In my previous blogs, I outlined strategies for public sector organisations to incorporate technology into citizen services and internal processes. Building on those perspectives, let’s talk about the critical role of data in powering digital transformation across the public sector.

Effectively leveraging data is integral to delivering enhanced digital services and streamlining operations. Organisations must adopt a forward-looking roadmap that accounts for different data maturity levels – from core data foundations and emerging catalysts to future-state capabilities.

1. Data Essentials: Establishing the Bedrock

Data model. At the core of developing government e-services portals, strategic data modelling establishes the initial groundwork for scalable data infrastructures that can support future analytics, AI, and reporting needs. Effective data models define how information will be structured and analysed as data volumes grow. Beginning with an Entity-Relationship model, these blueprints guide the implementation of database schemas within database management systems (DBMS). This foundational approach ensures that the data infrastructure can accommodate the vast amounts of data generated by public services, crucial for maintaining public trust in government systems.

Cloud Databases. Cloud databases provide flexible, scalable, and cost-effective storage solutions, allowing public sector organisations to handle vast amounts of data generated by public services. Data warehouses, on the other hand, are centralised repositories designed to store structured data, enabling advanced querying and reporting capabilities. This combination allows for robust data analytics and AI-driven insights, ensuring that the data infrastructure can support future growth and evolving analytical needs.

Document management. Incorporating a document or records management system (DMS/RMS) early in the data portfolio of a government e-services portal is crucial for efficient operations. This system organises extensive paperwork and records like applications, permits, and legal documents systematically. It ensures easy storage, retrieval, and management, preventing issues with misplaced documents.

Emerging Catalysts: Unleashing Data’s Potential

Digital Twins. A digital twin is a sophisticated virtual model of a physical object or system. It surpasses traditional reporting methods through advanced analytics, including predictive insights and data mining. By creating detailed virtual replicas of infrastructure, utilities, and public services, digital twins allow for real-time monitoring, efficient resource management, and proactive maintenance. This holistic approach contributes to more efficient, sustainable, and livable cities, aligning with broader goals of urban development and environmental sustainability.

Data Fabric. Data Fabric, including Data Lakes and Data Lakehouses, represents a significant leap in managing complex data environments. It ensures data is accessible for various analyses and processing needs across platforms. Data Lakes store raw data in its original format, crucial for initial data collection when future data uses are uncertain. In Cloud DB or Data Fabric setups, Data Lakes play a foundational role by storing unprocessed or semi-structured data. Data Lakehouses combine Data Lakes’ storage with data warehouses’ querying capabilities, offering flexibility, and efficiency for handling different types of data in sophisticated environments.

Data Exchange and MOUs. Even with advanced data management technologies like data fabrics, Data Lakes, and Data Lakehouses, achieving higher maturity in digital government ecosystems often depends on establishing data-sharing agreements. Memorandums of Understanding (MoUs) exemplify these agreements, crucial for maximising efficiency and collaboration. MoUs outline terms, conditions, and protocols for sharing data beyond regulatory requirements, defining its scope, permitted uses, governance standards, and responsibilities of each party. This alignment ensures data integrity, privacy, and security while facilitating collaboration that enhances innovation and service delivery. Such agreements also pave the way for potential commercialisation of shared data resources, opening new market opportunities.

Future-Forward Capabilities: Pioneering New Frontiers

Data Mesh. Data Mesh is a decentralised approach to data architecture and organisational design, ideal for complex stakeholder ecosystems like digital conveyancing solutions. Unlike centralised models, Data Mesh allows each domain to manage its data independently. This fosters collaboration while ensuring secure and governed data sharing, essential for efficient conveyancing processes. Data Mesh enhances data quality and relevance by holding stakeholders directly accountable for their data, promoting integrity and adaptability to market changes. Its focus on interoperability and self-service data access enhances user satisfaction and operational efficiency, catering flexibly to diverse user needs within the conveyancing ecosystem.

