Southeast Asia’s banking sector is poised for significant digital transformation. With projected Net Interest Income reaching USD 148 billion by 2024, the market is ripe for continued growth. While traditional banks still hold a dominant position, digital players are making significant inroads. To thrive in this evolving landscape, financial institutions must adapt to rising customer expectations, stringent regulations, and the imperative for resilience. This will require a seamless collaboration between technology and business teams.

To uncover how banks in Southeast Asia are navigating this complex landscape and what it takes to succeed, Ecosystm engaged in in-depth conversations with senior banking executives and technology leaders as part of our research initiatives. Here are the highlights of the discussions with leaders across the region.

#1 Achieving Hyper-Personalisation Through AI

As banks strive to deliver highly personalised financial services, AI-driven models are becoming increasingly essential. These models analyse customer behaviour to anticipate needs, predict future behaviour, and offer relevant services at the right time. AI-powered tools like chatbots and virtual assistants further enhance real-time customer support.

Hyper-personalisation, while promising, comes with its challenges – particularly around data privacy and security. To deliver deeply tailored services, banks must collect extensive customer information, which raises the question: how can they ensure this sensitive data remains protected?

AI projects require a delicate balance between innovation and regulatory compliance. Regulations often serve as the right set of guardrails within which banks can innovate. However, banks – especially those with cross-border operations – must establish internal guidelines that consider the regulatory landscape of multiple jurisdictions.

#2 Beyond AI: Other Emerging Technologies

AI isn’t the only emerging technology reshaping Southeast Asian banking. Banks are increasingly adopting technologies like Robotic Process Automation (RPA) and blockchain to boost efficiency and engagement. RPA is automating repetitive tasks, such as data entry and compliance checks, freeing up staff for higher-value work. CIMB in Malaysia reports seeing a 35-50% productivity increase thanks to RPA. Blockchain is being explored for secure, transparent transactions, especially cross-border payments. The Asian Development Bank successfully trialled blockchain for faster, safer bond settlements. While AR and VR are still emerging in banking, they offer potential for enhanced customer engagement. Banks are experimenting with immersive experiences like virtual branch visits and interactive financial education tools.

The convergence of these emerging technologies will drive innovation and meet the rising demand for seamless, secure, and personalised banking services in the digital age. This is particularly true for banks that have the foresight to future-proof their tech foundation as part of their ongoing modernisation efforts. Emerging technologies offer exciting opportunities to enhance customer engagement, but they shouldn’t be used merely as marketing gimmicks. The focus must be on delivering tangible benefits that improve customer outcomes.

#3 Greater Banking-Fintech Collaboration

The digital payments landscape in Southeast Asia is experiencing rapid growth, with a projected 10% increase between 2024-2028. Digital wallets and contactless payments are becoming the norm, and platforms like GrabPay, GoPay, and ShopeePay are dominating the market. These platforms not only offer convenience but also enhance financial inclusion by reaching underbanked populations in remote areas.

The rise of digital payments has significantly impacted traditional banks. To remain relevant in this increasingly cashless society, banks are collaborating with fintech companies to integrate digital payment solutions into their services. For instance, Indonesia’s Bank Mandiri collaborated with digital credit services provider Kredivo to provide customers with access to affordable and convenient credit options.

Partnerships between traditional banks and fintechs are essential for staying competitive in the digital age, especially in areas like digital payments, data analytics, and customer experience.

While these collaborations offer opportunities, they also pose challenges. Banks must invest in advanced fraud detection, AI monitoring, and robust authentication to secure digital payments. Once banks adopt a mindset of collaboration with innovators, they can leverage numerous innovations in the cybersecurity space to address these challenges.

#4 Agile Infrastructure for an Agile Business

While the banking industry is considered a pioneer in implementing digital technologies, its approach to cloud has been more cautious. While interest remained high, balancing security and regulatory concerns with cloud agility impacted the pace. Hybrid multi-cloud environments has accelerated banking cloud adoption.

Leveraging public and private clouds optimises IT costs, offering flexibility and scalability for changing business needs. Hybrid cloud allows resource adjustments for peak demand or cost reductions off-peak. Access to cloud-native services accelerates innovation, enabling rapid application development and improved competitiveness. As the industry adopts GenAI, it requires infrastructure capable of handling vast data, massive computing power, advanced security, and rapid scalability – all strengths of hybrid cloud.

Replicating critical applications and data across multiple locations ensures disaster recovery and business continuity. A multi-cloud strategy also helps avoid vendor lock-in, diversifies cloud providers, and reduces exposure to outages.

Hybrid cloud adoption offers benefits but also presents challenges for banks. Managing the environment is complex, needing coordination across platforms and skilled personnel. Ensuring data security and compliance across on-prem and public cloud infrastructure is demanding, requiring robust measures. Network latency and performance issues can arise, making careful design and optimisation crucial. Integrating on-prem systems with public cloud services is time-consuming and needs investment in tools and expertise.

