services in the credit and collections segment. Their customers in 2016 ranged from organisations across Financial Services, Utilities, and Federal and State Government. At that time, Probe employed about 300 people and their turnover was about USD 25 million. They did not rest on their laurels and realised that organic growth combined with strategic acquisitions would give them a foothold across various geographies and add new capabilities to their portfolio. With the rise in onshore activity, they will now be in a strong position to offer their customers various services and models of engagement to help drive CX excellence. The acquisition of Stellar will help Probe Group propel to greater heights and we see a new CX outsourcing giant being born.

This week, Vodafone New Zealand launched a contact centre solution known as Vodafone Connect that runs on AWS cloud infrastructure. The solution is designed for contact centres and customer service providers to reduce their operating cost and deliver an improved customer experience (CX).

The move comes as many businesses and governments are witnessing a spike in inbound contact centre volumes since the outbreak of the pandemic. The telecom company aims to help the contact centre industry through its on-demand contact centre suite of solutions that can be scaled up or down according to the organisations’ requirements. It can be combined with existing CRM platforms in a single dashboard for better access to data and resolution support.

Vodafone Connect is built on the AWS Connect cloud contact centre solution and uses data analytics and machine learning tools to automate customer interactions across multiple channels – email, messaging and social media – to support the contact centre agents with real-time information.

COVID-19 has accelerated the move to the cloud

The recent pandemic has seen many organisations make a leap almost overnight to cloud contact centre technologies. Many organisations that previously had concerns around data privacy, and securing customer data – and were thus hesitant about deploying cloud contact centre solutions – have moved to the cloud model. The cloud model helped get agents that were forced to work from home up and running in a short duration. The immediate urgency was primarily due to a massive spike in voice calls and non-voice activity such as emails. During the COVID-19 crisis, many organisations used Virtual Private Network (VPN) connections to their legacy on-premises phone system to enable the remote agents. However, there have been challenges reported by many organisations with that approach such as increases to IT budget, difficulty in scaling easily, and the requirement for more IT support that could have been avoided.

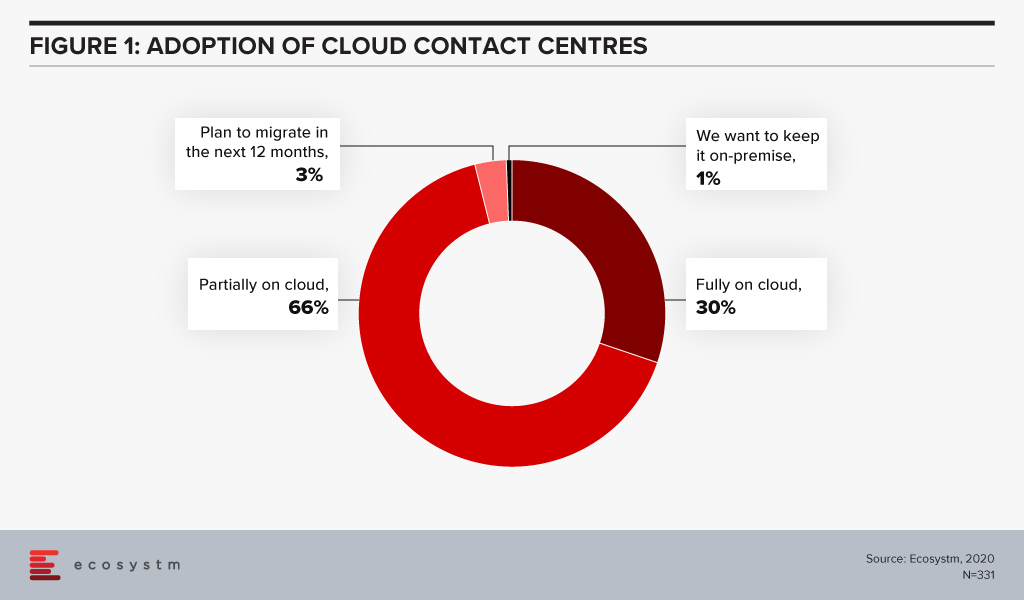

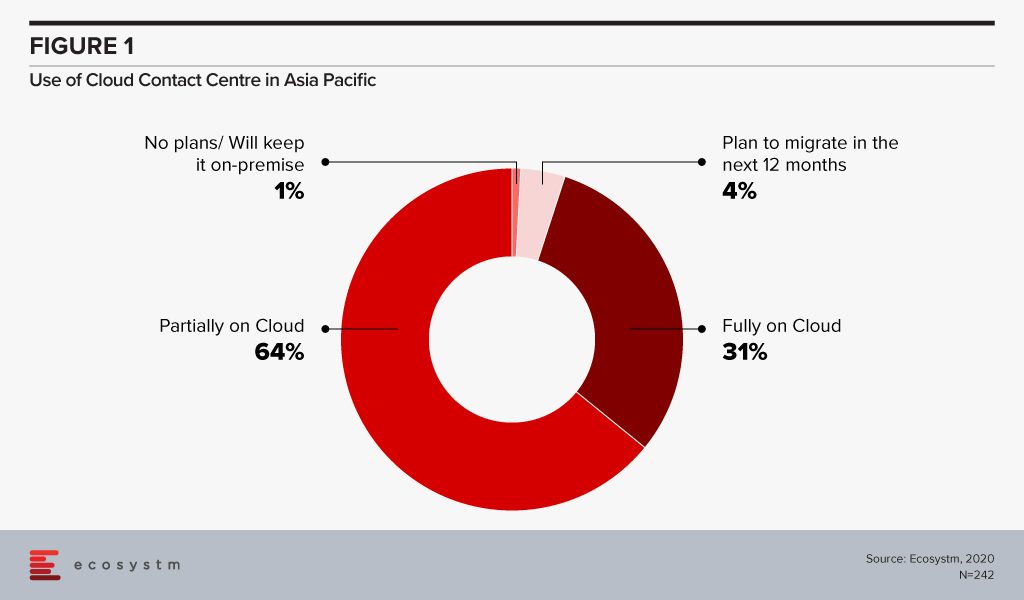

Ecosystm research finds that only 30% of organisations have fully migrated their cloud contact centre solutions on the cloud.

