Technological innovation is dramatically changing how organisations interact with modern consumers in the rapidly evolving banking, financial services, and insurance (BFSI) industry. The growing dependence on digital communication tools and platforms lies at the core of this transformation. These tools have become vital for BFSI organisations to meet the dynamic needs of today’s customers, enabling agile, responsive Sales & Support teams that can use real-time data to sustain customer engagement, ensure data security, comply with regulations, and streamline operations.

Customer Engagement Challenges in BFSI Organisations

Security Concerns. Customers in the BFSI industry are increasingly concerned about the security of their financial transactions and Personal Identifiable Information (PII). With the rise of cyber threats, customers expect robust security measures to protect their accounts and sensitive information. BFSI organisations need to continually invest in cybersecurity infrastructure and technologies to reassure customers and maintain their trust.

Customer Expectations. In the competitive landscape of the BFSI industry, customer retention and attraction are critical to sustaining profitability. Organisations must prioritise an agile approach that adapts swiftly to market changes. Central to this strategy is the delivery of personalised experiences aligned with individual preferences and needs, driven by advancements in digitalisation. To achieve this, BFSI organisations have to increase investments in AI-driven solutions to gain deep insights into customer behaviour, enabling them to accurately anticipate and meet evolving needs.

Regulatory Compliance. The industry operates in a highly regulated environment with strict compliance requirements imposed by various regulatory bodies. Ensuring compliance with constantly evolving regulations such as GDPR, PSD2, Dodd-Frank, etc., poses a significant challenge for organisations. To complicate the landscape further, institutions with cross-border operations need to consider the laws in different countries. Compliance efforts often result in additional operational complexities and costs, which can impact the overall customer experience if not managed effectively.

Digital Transformation. Rapid technological advancements and changing customer preferences are driving BFSI organisations to undergo digital transformation initiatives. However, legacy systems and processes hinder their ability to innovate and adapt to digital trends quickly. Transitioning to modern, agile architectures while ensuring uninterrupted services and minimal disruption to customers is a complex undertaking for many BFSI organisations.

Customer Education and Communication. Financial products and services can be complex, and customers often require guidance to make informed decisions. Sales & Support teams in BFSI organisations struggle to effectively educate their customers about the features, benefits, and risks associated with various products. Clear and transparent communication regarding fees, terms, and conditions is essential for building trust and maintaining customer satisfaction. Balancing regulatory requirements with the need for transparent communication can be challenging.

5 Ways to Empower Sales & Support Teams in BFSI

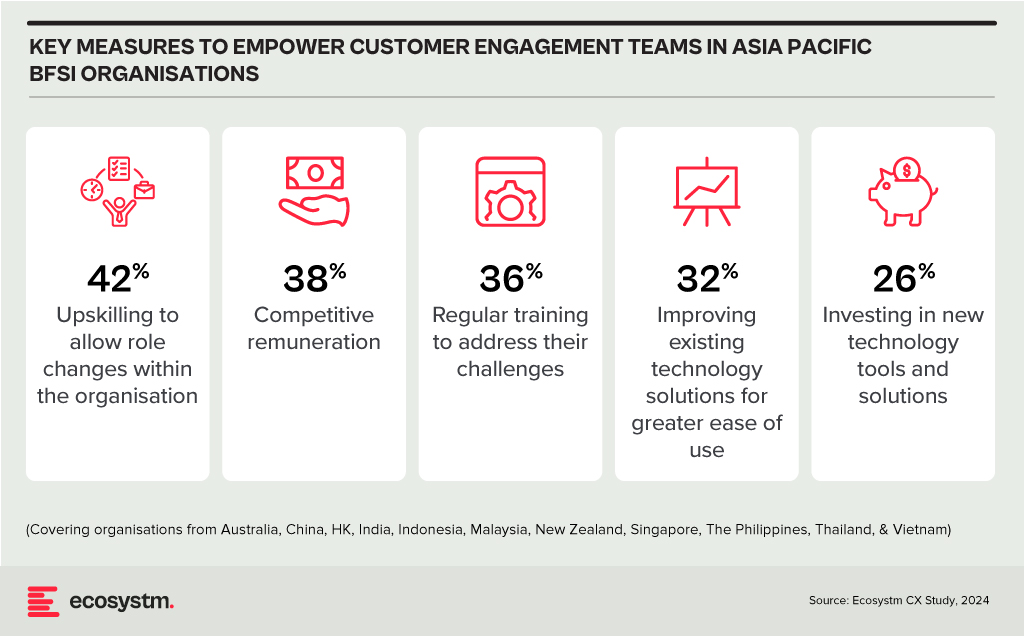

BFSI organisations in Asia Pacific often overlook technology enablement for the empowerment of their Sales & Support and other customer engagement teams. Key measures to empower these teams include upskilling for role flexibility and offering competitive remuneration for better employee retention.

Organisations should prioritise upgrading Sales & Support tools and solutions to address the team’s key pain points.

#1 Boost Customer Engagement with Omnichannel Support

BFSI organisations need to work on a suite of API-driven solutions to create a comprehensive omnichannel presence. This enables engagement with customers via their preferred channels, such as SMS, email, voice, chat, or video. Such flexibility enhances customer satisfaction and loyalty by ensuring personalised and convenient interactions. This includes capabilities such as the ability to deploy messaging and voice services to dispatch timely account activity alerts, secure transactions with two-factor authentication, and deliver customised financial advice through chatbots or direct communications.

#2 Streamline Customer Service with AI and Virtual Assistants

Integrating AI and virtual assistants allows BFSI companies to automate standard inquiries and transactions, freeing Sales & Support teams to tackle more sophisticated customer needs. These AI tools can interpret and process natural language, facilitating conversational interactions with automated services. This boosts efficiency and shortens response times, elevating the customer engagement experience. Also, consistently integrating these virtual assistants across various channels ensures a uniform customer experience – and brand image.

