Poly’s CEO Joe Burton was in Sydney recently to meet with staff, customers and partners. I had the privilege of interviewing him about the roadmap ahead for the company. Plantronics acquired Polycom for $2 billion at the end of March 2018 and earlier this year at Enterprise Connect, Poly was unveiled as the new brand – the coming together of Plantronics and Polycom. The company prides themselves on the strong engineering heritage they have across their product portfolio. Poly is playing in a large addressable market and these segments include unified communications (UC), video, headsets and contact centres.

Big news last week – Poly and Zoom partnership

At Zoomtopia last week, Zoom announced purpose-built appliances for their Zoom Rooms conference room system. These appliances are custom developed hardware that lets users gather room intelligence and analytics and will simplify installation and management of large-scale conference room deployments. One of the major partnerships for this was with Poly. Joe Burton was on stage with Eric Yuan the CEO of Zoom to unveil the Poly Studio X Series – The X30 (for smaller rooms) and the X50 (for midsize conference rooms).

What is promising about this offering is that the whole concept of launching a meeting by connecting to a screen has become simple. In a world where user experience is everything, simplicity and quality are what end-users expect. The Poly Studio X Series are all-in-one video bars that will simplify the Zoom Rooms experience and will feature Poly Meeting AI capabilities. Some of the features include advanced noise suppression to make it easier to hear human voices while simultaneously blocking out background noise.

For Poly, this is a great partnership given Zoom’s good growth in the Asia Pacific region. Poly is also increasingly deepening their relationships with other major players in the Video and UC market including Microsoft.

Flexible Workspaces and Contact Centres drives the headset market in Asia Pacific

According to JLL, the flexible space sector in Asia Pacific is expanding rapidly. From 2014 to 2017, flexible space stock across the region recorded a CAGR of 35.7% in Asia Pacific – much higher than in the United States (25.7%) and Europe (21.6%) over the same period. When you consider the changes in the modern workplace which include the rise of open flexible workplaces, remote and home working and the rise of freelancers, providing a seamless experience for the office worker will be important – it should be the same for a contractor as it is for full-time staff. As we move into more mobile and agile work practices and with the rise of open offices, headsets will play an important role for the office worker. More organisations across Asia are investing in headsets and whilst it may sound simple to just buy the headsets, it is more sophisticated than that. There is no one-size-fits-all headset and IT managers will have to invest in headsets to suit the persona of employees taking into account the role, workload, use of voice and video services and ultimately their comfort level. Vendors in the headset space are heavily investing in easy-to-use features, more automation, deep workflow integration and machine learning to deliver that experience. The opportunity for headsets does not stop there. In the contact centre space as agents spend long hours on calls, designing the right headset with feature rich AI capabilities will go a long way especially for training and coaching.

The one area Burton emphasised on is how AI and analytics is transforming this market and Poly investing in building these features into the headsets. Some of these examples include:

- Tracking conversations by using analytics to gain insights into long pauses of silence and “overtalking”. The analytics generated from these insights can help for training and coaching.

- AI can help track user behaviour patterns related to noise, volume and mute functions. These patterns can be used to detect problems during the call and could lead to possible training sessions for the agents. It is a great mechanism for supervisors to understand and work through where agents are struggling during the call.

Partnerships to expand their reach into the contact centre markets in the Asia Pacific region will be important. The market for contact centres is seeing a big shift and new entrants are making their presence felt in the Asia Pacific region. Poly will need to capitalise on this and expand their partnerships beyond the traditional vendors to expand their footprints across the contact centre markets.

Asia Pacific – an important growth theatre

Poly continues to win and have some large-scale deployments in Japan, China, India, and ANZ. They have also made several strides to develop what is best fit for the local market in terms of user requirements. With a deep understanding of the Chinese market, Poly released the Poly G200 in September this year which is tailor-made for the Chinese users with easy to use and collaborate solutions. The Poly G200 is the first and significant customised product launched in China, after Poly announced their ‘In China, for China’ strategy. This is a logical move given China is an important market and one that presents its own unique business dynamics.

Conclusion

The shift to mobility and the cloud has changed everything and is driving a new level of user experience. The ability to offer the same and frictionless experience when on the desktop, mobile device as well as other applications is what is driving fierce competition in the market. Users get frustrated when they cannot launch a video session instantly or when there is poor quality in audio. These may sound simple but addressing these frustrations are critical. Vendors in the UC, Collaboration and Video space are working hard to make sure that the experience is seamless when they are inside the office, out of the office and when they are working in open plan offices. Ultimately users want their daily office communication and collaboration solutions to work seamlessly and to integrate well into the various workflows such as Microsoft Teams.

