Consider the sheer volume of information flowing through today’s financial systems: every QR payment, e-KYC onboarding, credit card swipe, and cross-border transfer captures a data point. With digital banking and Open Banking, financial institutions are sitting on a goldmine of insights. But this isn’t just about data collection; it’s about converting that data into strategic advantage in a fast-moving, customer-driven landscape.

With digital banks gaining traction and regulators around the world pushing bold reforms, the industry is entering a new phase of financial innovation powered by data and accelerated by AI.

Ecosystm gathered insights and identified key challenges from senior banking leaders during a series of roundtables we moderated across Asia Pacific. The conversations revealed a clear picture of where momentum is building – and where obstacles continue to slow progress. From these discussions, several key themes emerged that highlight both opportunities and ongoing barriers in the Banking sector.

1. AI is Leading to End-to-End Transformation

Banks are moving beyond generic digital offerings to deliver hyper-personalised, data-driven experiences that build loyalty and drive engagement. AI is driving this shift by helping institutions anticipate customer needs through real-time analysis of behavioural, transactional, and demographic data. From pre-approved credit offers and contextual investment nudges to app interfaces that adapt to individual financial habits, personalisation is becoming a core strategy, not just a feature. This is a huge departure from reactive service models, positioning data as a long-term strategic asset.

But the impact of AI isn’t limited to customer-facing experiences. It’s also driving innovation deep within the banking stack, from fraud detection and SME loan processing to intelligent chatbots that scale customer support. On the infrastructure side, banks are investing in agile, AI-ready platforms to support automation, model training, and advanced analytics at scale. These shifts are redefining how banks operate, make decisions, and deliver value. Institutions that integrate AI across both front-end journeys and back-end processes are setting a new benchmark for agility, efficiency, and competitiveness in a fast-changing financial landscape.

2. Regulatory Shifts are Redrawing the Competitive Landscape

Regulators are moving quickly in Asia Pacific by introducing frameworks for Open Banking, real-time payments, and even AI-specific standards like Singapore’s AI Verify. But the challenge for banks isn’t just keeping up with evolving external mandates. Internally, many are navigating a complicated mix of overlapping policies, built up over years of compliance with local, regional, and global rules. This often slows down innovation and makes it harder to implement AI and automation consistently across the organisation.

As banks double down on AI, it is clear that governance can’t be an afterthought. Many are still dealing with fragmented ownership of AI systems, inconsistent oversight, and unclear rules around things like model fairness and explainability. The more progressive ones are starting to fix this by setting up centralised governance frameworks, investing in risk-based controls, and putting processes in place to monitor things like bias and model drift from day one. They are not just trying to stay compliant; they are preparing for what’s coming next. In this landscape, the ability to manage regulatory complexity with speed and clarity, both internally and externally, is quickly becoming a competitive edge.

3. Success Depends on Strategy, Not Just Tech

While enthusiasm for AI is high, sustainable success hinges on a clear, aligned strategy that connects technology to business outcomes. Many banks struggle with fragmented initiatives because they lack a unified roadmap that prioritises high-impact use cases. Without clear goals, AI projects often fail to deliver meaningful value, becoming isolated pilots with limited scalability.

To avoid this, banks need to develop robust return-on-investment (ROI) models tailored to their context — measuring benefits like faster credit decisioning, reduced fraud losses, or increased cross-selling effectiveness. These models must consider not only the upfront costs of infrastructure and talent, but also ongoing expenses such as model retraining, governance, and integration with existing systems.

Ethical AI governance is another essential pillar. With growing regulatory scrutiny and public concern about opaque “black box” models, banks must embed transparency, fairness, and accountability into their AI frameworks from the outset. This goes beyond compliance; strong governance builds trust and is key to responsible, long-term use of AI in sensitive, high-stakes financial environments.

4. Legacy Challenges Still Hold Banks Back

Despite strong momentum, many banks face foundational barriers that hinder effective AI deployment. Chief among these is data fragmentation. Core customer, transaction, compliance, and risk data are often scattered across legacy systems and third-party platforms, making it difficult to access the integrated, high-quality data that AI models require.

This limits the development of comprehensive solutions and makes AI implementations slower, costlier, and less effective. Instead of waiting for full system replacements, banks need to invest in integration layers and modern data platforms that unify data sources and make them AI-ready. These platforms can connect siloed systems – such as CRM, payments, and core banking – to deliver a consolidated view, which is crucial for accurate credit scoring, personalised offers, and effective risk management.