This indicates a market opportunity for vendors in the cloud contact centre space. The COVID-19 pandemic has definitely triggered a strong move towards the cloud model. It has become imperative for vendors and solutions providers to strengthen their cloud capabilities.

Driving an Omni-Channel Experience has become increasingly difficult

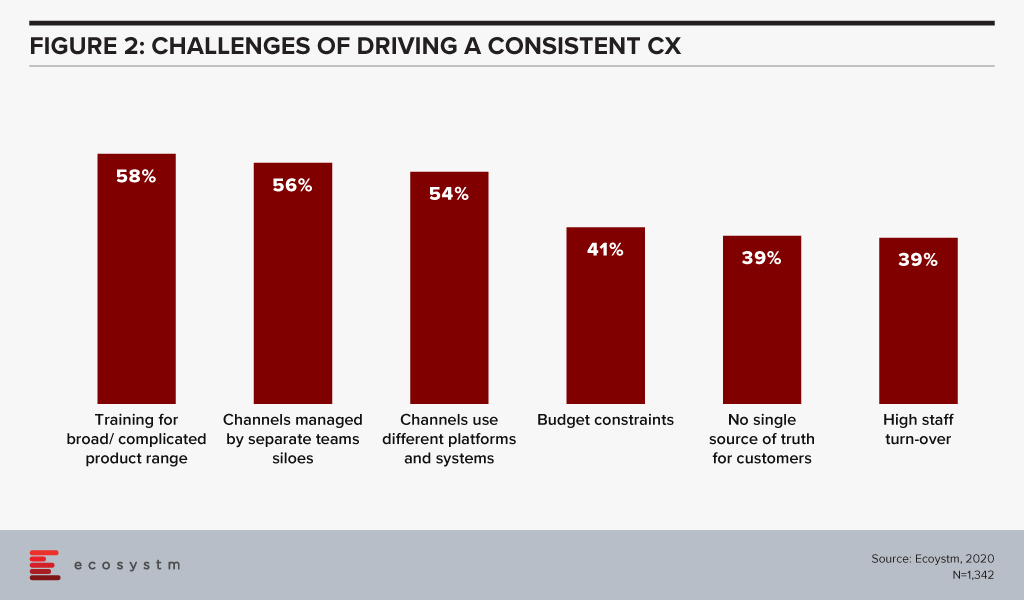

Ecosystm research also finds that organisations find siloed organisational data as one of the biggest challenges in driving consistent customer experience.

This has been further exacerbated by the high volume of interactions that organisations have been having with their customers, and the need to accommodate work-from-home policies for their customer care agents. At the same time, nearly 60% of organisations want to drive an omni-channel experience to improve CX. This provides a huge opportunity for contact centre vendors and partners to offer consulting services to help organisations bridge the gaps in achieving an omni-channel experience. For many organisations there has been a greater push to integrate CRM, the voice of the customer/surveys, customer journey analytics to the contact centre technologies and this is not an easy task as it involves different stakeholders with different sets of KPIs. Having a single platform that can manage this omni-channel experience will be a huge benefit for many organisations.

New Players in the Competitive Landscape

AWS is a relatively new player in the contact centre market, but it is starting to disrupt the existing players, with a global installed base. However, it is worth noting that Avaya, Cisco and Genesys have a higher installed base and they continue to win new deals. The move to the cloud is witnessing more service providers, telecom providers and other contact centre partners push more cloud-based solutions in the market. Apart from AWS, other important players include NICEinContact, 8×8, Talkdesk, Twillio, Five9, and UJet. The competitive battleground is heating up and there are a lot of options for customers to choose from. It will all come down to working with a vendor that can help them achieve their desired CX outcomes.

