Australia is making meaningful progress on its digital journey, driven by a vibrant tech sector, widespread technology adoption, and rising momentum in AI. But realising its full potential as a leading digital economy will depend on bridging the skills gap, moving beyond surface-level AI applications, accelerating SME digital transformation, and navigating ongoing economic uncertainty. For many enterprises, the focus is shifting from experimentation to execution, using technology to drive efficiency, resilience, and measurable outcomes.

Increasingly, leaders are asking not just how fast Australia can innovate, but how wisely. Strategic choices made now will shape a digital future grounded in national values where technology fuels both economic growth and public good.

These five key realities capture the current state of Australia’s technology landscape, based on insights from Ecosystm’s industry conversations and research.

1. Responsible by Design: Australia’s Path to Trusted AI

AI in Australia is progressing with a strong focus on ethics and public trust. Regulators like ASIC and the OAIC (Office of the Australian Information Commissioner) have made it clear that AI systems, especially in banking, insurance, and healthcare, must be transparent and fair. Banks like ANZ and Commonwealth Bank, have developed responsible AI frameworks to ensure their algorithms don’t unintentionally discriminate or mislead customers.

Yet a clear gap remains between ambition and readiness. Ecosystm research shows nearly 77% of Australian organisations acknowledge progress in piloting real-world use cases but worry they’re falling behind due to weak governance and poor-quality data.

The conversation around AI in Australia is evolving beyond productivity to include building trust. Success is now measured by the confidence regulators, customers, and communities have in AI systems. The path forward is clear: AI must drive innovation while upholding principles of fairness, transparency, and accountability.

2. The New AI Skillset: Where Data Science Meets Compliance and Context

Australia is on track to face a shortfall of 250,000 skilled workers in tech and business by 2030, according to the Future Skills Organisation. But the gap isn’t just in coders or engineers; it’s in hybrid talent: professionals who can connect AI development with regulatory, ethical, and commercial understanding.

In sectors like finance, AI adoption has stalled not due to lack of tools, but due to a lack of people who can interpret financial regulations and translate them into data science requirements. The same challenge affects healthcare, where digital transformation projects often slow down because technical teams lack domain-specific compliance and risk expertise.

While skilled migration has rebounded post-pandemic, the domestic pipeline remains limited. In response, organisations like Microsoft and Commonwealth Bank are investing in cross-skilling employees in AI, cloud, and risk management. Government initiatives such as CSIRO’s Responsible AI program and UNSW’s AI education efforts are also working to build talent fluent in both technology and ethics.

Despite these efforts, Australia’s shortage of hybrid talent remains a critical bottleneck, shaping not just how fast AI is adopted, but how responsibly and effectively it is deployed.

3. Beyond Coverage: Closing the Digital Gap for Regional Australia

Australia’s vast geography creates a uniquely local digital divide. Despite the National Broadband Network (NBN) rollout, many regional areas still face slow speeds and outages. The 2023 Regional Telecommunications Review found that over 2.8 million Australians remain without reliable internet access. Industries suffer tangible impacts. GrainCorp, a major agribusiness, uses AI to communicate with workers during the harvest season, but regional connectivity gaps hinder real-time monitoring and analytics. In healthcare, the Royal Flying Doctor Service reports that poor internet reliability in remote areas undermines telehealth consultations, particularly crucial for Indigenous communities.

Efforts to address these gaps are underway. Telstra launched satellite services through partnerships with Starlink and OneWeb to cover remote zones. However, these solutions often come with prohibitive costs, particularly for smaller businesses, farms, and community organisations that cannot afford private network infrastructure.

The implications are clear: without reliable and affordable internet, regional enterprises will struggle to adopt AI, cloud-based systems, and digital tools that drive efficiency and equity. The next step must be a coordinated approach involving government, telecom providers, and industry, focused not just on coverage, but on quality, affordability, and support for local innovation. Bridging this digital divide is not simply about infrastructure, it’s about ensuring inclusive access to the tools that power modern business and essential services.

4. Resilience Over Defence: Australia’s Evolving Cybersecurity Focus

Australia’s cyber landscape has shifted sharply following major breaches like Optus, Medibank, and Latitude Financial, which pushed cybersecurity to the top of national agendas. In response, regulators and organisations have adopted a more urgent, coordinated stance. Under the Security of Critical Infrastructure (SOCI) Act, critical sectors must now report serious incidents within hours, enabling faster, government-led responses and stronger collective resilience.

Organisations across sectors are stepping up their defences, moving from reactive measures to proactive preparedness. NAB confirmed that it spends over USD 150M annually on cybersecurity, focusing on real-time threat hunting, simulation exercises, and red teaming. Telstra continues to run annual “cyber war games” involving IT, legal, and crisis communications teams to prepare for worst-case scenarios.

This collective focus signals a broader shift across Australian industries: cybersecurity maturity is no longer judged by perimeter defence alone. Instead, resilience – an organisation’s ability to detect, respond, and recover swiftly – is now the benchmark for protecting critical assets in an increasingly complex threat landscape.

