We are heading into the one-year anniversary of global COVID confinements. This confinement period has seen the Hospitality industry impacted strongly by the lack of mobility of populations and government regulations. Hotels had previously used a consistent flow of booking and revenue information using historical and current pricing data from distribution and revenue management tools. They adapted in the “new normal” and the evolution of hotel infrastructure during this period – forced by necessity – has led them to try to create a contactless, more automated interaction, both for efficiency and for the work-from-home status of many employees.

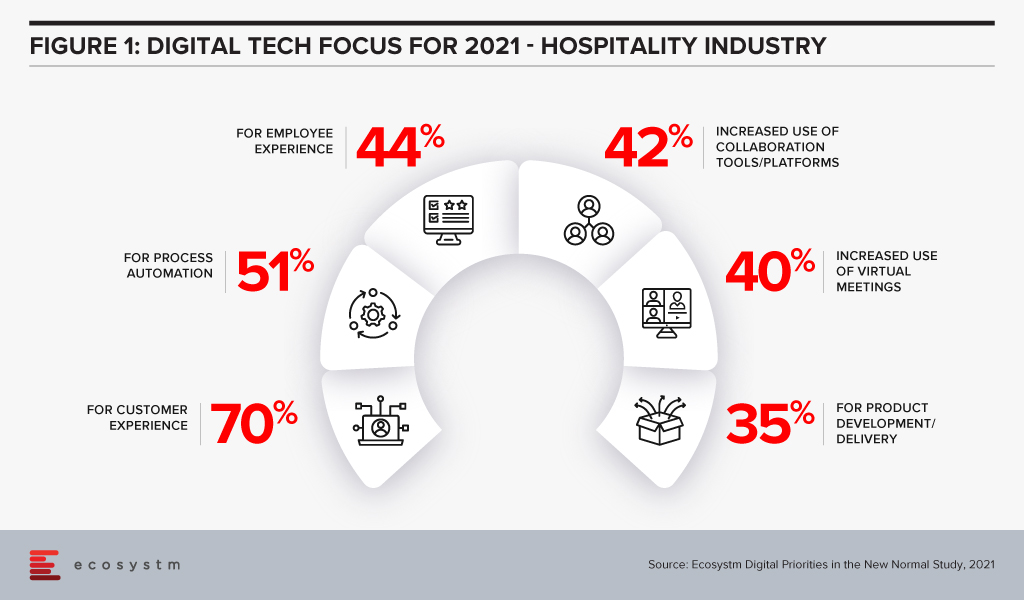

Ecosystm research shows the digital technology focus of the industry to address the necessary shifts, in 2021 (Figure 1).

Distribution Data in the New Normal

Hotels are still struggling to get a clear overview of demand forecasting. Their data infrastructure is evolving and will continue to evolve to tackle this problem. The reliance on distribution information had to shift as fluidity in bookings could not rely on historical norms.

Hotels use a complex structure of promotion via distribution channels. This included direct booking via websites or central call centres, and use of online travel agents (OTAs), bed banks and wholesalers. That mix of channels was monitored and managed by the properties to leverage across these channels to optimise room occupancy. Over the past decades there has been an increased reliance on OTAs. But in more recent years, many hotel players have pushed back, promoting direct bookings made through own website booking engines or other direct means.

The pandemic has disrupted this complex orchestration of data. Moving from 65-75% occupancy to 10-15% was not financially viable for hotels. Because the pandemic reduced demand, both direct booking and OTA bookings have grown their share at the expense of other channels such as bed banks and global distribution systems (GDS). Guests wanted confirmation of the status of the hotel and what services were available, so data with extra content from the hotel itself or frequently updated OTA services were reliable.

Building Better Bundles and Contact Points

The goals for many hotels were to create frictionless digital customer journey (preferably by brand), leveraging existing infrastructures and integrating them to mobile apps, more robust CRM, and a more flexible property management set of tools. Part of that integration was having newly launched hygiene initiatives and branding those as part of the offering.

New bundles and packages were created to deal with the hygiene constraints and the new form of guest stays (daycation, staycation, remote learning) that have developed from the pandemic conditions.

Workcations using the hotel facilities as a workplace became attractive for those stuck at home with many interruptions. InterContinental Hotels Group, Marriott and Accor are among the major names that have launched or are considering monthly payment plans, as the hotel industry tries to attract restless remote workers ready for a change of scene.

The disconnect in guest information is being addressed by rebuilding the infrastructure of the guest journey – tracking their pre-stay investigation and booking interaction, the kind of on-property engagement they have with the hotel and its staff, their in-room experience, and their sharing of feedback on social media post-stay are all part of their guest experience.