#3 Enhance Security Measures and Compliance Standards

Adhering to stringent security and compliance requirements is essential for BFSI organisations. A secure platform complies with critical global and country-level standards and regulations. The voice and video communication services must include comprehensive encryption, protecting all customer interactions. There is also a need to have a suite of tools for monitoring and auditing communications to meet compliance requirements, allowing BFSI organisations to protect sensitive data while providing secure communication options.

#4 Leverage Insights for Personalised Customer Interactions

BFSI organisations must focus on aggregating, harmonising, and scrutinising customer interactions across various channels. This holistic view of customer behaviour allows for more targeted and personalised services, enhancing customer engagement and loyalty. By leveraging insights into customers’ interaction histories, preferences, and financial objectives, companies can customise their outreach and recommendations, improving upselling, cross-selling, and retention strategies.

#5 Increase Operational Efficiency with Cloud-Based Solutions

Cloud-based communication solutions offer BFSI organisations the scalability and flexibility needed to respond swiftly to market shifts and customer demands. This adaptability is vital for fostering growth in a dynamic industry. A customisable solution supports organisations in refining their operations, from automating workflows to integrating CRM systems, enabling Sales & Support teams to operate more smoothly and effectively. Cloud technology helps reduce operational expenses, elevate service quality, and spur innovation.

Digital communication and collaboration tools have the power to revolutionise BFSI, enhancing engagement, security, and efficiency. Through APIs, AI, and cloud, organisations can meet evolving market needs, driving growth and innovation. Embracing these solutions ensures competitiveness and agility in a changing landscape.

As we return to the office, there is a growing reliance on devices to tell us how safe and secure the environment is for our return. And in specific application areas, such as Healthcare and Manufacturing, IoT data is critical for decision-making. In some sectors such as Health and Wellness, IoT devices collect personally identifiable information (PII). IoT technology is so critical to our current infrastructures that the physical wellbeing of both individuals and organisations can be at risk.

Trust & Data

IoT are also vulnerable to breaches if not properly secured. And with a significant increase in cybersecurity events over the last year, the reliance on data from IoT is driving the need for better data integrity. Security features such as data integrity and device authentication can be accomplished through the use of digital certificates and these features need to be designed as part of the device prior to manufacturing. Because if you cannot trust either the IoT devices and their data, there is no point in collecting, running analytics, and executing decisions based on the information collected.

We discuss the role of embedding digital certificates into the IoT device at manufacture to enable better security and ongoing management of the device.

Securing IoT Data from the Edge

So much of what is happening on networks in terms of real-time data collection happens at the Edge. But because of the vast array of IoT devices connecting at the Edge, there has not been a way of baking trust into the manufacture of the devices. With a push to get the devices to market, many manufacturers historically have bypassed efforts on security. Devices have been added on the network at different times from different sources.

There is a need to verify the IoT devices and secure them, making sure to have an audit trail on what you are connecting to and communicating with.

So from a product design perspective, this leads us to several questions:

- How do we ensure the integrity of data from devices if we cannot authenticate them?

- How do we ensure that the operational systems being automated are controlled as intended?

- How do we authenticate the device on the network making the data request?

Using a Public Key Infrastructure (PKI) approach maintains assurance, integrity and confidentiality of data streams. PKI has become an important way to secure IoT device applications, and this needs to be built into the design of the device. Device authentication is also an important component, in addition to securing data streams. With good design and a PKI management that is up to the task you should be able to proceed with confidence in the data created at the Edge.

Johnson Controls/DigiCert have designed a new way of managing PKI certification for IoT devices through their partnership and integration of the DigiCert ONE™ PKI management platform and the Johnson Controls OpenBlue IoT device platform. Based on an advanced, container-based design, DigiCert ONE allows organisations to implement robust PKI deployment and management in any environment, roll out new services and manage users and devices across your organisation at any scale no matter the stage of their lifecycle. This creates an operational synergy within the Operational Technology (OT) and IoT spaces to ensure that hardware, software and communication remains trusted throughout the lifecycle.

Rationale on the Role of Certification in IoT Management

Digital certificates ensure the integrity of data and device communications through encryption and authentication, ensuring that transmitted data are genuine and have not been altered or tampered with. With government regulations worldwide mandating secure transit (and storage) of PII data, PKI can help ensure compliance with the regulations by securing the communication channel between the device and the gateway.

Connected IoT devices interact with each other through machine to machine (M2M) communication. Each of these billions of interactions will require authentication of device credentials for the endpoints to prove the device’s digital identity. In such scenarios, an identity management approach based on passwords or passcodes is not practical, and PKI digital certificates are by far the best option for IoT credential management today.

Creating lifecycle management for connected devices, including revocation of expired certificates, is another example where PKI can help to secure IoT devices. Having a robust management platform that enables device management, revocation and renewal of certificates is a critical component of a successful PKI. IoT devices will also need regular patches and upgrades to their firmware, with code signing being critical to ensure the integrity of the downloaded firmware – another example of the close linkage between the IoT world and the PKI world.

Summary

PKI certification benefits both people and processes. PKI enables identity assurance while digital certificates validate the identity of the connected device. Use of PKI for IoT is a necessary trend for sense of trust in the network and for quality control of device management.

Identifying the IoT device is critical in managing its lifespan and recognizing its legitimacy in the network. Building in the ability for PKI at the device’s manufacture is critical to enable the device for its lifetime. By recognizing a device, information on it can be maintained in an inventory and its lifecycle and replacement can be better managed. Once a certificate has been distributed and certified, having the control of PKI systems creates life-cycle management.