Consider the sheer volume of information flowing through today’s financial systems: every QR payment, e-KYC onboarding, credit card swipe, and cross-border transfer captures a data point. With digital banking and Open Banking, financial institutions are sitting on a goldmine of insights. But this isn’t just about data collection; it’s about converting that data into strategic advantage in a fast-moving, customer-driven landscape.

With digital banks gaining traction and regulators around the world pushing bold reforms, the industry is entering a new phase of financial innovation powered by data and accelerated by AI.

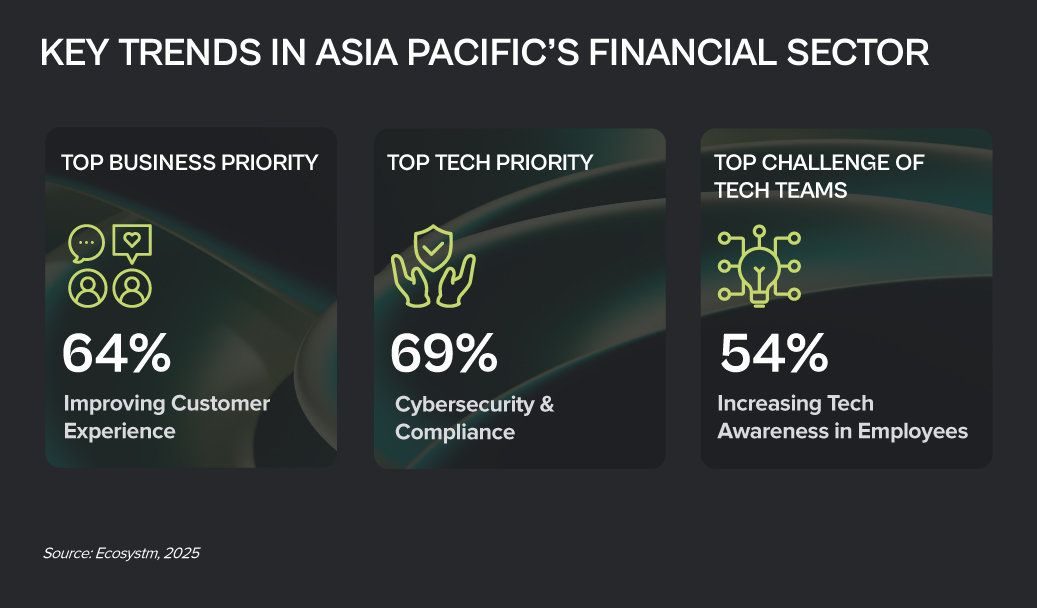

Ecosystm gathered insights and identified key challenges from senior banking leaders during a series of roundtables we moderated across Asia Pacific. The conversations revealed a clear picture of where momentum is building – and where obstacles continue to slow progress. From these discussions, several key themes emerged that highlight both opportunities and ongoing barriers in the Banking sector.

1. AI is Leading to End-to-End Transformation

Banks are moving beyond generic digital offerings to deliver hyper-personalised, data-driven experiences that build loyalty and drive engagement. AI is driving this shift by helping institutions anticipate customer needs through real-time analysis of behavioural, transactional, and demographic data. From pre-approved credit offers and contextual investment nudges to app interfaces that adapt to individual financial habits, personalisation is becoming a core strategy, not just a feature. This is a huge departure from reactive service models, positioning data as a long-term strategic asset.

But the impact of AI isn’t limited to customer-facing experiences. It’s also driving innovation deep within the banking stack, from fraud detection and SME loan processing to intelligent chatbots that scale customer support. On the infrastructure side, banks are investing in agile, AI-ready platforms to support automation, model training, and advanced analytics at scale. These shifts are redefining how banks operate, make decisions, and deliver value. Institutions that integrate AI across both front-end journeys and back-end processes are setting a new benchmark for agility, efficiency, and competitiveness in a fast-changing financial landscape.