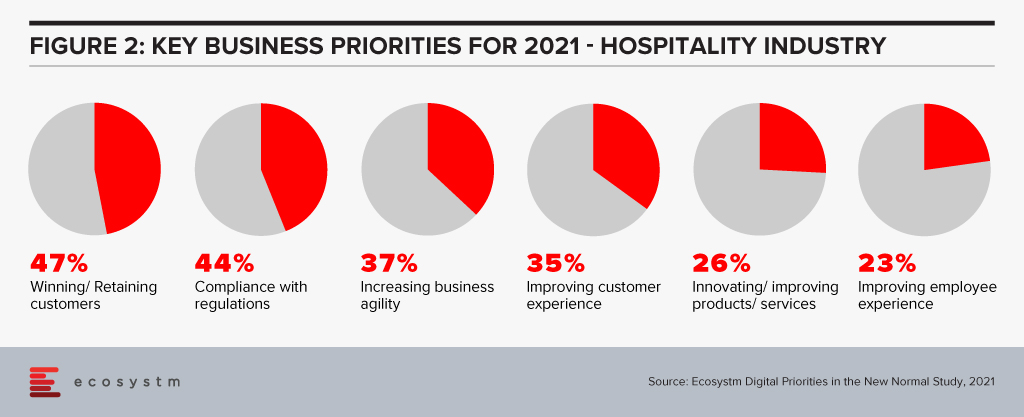

Multiple business priorities will guide the industry in 2021 (Figure 2).

For the hotels serving different customer segments, specific actions were initiated.

- For the economy hotel chains, the flow of customers was not that significantly different, but how they booked and how many rooms they needed changed. This was handled more at the individual hotel property level as different COVID constraints applied to different regions.

- Larger chains already had their property management systems (PMS) set up as tied to a centralised structure, but a chunk of their business (leisure, corporate and business events) was directly tied to the restrictions on the domestic population and inability to access international guests.

- For luxury brands, it was a bit of a challenge as the hygiene aspect impacted the use of several extras that luxury brands rely on, such as spas, one-to-one interaction and facilities.

- Independent hotels needed some guidance that they were not getting from historical norms. Many went to external infrastructure providers to try to create workflow processes that would help them stay afloat.

Technology investments: Some Examples

One of the first concerns of regional travellers was the operational status of the hotel. One example of a digital investment was the Louvre Hotels Group, Europe’s second-largest hotel group that used used its ‘Résa Pro’ dedicated reservation platform for working professionals. It showed the listing of available accommodation per city and region for business travellers to meet the accommodation and catering needs of retail and sales professionals. Using this digital platform, companies could locate the Group’s open hotels in the city or region of their choice and see what guest offering best suited their requirements.

This webcast of Radisson’s Remy Merckx and Managing Director Sally Richards from RaspberrySky is a great example of building a digital platform to restructure the guest experience. Radisson outsourced the building of a digital platform that linked their eight hotel brands under one platform for a consistent digital experience, leveraging mobile, social and cloud technologies. The higher engagement rate with the mobile app and the chatbot helped create the contactless experience the guests are now looking in their accommodation journeys.

Many brands are now focusing on app-centric approaches for the guests, adding the value of human engagement for the more complex tasks. The emphasis is on the brand and digitising the guest journey to make it more customer-centric. This has been a time of reflection for some of the more organised hotel chains to make the time investment into the digital journey, upskill and upscale their operations to be in line with customer engagement.

New Normal for Hotel Stays

But not every independent hotel or small hotel chain had that financial investment to make during this period. According to Ecosystm data, approximately 41% of hospitality firms put their digital transformation on hold in 2020 – higher than any other industry that we cover. Technologies that will see increased investments in 2021 included cloud collaboration (44%) and cloud enterprise solutions (23%).

What does cloud have to do with this? Cloud is part of the infrastructural investment that allows the Hospitality industry to connect and enable its participants throughout the ecosystem, enabling mobile and social as well. This enables service providers to engage with intermediary partners, travel agents and consolidators and consumers, hyperconnecting in ways that provide convenience, ease of use and seamless information retrieval to bed banks and timetables, from business rules to collaborative mapping of codes.

This use of technology transforms the elements of inventory and availability into experiences and destinations.

- Messaging tools help harmonise communication across the network.

- Monitoring apps manage factors that impact distribution health, including rate integrity, availability, and visibility.

- AI – for example in the form of voice assistants – helps guide consumers and partners to timely information and decision making.

But it will still be a blend of digital solutions and human interaction, where humans add the core competency and collective knowledge, and technology provides the seamless data exchange and network connectivity.

Acknowledgements

- Sally Richards at RaspberrySky

- Anders Johansson at Hospitality Visions

- Mark Haywood and Ankit Chaturvedi at RateGain

New Normal for The Hospitality Industry

Get more insights on the priorities and the road to recovery of the Hospitality industry. Create your free Ecosystm account to take part in this study and gain access to a benchmark of how you compare to your peers.