Data Embassies. A Data Embassy stores and processes data in a foreign country under the legal jurisdiction of its origin country, beneficial for digital conveyancing solutions serving international markets. This approach ensures data security and sovereignty, governed by the originating nation’s laws to uphold privacy and legal integrity in conveyancing transactions. Data Embassies enhance resilience against physical and cyber threats by distributing data across international locations, ensuring continuous operation despite disruptions. They also foster international collaboration and trust, potentially attracting more investment and participation in global real estate markets. Technologically, Data Embassies rely on advanced data centres, encryption, cybersecurity, cloud, and robust disaster recovery solutions to maintain uninterrupted conveyancing services and compliance with global standards.

Conclusion

By developing a cohesive roadmap that progressively integrates cutting-edge architectures, cross-stakeholder partnerships, and avant-garde juridical models, agencies can construct a solid data ecosystem. One where information doesn’t just endure disruption, but actively facilitates organisational resilience and accelerates mission impact. Investing in an evolutionary data strategy today lays the crucial groundwork for delivering intelligent, insight-driven public services for decades to come. The time to fortify data’s transformative potential is now.

Governments worldwide struggle with intricate social, economic, and environmental challenges. Tight budgets often leave them with limited resources to address these issues head-on. However, innovation offers a powerful path forward.

By embracing new technologies, adapting to cultural shifts, and fostering new skills, structures, and communication methods, governments can find solutions within existing constraints.

Find out how public sector innovation is optimising internal operations, improving service accessibility, bridging the financial gap, transforming healthcare, and building a sustainable future.

Click here to download ‘Innovation in Government: Social, Economic, and Environmental Wins’ as a PDF

Optimising Operations: Tech-Driven Efficiency

Technology is transforming how governments operate, boosting efficiency and allowing employees to focus on core functions.

Here are some real-world examples.

Singapore Streamlines Public Buses. A cloud-based fleet management system by the Land Transport Authority (LTA) improves efficiency, real-time tracking, data analysis, and the transition to electric buses.

Dubai Optimises Utilities Through AI. The Dubai Electricity and Water Authority (DEWA) leverages AI for predictive maintenance, demand forecasting, and grid management. This enhances service reliability, operational efficiency, and resource allocation for power and water utilities.

Automation Boosts Hospital Efficiency. Singapore hospitals are using automation to save man-hours and boost efficiency. Tan Tock Seng Hospital automates bacteria sample processing, increasing productivity without extra staff, while Singapore General Hospital tracks surgical instruments digitally, saving thousands of man-hours.

Tech for Citizens

Digital tools and emerging technologies hold immense potential to improve service accessibility and delivery for citizens. Here’s how governments are leveraging tech to benefit their communities.

Faster Cross-Border Travel. Malaysia’s pilot QR code clearance system expedites travel for factory workers commuting to Singapore, reducing congestion at checkpoints.

Metaverse City Planning. South Korea’s “Metaverse 120 Center” allows residents to interact with virtual officials and access services in a digital environment, fostering innovative urban planning and infrastructure management.

Streamlined Benefits. UK’s HM Revenue and Customs (HMRC) launched an online child benefit claim system that reduces processing time from weeks to days, showcasing the efficiency gains possible through digital government services.

Bridging the Financial Gap

Nearly 1.7 billion adults or one-third globally, remain unbanked.

However, innovative programs are bridging this gap and promoting financial inclusion.

Thailand’s Digital Wallet. Aimed at stimulating the economy and empowering underserved citizens, Thailand disburses USD 275 via digital wallets to 50 million low-income adults, fostering financial participation.

Ghana’s Digital Success Story. The first African nation to achieve 100% financial inclusion through modernised platforms like Ghana.gov and GhanaPay, which facilitate payments and fee collection through various digital channels.

Philippines Embraces QR Payments. The City of Alaminos leverages the Paleng-QR Ph Plus program to promote QR code-based payments, aligning with the central bank’s goal of onboarding 70% of Filipinos into the formal financial system by 2024.

Building a Sustainable Future

Governments around the world are increasingly turning to technology to address environmental challenges and preserve natural capital.

Here are some inspiring examples.

World’s Largest Carbon Capture Plant. Singapore and UCLA joined forces to build Equatic-1, a groundbreaking facility that removes CO2 from the ocean and creates carbon-negative hydrogen.

