Banks, insurers, and other financial services organisations in Asia Pacific have plenty of tech challenges and opportunities including cybersecurity and data privacy management; adapting to tech and customer demands, AI and ML integration; use of big data for personalisation; and regulatory compliance across business functions and transformation journeys.

Modernisation Projects are Back on the Table

An emerging tech challenge lies in modernising, replacing, or retiring legacy platforms and systems. Many banks still rely on outdated core systems, hindering agility, innovation, and personalised customer experiences. Migrating to modern, cloud-based systems presents challenges due to complexity, cost, and potential disruptions. Insurers are evaluating key platforms amid evolving customer needs and business models; ERP and HCM systems are up for renewal; data warehouses are transforming for the AI era; even CRM and other CX platforms are being modernised as older customer data stores and models become obsolete.

For the past five years, many financial services organisations in the region have sidelined large legacy modernisation projects, opting instead to make incremental transformations around their core systems. However, it is becoming critical for them to take action to secure their long-term survival and success.

Benefits of legacy modernisation include:

- Improved operational efficiency and agility

- Enhanced customer experience and satisfaction

- Increased innovation and competitive advantage

- Reduced security risks and compliance costs

- Preparation for future technologies

However, legacy modernisation and migration initiatives carry significant risks. For instance, TSB faced a USD 62M fine due to a failed mainframe migration, resulting in severe disruptions to branch operations and core banking functions like telephone, online, and mobile banking. The migration failure led to 225,492 complaints between 2018 and 2019, affecting all 550 branches and required TSB to pay more than USD 25M to customers through a redress program.

Modernisation Options

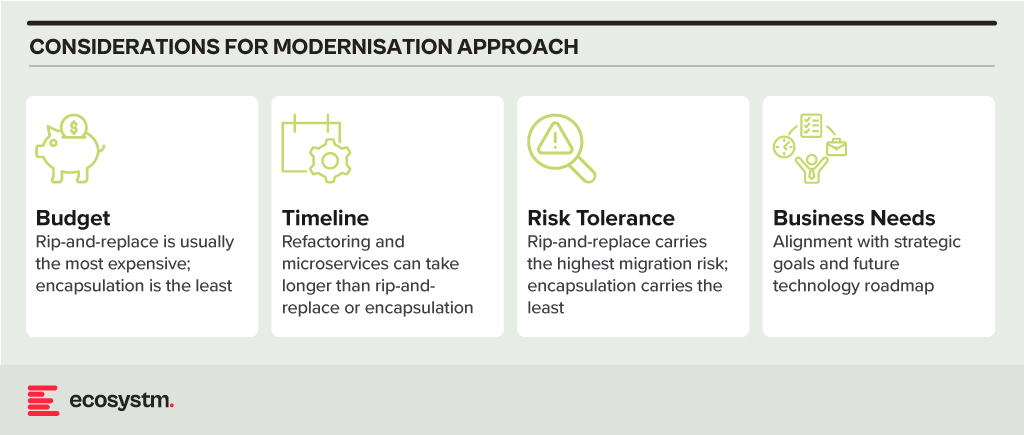

- Rip and Replace. Replacing the entire legacy system with a modern, cloud-based solution. While offering a clean slate and faster time to value, it’s expensive, disruptive, and carries migration risks.

- Refactoring. Rewriting key components of the legacy system with modern languages and architectures. It’s less disruptive than rip-and-replace but requires skilled developers and can still be time-consuming.

- Encapsulation. Wrapping the legacy system with a modern API layer, allowing integration with newer applications and tools. It’s quicker and cheaper than other options but doesn’t fully address underlying limitations.

- Microservices-based Modernisation. Breaking down the legacy system into smaller, independent services that can be individually modernised over time. It offers flexibility and agility but requires careful planning and execution.

Financial Systems on the Block for Legacy Modernisation

Data Analytics Platforms. Harnessing customer data for insights and targeted offerings is vital. Legacy data warehouses often struggle with real-time data processing and advanced analytics.

CRM Systems. Effective customer interactions require integrated CRM platforms. Outdated systems might hinder communication, personalisation, and cross-selling opportunities.

Payment Processing Systems. Legacy systems might lack support for real-time secure transactions, mobile payments, and cross-border transactions.

Core Banking Systems (CBS). The central nervous system of any bank, handling account management, transactions, and loan processing. Many Asia Pacific banks rely on aging, monolithic CBS with limited digital capabilities.

Digital Banking Platforms. While several Asia Pacific banks provide basic online banking, genuine digital transformation requires mobile-first apps with features such as instant payments, personalised financial management tools, and seamless third-party service integration.

Modernising Technical Approaches and Architectures

Numerous technical factors need to be addressed during modernisation, with decisions needing to be made upfront. Questions around data migration, testing and QA, change management, data security and development methodology (agile, waterfall or hybrid) need consideration.

Best practices in legacy migration have taught some lessons.

Adopt a data fabric platform. Many organisations find that centralising all data into a single warehouse or platform rarely justifies the time and effort invested. Businesses continually generate new data, adding sources, and updating systems. Managing data where it resides might seem complex initially. However, in the mid to longer term, this approach offers clearer benefits as it reduces the likelihood of data discrepancies, obsolescence, and governance challenges.

