Despite financial institutions’ unwavering efforts to safeguard their customers, scammers continually evolve to exploit advancements in technology. For example, the number of scams and cybercrimes reported to the police in Singapore increased by a staggering 49.6% to 50,376 at an estimated cost of USD 482M in 2023. GenAI represents the latest challenge to the industry, providing fraudsters with new avenues for deception.

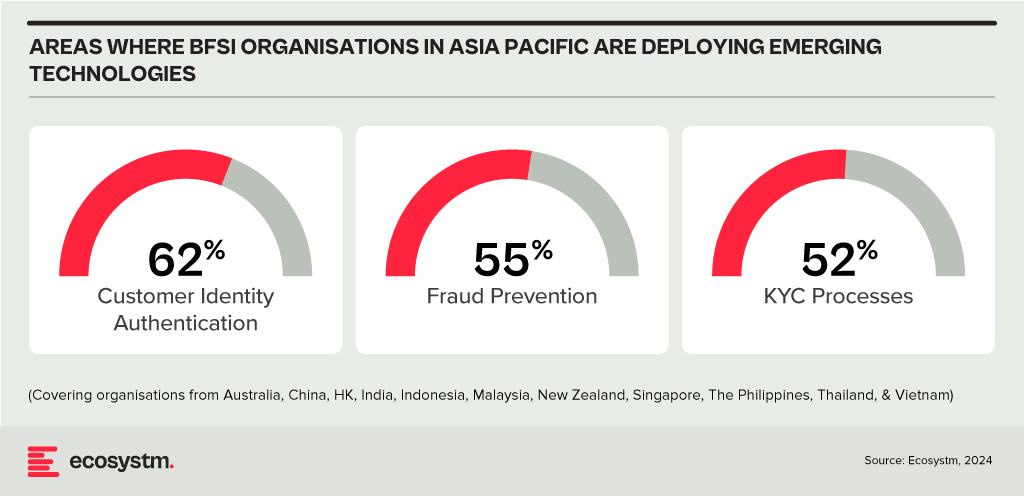

Ecosystm research shows that BFSI organisations in Asia Pacific are spending more on technologies to authenticate customer identity and prevent fraud, than they are in their Know Your Customer (KYC) processes.

The Evolution of the Threat Landscape in BFSI

Synthetic Identity Fraud. This involves the creation of fictitious identities by combining real and fake information, distinct from traditional identity theft where personal data is stolen. These synthetic identities are then exploited to open fraudulent accounts, obtain credit, or engage in financial crimes, often evading detection due to their lack of association with real individuals. The Deloitte Centre for Financial Services predicts that synthetic identity fraud will result in USD 23B in losses by 2030. Synthetic fraud is posing significant challenges for financial institutions and law enforcement agencies, especially with the emergence of advanced technologies like GenAI being used to produce realistic documents blending genuine and false information, undermining Know Your Customer (KYC) protocols.

AI-Enhanced Phishing. Ecosystm research reveals that in Asia Pacific, 71% of customer interactions in BFSI occur across multiple digital channels, including mobile apps, emails, messaging, web chats, and conversational AI. In fact, 57% of organisations plan to further improve customer self-service capabilities to meet the demand for flexible and convenient service delivery. The proliferation of digital channels brings with it an increased risk of phishing attacks.

While these organisations continue to educate their customers on how to secure their accounts in a digital world, GenAI poses an escalating threat here as well. Phishing schemes will employ widely available LLMs to generate convincing text and even images. For many potential victims, misspellings and strangely worded appeals are the only hint that an email from their bank is not what it seems. The maturing of deepfake technology will also make it possible for malicious agents to create personalised voice and video attacks.

Identity Fraud Detection and Prevention

Although fraudsters are exploiting every new vulnerability, financial organisations also have new tools to protect their customers. Organisations should build a layered defence to prevent increasingly sophisticated attempts at fraud.

- Behavioural analytics. Using machine learning, financial organisations can differentiate between standard activities and suspicious behaviour at the account level. Data that can be analysed includes purchase patterns, unusual transaction values, VPN use, browser choice, log-in times, and impossible travel. Anomalies can be flagged, and additional security measures initiated to stem the attack.

