Singapore is committed to empower its small and medium enterprises (SMEs) to make better financial decisions and avail of seamless trade and financial transactions across the larger global economy. In June, the Digital Economic Partnership Agreement (DEPA) was signed between New Zealand, Singapore and Chile. The initiative includes facilitating end-to-end digital trade – by creating digital identities, allowing paperless trade and developing Fintech solutions – and ensuring a trusted cross-border data flow. To learn more about the DEPA agreement, register for the “Re-image the Digital Economy” webinar on the 29th July at 10am SGT.

This follows the announcement that was made last year by the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA); of the successful completion of phase 1 of the proof-of-concept (POC) for its Business sans Borders (BSB). BSB is meant to be a “meta-hub” connecting several SME-centric platforms (starting within the Philippines, India and Singapore) giving SMEs seamless access to a larger ecosystem of buyers, sellers, logistics service providers, financing, and digital solution providers; and allowing them to be part of the larger global marketplace. The PoC involved a collaboration with private sector partners such as GlobalLinker, Mastercard, PwC, SAP and Yellow Pages.

AMTD Aligns with the BSB Objective

Hongkong-based investment banking firm AMTD Group leads a consortium that includes Xiaomi Finance, Singapore’s SP Group, and Funding Societies, that is a contender for one of Singapore’s digital wholesale banking licenses. While announcing their bid, they had clearly stated that they aimed to focus on SMEs in the region and globally. They continue to focus on SMEs by strengthening their partner ecosystem.

Last week AMTD announced a partnership with GlobalLinker making them the preferred financial services partner on the GlobalLinker’s SME-focused platform. AMTD intends to make available their entire ecosystem to SMEs including their virtual bank in Hong Kong, Airstar and their potential digital wholesale bank consortium in Singapore (which is to be called Singa Bank). In line with Singapore’s BSB objective, the partnership will see GlobalLinker join AMTD’s network which includes Fintech companies, regional banks and enterprises – SpiderNet. SpiderNet is a cross-sector ecosystem which is continuously expanding to connect and collaborate with shareholders, government bodies, industry associations, and clients. GlobalLinker’s AI-powered SME networking platform fosters SME digitalisation and helps members and customers connect with each other and use digital solutions. AMTD will be part of this network and bring the breadth of their partner ecosystem onto GlobalLinker’s platform.

Ecosystm Principal Advisor, Dheeraj Chowdhry says, “This marks the deepening of the trend of convergence between the established industry players and the Fintechs. The inefficiency of the obsession to ‘build’ and the associated resource and cost effort has perhaps been recognised on both sides and hence the path of coexistence and synergy seems more pragmatic. Fintechs are not competing but, in fact, complementing industry players by accelerating customer adoption of new digital formats for the entire landscape.”

AMTD Continues to Strengthen Partner Ecosystem

Last week also saw AMTD announce a collaboration with Singapore’s CIMB Bank and Funding Societies, to explore opportunities to create a wide range of banking and capital market services to aid SMEs with a one-stop solution for cross-regional and financial products.

Such partnerships by AMTD provides a glimpse of the group’s strong focus on Singapore. In April this year, AFIN and AMTD partnered to establish the USD 36 million AMTD ASEAN-Solidarity Fund. In May, AMTD, MAS, and Singapore FinTech Association (SFA) announced the launch of a USD 4.3 million MAS-SFA-AMTD FinTech Solidarity Grant to support Singapore-based FinTech firms.

AMTD remains committed to evolving their capabilities and ecosystem to empower the SME market in Singapore and the region. AMTD Digital announced their intention of acquiring a controlling stake in PolicyPal, Singapore’s InsureTech pioneer, and CapBridge Financial, a leading private capital platform for investing in growth companies globally. They have also expressed their intentions to acquire a controlling stake in FOMO Pay, a Singapore-based QR code and digital payment solution provider.

“AMTD’s early cognizance of the need for a strong ecosystem has led the organisation to their foray into partnerships and stakes in PolicyPal, FOMO Pay and now GlobalLinker. This strengthens AMTD’s commitment to the Fintech space including stakes in AirStar Digital Bank in Hong Kong and the Digital Bank application in Singapore,” says Chowdhry. “The Fintechs in AMTD’s stable will be part of the ‘AMTD web’ associated companies cutting across geographies and accelerate the ‘Business sans Borders’ objective of MAS and IMDA.”

The race for digital bank licenses in Singapore is on as the Monetary Authority of Singapore (MAS) deadline for applications closed at the end of last year.

The Singapore Government continues to promote fintech initiatives in the banking industry such as the FAST network (giving fintech and non-banking organisations access to the real-time payments network) and Project Ubin (focusing on inter-bank funds transfer using Blockchain). The digital bank licenses continue in the same vein and will offer the same banking services as traditional banks but operate online and without any physical infrastructure.

“The biggest gamechanger of the app-based and shared economy is that it puts the power of decision making and choice in the hands of the consumer. It also removes entry barriers for non-traditional market entrants, but the flipside is it also weakens a number of regulatory barriers that were put in place for safeguarding the consumer,” says Amit Gupta, Ecosystm CEO. “With digital banking at the verge of becoming mainstream, it will help spur the app-based economy with the advent of more complete ecosystems and the added benefit of stronger governance measures and frameworks that will come into play simply because financial regulators in Singapore are driving it.”

