The 28th United Nations Climate Change Conference (or COP28) took place at the end of 2023 in one of the most climate-vulnerable countries in the world – the UAE. The event brought together nations, leaders, and climate experts to unite around tangible climate action and deliver realistic solutions.

COP28 marked a watershed moment in the global effort to fight climate change because it concluded the first Global Stocktake – a routine assessment of progress under the Paris Agreement that occurs every five years. It is clear that we are not on track to meet the agreement’s goals, but the decisions and actions taken during COP28 can redefine the trajectory of climate action.

COP27: Laying the Foundation

COP27 laid the groundwork for this year’s conference. The summit focused on mitigation, adaptation, finance, and collaboration. The key outcomes of COP27 included the creation of the loss and damage fund, new pledges to the Adaptation Fund, and advancements in the Santiago Network focused on technical support for climate-affected regions. The conference also saw progress on the Global Stocktake and formal recognition of new issues such as water, food security, and forests within climate deliberations.

However, there was widespread criticism for failing to live up to the urgency of impending climate crisis. Despite being called the “implementation COP”, nothing decisive was done to ensure global warming is limited to 1.5 degrees celsius.

COP28: Milestones

Launching the first-ever Global Stocktake. The Global Stocktake was the spotlight of this year’s event and covered various climate issues, including energy, transport, and nature. Despite strong opposition from Oil & Gas interests, negotiators secured an agreement indicating the start of the end of the fossil fuel era – a much-needed conclusion to the hottest year in history. The next global assessment of Paris Agreement targets is expected to take place at COP33 in 2028.

Supporting sustainable agriculture. A landmark declaration on sustainable agriculture was adopted to address climate-related threats to global food systems. Signed by 160 countries, the declaration pledged a collective commitment by participating nations to expedite the integration of agriculture and food systems into national climate actions by 2025. For the first time ever, the summit also featured an entire day devoted to food and agriculture and saw a food systems roadmap laid out by the Food and Agriculture Organisation (FAO).

Operationalising the “Loss and Damage” fund. The conference saw the approval of the “loss and damage fund” that was first tabled at COP27 last year. The fund has been a long-requested support for developing nations facing the impact of climate change.

Tripling renewables and doubling energy efficiency by 2030. 118 countries signed a renewable energy pledge to triple the world’s green energy capacity to 11,000 GW by 2030, reducing the reliance on fossil fuels in generating energy. The pledge is expected to see global average annual rate of energy efficiency improvements from around 2% to over 4% every year until 2030. While the pledge spearheaded by the EU, the US, and the UAE is not legally binding, it is a step in the right direction.

Adapting to a warmer world. COP28 provided a framework for the ‘Global Goal on Adaptation’ to guide countries in their efforts to protect their people and ecosystems from climate change. An explicit 2030 date has been integrated into the text for targets on water security, ecosystem restoration, health, climate-resilient food systems, resilient human settlements, reduction of poverty, and protection of tangible cultural heritage.

Addressing methane. Methane took centre stage at COP28, reflecting its significant role in current global warming. US, Canada, Brazil, and Egypt announced more than USD 1 billion in funding to reduce methane emissions. Despite facing political challenges, these measures signify a shift towards concrete regulatory and pricing tools, marking a step forward in addressing methane’s impact on climate protection.

How COP28 Could Have Been More Impactful

Better funding allocations. Although the “loss and damage” funding agreement seems like a major outcome, the actual financial commitments fell far short. US and China, despite being the world’s largest emitters, extended only USD 17.5 million and USD 10 million to the fund, respectively. There is also debate about how funds should be distributed, with mature countries favouring aid allocation based on vulnerability. This approach might exclude middle-income countries that have suffered significant climate-related damage recently.

More focus on AI. While COP28 tackled critical climate issues, it overlooked a significant concern – the environmental impact of AI. While AI holds promise for improved sustainability, it is important to address the environmental consequences of AI model training and deployment. The absence of scrutiny on the ecological impact of AI represents a missed early opportunity, considering the widespread hype and significant investments in the technology.

Recognising climate refugees. The increase in climate-related displacement is a growing concern, with millions already affected and predictions of a significant rise by 2050. International law does not recognise those displaced by climate events as refugees. Despite this, the topic wasn’t adequately explored at COP28, highlighting the need for inclusive discussions and solutions for safe migration pathways.

