2024 and 2025 are looking good for IT services providers – particularly in Asia Pacific. All types of providers – from IT consultants to managed services VARs and systems integrators – will benefit from a few converging events.

However, amidst increasing demand, service providers are also challenged with cost control measures imposed in organisations – and this is heightened by the challenge of finding and retaining their best people as competition for skills intensifies. Providers that service mid-market clients might find it hard to compete and grow without significant process automation to compensate for the higher employee costs.

Why Organisations are Opting for IT Service

- Organisations are seeking further cost reductions. Managed services providers will see more opportunities to take cost and complexity out of organisation’s IT functions. The focus in 2024 will be less on “managing” services and more on “transforming” them using ML, AI, and automation to reduce cost and improve value.

- Big app upgrades are back on the agenda. SAP is going above and beyond to incentivise their customers and partners to migrate their on-premises and hyperscale hosted instances to true cloud ERP. Initiatives such as Rise with SAP have been further expanded and improved to accelerate the transition. Salesforce customers are also looking to streamline their deployments while also taking advantage of the new AI and data capabilities. But many of these projects will still be complex and time-consuming.

- Cloud deployments are getting more complex. For many organisations, the simple cloud migrations are done. This is the stage of replatforming, retiring, and refactoring applications to take advantage of public and hybrid cloud capabilities. These are not simple lift and shift – or switch to SaaS – engagements.

- AI will drive a greater need for process improvement and transformation. This will happen along with associated change management and training programs. While it is still early days for GenAI, before the end of 2024, many organisations will move beyond experimentation to department or enterprise wide GenAI initiatives.

- Increasing cybersecurity and data governance demands will prolong the security skill shortage. More organisations will turn to managed security services providers and cybersecurity consultants to help them develop their strategy and response to the rising threat levels.

Choosing the Right Cost Model for IT Services

Buyers of IT services must implement strict cost-control measures and consider various approaches to align costs with business and customer outcomes, including different cost models:

Fixed-Price Contracts. These contracts set a firm price for the entire project or specific deliverables. Ideal when project scope is clear, they offer budget certainty upfront but demand detailed specifications, potentially leading to higher initial quotes due to the provider assuming more risk.

Time and Materials (T&M) Contracts with Caps. Payment is based on actual time and materials used, with negotiated caps to prevent budget overruns. Combining flexibility with cost predictability, this model offers some control over total expenses.

Performance-Based Pricing. Fees are tied to service provider performance, incentivising achievement of specific KPIs or milestones. This aligns provider interests with client goals, potentially resulting in cost savings and improved service quality.

Retainer Agreements with Scope Limits. Recurring fees are paid for ongoing services, with defined limits on work scope or hours within a given period. This arrangement ensures resource availability while containing expenses, particularly suitable for ongoing support services.

Other Strategies for Cost Efficiency and Effective Management

Technology leaders should also consider implementing some of the following strategies:

Phased Payments. Structuring payments in phases, tied to the completion of project milestones, helps manage cash flow and provides a financial incentive for the service provider to meet deadlines and deliverables. It also allows for regular financial reviews and adjustments if the project scope changes.

Cost Transparency and Itemisation. Detailed billing that itemises the costs of labour, materials, and other expenses provides transparency to verify charges, track spending against the budget, and identify areas for potential savings.

Volume Discounts and Negotiated Rates. Negotiating volume discounts or preferential rates for long-term or large-scale engagements, makes providers to offer reduced rates for a commitment to a certain volume of work or an extended contract duration.

Utilisation of Shared Services or Cloud Solutions. Opting for shared or cloud-based solutions where feasible, offers economies of scale and reduces the need for expensive, dedicated infrastructure and resources.

Regular Review and Adjustment. Conducting regular reviews of the services and expenses with the provider to ensure alignment with the budget and objectives, prepares organisations to adjust the scope, renegotiate terms, or implement cost-saving measures as needed.

Exit Strategy. Planning an exit strategy that include provisions for contract termination, transition services, protects an organisation in case the partnership needs to be dissolved.

Conclusion

Many businesses swing between insourcing and outsourcing technology capabilities – with the recent trend moving towards insourcing development and outsourcing infrastructure to the public cloud. But 2024 will see demand for all types of IT services across nearly every geography and industry. Tech services providers can bring significant value to your business – but improved management, monitoring, and governance will ensure that this value is delivered at a fair cost.

Over the past year we have seen global systems integrators (SIs) – Accenture, IBM, Deloitte, Fujitsu, Capgemini and others – make many acquisitions, particularly in the public cloud, AI, cybersecurity and data space. Much of the growth in spending over the past few years have been driven by these categories: in 2020 if a software company was purely or mainly SaaS, they are likely to have witnessed strong growth. If they were on-premises software, they were lucky not to see declining revenues. While it is normal for the larger SIs and consultants to play catch up through acquisition, it is becoming harder for them to gain traction in these new areas.