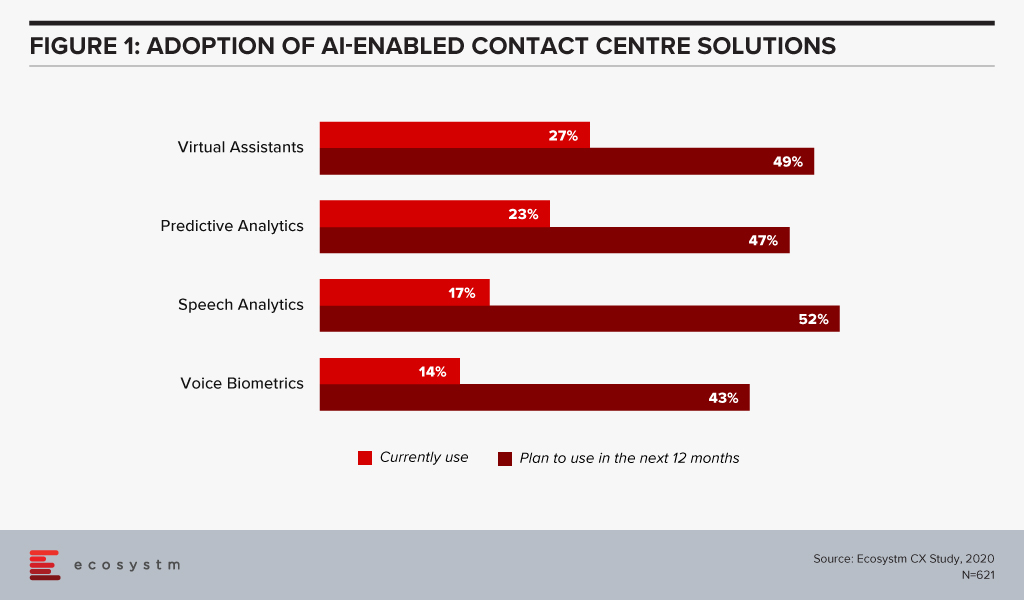

There are other important elements in CX that are growing in importance and these include conversational AI, voice biometrics, knowledge management systems, machine learning and CX management solutions. Contact centre solution providers are having discussions around these areas with tech buyers. This will mean that we can expect deeper partnerships and acquisitions in the short to medium term. Security has also emerged as an important issue to be resolved, especially with agents working from home. This is from a compliance perspective and pertaining to how agents are viewing and handling customer data. These new trends indicate that customers will need to work with different vendors to solve the variety of issues they are facing.

The Vodafone Connect solution on AWS Connect is one of the many examples of how more partners of contact centre solutions are gearing up for the rapid move to the cloud. Globally, Vodafone also sells contact centre solutions from Cisco and Genesys. The next 3 years will see a great movement in the market and this will include vendors from North America that will set up operations to push their offerings across Europe and the Asia Pacific.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

Agents are the most valuable assets in a contact centre. In the current environment, the biggest threat is agents getting infected, causing the closure of contact centres for weeks or possibly even longer. We are already seeing the impact of that with offices being shut, students not going to school and industry gatherings and events being put on hold or cancelled. So having a business continuity plan (BCP) is critical. The BCP should include ways to continue to engage with customers.

The contact centre manages live interactions. Every second there are voice calls coming in, emails received and self-service tools being accessed. It is important to have multiple backup plans – both from a people and a technology perspective – to keep operations running effectively, without calls being put on hold too long or with other channels going unanswered. Contact centres battle with these challenges every day and the situation will get far more serious with the ongoing changes we are witnessing.

Some important considerations include:

Having a backup plan allowing agents working from home

More contact centres today are gearing up to agents working from home, but the process is not an easy one. To begin with, the initial set up includes having the right connectivity and a reliable network. Ensuring that the agent has the right working environment with minimal distraction is crucial. A good quality headset can help. A poor-quality headset will only create unwanted problems with understanding customer issues and handling them. Other concerns include security, tracking how data is being handled, agent under-performance and safety of the agents from an operational and health perspective. Measures such as listening to call recordings and storing them centrally are growing in importance. Multi-factor authentication and analytics using agent logs are some measures that can be put in place.

While there are lots of tools and technologies to monitor and check on agents, the key for home-based agents will be trust. Some outsourced contact centre providers that have been using home-based agents for years have stated that having trust and not micromanaging the agents, is essential for the model to work. Some contact centres have also deployed a BYOD policy for home-based agents assuming the right security, device management, application management and authentication measures are in place.

Organisations should also consider actively recruiting additional home-based agents. These agents could be retirees, currently unemployed or people with mobility issues who prefer to work from home.

Given the difference in the working environment, the metrics used to measure agent performance needs to be modified to be more realistic and fair to both agents and organisations.

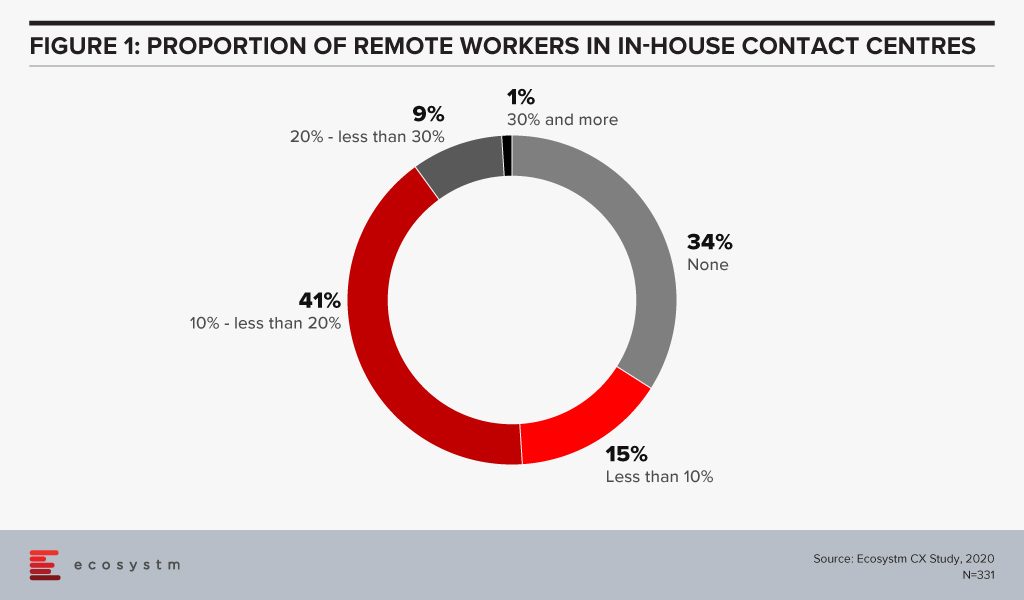

Employing home-based agents will drive employment amidst challenges in the economy. Ecosystm research finds that more than a third of organisations do not have provisions for agents working remotely (Figure 1).