A Call for Unified Action

While COP28 and similar forums highlight the severity of the climate crisis, the real power lies in continuous collective conversations that identify gaps, strive to bridge them, and drive meaningful change. Ecosystm, in collaboration with partners Kyndryl and Microsoft, conducted a Global Sustainability Barometer study, that reveals that while 85% of global organisations acknowledge the strategic importance of sustainability goals, only 16% have successfully integrated sustainability into their corporate and transformation strategies with tangible data.

While governments and policy makers continue to focus on building a sustainable future for the planet, this is time for a shift in mindset and action is pivotal for a unified global effort in addressing climate challenges and building a sustainable future – from organisations and individuals alike.

Climate summits have attempted to reach a consensus and firm international agreements on emission reduction strategies. However, countries continue to lag behind in the climate promises – many do not back their ambitious targets with real, measurable steps.

With the UN Climate Change Conference (COP28) on the horizon, the world’s attention is fixed on how the conference can operationalise climate outcomes.

Read on to find out about the pivotal discussions and potential breakthroughs that COP28 holds in the global fight against environmental change.

Download ‘Eyes on COP28: Shaping the Direction of Global Climate Policy’ as a PDF.

While there has been much speculation about AI being a potential negative force on humanity, what we do know today is that the accelerated use of AI WILL mean an accelerated use of energy. And if that energy source is not renewable, AI will have a meaningful negative impact on CO2 emissions and will accelerate climate change. Even if the energy is renewable, GPUs and CPUs generate significant heat – and if that heat is not captured and used effectively then it too will have a negative impact on warming local environments near data centres.

Balancing Speed and Energy Efficiency

While GPUs use significantly more energy than CPUs, they run many AI algorithms faster than CPUs – so use less energy overall. But the process needs to run – and these are additional processes. Data needs to be discovered, moved, stored, analysed, cleansed. In many cases, algorithms need to be recreated, tweaked and improved. And then that algorithm itself will kick off new digital processes that are often more processor and energy-intensive – as now organisations might have a unique process for every customer or many customer groups, requiring more decisioning and hence more digitally intensive.

The GPUs, servers, storage, cabling, cooling systems, racks, and buildings have to be constructed – often built from raw materials – and these raw materials need to be mined, transported and transformed. With the use of AI exploding at the moment, so is the demand for AI infrastructure – all of which has an impact on the resources of the planet and ultimately on climate change.

Sustainable Sourcing

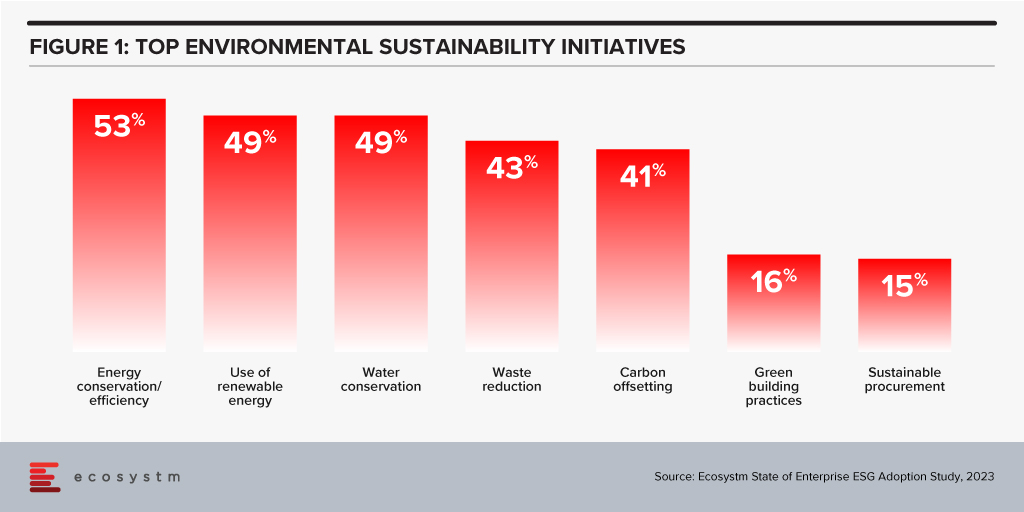

Some organisations understand this already and are beginning to use sustainable sourcing for their technology services. However, it is not a top priority with Ecosystm research showing only 15% of organisations focus on sustainable procurement.