On the contact centre front, Digital and AI initiatives are taking centre stage in nearly every conversation I have had with end-users. Company-wide CX strategy and customer journey mapping and analytics are what CX decision makers are talking about most. Poly is addressing that segment of the market by providing quality headsets coupled with AI to help in coaching and training by identifying trends and bridging the training gaps. There are new vendors starting to disrupt the status quo of some of the more traditional vendors in the contact centre market and hence deepening the partnerships with these new vendors in the contact centre space will be important.

Poly has a good addressable market to go after in unified communications and collaboration with their headsets and extensive range of video solutions. The most important part will be deepening the partnerships with the wide range of vendors in this space and engineering their products to be tightly integrated with their partner ecosystems’. The release of the Studio X series at Zoomtopia is a good example. I am confident that the road ahead for Poly is promising given the deep engineering capabilities the company invests in and how they are taking their partnerships seriously.

I was a guest last week at the NICE Interactions Summit in Sydney and it was great to hear from executives from NICE talk about the journey the company is taking their customers on. Australia and New Zealand are witnessing good adoption of cloud contact centres and many organisations (as covered in some of previous blogs) are at the inflection point of investing in a cloud contact centre, machine learning, customer journey mapping and predictive analytics technologies to drive greater customer experience (CX). Across Asia Pacific and in the ASEAN region, more organisations are at the verge of embarking on transformational CX projects to help them raise the bar on CX in a highly competitive environment. We can expect the adoption of cloud contact centres to grow rapidly in the next few years across the Asia Pacific region as companies move from expensive and traditional legacy environments to agile platforms.

Investing in Analytics and Cloud

Darren Rushworth, NICE’s Managing Director APAC, talked about how NICE has moved from being an infrastructure player to become an analytics company and talked about the acquisitions that are helping them alleviate their game in CX. Key acquisitions since 2016 have been instrumental to shaping their offerings and these include Nexidia, an Interaction Analytics software company and InContact, a cloud contact centre vendor. In 2019 NICE acquired Brand Embassy, whose technology brings to CXone a full range of integrated channels, enabling any digital channel to be integrated into customer service operations. In a Mobile First economy where customers want the applications of their choice, allowing customers to use the social media or messaging application of their choice in their contact centre interactions, will be critical. The Brand Embassy platform supports more than 30 channels and these include Facebook Messenger, Twitter, Apple Business Chat, WhatsApp, LinkedIn, SMS, email, and live chat. This is an important acquisition and not many contact centres have addressed the issue of allowing multiple forms of messaging to be used when customers want to communicate an issue or get answer to a query. Customers are gravitating towards social media platforms and messaging apps for daily communication and being able to integrate those channels to the contact centre is important.

The Move to the Cloud with NICEinContact

It was interesting to hear Tracy Duthie, Head of Service Development at 2degrees Mobile talk about why they deployed a NICEinContact solution. She talked about 2degrees having too many legacy systems that were not all integrated. The problems with not having the systems integrated drove the team to think hard about embarking on a journey with NICE. The objective was to grow their market share and to drive greater contact centre efficiency. She mentioned that 2degrees were keen on a SaaS option and it was not just about replacing the legacy solution. The move to the cloud as many organisations are starting to tell me, is to drive transformation and further innovation including deploying agile methodologies to deliver great CX. Also because this was a cloud deployment, they invested heavily in the network. This is an important aspect for an organisation when embarking on a cloud journey especially for mission critical applications such as voice, video and collaboration applications where latency and jitter can spoil the experience. Many times, I have heard customers blame the vendor for the technology. For cloud voice, video and other contact centre applications to work well in real time, the investment in the network must not be compromised especially when working on a tight budget. When this aspect is ignored, the problems discussed early are bound to arise. She also highlighted how important it was to eventually get the agents on board the new deployment and they adopted an open culture of allowing the agents to provide feedback and an open dialogue was initiated. As this was a big change from when they were running the contact centre in a traditional environment, the change management aspect was critical for the agents.