- Passive authentication. Accounts can be protected even before password or biometric authentication by analysing additional data, such as phone number and IP address. This approach can be enhanced by comparing databases populated with the details of suspicious actors.

- SIM swap detection. SMS-based MFA is vulnerable to SIM swap attacks where a customer’s phone number is transferred to the fraudster’s own device. This can be prevented by using an authenticator app rather than SMS. Alternatively, SIM swap history can be detected before sending one-time passwords (OTPs).

- Breached password detection. Although customers are strongly discouraged to reuse passwords across sites, some inevitably will. By employing a service that maintains a database of credentials leaked during third-party breaches, it is possible to compare with active customer passwords and initiate a reset.

- Stronger biometrics. Phone-based fingerprint recognition has helped financial organisations safeguard against fraud and simplify the authentication experience. Advances in biometrics continue with recognition for faces, retina, iris, palm print, and voice making multimodal biometric protection possible. Liveness detection will grow in importance to combat against AI-generated content.

- Step-up validation. Authentication requirements can be differentiated according to risk level. Lower risk activities, such as balance check or internal transfer, may only require minimal authentication while higher risk ones, like international or cryptocurrency transactions may require a step up in validation. When anomalous behaviour is detected, even greater levels of security can be initiated.

Recommendations

- Reduce friction. While it may be tempting to implement heavy handed approaches to prevent fraud, it is also important to minimise friction in the authentication system. Frustrated users may abandon services or find risky ways to circumvent security. An effective layered defence should act in the background to prevent attackers getting close.

- AI Phishing Awareness. Even the savviest of customers could fall prey to advanced phishing attacks that are using GenAI. Social engineering at scale becomes increasingly more possible with each advance in AI. Monitor emerging global phishing activities and remind customers to be ever vigilant of more polished and personalised phishing attempts.

- Deploy an authenticator app. Consider shifting away from OTP SMS as an MFA method and implement either an authenticator app or one embedded in the financial app instead.

- Integrate authentication with fraud analytics. Select an authentication provider that can integrate its offering with analytics to identify fraud or unusual behaviour during account creation, log in, and transactions. The two systems should work in tandem.

- Take a zero-trust approach. Protecting both customers and employees is critical, particularly in the hybrid work era. Implement zero trust tools to prevent employees from falling victim to malicious attacks and minimising damage if they do.

2023 has been an eventful year. In May, the WHO announced that the pandemic was no longer a global public health emergency. However, other influencers in 2023 will continue to impact the market, well into 2024 and beyond.

Global Conflicts. The Russian invasion of Ukraine persisted; the Israeli-Palestinian conflict escalated into war; African nations continued to see armed conflicts and political crises; there has been significant population displacement.

Banking Crisis. American regional banks collapsed – Silicon Valley Bank and First Republic Bank collapses ranking as the third and second-largest banking collapses in US history; Credit Suisse was acquired by UBS in Switzerland.

Climate Emergency. The UN’s synthesis report found that there’s still a chance to limit global temperature increases by 1.5°C; Loss and Damage conversations continued without a significant impact.

Power of AI. The interest in generative AI models heated up; tech vendors incorporated foundational models in their enterprise offerings – Microsoft Copilot was launched; awareness of AI risks strengthened calls for Ethical/Responsible AI.

Click below to find out what Ecosystm analysts Achim Granzen, Darian Bird, Peter Carr, Sash Mukherjee and Tim Sheedy consider the top 5 tech market forces that will impact organisations in 2024.

Click here to download ‘Ecosystm Predicts: Tech Market Dynamics 2024’ as a PDF

#1 State-sponsored Attacks Will Alter the Nature Of Security Threats

It is becoming clearer that the post-Cold-War era is over, and we are transitioning to a multi-polar world. In this new age, malevolent governments will become increasingly emboldened to carry out cyber and physical attacks without the concern of sanction.

Unlike most malicious actors driven by profit today, state adversaries will be motivated to maximise disruption.

Rather than encrypting valuable data with ransomware, wiper malware will be deployed. State-sponsored attacks against critical infrastructure, such as transportation, energy, and undersea cables will be designed to inflict irreversible damage. The recent 23andme breach is an example of how ethnically directed attacks could be designed to sow fear and distrust. Additionally, even the threat of spyware and phishing will cause some activists, journalists, and politicians to self-censor.

