What if your bank could predict your financial needs before you even realised them? Imagine a financial institution that understands your behaviours, anticipates your needs, and engages with you meaningfully in real time. That’s the power of modern marketing. We’re not talking about one-size-fits-all campaigns; we’re talking about creating personalised experiences that resonate on an individual level. Financial institutions are increasingly recognising that when marketing is done right, it becomes a powerful driver of customer loyalty and growth.

Take Netflix, for example – the frontrunner in personalisation. They don’t just serve content; they study audience preferences to deliver exactly what each viewer wants. Now, picture banks doing the same. Banks can apply the same principles by building a complete view of each customer based on transactions, preferences, and lifestyle signals. This allows them to deliver personalised content, products, and nudges that help customers make smarter financial decisions – and feel more understood in the process.

The Opportunity: Marketing Beyond the Surface

The real opportunity for banks today is to reimagine marketing – not as a support function, but as a strategic growth engine. This means pulling marketing out of the back office and placing it at the heart of business decision-making. When marketing is deeply embedded in strategy, aligned with business goals, and backed by executive support, it becomes a force multiplier. Cross-functional teams start working in sync, campaigns become smarter and more personalised, and outcomes become measurable and meaningful. The impact? Rapid customer growth, stronger retention, and sharper product uptake. This reimagination hinges on two foundational shifts:

- Culture Shift. Agile, cross-functional teams that focus on delivering specific customer outcomes rather than managing marketing channels in silos. These teams are empowered to act quickly, experiment, and refine based on feedback.

- Tech-Enabled Precision. A well-governed MarTech stack that enables real-time personalisation by effectively using data, decisioning models, and delivery mechanisms. This means moving from siloed systems to unified, intelligent platforms.

When these shifts align, marketing transforms from a function into a growth engine – fuelling innovation and building deeper customer relationships.

Embracing Modern Marketing Principles

Modern marketing starts with a few foundational shifts.

1. Embedding Marketing into Business Strategy. Marketing needs to be part of business strategy from the start – not bolted on at the end. When marketers have a seat at the table during strategy planning, they can shape priorities, align efforts, and measure impact more effectively.

This requires:

- Early involvement in strategic decision-making

- Marketing scorecards derived from business KPIs

- A unified voice across product, marketing, and operations

Also, Internal teams must be in sync with customer promises made externally. This means training, communication, and shared understanding across departments to ensure every touchpoint reinforces a consistent message. Whether it’s a branch interaction, a call centre response, or a chatbot exchange – each moment becomes a reflection of the brand’s commitment.

By embedding marketing within the business from the outset and aligning it with internal delivery mechanisms, organisations are better positioned to deliver on their promises and build lasting trust.

2. Turning Data into Action: Using MarTech for Smarter Decisions and Delivery. Modern marketing runs on data – but it only matters if it drives action. Banks need a systematic approach to turning raw data into relevant, timely customer experiences.

- Organise. Cleanse and consolidate data to form a single view of each customer.

- Decide. Apply AI/ML models to extract insights, make predictions, and personalise offerings.

- Deliver. Communicate through the most effective channels at the right moment.

But a smart stack needs structure. MarTech governance is essential to ensure tech investments are strategic – not duplicative. A cross-functional steering committee, with voices from marketing, IT, compliance, and business leadership, should guide decisions. This keeps tools aligned with business goals and ensures interoperability.

Equally important is fostering a culture of experimentation. A/B testing and continuous learning should be baked into campaign design – not as add-ons, but as core capabilities. This sharpens performance and fuels innovation by quickly scaling what works. Each test becomes a feedback loop, feeding a smarter, more agile marketing engine.

Embedding these practices into the data-decisioning-delivery loop helps banks move from scattered insights to coordinated, high-impact engagement.

3. Outcome-Focused Teams and Operating Models. Rather than being structured around traditional channels, high-performing marketing teams operate around customer journeys and outcomes. Agile squads can be created for:

- Seamless onboarding

- Product activation and adoption

- Retention and cross-sell strategies

These squads have to be multidisciplinary – combining marketing, data science, engineering, and product. They need to be empowered to experiment, move fast, and own KPIs tied to customer impact.

Outcome-driven teams focus on delivering measurable value – not just activity. For instance, a squad working on onboarding might track completion rates and activation time, while a cross-sell squad may target conversion on tailored offers. The shift to outcome-oriented delivery ensures that efforts are tied to clear business metrics, with faster feedback loops and accountability.

