The tech industry is experiencing a strategic convergence of AI, data management, and cybersecurity, driving a surge in major M&A activity. As enterprises tackle digital transformation, these three pillars are at the forefront, accelerating the race to acquire and integrate critical technologies.

Here are this year’s key consolidation moves, showcasing how leading tech companies are positioning themselves to capitalise on the rising demand for AI-driven solutions, robust data infrastructure, and enhanced cybersecurity.

AI Convergence: Architecting the Intelligent Enterprise

From customer service to supply chain management, AI is being deployed across the entire enterprise value chain. This widespread demand for AI solutions is creating a dynamic M&A market, with tech companies acquiring specialised AI capabilities.

IBM’s AI Power Play

IBM’s acquisitions of HashiCorp and DataStax mark a decisive step in its push to lead enterprise AI and hybrid cloud. The USD 6.4B HashiCorp deal that got finalised this year, brings Terraform, a top-tier infrastructure-as-code tool that streamlines multi-cloud deployments – key to integrating IBM’s Red Hat OpenShift and Watsonx AI. Embedding Terraform enhances automation, making hybrid cloud infrastructure more efficient and AI-ready.

The DataStax acquisition strengthens IBM’s AI data strategy. With AstraDB and Apache Cassandra, IBM gains scalable NoSQL solutions for AI workloads, while Langflow simplifies AI app development. Together, these moves position IBM as an end-to-end AI and cloud powerhouse, offering enterprises seamless automation, data management, and AI deployment at scale.

MongoDB’s RAG Focus

MongoDB’s USD 220M acquisition of Voyage AI signals a strategic push toward enhancing AI reliability. At the core of this move is retrieval-augmented generation (RAG), a technology that curbs AI hallucinations by grounding responses in accurate, relevant data.

By integrating Voyage AI into its Atlas cloud database, MongoDB is making AI applications more trustworthy and reducing the complexity of RAG implementations. Enterprises can now build AI-driven solutions directly within their database, streamlining development while improving accuracy. This move consolidates MongoDB’s role as a key player in enterprise AI, offering both scalable data management and built-in AI reliability.

Google’s 1B Bet on Anthropic

Google’s continued investment in Anthropic reinforces its commitment to foundation model innovation and the evolving GenAI landscape. More than a financial move, this signals Google’s intent to shape the future of AI by backing one of the field’s most promising players.

This investment aligns with a growing trend among cloud giants securing stakes in foundation model developers to drive AI advancements. By deepening ties with Anthropic, Google not only gains access to cutting-edge AI research but also strengthens its position in developing safe, scalable, and enterprise-ready AI. This solidifies Google’s long-term AI strategy, ensuring its leadership in GenAI while seamlessly integrating these capabilities into its cloud ecosystem.

ServiceNow’s AI Automation Expansion

ServiceNow’s USD 2.9B acquisition of Moveworks completed this year, marking a decisive push into AI-driven service desk automation. This goes beyond feature expansion – it redefines enterprise support operations by embedding intelligent automation into workflows, reducing resolution times, and enhancing employee productivity.

The acquisition reflects a growing shift: AI-powered service management is no longer optional but essential. Moveworks’ AI-driven capabilities – natural language understanding, machine learning, and automated issue resolution – will enable ServiceNow to deliver a smarter, more proactive support experience. Additionally, gaining Moveworks’ customer base strengthens ServiceNow’s market reach.

Data Acquisition Surge: Fuelling Digital Transformation

Data has transcended its role as a byproduct of operations, becoming the lifeblood that fuels digital transformation. This fundamental shift has triggered a surge in strategic acquisitions focused on enhancing data management and storage capabilities.

Lenovo Scaling Enterprise Storage

Lenovo’s USD 2B acquisition of Infinidat strengthens its position in enterprise storage as data demands surge. Infinidat’s AI-driven InfiniBox delivers high-performance, low-latency storage for AI, analytics, and HPC, while InfiniGuard ensures advanced data protection.

By integrating these technologies, Lenovo expands its hybrid cloud offerings, challenging Dell and NetApp while reinforcing its vision as a full-stack data infrastructure provider.