#2 AI Legislation Breaches Will Occur, But Will Go Unpunished

With US President Biden’s recently published “Executive order on Safe, Secure and Trustworthy AI” and the European Union’s “AI Act” set for adoption by the European Parliament in mid-2024, codified and enforceable AI legislation is on the verge of becoming reality. However, oversight structures with powers to enforce the rules are currently not in place for either initiative and will take time to build out.

In 2024, the first instances of AI legislation violations will surface – potentially revealed by whistleblowers or significant public AI failures – but no legal action will be taken yet.

#3 AI Will Increase Net-New Carbon Emissions

In an age focused on reducing carbon and greenhouse gas emissions, AI is contributing to the opposite. Organisations often fail to track these emissions under the broader “Scope 3” category. Researchers at the University of Massachusetts, Amherst, found that training a single AI model can emit over 283T of carbon dioxide, equal to emissions from 62.6 gasoline-powered vehicles in a year.

Organisations rely on cloud providers for carbon emission reduction (Amazon targets net-zero by 2040, and Microsoft and Google aim for 2030, with the trajectory influencing global climate change); yet transparency on AI greenhouse gas emissions is limited. Diverse routes to net-zero will determine the level of greenhouse gas emissions.

Some argue that AI can help in better mapping a path to net-zero, but there is concern about whether the damage caused in the process will outweigh the benefits.

#4 ESG Will Transform into GSE to Become the Future of GRC

Previously viewed as a standalone concept, ESG will be increasingly recognised as integral to Governance, Risk, and Compliance (GRC) practices. The ‘E’ in ESG, representing environmental concerns, is becoming synonymous with compliance due to growing environmental regulations. The ‘S’, or social aspect, is merging with risk management, addressing contemporary issues such as ethical supply chains, workplace equity, and modern slavery, which traditional GRC models often overlook. Governance continues to be a crucial component.

The key to organisational adoption and transformation will be understanding that ESG is not an isolated function but is intricately linked with existing GRC capabilities.

This will present opportunities for GRC and Risk Management providers to adapt their current solutions, already deployed within organisations, to enhance ESG effectiveness. This strategy promises mutual benefits, improving compliance and risk management while simultaneously advancing ESG initiatives.

#5 Productivity Will Dominate Workforce Conversations

The skills discussions have shifted significantly over 2023. At the start of the year, HR leaders were still dealing with the ‘productivity conundrum’ – balancing employee flexibility and productivity in a hybrid work setting. There were also concerns about skills shortage, particularly in IT, as organisations prioritised tech-driven transformation and innovation.

Now, the focus is on assessing the pros and cons (mainly ROI) of providing employees with advanced productivity tools. For example, early studies on Microsoft Copilot showed that 70% of users experienced increased productivity. Discussions, including Narayana Murthy’s remarks on 70-hour work weeks, have re-ignited conversations about employee well-being and the impact of technology in enabling employees to achieve more in less time.

Against the backdrop of skills shortages and the need for better employee experience to retain talent, organisations are increasingly adopting/upgrading their productivity tools – starting with their Sales & Marketing functions.

There are two types of organisations – those that know that they have had a cybersecurity breach and those that don’t. With ransomware accounting for a rapidly growing proportion of breaches, not knowing you have been breached is less likely. In the last two months, we have seen a series of devastating ransomware attacks. These have included attacks on critical infrastructure, Colonial Pipeline and JBS, and the more recent supply chain attack on Kaseya, infecting its customers’ customers with ransomware. We’ve also seen an increase in attacks on soft targets such as schools and hospitals.

What is ransomware? Well, it’s a type of malware that specialises in encrypting the victim’s data and demands a ransom for a decryption key which may or may not work. If the victim fails to pay, their data could be sold or published online. More worryingly, if the victim pays, their data could still be sold or published online, prolonging the agony. Common ransomware families include REvil, Locky, Wannacry, Cerber, NotPetya, Maze and Darkside.

Why is Ransomware Becoming more Widespread?