By storing, organising, and analysing customer data, banks equip these teams to predict needs more accurately. Insights fuel smarter decisions – enabling real-time, context-aware offers. Paired with agile delivery, this data-led approach makes every interaction timely, relevant, and impactful.

This approach ensures agility, accountability, and focus. By reducing reliance on rigid departmental structures, teams can iterate quickly and deliver greater value across the customer lifecycle.

The Modern Marketing Imperative

As customer needs and expectations evolve, marketing must adapt to modern standards, with a tighter alignment between business and marketing to deliver delightful customer experiences and impactful outcomes. These are the new imperatives for growth.

These principles are not just theoretical – they’re actionable steps that enable banks to anticipate needs, deliver hyper-personalised experiences, and build lasting relationships. By embracing this shift, banks can move from reactive to proactive, empowering customers to make smarter financial decisions while driving loyalty and growth. Ultimately, the future of banking lies in a personalised, integrated, and data-driven experience for every customer.

In the last decade, blockchain technology and crypto have been laying the foundations for an alternative reality in which humans interact and organise themselves without the mediation of a third party. Cryptocurrencies are almost a USD 2 trillion asset today and billions of dollars are being traded globally without the need of a bank or intermediary, with transactions secured on blockchains. Non-fungible tokens (NFTs) – currently valued at over USD 500 million – fuelled the democratisation of the art world and provided a proof-of-concept that crypto enables wider communities to transact pseudonymously.

The discovery, storytelling, evangelism, transfer of ownership in exchange for monetary value, are taking place seamlessly in the decentralised world, without a single dollar being spent on advertising. There is no central owner or authority directing this phenomenon.

Read on to find out more about:

- How crypto is causing a Marketing revolution

- The ways corporates, consumers and content creators are leveraging it

- The growth in Decentralised Marketing (DeMar)

- The NFT use case for brands

- Brands in Web 3.0 today

Download The Future of Marketing: Enabled by Crypto as a PDF

Back in 2019 – when life was simpler and customers only expected minor miracles from the brands they interacted with – personalisation of the customer experience (CX) was a “good idea but the time has not yet come” for the majority of marketing and CX professionals.

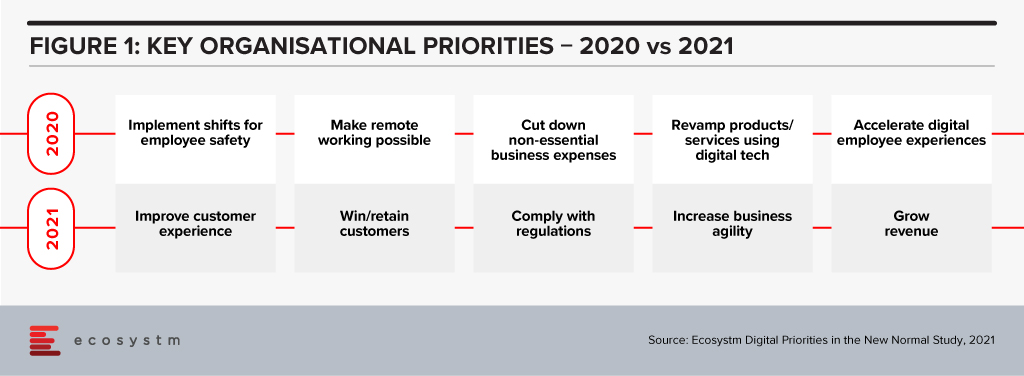

Fast forward 24 months and the world has changed – in more ways than we could have imagined! For a start, CX dropped off the top business priority during 2020 as businesses adapted to the changing market and employee experiences. But as some economies start to create a new sense of normal, CX has returned to the top of the list of business priorities (Figure 1) – renewing pressure on CX teams to create great experiences for customers.

In 2020 many marketing teams went back to the drawing board to create truly meaningful customer experiences. Suddenly “trust” was a core expectation of a brand, and that lens allowed marketers and CX teams to rethink what a personalised experience looks like. It is no longer about selling more products and creating more chances for commerce – it is now about creating an experience that makes brands easy to deal with. It is about understanding the customer and creating an optimised experience when they want or need to interact with the brand. A great personalised experience feels normal today – it has lost the “creepy” edge and is now about the brand giving customers the service, products, or levers that they need when and where they need them.