Databricks Streamlining Data Warehouse Migrations

Databricks’ USD 15B acquisition of BladeBridge accelerates data warehouse migrations with AI-driven automation, reducing manual effort and errors in migrating legacy platforms like Snowflake and Teradata. BladeBridge’s technology enhances Databricks’ SQL platform, simplifying the transition to modern data ecosystems.

This strengthens Databricks’ Data Intelligence Platform, boosting its appeal by enabling faster, more efficient enterprise data consolidation and supporting rapid adoption of data-driven initiatives.

Cybersecurity Consolidation: Fortifying the Digital Fortress

The escalating sophistication of cyber threats has transformed cybersecurity from a reactive measure to a strategic imperative. This has fuelled a surge in M&A aimed at building comprehensive and integrated security solutions.

Turn/River Capital’s Security Acquisition

Turn/River Capital’s USD 4.4 billion acquisition of SolarWinds underscores the enduring demand for robust IT service management and security software. This acquisition is a testament to the essential role SolarWinds plays in enterprise IT infrastructure, even in the face of past security breaches.

This is a bold investment, in the face of prior vulnerability and highlights a fundamental truth: the need for reliable security solutions outweighs even the most public of past failings. Investors are willing to make long term bets on companies that provide core security services.

Sophos Expanding Managed Detection & Response Capabilities

Sophos completed the acquisition of Secureworks for USD 859M significantly strengthens its managed detection and response (MDR) capabilities, positioning Sophos as a major player in the MDR market. This consolidation reflects the growing demand for comprehensive cybersecurity solutions that offer proactive threat detection and rapid incident response.

By integrating Secureworks’ XDR products, Sophos enhances its ability to provide end-to-end protection for its customers, addressing the evolving threat landscape with advanced security technologies.

Cisco’s Security Portfolio Expansion

Cisco completed the USD 28B acquisition of SnapAttack further expanding its security business, building upon its previous acquisition of Splunk. This move signifies Cisco’s commitment to creating a comprehensive security portfolio that can address the diverse needs of its enterprise customers.

By integrating SnapAttack’s threat detection capabilities, Cisco strengthens its ability to provide proactive threat intelligence and incident response, solidifying its position as a leading provider of security solutions.

Google’s Cloud Security Reinforcement

Google’s strategic acquisition of Wiz, a leading cloud security company, for USD 32B demonstrates its commitment to securing cloud-native environments. Wiz’s expertise in proactive threat detection and remediation will significantly enhance Google Cloud’s security offerings. This move is particularly crucial as organisations increasingly migrate their workloads to the cloud.

By integrating Wiz’s capabilities, Google aims to provide its customers with a robust security framework that can protect their cloud-based assets from sophisticated cyber threats. This acquisition positions Google as a stronger competitor in the cloud security market, reinforcing its commitment to enterprise-grade cybersecurity.

The Way Ahead

The M&A trends of 2025 underscore the critical role of AI, data, and security in shaping the technology landscape. Companies that prioritise these core areas will be best positioned for long-term success. Strategic acquisitions, when executed with foresight and agility, will serve as essential catalysts for navigating the complexities of the evolving digital world.

AI’s biggest impact in an organisation is on the tech teams.

From automating IT support to optimising infrastructure, development, and security, AI is transforming the way tech teams work. IT leaders are leveraging AI to boost productivity, cut costs, and drive innovation at scale.

Here’s how tech leaders are coming together to push AI initiatives forward.

Great customer engagement takes effort, but AI gives customer success leaders the edge to do more.

Ecosystm research shows that while 60% of Sales, Marketing, and CX leaders see productivity gains from AI, there’s still untapped potential. AI can deepen engagement, reduce churn, boost upsell opportunities, and drive real financial impact.

Here’s where customer success leaders stand today – and where the biggest gaps remain.