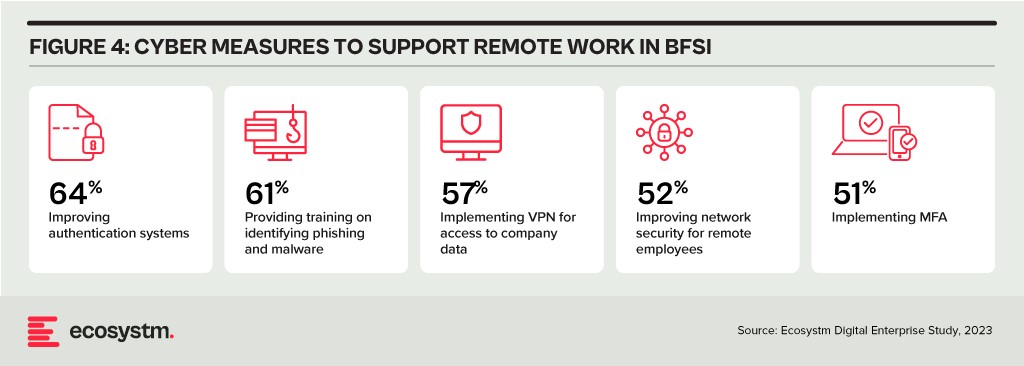

#5 Cyber Measures to Promote Customer & Stakeholder Trust

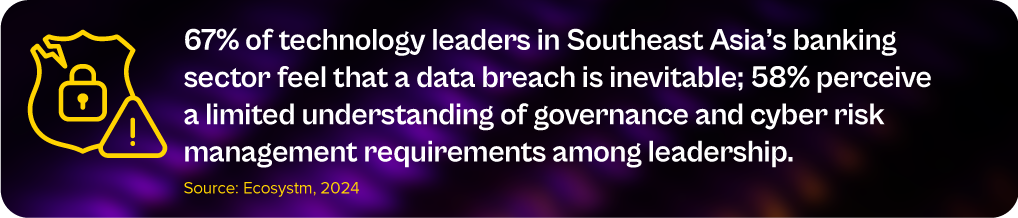

The banking sector is undergoing rapid AI-driven digital transformation, focusing on areas like digital customer experiences, fraud detection, and risk assessment. However, this shift also increases cybersecurity risks, with the majority of banking technology leaders anticipate inevitable data breaches and outages.

Key challenges include expanding technology use, such as cloud adoption and AI integration, and employee-related vulnerabilities like phishing. Banks in Southeast Asia are investing heavily in modernising infrastructure, software, and cybersecurity.

Banks must update cybersecurity strategies to detect threats early, minimise damage, and prevent lateral movement within networks.

Employee training, clear security policies, and a culture of security consciousness are critical in preventing breaches.

Regulatory compliance remains a significant concern, but banks are encouraged to move beyond compliance checklists and adopt risk-based, intelligence-led strategies. AI will play a key role in automating compliance and enhancing Security Operations Centres (SOCs), allowing for faster threat detection and response. Ultimately, the BFSI sector must prioritise cybersecurity continuously based on risk, rather than solely on regulatory demands.

Breaking Down Barriers: The Role of Collaboration in Banking Transformation

Successful banking transformation hinges on a seamless collaboration between technology and business teams. By aligning strategies, fostering open communication, and encouraging cross-functional cooperation, banks can effectively leverage emerging technologies to drive innovation, enhance customer experience, and improve efficiency.

A prime example of the power of collaboration is the success of AI initiatives in addressing specific business challenges.

This user-centric approach ensures that technology addresses real business needs.

By fostering a culture of collaboration, banks can promote continuous learning, idea sharing, and innovation, ultimately driving successful transformation and long-term growth in the competitive digital landscape.

The Banking, Financial Services, and Insurance (BFSI) industry, known for its cautious stance on technology, is swiftly undergoing a transformational modernisation journey. Areas such as digital customer experiences, automated fraud detection, and real-time risk assessment are all part of a technology-led roadmap. This shift is transforming the cybersecurity stance of BFSI organisations, which have conventionally favoured centralising everything within a data centre behind a firewall.

Ecosystm research finds that 75% of BFSI technology leaders believe that a data breach is inevitable. This requires taking a new cyber approach to detect threats early, reduce the impact of an attack, and avoid lateral movement across the network.

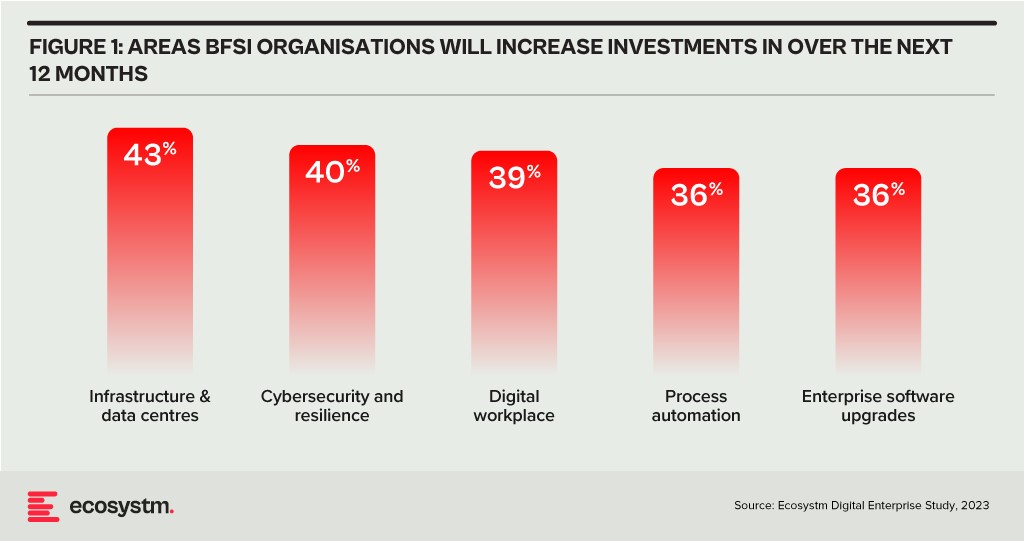

BFSI organisations will boost investments in two main areas over the next year: updating infrastructure and software, and exploring innovative domains like digital workplaces and automation. Cybersecurity investments are crucial in both of these areas.

As a regulated industry, breaches come with significant cost implications, underscoring the need to prioritise cybersecurity. BFSI cybersecurity and risk teams need to constantly reassess their strategies for safeguarding data and fulfilling compliance obligations, as they explore ways to facilitate new services for customers, partners, and employees.