For some brands and customers, a personalised experience is about getting out of the way of customers and just giving them the outcome they desire. For others it is about creating a memorable journey. Some customers require that extra hand holding along the way and need to be nudged in the right direction, and just need to be left alone to make their decisions – not requiring that extra EDM, alert or message.

In some sectors – such as Banking and eCommerce – if you are not personalising your CX you are a long way behind, but in others, such as Government and Insurance, personalisation is only beginning to gain traction today, and will see slow and steady growth over the next few years.

Good Data is Key to a Great Personalisation Strategy

Lack of data is the primary reason personalisation fails and why some marketing teams have abandoned their personalisation efforts. The right data may not exist completely within your business – you may need to partner or work with ecosystem providers to create a complete view of your customers – and new restrictions around the use of cookies is making this harder to achieve. Forward thinking businesses have already forged partnerships with third parties and partners to share relevant data to help them create the personalised experience their customers demand.

Personalisation Should Apply Across the Customer Journey

A clear understanding of brand values, customer desires and ideal customer journeys is also important to ensure personalised experiences meet the needs of customers. Creating a personalised experience that deviates from brand values means that either brands don’t understand their customers, or customer experience professionals don’t understand their brands (or both!).

Personalisation needs to focus on the entire customer journey – from prospect through to customer and even through to churn. While you have significantly more data about your customers than your prospects, a personalised experience for non-customers is still possible and sets the scene for better and easier CX once your prospects take the longer journey with your brand. Creating a personalised churn experience – making the departure from your brand memorable, friendly and easy – provides the perfect springboard for return and tells your customers that you care about them through the entire journey.

Build a Proof of Concept for Personalisation

If you have not yet started personalising your customer’s experience, now is the perfect time to build a Proof of Concept (POC) demonstrating the business and customer outcomes you can achieve. This will help the CX and/or marketing teams to understand what data you need to collect from existing systems and processes – or source externally to create the desired experience. Initially your personalisation experience may target a limited number of key personas – but it should have the capability to roll out to all customers and/or prospects, eventually considering many scenarios and requirements. It should continue to learn and adapt. Too many businesses discovered during the pandemic that static personalisation programs will fail when market conditions change.

The POC can provide the data that your senior leadership will need to deepen their investments in and think of personalisation as a business capability – not a single project. They can demonstrate the ROI (or lack of return) and will help to guide the larger spend should the POC be a success.

Invest in Behavioural Science Skills

Building a successful personalisation strategy often goes beyond simply listening to the experts within the business and even listening to your customers. Often your customers don’t know what affects their behaviour – and will mis-report motivations or mis-attribute actions. It is important to understand the science behind behaviour – what is possible, what can work, what is guidance and what is coercion. These experts, along with your legal or privacy teams, can help to set up the guide rails for the personalisation program to operate within, and help you create customer journeys where customers can achieve their desired outcomes.

Target Consent as a Key Customer KPI

Consent is a key enabler of deep personalisation capabilities. While some level of personalisation without formal consent can be created, the real benefits of personalised journeys come with consent to use customer data to offer better services. Many businesses ask for consent in the sign-up process, but often it feels like wishful thinking – not a serious attempt to offer a better customer experience. Businesses that make “Consent to Use Data” a CX KPI think more broadly of the customer journey, the brand promise and what that means to levels of consent. It isn’t a “tick-a-box” activity at sign-up – it considers what the customer wants to get out of the engagement or a longer relationship. It focuses on helping customers achieve their instant goals more effectively and the benefits the data can bring to nurture a longer-term relationship.

Businesses that seek a higher level of consent use more tangible outcomes, simpler language and no “sweeping statements” in their consent request. They are explicit how they will use data and what data they will use. Sometimes they don’t even ask for consent to use data at sign-up – they ask after they have formed a relationship and the customer has developed a level of trust in the brand or company.

Start Your Personalisation Journey Today

Your competitors are already thinking about personalisation – some have even implemented personalised elements within their existing or new customer journeys. Personalisation – while easier than ever – is still a significant capability to build within your business. You are likely to need new technology tools and/or platforms, new skills, and new budgets. The impact for your customers – and therefore for your business – can be significant. And the impact of no action can potentially be damaging. Start your personalisation journey today to help your business take the next step towards becoming a customer-obsessed, agile, and digital business.