Banks must also address talent gaps. The shortage of in-house AI expertise means many institutions rely on external consultants, which increases costs and reduces knowledge transfer. Without building internal capabilities and adjusting existing processes to accommodate AI, even sophisticated models may end up underused or misapplied.

5. Collaboration and Capability Building are Key Enablers

AI transformation isn’t just a technology project – it’s an organisation-wide shift that requires new capabilities, ways of working, and strategic partnerships. Success depends on more than just hiring data scientists. Relationship managers, credit officers, compliance teams, and frontline staff all need to be trained to understand and act on AI-driven insights. Processes such as loan approvals, fraud escalations, and customer engagement must be redesigned to integrate AI outputs seamlessly.

To drive continuous innovation, banks should establish internal Centres of Excellence for AI. These hubs can lead experimentation with high-value use cases like predictive credit scoring or real-time fraud detection, while ensuring that learnings are shared across business units. They also help avoid duplication and promote strategic alignment.

Partnerships with fintechs, technology providers, and academic institutions play a vital role as well. These collaborations offer access to cutting-edge tools, niche expertise, and locally relevant AI models that reflect the regulatory, cultural, and linguistic contexts banks operate in. In a fast-moving and increasingly competitive space, this combination of internal capability building and external collaboration gives banks the agility and foresight to lead.

Technological innovation is dramatically changing how organisations interact with modern consumers in the rapidly evolving banking, financial services, and insurance (BFSI) industry. The growing dependence on digital communication tools and platforms lies at the core of this transformation. These tools have become vital for BFSI organisations to meet the dynamic needs of today’s customers, enabling agile, responsive Sales & Support teams that can use real-time data to sustain customer engagement, ensure data security, comply with regulations, and streamline operations.

Customer Engagement Challenges in BFSI Organisations

Security Concerns. Customers in the BFSI industry are increasingly concerned about the security of their financial transactions and Personal Identifiable Information (PII). With the rise of cyber threats, customers expect robust security measures to protect their accounts and sensitive information. BFSI organisations need to continually invest in cybersecurity infrastructure and technologies to reassure customers and maintain their trust.

Customer Expectations. In the competitive landscape of the BFSI industry, customer retention and attraction are critical to sustaining profitability. Organisations must prioritise an agile approach that adapts swiftly to market changes. Central to this strategy is the delivery of personalised experiences aligned with individual preferences and needs, driven by advancements in digitalisation. To achieve this, BFSI organisations have to increase investments in AI-driven solutions to gain deep insights into customer behaviour, enabling them to accurately anticipate and meet evolving needs.

Regulatory Compliance. The industry operates in a highly regulated environment with strict compliance requirements imposed by various regulatory bodies. Ensuring compliance with constantly evolving regulations such as GDPR, PSD2, Dodd-Frank, etc., poses a significant challenge for organisations. To complicate the landscape further, institutions with cross-border operations need to consider the laws in different countries. Compliance efforts often result in additional operational complexities and costs, which can impact the overall customer experience if not managed effectively.

Digital Transformation. Rapid technological advancements and changing customer preferences are driving BFSI organisations to undergo digital transformation initiatives. However, legacy systems and processes hinder their ability to innovate and adapt to digital trends quickly. Transitioning to modern, agile architectures while ensuring uninterrupted services and minimal disruption to customers is a complex undertaking for many BFSI organisations.

Customer Education and Communication. Financial products and services can be complex, and customers often require guidance to make informed decisions. Sales & Support teams in BFSI organisations struggle to effectively educate their customers about the features, benefits, and risks associated with various products. Clear and transparent communication regarding fees, terms, and conditions is essential for building trust and maintaining customer satisfaction. Balancing regulatory requirements with the need for transparent communication can be challenging.

