It is estimated that nearly 1.7 billion adults remain unbanked globally. Besides the unbanked there are large sections of the world that are underbanked or underserved because of geographical, educational and gender divides. And then there are the entrepreneurs and small and medium enterprises that find it harder to secure funds.

There are several ongoing initiatives by policy organisations, governments, corporates and FinTechs that aim to fulfil the goal of creating an inclusive world.

This Ecosystm Snapshot looks at some recent examples from central banks such as MAS, RBI, BSP Philippines, the Royal Monetary Authority of Bhutan; financial services providers such as Mastercard and Citi; and FinTechs such as Microchip Payments and Sempo.

To download this VendorSphere as a PDF for easier sharing, please click here.

Scaling Sustainable Finance for a Green Recovery – Ecosystm SFF 2021 Roundtable in Partnership with Ecosystm.

The market for sustainable finance is rapidly growing in response to the climate emergency. Despite impressive recent growth, the sustainable finance market has a long road ahead to reach maturity. It faces competing initiatives, uneven coverage by geography and asset class, misalignment of definitions and a mismatch between supply and demand. Moreover, all around the world, countries are still facing social and economic fallout from the global pandemic, and rebuilding our economies in a post-Covid-19 era has never been more urgent.

How can the financial sector adequately respond to these global concerns? What is the role of finance in the green recovery and how can public and private sectors collaborate to scale credible ESG investments? Our experts discuss the most innovative financial products and instruments that aim to deliver social and environmental benefits alongside attractive returns. Moderated by Ecosystm’s Amit Gupta, hear from Marty Dropkin (FIL Asia), R. Raghunathan (WWF-Singapore), Sasja Beslik (SDG Impact Japan), and Zoë Knight (HSBC).

Organised by the Monetary Authority of Singapore, the 6th edition of the Singapore FinTech Festival (SFF) ran from the 8 -12 November 2021. The annual event brings together 60,000 participants from 160 countries – both virtually and in-person – for the development of financial services, public policy and technology.

For more information on the Singapore FinTech Festival please visit www.fintechfestival.sg

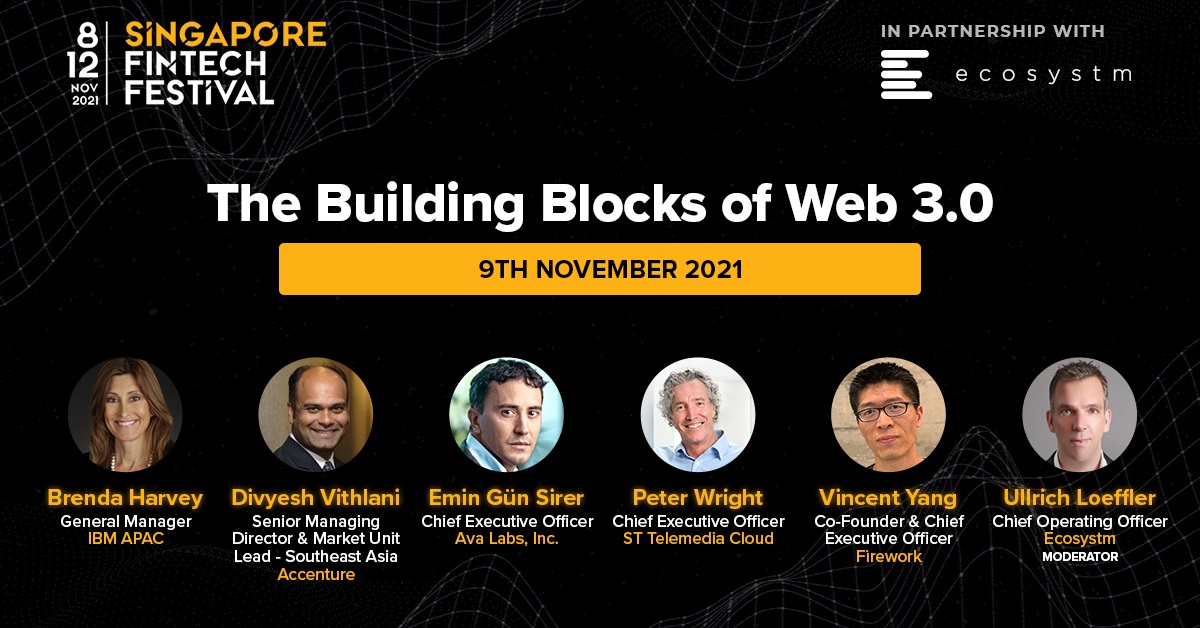

The Building Blocks of Web 3.0 – Singapore FinTech Festival 2021 Roundtable in Partnership with Ecosystm