5. Designing for the Long Term: Sustainability as a Core Capability

Organisations across Australia are under growing pressure – not only from regulators, but also from investors, customers, and communities – to demonstrate that their digital strategies are delivering real environmental and social outcomes. The bar has shifted from ESG disclosure to ESG performance. Technology is no longer just an efficiency lever; it’s expected to be a catalyst for sustainability transformation.

This expectation is especially acute in Australia’s core industries, where environmental impact is both material and highly scrutinised. In mining, for example, Rio Tinto’s 20-year renewable energy deal with Edify Energy aims to cut emissions by up to 70% at its Queensland aluminium operations by 2028. But the focus on transition is not limited to high-emission sectors. In financial services, institutions are actively supporting the shift to a low-carbon economy, from setting long-term net-zero targets to aligning lending practices with climate goals, including phasing out support for high-emission assets.

Yet for many, the path forward is still fragmented. ESG data often sits in silos, legacy systems constrain visibility, and ownership of sustainability metrics is scattered. Digital transformation efforts that treat ESG as an add-on, rather than embedding it into the foundations of data, governance, and decision-making, risk missing the mark. Australia’s next digital frontier will be measured not just by innovation, but by how effectively it enables a low-carbon, inclusive, and resilient economy.

Shaping Australia’s Digital Future

Australia’s technology journey is accelerating, but significant challenges must be addressed to unlock its full potential. Moving beyond basic digitalisation, the country is embracing advanced technologies as essential drivers of economic growth and productivity. Strong government initiatives and investments are creating a foundation for innovation and building a highly skilled digital workforce. However, overcoming barriers such as talent shortages, infrastructure gaps, and governance complexities is critical. Only by tackling these obstacles head-on and embedding technology deeply across organisations of all sizes can Australia transform automation into true data-driven autonomy and new business models, securing its position as a global digital leader.

Moving from a product or regional focus to an industry focus appears to be the “strategy du jour” for many technology vendors today. For some it is a new strategy – with the plan to improve customer focus and increase growth; for others it is the pendulum moving back to where they were five or ten years ago as they bounce from being industry-centric to product-centric to geography-centric and back again.

Getting your industry focus right is much harder than it seems – and has to be timed with client needs and market opportunity. The need to focus on the industry varies for different technology products, services and capabilities. For example, most technology buyers want their vendors to understand what their business does and how they add value to customers – that is a given and industry-aligned Sales teams make a lot of sense. Many tech buyers also want certain software functions to align directly to their processes – there is little appetite to customise ERP and financial suites to specific industry needs and processes – and tech vendors should support these out-of-the-box or cloud needs.

Industry Solutions May Not Drive Competitive Advantage

If the industry solution you are selling is the same as what any of their competitors can buy from you, then organisations get the exact same benefit as the market – no more, no less. For example, about 10-15 years ago, large telecom providers around the globe made significant investments in CRM platforms (often from Siebel) – bringing in one of a few large global systems integrators to deploy their standard processes and systems. These CRMs were supposed to provide business and customer benefit, and drive competitive advantage. And while they did deliver positive change (often at SIGNIFICANT cost!) when every telecom provider was using the same solution with the same or similar processes, any competitive advantage was lost.