Increased digitisation, remote working, accelerated adoption of cloud computing and growth in IoT devices, have expanded the attack surface for threat actors – offering more vulnerabilities that can be exploited. Launching a ransomware attack is a relatively easy and low-risk way to make money for cyber-criminals. Threat actors are usually outside the jurisdiction where the attack takes place and are typically protected by the absence of extradition treaties between the country where the crime occurred and the country from where the attack was launched. As well as posing a remarkably low risk to the attacker the rewards from a successful ransomware attack are potentially very large. Ransomware as a service (RaaS) kits can be purchased on the dark web for a few hundred dollars and if used repeatedly are likely to find at least one victim. Cryptocurrencies such as bitcoin make it virtually impossible for law enforcement authorities to track ransom payments. Consequently, the rapid growth in ransoms combined with the increasing risk of successful ransomware attacks is leading to banks stocking up on bitcoin. This allows their customers to quickly pay ransoms.

How to Mitigate the Risks?

Companies will not be able to completely eliminate the risk of ransomware attacks. They can, however, mitigate the risk of these attacks with a zero-trust approach to cybersecurity, renewed focus on training and awareness programs, and well-prepared and rehearsed incident response plans.

Rigorously applying the principle of least privilege will make it harder for threat actors to gain the credentials that they need to move laterally within systems and networks. Segmenting networks and isolating workloads will limit the blast radius of attacks. Training and awareness campaigns will make employees less likely to download malware via phishing attacks or other social engineering activities. Ensuring that all sensitive data is classified and encrypted will make double extortion more difficult – a miserable scenario where the victim pays a ransom for a decryption key and is then asked to pay a further ransom for the dubious promise that stolen data will not be leaked.

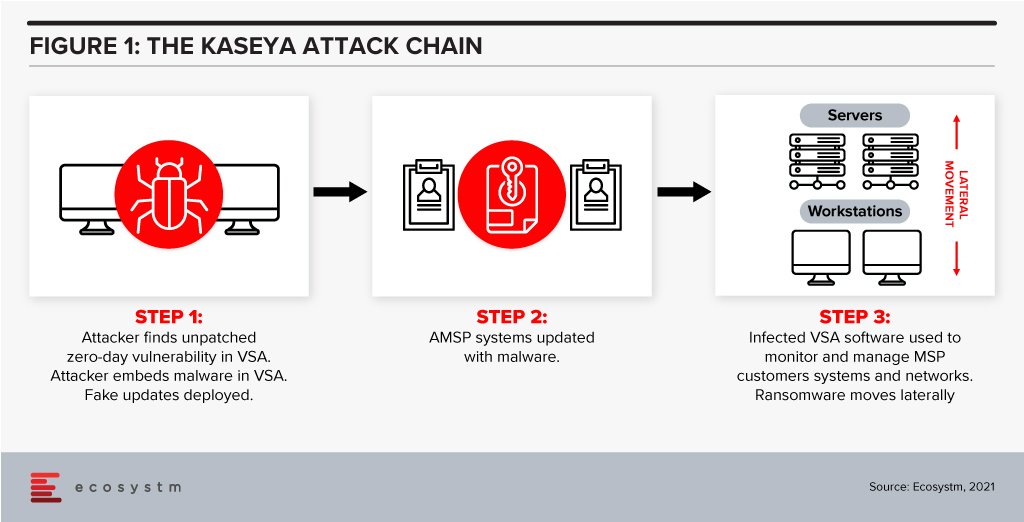

Protecting against supply chain ransomware attacks, such as the Kaseya breach, is fiendishly difficult. In the case of Kaseya, attackers identified a zero-day vulnerability in its VSA IT management and monitoring tool. An update was then infected with ransomware and shared with managed service providers, who, in turn infected their customers with the ransomware.

Rehearsed incident response plans that prepare for a successful ransomware attack are essential controls against such threats. A critical component of such a plan is backup and recovery. Backups are increasingly being targeted in well-orchestrated attacks so companies must find ways of ensuring that their data is stored in at least one immutable destination. This means that they can recover quickly – often almost instantly if the process is automated.

If companies follow cybersecurity best practices such as those outlined above, they should be able to manage ransomware risk and the misery associated with these attacks. If a ransomware attack occurs, well-prepared companies will be able to recover rapidly and be comfortable in the knowledge that the data which has been stolen is of little or no value to the attackers.