The process of developing advertising campaigns is evolving with the increasing use of artificial intelligence (AI). Advertisers want to optimise the amount of data at their disposal to craft better campaigns and drive more impact. Since early 2020, there has been a real push to integrate AI to help measure the effectiveness of campaigns and where to allocate ad spend. This now goes beyond media targeting and includes planning, analytics and creative. AI can assist in pattern matching, tailoring messages through AI-enabled hyper-personalisation, and analysing traffic to communicate through pattern identification of best times and means of communication. AI is being used to create ad copy; and social media and online advertising platforms are starting to roll out tools that help advertisers create better ads.

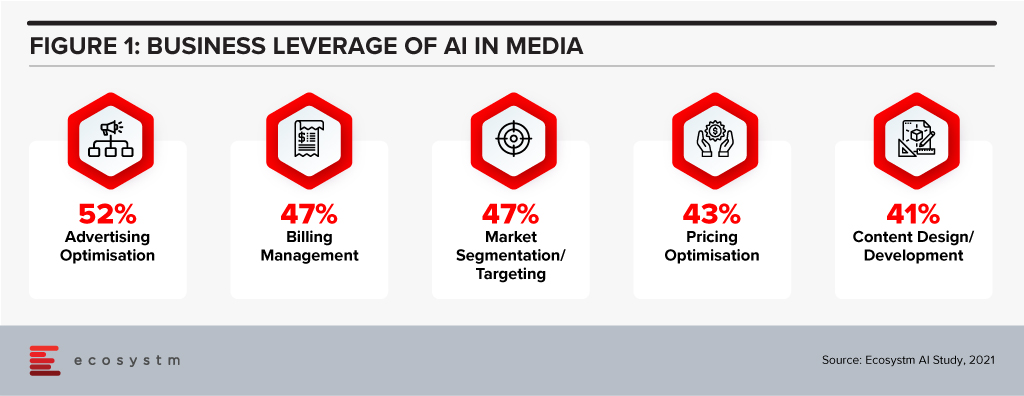

Ecosystm research shows that Media companies report optimisation, targeting and administrative functions such as billing are aided by AI use (Figure 1). However, the trend of Media companies leveraging AI for content design and media analysis is growing.

WPP Strengthening Tech Capabilities

This week, WPP announced the acquisition of Satalia, a UK-based company, who will consult with all WPP agencies globally to promote AI capabilities across the company and help shape the company’s AI strategy, including research and development, AI ethics, partnerships, talent and products.

It was announced that Satalia, whose clients include BT, DFS, DS Smith, PwC, Gigaclear, Tesco and Unilever, will join Wunderman Thompson Commerce to work on the technology division of their global eCommerce consultancy. Prior to the acquisition, Satalia had launched tools such as Satalia Workforce to automate work assignments; and Satalia Delivery, for automated delivery routes and schedules. The tools have been adopted by companies including PwC, DFS, Selecta and Australian supermarket chain Woolworths.

Like other global advertising organisations, WPP has been focused on expanding the experience, commerce and technology parts of the business, most recently acquiring Brazilian software engineering company DTI Digital in February. WPP also launched their own global data consultancy, Choreograph, in April. Choreograph is WPP’s newly formed global data products and technology company focused on helping brands activate new customer experiences by turning data into intelligence. This article from last year from the WPP CTO is an interesting read on their technology strategy, especially their move to cloud to enable their strategy.

Ethics & AI – The Right Focus

The acquisition of Satalia will give WPP and opportunity to evaluate important areas such as AI ethics, partnerships and talent which will be significantly important in the medium term. AI ethics in advertising is also a longer-term discussion. With AI and machine learning, the system learns patterns that help steer targeting towards audiences that are more likely to convert and identify the best places to get your message in front of these buyers. If done responsibly it should provide consumers with the ability to learn about and purchase relevant products and services. However, as we have recently discussed, AI has two main forms of bias – underrepresented data and developer bias – that also needs to be looked into.