2. Regulatory Shifts are Redrawing the Competitive Landscape

Regulators are moving quickly in Asia Pacific by introducing frameworks for Open Banking, real-time payments, and even AI-specific standards like Singapore’s AI Verify. But the challenge for banks isn’t just keeping up with evolving external mandates. Internally, many are navigating a complicated mix of overlapping policies, built up over years of compliance with local, regional, and global rules. This often slows down innovation and makes it harder to implement AI and automation consistently across the organisation.

As banks double down on AI, it is clear that governance can’t be an afterthought. Many are still dealing with fragmented ownership of AI systems, inconsistent oversight, and unclear rules around things like model fairness and explainability. The more progressive ones are starting to fix this by setting up centralised governance frameworks, investing in risk-based controls, and putting processes in place to monitor things like bias and model drift from day one. They are not just trying to stay compliant; they are preparing for what’s coming next. In this landscape, the ability to manage regulatory complexity with speed and clarity, both internally and externally, is quickly becoming a competitive edge.

3. Success Depends on Strategy, Not Just Tech

While enthusiasm for AI is high, sustainable success hinges on a clear, aligned strategy that connects technology to business outcomes. Many banks struggle with fragmented initiatives because they lack a unified roadmap that prioritises high-impact use cases. Without clear goals, AI projects often fail to deliver meaningful value, becoming isolated pilots with limited scalability.

To avoid this, banks need to develop robust return-on-investment (ROI) models tailored to their context — measuring benefits like faster credit decisioning, reduced fraud losses, or increased cross-selling effectiveness. These models must consider not only the upfront costs of infrastructure and talent, but also ongoing expenses such as model retraining, governance, and integration with existing systems.

Ethical AI governance is another essential pillar. With growing regulatory scrutiny and public concern about opaque “black box” models, banks must embed transparency, fairness, and accountability into their AI frameworks from the outset. This goes beyond compliance; strong governance builds trust and is key to responsible, long-term use of AI in sensitive, high-stakes financial environments.

4. Legacy Challenges Still Hold Banks Back

Despite strong momentum, many banks face foundational barriers that hinder effective AI deployment. Chief among these is data fragmentation. Core customer, transaction, compliance, and risk data are often scattered across legacy systems and third-party platforms, making it difficult to access the integrated, high-quality data that AI models require.

This limits the development of comprehensive solutions and makes AI implementations slower, costlier, and less effective. Instead of waiting for full system replacements, banks need to invest in integration layers and modern data platforms that unify data sources and make them AI-ready. These platforms can connect siloed systems – such as CRM, payments, and core banking – to deliver a consolidated view, which is crucial for accurate credit scoring, personalised offers, and effective risk management.

Banks must also address talent gaps. The shortage of in-house AI expertise means many institutions rely on external consultants, which increases costs and reduces knowledge transfer. Without building internal capabilities and adjusting existing processes to accommodate AI, even sophisticated models may end up underused or misapplied.

5. Collaboration and Capability Building are Key Enablers

AI transformation isn’t just a technology project – it’s an organisation-wide shift that requires new capabilities, ways of working, and strategic partnerships. Success depends on more than just hiring data scientists. Relationship managers, credit officers, compliance teams, and frontline staff all need to be trained to understand and act on AI-driven insights. Processes such as loan approvals, fraud escalations, and customer engagement must be redesigned to integrate AI outputs seamlessly.

To drive continuous innovation, banks should establish internal Centres of Excellence for AI. These hubs can lead experimentation with high-value use cases like predictive credit scoring or real-time fraud detection, while ensuring that learnings are shared across business units. They also help avoid duplication and promote strategic alignment.

Partnerships with fintechs, technology providers, and academic institutions play a vital role as well. These collaborations offer access to cutting-edge tools, niche expertise, and locally relevant AI models that reflect the regulatory, cultural, and linguistic contexts banks operate in. In a fast-moving and increasingly competitive space, this combination of internal capability building and external collaboration gives banks the agility and foresight to lead.