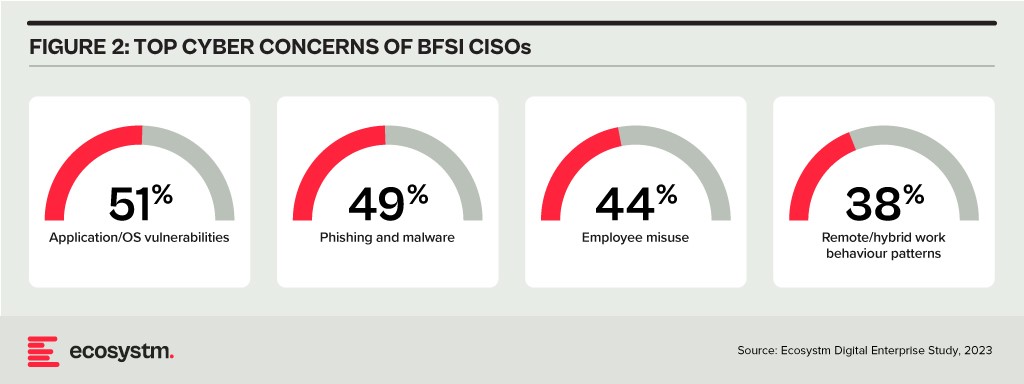

The primary concerns of BFSI CISOs can be categorised into two distinct groups:

- Expanding Technology Use. This includes the proliferation of applications and devices, as well as data access beyond the network perimeter.

- Employee-Related Vulnerabilities. This involves responses to phishing and malware attempts, as well as intentional and unintentional misuse of technology.

Vulnerabilities Arising from Employee Actions

Security vulnerabilities arising from employee actions and unawareness represent a significant and ongoing concern for businesses of all sizes and industries – the risks are just much bigger for BFSI. These vulnerabilities can lead to data breaches, financial losses, damage to reputation, and legal ramifications. A multi-pronged approach is needed that combines technology, training, policies, and a culture of security consciousness.

Training and Culture. BFSI organisations prioritise comprehensive training and awareness programs, educating employees about common threats like phishing and best practices for safeguarding sensitive data. While these programs are often ongoing and adaptable to new threats, they can sometimes become mere compliance checklists, raising questions about their true effectiveness. Conducting simulated phishing attacks and security quizzes to assess employee awareness and identify areas where further training is required, can be effective.

To truly educate employees on risks, it’s essential to move beyond compliance and build a cybersecurity culture throughout the organisation. This can involve setting organisation-wide security KPIs that cascade from the CEO down to every employee, promoting accountability and transparency. Creating an environment where employees feel comfortable reporting security concerns is critical for early threat detection and mitigation.

Policies. Clear security policies and enforcement are essential for ensuring that employees understand their roles within the broader security framework, including responsibilities on strong password use, secure data handling, and prompt incident reporting. Implementing the principle of least privilege, which restricts access based on specific roles, mitigates potential harm from insider threats and inadvertent data exposure. Policies should evolve through routine security audits, including technical assessments and evaluations of employee protocol adherence, which will help organisations with a swifter identification of vulnerabilities and to take the necessary corrective actions.

However, despite the best efforts, breaches do happen – and this is where a well-defined incident response plan, that is regularly tested and updated, is crucial to minimise the damage. This requires every employee to know their roles and responsibilities during a security incident.

Tech Expansion Leading to Cyber Complexity

Cloud. Initially hesitant to transition essential workloads to the cloud, the BFSI industry has experienced a shift in perspective due to the rise of inventive SaaS-based Fintech tools and hybrid cloud solutions, that have created new impetus for change. This new distributed architecture requires a fresh look at cyber measures. Secure Access Service Edge (SASE) providers are integrating a range of cloud-delivered safeguards, such as FWaaS, CASB, and ZTNA with SD-WAN to ensure organisations can securely access the cloud without compromising on performance.

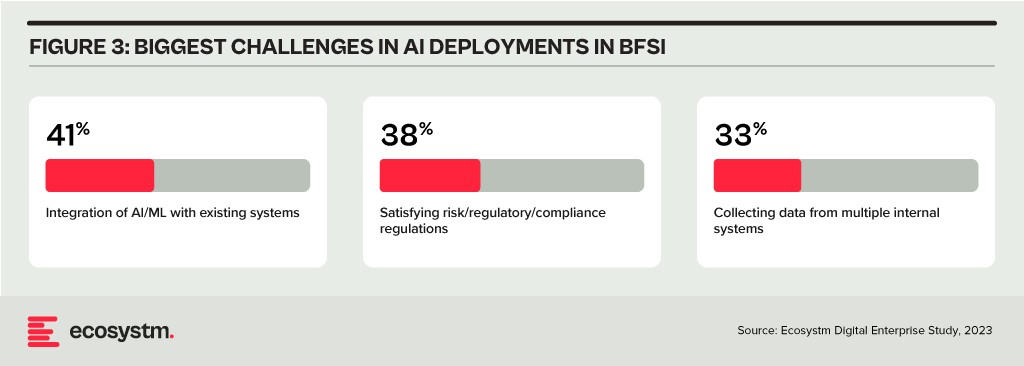

Data & AI. Data holds paramount importance in the BFSI industry for informed decision-making, personalised customer experiences, risk assessment, fraud prevention, and regulatory compliance. AI applications are being used to tailor products and services, optimise operational efficiency, and stay competitive in an evolving market. As part of their technology modernisation efforts, 47% of BFSI institutions are refining their data and AI strategies. They also acknowledge the challenges associated – and satisfying risk, regulatory, and compliance requirements is one of the biggest challenges facing BFSI organisations in the AI deployments.

The rush to experiment with Generative AI and foundation models to assist customers and employees is only heightening these concerns. There is an urgent need for policies around the use of these emerging technologies. Initiatives such as the Monetary Authority of Singapore’s Veritas that aim to enable financial institutions to evaluate their AI and data analytics solutions against the principles of fairness, ethics, accountability, and transparency (FEAT) are expected to provide the much-needed guidance to the industry.