For a long time, the industry has talked about the rise of home-based agents and while it has received positive momentum, it has never really taken off in a big way. This time it will.

Managing spikes in voice and non-voice calls

In industries such as healthcare and airlines, call volumes are exceeding normal volumes. Having the ability to deflect the calls to other non-voice channels will be important. It might need the Interactive Voice Response (IVR) scripts to be changed from time to time to manage the flow of the calls. This is when cloud architecture becomes important. The cloud model can be used to make changes to call workflows easily. The sudden peaks will also require changing the channels easily and without intervention from IT. This is where the agility of cloud comes in as it allows changes and additions – for example when 500 agents need to be added or moved to work on other areas – to be made more easily. Ecosystm research finds that currently, only a third of organisations have their contact centre solutions fully on a cloud, with another 66% with partial cloud solutions. This is set to change with the rise in the number of home-based agents.

There should be thought and planning on how to deflect voice calls to other self-service channels. In the current environment, some organisations deploy a call back option when there is an overflow calls. Similarly looking at deflecting voice calls to self-service channels to ease the load on agents should be evaluated.

Managing back up locations (onshore and offshore)

Contact centre operators are looking at ways to isolate agents and keep them safe. Apart from very strict hygiene measures, organisations are also restricting agents to their specific floor. Some are looking at having agents split into different centres, to contain the risk of mass infection.

Several contact centre operators are building contingency plans to route calls to outside the onshore location in case the situation in a site or a cluster worsens.

For back-end contact centre activities and non-voice calls, taking the load off from the current onshore setup and pushing them offshore, can be an option. The best place to start would be by evaluating each client contract and SLAs especially on security, regulation and privacy issues regarding customer data-handling.

There will be a lot to be considered too should the country go into the full lock-down mode as we are starting to see with a few countries. This makes the case for employing home-based agents stronger.

Using messaging apps, the website and FAQs for daily notifications

Many contact centres are informing citizens and customers about the changes in business operations, services offered, refunds, where to go for help, what do to in an emergency and other essential information through the website, app or the updated FAQ. This will help reduce unnecessary voice and non-voice enquiries to the contact centre. During an emergency, it is normal that phone queries will rise and developing a detailed FAQ is critical to counter that. The more detailed the FAQ giving essential information, the more agents will be able to focus on the more essential day to day activities. Several companies are now sending pop-ups within apps about daily changes to avoid an overflow of inbound enquiries.

Virtual Assistants and Conversational AI can help to ease the load

The more intelligent the virtual assistant and conversational AI platform, the more a customer will be able to get the right response. The challenge has been that many platforms are poorly designed and customers get frustrated because they are unable to get the basic information they need. In times of high inbound activity, if answers to simpler queries can be provided through a chatbot, it can help ease the load on agents. It is good to start planning for this as it will take some time to get the virtual assistant platform up and running and even longer for the algorithms to learn from historical patterns to work well. While it may not be the perfect solution now, planning for a Conversational AI can bring some sort of balance back to the contact centre. Having a solid knowledge management system at the back-end cannot be compromised. Without a good knowledge management system, the virtual assistant solution will force customers to leave the self-service platform and place a call to the contact centre, defeating its very purpose.

The challenging situation we are in is undoubtedly putting pressure on contact centres. It is not uncommon now for customers to be put on hold – for more than two hours and in some extreme cases more than 7 hours! In times like this, understanding data and the patterns around data from each customer touchpoint will help plan the next steps on how best to navigate the situation. Testing and pre-testing the channels and the changes made before they go live must be done rigorously.

Whilst these are very challenging times for the economy, the good news is that contact centres are successfully piloting or have already implemented some or all of the above discussed here. Outsourced contact centre providers are running pilots across various locations and applying technology to deal with the challenges they are witnessing daily. Technology has also come a long way in the contact centre space, and by the application of the right technologies, scale, and business continuity measures, resilience can be achieved.

This blog was created with input from CX leaders across the entire Asia Pacific region. The author wishes to thank everyone for their valuable input.

In the ‘Top 5 Customer Experience Trends for 2020’ that I authored with Tim Sheedy, we had spoken about the need for businesses to understand the end-to-end journey of each customer and to evaluate how to personalise it. To be able to personalise customer experience (CX), organisations need to get feedback from their customers. However, today’s customers are experiencing survey fatigue! Surveys are always the best way to measure how customers feel after they have interacted with a brand. Already, many will not participate unless there is a discount or incentive, which eats into future margins. Smart businesses will begin to use AI to detect emotions and mood, and analytics to measure experiences.

