We are increasingly seeing digital becoming a priority as governments look at socio-economic recovery. It is not just imperative that countries push the adoption of digital technologies – the crisis has also presented an opportunity for them to do so. In March this year, when governments across the world had started announcing stimulus packages designed to keep the economy afloat, Ecosystm Principal Advisor Tim Sheedy had said in his blog, Government Should Focus Coronavirus Stimulus on Digital Initiatives, “Good stimulus packages will have a broad impact but also drive improved business and employment outcomes. Stimulus packages have an opportunity to drive change – and the COVID-19 virus has shown that some businesses are not well equipped for the digital era.”

The pandemic has fast demonstrated the power of being aligned to the digital economy. Ecosystm CEO Amit Gupta says, “Organisations that were digital-ready were able to manage their business continuity almost immediately in enabling a remote workforce. The transfer was almost seamless for such businesses as the teams had already imbibed the principles of remote collaboration and were already familiar with tools that enable collaboration and communication. For many of these organisations, it was almost a matter of employees packing up their work-issued laptop and heading home.”

“In addition, those that were fully digitalised were better prepared to continue not only interacting with their clients remotely but also in many cases were able to deliver their offerings to their customers through their website or mobile apps.”

Gupta also notes that Ecosystm research shows that before the COVID-19 outbreak only about 35% of SMEs considered themselves ready for the digital economy, compared to half of the large enterprises. “This needs to change – and change fast!”

Singapore’s Digital Government Blueprint

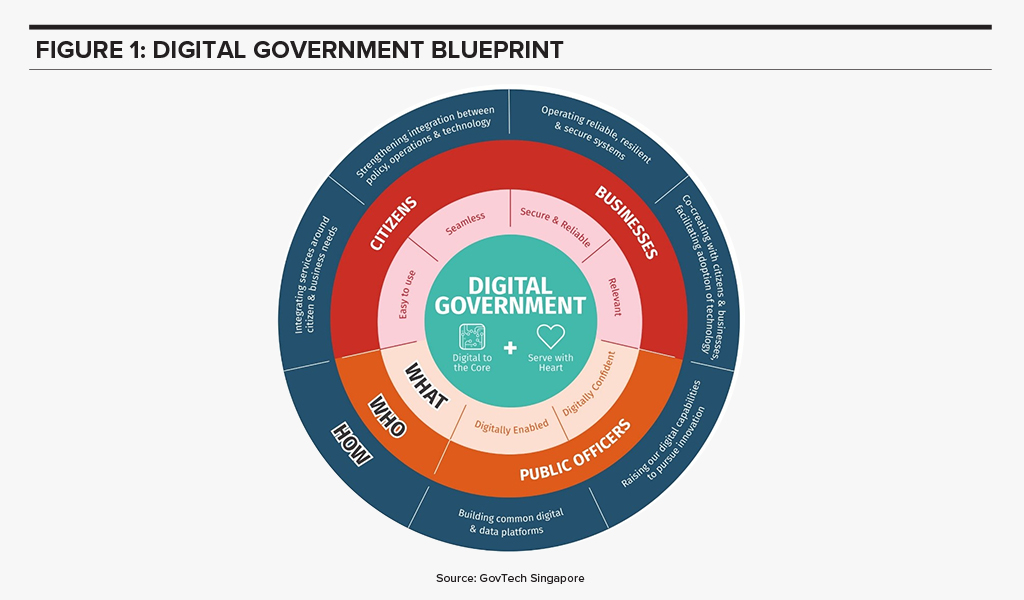

In Singapore’s Digital Government Blueprint that supports its Smart Nation vision, digitalisation is positioned as a key pillar for public service transformation. The focus for business stakeholders in this journey includes co-creating and facilitating the adoption of technologies (Figure 1).

Small and medium enterprises (SMEs) often struggle with going digital because of lack of resources – both financial and skills – and vision. In a country such as Singapore, where SMEs are estimated to account for 99% of all enterprises and 77% of employment, it is imperative that the Digital Economy vision includes a special focus on them.