Digital Workplace. As with other industries with a high percentage of knowledge workers, BFSI organisations are grappling with granting remote access to staff. Cloud-based collaboration and Fintech tools, BYOD policies, and sensitive data traversing home networks are all creating new challenges for cyber teams. Modern approaches, such as zero trust network access, privilege management, and network segmentation are necessary to ensure workers can seamlessly but securely perform their roles remotely.

Looking Beyond Technology: Evaluating the Adequacy of Compliance-Centric Cyber Strategies

The BFSI industry stands among the most rigorously regulated industries, with scrutiny intensifying following every collapse or notable breach. Cyber and data protection teams shoulder the responsibility of understanding the implications of and adhering to emerging data protection regulations in areas such as GDPR, PCI-DSS, SOC 2, and PSD2. Automating compliance procedures emerges as a compelling solution to streamline processes, mitigate risks, and curtail expenses. Technologies such as robotic process automation (RPA), low-code development, and continuous compliance monitoring are gaining prominence.

The adoption of AI to enhance security is still emerging but will accelerate rapidly. Ecosystm research shows that within the next two years, nearly 70% of BFSI organisations will have invested in SecOps. AI can help Security Operations Centres (SOCs) prioritise alerts and respond to threats faster than could be performed manually. Additionally, the expanding variety of network endpoints, including customer devices, ATMs, and tools used by frontline employees, can embrace AI-enhanced protection without introducing additional onboarding friction.

However, there is a need for BFSI organisations to look beyond compliance checklists to a more holistic cyber approach that can prioritise cyber measures continually based on the risk to the organisations. And this is one of the biggest challenges that BFSI CISOs face. Ecosystm research finds that 72% of cyber and technology leaders in the industry feel that there is limited understanding of cyber risk and governance in their organisations.

In fact, BFSI organisations must look at the interconnectedness of an intelligence-led and risk-based strategy. Thorough risk assessments let organisations prioritise vulnerability mitigation effectively. This targeted approach optimises security initiatives by focusing on high-risk areas, reducing security debt. To adapt to evolving threats, intelligence should inform risk assessment. Intelligence-led strategies empower cybersecurity leaders with real-time threat insights for proactive measures, actively tackling emerging threats and vulnerabilities – and definitely moving beyond compliance-focused strategies.

Ecosystm launches the Trending-Vendor series showcasing the Top 5 disruptive vendors that are shaking up their market segment. Our first Trending-Vendor RNx is focused on Robotic Process Automation (RPA) – Ecosystm research shows that process automation is the biggest driver for tech adoption, with a staggering 127% investment growth in 2021. The Ecosystm RNx – Top 5 Trending-Vendor for RPA evaluates Automation vendors based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an End User and looking to automate your back-end or customer processes, this vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience, integration capabilities, and strategy.

If you are an RPA vendor, you operate in a competitive work with several enterprise vendors vying for a larger share of the pie – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

ServiceNow announced their intention to acquire robotic process automation (RPA) provider, Intellibot, for an undisclosed sum. Intellibot is a significant tier 2 player in the RPA market, that is rapidly consolidating into the hands of the big three – UiPath, Automation Everywhere, and Blue Prism – and other acquisition-hungry software providers. This is unlikely to be the last RPA acquisition that we see this year with smaller players looking to either go niche or sell out while the market is hot.

Expanding AI/Automation Capabilities

Intellibot is the latest in a string of purchases by ServiceNow that reveals their intention to embed AI and machine learning into offerings. In 2020, they acquired Loom Systems, Passage AI (both January), Sweagle (June), and Element AI (November) in addition to Attivio in 2019. These acquisitions were integrated into the latest version of their Now Platform, code-named Quebec, which was launched earlier this month. As a result, Predictive AIOps and AI Search were newly added to the platform while the low-code tools were expanded upon and became Creator Workflows. This means ServiceNow now offers four primary solutions – IT Workflows, Employee Workflows, Customer Workflows, and Creator Workflows – demonstrating the importance they are placing on low-code and RPA.

ServiceNow was quick to remind the market that although they will be able to offer RPA functionality natively once Intellibot is integrated into their platform, they are still willing to work with competitors. They specifically highlighted that they would continue partnering with UiPath, Automation Anywhere, and Blue Prism, suggesting they plan to use RPA as a complementary technology to their current offerings rather than going head-to-head with the Big Three. Only a month ago, UiPath announced deeper integration with ServiceNow, by expanding automation capabilities for Test Management 2.0 and Agile Development projects.

Expansion in India

The acquisition of Intellibot, based in Hyderabad, is part of ServiceNow’s expansion strategy in India – one of their fastest growing markets. The country is already home to their largest R&D centre outside of the US and they intend to launch a couple of data centres there by March 2022. The company plans to double their local staff levels by 2024, having already tripled the number of employees there in the last two years. The expansion in India means they can increasingly offer services from there to global customers.

Market Consolidation Accelerates

In the Ecosystm Predicts: The Top 5 AI & AUTOMATION Trends for 2021, Ecosystm had talked about technology vendors adding RPA functionality either organically or through acquisitions, this year.

“Buyers will find that many of the automation capabilities that they currently purchase separately will increasingly be integrated in their enterprise applications. This will resolve integration challenges and will be more cost-effective.”

ServiceNow’s purchase is one of several recent examples of low-code vendors acquiring their way into the RPA space. Last year, Appian acquired Novayre Solutions for their Jidoka product and Microsoft snapped up Softomotive. Speculation continues to build that Salesforce could also be assessing RPA targets. Considering RPA market leader, UiPath recently announced that their Series F funding round values the company at USD 35 billion, there is pressure on acquirers to gobble up the remaining smaller players before they are all gone or become prohibitively expensive.