5 Ways to Empower Sales & Support Teams in BFSI

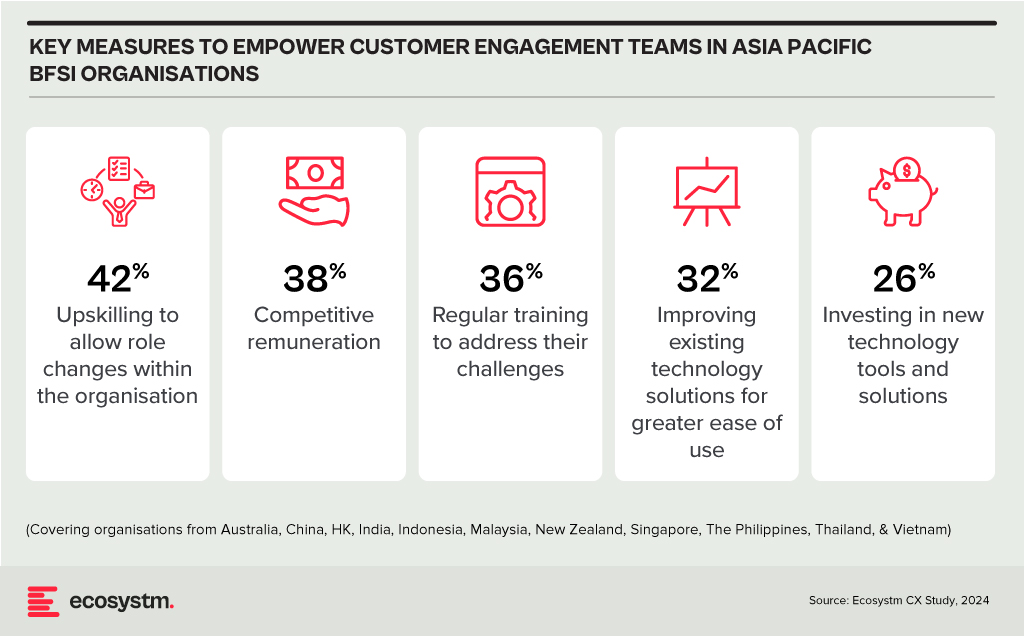

BFSI organisations in Asia Pacific often overlook technology enablement for the empowerment of their Sales & Support and other customer engagement teams. Key measures to empower these teams include upskilling for role flexibility and offering competitive remuneration for better employee retention.

Organisations should prioritise upgrading Sales & Support tools and solutions to address the team’s key pain points.

#1 Boost Customer Engagement with Omnichannel Support

BFSI organisations need to work on a suite of API-driven solutions to create a comprehensive omnichannel presence. This enables engagement with customers via their preferred channels, such as SMS, email, voice, chat, or video. Such flexibility enhances customer satisfaction and loyalty by ensuring personalised and convenient interactions. This includes capabilities such as the ability to deploy messaging and voice services to dispatch timely account activity alerts, secure transactions with two-factor authentication, and deliver customised financial advice through chatbots or direct communications.

#2 Streamline Customer Service with AI and Virtual Assistants

Integrating AI and virtual assistants allows BFSI companies to automate standard inquiries and transactions, freeing Sales & Support teams to tackle more sophisticated customer needs. These AI tools can interpret and process natural language, facilitating conversational interactions with automated services. This boosts efficiency and shortens response times, elevating the customer engagement experience. Also, consistently integrating these virtual assistants across various channels ensures a uniform customer experience – and brand image.

#3 Enhance Security Measures and Compliance Standards

Adhering to stringent security and compliance requirements is essential for BFSI organisations. A secure platform complies with critical global and country-level standards and regulations. The voice and video communication services must include comprehensive encryption, protecting all customer interactions. There is also a need to have a suite of tools for monitoring and auditing communications to meet compliance requirements, allowing BFSI organisations to protect sensitive data while providing secure communication options.

#4 Leverage Insights for Personalised Customer Interactions

BFSI organisations must focus on aggregating, harmonising, and scrutinising customer interactions across various channels. This holistic view of customer behaviour allows for more targeted and personalised services, enhancing customer engagement and loyalty. By leveraging insights into customers’ interaction histories, preferences, and financial objectives, companies can customise their outreach and recommendations, improving upselling, cross-selling, and retention strategies.

#5 Increase Operational Efficiency with Cloud-Based Solutions

Cloud-based communication solutions offer BFSI organisations the scalability and flexibility needed to respond swiftly to market shifts and customer demands. This adaptability is vital for fostering growth in a dynamic industry. A customisable solution supports organisations in refining their operations, from automating workflows to integrating CRM systems, enabling Sales & Support teams to operate more smoothly and effectively. Cloud technology helps reduce operational expenses, elevate service quality, and spur innovation.

Digital communication and collaboration tools have the power to revolutionise BFSI, enhancing engagement, security, and efficiency. Through APIs, AI, and cloud, organisations can meet evolving market needs, driving growth and innovation. Embracing these solutions ensures competitiveness and agility in a changing landscape.