Web 3.0 is the next phase of the internet’s evolution, but what technologies does it need to succeed? While the Web 3.0 stack is not yet fully developed, much progress has been made to set the foundations for a new online ecosystem that breaks away from the traditional web into new realms of online interaction. There are many examples of early-stage Web 3.0 applications that show how much potential the technologies can help realise. The concept of Web 3.0 may be interpreted differently but it is, at its core, a movement for a free web. A high-level discussion about Web 3.0 components and how they will shape the future of your online activities.

Hear from Brenda Harvey of IBM APAC, Divyesh Vithlani of Accenture, Emin Gün Sirer of Ava Labs, Peter Wright of ST Telemedia Cloud and Vincent Yang of Firework. This session was moderated by Ullrich Loeffler of Ecosystm.

Organised by the Monetary Authority of Singapore, the 6th edition of the Singapore FinTech Festival (SFF) ran from 8 -12 November 2021. The annual event brings together 60,000 participants from 160 countries – both virtually and in-person – for the development of financial services, public policy and technology.

For more information on the Singapore FinTech Festival, please visit www.fintechfestival.sg

Shaping the Future of Financial Services with Decentralised Finance – Ecosystm Global Leaders Roundtable at Singapore FinTech Festival 2021

Is Decentralised Finance taking over the banking world? Decentralised Finance is an emerging phenomenon, and it has been gaining the attention of the mainstream media since 2020.

Globally, about 1.7 billion adults remain unbanked. There’s a race to “bank the unbanked” to promote financial inclusion. On the other end of the spectrum, there are also efforts to “un-bank the banked”. With the rise of blockchain, it’s time to reformulate the consumer banking system with more secure and more affordable financial products. We hear from an unparalleled group of Decentralised Finance innovators and change-makers on how Decentralised Finance will define the next era of global finance. Hear from Dr Ben Goertzel of SingularityNET, Johann Eid of Chainlink Labs, Sudhir Pai of Capgemini and Justin Amos of Lygon. This session was moderated by Anjali Kapoor of Alt Key Theory.

Organised by the Monetary Authority of Singapore, the 6th edition of the Singapore FinTech Festival (SFF) ran from 8 -12 November 2021. The annual event brings together 60,000 participants from 160 countries – both virtually and in-person – for the development of financial services, public policy and technology.

When the FinTech revolution started, traditional banking felt the heat of competition from the ‘new kid on the block’. FinTechs promised (and often delivered) fast turnarounds and personalised services. Banks were forced to look at their operations through the lens of customer experience, constantly re-evaluating risk exposures to compete with FinTechs.

But traditional banks are giving their ‘neo-competitors’ a run for their money. Many have transformed their core banking for operational efficiency. They have also taken lessons from FinTechs and are actively working on their customer engagements. This Ecosystm Snapshot looks at how banks (such as Standard Chartered Bank, ANZ Bank, Westpac, Commonwealth Bank of Australia, Timo, and Welcome Bank) are investing in tech-led transformation and the ways tech vendors (such as IBM, Temenos, Mambu, TCS and Wipro) are empowering them.

To download this Ecosystm Bytes as a pdf for easier sharing and to access the hyperlinks, please click here.

Our financial system plays a central role in crystallising priorities and incentives for businesses and other stakeholders across the globe. So, many of us breathed a sigh of relief as the financial community got behind the Environmental, Social and Governance (ESG) movement in recent years, signalling a very visible acceleration in ESG as a hot button issue for investors and lenders.

Unfortunately, the growth of ESG as a priority for investors, lenders and consumers has driven many companies to oversell their green and/or social credentials in order to burnish their brands and attract investment. This is referred to as “greenwashing” and “social washing”.

As sustainability becomes a critical pillar for investors and consumers in their decision-making, data, analytics and technology play an increasingly critical role in enabling better decisions based on credible, accurate and more real-time information.