The cloud hyperscalers are also likely to play a growing role in the RPA market over the next year. Microsoft and IBM have already entered the market, coming from the angle of office productivity and business process management (BPM), respectively. Google announced just last week that they will work closely with Automation Anywhere to integrate RPA into their cloud offerings, such as Apigee, AppSheet, and AI Platform. More interestingly, they plan to co-develop new solutions, which might for now satisfy Google’s appetite for RPA rather than requiring an acquisition.

Here are some of the trends to watch for RPA, AI and Automation in 2021. Signup for Free to download Ecosystm’s Top 5 AI & Automation Trends Report.

This week at Microsoft Ignite, there was a heavy emphasis on RPA and low code as the tools it sees as the future of productivity. It used its annual conference for developers and IT professionals to make a slew of announcements about its Power Platform. Most notable is that from this week, Power Automate Desktop will be bundled with Microsoft Windows and is available as a free download. This marks a major step in the direction of mass adoption of RPA.

By Microsoft’s estimates, 50% of tasks carried out by information workers could be automated by currently available technology but are instead performed manually. Moreover, 500 million apps will need to be built by 2026, more than were developed in the last 40 years. Slowing down the pace of automation and the roll out of apps to enable digital business, is the skills gap, with a shortage of 1 million developers in the US alone. This is of course why Microsoft is betting on RPA and low code tools to empower citizen developers to do it themselves.

Microsoft was arguably slow to focus on RPA and low code considering its breadth of applications and good standing with developers. It only announced the general availability of UI Flows in Power Automate less than a year ago. Moreover, its automation suite worked best in the Microsoft universe but had limited interoperability with third-party tools. In May 2020, it acquired Softomotive, which signalled that it was taking RPA seriously and was willing to expand beyond the automation of its own software. By then, acquiring one of the big three – UiPath, Automation Anywhere, or Blue Prism – would have been excessively costly but Softomotive ensured it had both attended and unattended RPA capabilities to build upon. Softomotive’s WinAutomation remerged as Power Automate Desktop in September and with this week’s announcement, it becomes a native component in Windows.

By providing Power Automate Desktop for free with Windows, Microsoft appears to be attempting to generate interest from users who may not have previously been exposed to RPA. For the widespread adoption of RPA beyond just functions like finance, HR, and procurement, these tools need to be put into the hands of average users that can find their own use cases. Eventually, some of these basic users will need more advanced functionality available in the cloud-based version of Power Automate. Microsoft has a range of pricing plans including per user, per flow, with AI Builder, and unattended RPA.

Security and Governance

While making free desktop-based automation available to all, may be an effective means of raising the profile of RPA, Microsoft realises that it must provide IT and security teams with tools for control. It also announced this week additional features, such as:

- Endpoint filtering to turn on selected connections but with restrictions

- Connector action controls, e.g. allowing read permission but not write in some connectors

- Tenant isolation to provide differentiated access to connectors according to business unit

- Usage dashboards

Power Fx – Microsoft’s Low Code Language

Microsoft is one of the best-placed vendors to address the needs of citizen developers; bringing together its dominance as a productivity software provider and an important part of the developer ecosystem. This week it also introduced Power Fx, a low-code programming language based on Microsoft Excel. The logic of this new, simple language should be familiar to the millions of spreadsheet users. Power Fx provides more advanced citizen developers with a bridge from the drag-and-drop features of the Power Platform to low-code development.

Is 2021 the year RPA finally goes mainstream?

Microsoft’s announcements this week are one of many signs in the last few months that the RPA market is on its way to gaining mainstream acceptance. Also garnering attention was the lofty valuation given to the market leader, UiPath, this year. It recently announced that in its Series F funding round, it closed at $750M, valuing the company at $35B. This is hot on the heels of confirmation that it plans to IPO, probably in the first half of 2021. Last year was also a rapid period of consolidation, with Appian, IBM, and Microsoft all making RPA acquisitions. It seems highly likely that in the next few months we could see acquisitions or RPA launches by some of the cloud and application vendors that have until now been waiting to see the technology mature.

How will RPA be a part of your automation strategy in 2021? The Top 5 AI & Automation Trends for 2021 are available for download from the Ecosystm platform. Signup for Free to download the report.

Authored by Alea Fairchild and Audrey William

There is a lot of hope on AI and automation to create intellectual wealth, efficiency, and support for some level of process stability. After all, can’t we just ask Siri or Alexa and get answers so we can make a decision and carry on?

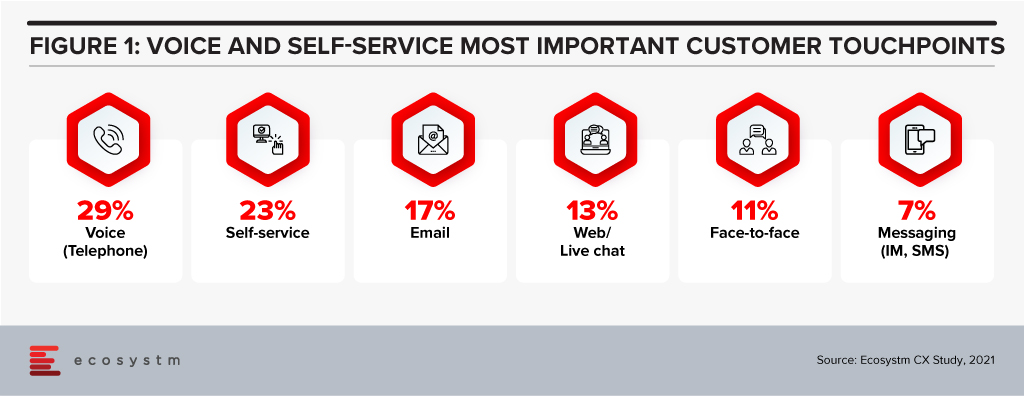

Automation has been touted as the wonder formula for workplace process optimisation. In reality it’s not the quick fix that many business leaders desire. But we keep raising the bar on expectations from automation. Investments in voice technologies, intelligent assistants, augmented reality and touchscreens are changing customer experience (Figure 1). Chatbots are ubiquitous, and everything has the potential to be personalised. But will they solve our problems?