Tech-Enhanced Disaster Preparedness. The UK’s Lincolnshire County Council uses cutting-edge geospatial technology like drones and digital twins. This empowers the Lincolnshire Resilience Forum with real-time data and insights to effectively manage risks like floods and power outages across their vast region.

Smart Cities for Sustainability. Bologna, Italy leverages the digital twins of its city to optimise urban mobility and combat climate change. By analysing sensor data and incorporating social factors, the city is strategically developing infrastructure for cyclists and trams.

Tech for a Healthier Tomorrow

Technology is transforming healthcare delivery, promoting improved health and fitness monitoring.

Here’s a glimpse into how innovation is impacting patient care worldwide.

Robotic Companions for Seniors. South Korea tackles elder care challenges with robots. Companion robots and safety devices provide companionship and support for seniors living alone.

VR Therapy for Mental Wellness. The UAE’s Emirates Health Services Corporation implements a Virtual Reality Lab for Mental Health, that creates interactive therapy sessions for individuals with various psychological challenges. VR allows for personalised treatment plans based on data collected during sessions.

Organisations are uncertain about how 2023 will shape up for them, amidst concerns about recessions, supply chain uncertainties, continued geopolitical volatility, energy crisis, and labour disruptions. At the same time, they have to continue to evolve their products and services, the customer experiences they deliver, and overall brand image.

If you are a tech leader, your first instinct would be to cut down on technology spend to align with your organisation’s cost optimisation strategy. And that is where you would make the first mistake – this is the time to invest in the right technologies to help your organisation face the uncertainties with agility.

Here are 5 things that you should keep in mind when shaping your organisation’s tech landscape in 2023.

- Focus on the shortest time to value. Choose a few smart digital improvements that are aligned with the strategic goals of the business and deliver value quickly.

- Drive better corporate outcomes through Sustainability programs. The transition to smart and sustainable digital assets and infrastructure should be a top priority for today’s technology leaders.

- Build resilience by improving value chain visibility. Digital technologies will continue to play an important role in providing visibility and insights across the value chains for risk management and resilience.

- Treat location data as a feedstock for AI & Automation. With the increasing importance of automation, especially to contemporary service models like digital twins and metaverse, incorporating spatial and location data into your strategy is essential for staying ahead of the competition and driving meaningful business outcomes.

- Find allies against cyber adversaries. Join the cybersecurity communities that exist in your geography and industry. Participate openly as possible so that lessons are shared quickly and widely. Don’t try to defeat the flood on your own.

Read on to find more.

Download Making the Right Tech Decisions for Better Value as a PDF

Cities worldwide have been facing unexpected challenges since 2020 – and 2022 will see them continue to struggle with the after-effects of COVID-19. However, there is one thing that governments have learnt during this ongoing crisis – technology is not the only aspect of a Cities of the Future initiative. Besides technology, Cities of the Future will start revisiting organisational and institutional structures, prioritise goals, and design and deploy an architecture with data as its foundation.

Cities of the Future will focus on being:

- Safe. Driven by the ongoing healthcare crisis

- Secure. Driven by the multiple cyber attacks on critical infrastructure

- Sustainable. Driven by citizen consciousness and global efforts such as the COP26

- Smart. Driven by the need to be agile to face future uncertainties

Read on to find out what Ecosystm Advisors, Peter Carr, Randeep Sudan, Sash Mukherjee and Tim Sheedy think will be the leading Cities of the Future trends for 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Cities of the Future in 2022

AI has become intrinsic to our personal lives – we are often completely unaware of technology’s influence on our daily lives. For enterprises too, tech solutions often come embedded with AI capabilities. Today, an organisation’s ability to automate processes and decisions is often dependent more on their desire and appetite for tech adoption, than the technology itself.

In 2022 the key focus for enterprises will be on being able to trust their Data & AI solutions. This will include trust in their IT infrastructure, architecture and AI services; and stretch to being able to participate in trusted data sharing models. Technology vendors will lead this discussion and showcase their solutions in the light of trust.