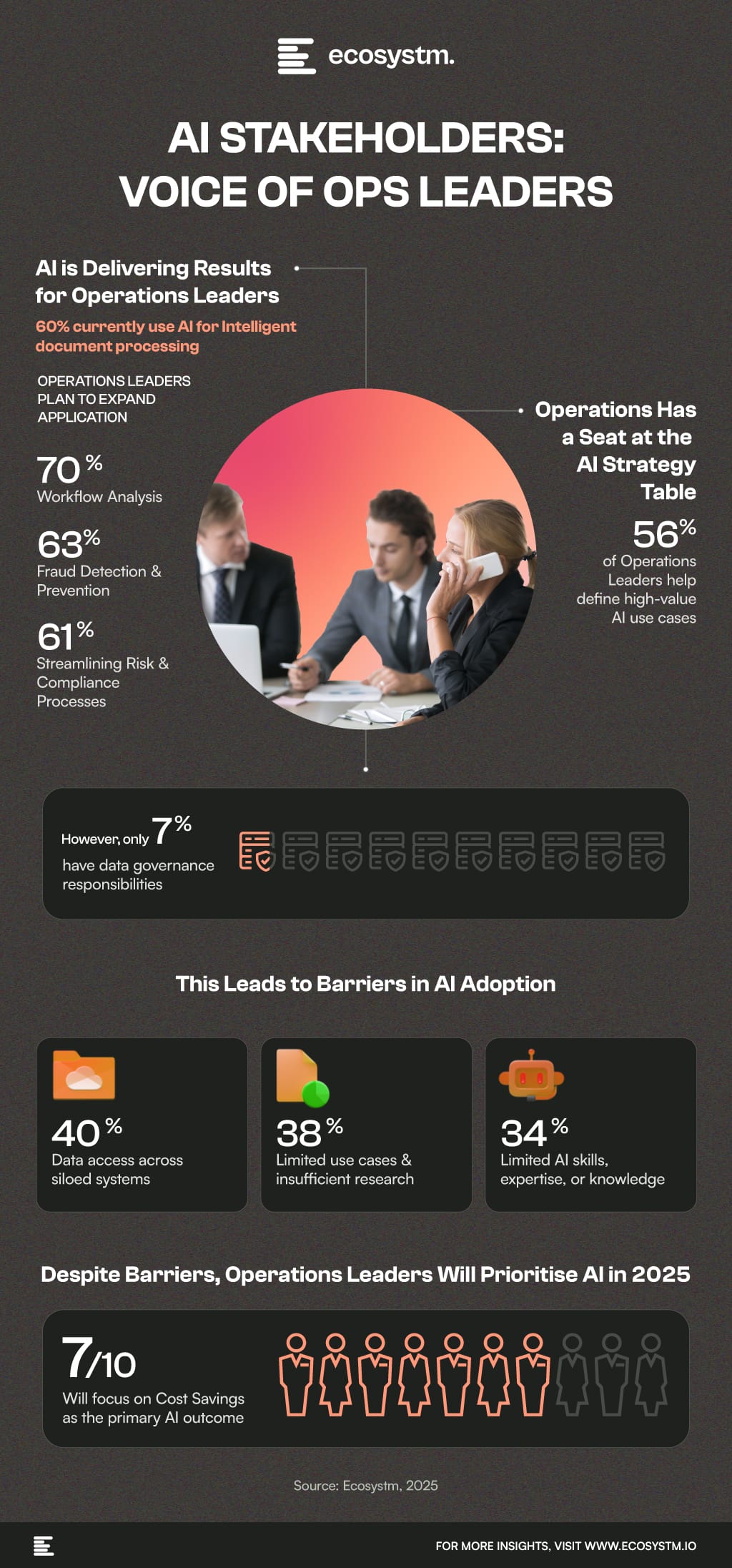

Ecosystm research finds that 54% of organisations place cost savings as the key focus of AI adoption. This explains why Operations shapes AI and use cases.

But the teams often lack control over data and solutions.

Overcoming these gaps will be crucial for stronger execution and long-term success.

Here’s where Operations leaders stand today.