Industry Solutions are Often the Sign of a Mature Market

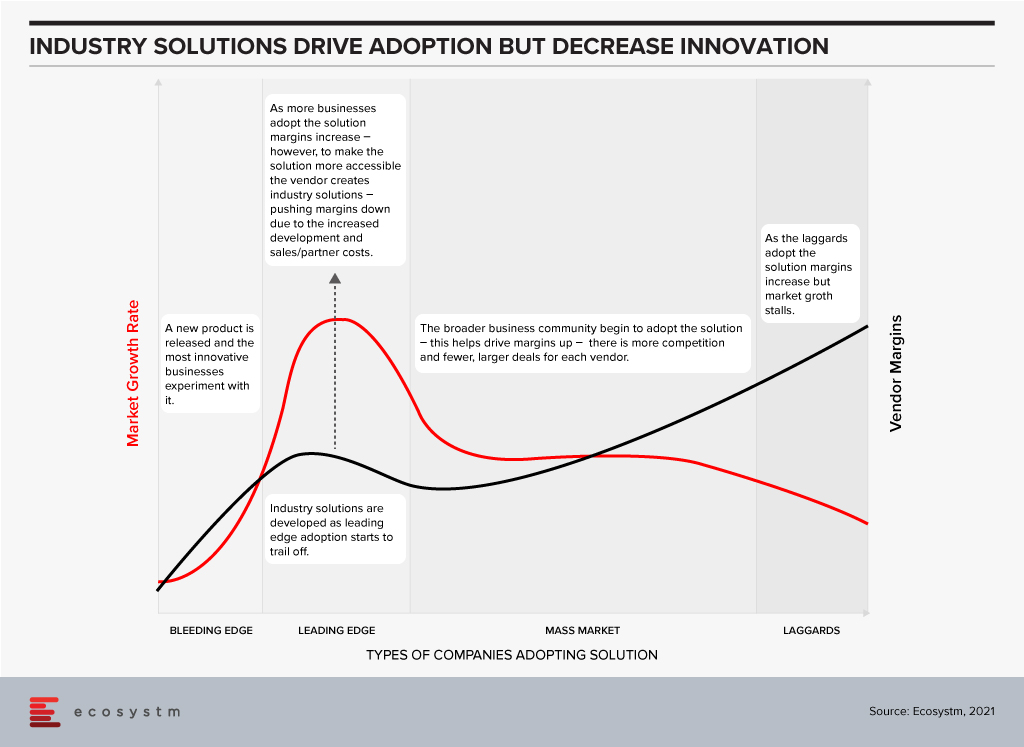

The widely accepted hypothesis is that the technology innovation and adoption happens in waves. The market has 5-7 year waves of innovation, followed by 5-7 year waves of deployment, adoption and consolidation.

The Innovation Phase. In this stage new companies emerge, new products or services are launched and leading/bleeding edge companies embrace these new technologies to drive competitive advantage and business growth. They experiment with new technologies that drive new business capabilities – sometimes failing, but always pushing the envelope for business innovation and forging the path for mass market adoption. In this stage there is often little demand for industry solutions – as both the providers and buyers of the solutions are still working out where the business benefit is; where the technology might be able to drive change or help them get ahead of competitors. If you examine the growth of a company such as Salesforce, you see that the early stage products are targeted towards a generic market – customers are expected to customise the solution based on their needs and individual requirements. In 2002 I worked for a challenger telecom provider that had deployed a traditional Peoplesoft CRM capability, and I was part of the team that brought Salesforce into the business – and as a cloud-based solution, we saw the competitive advantage was the pace at which we could customise the product (by excluding IT teams and processes). However, the solution was a “one-size-fits-all” product. The innovation stage is typically characterised by high growth of smaller vendors and technology service providers who challenge the status quo.

The Deployment, Adoption and Consolidation Phase. This stage of market growth is when the mass market starts to adopt these solutions. Many of these buyers walk the paths that have been forged before them by the more innovative, leading edge businesses. This stage typically sees less innovation, less experimentation, and more standard deployments. To make the solutions more palatable and easier to sell to the mass market tech vendors typically pre-configure or customise the solutions to specific needs – for business teams, roles or industries. It is usually in this stage of market growth and deployment that the industry solutions see significant interest and adoption. This is where the mass market gets access to the business benefits the more innovative businesses received many years earlier (and often profited from in this time). In my example of the Salesforce deployment in 2002, over the following years many partners started to create industry solutions, and eventually Salesforce themselves sold industry-specific solutions – or at least targeted certain products and capabilities at specific industries and provided accelerated deployment models to drive advantage at a faster rate. The deployment and consolidation stage of market growth is typically characterised by steady, slow growth across the entire market as benefits are being driven to all providers (product vendors and solutions or implementation providers). Legacy providers either play catch up or suffer declining business as they realise the solution they sell no longer provides the business and customer the benefits that it used to.

Industry Focus Should be Aligned to Customer Segments, Solution Type and Geography

The decision to sell industry-focused solutions should be driven by the type of solution you are selling; the business benefit you are promising; and the type of business you are targeting the solution towards. Businesses that are more innovative will still buy some pre-configured, industry-specific solutions that don’t differentiate their business or drive competitive advantage. But where they expect competitive advantage, they need to stand apart – to be the only business with that capability.

It is also worth understanding that an innovation in one market might be standard practice in another (and vice-versa). Countries across the globe and specifically here in Asia Pacific have different approaches to technology and innovation. China and parts of Southeast Asia are often innovators – pushing the boundaries of new and emerging tech to do things we never thought possible (in the same way Silicon Valley traditionally has done). Australia and India are traditional markets that adopt industry solutions after they have been tried and tested by others. Innovation in Japan seems to happen in stages and at pace but only once every 10-15 years or so. New Zealand and Singapore are generally more nimble economies where businesses often have to be innovative to gain global competitive advantage quickly.

Evidence indicates that the rate of innovation is increasing across the entire region – even in the less innovative economies. The window for industry solutions is much smaller regardless of location – as the next new innovation is just around the corner. Even the large, traditionally less agile businesses are driving innovation programs – for example, many of the big financial services “dinosaurs” such as DBS and Commonwealth Bank often win tech innovation awards and offer market-leading customer experiences.

Use this lens to better develop your industry approach. The depth of your industry solution or capability will dictate the opportunities that you will drive based on the type of customer and technology stage. Do you want to drive innovation or efficiency in your clients? Do you want to win the big “safer” deals – but be thought of as a technology solution provider; or win the smaller deals in companies that will become the market leaders of tomorrow – and be considered a market leader and king maker? Understanding your own business goals, the current sales and delivery capabilities, and the capacity to change will help your company create a go-to-market strategy that suits your current and future customers and will likely dictate the growth rate of your business over the next 5-7 years.

Keep yourself abreast with the latest industry trends

Ecosystm market insights, data, and reports are jam-packed with industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.