Read what Ecosystm analysts, Darian Bird, Niloy Mukherjee, Peter Carr and Tim Sheedy think will be the leading Data & AI trends in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Data & AI in 2022 as PDF

In this Ecosystm Insight, our guest author Randeep Sudan shares his views on how Cities of the Future can leverage technology for future resilience and sustainability. “Technology is not the only aspect of Smart City initiatives. Besides technology, we need to revisit organisational and institutional structures, prioritise goals, and design and deploy an architecture with data as its foundation.”

Earlier this year, Sudan participated in a panel discussion organised by Microsoft where he shared his views on building resilient and sustainable Cities of the Future. Here are his key messages for policymakers and funding agencies that he shared in that session.

“Think ahead, Think across, and Think again! Strategic futures and predictive analytics is essential for cities and is critical for thinking ahead. It is also important to think across through data unification and creating data platforms. And the whole paradigm of innovation is thinking again.”

Since the start of this millennium, no region has transformed as much as Asia. There has been significant paradigm shifts in the region and the perception that innovation starts in the US or in Europe and percolates through to Asia after a time lag, has been shattered. Asia is constantly demonstrating how dynamic, and technology-focused it is. This is getting fueled by the impact of the growing middle class on consumerism and the spirit of innovation across the region. The region has also seen a surge in new and upcoming business leaders who are embracing change and looking beyond success to creating impact.

What is Driving Innovation in Asia?

The “If you ain’t got it, build it” attitude. One of the key drivers of this shift is the age of the average population in Asia. According to the UN the Asia Pacific region has nearly 60% of the world’s youth population (between the age of 17-24). With youth comes dynamism, a desire to change the world, and innovation. As this age group enters the workforce, they will transform their lives and the companies they work in. They are already showing a spirit of agility when it comes to solving challenges – they will build what they do not have.

The Need to enable Foundational Shifts. The younger generation is more aware of environmental, social and governance issues that the world continues to face. Many of the countries in the region are emerging economies, where these issues become more apparent. COVID-19 has also inculcated an empathy in people and they are thinking of future success in terms of impact. The desire to enable foundational shifts is giving direction to the transformation journey in the region. The wonderful new paradigm that is the Digital Economy allows us to cut across all segments; and technology and its advancements has immense potential to create a more sustainable and inclusive future for the world.

Realising the Power of Momentum. The pandemic has caused major disruptions in the region. But every crisis also presents an opportunity to perhaps re-imagine a brighter world through a digital lens. The other thing that the pandemic has done is made people and organisations realise that to succeed they need to be open to change – and that momentum is important. As organisations had to pivot fast, they realised what I have been saying for years – we shouldn’t “let perfect get in the way of better”. This adaptability and the readiness to fail fast and learn from the mistakes early for eventual success, is leading to faster and more agile transformation journeys.

Where are we seeing the most impact?