Gupta says, “Despite significant incentives, there has been resistance from SMEs to go digital as it still involves time and monetary investment from them. The need to retrain and upskill their teams is also a perceived roadblock to the uptake.”

Singapore Empowering SMEs to go Digital

As the Government looks to open the economy up in a phased manner, it sees this as the right opportunity to make SMEs digital-ready. It is “seizing the moment” and has established the SG Digital Office (SDO) in an effort to enable every individual, worker and business to go digital. Initiatives include the recruitment and deployment of 1,000 Digital Ambassadors by end June to provide personalised as well as small group support to seniors and owners of local eateries, who require additional assistance to adopt digital solutions and technology.

In 2018, the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA) had launched SGQR to unify the fragmented e-payment landscape in the country, making it compatible with 27 payment schemes. The SDO aims to drive SMEs (especially in the F&B sector) to adopt SGQR codes for e-payments. The goal is to engage 18,000 stallholders of local eateries (hawker centres, wet markets, coffee shops and industrial canteens) to have the unified e-payment solution by June 2021. Further, multiple government agencies – IMDA, National Environment Agency (NEA), Jurong Town Corporation, Housing Development Board (HDB) and Enterprise Singapore – come together to offer a bonus of SGD 300 per month over five months to encourage more F&B SMEs to adopt e-payments.

“Financial Inclusion is one of the mainstays of a progressive economy. Given the significant investment that has gone into the e-payments infrastructure by government agencies led by MAS, we are placed well compared to other nations,” says Gupta. “However, there is work to be done in certain demographics and sectors. The drive to support F&B outlets and local eateries to get on the bandwagon will be an exceptional step and will be well received by consumers.”

“There are only a handful of governments that can compare with what the Singapore Government has put in place when it comes to initiatives to drive the uptake of technology by SMEs. This current crisis may well become the catalyst for SMEs to recognise the urgency of getting digital-ready and they should use this as an opportunity to leverage the government support around technology adoption and emerge as digital-savvy organisations.”

In his blog, The Cybercrime Pandemic, Ecosystm Principal Advisor, Andrew Milroy says, “Remote working has reached unprecedented levels as organisations try hard to keep going. This is massively expanding the attack surface for cybercriminals, weakening security and leading to a cybercrime pandemic. Hacking activity and phishing, inspired by the COVID-19 crisis, are growing rapidly.” Remote working has seen an increase in adoption of cloud applications and collaborative tools, and organisations and governments are having to re-think their risk management programs.

We are seeing the market respond to this need and May saw initiatives from governments and enterprises on strengthening risk management practices and standards. Tech vendors have also stepped up their game, strengthening their Cybersecurity offerings.

Market Consolidation through M&As Continues

The Cybersecurity market is extremely fragmented and is ripe for consolidation. The last couple of years has seen some consolidation of the market, especially through acquisitions by larger platform players (wishing to provide an end-to-end solution) and private equity firms (who have a better view of the Cybersecurity start-up ecosystem). Cybersecurity providers continue to acquire niche providers to strengthen their end-to-end offering and respond to market requirements.

As organisations cope with remote working, network security, threat identification and identity and access management are becoming important. CyberArk acquired Identity as a Service provider Idaptive to work on an AI-based identity solution. The acquisition expands its identity management offerings across hybrid and multi-cloud environments. Quick Heal invested in Singapore-based Ray, a start-up specialising in next-gen wireless and network technology. This would benefit Quick Heal in building a safe, secure, and seamless digital experience for users. This investment also shows Quick Heal’s strategy of investing in disruptive technologies to maintain its market presence and to develop a full-fledged integrated solution beneficial for its users.