Compliance is something that has to be adhered to seriously

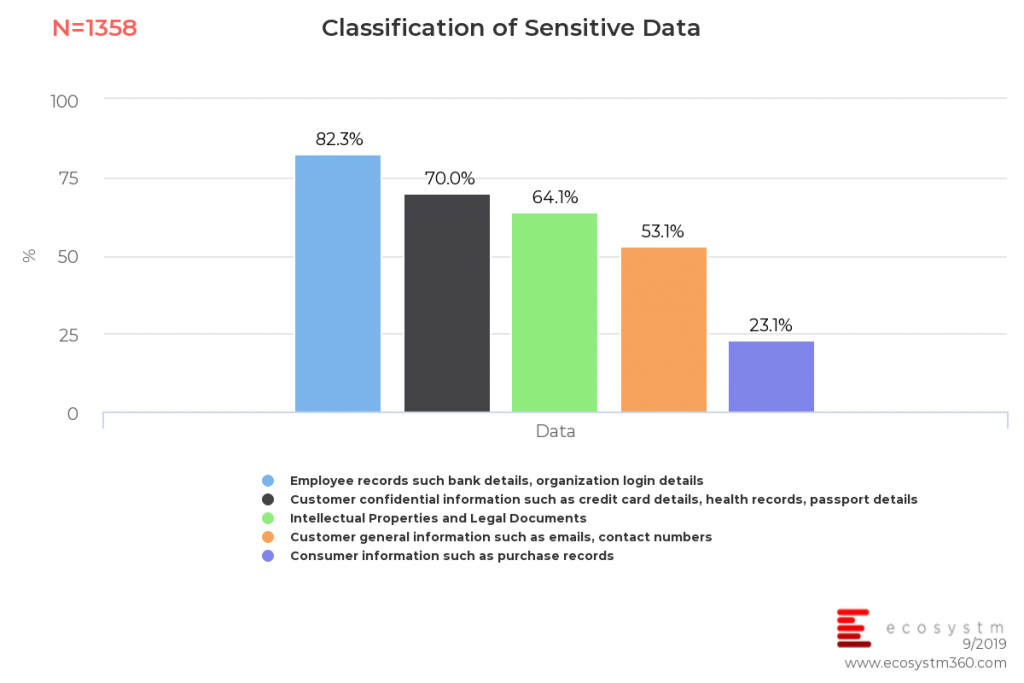

Efrat Kanner-Nissimov from NICE presented on driving a proactive compliance culture. This is a highly talked about area in the contact centre, given the increase in legislation around privacy and all countries having strict legislation around customer data and data privacy. Contact centres store sensitive customer information and knowing when to dispose off that data or for how long the data can be kept is an aspect that cannot be ignored. With what the banks have been through in Australia in recent times with the Royal Commission, serious questions around compliance and how compliant the agents are cannot be ignored. Ecosystm research finds that several organisations fail to identify what could be sensitive information. The journey towards a compliant environment starts with data classification, long before security roadmaps and solution implementations.

There is a greater emphasis on compliance and whilst many contact centres will claim that they have the processes in place, some of these have not been looked at for years. Compliance impacts the IT Manager, the agents, the Supervisor and ultimately the business. An automated compliance solution will help detect violations, prevent errors and allow for better visibility across different systems. She presented how Macy’s claims to have reduced their infrastructure and storage costs by 40%, through automating and deleting interactions that were no longer required. This helped lower IT costs and reduced time on audits. With the emphasis today on data privacy, data storage, data deletion and being compliant when you talk to your customers, the CX agents have a critical role to play in ensuring compliance.

Ecosystm comment:

Organisations across the Asia Pacific region are re-inventing how they look at CX as mentioned in my previous blogs. Banks, airlines, retailers, telcos and organisations from other verticals are investing in projects to drive transformation in CX. Applying deep analytics along every step of a customer’s journey will help the contact centre and the wider organisation better serve customers. The traditional methods of just looking at inbound and outbound interactions and setting KPIs for that, are no longer enough to drive this new vision. Machine learning, customer journey mapping and analytics, as well as shifting to the cloud is needed to drive transformation and agile ways of running CX. The Brand Embassy acquisition is an important one for NICE given one of the challenges not addressed by contact centres is integrating the various social and messaging applications and making them available to customers as a way to interact with the brand. This is an area contact centres have been looking to resolve.

In a highly competitive CX market where CRM, analytics, cloud and machine learning technologies are important aspects of a CX journey, NICE is investing in these areas to further strengthen their cloud contact centre value proposition. Compliance as highlighted earlier cannot be ignored and it is an area contact centres will be looking to invest in due to the multiple strict regulations underway across the Asia Pacific region surrounding how customers data is treated.