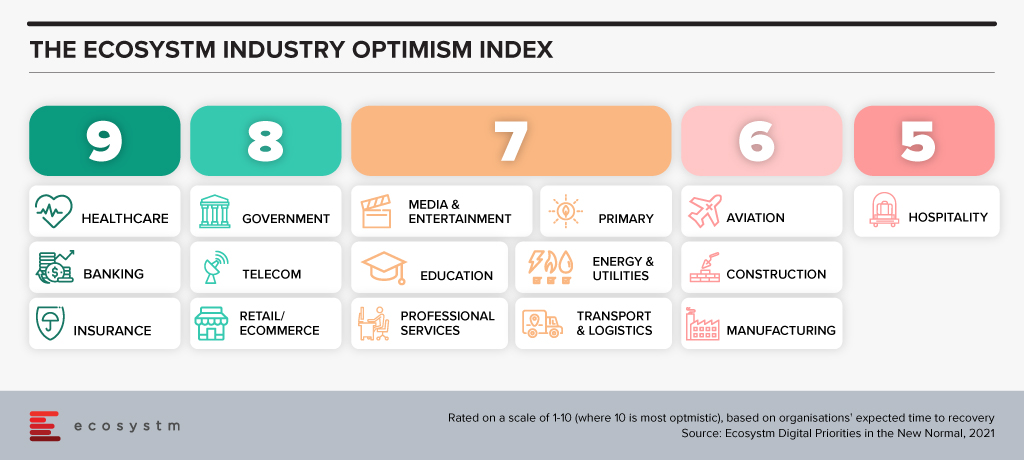

Industries are Transforming. There are industries such as Healthcare and Education that had to transform out of a necessity and urgency brought about by the COVID-19 pandemic. This has led to a greater impetus for change and optimism in these industries. These industries will continue to transform as governments focus significantly on creating “Social Safety Nets” and technology plays a key role in enabling critical services across Health, Education and Food Security. Then there are industries, such as the Financial Services and Retail, that had a strong customer focus and were well on their digital journeys before the pandemic. The pandemic boosted these efforts.

But these are not the only industries that are transforming. There are industries that have been impacted more than others. There are several instances of how organisations in these industries are demonstrating not only resilience but innovation. The Travel & Hospitality industry has had several such instances. As business models evolve the industry will see significant changes in digital channels to market, booking engines, corporate service offerings and others, as the overall Digital Strategy is overhauled.

Technologies are Evolving. Organisations depended on their tech partners to help them make the fast pivot required to survive and succeed in the last year – and tech companies have not disappointed. They have evolved their capabilities and continue to offer innovative solutions that can solve many of the ongoing business challenges that organisations face in their innovation journey. More and more technologies such as AI, machine learning, robotics, and digital twins are getting enmeshed together to offer better options for business growth, process efficiency and customer engagement. And the 5G rollouts will only accelerate that. The initial benefits being realized from early adoption of 5G has been for consumers. But there is a much bigger impact that is waiting to be realised as 5G empowers governments and businesses to make critical decisions at the edge.

Tech Start-ups are Flourishing. There are immense opportunities for technology start-ups to grow their market presence through innovative products and services. To succeed these companies need to have a strong investment roadmap; maintain a strong focus on customer engagement; and offer technology solutions that can fulfil the global needs of their customers. Technologies that promote efficiency and eliminate mundane tasks for humans are the need of the hour. However, as the reliance on technology-led transformation increases, tech vendors are becoming acutely aware that they cannot be best-in-class across the different technologies that an organisation will require to transform. Here is where having a robust partner ecosystem helps. Partnerships are bringing innovation to scale in Asia.

We can expect Asia to emerge as a powerhouse as businesses continue to innovate, embed technology in their product and service offerings – and as tech start-ups continue to support their innovation journeys.

Ecosystm CEO Amit Gupta gets face to face with Garrett Ilg, President Asia Pacific & Japan, Oracle to discuss the rise of the Asia Digital economies, the impact of the growing middle class on consumerism and the spirit of innovation across the region.

The Retail industry has had to do a sharp re-think of its digital roadmap and transformation journey – Ecosystm research shows that about 75% of retail organisations had to start, accelerate, or re-focus their digital transformation initiatives. However, that will not be enough as organisations move beyond survival to recovery – and future successes. While retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough in 2021. Ecosystm Principal Advisors, Alan Hesketh and Alea Fairchild present the top 5 Ecosystm predictions for Retail & eCommerce in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Retail & eCommerce Trends for 2021

- There Will Only be Omnichannel Retailers

The value of an omnichannel offer in Retail has become much clearer during the COVID-19 pandemic. Retailers that do not have the ability to deliver using the channel customers prefer will find it hard to compete. As the physical channel becomes less important new revenue opportunities will open up for businesses operating in adjacent market sectors – companies such as food and grocery wholesalers will increasingly sell direct to consumers, leveraging their existing online and distribution capabilities.

Most customers transact on mobile device – either a mobile phone or tablet. New capabilities will remove some of the barriers to using these mobile devices. For one, technologies such as Progressive Web Apps (PWA) and Accelerated Mobile Pages (AMP) will provide a better customer experience on mobile platforms than existing websites, while delivering a user experience at par or better than mobile apps. Also, as retailers become AI-enabled, machine learning engines will provide purchase recommendations through smartwatches or in-home, voice-enabled, smart devices.