Another interesting deal was Venafi acquiring Jetstack. Jetstack’s open-source Kubernetes certificate manager controller – cert-manager – with a thriving developer community of over 200 contributors, has been used by many global organisations as the go-to tool for using certificates in the Kubernetes space. The community has provided feedback through design discussion, user experience reports, code and documentation contributions as well as serving as a source for free community support. The partnership will see Venafi’s Machine Identity Protection having cloud-native capabilities. The deal came a day after VMware announced its intent to acquire Octarine to extend VMware’s Intrinsic Security Capabilities for Containers and Kubernetes and integrate Octarine’s technology to VMware’s Carbon Black, a security company which VMware bought last year.

Cybersecurity vendors are not the only ones that are acquiring niche Cybersecurity providers. In the wake of a rapid increase in user base and a surge in traffic, that exposed it to cyber-attacks (including the ‘zoombombing’ incidents), Zoom acquired secure messaging service Keybase, a secure messaging and file-sharing service to enhance their security and to build end-to-end encryption capability to strengthen their overall security posture.

Governments actively working on their Cyber Standards

Governments are forging ahead with digital transformation, providing better citizen services and better protection of citizen data. This has been especially important in the way they have had to manage the COVID-19 crisis – introducing restrictions fast, keeping citizens in the loop and often accessing citizens’ health and location data to contain the disaster. Various security guidelines and initiatives were announced by governments across the globe, to ensure that citizen data was being managed and used securely and to instil trust in citizens so that they would be willing to share their data.

Singapore, following its Smart Nation initiative, introduced a set of enhanced data security measures for public sector. There have been a few high-profile data breaches (especially in the public healthcare sector) in the last couple of years and the Government rolled out a common security framework for public agencies and their officials making them all accountable to a common code of practice. Measures include clarifying the roles and responsibilities of public officers involved in managing data security, and mandating that top public sector leadership be accountable for creating a strong organisational data security regime. The Government has also empowered citizens to raise a flag against unauthorised data disclosures through a simple incident report form available on Singapore’s Smart Nation Website.

Australia is also ramping up measures to protect the public sector and the country’s data against threats and breaches by issuing guidelines to Australia’s critical infrastructure providers from cyber-attacks. The Australian Cyber Security Centre (ACSC) especially aims key employees working in services such as power and water distribution networks, and transport and communications grids. In the US agencies such as the Cybersecurity and Infrastructure Security Agency (CISA) and the Department of Energy (DOE) have issued guidelines on safeguarding the country’s critical infrastructure. Similarly, UK’s National Cyber Security Centre (NCSC) issued cybersecurity best practices for Industrial Control Systems (ICS).

Cyber Awareness emerges as the need of the hour

While governments will continue to strengthen their Cybersecurity standards, the truth is Cybersecurity breaches often happen because of employee actions – sometimes deliberate, but often out of unawareness of the risks. As remote working becomes a norm for more organisations, there is a need for greater awareness amongst employees and Cybersecurity caution should become part of the organisational culture.

Comtech received a US$8.4 million in additional orders from the US Federal Government for a Joint Cyber Analysis Course. The company has been providing cyber-training to government agencies in the communications sector. Another public-private partnership to raise awareness on Cybersecurity announced in May was the MoU between Europol’s European Cybercrime Centre (EC3) and Capgemini Netherlands. With this MoU, Capgemini and Europol are collaborating on activities such as the development of cyber simulation exercises, capacity building, and prevention and awareness campaigns. They are also partnered on a No More Ransomware project by National High Tech Crime Unit of the Netherlands’ Police, Kaspersky and McAfee to help victims fight against ransomware threats.

The Industry continues to gear up for the Future

Technology providers, including Cybersecurity vendors, continue to evolve their offerings and several innovations were reported in May. Futuristic initiatives such as these show that technology vendors are aware of the acute need to build AI-based cyber solutions to stay ahead of cybercriminals.