Read on to find out the three themes for technology enablement in sustainable finance, together with examples and potential use cases including companies such as IBM, Triodos Bank, Alipay, Floodmapp, and Data Gumbo.

Blockchain and Distributed Ledger Technology (DLT) is set to transform various aspects of the Financial Services industry. The technologies have a role to play in automating processes such as payments and securitisation, claims, and compliance monitoring.

Where the industry will see real value is in governance and standards around data sharing and collaboration – which lies at the core of the Open Banking revolution.

This Ecosystm Snapshot looks at how Blockchain in Financial Services is fast becoming a reality – and how different stakeholders (such as ABF, IMDA, Singapore Customs, Visa, Mastercard, TCS, Bitpanda and others) are looking to leverage it.

In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

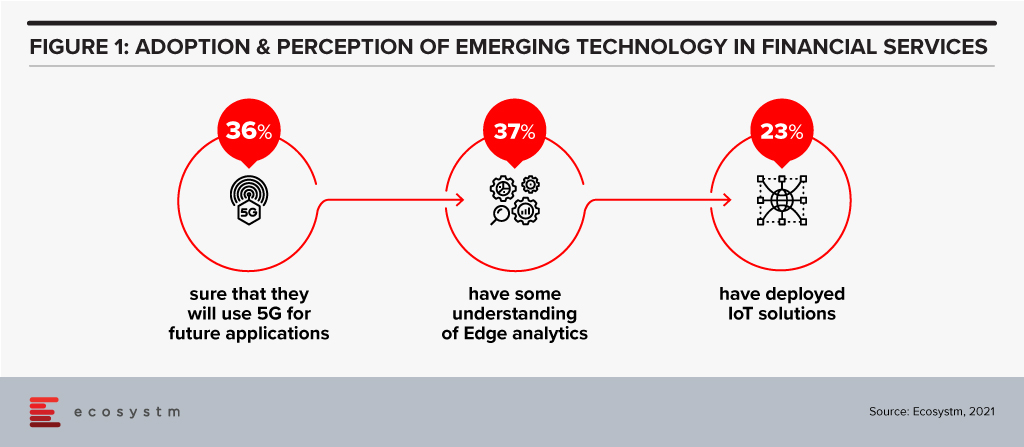

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

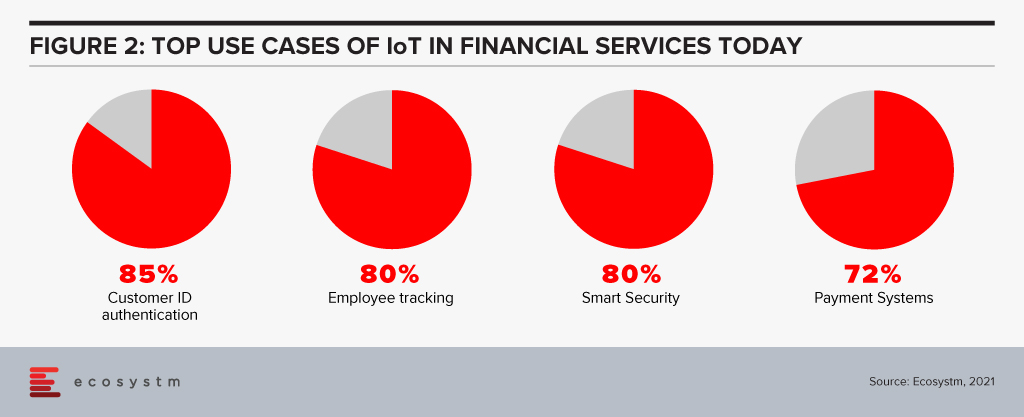

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Innovation is at the core of FinTechs. The Financial Services industry has been disrupted over the last few years because of the innovation and customer experience that FinTechs offer. But the FinTech world has become highly competitive, and there are many companies that do not make it, despite the innovations.

There are many factors that contribute to the success of a FinTech – and creating the right market differentiation is one of the key factors. This Ecosystm Snapshot looks at how FinTechs – such Earnest, Flock, Billd, Littlepay, Willa and AffiniPay – are disrupting industries as they build solutions targeted at those specific industries, to create the market differentiation required to succeed.