Focus modernisation on the customer metrics and journeys that matter. Legacy modernisation need not be an all-or-nothing initiative. While systems like mainframes may require complete replacement, even some mainframe-based software can be partially modernised to enable services for external applications and processes. Assess the potential of modernising components of existing systems rather than opting for a complete overhaul of legacy applications.

Embrace the cloud and SaaS. With the growing network of hyperscaler cloud locations and data centres, there’s likely to be a solution that enables organisations to operate in the cloud while meeting data residency requirements. Even if not available now, it could align with the timeline of a multi-year legacy modernisation project. Whenever feasible, prioritise SaaS over cloud-hosted applications to streamline management, reduce overhead, and mitigate risk.

Build for customisation for local and regional needs. Many legacy applications are highly customised, leading to inflexibility, high management costs, and complexity in integration. Today, software providers advocate minimising configuration and customisation, opting for “out-of-the-box” solutions with room for localisation. The operations in different countries may require reconfiguration due to varying regulations and competitive pressures. Architecting applications to isolate these configurations simplifies system management, facilitating continuous improvement as new services are introduced by platform providers or ISV partners.

Explore the opportunity for emerging technologies. Emerging technologies, notably AI, can significantly enhance the speed and value of new systems. In the near future, AI will automate much of the work in data migration and systems integration, reducing the need for human involvement. When humans are required, low-code or no-code tools can expedite development. Private 5G services may eliminate the need for new network builds in branches or offices. AIOps and Observability can improve system uptime at lower costs. Considering these capabilities in platform decisions and understanding the ecosystem of partners and providers can accelerate modernisation journeys and deliver value faster.

Don’t Let Analysis Paralysis Slow Down Your Journey!

Yes, there are a lot of decisions that need to be made; and yes, there is much at stake if things go wrong! However, there’s a greater risk in not taking action. Maintaining a laser-focus on the customer and business outcomes that need to be achieved will help align many decisions. Keeping the customer experience as the guiding light ensures organisations are always moving in the right direction.

The AI landscape is undergoing a significant transformation, moving from traditional predictive AI use cases towards Generative AI (GenAI). Currently, most GenAI use cases promise an improvement in employee productivity, without focusing on how to leverage this into new or additional revenue generating streams. This raises concerns about the long-term return on investment (ROI) if this is not adequately addressed.

The Rise of Generative AI Over Predictive AI

Traditionally, predictive AI has been integral to business strategies, leveraging data to forecast future outcomes with remarkable accuracy. Industries across the board have used predictive models for a range of applications, from demand forecasting in retail to fraud detection in finance. However, the tide is changing with the emergence of GenAI technologies. GenAI, capable of creating content, designing products, and even coding, holds the promise to revolutionise how businesses operate, innovate, and compete.

The appeal of GenAI lies in its versatility and creativity, offering solutions that go beyond the capabilities of predictive models. For example, in the area of content creation, GenAI can produce written content, images, and videos at scale, potentially transforming marketing, entertainment, and education sectors. However, the current enthusiasm for GenAI’s productivity enhancements overshadows a critical aspect of technology adoption: monetisation.

The Productivity Paradox

While the emphasis on productivity improvements through GenAI applications is undoubtedly beneficial, there is a notable gap in exploring use cases that directly contribute to creating new revenue streams. This productivity paradox – prioritising operational efficiency and cost reduction – may not guarantee the sustained growth and ROI necessary from AI investments.

True innovation in AI should not only aim at making existing processes more efficient but also at uncovering opportunities for monetisation. This involves leveraging GenAI to develop new products, services, or business models to access untapped markets or enhance customer value in ways that directly impact the bottom line.

The Imperative for Strategic Reorientation

Ignoring the monetisation aspect of GenAI applications poses a significant risk to the anticipated ROI from AI investments. As businesses allocate resources to AI adoption and integration, it’s also important to consider how these technologies can generate revenue, not just save costs. Without a clear path to monetisation, the investments in AI, particularly in the cutting-edge domain of GenAI, may not prove viable in the next financial year and beyond.

To mitigate this risk, companies need to adopt a dual approach. First, they must continue to explore and exploit the productivity gains offered by GenAI, which are crucial for maintaining a competitive edge and achieving operational excellence. At the same time, businesses must strategically explore and invest in GenAI-driven opportunities for monetisation. This could mean innovating in product design, personalised customer experiences, or entirely new business models that were previously unfeasible.

Conclusion

The excitement around GenAI’s potential to transform industries is well-founded, but it must be tempered with strategic planning to ensure long-term viability and ROI. Businesses that recognise and act on the opportunity to not only improve productivity but also to monetise GenAI innovations will lead the next wave of growth in their respective sectors. The challenge lies in balancing the drive for efficiency with the pursuit of new revenue streams, ensuring that investments in AI deliver sustainable returns. As the AI landscape evolves, the ability to innovate in monetisation as much as in technology will distinguish the leaders from the followers.