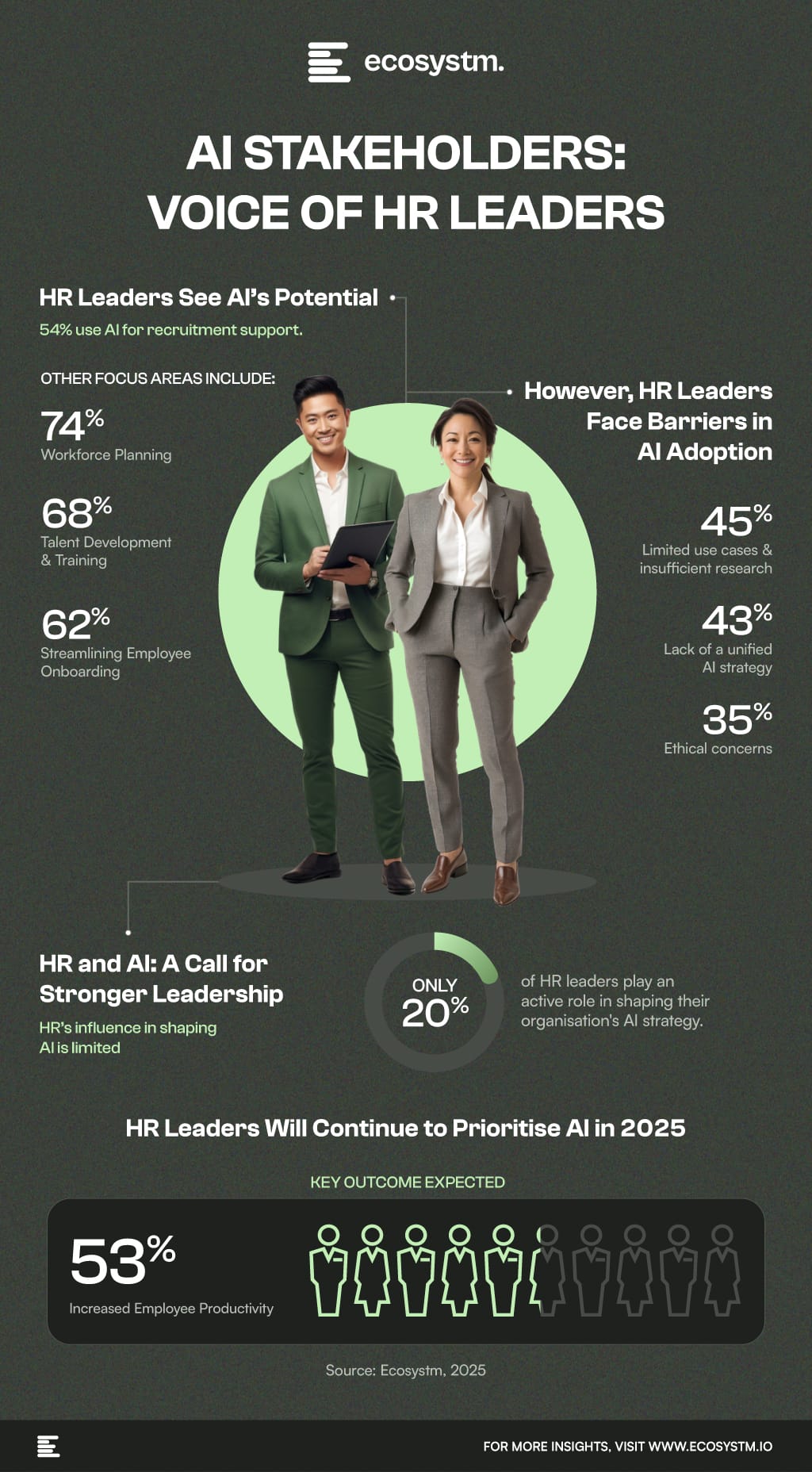

AI is set to transform the workplace – enhancing productivity and reshaping roles. HR isn’t just a bystander; it’s key to ensuring employees benefit while managing AI’s uncertainties. It’s time HR had a bigger seat at the table.

Here’s where AI adoption in HR stands today.

Barely weeks into 2025, the Consumer Electronics Show (CES) announced a wave of AI-powered innovations – from Nvidia’s latest RTX 50-series graphics chip with AI-powered rendering to Halliday’s futuristic augmented reality smart glasses. AI has firmly emerged from the “fringe” technology to become the foundation of industry transformation. According to MIT, 95% of businesses are already using AI in some capacity, and more than half are aiming for full-scale integration by 2026.

But as AI adoption increases, the real challenge isn’t just about developing smarter models – it’s about whether the underlying infrastructure can keep up.