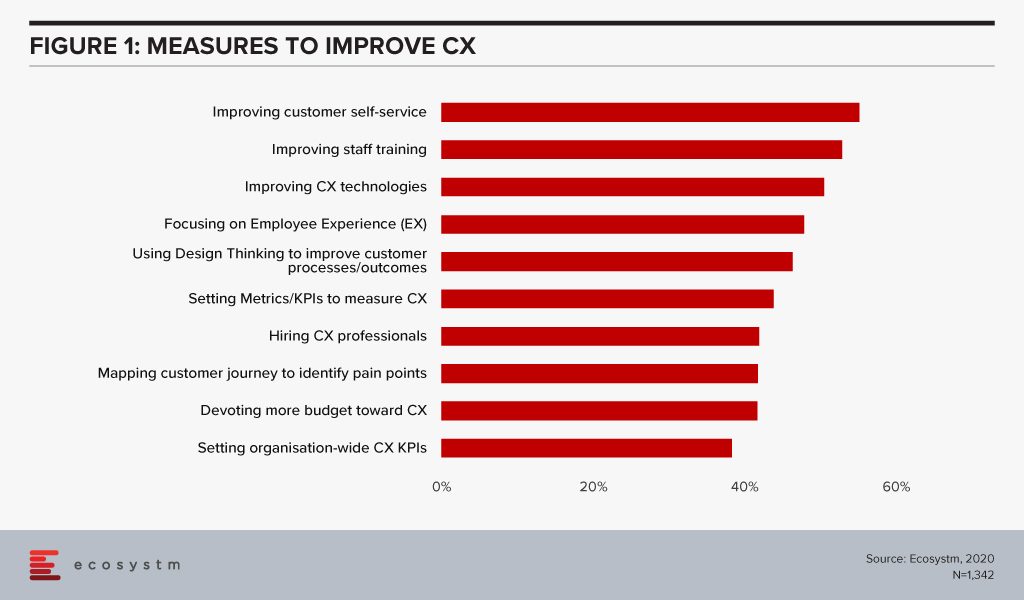

The challenge for years has been that customer teams have focused on the traditional inbound and outbound customer interactions. Ecosystm research finds that while organisations are investing in improving customer self-service, not all of these organisations focus on customer journey mapping and analysis (Figure 1).

Brands now need to understand and personalise the experience before the customer interacts with the brand and after they are done interacting with the brand. The ability to apply machine learning and AI to offer insights to predict the movement and journey of the customer will be a significant focus – and challenge – for customer teams. Customer Journey Analytics will allow brands to deliver that “frictionless” service.

Detecting the problem earlier in the CX loop or before the call is placed to the contact centre has significant benefits. The emotion of the customer at every part of their journey and not just when they call the contact centre needs to be captured in real-time and analysed to address the problem as soon as it arises. For example, if it can be identified prior to the customer calling the airlines to complain about a booking, the agent can call the customer preemptively to inform the customer the problem will be fixed and even go the extra mile to give the customer a discount or a good seat. Another scenario is when a hotel customer has had a bad experience with the meal they ordered, their feedback to the frontline staff earlier in the loop can be passed on and before they check out of the hotel, incentives such as free vouchers can be used to improve the CX. When such measures are taken earlier in the CX journey, the customer will go a long way to buy more products and services from the organisation. This can have an impact too on post-experience surveys or Net promoter scores (NPS).

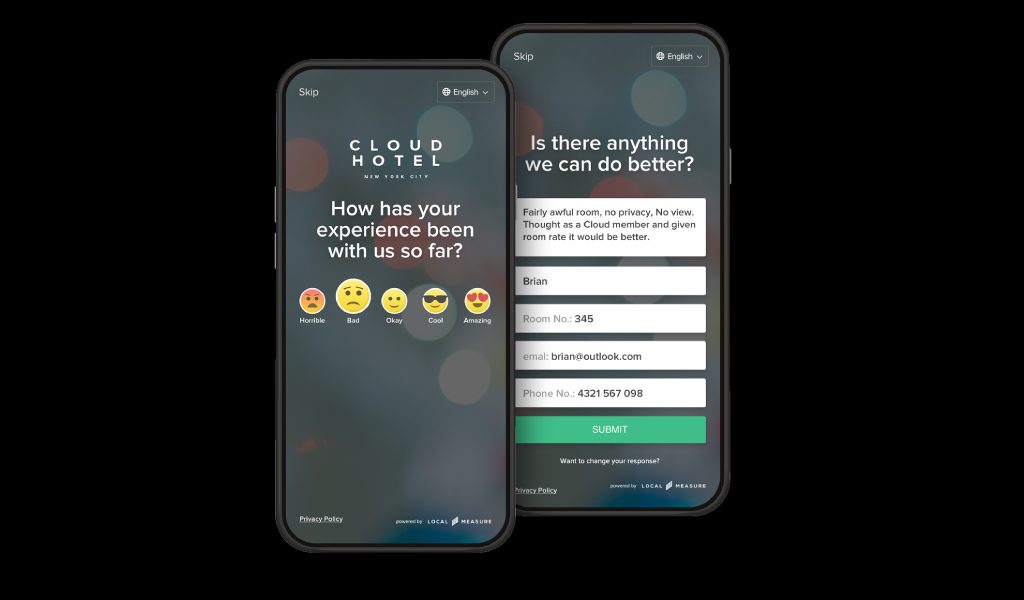

As organisations design, customer feedback platforms for customers such as simple surveys through an app or as a prompt on the mobile device or laptop, the look and feel of the platform combined with simplicity cannot be ignored. The design has to be carefully thought about and should be intuitive and also easy for the customer to enter the feedback.