Technology Shifts Drive Market Fragmentation

With every technology-driven business change new SIs, consultants, and managed services providers emerge. It happened with the move to big ERP systems, the move towards Business Intelligence, the emergence of SaaS etc. But I think we are now seeing something different. More than just the smaller players going after opportunities earlier, I believe we are seeing a changing buying behaviour from tech and business buyers – a greater willingness for larger enterprises to give their most important, business-critical strategies and implementations to smaller, less established players.

And I am not suggesting that the larger SIs are not performing well. Many are growing at 10-25% YoY – but at the same time, many are also growing at a slower rate than the markets they play in. The Ecosystm RNx for global IT services and consulting providers shows that the global providers continue to power ahead. But they need to adapt to changing market conditions.

New Cloud/AI Partners Winning Consulting and Implementation Deals

We have seen a new community of partners emerge with tech changes, such as the hyperscale cloud platforms and AI/machine learning tools. Traditionally, these companies would be good at one thing – and would learn slowly. For example, in the SAP ERP growth period, the projects were large and long. A single, mid-sized SI might only be working with 2-3 clients at a time. Therefore, the IP that they collected was limited – and they would find themselves with focused or niche skills. The large SIs had done many large, long projects across the globe and had much best-practice IP to call upon, giving them a broader and deeper knowledge of the technology and industries. Smaller providers had limited IP and industry experience.

But in this cloud and AI era, specialist providers work on hundreds of smaller projects with dozens or hundreds of clients. With the technology constantly evolving, the skills are constantly improving. While the global SIs are working on many cloud and AI engagements, they are often part of longer engagements – giving the consultants and tech teams less exposure to the new and evolving cloud platforms.

In a world where technology is changing at pace, the traditional global SI practice of “learning from peers across the globe” doesn’t happen at the pace the market requires. By the time your peers in the business have completed a project, documented it, and shared learnings, the market has moved on and technology has changed. Today it is easier and faster to learn directly from the tech vendors and cloud platform providers and their training partners. The network effect of knowledge in a team on the opposite side of the globe for a global SI is less valuable to clients. Often the smaller and mid-sized SIs have a deeper, broader knowledge of the technology platforms and toolsets than the larger providers – giving them a competitive advantage. For example, if you want the actual experience of moving SAP to Azure, or Oracle to AWS – you’ll often find the smaller providers have more experience. And this continues to play out. In many markets in the world, the top 5-10 SIs for cloud, AI and cybersecurity has a high proportion of local specialist providers.

Tech Buyers No Longer Look for Culturally Aligned Partners

Tech buyers themselves are changing too. In years gone by, the smaller tech partners would tell us that they felt they were included in bids to drive down the price from the global SIs. But today the story is different. Smaller partners are admired for their agility and innovation. Large enterprise customers will choose small providers because the small SI is NOT like them. In the past, they chose the global SI because they were just like them!

Because of this, the large SIs are mopping up their smaller competitors across the globe. Accenture has acquired 40 companies in the past 10-11 months, IBM has acquired over 10, Atos and Cognizant have also acquired many companies in the past 12 months. They are doing this for the skills as much as for the clients, along with getting a foothold in a new market or strengthening their position in geography. The challenge will be to hang on to the clients, culture, and the IP of the acquired business. Often these smaller competitors are growing at a significant pace – and the biggest risk is that the acquiring company takes their eyes off the prize.

Global SIs Still Own the Industry Play

Despite these challenges, one of the areas that the global SIs will continue to dominate is the industry play. I have discussed how as technologies mature, industry plays become more relevant.

Smaller and mid-sized SIs and consultants find it hard to create deep pools of expertise across multiple industries. While some may have a deep focus on a single or two industries, only the large players have broad and deep geography and industry experience. This puts many of the acquisitions into context – the global SIs will take these acquisitions and use that deep and broad technical and business knowledge and add it to their industry knowledge to create a more compelling offering.

Their challenge will still be one of cultural alignment. As discussed, many companies seek out tech partners who represent what they want to be, not what they are. The ability for the Global SIs to retain the culture, agility and innovation of the acquired business will determine their ability to continue to see similar or improved levels of growth from the acquired business. Using their IP in the context of industries will be the key to their ongoing success.