The financial services sector stands at a pivotal moment. Shaped by shifting customer expectations, fintech disruption, and rising demands for security and compliance, the industry is undergoing deep, ongoing transformation. From personalised digital engagement to AI-driven decisions and streamlined operations, BFSI is being fundamentally reshaped.

To thrive in this intelligent, interconnected future, financial organisations must embrace new strategies that turn challenges into opportunities.

Click here to download “Future Forward: Reimagining Financial Services” as a PDF.

Scaling for Impact

CreditAccess Grameen, a leading microfinance institution in India, struggled to scale its operations to meet the rising demand for microloans. Its manual processes were inefficient, causing delays and hindering its ability to serve an expanding customer base.

To overcome this, CreditAccess Grameen digitised its operations, automating processes to handle over 80,000 loans per day, streamlining loan approvals and improving operational efficiency.

This transformation significantly reduced loan processing times, from seven to ten days down to a more efficient, timely process. It also enhanced customer satisfaction, empowered financial independence, and strengthened CreditAccess Grameen’s position as a leader in financial inclusion, driving economic growth in rural India.

Seamless Operations, Improved Reporting

After merging three separate funds, Aware Super, one of Australia’s largest superannuation funds, faced fragmented operations, inconsistent documentation, and poor visibility into workflows. These inefficiencies hampered the organisation’s ability to optimise operations, ensure compliance, and deliver a seamless member experience.

To overcome this, Aware Super implemented a business process management suite to standardise and automate key processes, providing a unified platform for continuous improvement.

The transformation streamlined operations across all funds, improving reporting accuracy, reducing waste, and boosting procurement efficiency. The creation of a Centre of Excellence fostered a culture of ongoing process improvement and regulatory compliance, elevating Aware Super’s process maturity and solidifying its leadership in the financial services sector.

Empowering Employees and Improving Operations

The Norinchukin Bank, a major financial institution serving Japan’s agriculture, forestry, and fisheries sectors, struggled with outdated, paper-based processes and disconnected systems. Manual approvals and repetitive data entry were hindering operations and frustrating staff.

The digital team implemented a low-code platform that quickly automated approvals, integrated siloed systems, and streamlined processes into a single, efficient workflow.

The results were striking: approval times dropped, development cycles halved, and implementation costs fell by 30% compared to legacy upgrades. Employees gained real-time visibility over requests, cutting errors and speeding decisions. Crucially, the shift sparked a wave of digital adoption, with teams across the bank now embracing automation to drive further efficiency.

Eliminating Handoffs, Elevating Experience

Axis Bank, one of India’s largest private sector banks, struggled with slow, manual corporate onboarding processes, which hindered efficiency and customer satisfaction. The bank sought to streamline this process to keep up with growing demand for faster, digital services.

The bank implemented a robust API management solution, automating document handling and onboarding tasks, enabling a fully digital and seamless corporate client experience.

This transformation reduced corporate onboarding time by over 50%, eliminated manual handoffs, and enabled real-time monitoring of API performance, resulting in faster service delivery. As a result, Axis Bank saw a significant increase in customer satisfaction, a surge in API traffic, and a deeper, more loyal corporate client base.

Taming Latency, Unleashing Bandwidth

WebSpace, renowned for its in-store payment systems, faced challenges as it expanded to wholesalers. The migration to a new architecture required low-latency cloud connectivity, but its legacy network, relying on hardware routers, caused performance slowdowns, complexity, and high costs.

WebSpace adopted a cloud-based routing solution, replacing physical routers with a virtual, automated system for multicloud connectivity, enabling on-demand configuration changes from a central control point.

With the new solution, WebSpace achieved faster cloud connectivity, reducing latency and increasing bandwidth. The modern, agile network reduced management costs and complexity, while usage-based billing ensured that WebSpace only paid for the resources it used, supporting its strategic expansion and enhancing overall efficiency.