Samsung introduced a new secure element (SE) Cybersecurity chip to protect mobile devices against security threats. The chip received an Evaluation Assurance Level (EAL) 6+ certification from CC EAL – a technology security evaluation agency which certifies IT products security on a scale of EAL0 to EAL7. Further applications of the chip could include securing e-passports, crypto hardware wallets and mobile devices based on standalone hardware-level security. Samsung also introduced a new smartphone in which Samsung is using a chipset from SK Telecom with quantum-crypto technology. This involves Quantum Random Number Generator (QRNG) to enhance the security of applications and services instead of using normal random number generators. The technology uses LED and CMOS sensor to capture quantum randomness and produce unpredictable strings and patterns which are difficult to hack. This is in line with what we are seeing in the findings of an Ecosystm business pulse study to gauge how organisations are prioritising their IT investments to adapt to the New Normal. 36% of organisations in the Asia Pacific region invested significantly in Mobile Security is a response to the COVID-19 crisis.

The same study reveals that nearly 40% of organisations in the region have also increased investments in Threat Analysis & Intelligence. At the Southern Methodist University in Texas, engineers at Darwin Deason Institute for Cybersecurity have created a software to detect and prevent ransomware threats before they can occur. Their detection method known as sensor-based ransomware detection can even spot new ransomware attacks and terminates the encryption process without relying on the signature of past infections. The university has filed a patent for this technique with the US Patent and Trademark Office.

Microsoft and Intel are working on a project called STAMINA (static malware-as-image network analysis). The project involves a new deep learning approach that converts malware into grayscale images to scan the text and structural patterns specific to malware. This works by converting a file’s binary form into a stream of raw pixel data (1D) which is later converted into a photo (2D) to feed into image analysis algorithms based on a pre-trained deep neural network to scan and classify images as clean or infected.

The race for digital bank licenses in Singapore is on as the Monetary Authority of Singapore (MAS) deadline for applications closed at the end of last year.

The Singapore Government continues to promote fintech initiatives in the banking industry such as the FAST network (giving fintech and non-banking organisations access to the real-time payments network) and Project Ubin (focusing on inter-bank funds transfer using Blockchain). The digital bank licenses continue in the same vein and will offer the same banking services as traditional banks but operate online and without any physical infrastructure.

“The biggest gamechanger of the app-based and shared economy is that it puts the power of decision making and choice in the hands of the consumer. It also removes entry barriers for non-traditional market entrants, but the flipside is it also weakens a number of regulatory barriers that were put in place for safeguarding the consumer,” says Amit Gupta, Ecosystm CEO. “With digital banking at the verge of becoming mainstream, it will help spur the app-based economy with the advent of more complete ecosystems and the added benefit of stronger governance measures and frameworks that will come into play simply because financial regulators in Singapore are driving it.”

Digital banking is not new, and MAS has been encouraging banks to offer digital services since 2000. Taking it a step forward, in June 2019, MAS announced their intentions to issue 5 digital bank licences in Singapore, opening up the banking industry to the non-banking sector.

Following the announcement, in August 2019, MAS invited applications for 2 digital full banks (DFBs) aimed primarily at retail banking, and 3 digital wholesale banks (DWBs) primarily for SMEs and other non-retail segments. While DFB licenses are restricted to Singapore based companies (including foreign joint ventures with a Singapore entity and headquarters), DWB licenses have no such restrictions, opening the market to overseas players.

Applicants for the New Digital Bank License

MAS announced on January 7, 2020, that it had received 21 applications (7 for DFB and 14 for DWB licenses). A list of applicants has not been made available, and confirmation of application has typically come from the applicants themselves. The licences will be issued in mid-2020 with the commencement of business expected about a year later.

