Over the last 2 years, the primary focus for Retail & eCommerce organisations has been on creating the right customer experience and digital engagements – mainly to survive.

In 2022 the focus will be on creating market differentiation. This will extend to business strategies and process optimisation. The Retail & eCommerce industry will explore ways to leverage data to empower multiple roles across the organisation and engage with customers irrespective of where they are on their customer journeys.

Read on to find out what Ecosystm Analysts Alan Hesketh, Niloy Mukherjee and Tim Sheedy think will be the leading trends in the Retail & eCommerce industry in 2022.

It is true that the Retail industry is being forced to evolve the experiences they deliver to their customers. However, if Retail organisations are only focused on creating digital experiences, they are not creating the differentiation that will be required to leap ahead of the competition.

It is time for Retail organisations to leverage data to empower multiple roles across the organisation to prepare for the different ways customers want to engage with their brands.

So what are the phases of customer engagement? How are companies such as Singapore Airlines and TikTok preparing for the future of Retail?

Your CEO and Board are asking you to cut costs and do more with the IT budget.

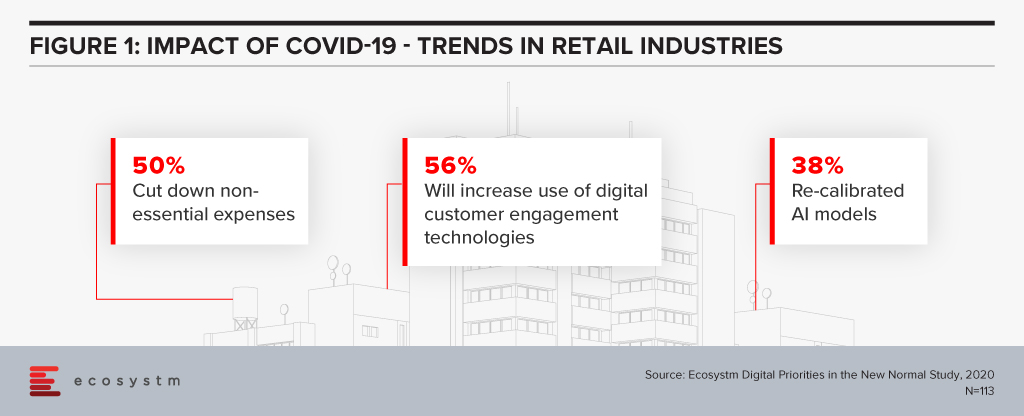

This is the usual refrain you get used to as a Chief Digital or Information Officer. COVID-19 has increased the need for cost savings, without compromising your organisation’s mission. In Ecosystm’s on-going research, Digital Priorities in the New Normal – a COVID-19 Study, there are several common themes that emerge for retailers.

The impact of the cost-cutting measures that organisations are implementing, on CDOs and CIOs has been discussed in my report Managing Costs in the New Normal, where I provide guidance on how to address the necessary cuts.

Super Retail Group (SRG) recently presented at SalesForce Live on their success in using AI to improve their customer engagement – linking digital customer engagement and re-calibration of AI models. I want to highlight a couple of aspects of SRG’s experience for those retailers addressing these themes.

Increasing Customer Engagement

In a well-run online presence, retailers acquire a significant amount of data about their customers’ online behaviour. Data such as customer’s purchase history as well as how they traverse the site, how long they remain on the site and how they leave – often without purchasing. The challenge is how you can collect and use this data to improve the customer experience (CX) and increase sales in our new normal.

SRG, trading under banners such as Super Cheap Auto, BCF and Rebel across Australasia, has adopted a Salesforce tool called Einstein to address this challenge. SRG is using this AI engine to present product recommendations in several contexts across a customer’s online journey.

The impact of COVID-19 means overall sales across the group has declined. At the same time, online sales have grown to be generating almost 20% of the overall sales. Within these online sales, the AI recommendation engine has directly influenced 1 in 5 customer purchases.

SRG has developed a significant base of customer data since they introduced omnichannel and club offers; and are now seeing the return from this investment. Recommendation engines operate best when they have quality data in volume – and the proportion of and growth in, online customers using these recommendations is a guide to the quality of the platform.

Coping with Increasing Online Demands

Ecosystm research finds that over 56% of retailers are increasing their use of digital technologies for CX and will continue to invest after the immediate crisis. As always, getting the right value from this increased expenditure will be critical to a retailer’s price competitiveness and profitability.

With online sales growing dramatically, SRG’s online share of sales has more than doubled over April and May, the potential return from an engaging online CX has increased significantly. In turn, this has increased the importance of the online CX to a retailer’s competitive positioning and market share.

Tech leaders will be expected to provide direction on how to achieve this improvement, with AI engines offering an increasingly important tool in increasing the speed of response to changing customer behaviours.

With their mapping of customer journeys, SRG has been able to target specific stages in the journey for the use of the AI recommendation engine. Their focus on increasing the size and value of a customer’s basket provides the explicit measure of success. And SRG’s customers are showing their enthusiasm for these recommendations. The share of online sales influenced by the AI engine grew by over 600% in the past 12 months.

Customer expectations are continually being redefined by their experiences across the online environment, not just by retailers. In our new normal, with online becoming significantly important, retailers need to be consistently improving their offer to remain competitive.

Our study results shows that retailers are taking this step and will need to pay careful attention to their cost base and profitability while making these changes. SRG’s success with the AI engine shows that this is possible.

Lessons to Learn

COVID-19 has changed customer behaviour significantly, and tech leaders are identifying new tools and processes to improve their CX in line with these changes. SRG has continued its customer-focused omnichannel approach by adopting the Salesforce Einstein AI engine. By using one of their key sales metrics – size and value of basket – they have been able to assess the contribution of this tool.

There are some clear lessons for other retailers from their experience:

- Be very clear on why you are introducing the new tool – how you are going to achieve value.

- Understand the foundation that you need, to introduce new technology. You will find being successful using AI without quality data in volume will be difficult.

- Experiment and learn quickly from experience gained. In this cost-constrained world, don’t over-commit to a new approach without evidence.

- Use products and services that have a low cost of entry and a variable cost model. Cloud services generally provide this cost model.

Our research, along with press release such as SRG’s, show that retail leaders are continuously improving their customer engagement. As a tech leader, you need to be aware that customers will vote with their clicks, for retailers that are delivering.

And getting those non-essential costs out has never been more critical.