Technology Providers Can Help

Leading technology providers are introducing initiatives that make it easier for organisations to procure sustainable IT solutions. The recently announced HPE GreenLake for Large Language Models will be based in a data centre built and run by Qscale in Canada that is not only sustainably built and sourced, but sits on a grid supplying 99.5% renewable electricity – and waste (warm) air from the data centre and cooling systems is funneled to nearby greenhouses that grow berries. I find the concept remarkable and this is one of the most impressive sustainable data centre stories to date.

The focus on sustainability needs to be universal – across all cloud and AI providers. AI usage IS exploding – and we are just at the tip of the iceberg today. It will continue to grow as it becomes easier to use and deploy, more readily available, and more relevant across all industries and organisations. But we are at a stage of climate warming where we cannot increase our greenhouse gas emissions – and offsetting these emissions just passes the buck.

We need more companies like HPE and Qscale to build this Sustainable Future – and we need to be thinking the same way in our own data centres and putting pressure on our own AI and overall technology value chain to think more sustainably and act in the interests of the planet and future generations. Cloud providers – like AWS – are committed to the NetZero goal (by 2040 in their case) – but this is meaningless if our requirement for computing capacity increases a hundred-fold in that period. Our businesses and our tech partners need to act today. It is time for organisations to demand it from their tech providers to influence change in the industry.

Environmental, social, and governance (ESG) ratings towards investment criteria have become popular for potential investors to evaluate companies in which they might want to invest. As younger investors and others have shown an interest in investing based on their personal values, brokerage firms and mutual fund companies have begun to offer exchange-traded funds (ETFs) and other financial products that follow specifically stated ESG criteria. Passive investing with robo-advisors such as Betterment and Wealthfront have also used ESG criteria to appeal to this group.

The disruption caused by the pandemic has highlighted for many of us the importance of building sustainable and resilient business models based on multi-stakeholder considerations. It has also created growing investor interest in ESG.

ESG signalling for institutional investors

The increased interest in climate change, sustainable business investments and ESG metrics is partly a reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Efforts for ESG standards for risk measurement will benefit and support that effort.

A recent study of asset managers by the investment arm of Institutional Shareholder Services (ISS) showed that more than 12% of respondents reported heightened importance of ESG considerations in their investment decisions or stewardship activities compared to before the pandemic.

In the area of hedge funds, there has been an increased demand for ESG-integrated investments since the start of COVID-19, according to 50% of all respondents of a hedge fund survey conducted by BNP Paribas Corporate and Institutional Banking of 53 firms with combined assets under management (AUM) of at least USD 500B.

ESG criteria may have a practical purpose beyond any ethical concerns, as these criteria may be able to help avoidance of companies whose practices could signal risk. As ESG gets more traction, investment firms such as JPMorgan Chase, Wells Fargo, and Goldman Sachs have published annual reports that highlight and review their ESG approaches and the bottom-line results.

But even with more options, the need for clarity and standards on ESG has never been so important. In my opinion, there must be an enhanced effort to standardise and harmonise ESG rating metrics.

How are ESG ratings made?

ESG ratings need both quantitative and qualitative/narrative disclosures by companies in order to be calculated. And if no data is disclosed or available, companies then move to estimations.

No global standard has been defined for what is included in a given company’s ESG rating. Attempts at standardising the list of ESG topics to consider include the materiality map developed by the Sustainable Accounting Standard Board (SASB) or the reporting standards created by the Global Reporting Initiative (GRI). But most ESG rating providers have been defining their own materiality matrices to calculate their scores.

Can ESG scoring be automatically integrated?

Just this month, Morningstar equity research analysts announced they will employ a globally consistent framework to capture ESG risk across over 1,500 stocks. Analysts will identify valuation-relevant risks for each company using Sustainalytics’ ESG Risk Ratings, which measure a company’s exposure to material ESG risks, then evaluate the probability those risks materialise and the associated valuation impact. ESG rating firms such as MSCI, Sustainalytics, RepRisk, and ISS use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks, as well as how well they manage those risks relative to peers.