The AI-Driven Cloud: Strategic Growth

Cloud providers are at the heart of the AI revolution, but in 2025, it is not just about raw computing power anymore. It’s about smarter, more strategic expansion.

Microsoft is expanding its AI infrastructure footprint beyond traditional tech hubs, investing USD 300M in South Africa to build AI-ready data centres in an emerging market. Similarly, AWS is doubling down on another emerging market with an investment of USD 8B to develop next-generation cloud infrastructure in Maharashtra, India.

This focus on AI is not limited to the top hyperscalers; Oracle, for instance, is seeing rapid cloud growth, with 15% revenue growth expected in 2026 and 20% in 2027. This growth is driven by deep AI integration and investments in semiconductor technology. Oracle is also a key player in OpenAI and SoftBank’s Stargate AI initiative, showcasing its commitment to AI innovation.

Emerging players and disruptors are also making their mark. For instance, CoreWeave, a former crypto mining company, has pivoted to AI cloud services. They recently secured a USD 12B contract with OpenAI to provide computing power for training and running AI models over the next five years.

The signs are clear – the demand for AI is reshaping the cloud industry faster than anyone expected.

Strategic Investments In Data Centres Powering Growth

Enterprises are increasingly investing in AI-optimised data centres, driven by the need to reduce reliance on traditional data centres, lower latency, achieve cost savings, and gain better control over data.

Reliance Industries is set to build the world’s largest AI data centre in Jamnagar, India, with a 3-gigawatt capacity. This ambitious project aims to accelerate AI adoption by reducing inferencing costs and enabling large-scale AI workloads through its ‘Jio Brain’ platform. Similarly, in the US, a group of banks has committed USD 2B to fund a 100-acre AI data centre in Utah, underscoring the financial sector’s confidence in AI’s future and the increasing demand for high-performance computing infrastructure.

These large-scale investments are part of a broader trend – AI is becoming a key driver of economic and industrial transformation. As AI adoption accelerates, the need for advanced data centres capable of handling vast computational workloads is growing. The enterprise sector’s support for AI infrastructure highlights AI’s pivotal role in shaping digital economies and driving long-term growth.

AI Hardware Reimagined: Beyond the GPU

While cloud providers are racing to scale up, semiconductor companies are rethinking AI hardware from the ground up – and they are adapting fast.

Nvidia is no longer just focused on cloud GPUs – it is now working directly with enterprises to deploy H200-powered private AI clusters. AMD’s MI300X chips are being integrated into financial services for high-frequency trading and fraud detection, offering a more energy-efficient alternative to traditional AI hardware.

Another major trend is chiplet architectures, where AI models run across multiple smaller chips instead of a single, power-hungry processor. Meta’s latest AI accelerator and Google’s custom TPU designs are early adopters of this modular approach, making AI computing more scalable and cost-effective.

The AI hardware race is no longer just about bigger chips – it’s about smarter, more efficient designs that optimise performance while keeping energy costs in check.

Collaborative AI: Sharing The Infrastructure Burden

As AI infrastructure investments increase, so do costs. Training and deploying LLMs requires billions in high-performance chips, cloud storage, and data centres. To manage these costs, companies are increasingly teaming up to share infrastructure and expertise.

SoftBank and OpenAI formed a joint venture in Japan to accelerate AI adoption across enterprises. Meanwhile, Telstra and Accenture are partnering on a global scale to pool their AI infrastructure resources, ensuring businesses have access to scalable AI solutions.

In financial services, Palantir and TWG Global have joined forces to deploy AI models for risk assessment, fraud detection, and customer automation – leveraging shared infrastructure to reduce costs and increase efficiency.

And with tech giants spending over USD 315 billion on AI infrastructure this year alone – plus OpenAI’s USD 500 billion commitment – the need for collaboration will only grow.

These joint ventures are more than just cost-sharing arrangements; they are strategic plays to accelerate AI adoption while managing the massive infrastructure bill.

The AI Infrastructure Power Shift

The AI infrastructure race in 2025 isn’t just about bigger investments or faster chips – it’s about reshaping the tech landscape. Leaders aren’t just building AI infrastructure; they’re determining who controls AI’s future. Cloud providers are shaping where and how AI is deployed, while semiconductor companies focus on energy efficiency and sustainability. Joint ventures highlight that AI is too big for any single player.

