In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

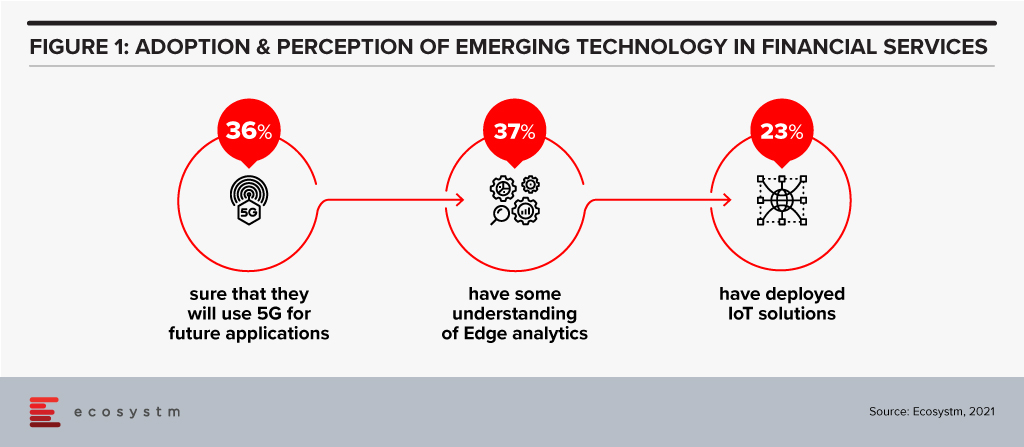

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

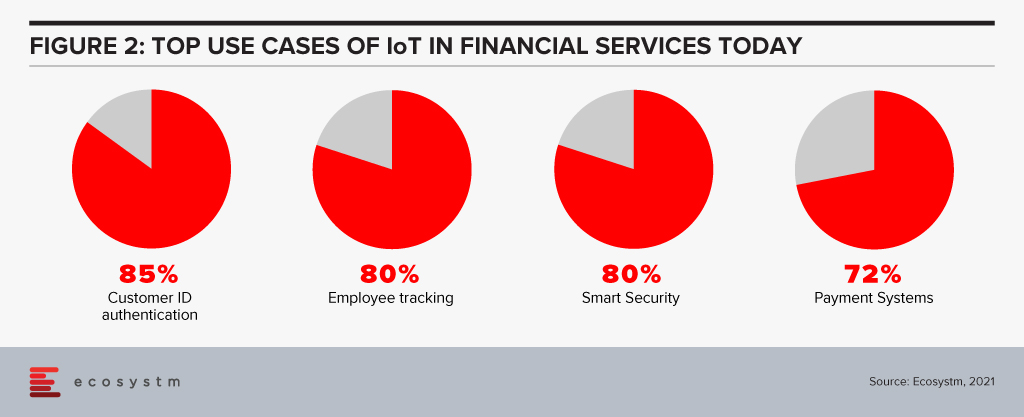

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

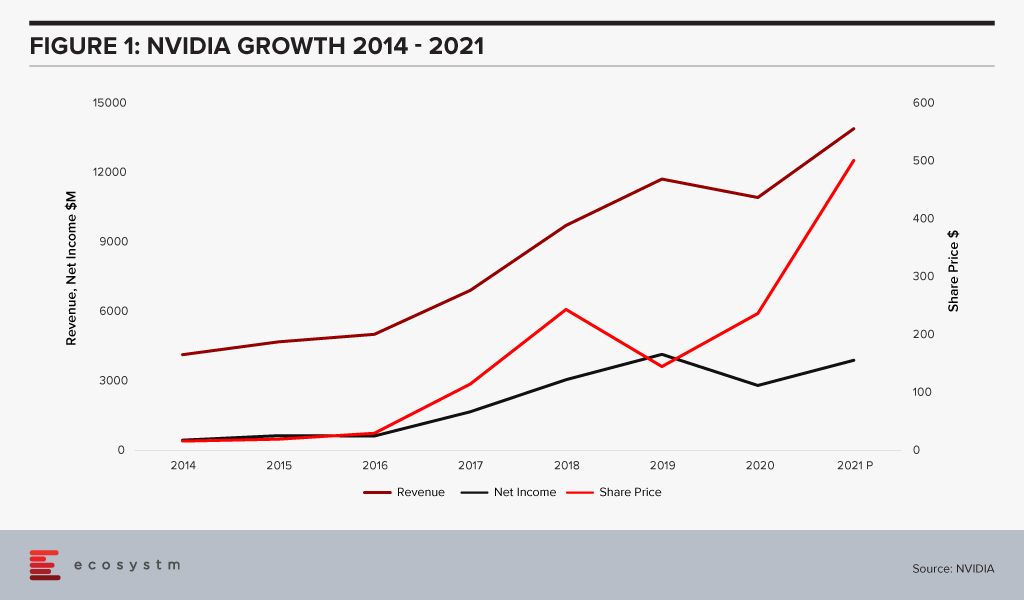

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

I was invited recently by NEC to attend their briefing where Walter Lee, their Evangelist and Government Relations Leader presented to analysts and journalists about how they are winning large contracts across various sectors in the areas of biometrics and surveillance. Biometrics is not just used as a way to drive greater security, but is also helping increase speed in processing times, reducing waiting period in queues and used as a way to drive efficiency and reduce costs which was highlighted by Lee through the various projects NEC had won recently.

NEC’s Artificial intelligence (AI) engine, NeoFace’s strength lies in its tolerance of poor-quality images. The NeoFace solution can match images with low resolutions down to 24 pixels between the eyes and this has allowed it to demonstrate the matching accuracy which is hard to achieve for most vendors offering Facial Recognition solutions. It is its ability to work across various challenges around low resolution, light and images that has allowed NEC to be one of the leading suppliers of Facial Recognition solutions globally.

Key Case Studies Presented

In 2018 Delta Airlines launched the first ‘biometric terminal’ in the US at the international terminal in Atlanta’s Hartsfield-Jackson airport. The biometric push according to Lee replaces tickets and customers now check in by using their face. The system recognises their face and they are checked in. Customers no longer need to use their passports to get through checkpoints around the airport. Lee emphasised on how it takes 9 minutes to board an international flight. Apart from driving identification and security, this use case highlights how airports around the world can increase efficiency in their overall check in and boarding processes at airports. Other core benefits derived from this implementation include better security for border control, seamless service, speed of boarding (savings of 9 minutes per flight). Privacy issues were addressed with regards to where the data was residing and how long the data would be kept for and in this case the data was kept for only 24 hours.