Their ESG Risk Ratings measure a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks. This approach to measuring ESG risk combines the concepts of management and exposure to arrive at an assessment of ESG risk – the ESG Risk Rating – which should be comparable across all industries. But some critics of this form of approach feel it is still too subjective and too industry-specific to be relevant. This criticism is relevant when you understand that the use of the ESG ratings and underlying scores may in future inform asset allocation. How might this better automated and controlled? Perhaps adding some AI might be useful to address this?

In one example, Deutsche Börse has recently led a USD 15 million funding round in Clarity AI, a Spanish FinTech firm that uses machine learning and big data to help investors understand the societal impact of their investment portfolios. Clarity AI’s proprietary tech platform performs sustainability assessments covering more than 30,000 companies,198 countries,187 local governments and over 200,000 funds. Where companies like Cooler Future are working on an impact investment app for everyday individual users, Clarity AI has attracted a client network representing over $3 trillion of assets and funding from investors such as Kibo Ventures, Founders Fund, Seaya Ventures and Matthew Freud.

What about ESG Indices? What do they tell us about risk?

Core ESG indexing is the use of indices designed to apply ESG screening and ESG scores to recognised indices such as the S&P 500®, S&P/ASX 200, or S&P/TSX Composite. SAM, part of S&P Global, annually conducts a Corporate Sustainability Assessment, an ESG analysis of over 7,300 companies. Core ESG indices can then become actionable components of asset allocation when a fund or separately managed accounts (SMAs) provider tracks the index.

Back in 2017, the Swiss Federal Office for the Environment (FOEN) and the State Secretariat for International Finance (SIF) made it possible for all Swiss pension funds and insurance firms to measure the environmental impact of their stocks and portfolios for free. Currently, these federal bodies are testing use case with banks and asset managers. Its initial activities will be recorded in an action plan, which is due to be published in Spring 2021.

How can having a body of sustainable firms help create ESG metrics?

Creating ESG standard metrics and methodologies will be aided when there is a network of sustainable companies to analyse, which leads us to green fintech networks (GFN) of companies interested in exploring how their own technology investments can be supportive of ESG objectives. Switzerland is setting up a Green Fintech Network to help the country take advantage of the “great opportunity” presented by sustainable finance. The network has been launched by SIF alongside industry players, including green FinTech companies, universities, and consulting and law firms. Stockholm also has a Green Fintech Network that allows collaboration towards sustainability goals.

Concluding Thought

We should be curious about how ESG can provide decision-oriented information about intangible assets and non-financial risks and opportunities. More information and data from ESG data providers like SAM, combined with automation or AI tools can potentially provide a more complete picture of how to measure the long-term sustainable performance of equity and fixed income asset classes.

Singapore FinTech Festival 2020: Investor Summit

For more insights, attend the Singapore FinTech Festival 2020: Investor Summit which will cover topics tied to 2021 Investor Priorities, and Fundraising and exit strategies

In this blog, our guest authors Randeep Sudan and Yamin Oo talk about the pervasiveness of the Digital Economy, and the key trends that will determine its future trajectory. “That the world in 2030 will be very different from today is obvious. We may, however, be surprised by the extent and sweep of the change ahead of us.”

The Digital Economy – a term first coined by Don Tapscott in 1994 – is not easy to define or measure. At one end, it is limited to the production and consumption of digital goods and services. On the other end, according to the European Parliament, “The digital economy is increasingly interwoven with the physical or offline economy making it more and more difficult to clearly delineate the digital economy“. We are, however, witnessing the Digital Economy transitioning to an economy that is digital.

Given the pervasiveness of the Digital Economy, its future will be determined by the complex interplay of several trends. Some of the trends that illustrate the future trajectory of the Digital Economy are:

Technology

We will see AI becoming ubiquitous as it is leveraged in every sector and sphere of activity. According to one estimate, AI is estimated to contribute USD 15.7 trillion to the global economy by 2030, which is more than the current GDP of China and India combined! We are also likely to see rapid progress in technologies related to Extended Reality (XR) in the coming years. COVID-19 is accelerating this trend, as we can see from the offerings of companies like Spatial and MeetinVR that facilitate virtual business meetings. The analog world’s rendering into its digital twin will see us moving towards a metaverse – a virtual shared space imagined in Neal Stephenson’s novel Snowcrash. Some of the biggest names in the tech industry – Apple (Apple glass), Facebook (Oculus), Sony (Playstation) – are assiduously working towards this direction.