Summary

The role of AI in the orchestration of the advertising process is developing rapidly. Media firms are adopting cloud platforms, making IP investments, and developing partnerships to build the support they can offer with their advertising services. The use of AI in advertising will help mature and season the process to be even more tailored to customer preferences.

Australia’s data centre market has grown exponentially, to a large part due to the Government’s strong policies around cloud adoption. This is in line with the vision of creating a Digital Economy by 2025. Australia’s Tech Future talks about technological changes in 4 key areas including building infrastructure and providing secure access to high-quality data. Availability of local data centres is key to building better infrastructure to support the Digital Economy.

Cloud adoption, especially in the small and medium enterprise (SME) sector is expected to continue to rise. The Ecosystm Business Pulse Study shows that only 16% of Australian organisations had not increased their cloud investments after the COVID-19 crisis and its impact on the economy.

Ecosystm Principal Advisor, Tim Sheedy says, “The current pandemic has highlighted the digital ‘haves and have nots’ in Australia. The NBN has helped to narrow the gap, but too many in rural and regional Australia continue to suffer the tyranny of distance. Businesses and government departments have been reluctant to relocate outside of the major cities due to the lack of internet and data centre infrastructure. Investing in data centres in rural and regional locations will not only help to close the digital divide but also remove a significant barrier that stops businesses from investing in and relocating to locations out of cities.”

Growing Australia’s Data Centre Footprint

This week, Australia’s Leading Edge Data Centres and Schneider Electric announced a AU$30 million project where Schneider Electric will provide Tier-3-designed prefabricated data centre modules for Leading Edge’s six locations in Australia. Each site will host 75 racks with 5kW power density to support computing operations and minimise data exchange delays. Ecosystm Principal Advisor, Darian Bird says, “The inaccessible nature of some sites makes them suitable for prefabricated data centres, which are plug-and-play containers that can be set up and maintained by a relatively small IT team. Standardisation in edge data centres and automation are key to remote management for anyone deploying distributed infrastructure.”

This announcement follows the news that Leading Edge has secured an investment of AU$20 million from Washington H. Soul Pattinson to construct 20 Tier-3 data centres across Australia. They have also received funding from the SparkLabs Cultiv8 2020 accelerator group. The funding will be used to build more than 20 Tier 3 data centres across regional Australia to provide faster internet speeds and direct cloud connectivity.

This will impact businesses that host mission-critical applications, and stricter uptime requirements, and is expected to benefit IoT, AgriTech and telecom industry applications.

Impact on Industry

Edge connectivity will create a seamless experience for the users to take advantage of faster computing with a local host, lower latency by taking connectivity to where operations reside, and data sovereignty by keeping data within the region, aiding in the development of Australia’s Digital Economy.

Sheedy sees this as an opportunity for primary industries. “One of the real challenges for farms and other agribusinesses investing in IoT and other tech-based solutions has been the lack of local or nearby computing infrastructure that will support applications that require low latency. Leading Edge’s investments in providing data centres in rural and regional Australia will mean these businesses can accelerate their digital transformations.”

With the simultaneous rollout of 5G, Smart City initiatives will also benefit from edge data centres. “Investment in edge infrastructure is likely to take off and follow the 5G coverage map across Australia. We will see operators take advantage of their vast network footprint and combine micro data centres with some 5G antenna locations,” says Bird. “Smart City initiatives will be made possible by 5G connected IoT devices but computing at the edge will be needed to keep, for example, public safety systems, operating in real-time. Many monitoring systems will require local data analysis to be effective.”

Bird also sees potential impacts on the Entertainment industry. “The COVID-19 restrictions and the launch of new services such as Disney+ and Binge in Australia will ensure streaming video continues its impressive growth trajectory. Even facilities such as sports stadiums are beginning to deliver in-person digital experiences to grab back attention from their online competitors. Positive user experience is crucial here and low latency is a must. We’ll see a shift towards edge computing delivered on-site as part of a distributed network. Regional data centres and local caching have always been vital for content delivery to ensure the quality of service and reduce bandwidth costs but the scale is unprecedented.”