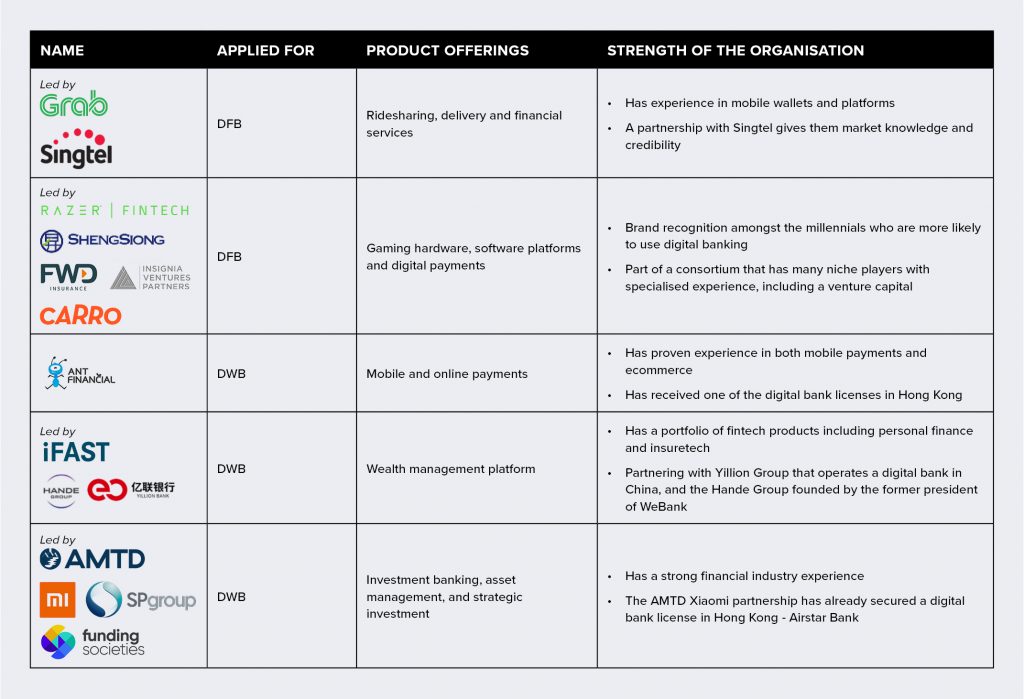

The race for the digital bank license in Singapore has seen several non-banking contenders. MAS has mentioned that applicants will be selected based on their market reputation, a proven track record, financial strength, innovative business models, and a commitment to develop the skills of the Singaporean workforce. The contenders who have announced their applications cover a wide range – from the Sea Group (whose eCommerce site, Shoppee has a strong presence in Singapore) to the Enigma Group (a financial organisation based in the UK). Here are some organisations that may well be ahead of the race:

“From the nature of consortium of bidders for DFBs and DFWs in Singapore, we can safely anticipate that the financial ecosystems will be aligned very closely with certain consumer demographics that make up the core target segments. As an example, Razer will be in a position to meet the specific needs of the millennial consumer base,” adds Gupta. “In saying that, it will also be important to evaluate how digital banks deal with educating consumers on wealth creation offerings and financial literacy, which is currently being achieved through personal touchpoints by the traditional banks.”

Ecosystm Comments

Singapore has emerged as one of the global leaders in fintech due largely to the maturity of the technology infrastructure, the banking sector and data compliance laws, as well as the tech-savviness of its citizens. The buzz created in the market when MAS announced the initiative last year is partly because a successful implementation in Singapore carries weight globally, especially in the relatively untapped Southeast Asian market.

Singapore also collaborates with the countries in the region empowering them with talent development and co-creation of fintech solutions. Initiatives such as the ASEAN Financial Innovation Network (AFIN) further promote fintech adoption through its open-architecture platform. Several countries in the region will take inspiration from Singapore and evaluate digital banks as a means to better financial inclusion. Thailand’s central bank has already indicated its interest in digital banks, prompted by the Singapore and Hong Kong initiatives.

Talking specifically about the competition in the Singapore financial industry, Gupta says, “Unlike some of the other markets, traditional banks in Singapore will continue to offer competing digital offerings as local banks such as DBS have been very savvy in building their digital offerings over the years. If their digital innovation keeps evolving at the pace they have been setting in recent years, they will present very stiff competitive barriers to the new digital bank entrants, especially given their ability to continue offering personalised service and touchpoints, coupled with compelling digital offerings.”