But rapid growth comes with challenges: Will smaller enterprises be locked out? Can regulations keep pace? As investments concentrate among a few, how will competition and innovation evolve?

One thing is clear: Those who control AI infrastructure today will shape tomorrow’s AI-driven economy.

2025 is already shaping up to be a battleground for cybersecurity. With global cybercrime costs projected to reach USD 10.5T, by year’s end, the stakes have never been higher. Cybercriminals are getting smarter, using AI-driven tactics and large-scale exploits to target critical sectors. From government breaches to hospital data leaks and a surge in phishing scams, recent attacks highlight the growing financial and operational toll of cyber threats.

As cyber threats intensify, the demand for stronger defences, top-tier cybersecurity talent, and global collaboration has never been more urgent.

Here’s a look at the recent cyber developments that are shaping 2025.

Click here to download “Cyber Lessons from the Frontlines” as a PDF.

Major Security Breaches: A Costly Wake-Up Call

Cyberattacks are becoming more targeted, disruptive, and costly – impacting governments and organisations worldwide.

In Singapore, mobile wallet fraud is surging, with phishing tactics causing USD 8.9K in losses – 80% linked to Apple Pay. In the UK, security flaws in government IT systems have exposed sensitive data and infrastructure. South Africa’s government-run weather service (SAWS) was also forced offline, disrupting a critical resource for airlines, farmers, and emergency responders. Across the Atlantic, a data breach at a Georgia hospital compromised 120,000 patient records, while BayMark Health Services, the largest addiction treatment provider in the US, alerted patients to a similar breach.

What steps are governments, tech providers, and enterprises taking to protect themselves, critical infrastructure, and individuals?

Protecting Critical Infrastructure: The Digital Backbone

As global connectivity expands, securing critical infrastructure is paramount to sustaining growth, stability, and public trust.

Undersea cables, which carry much of the world’s internet traffic, are a major focus. While tech giants like Amazon, Meta, and Google are expanding these networks to boost global data speed and reliability, the need for protection is just as urgent – prompting the EU to invest nearly a billion dollars in securing them against emerging threats.

Governments and tech providers alike are stepping up. The European Commission has introduced a cybersecurity blueprint to strengthen crisis coordination, rapid response, and information sharing. Meanwhile, Microsoft is investing USD 700M in Poland’s cloud and AI infrastructure, working with the Polish National Defense to enhance cybersecurity through AI-driven strategies.

Quantifying Cyber Risk: Standardised Threat Assessment

As cyber threats grow more sophisticated, so must our ability to detect, measure, and respond to them.

A major shift in cybersecurity is underway – one that prioritises standardised threat assessment and coordinated defense.

The UK is leading the charge with a new cyber monitoring centre that will introduce a “Richter Scale” for cyberattacks, ranking threats much like earthquake magnitudes. Emerging countries are also joining in; Vietnam is strengthening its cyber defences with a new intelligence-sharing platform designed to improve coordination between the government and private sector.

By quantifying cyber risks and enhancing intelligence-sharing, these efforts are shaping global cybersecurity norms, improving response times, and building a more resilient digital ecosystem.

Beyond Defence: Proactive Measures to Combat AI-Driven Cybercrime

Cyber threats evolve faster than defences can keep up – a single click on a malicious email can lead to a breach in just 72 minutes.

With AI making cyberattacks more sophisticated, governments are taking an active role in cyber law enforcement.

Indonesia set up a cyber patrol to monitor and regulate harmful online content while also working to create a safer digital space for children. Thailand, Cambodia, and Laos are cooperating to curb cross-border scams through intelligence sharing and joint enforcement efforts.

Building Trust Online: Digital Identity Solutions

Governments are moving beyond enforcement to strengthen security with digital identity frameworks.

The EU is leading this shift with large-scale pilots for digital identity wallets, designed to offer citizens a secure, seamless way to verify credentials for services, transactions, and age-restricted content. By 2026, each EU member state will issue its own wallet, built on unified technical standards to ensure cross-border interoperability and stronger cybersecurity.

Digital identity wallets mark a major shift in data security, giving citizens greater control over their information while strengthening online trust. By securing identity verification, governments are reducing fraud and identity theft, creating a safer digital landscape.