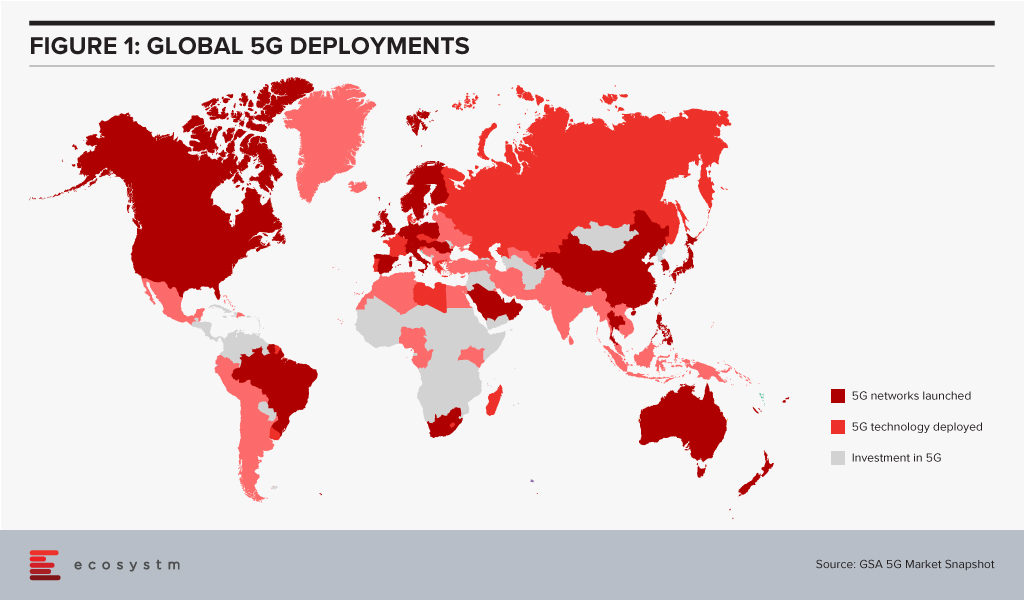

Given the importance of telecom infrastructure to the Digital Economy, 5G networks are being rolled out in countries worldwide (Figure 1). However, even as 5G is being deployed, the buzz around 6G is getting louder. 6G may transmit data 100 times faster than 5G and may see deployment by 2030 given the decadal cycles for telecom: 1G in the 80s, 2G in the 90s, 3G in the decade following 2000, 4G in the decade starting 2010, and 5G beginning in the 2020s.

The availability of high bandwidth, low latency networks could lead to newer applications and further breakthroughs in innovative technologies.

The Future of Work

With the rapid growth in automation and AI, we are likely to see significant labour market disruptions. Moreover, COVID-19 has been a watershed for the global economy – its impacts will continue to be felt for many years to come. According to the International Labor Organization, 495 million full-time jobs were lost in the first two quarters of 2020 due to COVID-19. Lower and middle-income countries have suffered the most, with an estimated 23.3% drop in working hours – equivalent to 240 million jobs.

A recent report from the World Economic Forum estimates that by 2025, 85 million jobs may be displaced due to automation and AI, while 97 million new roles may emerge. We will see significant changes and turbulence in labour markets across multiple industries and geographies in the years ahead. If we look at how the top ten skills required by the top 10 US companies have been changing over time, we get an indication of the Future of Work. Companies are more focused on “soft” skills, that are not easily addressed by AI & Automation.

We are also likely to see a shift from humans adapting to technology to technologies adapting to humans. For example, the acceleration in digital twins combined with advancements in XR could allow unskilled workers to do skilled jobs. AR could guide a worker to repair a piece of mechanical equipment without long years of previous training. Similarly, the emergence of ‘Low Code No Code’ (LCNC) applications will allow ordinary individuals to do tasks that previously required specialised training.

Climate Change

Scientists have long focused our attention to limit the carbon dioxide in the atmosphere to 450 parts per million to avoid catastrophic climate change. In 2016, the World Meteorological Organization reported this concentration had crossed 400 parts per million, leaving us with a shorter runway to prevent calamitous climate change. We are, therefore, likely to see increased efforts to tackle climate change in the decade ahead.