Niche Vendors will play a crucial role in connecting the missing dots in CX

There are niche vendors emerging in this space and we can expect more players to emerge that will develop applications that can address CX issues very early in the journey of the customer. For example, Australian vendor Local Measure’s solution is used to capture feedback during the different points of a customer’s journey, especially in the tourism, hospitality, retail and entertainment industries. One of their solutions, Pulse is a real-time feedback tool to help improve satisfaction while customers are still on site. The company works in collaboration with Cisco and when customers log on to wifi on a site, a pop up appears on their screen to ask customers how their experience has been so far. By rating the experience using emojis (happy, sad, etc), the front desk staff or personnel within the premises, can see the feedback in real time. This can send alerts that will trigger that something has gone wrong to frontline staff or the contact centre team. The idea is to drive a positive outcome for the customer, identify problems early in the journey and address the problems immediately for higher customer satisfaction.

Figure 2: Local Measure’s Real-Time Customer Feedback Tool

The company has clients such as Dubai-based Majid Al Futtaim that includes 13 major entertainment and retail-focused hotels, serving 1.6 million guests annually. Instead of giving feedback only at check-out, the Pulse feedback screen displays on guests’ computers or mobile devices as they log in to the hotel’s Wi-Fi, asking them to leave feedback on their experience. Novotel Bangkok Sukhumvit 20 has also implemented the solution so that staff can view feedback immediately as responses come through on their mobile devices, and after addressing the issues they can mark each response as ‘actioned’, providing visibility to the whole team.

The Local Measure solution integrates into Cisco’s Wifi offering and when the customer opts a pop up will appear on their screen to lead the customer to the Local Measure platform. Products such as this help fill the gaps where the complaint by the customer can be escalated to the contact centre very early in the journey of the customer. Contact centre vendors have not addressed this space in a dedicated manner and we can expect more niche vendors to make their mark in this space. The data collected include real-time feedback, social media alerts, post-event experience and location analytics. When this data is further integrated into CRM and with the data gathered from the contact centre channels, organisations will be able to gain a better understanding of the customer journeys and analyse what should be done better.

As larger contact centre solution providers realise the value of such niche offerings that help connect the CX dots, they will look to acquire some of these niche solution providers in the customer experience segment. Cisco’s acquisition of Cloud Cherry last year, is an example. The solution allows organisations to listen to their customers across 17 different channels (e.g. email, chat, web) along the entire journey and leverage the Cisco’s contact centre solution to drive better. NICE acquired Satmetrix two years ago, to further enhance its presence in the CX management space.

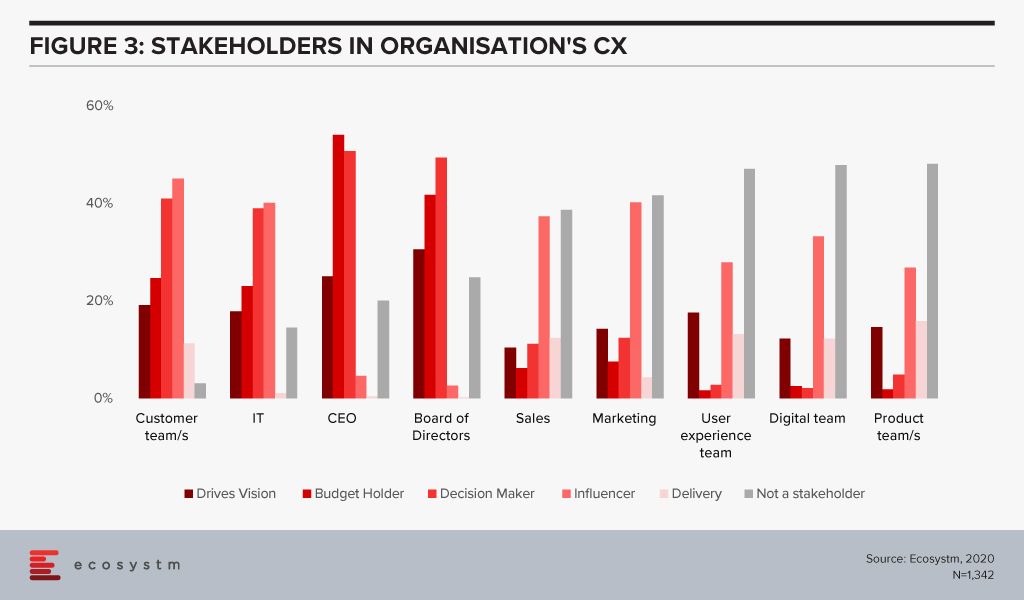

CX is becoming a company-wide initiative

Technologies across customer journey analytics and CX management have often been sold to the marketing and sales teams. As companies look to complete the full loop of understanding the customer journey, the solution must be integrated into the contact centre teams. Based on the global Ecosystm CX Study, the marketing, sales, product, customer service, digital and UX teams are becoming influencers in CX (Figure 3). The Board and CEO are starting to play an important role in decision making. As organisations look to further drive greater CX, more teams across the organisation are starting to realise the need to collaborate to deliver on the vision.

Moving the needle from being Reactive to Proactive in CX will be important

The traditional way of getting feedback after the customer has had the experience or after the customer has spoken to the agent is one of the reasons why organisations are finding it hard to deal with customer frustrations. Being proactive rather than reactive is how customer journey analytics and CX management technologies can help organisations address these issues. AI and machine learning will play an important part in this area moving forward as after the call is placed to the customer, data around customer emotions, sentiments, tone of the voice and keywords used in the discussion, can help in better understanding of how to provide a solution or solve the customers’ challenges.