Digital banking is not new, and MAS has been encouraging banks to offer digital services since 2000. Taking it a step forward, in June 2019, MAS announced their intentions to issue 5 digital bank licences in Singapore, opening up the banking industry to the non-banking sector.

Following the announcement, in August 2019, MAS invited applications for 2 digital full banks (DFBs) aimed primarily at retail banking, and 3 digital wholesale banks (DWBs) primarily for SMEs and other non-retail segments. While DFB licenses are restricted to Singapore based companies (including foreign joint ventures with a Singapore entity and headquarters), DWB licenses have no such restrictions, opening the market to overseas players.

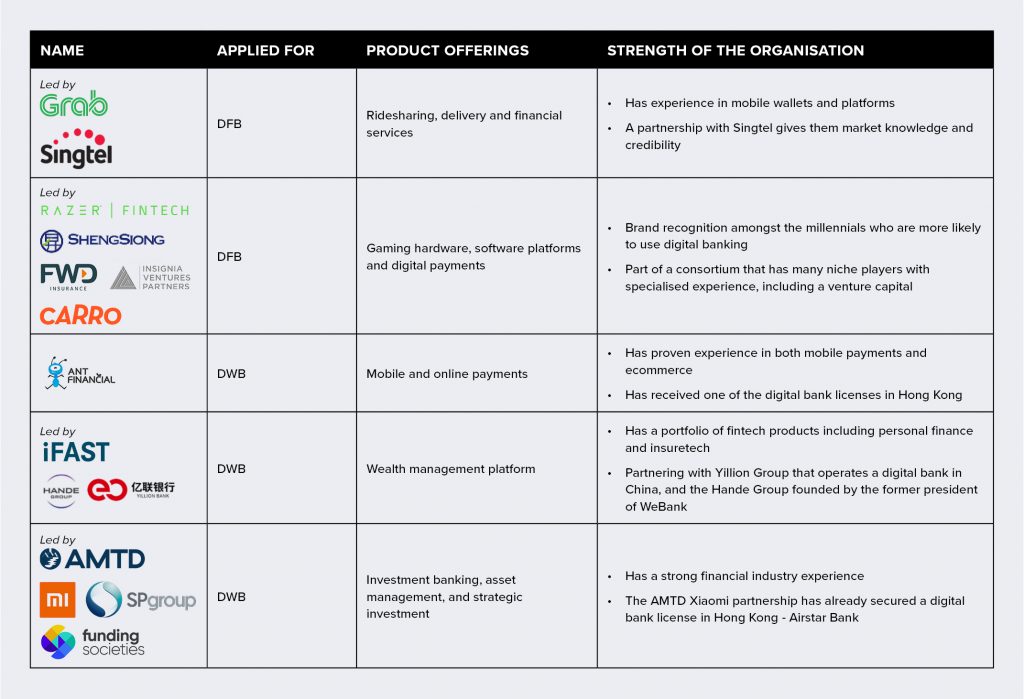

Applicants for the New Digital Bank License

MAS announced on January 7, 2020, that it had received 21 applications (7 for DFB and 14 for DWB licenses). A list of applicants has not been made available, and confirmation of application has typically come from the applicants themselves. The licences will be issued in mid-2020 with the commencement of business expected about a year later.

The race for the digital bank license in Singapore has seen several non-banking contenders. MAS has mentioned that applicants will be selected based on their market reputation, a proven track record, financial strength, innovative business models, and a commitment to develop the skills of the Singaporean workforce. The contenders who have announced their applications cover a wide range – from the Sea Group (whose eCommerce site, Shoppee has a strong presence in Singapore) to the Enigma Group (a financial organisation based in the UK). Here are some organisations that may well be ahead of the race:

“From the nature of consortium of bidders for DFBs and DFWs in Singapore, we can safely anticipate that the financial ecosystems will be aligned very closely with certain consumer demographics that make up the core target segments. As an example, Razer will be in a position to meet the specific needs of the millennial consumer base,” adds Gupta. “In saying that, it will also be important to evaluate how digital banks deal with educating consumers on wealth creation offerings and financial literacy, which is currently being achieved through personal touchpoints by the traditional banks.”

Ecosystm Comments

Singapore has emerged as one of the global leaders in fintech due largely to the maturity of the technology infrastructure, the banking sector and data compliance laws, as well as the tech-savviness of its citizens. The buzz created in the market when MAS announced the initiative last year is partly because a successful implementation in Singapore carries weight globally, especially in the relatively untapped Southeast Asian market.

Singapore also collaborates with the countries in the region empowering them with talent development and co-creation of fintech solutions. Initiatives such as the ASEAN Financial Innovation Network (AFIN) further promote fintech adoption through its open-architecture platform. Several countries in the region will take inspiration from Singapore and evaluate digital banks as a means to better financial inclusion. Thailand’s central bank has already indicated its interest in digital banks, prompted by the Singapore and Hong Kong initiatives.

Talking specifically about the competition in the Singapore financial industry, Gupta says, “Unlike some of the other markets, traditional banks in Singapore will continue to offer competing digital offerings as local banks such as DBS have been very savvy in building their digital offerings over the years. If their digital innovation keeps evolving at the pace they have been setting in recent years, they will present very stiff competitive barriers to the new digital bank entrants, especially given their ability to continue offering personalised service and touchpoints, coupled with compelling digital offerings.”