Digital technologies can impact the global climate agenda in multiple ways: smart grids, smart buildings, smart appliances, intelligent transport systems, shared mobility, and 3D printing, to name a few. Digital technologies will also allow new sources of renewable energy to be tapped. For example, the molten core of the earth is over 6,000°C. “Just 0.1% of the heat content of Earth could supply humanity’s total energy needs for 2 million years,” according to AltaRock Energy. Advances in the use of digital technologies that allow for precise directional drilling will allow for advanced geothermal systems to be established as reliable power sources.

Splinternet

Tech bloggers like Doc Searls and Stephen Lewis had begun to theorise about a Splinternet as early as 2008. There was a danger of governments carving the world into geopolitical blocks and creating technology barriers. China’s Great Firewall and the US’s recent responses under the Trump administration are likely to hurtle us in the direction of a fractured internet. We may end up with the US dominating the western internet and China dominating a competing block of countries. The Digital Economy’s evolution would fracture into different camps, making it very different from what it is today.

Tech Regulation

The most valuable companies in the world today are in tech. Seven of the top ten companies in the world by market cap in 2020 are tech companies.

The recent investigation into competition in digital markets undertaken by the US House Judiciary Committee observed: “Over the past decade, the digital economy has become highly concentrated and prone to monopolisation. Several markets investigated by the Subcommittee – such as social networking, general online search, and online advertising – are dominated by just one or two firms. The companies investigated by the Subcommittee – Amazon, Apple, Facebook, and Google – have captured control over key channels of distribution and have come to function as gatekeepers. Just a decade into the future, 30% of the world’s gross economic output may lie with these firms, and just a handful of others.“

We have also witnessed the rapid diversification of data monopolies into other sectors. See, for example, the diversification of VC investments by Alibaba’s Ant Group over time. In 2015 they were investing in 5 areas, which has doubled in the last 5 years.

The call for the regulation of big tech will gain momentum in the coming years. The European Union is likely to lead here, just the way just it did in the case of its General Data Protection Regulation.

Governments will also require data monopolies to share data. China mandates its automakers to share data generated by electric vehicles with a government research institute. This data is essential for public safety and planning battery-recharging stations. The Australian Government promotes the concept of sharing “designated datasets” that could include data held by the private sector that has significant community benefits. Similarly, France’s Law for a Digital Republic requires the sharing data by certain categories of the private sector. Such blurring of boundaries between public and private data will become more important.

We will also see the growing importance of data trusts. These are structures where data is placed in the custody of a “Board of Trustees” who have a fiduciary responsibility to look after the interests of data owners. Such data trusts might give individuals better control over their data.

Every aspect of the economy is being digitalised today. In the next decade we are likely to witness foundational shifts in how the Digital or Data Economy is structured. It will also see increasing risks as cyber threats grow exponentially from cybercriminals and state actors. That the world in 2030 will be very different from today is obvious. We may, however, be surprised by the extent and sweep of the change ahead of us.

Singapore FinTech Festival 2020: Economic Summit

For more insights, attend the Singapore FinTech Festival 2020: Economic Summit which will cover topics tied to the state of the economy, path to recovery and re-framing the new financial services landscape

In this blog, our guest author HE Jo Tyndall, delivers a message of hope for the future and talks about initiatives across all levels to combat climate change and biodiversity loss. “The pieces of the puzzle that will create a sustainable future are all there – it is time to start fitting them together.”

If, like me, you have watched Sir David Attenborough’s “witness statement” (A Life On Our Planet), it is easy to despair of the wanton, wilful destruction humanity has wreaked on the Earth, and to be horrified that so much of this has happened in one man’s (admittedly long) lifetime. The images he conjures – of distressed orangutans, starving polar bears, floods, fires and droughts, and of rampant deforestation – underscore how ubiquitous, urgent and overwhelming the climate change and biodiversity crises are.

But Sir David ends with a message of hope, and it is this I want to emphasise. Everywhere we look, there are green shoots of hope, many growing into sturdy saplings. They are coming thick and fast, and they are becoming mainstream – no longer relegated to the tick-box margins of policy or practice. The pieces of the puzzle that will create a sustainable future are all there – it is time to start fitting them together.