On December 18, AWS launched Amazon Connect in ASEAN from the Singapore region. I was invited to the ASEAN launch of Connect in Singapore 3 weeks ago where Pasquale DeMaio, GM of Amazon Connect and Robert Killory, ASEAN Solutions Lead presented to analysts.

Pasquale told the audience that the Amazon Connect solution used today has been built over 10 years ago to serve Amazon’s internal needs of servicing millions of customer interactions for their e-commerce transactions. At that time Amazon could not find a solution that was pure cloud-based, cost-effective, scalable and that was easy to use. Since launching Amazon Connect a few years ago, AWS has seen not just small and medium enterprises using Connect – larger organisations have embraced the solution as well.

Amazon Connect has a list of notable clients – Intuit, Rackspace, John Hancock, CapitalOne, GE Appliances, Subway and many others. Intuit, as an example, has had difficulties running experiments in the past and proofs of concept were expensive, complex and time-consuming. With Amazon Connect these run on a test environment allowing their engineers to experiment and if they do not work out, it does not cost Intuit a lot of money to spin up a proof of concept. Philippines telecommunications provider, Globe Telecom wanted to automate and improve their services for their broadband and residential services. It was taking about 2-3 days from payment to the restoration of services. Amazon Connect was deployed to solve this problem by understanding the customer data when calls came through to the contact centre and by using APIs and the Connect suite of applications, there was deep integration with the CRM systems and other platforms that held various pools of data. This produced a faster and scalable way of integrating the payment process and customer service.

The demo of the solution showcased how features such as Amazon Lex can build conversational interfaces for an organisation’s applications powered by the same deep learning technologies like Alexa. With Amazon Lex and Polly, organisations can now build a chatbot without knowing or understanding code.

The Amazon Connect Solution – scaling to become more feature-rich

At ReInvent in Las Vegas in December 2019, Andy Jassy the CEO of AWS unveiled a new offering for their contact centre customers called Contact Lens. The solution is a set of machine learning capabilities integrated into Amazon Connect. The service can be activated through a single click in Connect and can analyse, transcribe calls including previously recorded calls. Jassy also talked about how it allows users to determine the sentiment of the call, pick up on long periods of silence, and times when an agent and customer are talking over the top of each other. These additions can help supervisors understand the challenges faced by agents that can then be addressed during training and coaching sessions. The machine learning models that power Contact Lens for Amazon Connect have been trained specifically to understand the nuances of contact centre conversations including multiple languages and custom vocabularies.

Several other announcements have also been made recently:

- Web and Mobile Chat for customers is a single unified contact centre service for voice and chat. Agents have a single user interface for both voice and chat, reducing the number of screens they have to interact with.

- Amazon Transcribe now supports 31 languages including Indonesian, Malay, Japanese, Korean, and several Indian languages. These are important languages as they expand further across ASEAN and the rest of Asia, given the diversity of languages spoken in the region. Contact centres can convert call recordings into text and analyse the data for actionable intelligence.

Deepening their relationship with Salesforce

At Dreamforce 2019 late last year, Salesforce announced that they will be offering AWS telephony and call transcription services with Amazon Connect as part of their Service Cloud call centre solution. The announcement indicates how the CRM world and the contact centre segments are starting to get closer. CRM vendors are starting to realise that whilst they own the agent at the desktop who have access to the CRM solution, the data from the calls and the actual calls are important. Voice/Telephony is also witnessing greater innovation with vendors in the contact centre space applying machine learning and AI to voice so that intelligence is gathered prior to the call coming to the contact centre and the agent is further empowered through prompts that they can apply when speaking to a customer. As CRM integrates deeper with contact centre solutions, the tight integration between these two solutions cannot be ignored. Salesforce is partnering to innovate in the voice space by applying machine learning at the core of all they do. This is a big announcement given the sheer size of both companies and how both companies are innovating in the contact centre space.

Cloud Contact Centre is high on the agenda in Asia Pacific

Ecosystm’s CX research finds that most organisations in Asia Pacific are at the inflection point of moving from an on-premise environment to a cloud model. Only 1% of CX decision-makers want to keep their contact centres on-premise – many organisations are evaluating which contact centre vendor they should use to migrate to the cloud. Some countries may see higher adoption than others. Australia and New Zealand have higher cloud contact centre adoption. In ASEAN many organisations are starting to build a wider CX strategy beyond the contact centre including areas such as customer journey analytics and data-driven personalised CX.

Ecosystm comments

In Australia, Amazon Connect has grown its customer base and these include some large enterprises. Big wins in the last 2 years include National Australia Bank and NSW Health. NSW Health shifted its IT service desk and shared services contact centres onto a new cloud-based contact centre platform as part of a broader digital transformation.

AWS has been gearing up for the launch in ASEAN over the last 6 months. The region is very competitive with some long-standing contact centre players having a large share and installed base in the large and medium enterprise accounts. The launch indicates how serious they are about growing their contact centre business in the region. There has been good progress so far in Singapore and the Philippines. Amazon Connect will look to grow its presence in Indonesia, Malaysia, Thailand, and Vietnam in the months to come. The market dynamics in each Asian country is unique and AWS will work with partners such as Accenture, Deloitte, DXC, ECS, NTT and VoiceFoundry to grow their presence in the region. Some of the more traditional partners will need education and upskilling to understand the Amazon Connect value proposition

Poly’s CEO Joe Burton was in Sydney recently to meet with staff, customers and partners. I had the privilege of interviewing him about the roadmap ahead for the company. Plantronics acquired Polycom for $2 billion at the end of March 2018 and earlier this year at Enterprise Connect, Poly was unveiled as the new brand – the coming together of Plantronics and Polycom. The company prides themselves on the strong engineering heritage they have across their product portfolio. Poly is playing in a large addressable market and these segments include unified communications (UC), video, headsets and contact centres.