100 percent automation is not effective

Let’s first consider using automation to replace face-to-face interactions. There was a time when people were raving about the check-in experience at some of the hotels in Japan where robots and automated systems would take care of the check-in, in-stay and check-out processes. Sounds simple and good? Till 2019, if you checked into the Henn-na Hotel in Japan, you would be served and taken care of by 243 robots. It was viewed by many as a template for what a fully automated hotel could look like in the future.

The hotel had an in-room voice assistant called Churi. It could cope with basic commands, such as turning the lights on and off, but it was found to be deficient when guests started asking questions about places to visit or other more sophisticated queries. It was not surprising that the hotel decided to retire their robots. In the end it created more work for the hotel staff on-site.

People love the personal touch when they are in a hotel; and talking to someone at the front desk, requesting assistance from hotel staff, or even just a short chat over breakfast are some of the small nuances of why the emotional connection matters. Many quarantine hotels today use robots for food delivery, but the hotel staff is still widely available for questions. That automation is good, but you need the human intervention. So, getting the balance right is key.

Empathy plays a big role in delivering great Customer Experience

Similarly, there was a time when many industry observers and technology providers said that a contact centre will be fully automated, reducing the number of agents. While technologies such as Conversational AI have come along where you can now automate common or repetitive questions and with higher accuracy levels, the human agent still plays a critical role in answering the more complex queries. When the customer has a complicated question or request, then they will WANT to speak to an agent.

When it reaches a point where the conversation with the chatbot starts getting complicated and the customers need more help there should be the option – within the app, website or any other channel – to escalate the call seamlessly to a human agent. Sometimes, a chat is where the good experience happens – the emotional side of the conversation, the laughter, the detailed explanation. This human touch cannot be replaced by machines. Disgruntled customers are happier when an agent shows empathy. Front line staff and human agents act as the face of a company’s brand. Complete automation will not allow the individual to understand the culture of the company. These can be attained through conversations.

Humans as supervisors for AI – The New Workplace

Empathy, intuitiveness, and creativity are all human elements in the intelligence equation. Workers in the future will need to make their niche in a fluid and unpredictable environment; and translating data into action in a non-replicable way is one of the values of human input. The essence of engineering is the capacity to design around human limitations. This requires an understanding of how humans behave and what they want. We call that empathy. It is the difference between the engineer who designs a product, and the engineer who delivers a solution. We don’t teach our computer scientists and engineering students a formula for empathy. But we do try to teach them respect for both the people and the process.

For efficiency, we turn to automation of processes, such as RPA. This is designed to try to eradicate human error and assist us in doing our job better, faster and at a lower cost by automating routine processes. If we design it right, humans take the role of monitoring or supervisory controlling, rather than active participation.

At present, AI is not seen as a replacement for our ingenuity and knowledge, but as a support tool. The value in AI is in understanding and translating human preferences. Humans-in-the-loop AI system building puts humans in the decision loop. They also shift pressure away from building “perfect” algorithms. Having humans involved in the ethical norms of the decision allows the backstop of overly orchestrated algorithms.

That being said, the astute use of AI can deepen insights into what truly makes us human and can humanise experiences by setting a better tone and a more trusted engagement. Using things like sentiment analysis can de-escalate customer service encounters to regain customer loyalty.

The next transformational activity for renovating work is to advance interactions with customers by interpreting what they are asking for and humanising the experience of acquiring it which may include actually dealing with a human contact centre agent – decisions that are supported at the edge by automation, but at the core by a human being.

Implications

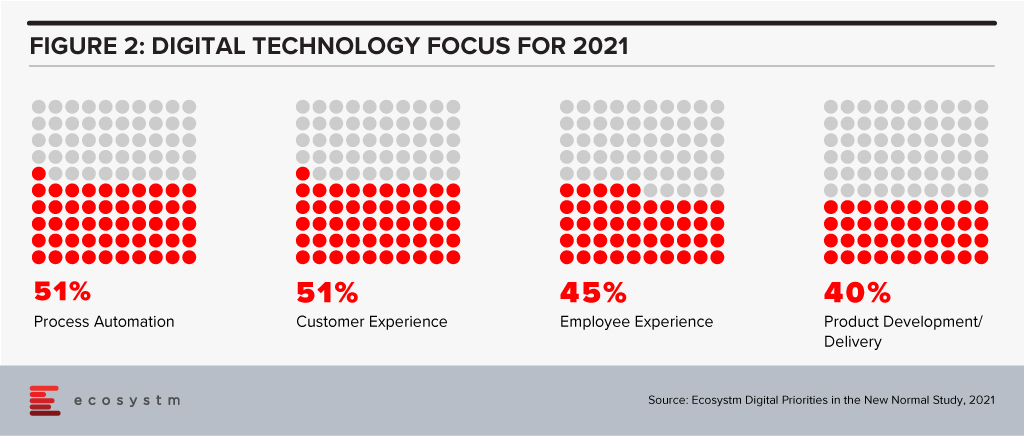

Ecosystm research shows that process automation will be a key priority for technology investments in 2021 (Figure 2).

With AI and automation, a priority in 2021, it will be important to keep these considerations in mind:

- Making empathy and the human connection the core of customer experiences will bring success.

- Rigorous, outcome-based testing will be required when process automation solutions are being evaluated. In areas where there are unsatisfactory results, human interactions cannot – and should not – be replaced.