Bird talks about potential retail opportunities in the future. “We may see anchor tenants at malls offering their excess capacity to smaller, nearby stores that need the benefits of edge but can’t justify the investment, similar to the way Amazon launched AWS.”

Scenario one: I have two friends in their late 50s, home on quarantine in the UK. As they need exercise, it is a wonderful time for them to update their old Nordic cross-track system. They eyeballed the website, thought it was the same footprint and weight as the existing one that was upstairs in their home and placed the order.

The delivery man left the 100kg+ package next to their doorstep doing social distancing properly. Not only is it not portable but had to be constructed piece by piece in their living room as they could not carry the bigger parts up the stairs.

Scenario two: Friends who are seasoned travelers with wandering feet want to go travelling once quarantine is over. They want to go to a resort in Cabo San Lucas, but they cannot find a good travelogue of experiences and dining options at the resort other than Yelp or TripAdvisor with very two-dimensional reviews.

As you can see from the recent article in The Times, a number of people are taking this time to plan where they want to go.

These are two examples of why now is the time for implementing a mobile AR app solution.

Invest Now in AR

At this moment you have a captive audience with more time on their hands than normal, and eager to consume. And many are building home offices or making medium-term travel plans and need more than what a flat website experience offers them.

So now is the time for investment in augmented reality mobile apps. How many firms are seeing this and what has been their experience?

Based on the tech buyer feedback from the ongoing global Ecosystm Mobility Study:

- Only about 1% of organisations have a mobile AR app, with another 5% evaluating it in 2020

- Average current implementations tend to look at a CapEx spend of about 45% – however, those who are planning to implement a mobile AR app expect to pay about 53% CapEx

- 7 out of 10 organisations say that implementation cost was less than US$10,000

- 8 out of 10 organisations say the implementation took more than 3 months (with 4 out of 10 saying it took 6 months to a year)

Extending to digital experience

Traditional print publications already understand the need to extend the digital experience for readers. The New York Times has been rethinking how it can connect the print and digital reading experiences. In partnership with Google Lens, smartphone users can access additional information online that corresponds to the print version of their New York Times Magazine. In the next three months, all New York Times Magazines will have some features that are Google Lens-enabled.

It is a great moment for both product and experiential marketers to be taking advantage of time at home by using an augmented reality mobile apps to bring the product into the home or home office, and the experience to life in your own kitchen or living room. And in return, getting great real-time feedback on what customers are looking for.

We’ve all seen the demo of the IKEA mobile app on where to place your couch. But product location placement is missing from any number of key categories. This is including computer monitors and TVs, as well as office furniture and professional lighting equipment for that better quality of video con-call.

What other kinds of market engagement uses are there?

Packaging links to AR

Create custom “trackers”, either printed or on-screen icons, when scanned with a white labeled app to trigger a video or a 3D model overlaid on the real world. Design a scannable package with customer experience in mind and include tracking engagement and sharing links. Set up an AR trigger based on a packaging feature and invite the customer to scan the same with their phones. Note that you can also add AR as a feature into your existing Android or IOS app. Dependency on dedicated app or app plug-ins is gone. Brands can now leverage the potential offered by augmented reality using just a URL. Users can open the URL in any mobile-based browser and augment interactive digital content on their camera view.

Reverse product placement

As the opposite of how locations tried to link to Pokemon Go, your product could be an element in a popular Augmented Reality game. It could attract new customers who would link to more AR provided information on the product.

Weather as a factor

These types of apps can show what the weather may be like at a location. Possible app usage for showing residential real estate. It could show impact in a flood zone as to how much water may enter the area. Or it can warn people on urgent physical issues.

Practical advice before consumption

Too much time on your hands and hate your hair? See what the color will look like before you make a hair color mistake. Perhaps more AI than AR. Note that right now you may be able to buy hair dye. But you will likely not have access to the person who can repair any mistakes you make at this point. Think carefully.

Final Thoughts

Now is this time to engage bored consumers and eager potential users. Take advantage of what this uncertain time can bring to your firm. Use Augmented Reality as a benefit to create value and content stickiness for your customers.