Big news last week – Poly and Zoom partnership

At Zoomtopia last week, Zoom announced purpose-built appliances for their Zoom Rooms conference room system. These appliances are custom developed hardware that lets users gather room intelligence and analytics and will simplify installation and management of large-scale conference room deployments. One of the major partnerships for this was with Poly. Joe Burton was on stage with Eric Yuan the CEO of Zoom to unveil the Poly Studio X Series – The X30 (for smaller rooms) and the X50 (for midsize conference rooms).

What is promising about this offering is that the whole concept of launching a meeting by connecting to a screen has become simple. In a world where user experience is everything, simplicity and quality are what end-users expect. The Poly Studio X Series are all-in-one video bars that will simplify the Zoom Rooms experience and will feature Poly Meeting AI capabilities. Some of the features include advanced noise suppression to make it easier to hear human voices while simultaneously blocking out background noise.

For Poly, this is a great partnership given Zoom’s good growth in the Asia Pacific region. Poly is also increasingly deepening their relationships with other major players in the Video and UC market including Microsoft.

Flexible Workspaces and Contact Centres drives the headset market in Asia Pacific

According to JLL, the flexible space sector in Asia Pacific is expanding rapidly. From 2014 to 2017, flexible space stock across the region recorded a CAGR of 35.7% in Asia Pacific – much higher than in the United States (25.7%) and Europe (21.6%) over the same period. When you consider the changes in the modern workplace which include the rise of open flexible workplaces, remote and home working and the rise of freelancers, providing a seamless experience for the office worker will be important – it should be the same for a contractor as it is for full-time staff. As we move into more mobile and agile work practices and with the rise of open offices, headsets will play an important role for the office worker. More organisations across Asia are investing in headsets and whilst it may sound simple to just buy the headsets, it is more sophisticated than that. There is no one-size-fits-all headset and IT managers will have to invest in headsets to suit the persona of employees taking into account the role, workload, use of voice and video services and ultimately their comfort level. Vendors in the headset space are heavily investing in easy-to-use features, more automation, deep workflow integration and machine learning to deliver that experience. The opportunity for headsets does not stop there. In the contact centre space as agents spend long hours on calls, designing the right headset with feature rich AI capabilities will go a long way especially for training and coaching.

The one area Burton emphasised on is how AI and analytics is transforming this market and Poly investing in building these features into the headsets. Some of these examples include:

- Tracking conversations by using analytics to gain insights into long pauses of silence and “overtalking”. The analytics generated from these insights can help for training and coaching.

- AI can help track user behaviour patterns related to noise, volume and mute functions. These patterns can be used to detect problems during the call and could lead to possible training sessions for the agents. It is a great mechanism for supervisors to understand and work through where agents are struggling during the call.

Partnerships to expand their reach into the contact centre markets in the Asia Pacific region will be important. The market for contact centres is seeing a big shift and new entrants are making their presence felt in the Asia Pacific region. Poly will need to capitalise on this and expand their partnerships beyond the traditional vendors to expand their footprints across the contact centre markets.

Asia Pacific – an important growth theatre

Poly continues to win and have some large-scale deployments in Japan, China, India, and ANZ. They have also made several strides to develop what is best fit for the local market in terms of user requirements. With a deep understanding of the Chinese market, Poly released the Poly G200 in September this year which is tailor-made for the Chinese users with easy to use and collaborate solutions. The Poly G200 is the first and significant customised product launched in China, after Poly announced their ‘In China, for China’ strategy. This is a logical move given China is an important market and one that presents its own unique business dynamics.

Conclusion

The shift to mobility and the cloud has changed everything and is driving a new level of user experience. The ability to offer the same and frictionless experience when on the desktop, mobile device as well as other applications is what is driving fierce competition in the market. Users get frustrated when they cannot launch a video session instantly or when there is poor quality in audio. These may sound simple but addressing these frustrations are critical. Vendors in the UC, Collaboration and Video space are working hard to make sure that the experience is seamless when they are inside the office, out of the office and when they are working in open plan offices. Ultimately users want their daily office communication and collaboration solutions to work seamlessly and to integrate well into the various workflows such as Microsoft Teams.

On the contact centre front, Digital and AI initiatives are taking centre stage in nearly every conversation I have had with end-users. Company-wide CX strategy and customer journey mapping and analytics are what CX decision makers are talking about most. Poly is addressing that segment of the market by providing quality headsets coupled with AI to help in coaching and training by identifying trends and bridging the training gaps. There are new vendors starting to disrupt the status quo of some of the more traditional vendors in the contact centre market and hence deepening the partnerships with these new vendors in the contact centre space will be important.

Poly has a good addressable market to go after in unified communications and collaboration with their headsets and extensive range of video solutions. The most important part will be deepening the partnerships with the wide range of vendors in this space and engineering their products to be tightly integrated with their partner ecosystems’. The release of the Studio X series at Zoomtopia is a good example. I am confident that the road ahead for Poly is promising given the deep engineering capabilities the company invests in and how they are taking their partnerships seriously.