- It may be easy to achieve 90% automation for dealing with common, repetitive questions and processes. But there should always be room for human intervention in the event of an issue – and it should be immediate and not 24 hours later!

- Employees can drive greater value by working alongside the chatbot, robot or machine.

Ecosystm Predicts: The Top 5 Customer Experience Trends for 2021

Download Ecosystm’s complimentary report detailing the top 5 customer experience trends for 2021 that your company should pay attention to along with tips on how to stay ahead of the curve.

The Education sector is currently facing immense challenges with enabling a remote learning environment and ensuring the safety of staff, employees, and students. This is on top of the usual challenges of resource optimisation, student retention, student recruitment, and so on. Moreover, today’s students are millennials and post-millennials, who are digital natives – pushing educational institutions to adopt technology to attract the right cohort and provide an education that equips the students for the workplace of the future. The industry is being driven to transform, to keep up with student expectations on delivery, access to the resource, and how they choose to communicate with their educators and peers.

Ecosystm Principal Advisor, Dr Alea Fairchild says, “Education administration budgets are not increasing, but the pressure for quick response and more personalised interaction for students, means that administrators need to focus on interaction as the core competency. This requires institutions to automate as much of the volume back-office activity as feasible. The challenge is that individualised course structures mean more complex billing configurations.”

Dr Fairchild, who is active in international education in Belgium, says, “Individual study paths, including Erasmus exchanges, create a need for an audit trail on transfers, exemptions and completions.”

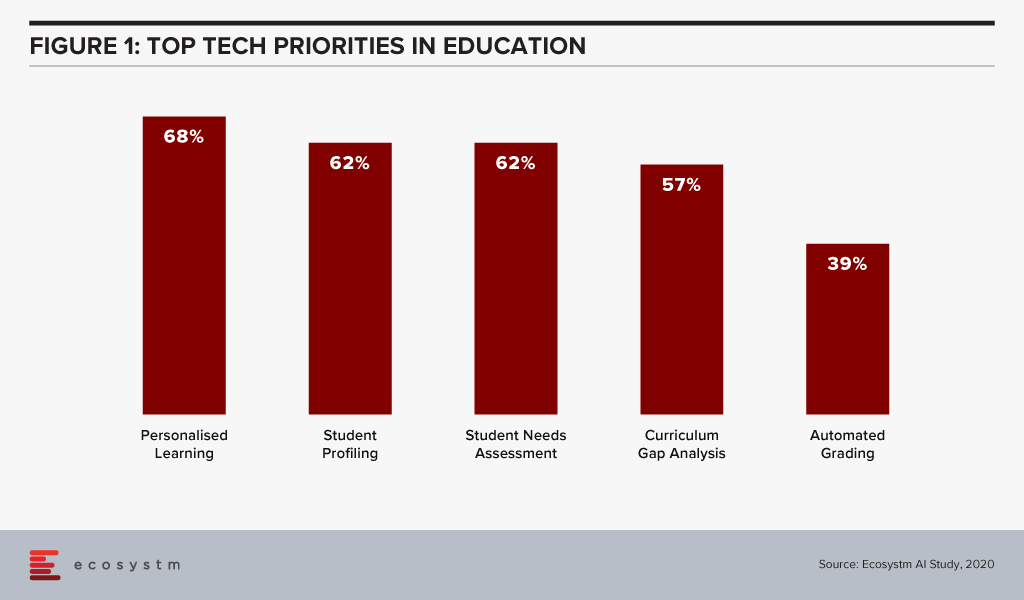

Ecosystm research finds that educational institutions are focused on adopting emerging technologies mainly to improve student services (Figure 1). The processes are being automated to reduce risks, errors and turnaround times for results and application processing, while also removing repetitive tasks so administration can focus on more value-add student-facing activities.

University of Staffordshire Embraces Digital Transformation

The University of Staffordshire is a “connected university” with an emphasis on industry connections and graduate employability. At the heart of Stoke-on-Trent and a regional hub for healthcare education, the university has six schools as well as a well-known degree in computer games design.

The UK-based University has over the years built a reputation for being keen on embracing digital as a way of better management, offering better student services, and serving the larger community. In 2018, Staffordshire University announced plans to build a multi-million-pound apprenticeship hub at its Stoke-on-Trent campus supported by tech giants including Microsoft to equip students with digital skills and to deliver more than 6,500 new apprenticeships over the next decade.

Last year, the University implemented a digital assistant, called Beacon, hosted on Microsoft Azure Cloud that provides support to their students on their learning and on-campus activities, including monitoring their emotional well-being and providing recommendations on groups and societies that they might be interested in. Beacon aims to ease the life of a university student, acting as a digital coach, and to minimise drop-outs due to stress and uncertainty.

Like its peer organisations, in the wake of the pandemic, the university was able to implement a blended learning program – offering courses through digital and remote learning systems from this semester for the entire 2020-21 session.

Focusing on Transformation through Automation

The University of Staffordshire, recently implemented robotic process automation (RPA) as part of its digital transformation plan. Talking about the role of RPA in Education, Dr Fairchild says, “This is a recent trend in higher education, with other new initiatives seen at the University of Auckland and University of Melbourne. RPA as a tool is used in Education to achieve the service levels required to meet both students’ and potential students’ expectations. This includes downloading student applications, processing language waiver requests, and entering academic results. These are all rule-based, high volume applications where automation increases speed and reduces errors.”

The University is using Blue Prism Cloud to access the RPA software and has plans for a automation-led digital transformation roadmap. Dr Fairchild says, “Blue Prism is based on Java and uses a Top-Down approach. It offers a visual designer with no recorders, scripts, or any intervention. Blue Prism is based on process diagrams that utilise core programming concepts and create the operational process flows to analyse, modify and scale business capability.”