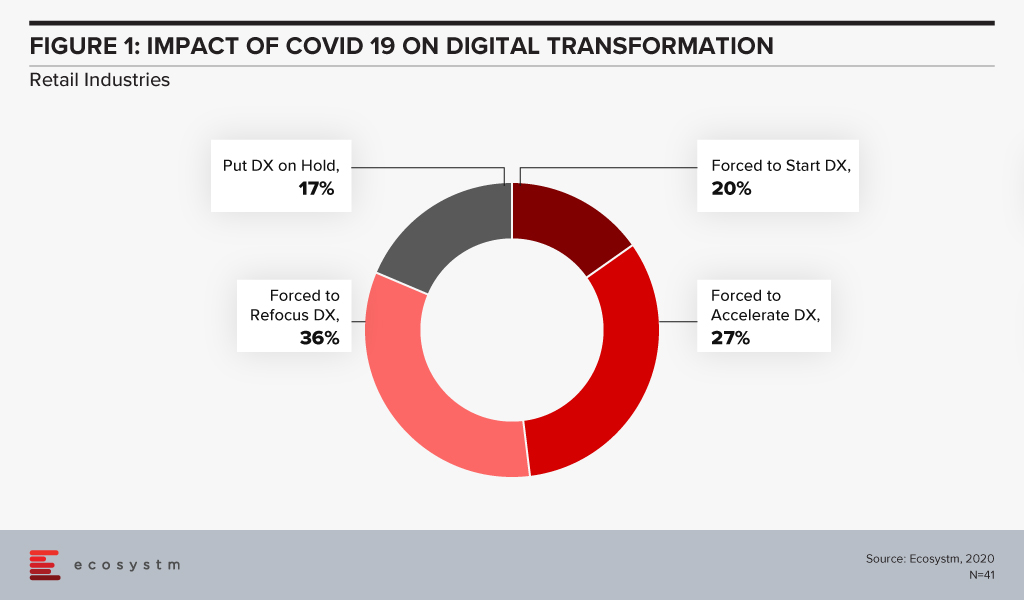

The Retail industry has been one of the hardest-hit industries during the COVID-19 crisis. The industry had to pivot faster than many to cater to an evolving market need and customer expectation, amidst social distancing measures and supply chain disruption. Ecosystm’s Digital Priorities in the New Normal study finds that nearly 83% of organisations in Asia Pacific’s Retail industries were forced to work on digital transformation (DX) in the aftermath of the crisis (Figure 1).

Retail organisations that had not walked the DX path found themselves struggling to cope in recent times. Ecosystm Principal Advisor, Alan Hesketh says, “Digital transformation in retail, as represented by deep customer understanding and omnichannel operations, is far from new. Industry leaders launched these activities almost 20 years ago and continue to aggressively develop these capabilities. Retailers not actively leveraging these capabilities to understand their customer preferences are at a massive competitive disadvantage.”

Anta Group Accelerates DX

The Anta Group, a sports products manufacturer based in China with over 12,500 stores, has launched a group-wide digital platform designed and deployed by IBM Services based on SAP S/4HANA. The initial phase of Anta Group’s DX included creating intelligent workflows and was completed in January 2020. This enabled the company to adjust its retail operations and switch to quickly to online channels during the COVID-19 pandemic.

Like any retail organisation, the Anta Group realised that their product offerings had to be diverse to cater to an evolving customer base. This growth required an upgrade to a group-level management platform to help the business run more efficiently across the entire value chain of procurement, supply, production and sales. The SAP S/4HANA platform gives the senior management a single view of data across business units to help with better decision making regarding production and sales optimisation. The company claims to have improved its supply chain efficiency by 80%, that has led to faster delivery and business growth even in these difficult times.

IBM Services has a role to play in providing the business intelligence required for agile decision-making. By integrating data from multiple sources – retail stores, multi-brand products, channels, customers, suppliers and finance teams – on the one platform can help Anta Group to settle accounts quickly and issue business analysis reports for different entities as well as a real-time view of the operation across the organisation.

Hesketh says, “Retailers must have an accurate, timely understanding of their customers’ behaviour and resulting sales performance. COVID-19 has dramatically increased the volatility of sales, making rapid recognition of changes essential. For those lagging in their digital transformation to acquire this understanding, an attractive option is partnering with organisations with demonstrated relevant capabilities; in this case with SAP, for the capabilities and performance of their in-memory product, and IBM for their configuration and implementation expertise.”

IBM and SAP evolving their partnership

In 2016, IBM and SAP had expressed intentions of increasing investments to help their customers on their DX journeys. As some economies move into the recovery phase, all businesses will be forced to transform – or keep transforming if they are already along that path. Last month saw IBM and SAP announce the evolution of their partnership with new offerings to help businesses transform faster. The next evolution of the IBM and SAP partnership aims to focus on faster DX time to value, innovation through industry-specific offerings, customer and employee experiences and providing flexibility and choice to organisations to run their workloads in hybrid cloud environments.

Hesketh adds, “But the product and implementation partners are, while important, not the real determinant of the success of DX activity and time to value. Retailers must recognise and commit to the strategic reshaping of their business, taking their large workforces with them on the journey. This is a high-risk change. A strong relationship between product vendor and implementation partner, as SAP and IBM demonstrate here, assists in reducing, not removing, this risk.”