- COVID-19 Will Continue to be an Influence Forcing Radical Shifts

In driving the economic recovery in 2021, we will see ‘glocal’ consumption – emphasis on local retailers and global players taking local actions to win the hearts and minds of local consumers. There will be significant actions within local communities to drive consumers to support local retailers. Location-based services (LBS) will be used extensively as consumers on the high street carry more LBS-enabled devices than ever before. Bluetooth beacon technology and proximity marketing will drive these efforts. Consumers will have to opt-in for this to work, so privacy and relationship management are also important to consider.

But people still want to “physically” browse, and design aesthetics of a store are still part of the attraction. In the next 18 months, the concept of virtual stores that are digital twins will take off, particularly in the holiday and Spring clearance sales. Innovators like Matterport can help local retailers gain a more global audience with a digital twin with a limited technological investment. At a minimum, Shopify or other intermediaries will be necessary for a digital shop window.

- The Industry will See Artificial Intelligence in Everything

AI will increase its impact on Retail with an uptake in two key areas.

- Customer interactions. Retail AI will use customer data to deliver much richer and targeted experiences. This may include the ability to get to a ‘segment of one’. Tools will include chatbots that are more functional and support for voice-based commerce using mobile and in-home edge devices. Also, in-store recognition of customers will become easier through enhanced device or facial recognition. Markets where privacy is less respected will lead in this area – other markets will also innovate to achieve the same outcomes without compromising privacy but will lag in their delivery. This mismatch of capability may allow early adopters to enter other geographic markets with competitive offers while meeting the privacy requirements of these markets.

- Supply chain and pricing capabilities. AI-based machine learning engines using both internal and increased sources of external data will replace traditional math-based forecasting and replenishment models. These engines will enable the identification of unexpected and unusual demand influencing factors, particularly from new sources of external data. Modelling of price elasticity using machine learning will be able to handle more complex models. Retailers using this capability will be in a better position to optimise their customer offers based on their pricing strategies. Supply chains will be re-engineered so products with high demand volatility are manufactured close to markets, and the procurement of products with stable demands will be cost-based.

- Distribution Woes Will Continue

Third party delivery platforms such as Wish and RoseGal are recruiting additional international non-Asian suppliers to expand their portfolios. Amazon and AliExpress are leaders here, but there are many niche eCommerce platforms taking up the slack due to the uneven distribution patterns from the ongoing economic situation. Expect to see a number of new entrants taking up niche spaces in the second half of 2021, sponsored by major retail product brands, to give Amazon a run for their money on a more local basis.

As the USPS continues to be under strain, delivery companies like FedEx in the US who partner with the USPS are already suffering from the USPS’s operational slowdown, in both their customer reputation and delivery speed. In 2021, COVID-19 – and workers’ unions – will continue to impact distribution activities. Increased spending in warehouse automation and new retail footprints such as dark stores will be seen to make up for worker shortfalls.

- China’s Retail Models Will Expand into Other Markets

China’s online businesses operate in a large domestic market that is comparatively free of international competitors. Given the scale of the domestic market, these online companies have been able to grow to become substantial businesses using advanced technologies. All the Chinese tech giants – among them Alibaba, ByteDance, DiDi Chuxing, and Tencent – are expanding internationally.

China’s rapidly recovering economy puts those businesses in a strong position to fund a competitive expansion into international markets using their domestic base, particularly with their Government’s promotion of the country’s tech sector. It is harder to impose restrictions on software-based businesses, unlike the approach that we have witnessed the US Government take for hardware companies such as Huawei – placing constraints on mobile phone components and operating systems.

These tech giants also have significant experience in a Big Data environment that provides little privacy protection, as well as leading-edge AI capabilities. While they will not be able to operate with the same freedom in global markets, and there will be other large challenges in translating Chinese experience to other markets – these tech players will be able to compete very effectively with incumbent global companies. Chinese companies also continue to raise capital from US stock exchanges with The Economist reporting Chinese listings have raised close to USD 17 billion since January 2020.