The Staffordshire Digital team initially implemented RPA in the Finance department, as it involves a lot of administrative and back-office operations such as management of finance, records, tuition fees details and more. The University’s emphasis is to free up personnel and make them focus on more productive areas. This is beneficial for both the administrative staff’s feeling of personal contribution as well as student service satisfaction levels. “Using RPA gives the opportunity to universities to revisit, redesign, and improve their existing processes in line with expectations from digital native students. For prospective students, the next wave of RPA integration is intelligent machine learning algorithms to help route emails and integrate chatbots to address questions on course selection,” says Dr Fairchild.

The pandemic crisis has rapidly accelerated digitalisation across all industries. Organisations have been forced to digitalise entire processes more rapidly, as face-to-face engagement becomes restricted or even impossible.

The most visible areas where face-to-face activity is being swiftly replaced by digital alternatives include conferencing and collaboration, and the use of digital channels to engage with customers, suppliers, and other stakeholders.

For example, the crisis has made it difficult – even impossible, sometimes – for contact centre agents to physically work in contact centres, and they often do not have the tools to work effectively from home. This challenge is particularly apparent for offshore contact centres in the Philippines and India. The creation of chatbots has reduced the need for customer service staff and enabled data to by entered into front-office systems, and analysed immediately.

Less visible are back-office processes which are commonly inefficient and labour-intensive. Remote working makes some back-office workflows challenging or impossible. For example, some essential finance and accounting workflows involve a mix of digital communications, printing, scanning, copying and storage of physical documents – making these workflows inefficient, difficult to scale and labour-intensive. This has been highlighted during the pandemic. RPA adoption has grown faster than expected as organisations seek to resolve these and other challenges – often caused by inefficient workflows being scrambled by the crisis.

The RPA Market in Asia Pacific

There are many definitions of the RPA market, but it can broadly be defined as the use of software bots to execute processes which involve high volumes of repeatable tasks, that were previously executed by humans. When processes are automated, the physical location of employees and other stakeholders becomes less important. RPA makes these processes more agile and flexible and makes businesses more resilient. It can also increase operational efficiency, drive business growth, and enhance customer and employee experience.

RPA is a comparatively new and fast-growing market – this is leading to rapid change. In its infancy, it was basically the digitalisation of BPO. It was viewed as a way of automating repetitive tasks, many of which had been outsourced. While its cost saving benefits remain important as with BPOs, customers are now seeking more. They want RPA to help them to improve or transform front-office, back-office and industry-specific processes throughout the organisation. RPA vendors are addressing these enhanced requirements by blending RPA with AI and re-branding their offerings as intelligent automation or hyper-automation.

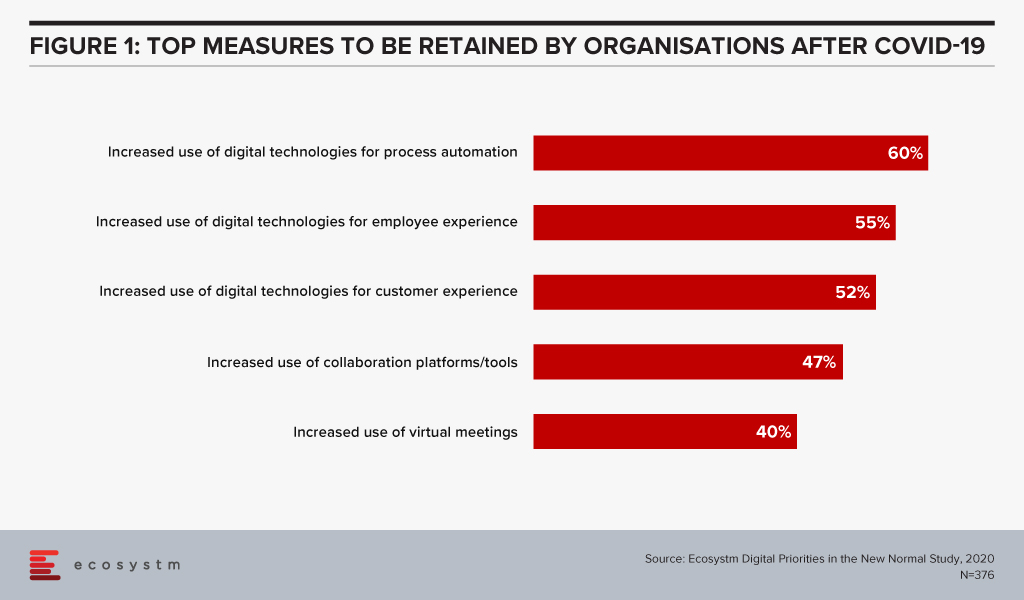

Asia Pacific organisations have been relatively slow to adopt RPA, but this is changing fast. The findings of the Ecosystm Digital Priorities in the New Normal study show that in the next 12 months, organisations will continue to focus on digital technologies for process automation (Figure 1).

The market is growing rapidly with large global RPA specialists such as UiPath, Automation Anywhere, Blue Prism and AntWorks experiencing high rates of growth in the region.

RPA vendors in Asia Pacific, are typically addressing immediate, short-term requirements. For example, healthcare companies are automating the reporting of COVID-19 tests and ordering supplies. Chatbots are being widely used to address unprecedented call centre volumes for airlines, travel companies, banks and telecom providers. Administrative tasks increasingly require automation as workflows become disrupted by remote working.

Companies can also be expected to scale their current deployments and increase the rate at which AI capabilities are integrated into their offerings

RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft and IBM. For example, some invoicing processes involve the use of Salesforce, SAP and Microsoft products. Rather than having an operative enter data into multiple systems, a bot can be created to do this.

Large software vendors such as IBM, Microsoft, Salesforce and SAP are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors. RPA may soon be integrated into larger enterprise applications, unless pureplay RPA vendors can innovate and continually differentiate their offerings.