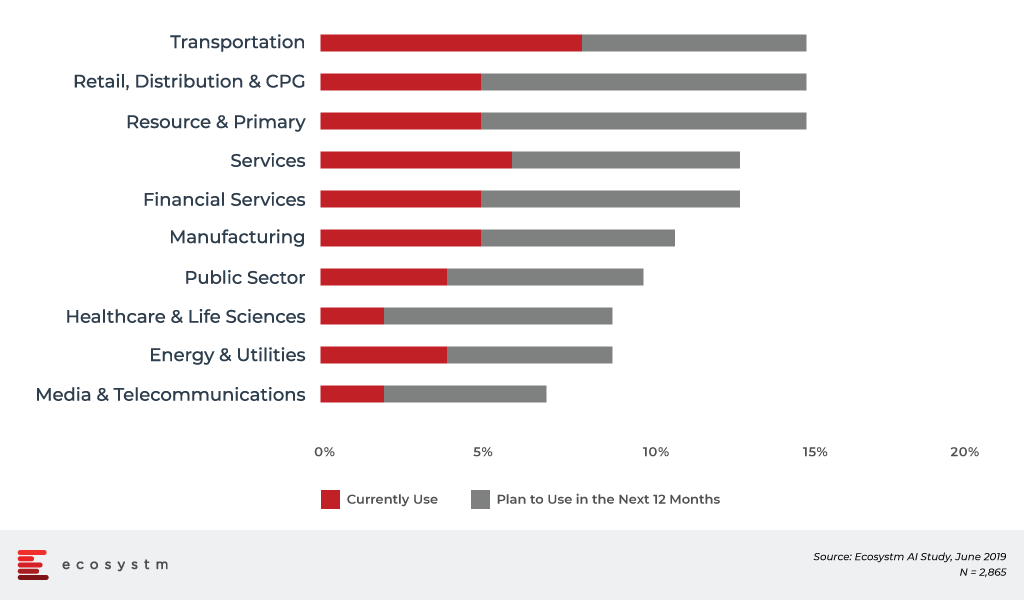

According to the global Ecosystm AI study of current and planned Facial Recognition adoption by industry, the transportation industry is leading the number of deployments globally.

Adoption of Facial Recognition by Industries

Another case study presented is the upcoming 2020 Summer Olympic and Paralympic Games in Tokyo., for which NEC will provide the Facial Recognition solution. The solution will be used to identify over 300,000 people at the games including athletes and officials. It is the first time that Facial Recognition technology will be used for this purpose at an Olympic Games. The NEC solution will allow the matching of tens of thousands of faces in a nano second according to Lee.

The Tokyo 2020 implementation will involve linking photo data with an IC card to be carried by accredited people. NEC says that it has the world’s leading face recognition tech based on benchmark tests from the US’s National Institute of Standards and Technology (NIST).

Ecosystm Comment.

NEC has years of experience in biometrics and Facial Recognition. Not many vendors have solutions that can capture vast amounts of images in a nano second. Their solutions are used by some of the largest organisations in the world. NEC has also perfected the art of handling low resolution images which if not analysed accurately can lead to unintended consequences. The ability to process low resolution images with speed and accuracy is not something that is easily achievable. Security and the rise of terrorism are some of the needs as to why Facial Recognition is important. Additionally, speed and efficiency in administrating passenger boarding at airports whilst ensuring that the security and identity checks have been made is important. The Delta Airlines case study is a great example of how there can be a savings of 9 minutes per flight. NEC continues to gain traction in the market and the Ecosystm AI study has them as one of the top vendors being evaluated for planned implementations for Facial Recognition globally.

The benefits of Facial Recognition solutions are huge – however there must be greater scrutiny around the possible outcomes of AI. Whilst regulation on AI is still at its infancy, 2019 and 2020 will see greater scrutiny and regulation around AI implementations. These will be directed towards protecting individual’s data but also there will be greater emphasis on addressing issues around privacy, ethics and bias in AI implementations. Feeding the machine with the right data (unbiased and ethical) and measuring the various outcomes before the project goes live must be looked at with greater diligence.

2 weeks ago, San Francisco became the first US city to ban the use of Facial Recognition technology by the police and local government agencies. One of the reasons for the ban was with regard to bias. When designing the systems, if technology specialists feed the wrong information for example recognising only a certain skin colour, then the problem of making the wrong and unwanted assumptions start arising. The ecosystem of players in the AI industry ranging from government, academia right down to vendors have a greater role to play in ensuring ethics and bias issues are addressed from the onset of the project. There are consultants in the market as I highlighted in my recent Ecosystm report, that prepare companies for the impact of ethics, fairness and bias. We can expect more of such consultancies and specialist agencies to grow in the market.

NEC has taken this into consideration and published a set of principles for the application of biometrics and AI. The “NEC Group AI and Human Rights Principles” will guide the company along the lines of privacy and human rights. These initiatives were led by the Digital Trust Business Strategy Division, in collaboration with several other divisions within the company, as well as industry stakeholders including industry experts and non-profit organisations.