Closing the Gap: Global Cyber Education Push

Cybersecurity education is no longer just for IT teams – it’s essential at every level, from executives to employees, to build long-term resilience.

Again, governments and tech giants alike are stepping up to bridge the skills gap and enhance cyber awareness.

Singapore is leading by example with a cyber-resilience training program for board directors, ensuring corporate leaders understand cyber risk management. AWS is investing USD 6.35M to support cybersecurity education in the UK, and Microsoft is expanding its global training efforts. The company has partnered with Kazakhstan to strengthen public sector cybersecurity and has committed to training one million South Africans in AI and cybersecurity by 2026.

The Path Forward: A Collective Responsibility

The cybersecurity landscape underscores a crucial truth: resilience can’t be built in isolation. Governments, businesses, and individuals must move past reactive measures and adopt a collective, intelligence-driven approach. As threats grow more sophisticated, so must our commitment to collaboration, vigilance, and proactive defence.

In an increasingly interconnected world, securing the digital landscape is not just necessary – it’s a shared responsibility.

Tech leaders, to create business impact with AI, stop viewing it as just a tool – it demands the right strategy and foundation.

Maximising AI requires focus on:

• Identifying capability gaps & setting realistic goals

• Building skilled AI teams

• Enabling data ownership for business units

• Embedding AI governance early

• Forming strategic partnerships & managing AI holistically

Discover how AI can be the cornerstone of your transformation journey.

AI has rapidly transitioned from a theoretical concept to a strategic imperative, reshaping core business functions and fundamentally altering the operational landscape of technology teams. By empowering teams with increased autonomy and data-driven capabilities, organisations are positioned to realise substantial value and achieve a decisive competitive advantage.

The most profound impact of AI can be observed within tech teams. AI-driven automation of routine tasks and streamlined operations are enabling technology professionals to refocus their efforts on strategic initiatives. This shift transforms the technology function from a reactive system maintenance role to a proactive developer of intelligent infrastructure and future-oriented systems.

Ecosystm research reveals key findings that Tech Leaders need to know.

Click here to download “AI Stakeholders: The Tech Leader’s Perspective” as a PDF.