Political Signals Create a Ripple Effect

First, and foremost, in 2015 we got the Paris Agreement (and subsequently its rulebook). This was no mean feat. It set climate goals, gave us global rules for being transparent and accountable, and put governments on a path of continuous improvement to reach those collective goals. It is easy to dismiss global treaties as just words on paper, but this is to ignore the profound ripple effect those words have already had. (The Agreement held firm despite the US withdrawal – but the fillip when it re-joins will be welcome.)

The political signals set the first ripples off as governments needed climate policies to meet their Paris undertakings. The European Green Deal aims for a sustainable EU economy, with no net greenhouse gas emissions by 2050, decoupling economic growth from resource use. The UK will host next year’s UN Climate Change Conference of the Parties (COP26) – and has doubled its climate finance for the period 2021-2025.

In September this year, China – the world’s largest emitter of greenhouse gases – announced it would achieve carbon neutrality by 2060. Japan and Korea, too, have upped their mid-century targets to bring net emissions to zero.

The New Zealand Government has set a legislated goal for the country to be carbon neutral by 2050; has amended our Emissions Trading System (ETS) to ensure price signals encourage a move to low carbon; set up a green investment fund; invested heavily in research into reducing emissions from livestock production; and, most recently, made carbon-related financial disclosures mandatory for specified companies, banks, insurers and investment managers. We have also made it our mission to encourage governments to phase out fossil fuel subsidies (some US$400bn each year) that promote excessive consumption.

The Ripples Reach Cities and Businesses…

The political signals have flowed through to regional and local government. The C40 group (cities around the world working towards sustainability goals) now has 96 participating members – with many cities finding opportunities to collaborate with others in the network on joint projects.

It is becoming obvious that fossil fuel industries are at a disadvantage against increasingly cost-competitive renewable energy. Governments are working out how to manage a ‘just transition’ for the energy sector, while forward-leaning energy companies are re-shaping their business models in anticipation of a low carbon future.

Political signals encourage businesses to factor climate change into their planning and investment decisions. Businesses everywhere have read the political tea leaves and we see weekly announcements of pledges for carbon neutrality, ethical investing, green financing and so on. Whether it is Blackrock or NZ Super Fund making environmental, social, and governance (ESG) considerations integral to their investments, or Ikea’s IWAY (its ESG code of conduct for itself and its suppliers), business is showing a deeper commitment to sustainability than ever before.

Some industries will have to be more invested than others in emissions reduction, but this opens a world of opportunity and innovation. Energy & Utilities companies are implementing waste-to-energy solutions – Singapore’s Integrated Waste Management Facility (IWMF) is set to be the world’s largest energy recovery facility – and adoption of carbon capture, utilisation and storage (CCUS) facilities is at last gathering momentum across energy systems. Industries like aviation and maritime, too, have to play a key role in a circular economy.

… And Individuals (the Last – and First – Pieces of the Puzzle)

The ripples have spread to individuals – people like you and me. I know there are still plenty of climate deniers around. But mindsets are changing – and when that happens, the ripples become a tidal wave of real change. If we each start thinking we can do it and we will do it, the change will happen. If we make it clear, in our preferences as consumers, and in our expectations of the businesses we buy from or invest in, the change will happen.

The numbers who recognise we must live within our planetary boundaries are growing, values are changing (especially in light of the pandemic), and our low-carbon future is a high-tech one – not hemp shirts and home-made candles (unless of course these are your thing). Digital is a critical part of the story. Blockchain and distributed ledger technology (DLT) is being used to cater to a new generation of consumers, conscious of buying what is good for the world in the face of climate change and biodiversity loss. Food products are being branded using track-and-trace capabilities of Blockchain for ‘farm to fork’ visibility.

Who doesn’t want to breathe clean air, have lower energy bills, and eat safe and healthy food? Maybe we will see more initiatives like America’s Pledge, bringing together an entire ecosystem committed to fighting climate change, growing the economy, and protecting public health – an ecosystem of states, cities, businesses, universities, and citizens.

We now have the rules, the policy tools, the technologies, and – increasingly – we have the will to act. As we re-build our economies, our businesses, and our lives, let us re-build better. So, I would echo Sir David Attenborough’s optimism – it is just that we do not have his (95 years) lifetime left to put things right.

Singapore FinTech Festival 2020: Impact Summit

For more insights, attend the Singapore FinTech Festival 2020: Impact Summit which will cover topics tied to climate change and sustainability to build a better future