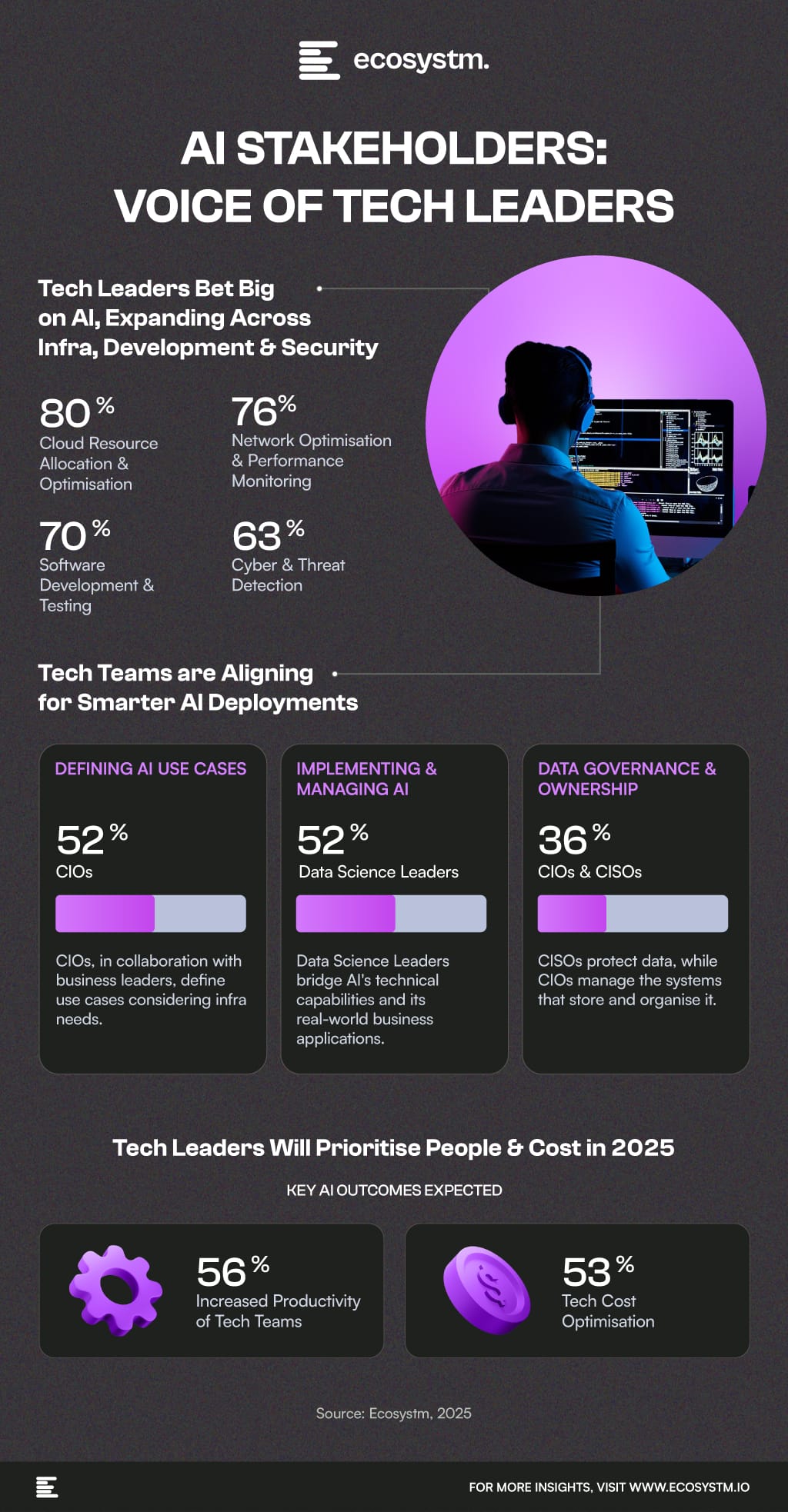

Strategic AI Deployment

Ecosystm research reveals a clear trend: technology leaders are strategically investing in the immense potential of AI. While 61% currently leverage AI for IT support and helpdesk automation, there is a clear aspiration for broader deployment across infrastructure, development, and security. 80% are prioritising cloud resource allocation and optimisation, followed by 76% focusing on network optimisation and performance monitoring, along with significant interest in software development and testing, and cyber threat detection.

One Infrastructure Leader shared that the organisation uses AI to dynamically scale infrastructure while automating maintenance to prevent outages. This approach has led to unprecedented efficiency and freed up their teams for more strategic work. The leader emphasised that AI is helping to tackle complex infrastructure challenges and is key to achieving operational excellence.

A Cyber Leader discussed the role of AI in enhancing their defense capabilities. While not a “silver bullet,” it is a powerful tool in the fight against cyber threats. AI significantly enhances threat intelligence and fraud analysis, complementing, rather than replacing, security team efforts. This integration has helped streamline security operations and improve the ability to respond to emerging risks.

AI is also making waves in software development. A Data Science Leader explained how AI quality control tools have reduced bug counts by 30%, enabling faster release cycles and a 10% improvement in internal customer satisfaction.

Collaborative AI Implementation: A Cross-Functional Approach

The successful implementation of AI requires a collaborative, cross-functional approach. The responsibility for identifying viable use cases, developing and maintaining systems, and ensuring robust data governance is distributed among various technology leadership roles. CIOs, in collaboration with business stakeholders, define strategic use cases, considering infrastructure requirements. Data Science Leaders bridge the gap between AI’s technical capabilities and practical business applications. CISOs safeguard data, while CIOs manage the systems that store and organise it.

Navigating Challenges, Prioritising Strategic AI Initiatives

Despite the acknowledged potential of AI, technology leaders must address several critical challenges, including use case prioritisation, skill gaps, and the development of comprehensive AI strategies. Nevertheless, the strategic importance of AI will continue to drive its prioritisation in 2025. Key anticipated outcomes include increased technology team productivity (56%) and technology cost optimisation (53%).

AI is no longer a supplementary tool but a core strategic asset. By strategically integrating AI, technology teams are transitioning from operational support to strategic innovation, building the intelligent systems that will define the future of business.